Market Overview

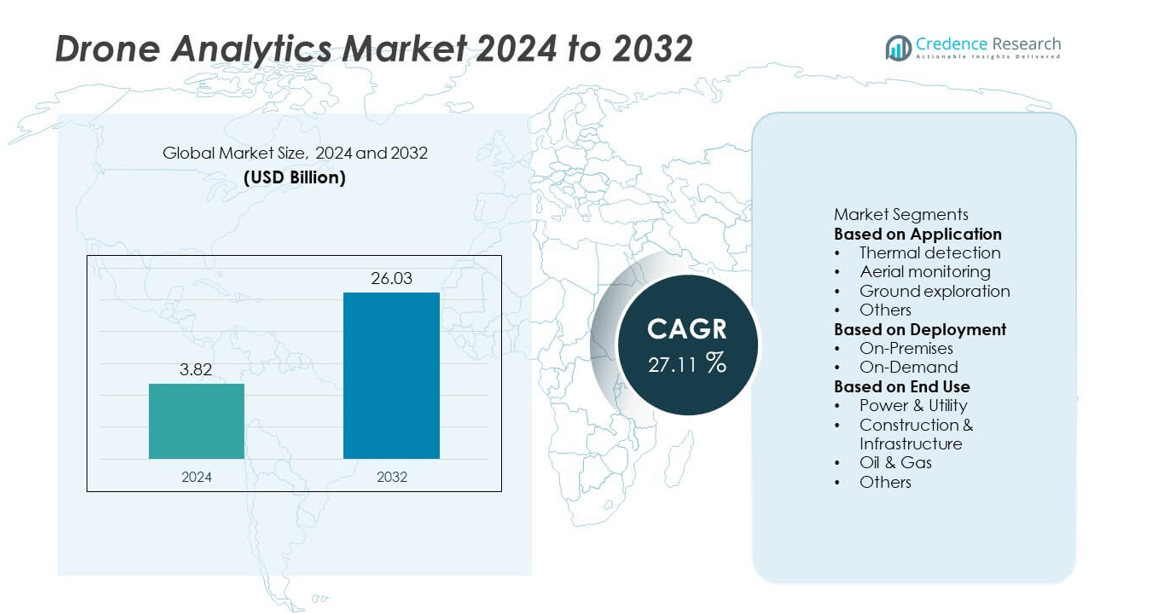

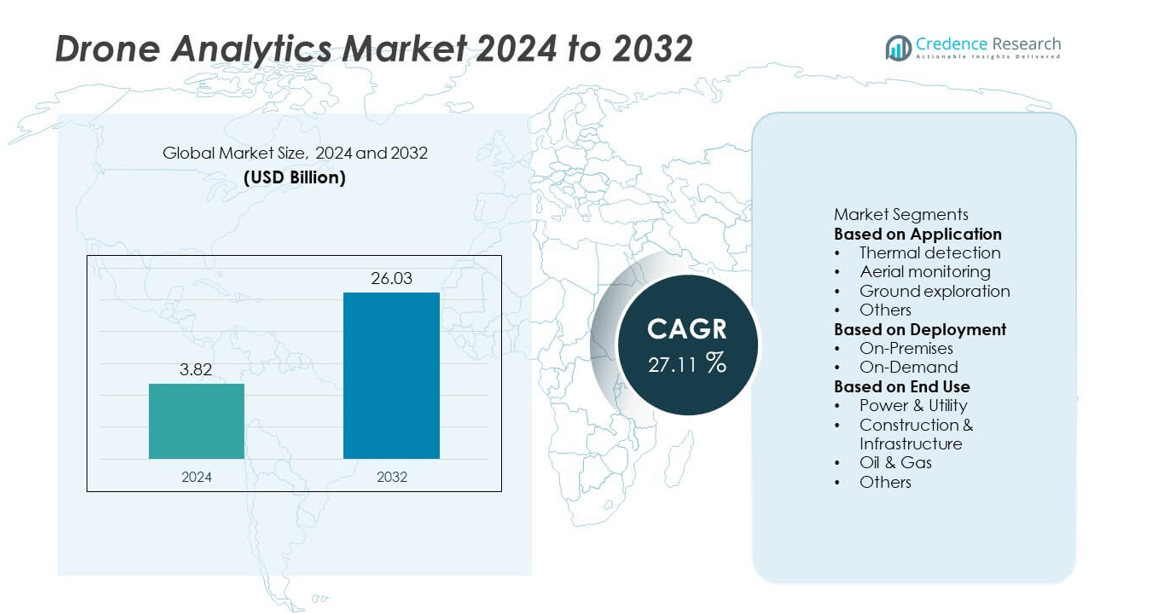

The drone analytics market was valued at USD 3.82 billion in 2024 and is projected to reach USD 26.03 billion by 2032, growing at a CAGR of 27.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Analytics Market Size 2024 |

USD 3.82 billion |

| Drone Analytics Market, CAGR |

27.11% |

| Drone Analytics Market Size 2032 |

USD 26.03 billion b |

The drone analytics market is led by major players including Kespry Inc., DroneDeploy, PrecisionHawk, ESRI, Huvrdata, Airware, Optelos, Delta Drone, Agribotix, and AeroVironment, Inc. These companies dominate through advanced AI-based analytics, real-time mapping, and cloud-integrated data visualization platforms. Kespry and DroneDeploy lead in construction and infrastructure analytics, while PrecisionHawk and AeroVironment specialize in agriculture and defense applications. Regional analysis indicates that North America held the largest share of 39% in 2024, supported by strong regulatory frameworks, rapid industrial digitalization, and high adoption of drone technologies across sectors such as energy, mining, and urban infrastructure.

Market Insights

- The drone analytics market was valued at USD 3.82 billion in 2024 and is projected to reach USD 26.03 billion by 2032, growing at a CAGR of 27.11%.

- Market growth is driven by rising adoption of drones for industrial monitoring, infrastructure inspection, and precision agriculture, supported by advancements in AI and data analytics technologies.

- Key trends include the integration of 3D mapping, cloud-based analytics, and machine learning for real-time decision-making and predictive maintenance across industries.

- Leading players such as Kespry Inc., DroneDeploy, PrecisionHawk, and AeroVironment, Inc. focus on AI-enabled analytics, strategic partnerships, and software-as-a-service platforms to strengthen their global presence.

- North America led with a 39% share in 2024, followed by Europe with 28% and Asia-Pacific with 25%, while the aerial monitoring segment dominated with a 47% share due to widespread application in construction, defense, and energy sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Aerial monitoring dominated the drone analytics market with a 47% share in 2024. The segment’s leadership is driven by increasing use of drones for real-time inspection, mapping, and surveillance across industries such as agriculture, construction, and defense. Aerial monitoring enables organizations to capture high-resolution imagery and geospatial data efficiently, reducing operational costs and risks. The growing adoption of AI-based image recognition and automated flight systems enhances precision and data quality. Expanding use in smart city development and disaster management applications further strengthens this segment’s position in the global market.

- For instance, AeroVironment’s Quantix Recon collects multispectral data from user-selectable altitudes, with autonomous flight planning and automated terrain mapping capabilities.

By Deployment

The on-demand segment held the largest share of 58% in 2024, driven by its scalability, cost efficiency, and ease of integration. Businesses increasingly prefer cloud-based analytics platforms to process drone-generated data without heavy infrastructure investments. On-demand deployment allows real-time data sharing, remote collaboration, and automated updates, supporting flexible operations across industries. The growing popularity of subscription-based models and integration with AI and IoT ecosystems further accelerates adoption. Rising demand for data-driven insights in agriculture, energy, and logistics continues to boost the on-demand drone analytics segment worldwide.

- For instance, Firmatek’s cloud analytics platform, which incorporated Kespry’s software in 2021, processes drone data for mining and construction clients, enabling automated volumetric analysis.

By End Use

Construction and infrastructure accounted for a 35% share of the drone analytics market in 2024, emerging as the dominant end-use segment. The adoption of drones for site surveying, progress tracking, and structural inspection has transformed project management practices. Drone analytics help construction firms reduce delays, detect anomalies, and enhance safety through precise aerial imaging and 3D modeling. Infrastructure development projects, particularly in emerging economies, are driving consistent demand for aerial data solutions. Government investments in smart infrastructure and urban planning further reinforce this segment’s growth in the global market.

Key Growth Drivers

Rising Adoption Across Industrial and Commercial Sectors

The growing use of drone analytics in sectors such as construction, oil and gas, power utilities, and agriculture is driving market growth. Organizations are leveraging aerial data for asset monitoring, mapping, and predictive maintenance to enhance operational efficiency. Drones equipped with advanced sensors and AI-based analytics reduce manual inspection costs and improve accuracy. The expansion of smart infrastructure projects and digital transformation initiatives across industries continues to accelerate demand for real-time aerial intelligence and data-driven decision-making.

- For instance, HUVRdata’s inspection platform processed drone-acquired data from more than 45,000 industrial assets, improving asset uptime for oil and gas operators.

Advancements in AI and Machine Learning Integration

Integration of artificial intelligence and machine learning technologies has revolutionized drone analytics capabilities. These technologies enable automated object detection, thermal imaging interpretation, and pattern recognition for high-precision analysis. AI-powered systems enhance data processing speed and allow predictive insights in sectors like agriculture and mining. The increasing availability of cloud-based analytics platforms further supports scalability and real-time collaboration. As industries shift toward automation, AI-driven drone analytics solutions are becoming essential for operational optimization and risk management.

- For instance, ESRI s ArcGIS AI integration uses deep learning models to classify objects from drone imagery, which can be applied to optimize asset inspection workflows globally.

Expanding Government and Regulatory Support

Supportive regulations for commercial drone operations are fueling market expansion. Governments worldwide are establishing frameworks for safe drone deployment in infrastructure, agriculture, and environmental monitoring. Initiatives promoting drone-based surveying and inspection are enhancing public and private sector adoption. Regulatory clarity around airspace management and data handling is enabling broader commercial use. This positive policy environment encourages investments in drone analytics solutions that deliver higher productivity, safety, and sustainability across multiple industries.

Key Trends & Opportunities

Growth of Cloud-Based and On-Demand Analytics Platforms

Cloud-based drone analytics is becoming a key market trend, offering flexibility and accessibility for data processing and storage. On-demand solutions allow organizations to analyze high volumes of aerial data without investing in in-house systems. This model supports real-time collaboration, multi-location data access, and lower operational costs. Integration with IoT and edge computing enhances efficiency in managing complex datasets. The growing reliance on digital ecosystems creates strong opportunities for cloud service providers to develop customized drone analytics solutions for diverse industries.

- For instance, Kespry implemented its drone analytics platform on Microsoft Azure, enabling clients in industries like construction and mining to process and analyze aerial data. The integration uses cloud capabilities and machine learning to accelerate processing times and provide quicker access to insights for global teams.

Integration of 3D Mapping and Digital Twin Technologies

The increasing use of 3D mapping and digital twin solutions is transforming data visualization and asset management. Drone analytics platforms now create detailed digital replicas of structures, landscapes, and industrial assets. These virtual models enable real-time monitoring, risk analysis, and predictive maintenance. Sectors like construction, mining, and utilities benefit from enhanced accuracy in site evaluation and project planning. As industries embrace digital transformation, integrating drone-generated 3D data into operational workflows presents significant opportunities for improving safety, efficiency, and productivity.

- For instance, Bentley Systems used drone-based 3D mapping with its iTwin platform and integrated reality modeling software to generate digital twins for infrastructure projects.

Rising Use in Environmental and Agricultural Monitoring

Drone analytics is increasingly used for environmental monitoring, crop assessment, and disaster management. In agriculture, analytics platforms track crop health, irrigation patterns, and soil conditions to optimize yields. Environmental agencies use drones to monitor deforestation, pollution, and wildlife habitats. The ability to process large-scale geospatial data quickly supports sustainable land and resource management. Growing emphasis on precision agriculture and climate resilience creates new opportunities for drone analytics providers specializing in environmental applications.

Key Challenges

Data Privacy and Regulatory Compliance Issues

Data security and privacy remain major concerns in drone analytics adoption. Aerial data often includes sensitive information related to private property, infrastructure, and geographic boundaries. Inconsistent regulatory frameworks across regions create operational challenges for cross-border deployments. Companies must comply with strict airspace, cybersecurity, and data protection regulations to avoid legal risks. Strengthening encryption, ensuring secure data transmission, and adhering to international privacy standards are crucial to building user trust and expanding drone analytics applications globally.

High Initial Costs and Limited Technical Expertise

High implementation costs and lack of skilled professionals hinder drone analytics adoption, particularly among small and medium enterprises. Procuring drones, advanced sensors, and software platforms requires significant investment. Additionally, interpreting complex aerial data demands technical expertise in geospatial analytics and AI integration. Many organizations face barriers in managing large datasets and integrating analytics into existing workflows. Addressing these challenges through affordable subscription models, training programs, and user-friendly software will be essential for accelerating market adoption.

Regional Analysis

North America

North America dominated the drone analytics market with a 39% share in 2024. The region’s leadership is driven by strong adoption of drones across construction, agriculture, and defense sectors. The United States leads in deploying AI-integrated analytics platforms for aerial mapping, surveillance, and asset monitoring. Supportive government policies for commercial drone operations and technological innovation from key players enhance market growth. The expansion of smart city projects and increasing investment in precision agriculture further strengthen the region’s dominance in drone data management and real-time analytics applications.

Europe

Europe accounted for 28% of the drone analytics market share in 2024, supported by growing demand for data-driven insights in industrial and environmental applications. The region’s focus on infrastructure modernization and renewable energy inspection is fueling drone adoption. Countries such as Germany, France, and the United Kingdom are leading in implementing drone-based analytics for project planning and maintenance. Regulatory frameworks promoting safe drone use and integration with digital twins are encouraging technological advancements. The increasing role of drones in environmental monitoring and sustainable land management continues to boost regional market growth.

Asia-Pacific

Asia-Pacific held a 25% share in the drone analytics market in 2024, emerging as the fastest-growing region. Rapid industrialization, expanding construction activity, and government-led digital infrastructure initiatives are major growth drivers. China, Japan, and India are leading markets, with strong local manufacturing and technology development in drone systems. The growing use of drone analytics in agriculture, mining, and urban planning enhances operational efficiency across sectors. Rising investment in smart city development and the integration of 5G networks are further supporting widespread adoption of cloud-based and AI-powered analytics platforms in the region.

Latin America

Latin America accounted for 5% of the drone analytics market share in 2024, driven by increasing use of drones for agriculture, mining, and energy infrastructure monitoring. Brazil and Mexico are leading adopters, supported by rising investments in precision farming and natural resource management. Local governments are promoting drone-based solutions for land mapping and disaster response. The expansion of digital connectivity and growing awareness of aerial analytics benefits are improving market accessibility. Partnerships between international drone firms and regional service providers continue to strengthen the competitive landscape in Latin America.

Middle East & Africa

The Middle East & Africa region captured a 3% share of the drone analytics market in 2024. Growth is supported by rising demand for infrastructure surveillance, oil and gas inspection, and environmental monitoring. The UAE and Saudi Arabia lead the region’s adoption, driven by smart city initiatives and investments in advanced analytics. Drone analytics is gaining traction in precision agriculture and mining applications across Africa. Expanding 4G and 5G networks, combined with regulatory progress in commercial drone operations, are expected to unlock new opportunities and enhance regional market penetration.

Market Segmentations:

By Application

- Thermal detection

- Aerial monitoring

- Ground exploration

- Others

By Deployment

By End Use

- Power & Utility

- Construction & Infrastructure

- Oil & Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the drone analytics market is shaped by key players such as Kespry Inc., DroneDeploy, PrecisionHawk, ESRI, Huvrdata, Airware, Optelos, Delta Drone, Agribotix, and AeroVironment, Inc. These companies are leading innovation through AI-driven analytics, 3D mapping, and geospatial data processing solutions tailored for industrial and commercial applications. The competition focuses on enhancing real-time data accuracy, predictive modeling, and cloud-based analytics integration. Strategic partnerships with construction, energy, and agriculture sectors are strengthening market positions. Many players are investing in advanced computer vision and machine learning technologies to improve data automation and interpretation. Expanding software-as-a-service (SaaS) models and customizable analytics platforms are also key growth strategies. As demand for aerial intelligence accelerates, companies are prioritizing scalability, affordability, and regulatory compliance to capture emerging opportunities across diverse industries worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, DJI launched the RS 4 Mini, a lightweight 890 g gimbal capable of supporting up to 2 kg payloads. Features include automated axis locks and fast setup for filmmakers and creators.

- In April 2024, DroneDeploy announced the integration of fixed-camera data sources (from partners such as TrueLook, EverCam, Sensera Systems) into its reality-capture platform for enterprise customers.

- In April 2024, Optelos also partnered with Logic20/20 to deliver drone-based power-line inspection workflows combining AI analytics and drone imagery for utility asset management.

- In October 2023, DroneDeploy introduced a comprehensive new platform that allows users to seamlessly collaborate and manage data captured from aerial and ground sources. This unified solution integrates exterior and interior data, streamlining workflows and enhancing the accuracy of reality capture applications.

- In 2023, Verge Aero launched the Verge Aero X7 drone alongside significant upgrades to its all-in-one drone show product suite

Report Coverage

The research report offers an in-depth analysis based on Application, Deployment, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for drone analytics will grow rapidly with wider adoption across industrial sectors.

- Integration of artificial intelligence and machine learning will enhance data accuracy and automation.

- Cloud-based analytics platforms will dominate due to scalability and real-time accessibility.

- Use of 3D mapping and digital twin technologies will expand in infrastructure and energy projects.

- Government support for commercial drone regulations will accelerate market expansion.

- The agriculture sector will increasingly rely on drone analytics for precision farming and yield optimization.

- Partnerships between drone manufacturers and analytics software providers will strengthen product innovation.

- Advancements in sensor technology will improve thermal, aerial, and volumetric analysis capabilities.

- North America will continue leading, while Asia-Pacific will emerge as the fastest-growing regional market.

- Growing use of drones in environmental monitoring and disaster management will create new long-term opportunities.