Market Overview:

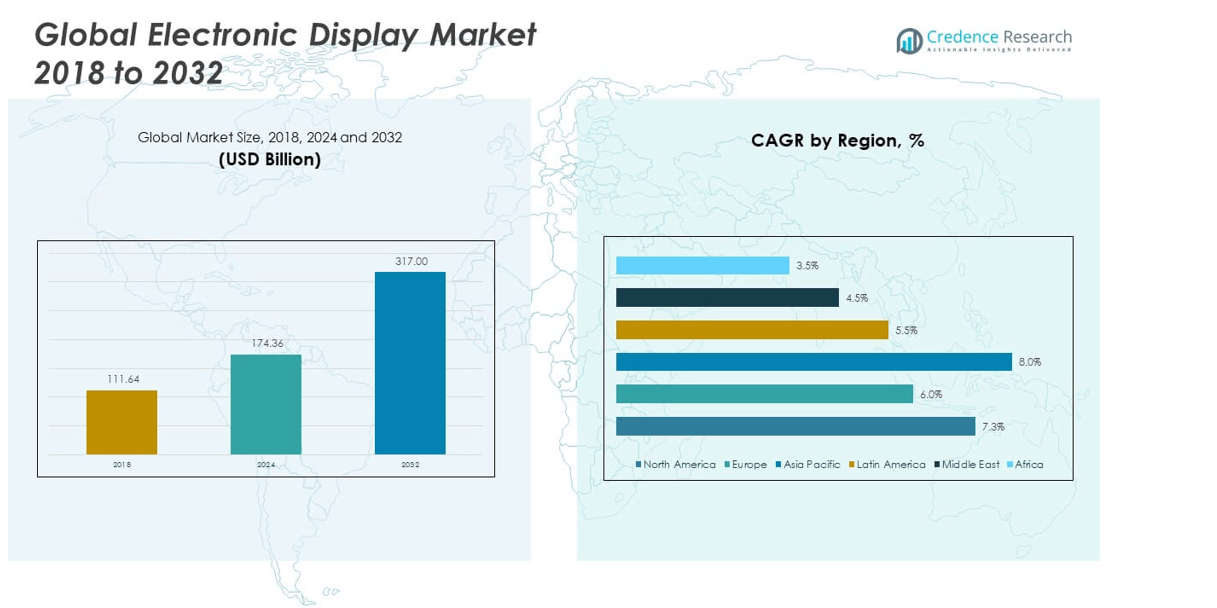

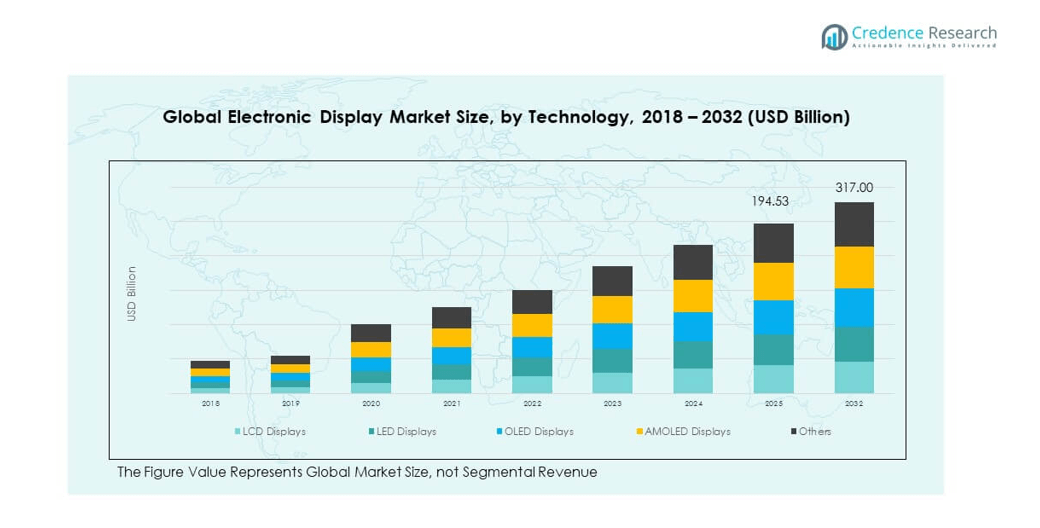

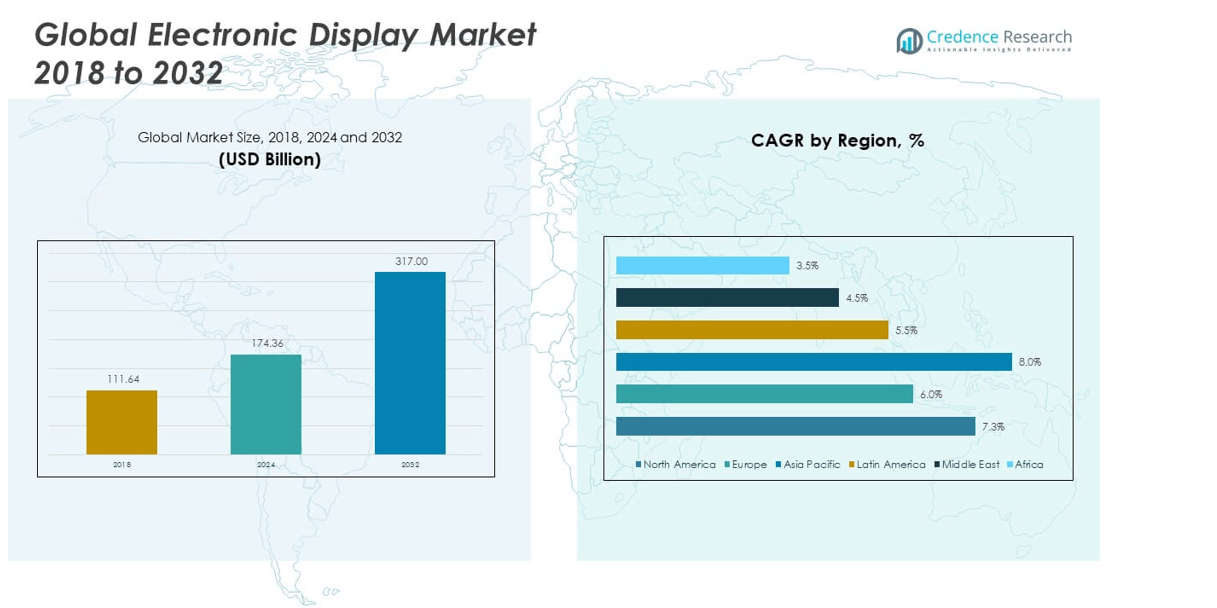

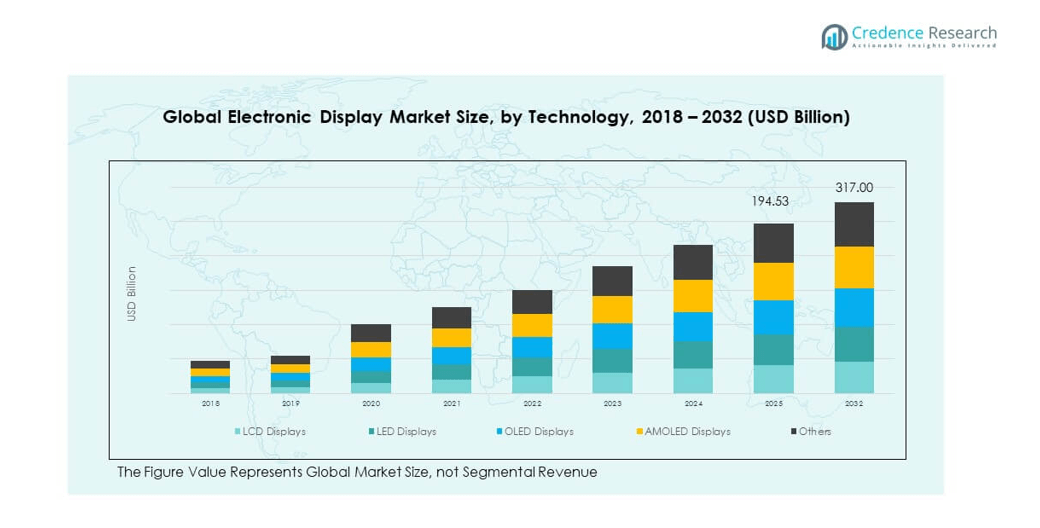

The Global Electronic Display Market size was valued at USD 111.64 billion in 2018 to USD 174.36 billion in 2024 and is anticipated to reach USD 317.00 billion by 2032, at a CAGR of 7.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Display Market Size 2024 |

USD 174.36 billion |

| Electronic Display Market, CAGR |

7.23% |

| Electronic Display Market Size 2032 |

USD 317.00 billion |

The market growth is driven by increasing demand for high-resolution displays across consumer electronics, automotive, and commercial applications. Manufacturers focus on energy-efficient, flexible, and interactive display technologies to meet evolving consumer preferences. Advancements in OLED, AMOLED, and QLED panels enhance visual quality and performance. Rising adoption of digital signage, gaming displays, and medical imaging solutions further propels expansion. It encourages continuous innovation, strategic partnerships, and investment in research and development. Consumer interest in immersive and AI-enabled displays sustains momentum. Market competition fuels rapid technological upgrades.

Regionally, Asia Pacific leads the Global Electronic Display Market due to strong manufacturing capabilities and rapid technology adoption in China, Japan, and South Korea. North America follows with high demand for premium consumer electronics and automotive displays. Europe maintains steady growth driven by mature markets and industrial applications. Emerging markets in Latin America and the Middle East show increasing adoption in commercial, retail, and healthcare sectors. Africa represents a developing market with gradual penetration in urban centers. It reflects diverse regional strategies and technology-driven opportunities.

Market Insights:

- The Global Electronic Display Market size was valued at USD 111.64 billion in 2018, grew to USD 174.36 billion in 2024, and is projected to reach USD 317.00 billion by 2032, at a CAGR of 7.23% during the forecast period.

- Asia Pacific leads with 44% market share due to strong manufacturing hubs and rapid technology adoption, followed by North America at 28% driven by premium consumer electronics, and Europe at 20% supported by mature industrial and commercial applications.

- Asia Pacific is also the fastest-growing region, propelled by rising smartphone penetration, automotive display demand, and government investments in digital infrastructure.

- By technology, LCD displays lead the market due to cost efficiency, while OLED and AMOLED gain traction for high-resolution, flexible, and energy-efficient panels.

- In terms of application, consumer electronics dominate, followed by digital signage and automotive displays, reflecting rising adoption across commercial and automotive sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Adoption Of Advanced Consumer Electronics Fueling Market Expansion

The Global Electronic Display Market experiences growth due to increased demand for smartphones, televisions, and tablets. Consumers prioritize high-resolution, energy-efficient displays, prompting manufacturers to innovate continuously. It integrates technologies such as OLED, AMOLED, and quantum dot displays, improving visual experience and performance. Enterprises in healthcare, automotive, and retail sectors adopt it for interactive and informative solutions. Rising investments in digital signage and smart devices enhance visibility across applications. It drives production efficiency and expands market reach worldwide. Manufacturers pursue research to deliver flexible, transparent, and high-definition displays. Strong consumer preference for premium display quality strengthens its growth trajectory.

Technological Advancements Driving Increased Integration In Multiple Industries

Innovations in display technology influence the Global Electronic Display Market significantly. It allows integration of touch, foldable, and transparent features, enabling versatile applications. Manufacturers implement high-performance backlighting and color accuracy to meet evolving consumer needs. It supports immersive experiences in gaming, virtual reality, and automotive interfaces. Rapid improvements in energy efficiency reduce operational costs and attract enterprises. It facilitates real-time data visualization in healthcare and industrial monitoring. Businesses focus on custom solutions to enhance brand engagement. Continuous research enhances durability, brightness, and resolution of displays, maintaining competitiveness.

- For example, in May 2023, BOE Technology Group showcased a 110-inch 16K display with 15,360×8,640 resolution, 400 nits brightness, and wide color gamut coverage, highlighting advances in ultra-high-definition visualization for professional and research applications.

Expanding Automotive And Transportation Applications Boosting Market Demand

Automotive and transportation sectors increasingly rely on electronic displays for navigation, infotainment, and safety systems. The Global Electronic Display Market supports integration of advanced driver-assistance systems with high-resolution screens. It improves vehicle interiors, enhancing passenger experience and safety. Automakers invest in curved and flexible displays for dashboards and entertainment units. It contributes to smart vehicle solutions that require real-time data visualization. Adoption of electric and autonomous vehicles drives demand for interactive displays. It creates opportunities for collaborative development between tech companies and automotive manufacturers. Rising consumer expectation for premium in-vehicle interfaces accelerates market growth.

Growing Digital Signage And Retail Adoption Accelerating Industry Expansion

Retail and commercial sectors deploy electronic displays for promotions, advertisements, and customer engagement. The Global Electronic Display Market provides interactive and visually appealing solutions. It enables real-time content updates and personalized marketing strategies. Businesses use it to enhance brand visibility and attract foot traffic. Large-scale events, exhibitions, and public spaces increasingly integrate digital signage. It supports dynamic pricing and product information display in retail environments. Enterprises invest in high-brightness and energy-efficient panels for sustainability. It drives market expansion by creating continuous demand for innovative display solutions.

- For example, in 2024, at ISE, Panasonic Connect launched a new series of 4K professional display panels and RQ7 DLP projectors with 7,500 lumens, designed for high-brightness performance in commercial retail and event venues, deploying over 100 units to enhance dynamic content display and customer engagement.

Market Trends

Emergence Of Flexible And Foldable Display Technology Transforming Market Dynamics

The Global Electronic Display Market benefits from growing popularity of foldable smartphones and tablets. It introduces flexibility without compromising image quality or resolution. Consumers seek compact devices with larger screens for multitasking and entertainment. It enables designers to explore new form factors and user interfaces. Manufacturers experiment with bendable OLED and polymer displays to meet demand. It supports automotive, wearable, and industrial applications. Rising research efforts reduce durability concerns and production costs. It positions flexible displays as a mainstream innovation trend influencing adoption globally.

- For example, in July 2025, Samsung’s Galaxy Z Fold 7 recorded the highest preorders in the US for the Z Fold series, with a 25% increase over the previous generation and nearly 50% higher sales after the first week.

Integration Of Smart And Interactive Displays Enhancing Consumer Experiences

Interactive displays are shaping the Global Electronic Display Market with intuitive touch interfaces. It supports retail, hospitality, and educational environments effectively. Consumers prefer engaging and visually rich content to enhance decision-making. It allows real-time data updates and interactive presentations. Businesses adopt it for immersive brand experiences and digital signage. It encourages collaborations with software developers to create innovative applications. Enterprises focus on multi-touch and gesture-based technologies for usability. It contributes to increasing adoption across public and private sectors, driving market growth.

- For example, in June 2025, DISPLAX and T1V showcased integrated touchscreen collaboration solutions at InfoComm, demonstrating TILE video wall technology with T1V Story and ThinkHub software for real-time audience engagement and enterprise collaboration.

Growth Of High-Resolution And Energy-Efficient Displays Dominating Market Trends

High-resolution displays remain a key trend in the Global Electronic Display Market. It delivers superior color accuracy and brightness for consumer and professional applications. Consumers demand 4K, 8K, and ultra-HD screens for entertainment and productivity. It reduces power consumption, aligning with global sustainability goals. Manufacturers adopt quantum dot and micro-LED technologies to enhance display quality. It finds applications in healthcare imaging, broadcasting, and automotive dashboards. Rising awareness of energy efficiency drives preference for low-power displays. It positions the market for long-term technological advancement and wider adoption.

Expansion Of AR And VR Applications Driving Display Innovation And Adoption

Augmented and virtual reality technologies fuel the Global Electronic Display Market. It provides immersive experiences for gaming, training, and industrial simulations. Developers focus on high-refresh-rate displays to minimize latency and enhance realism. It supports head-mounted and wearable devices for consumer and enterprise use. Businesses integrate it in simulation, design, and entertainment environments. It promotes collaboration between hardware manufacturers and software developers. Enhanced graphics and resolution improve user engagement and satisfaction. It accelerates the adoption of advanced electronic displays across diverse sectors.

Market Challenges Analysis

High Production Costs And Supply Chain Constraints Limiting Market Expansion

The Global Electronic Display Market faces challenges due to high manufacturing costs. It requires advanced materials and complex assembly processes for OLED and micro-LED technologies. Manufacturers face fluctuations in raw material prices affecting profitability. It experiences supply chain disruptions from component shortages and logistic constraints. Strict regulatory compliance and quality standards increase operational expenses. It demands continuous investment in research and development for competitive advantage. Price-sensitive consumers limit mass adoption in emerging markets. It constrains rapid market penetration despite strong demand and technological progress.

Intense Competition And Rapid Technological Obsolescence Affecting Market Stability

The Global Electronic Display Market contends with fierce competition among key players. It faces constant innovation pressures to maintain market share. Rapid technological advancements render older products obsolete quickly. It requires manufacturers to invest in frequent upgrades and new product launches. Short product life cycles reduce profitability and increase marketing costs. It encounters challenges in differentiating products in a crowded market. Consumer preference shifts toward new technologies impact long-term planning. It demands strategic partnerships and innovation to sustain growth in a competitive landscape.

Market Opportunities

Emerging Markets And Increasing Urbanization Providing Growth Prospects

The Global Electronic Display Market finds opportunities in emerging economies with rising urbanization. It supports expanding consumer electronics adoption in India, Southeast Asia, and Latin America. Growing disposable incomes encourage purchase of premium displays and smart devices. It enables enterprises to introduce interactive solutions in retail, transportation, and healthcare sectors. Infrastructure development and smart city initiatives create demand for digital signage and advanced displays. It allows manufacturers to expand production and distribution networks. Rising awareness of technology benefits strengthens market prospects. It positions the market for sustainable long-term growth in untapped regions.

Collaborations And Technological Partnerships Enhancing Market Expansion Potential

Collaborations between tech companies and display manufacturers offer opportunities in the Global Electronic Display Market. It promotes co-development of innovative display technologies, reducing time-to-market. Businesses leverage partnerships to introduce customized solutions for automotive, healthcare, and commercial sectors. It facilitates integration with AI, IoT, and smart city initiatives. Joint ventures expand geographic reach and strengthen brand presence. It allows access to new research capabilities and advanced materials. Increasing demand for interactive and immersive displays fuels strategic collaborations. It accelerates innovation, adoption, and competitive advantage globally.

Market Segmentation Analysis:

By Technology

The Global Electronic Display Market by technology includes LCD, LED, OLED, AMOLED, and other emerging display solutions. LCD displays maintain significant adoption due to cost-efficiency and wide compatibility across consumer electronics. LED displays drive growth in commercial signage and large-format applications due to high brightness and energy efficiency. OLED and AMOLED technologies gain traction in premium devices for high-resolution, flexible, and energy-efficient panels. Other technologies, including micro-LED and QD-OLED, target specialized applications and high-performance requirements. It demonstrates that innovation in display technologies continues to shape market dynamics and investment strategies.

- For example, in 2025, BOE showcased its 23.8-inch BD Cell LCD ultrasound display featuring ADS Pro technology, achieving an ultra-high contrast ratio of 300,000:1, recognized at SID Display Week and highlighted in industry publications.

By Application

The Global Electronic Display Market by application spans consumer electronics, automotive displays, digital signage, healthcare, and other specialized sectors. Consumer electronics dominate demand, fueled by smartphones, televisions, and personal computing devices. Automotive displays grow steadily, supporting infotainment, navigation, and advanced driver-assistance systems. Digital signage and advertising leverage interactive, high-visibility displays to enhance customer engagement in retail and public environments. Healthcare and medical devices increasingly adopt high-resolution displays for imaging and diagnostics. Other applications include industrial, education, and hospitality sectors where specialized display solutions create additional growth opportunities. It highlights that end-use demand strongly influences product development and regional strategies.

- For example, in 2023, Apple’s iPhone 15 Pro models, equipped with Samsung Display OLED panels, achieved peak outdoor brightness of 2,000 nits, confirmed by third-party technical reviews and Apple’s official specifications.

Segmentation:

By Technology

- LCD Displays

- LED Displays

- OLED Displays

- AMOLED Displays

- Others

By Application

- Consumer Electronics

- Automotive Displays

- Digital Signage and Advertising

- Healthcare and Medical Devices

- Others

By Geography / Regional Analysis

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis:

North America

The North America Global Electronic Display Market size was valued at USD 31.84 billion in 2018, growing to USD 48.94 billion in 2024, and is anticipated to reach USD 89.36 billion by 2032, at a CAGR of 7.3% during the forecast period. North America holds a significant share of the global market due to advanced technological infrastructure and high consumer demand. It benefits from strong adoption in consumer electronics, automotive, and digital signage sectors. The U.S. leads in innovation and manufacturing capabilities, supporting premium product launches. Canada contributes through healthcare and commercial applications. Mexico shows growing interest in automotive and retail displays. It attracts investments from leading global display manufacturers. Rising demand for high-resolution, energy-efficient displays drives regional market expansion. Strategic partnerships and R&D activities strengthen North America’s market position.

Europe

The Europe Global Electronic Display Market size was valued at USD 21.80 billion in 2018, increasing to USD 32.26 billion in 2024, and is expected to reach USD 53.58 billion by 2032, at a CAGR of 6.0% during the forecast period. Europe accounts for a substantial portion of the global market due to mature consumer markets and strong industrial adoption. It benefits from innovations in OLED, LED, and AMOLED technologies. Germany, France, and the UK lead in manufacturing and deployment of advanced displays. It supports digital signage and automotive applications extensively. Italy and Spain contribute through expanding retail and commercial demand. Investments in smart city projects drive display adoption. It maintains a competitive edge with government initiatives promoting digital transformation. Growing consumer preference for high-quality displays strengthens market growth.

Asia Pacific

The Asia Pacific Global Electronic Display Market size was valued at USD 48.83 billion in 2018, rising to USD 79.07 billion in 2024, and is projected to reach USD 152.52 billion by 2032, at a CAGR of 8.0% during the forecast period. Asia Pacific dominates the global market due to strong manufacturing capabilities and rapid technology adoption. China, Japan, and South Korea lead in production of advanced LCD, OLED, and AMOLED displays. It benefits from rising smartphone penetration, automotive, and consumer electronics demand. India and Southeast Asia are emerging markets with expanding retail and healthcare sectors. It attracts investments from global display manufacturers for regional production hubs. Government initiatives support smart city and digital infrastructure projects. Rising disposable incomes fuel demand for premium electronic displays. It remains a hotspot for innovation and market expansion.

Latin America

The Latin America Global Electronic Display Market size was valued at USD 5.05 billion in 2018, reaching USD 7.78 billion in 2024, and is expected to hit USD 12.45 billion by 2032, at a CAGR of 5.5% during the forecast period. Latin America contributes a moderate share to the global market, driven by consumer electronics and automotive demand. Brazil leads regional adoption due to rising urbanization and technology awareness. Argentina follows with investments in retail and digital signage applications. It supports healthcare and commercial sectors through interactive displays. Infrastructure improvements and increasing smartphone penetration enhance market opportunities. Mexico shows growing adoption in automotive and entertainment sectors. It attracts foreign investments for display manufacturing and distribution. Regional demand continues to expand with rising disposable income.

Middle East

The Middle East Global Electronic Display Market size was valued at USD 2.71 billion in 2018, increasing to USD 3.81 billion in 2024, and is projected to reach USD 5.65 billion by 2032, at a CAGR of 4.5% during the forecast period. The Middle East holds a smaller share of the global market but shows steady growth. GCC countries lead due to investments in smart infrastructure and retail technology. It supports digital signage, commercial, and automotive applications. Israel and Turkey contribute through technology integration and innovative product adoption. It attracts regional investments for high-resolution and energy-efficient displays. Government initiatives promote modernization of public spaces and commercial centers. Urbanization and expanding consumer electronics markets fuel adoption. It presents opportunities for international manufacturers to strengthen market presence.

Africa

The Africa Global Electronic Display Market size was valued at USD 1.42 billion in 2018, growing to USD 2.50 billion in 2024, and is anticipated to reach USD 3.44 billion by 2032, at a CAGR of 3.5% during the forecast period. Africa represents the smallest share of the global market, yet it shows gradual adoption. South Africa drives regional demand through commercial and retail applications. Egypt follows with growth in healthcare and consumer electronics. It attracts international companies for high-resolution and interactive display solutions. Infrastructure development and urbanization enhance market penetration. Technology awareness and rising disposable income fuel adoption in key urban centers. It remains an emerging market with long-term growth potential. International partnerships strengthen its market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Samsung Electronics

- LG Electronics

- Sony Corporation

- BOE Technology Group

- Innolux Corporation

- AU Optronics

- Panasonic Corporation

- Sharp Corporation

- Japan Display Inc.

- NanoLumens

- Delta Systems

- 3M

Competitive Analysis:

The Global Electronic Display Market exhibits intense competition among leading manufacturers and emerging players. It is driven by continuous innovation in display technologies, including OLED, AMOLED, and micro-LED solutions. Key players focus on product differentiation through high-resolution, energy-efficient, and flexible displays. It experiences frequent new product launches, mergers, and strategic partnerships to strengthen market positions. Samsung Electronics, LG Electronics, Sony Corporation, and BOE Technology Group dominate through extensive R&D and global distribution networks. It faces challenges from price-sensitive markets and rapid technological obsolescence, pushing companies to maintain agility. Regional expansion and collaborations support entry into emerging markets in Asia Pacific, Latin America, and the Middle East. It encourages manufacturers to enhance production capacity, optimize supply chains, and deliver innovative solutions. Continuous competitive benchmarking and investment in advanced technologies sustain leadership and long-term growth.

Recent Developments:

- In August 2025, leading players such as Samsung Electronics, TCL, and Hisense accelerated the integration of artificial intelligence into QLED display products. Their newest launches feature AI-driven algorithms enhancing image rendering, color accuracy, and overall visual quality, resulting in richer, immersive viewing experiences for both gaming and commercial users.

- In May 2025, Samsung Electronics launched its 115-inch 4K Smart Signage display (QHFX 115”) into the market, designed to bridge the gap between videowalls and LED solutions for commercial applications. The company also showcased its “UT One” OLED portfolio at Display Week 2025, featuring ultra-thin panels with 30% lower power consumption and weight, including QD-OLED prototypes with 220 PPI and 500 Hz refresh rates targeting high-performance laptops and professional monitors.

- In May 2025, LG Display unveiled its fourth-generation OLED TV panel at SID Display Week, featuring enhanced AI TV capabilities like advanced upscaling and approximately 20% improved energy efficiency compared to the previous generation. The company also showcased a 45-inch 5K2K Gaming OLED with the world’s highest resolution for gaming monitors and demonstrated its Dynamic Frequency & Resolution (DFR) technology for optimizing gaming performance.

- In March 2025, Sony Corporation announced the development of a next-generation display system with proprietary signal processing for individual RGB control of high-density LED backlights, aiming for mass production and integration into consumer TVs and content creation displays.

Report Coverage:

The research report offers an in-depth analysis based on technology and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Electronic Display Market will benefit from rising adoption of flexible and foldable display technologies.

- Expansion in consumer electronics, automotive, and healthcare applications will drive consistent demand.

- Integration of interactive and smart display solutions will enhance user experiences across sectors.

- Technological advancements in OLED, AMOLED, and micro-LED displays will support market differentiation.

- Increased investments in digital signage and retail applications will fuel regional growth.

- Emerging economies will witness accelerated adoption due to rising urbanization and disposable incomes.

- Collaborations between manufacturers and technology firms will foster innovative product development.

- Energy-efficient and high-resolution displays will remain a key focus to meet consumer preferences.

- Regional expansion in Asia Pacific and Latin America will provide long-term market opportunities.

- Strategic partnerships and continuous R&D will sustain competitive advantage and global market leadership.