Market Overview

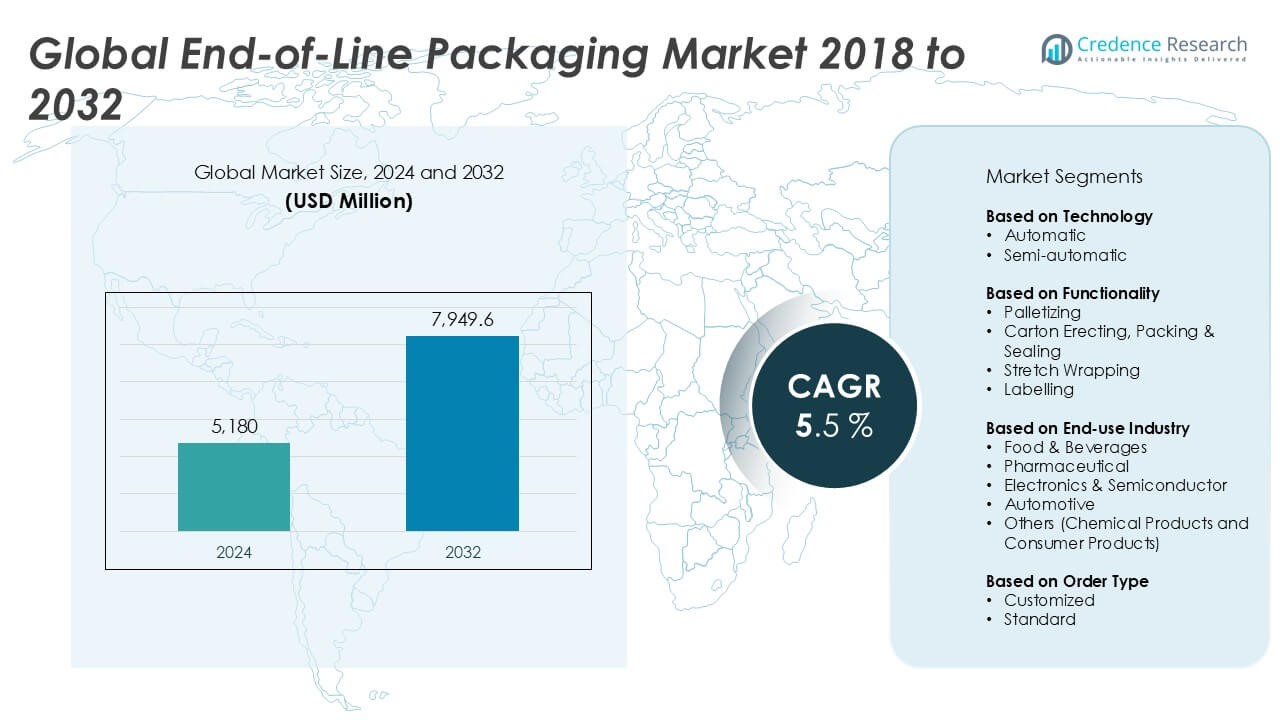

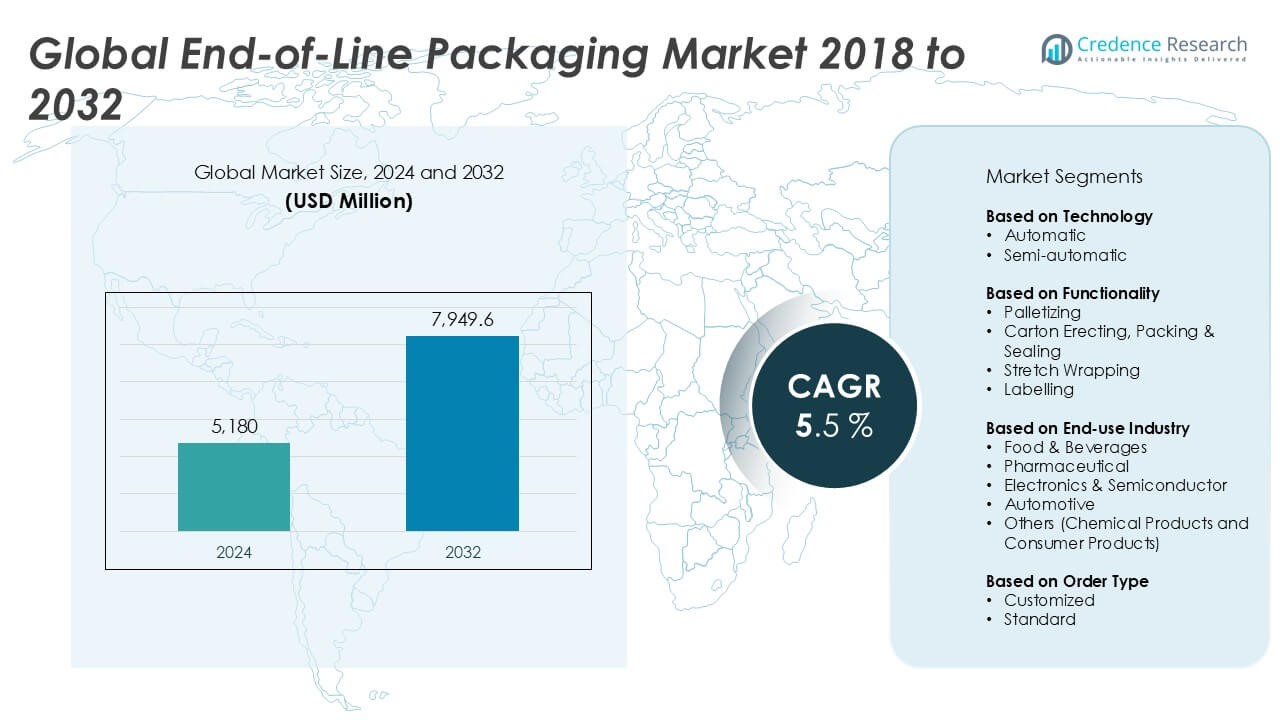

The End-of-Line Packaging market size was valued at USD 5,180 million in 2024 and is anticipated to reach USD 7,949.6 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| End-of-Line Packaging Market Size 2024 |

USD 5,180 Million |

| End-of-Line Packaging Market, CAGR |

5.5% |

| End-of-Line Packaging Market Size 2032 |

USD 7,949.6 Million |

The End-of-Line Packaging market is led by prominent players such as Krones AG, Bosch Packaging Technology, IMA S.p.A, DS Smith plc., Pro Mach Inc., BluePrint Automation, and Schneider Packaging Equipment Co. Inc., each offering technologically advanced and industry-specific packaging solutions. These companies focus on automation, sustainability, and integration with smart manufacturing systems to maintain a competitive edge. Asia Pacific emerged as the leading region in 2024, accounting for over 32% of the global market share, driven by rapid industrialization, expanding manufacturing sectors, and strong demand in consumer goods and e-commerce. North America and Europe follow, supported by established industrial bases and early adoption of automation technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The End-of-Line Packaging market was valued at USD 5,180 million in 2024 and is projected to reach USD 7,949.6 million by 2032, growing at a CAGR of 5.5% during the forecast period.

- Rising automation in manufacturing and increasing demand for operational efficiency are key drivers boosting the adoption of advanced end-of-line packaging solutions across food & beverages, pharmaceuticals, and electronics sectors.

- Trends such as the integration of smart technologies, IoT-enabled systems, and sustainable packaging machinery are reshaping the market, offering enhanced productivity and compliance with environmental standards.

- The market is moderately consolidated, with major players like Krones AG, Bosch Packaging Technology, and DS Smith plc. competing through innovation, geographic expansion, and customized solutions; however, high initial investment costs act as a restraint for smaller manufacturers.

- Asia Pacific led the market with over 32% share in 2024, followed by North America at 28%, while automatic systems held the largest segment share at over 65%.

Market Segmentation Analysis:

By Type

The End-of-Line Packaging market is segmented into automatic and semi-automatic technologies, with automatic systems dominating the segment by accounting for over 65% of the market share in 2024. This dominance is driven by increasing demand for production efficiency, labor cost reduction, and improved operational consistency. Automatic systems are widely adopted in large-scale manufacturing due to their ability to streamline packaging processes, reduce downtime, and handle high-volume outputs. Additionally, ongoing advancements in robotics and machine learning technologies are further enhancing the performance and appeal of fully automated packaging lines across various industries.

- For instance, Krones AG has integrated its automatic Variopac Pro machine in beverage production lines, which enables up to 60 cycles per minute in shrink-packing operations, enhancing high-speed automation for bottling plants.

By Functionality:

Among the key functionalities, palletizing emerged as the dominant sub-segment, capturing approximately 38% of the market share in 2024. The growth in palletizing demand is attributed to the need for improved handling, storage, and shipment efficiency, particularly in high-throughput industries. Moreover, automation in palletizing helps minimize labor-intensive tasks and enhances workplace safety. Other functionalities like carton erecting, packing & sealing, stretch wrapping, and labelling are also gaining traction, supported by increasing packaging complexity and regulatory emphasis on accurate product identification and secure sealing.

- For instance, Festo Group offers a high-speed robotic palletizing system capable of handling up to 120 pallets per hour, improving output in logistics-intensive sectors.

By End-use Industry:

In terms of end-use industries, the food & beverages segment led the market, holding over 40% of the total share in 2024. The dominance of this segment is fueled by rising global food demand, stringent hygiene standards, and a growing need for packaging flexibility to accommodate diverse product types. The pharmaceutical industry follows closely, driven by regulatory compliance and the need for tamper-evident and traceable packaging. Electronics, semiconductors, automotive, and other sectors such as chemical and consumer products are steadily adopting end-of-line packaging solutions to enhance product protection, improve packaging speed, and ensure supply chain efficiency.

Key Growth Drivers

Rising Automation in Manufacturing Operations

The increasing adoption of automation in manufacturing is a major driver for the End-of-Line Packaging market. Manufacturers across industries such as food & beverages, pharmaceuticals, and electronics are investing in automated packaging lines to enhance efficiency, reduce labor costs, and improve output consistency. Automatic end-of-line systems enable faster processing, real-time data monitoring, and improved quality control, making them essential for high-volume operations. As industries move towards smart factories and Industry 4.0 integration, demand for automated packaging solutions is expected to accelerate significantly.

- For instance, Schneider Packaging Equipment Co. Inc. installed robotic case packers in a U.S.-based dairy facility that resulted in a 40% increase in throughput, cutting manual handling by more than 25,000 cases per week.

Demand for Operational Efficiency and Cost Reduction

Businesses are increasingly seeking ways to streamline operations and reduce production costs, which is propelling the demand for end-of-line packaging solutions. These systems help minimize human errors, reduce downtime, and optimize floor space utilization. By automating repetitive tasks such as palletizing, sealing, and labeling, manufacturers can achieve greater consistency and faster throughput. This operational efficiency translates into lower long-term costs and improved return on investment, making end-of-line packaging systems a strategic priority for companies operating in competitive and high-margin sectors.

- For instance, BluePrint Automation deployed a compact end-of-line packaging system for a snack food producer that enabled the handling of up to 150 bags per minute, reducing packaging-related labor costs by 30%.

Growth in Packaged Goods and E-commerce Sectors

The global surge in consumption of packaged goods, fueled by changing lifestyles and growing e-commerce activity, has significantly boosted the demand for efficient end-of-line packaging systems. These systems play a critical role in ensuring product integrity during storage and transit, which is crucial for e-commerce and retail logistics. Additionally, the need for rapid order fulfillment and accurate labeling in online retail creates demand for advanced packaging technologies. The expanding distribution networks and increasing global trade are further reinforcing the necessity of robust end-of-line packaging infrastructure.

Key Trends & Opportunities

Integration of Smart and IoT-Enabled Packaging Systems

The incorporation of smart technologies and IoT-enabled solutions into end-of-line packaging is a rising trend, offering enhanced control and real-time monitoring capabilities. These systems provide predictive maintenance alerts, machine performance data, and remote diagnostics, leading to reduced downtime and optimized efficiency. With the growing push towards digital transformation, smart packaging solutions are becoming integral to intelligent supply chains. This trend presents opportunities for manufacturers to offer connected, adaptive systems that cater to the evolving needs of industries seeking digital visibility and traceability in operations.

- For instance, Bosch Packaging Technology offers its Industry 4.0-ready HMI 4.0 interface, which logs over 500 real-time performance parameters per minute, providing advanced diagnostics and predictive maintenance tools for continuous uptime.

Sustainable and Energy-Efficient Packaging Solutions

Sustainability is becoming a key focus in the packaging industry, driving innovation in energy-efficient and eco-friendly end-of-line solutions. Manufacturers are increasingly developing systems that support recyclable materials, reduce energy consumption, and minimize waste. The adoption of low-energy palletizers and systems compatible with biodegradable packaging materials aligns with global environmental goals and government regulations. This trend opens up new opportunities for companies offering green packaging technologies and helps businesses enhance their sustainability credentials while maintaining operational performance.

- For instance, IMA S.p.A introduced its Eco-Labelling end-of-line solution, which reduces energy use by 28% per production cycle and supports the application of FSC-certified paper labels in compliance with EU sustainability regulations.

Key Challenges

High Initial Investment and Integration Costs

One of the major challenges in the End-of-Line Packaging market is the high capital investment required for automation and system integration. Small and medium enterprises (SMEs), in particular, may find it difficult to justify or afford the upfront costs of implementing fully automated packaging lines. Additionally, retrofitting existing facilities with new technologies may lead to operational disruptions and added expenditure. Despite long-term cost benefits, the initial financial burden remains a barrier for broader adoption across smaller businesses.

Complexity in System Customization and Compatibility

Tailoring end-of-line packaging systems to meet specific production requirements can be complex and time-consuming. Variability in product sizes, materials, and throughput needs across different industries often necessitates customized solutions, which increases design and installation complexity. Moreover, integrating these systems with existing manufacturing infrastructure and software platforms can pose compatibility issues. Ensuring seamless communication among diverse hardware and software systems requires technical expertise and poses challenges, particularly for companies with legacy equipment.

Workforce Skill Gaps and Maintenance Challenges

As end-of-line packaging systems become more technologically advanced, there is a growing need for skilled personnel to operate, maintain, and troubleshoot them. However, many organizations face workforce shortages and skill gaps in automation and robotics. This limits the efficient utilization of sophisticated systems and can lead to longer downtimes in the event of malfunctions. Regular maintenance is also crucial for optimal performance, and the lack of trained technical staff can impact the reliability and longevity of the equipment.

Regional Analysis

North America

North America held a significant share of approximately 28% in the global End-of-Line Packaging market in 2024, driven by advanced manufacturing infrastructure and widespread adoption of automation technologies. The region benefits from strong demand in industries such as food & beverages, pharmaceuticals, and consumer goods. The United States leads the market due to its focus on operational efficiency and strong investments in smart packaging solutions. Additionally, the presence of key manufacturers and technology providers supports innovation and product development. Ongoing digital transformation and regulatory emphasis on safety and quality further boost the adoption of end-of-line systems.

Europe

Europe accounted for around 25% of the global End-of-Line Packaging market share in 2024, supported by robust industrial automation and sustainability initiatives. Countries such as Germany, France, and Italy are major contributors, driven by well-established manufacturing sectors and increasing environmental regulations. The demand for energy-efficient and recyclable packaging solutions is growing, prompting manufacturers to invest in advanced end-of-line systems. The region’s focus on high precision, quality control, and compliance with stringent safety norms further accelerates market growth. Additionally, government support for Industry 4.0 technologies has encouraged widespread integration of smart packaging systems across various industries.

Asia Pacific

Asia Pacific dominated the global market with a market share of over 32% in 2024, making it the leading regional contributor to the End-of-Line Packaging market. Rapid industrialization, expanding manufacturing bases, and increasing demand for consumer goods in countries like China, India, and Japan are key growth drivers. The region is witnessing strong investments in automation technologies to improve packaging efficiency and reduce labor dependency. Moreover, the growing e-commerce sector and rising exports from Asia Pacific economies are boosting demand for robust and scalable end-of-line packaging solutions tailored for high-volume production environments.

Latin America

Latin America held a moderate share of approximately 7% in the End-of-Line Packaging market in 2024, with Brazil and Mexico being the primary contributors. The region is gradually adopting automated packaging technologies, especially in the food & beverage and pharmaceutical industries. Economic development, increased foreign direct investments, and regional manufacturing expansion are encouraging the adoption of modern packaging systems. However, high initial investment costs and limited technical infrastructure remain key challenges. Despite these barriers, growing demand for packaged consumer goods and efforts to improve production efficiency are expected to support steady market growth in the region.

Middle East & Africa

The Middle East & Africa accounted for nearly 8% of the global End-of-Line Packaging market share in 2024, driven by ongoing industrial development and diversification of economies beyond oil. The UAE, Saudi Arabia, and South Africa are among the leading markets, supported by growing food processing, pharmaceuticals, and logistics sectors. While the adoption of fully automated systems is still emerging, the demand for efficient and reliable packaging solutions is rising. Government initiatives to boost local manufacturing and improve supply chain infrastructure are expected to fuel market expansion, despite challenges such as limited access to skilled labor and high automation costs.

Market Segmentations:

By Technology:

By Functionality:

- Palletizing

- Carton Erecting, Packing & Sealing

- Stretch Wrapping

- Labelling

By End-use Industry:

- Food & Beverages

- Pharmaceutical

- Electronics & Semiconductor

- Automotive

- Others (Chemical Products and Consumer Products)

By Order Type:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the End-of-Line Packaging market is characterized by the presence of both global and regional players striving to enhance their market share through innovation, strategic partnerships, and geographic expansion. Key players such as Krones AG, Bosch Packaging Technology, IMA S.p.A, and DS Smith plc. are focusing on developing advanced, automated, and energy-efficient solutions to meet the growing demand for high-speed and flexible packaging. Companies like Pro Mach Inc., BluePrint Automation, and Schneider Packaging Equipment Co. Inc. are expanding their product portfolios to cater to diverse end-use industries including food & beverages, pharmaceuticals, and electronics. Additionally, strategic mergers and acquisitions, along with investments in smart packaging technologies and Industry 4.0 integration, are becoming critical approaches for market players to strengthen their competitive edge. With increasing demand for customized and scalable systems, firms are also emphasizing customer-centric solutions and after-sales support to differentiate themselves in this highly dynamic and innovation-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DS Smith plc.

- Combi Packaging Systems LLC

- BluePrint Automation

- Schneider Packaging Equipment Co. Inc.

- Endoline Automation

- Bosch Packaging Technology

- Gebo Cermex

- Krones AG

- Pro Mach Inc.

- Festo Group

- IMA S.p.A

Recent Developments

- In October 2024, EndFlex, a renowned end of line packaging machinery provider announced the launch of new end-of-line packaging machine called Boxxer Wrap Around Case Packer. The new machine offers unparalleled efficiency and versatility to meet the rapidly evolving needs of the packaging industry. The new machine offers a high level of protection and stability for packaged products. The machine groups products together and then bundle them in a corrugated case. The new end-of-line packaging machine also benefits packaging companies by using less corrugated material as compared to pre-formed cases and is highly suitable for industries with large-scale packaging needs.

- In September 2024, Bostik, the adhesive business of specialty materials company Arkema announced the launch of new packaging adhesives. The new launch is a testament to Arkema’s Net Zero trajectory focusing on improving sustainability in end-of-line packaging. Kizen LIME range of packaging adhesives is made from proprietary formulation made with a minimum of 80% renewable ingredients. The product is the result of a collaborative effort of Bostik, Dow and Nordson. Kizen adhesive solutions are expected to provide a tamper-evident sealing by fiber tearing of cardboard packaging for the Fast-Moving Consumer Goods (FMCG) industry.

- In September 2024, Combi Packaging Systems, a leading provider of end-pf-line automation solutions from the United States announced the launch of BeeWrap+ Robotic Stretch-Wrapping Technology in the North American region. BeeWrap+™ is the first Siat product range directly marketed under Combi brand in this region. Through this addition, Combi has emerged as top provider of multiple end-of-line packaging solutions backed by industry-leading technical and aftermarket support. Combi also had plans of releasing additional models from Siat’s established ProWrap+ and OneWrap+ portfolio in the North American region to enhance its business scope in the long run.

- In June, 2024, the recent acquisition of Descon Integrated Conveyor Solutions was officially announced by Pacteon Group. This strategic action confirms Pacteon’s dedication to product handling competence and represents a major turning point in the company’s growth plan. The acquisition of Descon expands Pacteon’s product line and is in keeping with its mission to be the single supplier for end-of-line packaging automation equipment. Pacteon hopes to provide even more value to its partners and clients by utilizing the knowledge, assets and technology of both companies.

- In February, 2024, with the addition of three revolutionary digital tools, Ranpak Holdings Corp. unveiled the expansion of its ground-breaking Cut’it! EVO automated in-line packaging machine, offering unparalleled return on investment for end-of-line packaging applications. With the use of these three digital tools, Cut’it! EVO can produce ROI at a rate that is unmatched. These consist of Ranpak Connect, DecisionTower, and Ranpak Precube’it. The technology promotes more sustainable EOL packaging practices while also helping warehouses operate more efficiently.

Market Concentration & Characteristics

The End-of-Line Packaging Market demonstrates a moderately concentrated structure, with several key players dominating the global landscape through extensive product portfolios, technological capabilities, and global distribution networks. It features a blend of multinational corporations and specialized regional manufacturers, each offering tailored solutions to meet industry-specific packaging needs. The market reflects a strong focus on automation, customization, and integration with smart factory systems. It continues to evolve toward energy-efficient and space-saving systems that increase throughput and minimize labor dependency. Large companies invest heavily in R&D to introduce compact, high-speed solutions that address shifting consumer demands and regulatory compliance. Smaller players compete through niche innovations and localized services, particularly in emerging economies. Demand remains strong in high-growth sectors such as food and beverages, pharmaceuticals, and electronics, which prioritize packaging accuracy, traceability, and product safety. It also exhibits characteristics of high capital intensity, moderate supplier power, and steady innovation cycles that shape long-term competitiveness and differentiation.

Report Coverage

The research report offers an in-depth analysis based on Technology, Functionality, End-use Industry, Order Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increased adoption of fully automated packaging systems across major industries to enhance productivity.

- Demand for smart and IoT-enabled end-of-line solutions will grow as manufacturers focus on real-time monitoring and predictive maintenance.

- Food and beverage will remain the leading end-use industry due to high demand for packaged products and safety compliance.

- Sustainability will drive innovation in energy-efficient machinery and recyclable packaging compatibility.

- Manufacturers will focus on modular and customizable systems to cater to diverse product sizes and operational layouts.

- Asia Pacific will continue to dominate the market due to industrial expansion and rising automation investments.

- Integration with Industry 4.0 technologies will become a standard feature in new end-of-line packaging systems.

- Medium and small enterprises will gradually adopt semi-automated solutions to improve efficiency and reduce labor dependency.

- Mergers and acquisitions will increase as key players seek to expand portfolios and regional presence.

- Regulatory compliance and product traceability will shape the development of advanced labeling and sealing functionalities.