Market Overview

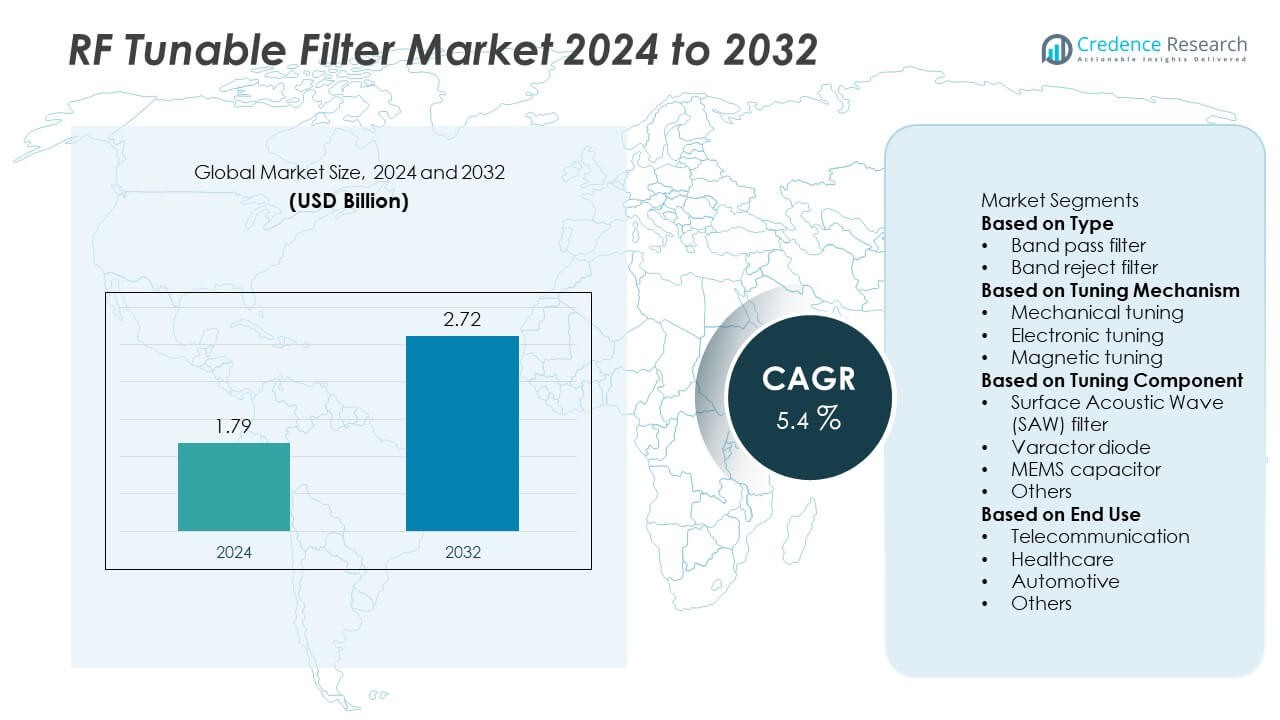

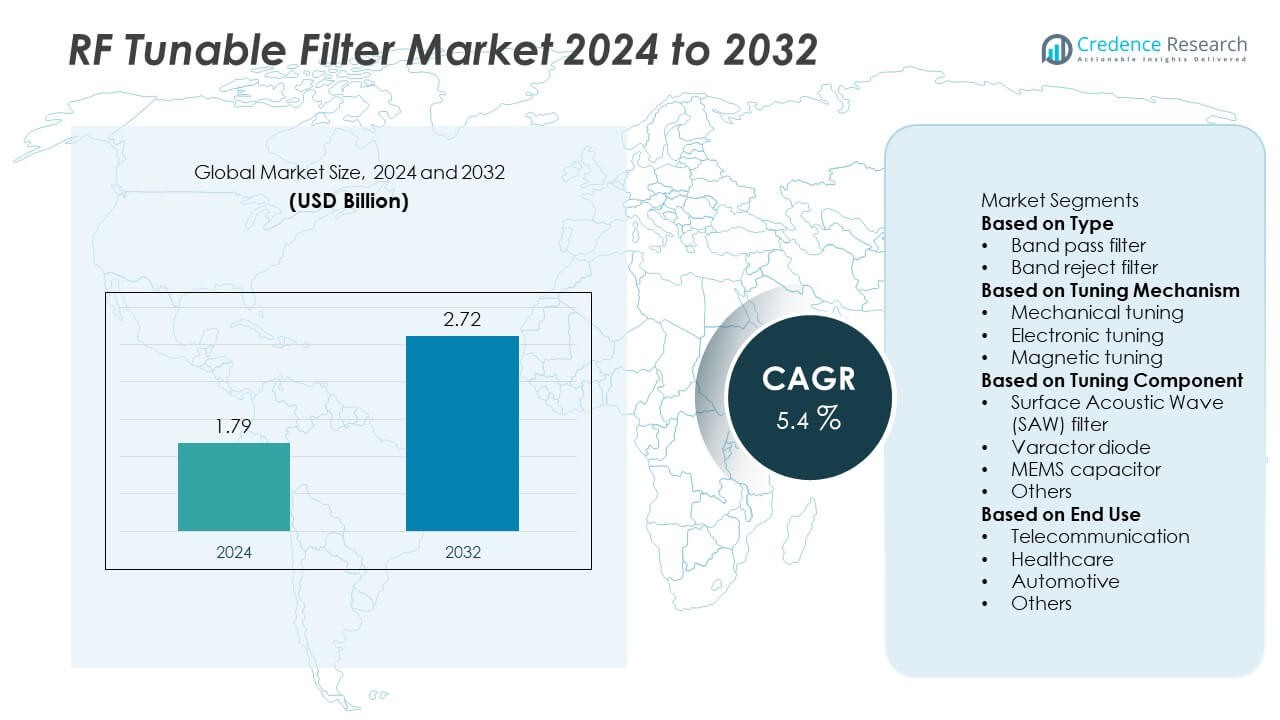

The RF Tunable Filter market was valued at USD 1.79 billion in 2024 and is projected to reach USD 2.72 billion by 2032, expanding at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RF Tunable Filter Market Size 2024 |

USD 1.79 Billion |

| RF Tunable Filter Market, CAGR |

5.4% |

| RF Tunable Filter Market Size 2032 |

USD 2.72 Billion |

The RF tunable filter market is led by major players such as Broadcom Inc., Analog Devices, Inc., Infineon Technologies AG, M/A-COM Technology Solutions Holdings, Inc., Mini-Circuits, Murata Manufacturing Co., Ltd., Skyworks Solutions, Inc., Pasternack Enterprises, Inc., and NEWEDGE SIGNAL SOLUTIONS INC. These companies dominate through strong product portfolios, advanced semiconductor integration, and extensive global distribution networks. North America led the market with a 37% share in 2024, driven by large-scale defense and 5G infrastructure investments. Europe followed with a 28% share, supported by aerospace modernization and telecom expansion, while Asia-Pacific accounted for 25%, fueled by rapid 5G rollout and increasing defense communication upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The RF tunable filter market was valued at USD 1.79 billion in 2024 and is projected to reach USD 2.72 billion by 2032, growing at a CAGR of 5.4%.

- Market growth is driven by rising adoption of 5G communication systems, increasing defense modernization, and expanding applications in radar, satellite, and wireless networks.

- Key trends include the integration of AI-based signal control, miniaturized MEMS filters, and electronic tuning mechanisms to enhance precision and reduce interference.

- The market is moderately consolidated, with major players such as Broadcom Inc., Analog Devices, and Infineon Technologies focusing on innovation, R&D, and strategic collaborations to strengthen product capabilities.

- North America led the market with a 37% share in 2024, followed by Europe with 28% and Asia-Pacific with 25%; among types, band pass filters held a 62% share due to their extensive use in communication and defense systems.

Market Segmentation Analysis:

By Type

The band pass filter segment dominated the RF tunable filter market with a 62% share in 2024. Its leadership is driven by the growing use of band pass filters in communication systems, radar, and electronic warfare for precise frequency selection and interference suppression. The ability to allow specific frequency ranges while attenuating unwanted signals enhances signal clarity in 5G and defense applications. Increasing deployment of advanced communication infrastructure and software-defined radios further supports demand for tunable band pass filters across military, aerospace, and commercial networks.

- For instance, Murata Manufacturing has developed and mass-produced tunable filters using a variety of technologies, including LTCC, for wireless communication modules, with research and products addressing a wide range of frequencies.

By Tuning Mechanism

The electronic tuning segment held the largest 54% share of the RF tunable filter market in 2024. This dominance is attributed to its fast response time, compact design, and suitability for high-frequency applications in modern communication and radar systems. Electronic tuning enables dynamic adjustment of frequency bands without mechanical movement, improving reliability and precision. Growing adoption in satellite communication and 5G base stations continues to drive segment growth. Moreover, advancements in semiconductor-based tuning components enhance scalability and energy efficiency in high-performance RF systems.

- For instance, Analog Devices, Inc. introduced the ADMV8818 digitally tunable filter covering 2 GHz to 18 GHz with a typical wideband rejection of 35 dB and a typical insertion loss of 9 dB for radar and EW systems.

By Tuning Component

Varactor diode-based filters accounted for a 46% share of the RF tunable filter market in 2024. The segment’s prominence arises from its ability to provide wide tuning ranges, low power consumption, and compact integration in RF front-end modules. These filters are widely utilized in defense, wireless communication, and test equipment for adaptive frequency control. Increasing adoption of varactor diodes in next-generation communication systems enhances overall system flexibility and performance. MEMS capacitors and surface acoustic wave filters follow, supported by miniaturization trends and demand for low-loss, high-speed signal processing.

Key Growth Drivers

Rising Demand for Advanced Communication Systems

The expansion of 5G networks and next-generation communication systems is a major growth driver for the RF tunable filter market. These filters enable precise frequency selection and interference suppression, essential for dynamic wireless communication. The shift toward real-time adaptive frequency control across commercial and defense networks strengthens their use. Increasing deployment of software-defined radios in telecommunications and military applications continues to enhance demand for high-performance tunable filters with broad frequency coverage and low signal distortion.

- For instance, Broadcom Inc. integrated FBAR filter technology into its Wi-Fi 7 FEM modules, which provides superior 5 GHz and 6 GHz band coexistence for dense network environments.

Growing Adoption in Defense and Aerospace Applications

Defense and aerospace sectors increasingly rely on tunable filters for radar, surveillance, and electronic warfare systems. Their ability to adapt to changing frequencies and counter signal interference enhances mission efficiency. Rising investments in military modernization and secure communication systems are supporting widespread adoption. Integration into advanced radar architectures and satellite communication equipment further drives growth, as these systems require robust filters capable of maintaining accuracy under varying environmental conditions.

- For instance, M/A-COM Technology Solutions launched the MASW-011107-DIE GaAs SPDT non-reflective switch, which provides greater than 40 dB isolation and is suitable for electronic warfare (EW) platforms.

Miniaturization and Integration of Tunable Components

The trend toward smaller, energy-efficient devices has encouraged innovation in tunable filter design. Manufacturers are integrating varactor diodes, MEMS capacitors, and SAW technologies to create compact, high-performance modules. These advancements improve signal precision and reduce power consumption, making them ideal for portable and space-constrained applications. As the demand for compact communication systems grows across defense, satellite, and IoT networks, miniaturized RF tunable filters are becoming critical for enabling multi-band and adaptive frequency operations.

Key Trends & Opportunities

Integration of AI and Digital Signal Control

Artificial intelligence and digital signal processing are reshaping the RF tunable filter market by enabling automated frequency tuning and optimization. AI-assisted filters can predict and adjust to changing signal environments, improving communication reliability. The adoption of software-controlled tunable modules enhances flexibility across 5G, radar, and satellite networks. These innovations create opportunities for advanced, intelligent RF front-end systems with faster response times and minimal manual calibration requirements.

- For instance, Murata Manufacturing Co., Ltd. announced in July 2025 the mass production of the world’s first high-frequency filter using XBAR technology for 5G, Wi-Fi 7, and future 6G networks. This filter addresses the limitations of traditional technologies by achieving low insertion loss, wide bandwidth, and high attenuation, especially at frequencies above 3 GHz.

Expansion of 5G and IoT Ecosystems

The rollout of 5G and the growth of IoT networks are generating strong opportunities for tunable filters. These technologies demand efficient frequency control and low-latency communication. Tunable filters play a vital role in dynamic spectrum management, reducing interference across shared frequency bands. As connected devices and smart infrastructure expand globally, tunable filters are becoming essential for maintaining seamless data transmission and optimal network performance in dense and variable signal environments.

- For instance, Skyworks Solutions, Inc. introduced Bulk Acoustic Wave (BAW) filters for Wi-Fi 7 applications that allow simultaneous operation across the full 5 GHz (5.170–5.895 GHz) and 6 GHz (5.945–7.125 GHz) bands for routers and other wireless devices.

Key Challenges

High Production and Integration Costs

Developing and manufacturing RF tunable filters with high precision and wide bandwidth remains costly. The integration of advanced materials and components, such as MEMS and varactor diodes, increases production expenses. Complex circuit design and testing requirements also limit scalability. These cost factors pose challenges for smaller manufacturers and slow adoption across price-sensitive markets, particularly in developing regions where infrastructure budgets remain constrained.

Technical Complexity and Signal Loss Issues

Maintaining signal integrity and tuning accuracy across broad frequency ranges presents significant engineering challenges. Tunable filters often face issues such as insertion loss, temperature instability, and limited linearity, especially at high frequencies. These factors can degrade performance in demanding environments like radar and satellite communication. Continuous R&D investment is required to overcome these challenges and develop tunable filters capable of providing stable and efficient operation under variable conditions.

Regional Analysis

North America

North America held the largest share of 37% in the RF tunable filter market in 2024. The dominance is driven by strong investments in defense, aerospace, and 5G infrastructure. The United States leads the regional demand, supported by large-scale radar, satellite communication, and electronic warfare programs. Growing deployment of advanced wireless networks and military modernization initiatives continues to enhance adoption. Major manufacturers are also focusing on R&D and component innovation to improve filter performance and scalability, further strengthening the region’s technological leadership in adaptive RF communication systems.

Europe

Europe accounted for a 28% share of the RF tunable filter market in 2024. The region benefits from growing adoption of defense communication systems, satellite technologies, and next-generation radar applications. Countries such as Germany, France, and the United Kingdom are investing in modernizing electronic warfare capabilities and air defense networks. European research programs focused on 5G spectrum optimization and RF component miniaturization are fueling regional innovation. Collaboration between public defense agencies and private manufacturers supports the integration of tunable filters into secure and high-frequency communication systems.

Asia-Pacific

Asia-Pacific captured a 25% share of the RF tunable filter market in 2024. The region’s growth is propelled by expanding telecommunications infrastructure, large-scale 5G rollouts, and rising defense spending in China, India, Japan, and South Korea. Increasing demand for adaptive frequency control in mobile networks and aerospace systems strengthens market presence. Local manufacturers are investing in MEMS-based tunable filters and compact RF modules to support domestic production. Government-backed initiatives to enhance communication security and self-reliance in defense technologies continue to stimulate market expansion across Asia-Pacific economies.

Middle East & Africa

The Middle East & Africa region accounted for a 6% share of the RF tunable filter market in 2024. The market is supported by defense modernization efforts and growing investments in radar and satellite communication systems. Countries such as Saudi Arabia, Israel, and the United Arab Emirates are deploying advanced signal processing and surveillance solutions. The region’s emphasis on strengthening air defense and cross-border communication infrastructure fuels adoption. Collaborations with global defense contractors are further accelerating the integration of tunable filters in high-performance electronic systems.

Latin America

Latin America represented a 4% share of the RF tunable filter market in 2024. The region is witnessing gradual adoption of tunable filters in telecommunications, defense, and satellite systems. Brazil leads demand with expanding aerospace programs and enhanced investment in 5G network deployment. Regional governments are prioritizing upgrades to communication security and military radar capabilities. Partnerships with international equipment suppliers are supporting technology transfer and local manufacturing. The growing shift toward advanced wireless connectivity and signal management is expected to sustain steady market growth in the region.

Market Segmentations:

By Type

- Band pass filter

- Band reject filter

By Tuning Mechanism

- Mechanical tuning

- Electronic tuning

- Magnetic tuning

By Tuning Component

- Surface Acoustic Wave (SAW) filter

- Varactor diode

- MEMS capacitor

- Others

By End Use

- Telecommunication

- Healthcare

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the RF tunable filter market includes key players such as Broadcom Inc., Analog Devices, Inc., Infineon Technologies AG, M/A-COM Technology Solutions Holdings, Inc., Mini-Circuits, Murata Manufacturing Co., Ltd., Skyworks Solutions, Inc., Pasternack Enterprises, Inc., and NEWEDGE SIGNAL SOLUTIONS INC. These companies compete through innovation, high-frequency product design, and integration of advanced semiconductor technologies. Leading manufacturers are focusing on compact, low-loss, and wideband tunable filters to support next-generation 5G and radar applications. Strategic partnerships with defense and telecommunication organizations help expand market reach and strengthen technological capabilities. Continuous investment in R&D enables the development of MEMS-based and varactor-diode filters with enhanced frequency agility and signal precision. The market remains moderately consolidated, with top players emphasizing product customization, mass production efficiency, and reliable performance to cater to growing demand from communication, aerospace, and electronic warfare applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis

- Broadcom Inc.

- Mini-Circuits

- Murata Manufacturing Co., Ltd.

- Analog Devices, Inc.

- Pasternack Enterprises, Inc.

- Infineon Technologies AG

- Skyworks Solutions, Inc.

- NEWEDGE SIGNAL SOLUTIONS INC.

- M/A-COM Technology Solutions Holdings, Inc.

- Smiths Interconnect

Recent Developments

- In August 2025, Analog Devices, Inc. expanded its range of tunable filters to include programmable variable gain amplifiers (VGAs), low-pass harmonic, band-pass, and band-reject models tailored for communications, instrumentation, and defense sectors.

- In July 2025, Murata Manufacturing Co., Ltd. introduced its first high-frequency XBAR (X-coupled Bulk Acoustic Resonator) filter for next-generation wireless networks, enhancing the performance of tunable RF modules by improving frequency selectivity and insertion efficiency.

- In 2025, Broadcom Inc. continued strengthening its RF tunable filter portfolio for 5G infrastructure and mobile devices, focusing on scalable solutions featuring enhanced miniaturization and higher frequency precision.

- In 2025, Skyworks Solutions, Inc. announced the expanded Wi-Fi 7 portfolio featuring full-band filters that cover full 5 GHz and 6 GHz bands with simultaneous transmit/receive capability.

Report Coverage

The research report offers an in-depth analysis based on Type, Tuning Mechanism, Tuning Component, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for RF tunable filters will grow with the expansion of 5G and next-generation communication networks.

- Defense and aerospace sectors will continue to adopt tunable filters for radar and secure communication systems.

- Integration of AI and machine learning will enhance automatic frequency tuning and signal optimization.

- Miniaturized and MEMS-based filters will gain traction for compact and portable devices.

- Manufacturers will invest in low-loss and wideband tunable filters for high-frequency applications.

- Collaboration between telecom operators and semiconductor firms will drive product innovation.

- Increased use of tunable filters in satellite and space communication will boost market adoption.

- Electronic tuning technology will dominate as demand for faster and more efficient filters rises.

- Asia-Pacific will emerge as a key growth hub due to expanding 5G infrastructure and defense investments.

- Ongoing R&D in high-performance materials will improve filter reliability and energy efficiency.