Market Overview:

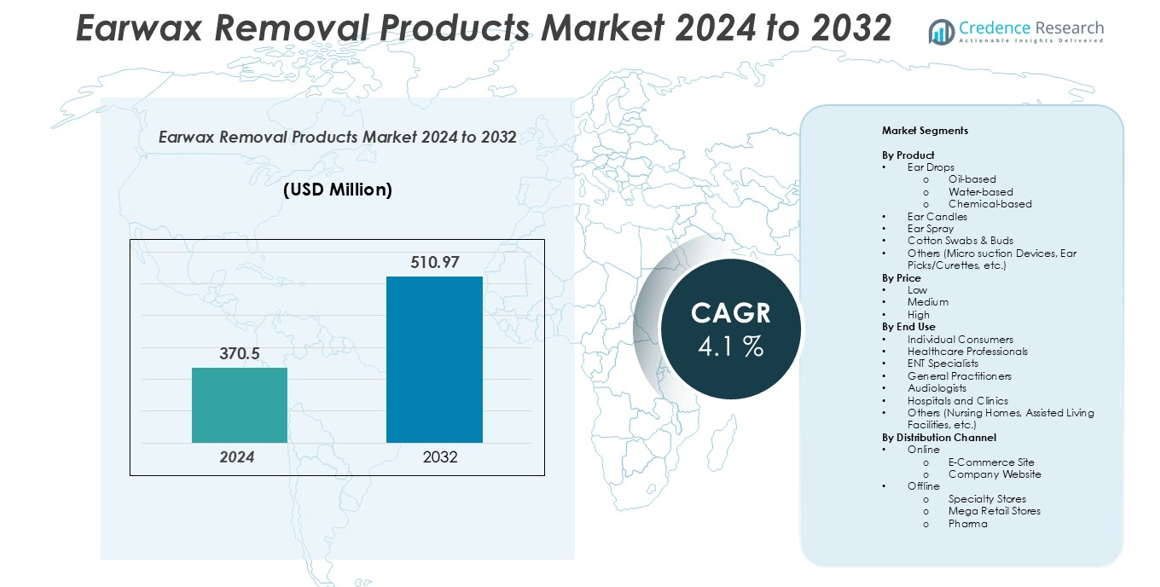

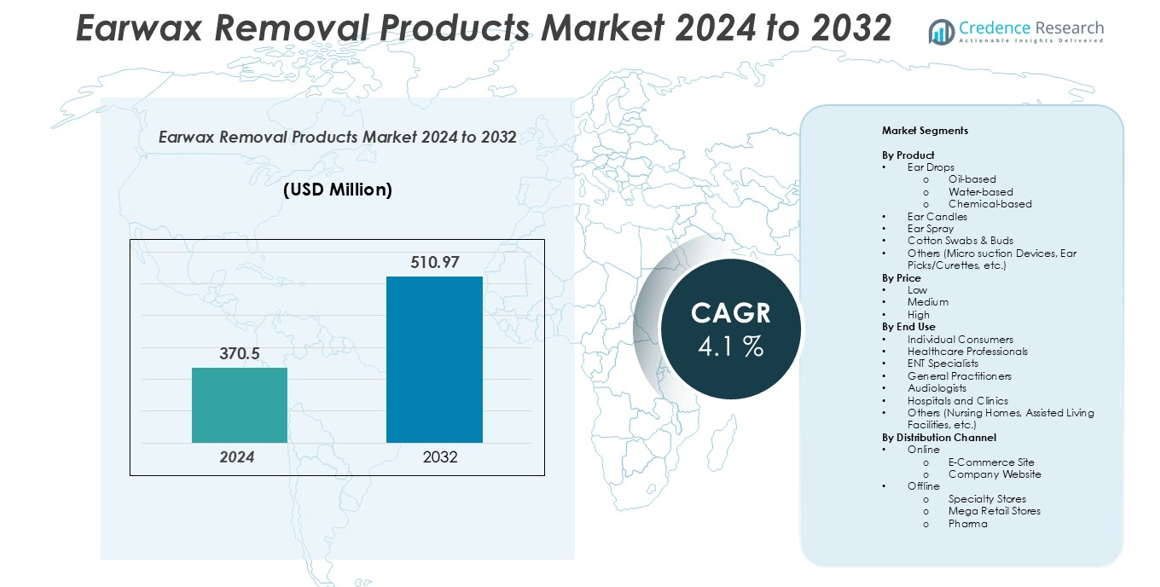

Earwax removal products market size was valued at USD 370.5 million in 2024 and is anticipated to reach USD 510.97 million by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Earwax Removal Products Market Size 2024 |

USD 370.5 million |

| Earwax Removal Products Market, CAGR |

4.1% |

| Earwax Removal Products Market Size 2032 |

USD 510.97 million |

The earwax removal products market is led by prominent players such as Johnson & Johnson, Bausch + Lomb, Cerumol (Reckitt Benckiser), Neil Med Pharmaceuticals, Prestige Consumer Healthcare, Eosera Inc., Hear Right Technologies, Doctor Easy Medical Products, Hydro Clean (EarTech), and Murine Ear. These companies dominate through strong brand recognition, innovative product portfolios, and extensive distribution networks spanning retail pharmacies, e-commerce platforms, and professional healthcare channels. North America emerges as the leading region, accounting for approximately 35% of the global market share, driven by high consumer awareness, widespread adoption of at-home solutions, and robust healthcare infrastructure. Europe follows with a 28% share, supported by technological advancements, safety-focused formulations, and professional endorsements. Asia-Pacific is a high-growth region with a 22% share, fueled by rising urbanization, digital adoption, and increasing awareness of ear hygiene, presenting significant expansion opportunities for market players.

Market Insights

- The earwax removal products market was valued at USD 370.5 million in 2024 and is projected to reach USD 510.97 million by 2032, growing at a CAGR of 4.1%.

- Increasing awareness of personal ear hygiene and preference for at-home treatments are driving growth, with oil-based ear drops dominating the product segment and individual consumers leading the end-use segment.

- Home-based ear care solutions, online sales expansion, and technological innovations in micro suction devices and sprays are key trends creating new opportunities for market players.

- The market is moderately competitive, led by Johnson & Johnson, Bausch + Lomb, Cerumol (Reckitt Benckiser), and Neil Med Pharmaceuticals, focusing on product innovation, e-commerce penetration, and professional endorsements.

- North America leads the regional market with a 35% share, followed by Europe at 28% and Asia-Pacific at 22%, while safety concerns, regulatory compliance, and risk of misuse remain key restraints limiting faster adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The earwax removal products market is primarily segmented by product type, including ear drops, ear candles, ear sprays, cotton swabs & buds, and others such as micro suction devices and ear picks/curettes. Among these, ear drops dominate the market, particularly oil-based formulations, capturing the largest share due to their ease of use, safety, and effectiveness in softening and removing cerumen. The rising awareness of at-home ear hygiene and the preference for non-invasive solutions are driving growth in this sub-segment. Innovations in chemical and water-based drops are further expanding consumer choices, enhancing market penetration.

- For instance, Otex Olive Oil Ear Drops are formulated with medicinal-grade olive oil to soften and help remove hardened earwax, making professional cleaning like syringing or microsuction easier.

By Price

The market segmentation by price includes low, medium, and high-priced products. Medium-priced products hold the largest market share, as they offer an optimal balance between affordability and perceived quality. This segment benefits from strong consumer trust in branded formulations that deliver safe and effective results without premium pricing. Growth is further supported by the increasing adoption of home-use ear care products, coupled with promotional campaigns by manufacturers emphasizing value for money and ease of use across diverse demographic groups.

- For instance, SafKan Health’s OtoSet device, which combines irrigation and micro-suction for earwax removal, was a winner of the Hearing Technology Innovator Award in 2021.

By End Use

The earwax removal products market is classified by end users, including individual consumers, healthcare professionals, ENT specialists, general practitioners, audiologists, hospitals, and other facilities. Individual consumers represent the dominant sub-segment, driven by rising awareness of personal ear hygiene and the convenience of self-administered treatments. The expanding availability of over-the-counter products and online sales channels also fuels growth in this segment. Additionally, healthcare professionals contribute to adoption through recommendations, while hospitals and clinics increasingly integrate advanced devices like micro suction tools to meet patient care demands.

Key Growth Drivers

Rising Awareness of Personal Ear Hygiene

Increasing awareness among consumers regarding personal ear care is a primary driver for the earwax removal products market. Individuals are actively seeking safe and effective methods to maintain ear health and prevent infections. Easy accessibility of over-the-counter ear drops, ear sprays, and at-home devices has encouraged regular use, particularly in urban populations. Additionally, educational campaigns by healthcare professionals and manufacturers highlighting the risks of untreated cerumen build-up further boost product adoption. The convenience of self-administered treatments and growing preference for non-invasive solutions also contribute to the segment’s expansion, driving sales across both retail and online channels.

- For instance, Earways Medical Ltd. secured its 9th patent in the United States, Europe and China for its ear-care innovation, covering its home-use device EarWay and professional device EarWay Pro.

Technological Advancements in Earwax Removal Devices

Innovation in earwax removal tools and devices is significantly propelling market growth. Advanced solutions such as micro suction devices, ear curettes, and modern ear sprays offer safer and more effective alternatives to traditional methods. These devices reduce the risk of ear injuries and provide faster, professional-grade results, encouraging both individual consumers and healthcare professionals to adopt them. Companies investing in ergonomic, user-friendly designs and efficient chemical formulations are attracting wider adoption, while integration with online retail platforms enhances visibility and accessibility, stimulating overall market demand.

- For instance, The OtoSet® from SafKan Health is the first FDA-cleared, automated ear cleaning device that uses a combination of irrigation and micro-suction technology to remove impacted earwax.

Expansion of Online and E-Commerce Channels

The growing penetration of e-commerce platforms and online pharmacies is facilitating wider product availability and consumer convenience. Online sales allow consumers to compare products, read reviews, and purchase earwax removal solutions discreetly, driving higher adoption rates. E-commerce also enables manufacturers to reach remote markets where physical stores are limited. Coupled with targeted digital marketing campaigns, subscription models, and home delivery options, online channels have become a critical growth driver. This expansion not only increases consumer engagement but also promotes the visibility of innovative products like water-based drops, chemical solutions, and micro suction devices.

Key Trends & Opportunities

Rise of Home-Based Ear Care Solutions

Home-based ear care solutions are gaining traction as consumers increasingly prefer self-administered treatments over clinic visits. Products such as oil-based and water-based ear drops, ear sprays, and at-home suction devices allow safe, convenient, and cost-effective ear hygiene management. Manufacturers are capitalizing on this trend by developing easy-to-use packaging, clear usage instructions, and travel-friendly options. The integration of digital tools like smartphone apps and virtual guidance for proper application presents further opportunities. This shift towards home care not only enhances market penetration but also creates opportunities for subscription services and bundled packages that target repeat usage and long-term consumer loyalty.

- For instance, The BEBIRD Home 30S is a smart ear care system that includes a flexible endoscope camera, a UVC sterilizing light, a visual ear-drops applicator, and tweezers, but despite manufacturer claims, health experts warn that using such tools for at-home earwax removal is dangerous and can cause serious ear injuries.

Growing Adoption in Healthcare and Professional Settings

The adoption of earwax removal products among healthcare professionals, including ENT specialists, audiologists, and hospitals, is a key trend offering market opportunities. Advanced tools like micro suction devices and professional-grade sprays are being integrated into clinics and hospitals for patient care, reducing procedural risks and improving treatment efficiency. Partnerships between manufacturers and healthcare institutions enable product demonstrations, professional training, and bulk procurement. This trend drives B2B sales while supporting professional endorsement, increasing consumer confidence in over-the-counter solutions, and fostering opportunities for product innovation tailored to clinical requirements.

- For instance, The Vorotek VMS-PK Suction Pump operates at a vacuum level of 0.065–0.080 MPa (approximately 500–600 mmHg) and a flow rate of 15–20 L/min. It is a portable, electrically powered device specifically designed for effective micro-suction performance in professional ear care.

Product Innovation and Diversification

Innovation in formulations, delivery methods, and device design is shaping market opportunities. Manufacturers are introducing chemical, oil-based, and water-based drops with enhanced efficacy and comfort. Ear sprays, candles, and ergonomic suction devices are evolving to meet safety and user-friendliness demands. Product diversification, including bundled kits for home care and specialized packages for professional use, expands the target audience. Sustainable and eco-friendly packaging also aligns with consumer preferences, enhancing brand reputation. This focus on innovation enables companies to differentiate their offerings, capture new market segments, and drive repeat purchases across both consumer and professional channels.

Key Challenges

Safety Concerns and Risk of Misuse

Safety concerns associated with improper use of earwax removal products remain a significant challenge. Overuse of ear drops, incorrect insertion of swabs, and improper handling of micro suction devices can cause ear injuries, infections, or perforation of the eardrum. These risks deter potential consumers and necessitate stringent regulatory compliance and clear labeling. Manufacturers must invest in consumer education, tutorials, and safety warnings to mitigate misuse. Additionally, concerns over the quality and authenticity of online-purchased products pose challenges for market trust and require effective quality assurance and certification measures.

Regulatory Compliance and Stringent Standards

The earwax removal products market faces challenges from stringent regulatory requirements across different regions. Products, particularly chemical-based drops and medical-grade devices, must comply with safety, efficacy, and manufacturing standards imposed by healthcare authorities. Approval processes can be time-consuming and costly, limiting the speed of product launches. Companies also face challenges in aligning marketing claims with regulatory guidelines to avoid legal complications. Navigating diverse regulations in global markets adds complexity, creating barriers to entry for smaller players and increasing operational costs for manufacturers aiming for international expansion.

Regional Analysis

North America

North America holds a significant share in the earwax removal products market, driven by high consumer awareness and widespread adoption of over-the-counter ear care solutions. The United States and Canada dominate due to the presence of leading manufacturers, strong healthcare infrastructure, and a preference for advanced at-home devices. Ear drops, particularly oil-based and water-based formulations, capture the largest sub-segment share. Growth is also fueled by online retail penetration and professional endorsements from ENT specialists and audiologists. The region accounts for approximately 35% of the global market, maintaining its position as a key revenue contributor.

Europe

Europe represents a substantial share of the global earwax removal products market, led by countries such as Germany, the UK, and France. The market benefits from high healthcare standards, increasing consumer awareness, and the growing use of professional devices in clinics and hospitals. Ear drops and micro suction devices dominate the product sub-segments, supported by technological advancements and safety-focused innovations. Online and pharmacy retail channels drive consumer accessibility. Europe contributes nearly 28% of the global market share, reflecting steady growth influenced by aging populations, rising disposable incomes, and strong regulatory compliance ensuring product quality.

Asia-Pacific

Asia-Pacific is emerging as a high-growth market for earwax removal products, fueled by rising urbanization, increasing health awareness, and expanding e-commerce channels. Countries such as China, Japan, and India lead adoption, driven by a growing middle-class population and demand for convenient, at-home ear care solutions. Ear drops and cotton swabs remain dominant, while innovative devices gain traction in urban healthcare centers. The region accounts for approximately 22% of the global market share, with strong growth potential due to rising disposable incomes, rapid technological adoption, and the proliferation of digital marketing campaigns targeting young and health-conscious consumers.

Latin America

Latin America shows steady growth in the earwax removal products market, supported by increasing awareness of personal hygiene and gradual penetration of modern ear care solutions. Brazil and Mexico lead the market, with ear drops and cotton swabs capturing the largest shares. Online retail expansion and pharmacy distribution channels are contributing to accessibility in urban and semi-urban areas. Latin America holds around 8% of the global market share, with opportunities for growth through professional endorsements, educational campaigns, and the introduction of affordable, medium-priced products to cater to cost-sensitive consumers.

Middle East & Africa

The Middle East & Africa region accounts for a smaller but growing share of the earwax removal products market, approximately 7% of global revenue, driven by rising awareness of ear health and increasing healthcare infrastructure in GCC countries and South Africa. Ear drops and sprays dominate consumer preference, while professional-grade devices are gradually gaining traction in clinics. Expansion of pharmacy networks and e-commerce platforms enhances product accessibility. The market growth is supported by health campaigns, urbanization, and the rising adoption of safe, home-based ear care solutions, although regulatory challenges and low awareness in rural areas may limit rapid expansion.

Market Segmentations:

By Product

- Ear Drops

- Oil-based

- Water-based

- Chemical-based

- Ear Candles

- Ear Spray

- Cotton Swabs & Buds

- Others (Micro suction Devices, Ear Picks/Curettes, etc.)

By Price

By End Use

- Individual Consumers

- Healthcare Professionals

- ENT Specialists

- General Practitioners

- Audiologists

- Hospitals and Clinics

- Others (Nursing Homes, Assisted Living Facilities, etc.)

By Distribution Channel

- Online

- E-Commerce Site

- Company Website

- Offline

- Specialty Stores

- Mega Retail Stores

- Pharma

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The earwax removal products market is moderately fragmented, with a mix of global healthcare giants and specialized regional players driving competition. Leading companies such as Johnson & Johnson, Bausch + Lomb, Cerumol (Reckitt Benckiser), Neil Med Pharmaceuticals, and Prestige Consumer Healthcare leverage brand recognition, extensive distribution networks, and continuous product innovation to maintain market leadership. Emerging players, including Eosera Inc., Hear Right Technologies, and Doctor Easy Medical Products, focus on technological advancements, ergonomic device designs, and niche formulations to differentiate themselves. Market competition is intensified by the growing adoption of online sales channels, promotional strategies, and home-use solutions. Companies increasingly invest in research and development to enhance efficacy, safety, and convenience, while regulatory compliance and quality certifications serve as key competitive advantages. Strategic collaborations, mergers, and acquisitions further strengthen market positioning and enable expansion into new regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Black Wolf Nation

- Cerumol (Reckitt Benckiser)

- Doctor Easy Medical Products

- Eosera Inc.

- Hear Right Technologies LLC

- Hydro Clean (EarTech)

- Johnson & Johnson

- Murine Ear

- Neil Med Pharmaceuticals, Inc.

- Prestige Consumer Healthcare Inc

- Bausch + Lomb

Recent Developments

- In July 2024, Eosera unveiled its newest ear care innovation—a single-use delivery system for its doctor-recommended, over-the-counter ear care products. These vials are designed for one-handed dosage application, emphasizing convenience and ease of use.

- In May 2024, Ear ways Medical unveiled its latest innovations the user-friendly devices, Ear Way Pro and Ear Way. These devices cater to both medical professionals and individuals, marking a significant step in accessible ear care solutions.

- In March 2024, Johnson & Johnson (NYSE: JNJ) announced the successful completion of its acquisition of Ambrx Biopharma, Inc.

- In May 2022, Allstar Innovations and Black Wolf launched WUSH, an innovative ear cleaner, marking Allstar’s entry into the ear care market. This product expands their portfolio of solution-based offerings. The WUSH Ear Cleaner provides a safe and effective method for earwax removal, suitable for both consumers and healthcare professionals. It features a foldable nozzle and a soft, antimicrobial irrigation tip for a comfortable fit. With the press of a button, WUSH generates a massaging triple jet stream of water, effectively dislodging and flushing away earwax build-up

Report Coverage

The research report offers an in-depth analysis based on Product, Price, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of home-based ear care solutions is expected to increase significantly.

- Technological innovations in micro suction devices and ear sprays will drive market expansion.

- Online and e-commerce sales channels will continue to play a major role in product accessibility.

- Oil-based and water-based ear drops are likely to maintain dominance in the product segment.

- Individual consumers will remain the largest end-use segment due to convenience and awareness.

- Healthcare professionals and clinics will increasingly adopt advanced earwax removal devices.

- Emerging markets in Asia-Pacific and Latin America will offer strong growth opportunities.

- Companies will focus on product innovation, safety, and user-friendly designs to differentiate themselves.

- Strategic collaborations, partnerships, and regional expansions will enhance competitive positioning.

- Regulatory compliance and quality certifications will remain critical for market credibility and adoption.