Market Overview

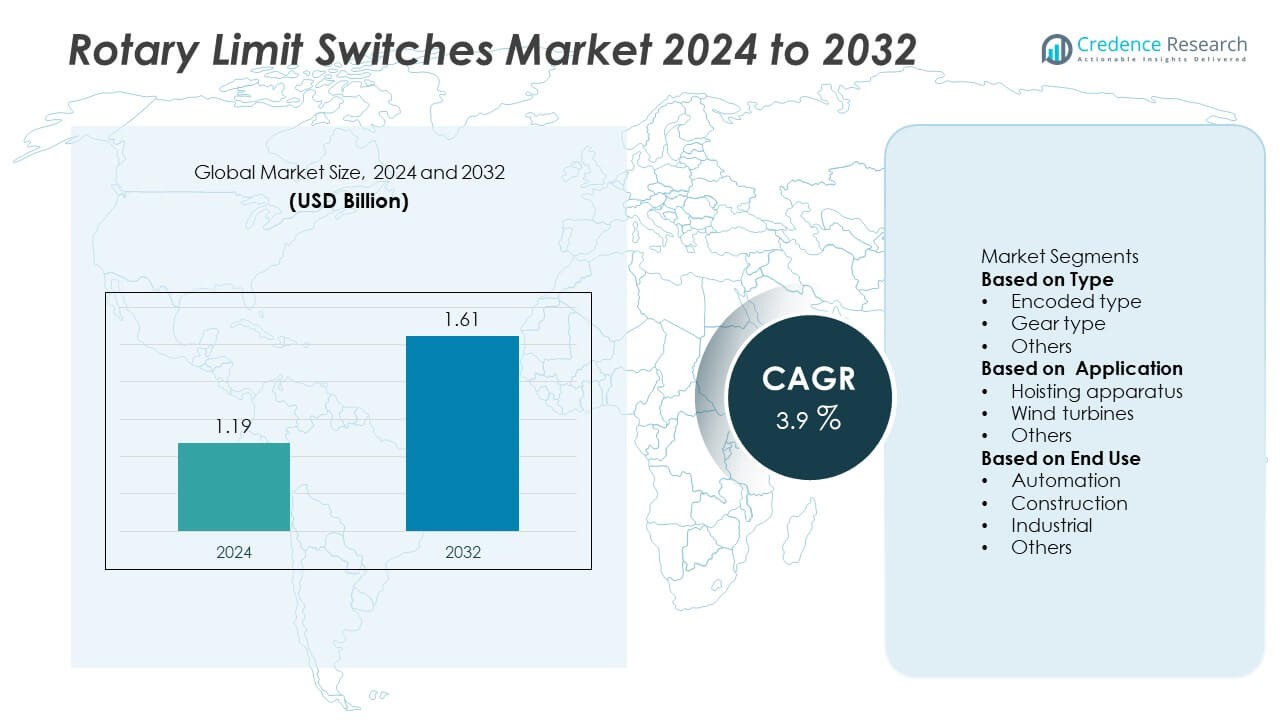

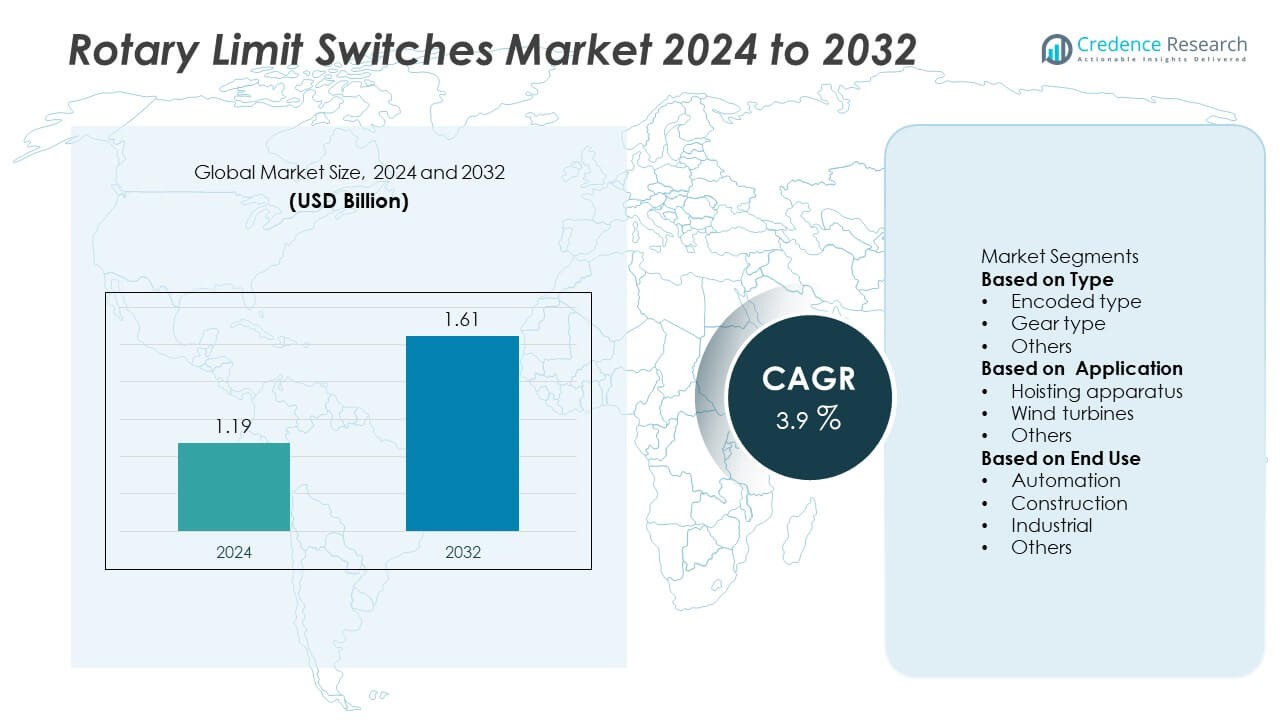

The Rotary Limit Switches market was valued at USD 1.19 billion in 2024 and is projected to reach USD 1.61 billion by 2032, growing at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rotary Limit Switches market Size 2024 |

USD 1.19 Billion |

| Rotary Limit Switches market , CAGR |

3.9% |

| Rotary Limit Switches market Size 2032 |

USD 1.61 Billion |

The rotary limit switches market is led by prominent companies such as Siemens AG, Omron Corporation, Honeywell International Inc., ABB Group, SICK AG, Eaton Corporation plc, Schneider Electric SE, Rockwell Automation Inc., Pepperl+Fuchs GmbH, and IFM Electronic GmbH. These players dominate through innovation in motion control technology, durable switch design, and integration with industrial automation systems. Asia-Pacific led the global market with a 31% share in 2024, supported by rapid industrialization and automation growth. North America followed with a 33% share, driven by advanced manufacturing and strong adoption of safety-compliant control systems across industrial and renewable energy sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The rotary limit switches market was valued at USD 1.19 billion in 2024 and is projected to reach USD 1.61 billion by 2032, growing at a CAGR of 3.9%.

- Growth is driven by increasing automation in industrial and construction sectors, alongside higher safety and performance standards in lifting and motion control systems.

- Smart rotary switches integrated with IoT sensors and digital feedback mechanisms are emerging as key trends, improving efficiency and predictive maintenance capabilities.

- The market is moderately competitive, with leading players such as Siemens, ABB, Honeywell, and Schneider Electric focusing on innovation, precision, and compliance with safety regulations.

- Regionally, North America held 33% of the market in 2024, while Asia-Pacific followed with 31%, supported by rapid industrial expansion and the strong presence of manufacturing hubs.

Market Segmentation Analysis:

By Type

The gear-type segment dominated the rotary limit switches market with a 54% share in 2024. This segment leads due to its precise motion control and high load-bearing capacity in heavy-duty applications. Gear-type switches are widely used in cranes, hoists, and industrial lifting systems for accurate position feedback. Their durability and compatibility with harsh environments enhance operational reliability. The encoded-type switches follow, supported by demand in automation systems requiring digital accuracy and signal precision, while the “others” category includes hybrid designs suited for specialized motion-control setups.

- For instance, Siemens AG developed the 3SE5 series rotary gear limit switch, engineered to endure over 20 million operating cycles in industrial cranes. The unit features modular cam assemblies that allow angular adjustments up to 360°, ensuring precise travel limits in heavy-duty lifting systems used across steel and port handling sectors.

By Application

The hoisting apparatus segment accounted for a 49% share of the rotary limit switches market in 2024. This dominance stems from rising use in material handling, elevators, and cranes to prevent over-travel and ensure operational safety. Manufacturers in the construction and logistics industries rely on these switches for consistent position monitoring and automatic stop control. The wind turbine segment is expanding rapidly as rotary limit switches support efficient blade pitch control and yaw system management, contributing to enhanced turbine reliability and performance in varied wind conditions.

- For instance, ABB Group supplied its ACS880 drive systems for industrial hoists and other demanding applications, utilizing Direct Torque Control (DTC) for precise speed and torque control. The integrated position control capabilities of the ACS880 allow for accurate and synchronized movements in applications like cranes and wind turbine pitch mechanisms.

By End Use

The industrial segment held the largest 42% share of the rotary limit switches market in 2024. This leadership is driven by automation across manufacturing, oil & gas, and marine applications requiring precise motion control. Industries employ these switches in conveyor systems, hoists, and robotics to enhance safety and equipment efficiency. The construction segment follows, supported by demand for durable limit switches in tower cranes and lifting machinery. Automation and “others” categories, including energy and transportation, continue to grow with the shift toward digitalized control systems and predictive maintenance solutions.

Key Growth Drivers

Rising Automation in Industrial and Construction Applications

The increasing automation in industrial and construction sectors is a major driver for rotary limit switches. These switches ensure safe operation and accurate motion control in cranes, conveyors, and hoists. As smart manufacturing and digital control systems expand, demand for reliable position feedback devices is rising. Industries prefer rotary limit switches for their precision, durability, and compatibility with PLC-based systems, improving productivity and safety across production and lifting operations.

- For instance, Schneider Electric’s XCKD series rotary limit switches are deployed in automated lifting systems, supporting mechanical endurance of at least 10 million operating cycles. Each switch integrates seamlessly with Modicon PLCs for precise feedback and is suitable for reducing downtime in industrial cranes and conveyors.

Expanding Renewable Energy Installations

Growing investment in renewable energy, particularly wind power, drives the adoption of rotary limit switches. These switches play a vital role in managing turbine yaw and blade pitch systems, improving efficiency and safety. As global wind power capacity surpasses 1,000 GW, the need for precise motion and position control continues to increase. Manufacturers are developing compact, weather-resistant switches for offshore and onshore turbines, aligning with the rising focus on sustainability and grid modernization.

- For instance, Pepperl+Fuchs provides robust absolute rotary encoders for wind turbines, such as those used for yaw control to ensure accurate nacelle alignment with the wind. These industrial sensors, including models with IP67 sealing, are engineered for demanding environments and long-term endurance.

Increasing Demand for Safety and Compliance Standards

Strict industrial safety and regulatory requirements are fueling the adoption of rotary limit switches. Industries such as mining, oil & gas, and construction increasingly rely on these switches to prevent accidents and ensure operational safety. Compliance with IEC and ISO safety standards encourages manufacturers to integrate robust, certified components into lifting and automation systems. This regulatory push enhances product reliability, reduces maintenance downtime, and supports consistent safety performance across critical applications.

Key Trends & Opportunities

Integration of Smart and Digital Monitoring Systems

A major trend shaping the market is the integration of IoT-enabled and sensor-based rotary limit switches. These smart switches enable real-time position monitoring, predictive maintenance, and remote diagnostics. Manufacturers are adopting digital encoders and communication interfaces for seamless integration with modern automation systems. This evolution supports Industry 4.0 adoption, improves operational visibility, and extends equipment life through early fault detection and automated control optimization.

- For instance, IFM Electronic GmbH introduced its smart rotary position sensors integrated with IO-Link communication, transmitting over 12-bit absolute position data per revolution. Each unit supports diagnostic feedback for temperature and operating cycles up to 100 million switch actions, improving predictive maintenance accuracy in automated production lines.

Rising Focus on Customization and Modular Designs

Manufacturers are increasingly offering modular rotary limit switch designs to meet varied industrial needs. Custom configurations with adjustable cams, different gear ratios, and compact enclosures are gaining traction. This flexibility enables end users to deploy switches across heavy-duty cranes, wind turbines, and automated assembly lines. The trend toward modularity enhances system compatibility, simplifies maintenance, and supports tailored installations for diverse motion control applications across sectors.

- For instance, Eaton Corporation launched its modular E50 series limit switch platform, featuring interchangeable actuator heads and gear modules configurable in 10-degree increments. Each assembly withstands over 30 million mechanical operations and supports torque loads up to 40 N·m, enabling reliable performance in cranes and industrial hoists.

Key Challenges

High Maintenance and Mechanical Wear Issues

Rotary limit switches, especially mechanical gear types, face wear and maintenance challenges due to continuous operation in demanding environments. Frequent exposure to vibration, dust, and high load can reduce performance and operational life. Downtime for repairs or replacement increases overall maintenance costs. Manufacturers are responding with sealed housings, advanced lubricants, and improved materials, but achieving long-term durability under extreme industrial conditions remains a significant challenge.

Limited Adoption in Fully Automated Digital Systems

The growing shift toward fully digital and non-contact sensing technologies limits the adoption of traditional rotary limit switches. Industries adopting proximity or optical sensors for position feedback see reduced demand for mechanical models. Integration challenges with high-speed automation systems and lack of compatibility with modern communication protocols further restrict usage. Manufacturers must innovate hybrid or digitally enhanced models to maintain relevance in next-generation industrial automation ecosystems.

Regional Analysis

North America

North America held a 33% share of the rotary limit switches market in 2024. The region’s dominance is supported by strong demand across industrial automation, material handling, and construction equipment sectors. The U.S. leads with extensive adoption of safety-compliant motion control systems in cranes and hoists. Growth in renewable energy installations, particularly wind farms in Texas and the Midwest, also boosts product deployment. Key manufacturers focus on integrating IoT-enabled switches and predictive maintenance solutions to enhance operational efficiency, reliability, and compliance with OSHA and ANSI industrial safety standards.

Europe

Europe accounted for a 29% share of the rotary limit switches market in 2024. The region benefits from advanced manufacturing and strict worker safety regulations driving automation investments. Germany, Italy, and the U.K. are major contributors, supported by the presence of leading industrial machinery and wind turbine manufacturers. Rotary limit switches are widely used in hoisting systems, automated assembly lines, and offshore wind projects. The EU’s focus on renewable energy and carbon reduction policies promotes adoption of precision control devices, ensuring reliability and sustainability in large-scale industrial operations.

Asia-Pacific

Asia-Pacific dominated the rotary limit switches market with a 31% share in 2024. Rapid industrialization, urban infrastructure projects, and manufacturing expansion across China, Japan, India, and South Korea drive market growth. The region’s strong presence in wind turbine and construction equipment production further accelerates adoption. Local manufacturers are enhancing cost-efficient and durable switches for diverse applications. Rising automation in automotive, logistics, and energy sectors, combined with government incentives for smart factories, positions Asia-Pacific as the fastest-growing region for rotary limit switch demand during the forecast period.

Middle East & Africa

The Middle East & Africa region held a 4% share of the rotary limit switches market in 2024. Market growth is driven by expanding oil & gas, construction, and mining sectors demanding robust and explosion-proof control devices. Countries like Saudi Arabia and the UAE are investing in large-scale infrastructure and renewable energy projects, supporting deployment of durable rotary limit switches. Increasing modernization of lifting and handling systems in industrial plants and ports enhances adoption, while local distributors strengthen product availability to meet diverse operational requirements.

Latin America

Latin America captured a 3% share of the rotary limit switches market in 2024. The region’s demand is supported by construction, mining, and renewable energy development in Brazil, Mexico, and Chile. Growing focus on workplace safety and machinery modernization encourages the use of limit switches in hoists, cranes, and conveyors. Manufacturers are targeting the region with cost-effective, weather-resistant models suitable for heavy-duty operations. Expansion of wind energy projects in Brazil and Mexico further drives adoption, while industrial automation initiatives enhance long-term market potential across Latin American economies.

Market Segmentations:

By Type

- Encoded type

- Gear type

- Others

By Application

- Hoisting apparatus

- Wind turbines

- Others

By End Use

- Automation

- Construction

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rotary limit switches market includes major players such as Siemens AG, Omron Corporation, Honeywell International Inc., ABB Group, SICK AG, Eaton Corporation plc, Schneider Electric SE, Rockwell Automation Inc., Pepperl+Fuchs GmbH, and IFM Electronic GmbH. These companies compete through product innovation, advanced automation integration, and durable designs tailored for industrial and construction applications. Global leaders emphasize precision control, safety compliance, and IoT-enabled switch systems to enhance operational efficiency. Many are investing in smart sensing technologies and modular configurations to address varied motion-control demands. Strategic partnerships and acquisitions strengthen their distribution networks and after-sales support, while regional manufacturers focus on cost optimization and customization. Collectively, these players drive the market toward digitalization, improved safety standards, and expanded applications across renewable energy, heavy machinery, and manufacturing sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Honeywell International Inc. announced the planned full separation of its Automation and Aerospace businesses, with the Automation segment-which includes its industrial switches and sensing solutions-targeted for completion in the second half of 2026.

- In 2025, Schneider Electric SE officially launched its Modicon Edge I/O NTS system at ProMat, designed for distributed IP20 I/O applications.

- In 2025, Schneider Electric SE unveiled upgraded rotary limit switches within its Telemecanique Sensors line, designed for modular architecture compatibility and improved sealing performance under harsh industrial environments.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by industrial automation expansion.

- Demand from wind energy applications will continue to rise with renewable investments.

- Smart rotary switches with IoT integration will gain wider adoption.

- Manufacturers will focus on compact, durable, and weather-resistant designs.

- Safety compliance and regulatory standards will strengthen product demand.

- Asia-Pacific will remain the fastest-growing regional market through the forecast period.

- Europe will benefit from modernization in manufacturing and renewable sectors.

- Technological partnerships will accelerate product innovation and customization.

- Digital monitoring and predictive maintenance features will enhance operational reliability.

- Competition will intensify as global players expand regional manufacturing capabilities.