Market Overview

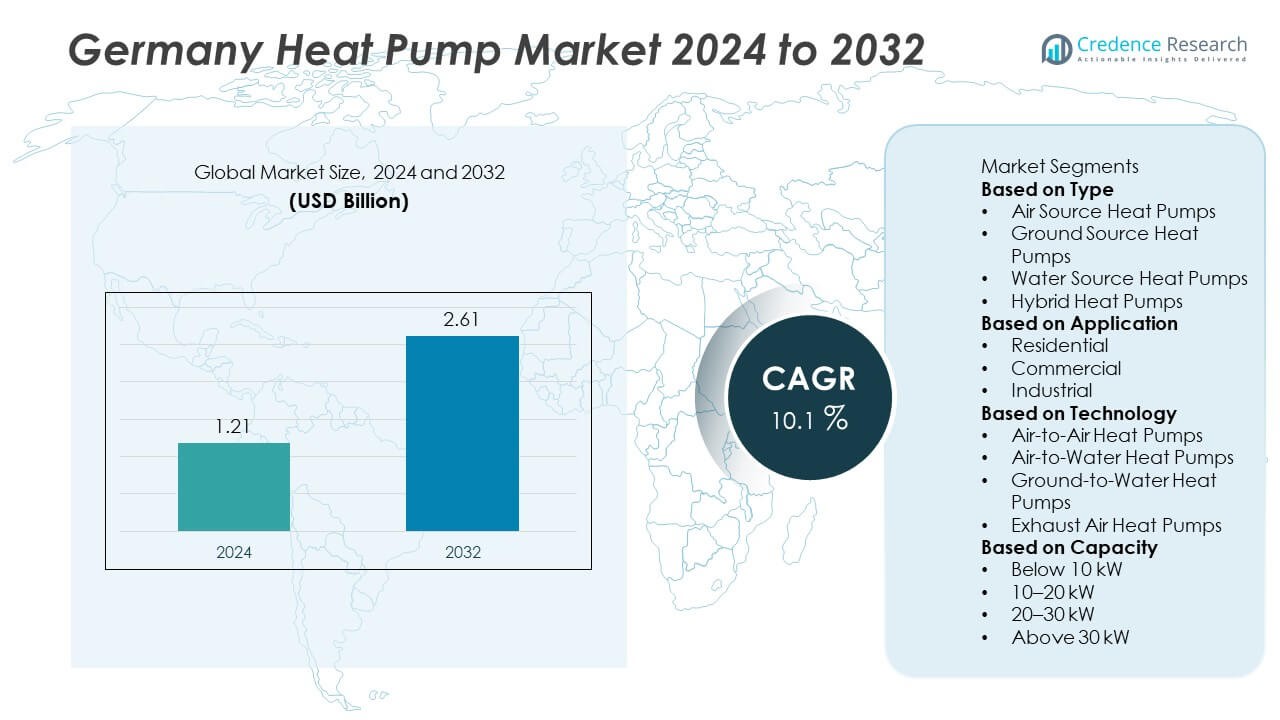

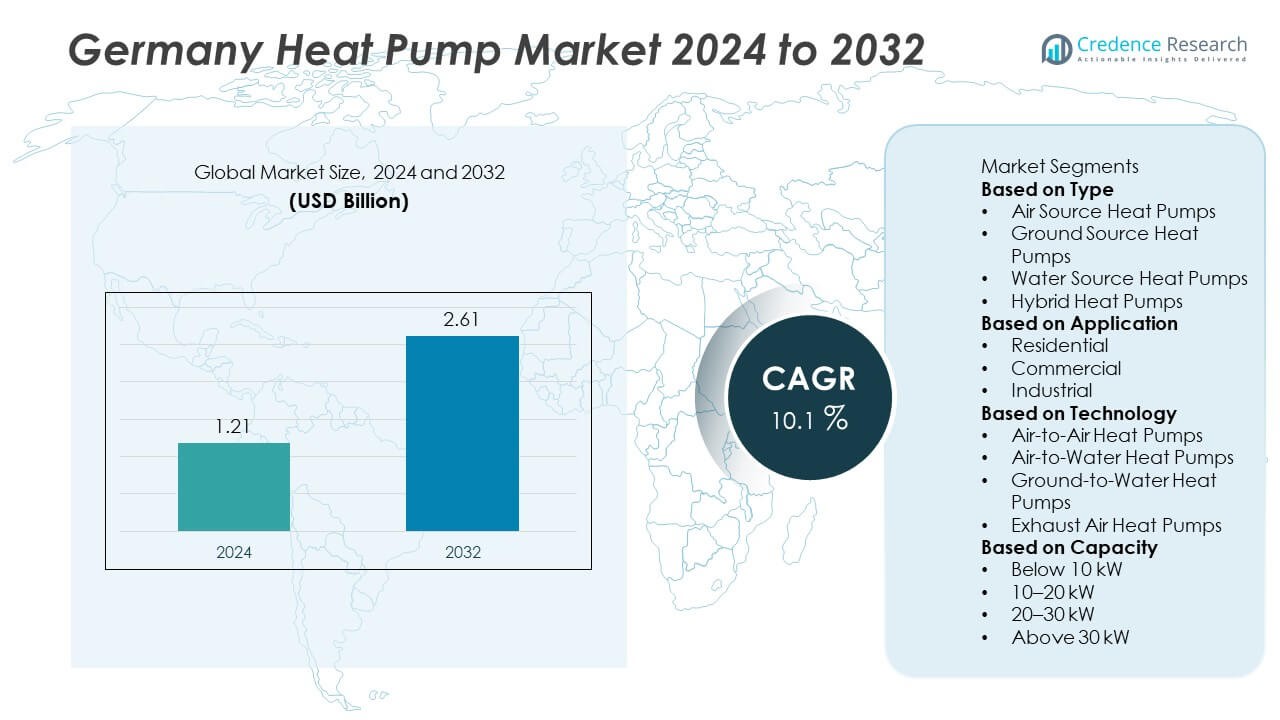

The Germany Heat Pump Market was valued at USD 1.21 billion in 2024 and is projected to reach USD 2.61 billion by 2032, growing at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Heat Pump Market Size 2024 |

USD 1.21 Billion |

| Germany Heat Pump Market, CAGR |

10.1% |

| Germany Heat Pump Market Size 2032 |

USD 2.61 Billion |

The Germany Heat Pump Market is led by key players including Stiebel Eltron GmbH & Co. KG, Vaillant Group, Bosch Thermotechnik GmbH, Viessmann Climate Solutions SE, NIBE Energy Systems, Mitsubishi Electric Corporation, Daikin Europe N.V., Glen Dimplex Deutschland GmbH, Alpha-InnoTec GmbH, and Wolf GmbH. These companies focus on developing energy-efficient, low-carbon heating technologies that align with Germany’s climate-neutral goals. Northern Germany dominated the market with a 34% share in 2024, driven by residential retrofitting projects and renewable heating incentives. Southern Germany followed with 28% share, supported by large-scale installations in industrial and commercial sectors adopting hybrid and geothermal heat pump systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Heat Pump Market was valued at USD 1.21 billion in 2024 and is projected to reach USD 2.61 billion by 2032, growing at a CAGR of 10.1%.

- Growth is driven by government incentives under Germany’s Energy Efficiency Strategy and rising demand for renewable-based heating in residential buildings.

- Hybrid and air-source heat pumps are trending due to their cost-effectiveness, flexibility, and easy integration with existing systems.

- Major players such as Stiebel Eltron, Vaillant, and Bosch Thermotechnik are investing in smart control technologies and eco-friendly refrigerants to strengthen market presence.

- Northern Germany led with 34% share in 2024, followed by Southern Germany (28%) and Western Germany (23%), while the air-source heat pump segment dominated with 46% share due to strong adoption in residential retrofitting projects.

Market Segmentation Analysis:

By Type

Air source heat pumps dominated the Germany Heat Pump Market with a 61% share in 2024. Their popularity stems from low installation costs, ease of integration, and high efficiency in moderate climates. Government incentives under the Federal Funding for Efficient Buildings (BEG) and the Renewable Energy Heat Act (EEWärmeG) further encourage adoption. These systems are widely used in both new constructions and retrofits, contributing significantly to the country’s decarbonization goals. Ground source and hybrid heat pumps are gaining traction as alternatives for higher efficiency and large-scale building applications.

- For instance, Viessmann introduced the Vitocal 250-A air source heat pump, which utilizes a natural R290 refrigerant and inverter technology to deliver efficient heating. Depending on the specific model and operating conditions, it can achieve a high coefficient of performance (COP) and is available with a range of heating outputs.

By Application

The residential segment held a 57% share in 2024, making it the leading application area in the Germany Heat Pump Market. Demand is driven by the rising replacement of gas and oil heating systems with sustainable options. Supportive policies, such as tax rebates and grants under Germany’s Climate Action Program, are accelerating adoption in single-family and multi-unit homes. Homeowners prefer air-to-water systems for space heating and domestic hot water generation. The commercial and industrial segments are expanding due to efficiency mandates in public buildings and manufacturing facilities.

- For instance, the Stiebel Eltron Group has seen a significant increase in heat pump sales, contributing to its turnover exceeding €1 billion for the first time. The company is a key player in Germany’s energy transition, a sector where heat pumps are crucial for reducing CO₂ emissions.

By Technology

Air-to-water heat pumps led the Germany Heat Pump Market with a 54% share in 2024. Their dominance is attributed to their suitability for heating, cooling, and hot water supply across residential and commercial sectors. The technology supports efficient operation even at low ambient temperatures and aligns with Germany’s push for renewable-based heating systems. Ground-to-water heat pumps follow closely, favored for high energy efficiency in larger buildings. Advancements in inverter technology and R-32 refrigerants continue to improve performance, while exhaust air systems gain interest in multi-family buildings focused on energy recovery.

Key Growth Drivers

Government Incentives and Decarbonization Targets

Germany’s strong climate policies and renewable energy mandates are major growth drivers for the heat pump market. The Federal Climate Action Plan 2045 and BEG subsidy programs promote energy-efficient heating to reduce CO₂ emissions. Subsidies covering up to 40% of installation costs have significantly boosted residential adoption. These initiatives align with Germany’s goal to phase out fossil-fuel heating systems and achieve net-zero emissions. As a result, demand for modern air and ground source heat pumps continues to rise nationwide.

- For instance, Bosch is a significant manufacturer of heat pumps, and models like the Compress 7800i air-to-water heat pump operate with high Coefficients of Performance (COP). The German government’s Building Energy Act (BEG) incentivizes the installation of efficient heat pumps.

Rising Residential Retrofits and Construction Activity

Growing renovation of older buildings and expansion of residential construction are fueling heat pump demand. Consumers are replacing gas and oil systems with eco-friendly heating technologies. The market benefits from higher energy prices, which push homeowners toward long-term cost-efficient solutions. The increasing availability of compact, hybrid, and inverter-based systems enhances installation flexibility. This surge in home modernization aligns with national targets for energy-efficient housing and green building certification.

- For instance, the Vaillant Group manufactures the aroTHERM plus heat pump, which is suitable for retrofit homes and available in a 12 kW heating output model using the natural refrigerant R290. The system is highly efficient, with a maximum seasonal coefficient of performance (SCOP) up to 5.03, and contributes to carbon reduction compared to fossil fuel heating systems.

Technological Advancements in Efficiency and Smart Controls

Innovation in compressor technology, refrigerants, and digital monitoring systems is improving heat pump performance. Advanced models using low-GWP refrigerants and inverter-driven compressors enhance energy savings while complying with EU environmental standards. Integration of IoT and smart thermostats allows real-time energy management, reducing operating costs. Manufacturers are developing hybrid systems combining renewable and electric heat sources for higher efficiency. These technological improvements strengthen Germany’s position as a leading market for sustainable heating solutions in Europe.

Key Trends & Opportunities

Integration with Renewable Energy Systems

The integration of heat pumps with solar PV systems and energy storage is becoming a key trend in Germany. Homeowners and businesses are adopting hybrid solutions to optimize self-consumption of renewable electricity. This integration supports Germany’s goal of decarbonizing the heating sector while reducing dependence on fossil fuels. The shift toward smart energy homes and district heating networks provides opportunities for energy service companies and utilities to expand into integrated heating solutions.

- For instance, SMA offers energy management systems, like the Sunny Home Manager 2.0, that can integrate with heat pumps from manufacturers such as Stiebel Eltron. These systems use battery storage and smart controls, including self-learning algorithms, to optimize the use of self-generated solar power.

Growing Focus on Commercial and Industrial Applications

While residential installations dominate, the commercial and industrial sectors are emerging as new growth areas. Factories, offices, and public institutions are adopting large-capacity and water-source heat pumps to meet sustainability mandates. Government support for industrial decarbonization and waste heat recovery systems drives this trend. Manufacturers are developing high-temperature heat pumps capable of replacing traditional boilers in process heating. This shift opens significant opportunities for system integrators and energy service providers.

- For instance, MAN Energy Solutions installed a 7 MW high-temperature heat pump at the Esbjerg district heating plant, capable of producing hot water up to 150 °C while reducing CO₂ emissions by 100,000 tons annually. The system utilizes industrial waste heat from nearby facilities, showcasing scalable application of large-capacity heat pump technology in industrial operations.

Key Challenges

High Upfront Installation and System Costs

Despite long-term savings, high initial costs for heat pump installation remain a challenge for many consumers. Complex retrofitting in older buildings and the need for insulation upgrades increase total expenses. Although government subsidies offset part of the cost, budget constraints in low-income households limit adoption. Manufacturers and installers are focusing on modular, cost-efficient designs to enhance affordability. Financing solutions and rental models could further accelerate market penetration in coming years.

Skilled Labor Shortage and Installation Delays

The growing demand for heat pumps has exposed a shortage of trained HVAC technicians in Germany. Limited workforce availability has led to installation delays and higher labor costs. The shortage also affects quality control and maintenance efficiency in large-scale projects. Industry associations and training institutes are collaborating to expand vocational programs and certifications. Addressing this labor gap is essential for maintaining installation pace and supporting Germany’s energy transition targets.

Regional Analysis

Northern Germany

Northern Germany held a 26% share of the Germany Heat Pump Market in 2024. The region benefits from high adoption in residential and commercial buildings, driven by supportive municipal energy policies. Coastal areas such as Hamburg and Schleswig-Holstein promote heat pump installations as part of renewable energy integration with wind and solar power. Cold climate suitability of air-to-water and ground source systems further drives installations. Government-funded retrofitting programs and strong infrastructure development contribute to consistent demand growth in both urban and suburban housing sectors.

Southern Germany

Southern Germany accounted for 34% of the market share in 2024, making it the leading regional segment. Bavaria and Baden-Württemberg are key contributors, driven by strong green energy initiatives and extensive use of geothermal resources. The region’s high residential renovation rate and presence of premium housing projects support the widespread adoption of advanced air and ground source heat pumps. Manufacturers and installers are also concentrated in this region, ensuring faster technological adoption. Local subsidies promoting renewable heating technologies continue to strengthen Southern Germany’s leadership in the national heat pump market.

Western Germany

Western Germany represented a 25% share of the market in 2024, supported by growing deployment across industrial and commercial facilities. North Rhine-Westphalia, the country’s industrial hub, leads adoption for process heating and office buildings. Government incentives and corporate sustainability goals have encouraged retrofitting projects in commercial complexes and logistics centers. The strong focus on carbon reduction and modernization of heating infrastructure across major cities like Cologne and Düsseldorf drives further growth. Energy service companies are increasingly investing in hybrid and large-scale systems to cater to regional industrial energy requirements.

Eastern Germany

Eastern Germany captured a 15% share of the Germany Heat Pump Market in 2024. Market growth is driven by government-backed residential modernization programs and renewable energy initiatives in states such as Saxony and Brandenburg. The region is witnessing rising installations of air-source and hybrid systems due to expanding housing construction and urban redevelopment. Improved affordability through national subsidy schemes is encouraging heat pump adoption among homeowners. However, slower economic development compared to western regions and limited skilled workforce availability remain key barriers, though investments in regional energy transition projects continue to rise.

Market Segmentations:

By Type

- Air Source Heat Pumps

- Ground Source Heat Pumps

- Water Source Heat Pumps

- Hybrid Heat Pumps

By Application

- Residential

- Commercial

- Industrial

By Technology

- Air-to-Air Heat Pumps

- Air-to-Water Heat Pumps

- Ground-to-Water Heat Pumps

- Exhaust Air Heat Pumps

By Capacity

- Below 10 kW

- 10–20 kW

- 20–30 kW

- Above 30 kW

By Geography

- Northern Germany

- Southern Germany

- Western Germany

- Eastern Germany

Competitive Landscape

Competitive landscape analysis of the Germany Heat Pump Market features major players such as Stiebel Eltron GmbH & Co. KG, Vaillant Group, Bosch Thermotechnik GmbH, Viessmann Climate Solutions SE, NIBE Energy Systems, Mitsubishi Electric Corporation, Daikin Europe N.V., Glen Dimplex Deutschland GmbH, Alpha-InnoTec GmbH, and Wolf GmbH. These companies focus on product innovation, sustainable technology, and expanding their domestic manufacturing capacities to meet rising demand. Market leaders are prioritizing the development of hybrid and air-to-water heat pumps that align with Germany’s energy transition goals. Strategic collaborations with construction firms and renewable energy providers are enhancing distribution and installation capabilities. European players emphasize energy efficiency, low-carbon technologies, and compliance with national regulations, while foreign companies strengthen their market presence through localized production. Continuous R&D investments, digital control integration, and government support for decarbonized heating solutions are shaping competition across the German heat pump industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stiebel Eltron GmbH & Co. KG

- Vaillant Group

- Bosch Thermotechnik GmbH

- Viessmann Climate Solutions SE

- NIBE Energy Systems

- Mitsubishi Electric Corporation

- Daikin Europe N.V.

- Glen Dimplex Deutschland GmbH

- Alpha-InnoTec GmbH

- Wolf GmbH

Recent Developments

- In April 2025, Viessmann Climate Solutions SE, launched new residential air-to-water heat-pump families (Vitocal 250 and Vitocal 150) and highlighted smart factory/production improvements to scale heat-pump output.

- In March 2025, Vaillant Group, presented its next-generation residential heat-pump solutions (new aroTHERM family / new safety & system concepts) and digital services at ISH 2025.

- In February 2025, Bosch Thermotechnik GmbH, launched its new IDS family of heat pumps (low-GWP refrigerant models) and has continued investing to expand European heat-pump manufacturing/development capacity.

- In August 2024, Stiebel Eltron GmbH & Co. KG reported a slowdown that led to cut jobs and also confirmed state support/funding while continuing product investment (coverage of workforce changes and funding).

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for heat pumps will rise as Germany accelerates its clean energy transition.

- Air-source heat pumps will remain the most adopted type for residential retrofits.

- Hybrid heat pumps will gain traction due to compatibility with gas and solar systems.

- Government subsidies and tax incentives will continue to boost household adoption.

- Technological innovations will enhance system efficiency and reduce energy consumption.

- Manufacturers will focus on low-GWP refrigerants to meet EU environmental targets.

- Smart and connected heat pump systems will see rapid integration in new buildings.

- Commercial and industrial applications will expand with the growth of district heating networks.

- Northern and Southern Germany will remain key markets due to supportive regional policies.

- Continuous investment in R&D and local manufacturing will strengthen domestic production capacity.