Market Overview:

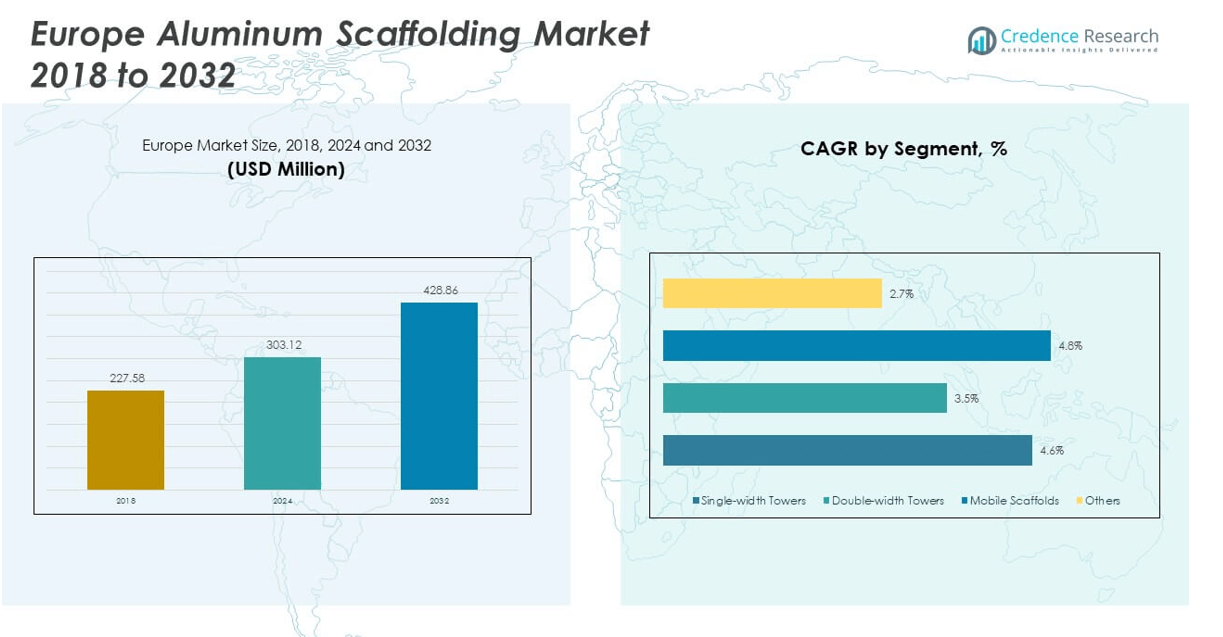

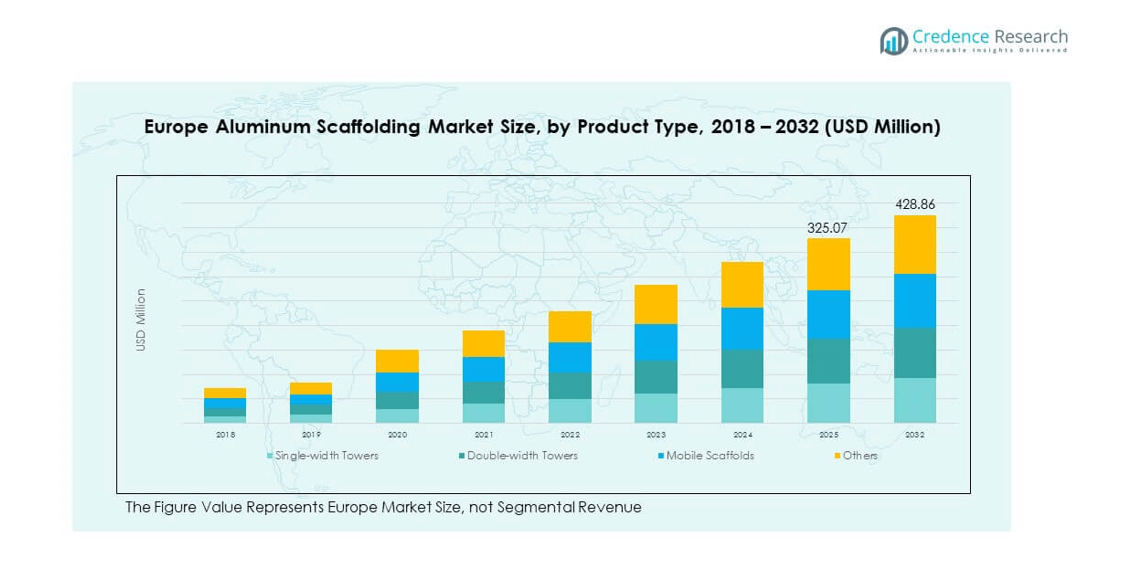

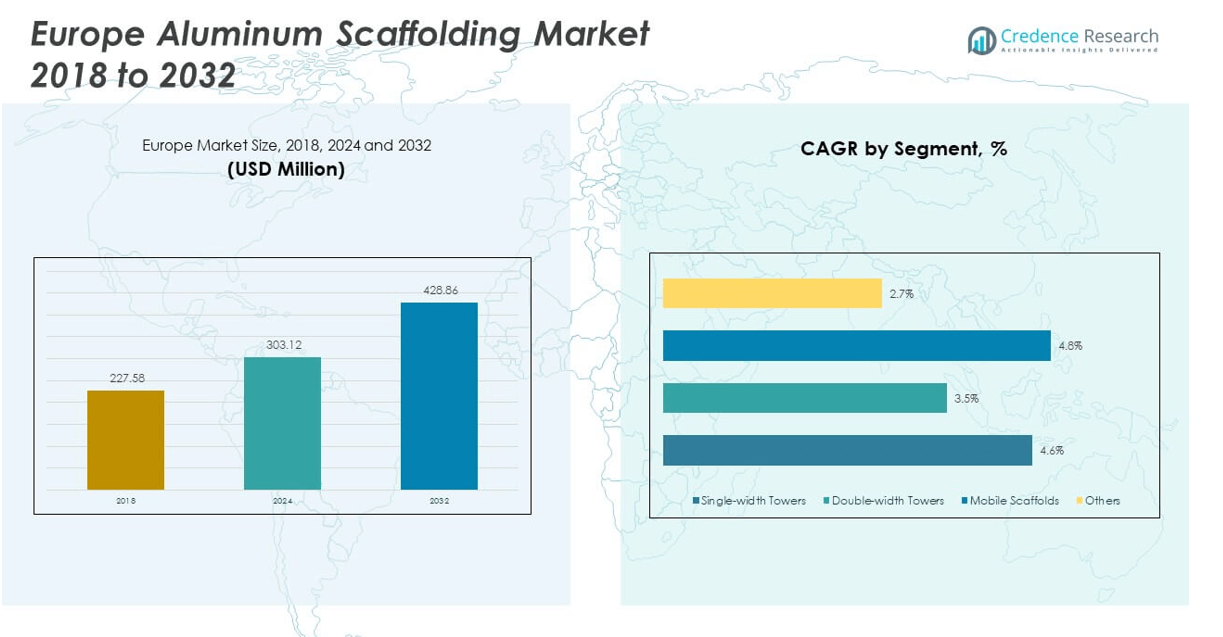

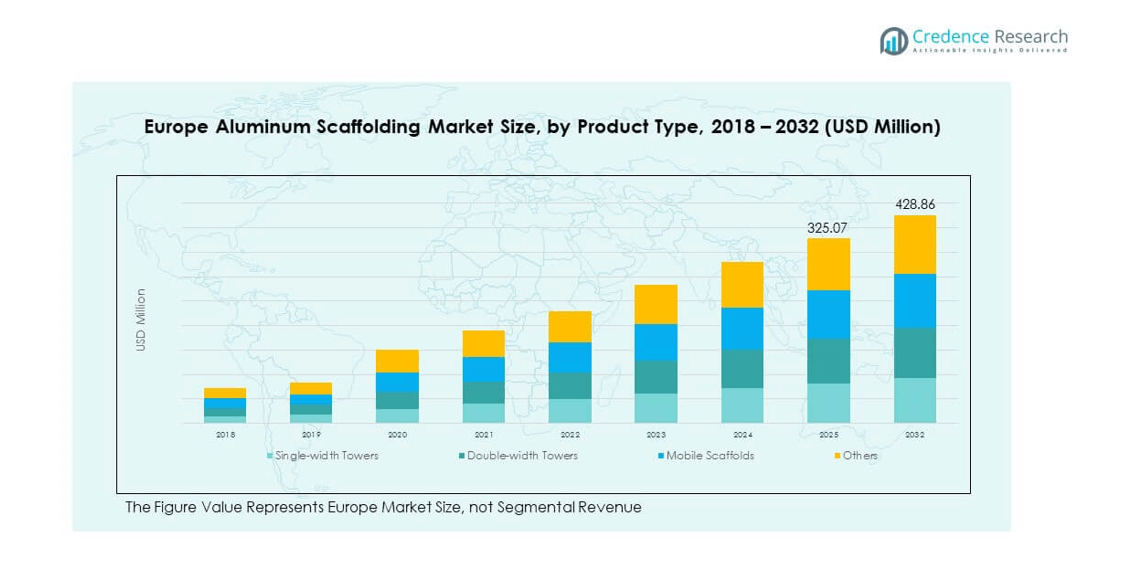

The Europe Aluminum Scaffolding Market size was valued at USD 227.58 million in 2018 to USD 303.12 million in 2024 and is anticipated to reach USD 428.86 million by 2032, at a CAGR of 4.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Aluminum Scaffolding Market Size 2024 |

USD 303.12 million |

| Europe Aluminum Scaffolding Market, CAGR |

4.00% |

| Europe Aluminum Scaffolding Market Size 2032 |

USD 428.86 million |

The market growth is driven by the increasing demand for lightweight, durable, and corrosion-resistant scaffolding solutions across construction, industrial maintenance, and infrastructure projects. Aluminum scaffolding offers ease of transport and quick assembly, which makes it preferable over traditional steel alternatives. Rapid urbanization, coupled with stringent worker safety regulations across European countries, has further pushed the adoption of advanced scaffolding systems. Moreover, the growing trend toward sustainable and recyclable construction materials continues to encourage the use of aluminum-based frameworks.

Regionally, Western Europe remains the dominant market due to its mature construction industry and early adoption of modern scaffolding technologies, with countries like Germany, France, and the UK leading in usage. Northern and Southern Europe are emerging markets, driven by ongoing infrastructure upgrades and residential renovation activities. Eastern European countries are witnessing steady growth as construction activities gain momentum with EU-supported development programs. The demand is also bolstered by cross-border projects and the emphasis on safety compliance across the region.

Market Insights:

- The Europe Aluminum Scaffolding Market was valued at USD 303.12 million in 2024 and is projected to reach USD 428.86 million by 2032, growing at a CAGR of 4.00%.

- The Global Aluminum Scaffolding Market size was valued at USD 1,221.32 million in 2018 to USD 1,721.17 million in 2024 and is anticipated to reach USD 2,678.48 million by 2032, at a CAGR of 5.29% during the forecast period.

- Demand is rising due to the increased use of lightweight and corrosion-resistant materials in urban construction projects.

- Strict safety regulations across European countries are driving the adoption of certified aluminum scaffolding systems.

- High initial investment and cost sensitivity among small contractors continue to restrain broader market penetration.

- Western Europe leads the market with 48% share in 2024, supported by infrastructure upgrades and advanced construction practices.

- Mobile scaffolds dominate product demand due to their portability, ease of use, and suitability for fast-paced projects.

- Growing adoption in Eastern and Southern Europe is supported by EU funding and regional infrastructure development programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surge in Demand for Lightweight and High-Strength Scaffolding in Urban Projects

The Europe Aluminum Scaffolding Market is witnessing strong demand from urban construction sectors that prioritize lightweight and durable materials. Aluminum scaffolding enables faster assembly and disassembly, improving on-site efficiency. Construction firms prefer aluminum over traditional steel for its superior corrosion resistance and ease of transport. The rising number of high-rise buildings and complex structures requires scaffolding systems that offer both safety and flexibility. Cities across Western Europe are driving adoption through investments in urban redevelopment. High labor costs in the region encourage equipment that minimizes time on-site. The preference for modular systems that integrate quickly with modern construction methods supports this trend.

Increased Focus on Worker Safety Standards Across the Construction Sector

Governments and private firms across Europe are emphasizing compliance with updated safety regulations. The Europe Aluminum Scaffolding Market benefits from strict enforcement of occupational safety norms. Contractors are required to use certified and stable scaffolding systems, which aluminum units fulfill more effectively than wooden or steel frames. Workplace accident prevention initiatives are influencing equipment purchase decisions. The industry sees growing investments in equipment that reduces the risk of falls and injuries. Aluminum scaffolds come equipped with secure locking mechanisms and guard rails that enhance worker protection. Insurance policies now reflect scaffold safety ratings, influencing user behavior.

Rising Infrastructure Renovation and Maintenance Activities in Mature Economies

Aging infrastructure across several Western and Northern European countries has triggered widespread renovation activity. The Europe Aluminum Scaffolding Market supports this activity with versatile and reusable scaffold designs. Governments are prioritizing refurbishment of bridges, public buildings, and transport networks. These projects often take place in constrained environments where aluminum scaffolding offers mobility and efficiency. The material’s light weight makes it ideal for indoor maintenance or sites with limited access. Repeated use without degradation also increases cost-effectiveness. Public-private partnerships further encourage contractors to adopt reliable and long-life solutions.

- For instance, Total Contec deployed its modular aluminum scaffolding and formwork systems during the Hong Kong–Zhuhai–Macao Bridge (HZMB) project. The company played a significant role in the construction process on the artificial islands and immersed tunnel sections. Its aluminum modular scaffold towers enabled repeated reuse, stable support in marine environments, and flexibility in constrained work zones.

Increased Adoption of Sustainable Construction Materials and Practices

The shift toward sustainable construction practices is shaping procurement decisions across Europe. The Europe Aluminum Scaffolding Market aligns with this transition by offering recyclable and energy-efficient materials. Stakeholders are selecting scaffolding systems that contribute to environmental certifications such as LEED and BREEAM. Aluminum’s long lifecycle and low maintenance requirements position it as an environmentally sound choice. Regulatory pressure is prompting firms to report lifecycle emissions, making aluminum attractive over alternatives. The industry is aligning itself with net-zero goals by replacing traditional steel frameworks. The focus on circular economy principles further supports the demand for aluminum-based systems.

- For example, BDC Scaffolding, operating in Norfolk, Suffolk, Essex, and Cambridge in the UK, implements modular aluminum scaffolding systems designed with lifecycle management in mind. Its systems feature precision-manufactured modules for extended service life, which maximize reuse and minimize waste, supporting sustainable construction practices across East Anglia.

Market Trends:

Integration of Mobile and Foldable Aluminum Scaffolding Solutions

Manufacturers are launching mobile and foldable scaffolding units tailored for quick transport and compact storage. The Europe Aluminum Scaffolding Market is evolving with growing demand for space-efficient solutions in urban environments. Construction sites with limited room now opt for systems that reduce assembly time and manual effort. Foldable designs help contractors complete shorter-term or multi-location projects with ease. Firms are equipping these scaffolds with wheels and height-adjustment features. Demand is strong in retail store setups, facility maintenance, and interior works. This trend supports faster project turnover and better logistics management for scaffolding service providers.

Growing Popularity of DIY and Rental-Based Scaffolding Use in Smaller Projects

The rise of home renovation and self-managed building projects is driving demand for easy-to-use scaffolding. The Europe Aluminum Scaffolding Market is responding with compact and user-friendly systems targeted at the DIY segment. Households and small contractors prefer aluminum for its manageable weight and simple locking mechanisms. Rental services are seeing higher turnover for aluminum units as consumers avoid permanent purchases. Demand is high for weekend and short-term projects that require safe elevation support. Rental firms are investing in robust yet intuitive scaffold lines to meet this need. This trend also fosters product innovation in safety and simplicity.

- For example, Synergy’s DT250-QF Q‑Folding Mobile Scaffold Tower holds CE, TUV, and SGS certifications and complies with EN 1004 and AS/NZS 1576 standards. It supports a maximum load of 275 kg, and its compact foldable design enables single‑person erection through standard doorways. Trades such as painters, decorators, electricians, and DIY users frequently adopt this versatile aluminum mobile scaffold for low‑level access tasks.

Use of Modular and Customizable Scaffolding Designs for Complex Structures

Architectural complexity in commercial and public infrastructure has increased demand for modular scaffolding. The Europe Aluminum Scaffolding Market is moving toward adjustable and customizable frameworks. Projects involving domes, arches, and inclined surfaces need scaffolding systems that conform to unique dimensions. Aluminum units are being designed with interchangeable parts and rotational components. Engineers and contractors now prioritize scaffolds that offer flexibility without compromising safety. This trend is shaping procurement for stadiums, cultural centers, and transport hubs. Manufacturers are responding by offering software-assisted design services alongside scaffolding systems.

- For example, MJ-Gerüst’s COMBI modular aluminum system features up to eight connections per knot and 0.5 m height adjustments, enabling flexible configurations for complex structures like domes, arches, and emergency stair towers. Its design supports both standard and custom geometries with high load capacity and precision.

Digital Tools and Smart Monitoring Features Embedded in Scaffolding Systems

Technology integration is transforming how scaffolding equipment is managed and monitored on-site. The Europe Aluminum Scaffolding Market is embracing digital transformation with IoT and sensor-enabled systems. Firms are embedding tilt sensors, load indicators, and anti-theft mechanisms into aluminum scaffolds. Contractors can now monitor structural integrity in real time, reducing on-site inspection delays. These features also support regulatory compliance by maintaining digital logs. QR-coded parts improve asset tracking across multiple locations. This trend supports efficient resource use and enhances safety documentation processes.

Market Challenges Analysis:

High Initial Investment and Cost Sensitivity in Small-Scale Construction Firms

Small contractors and individual builders often struggle with the upfront cost of aluminum scaffolding. The Europe Aluminum Scaffolding Market faces resistance from price-sensitive segments despite long-term value. Steel and wooden scaffolding alternatives still dominate where budget constraints prevail. Some firms opt for second-hand equipment that lacks modern safety features. Rental options help bridge this gap but limit product standardization across sites. Buyers in cost-sensitive regions prefer products with minimal customization, restricting innovation adoption. The perception of high investment risk also reduces volume purchasing. Manufacturers need to balance innovation with affordability to capture wider market share.

Regulatory Variation Across European Countries Slows Cross-Border Adoption

Europe’s diverse regulatory landscape presents hurdles for uniform scaffolding standards. The Europe Aluminum Scaffolding Market contends with country-specific certification, testing, and compliance criteria. This fragmentation slows the deployment of standardized scaffolding systems across borders. Manufacturers must tailor documentation, labels, and safety specs for each region. Such variation increases production and logistics costs. Distributors face delays during cross-border expansion due to approval timelines. Inconsistent enforcement also leads to uneven market competitiveness. Harmonizing regional regulations could ease trade and improve scalability for suppliers.

Market Opportunities:

Government-Led Infrastructure and Public Housing Programs Open New Demand Channels

Ongoing investments in public housing, energy infrastructure, and green building projects present growth avenues. The Europe Aluminum Scaffolding Market can benefit from contracts driven by public sector funding. Governments seek modern and safe construction equipment to meet sustainability and safety benchmarks. Aluminum scaffolds offer both regulatory compliance and cost efficiency over multiple reuse cycles. Contractors engaged in public contracts increasingly prioritize certified aluminum systems. Market participants can leverage bidding opportunities tied to EU recovery funds and green deals.

Product Differentiation Through Innovation and Customization for Niche Segments

Manufacturers have an opportunity to design scaffold models for specialized end-users like event planners, facility managers, and telecom firms. The Europe Aluminum Scaffolding Market can expand by offering adjustable heights, modular sections, and lightweight frames for mobile crews. Companies focusing on ergonomic features and digital integration will attract clients seeking premium performance. Differentiated product lines can also strengthen brand loyalty and justify higher pricing. Tailored scaffolds for interior work, exhibitions, or industrial cleaning provide room for expansion.

Market Segmentation Analysis:

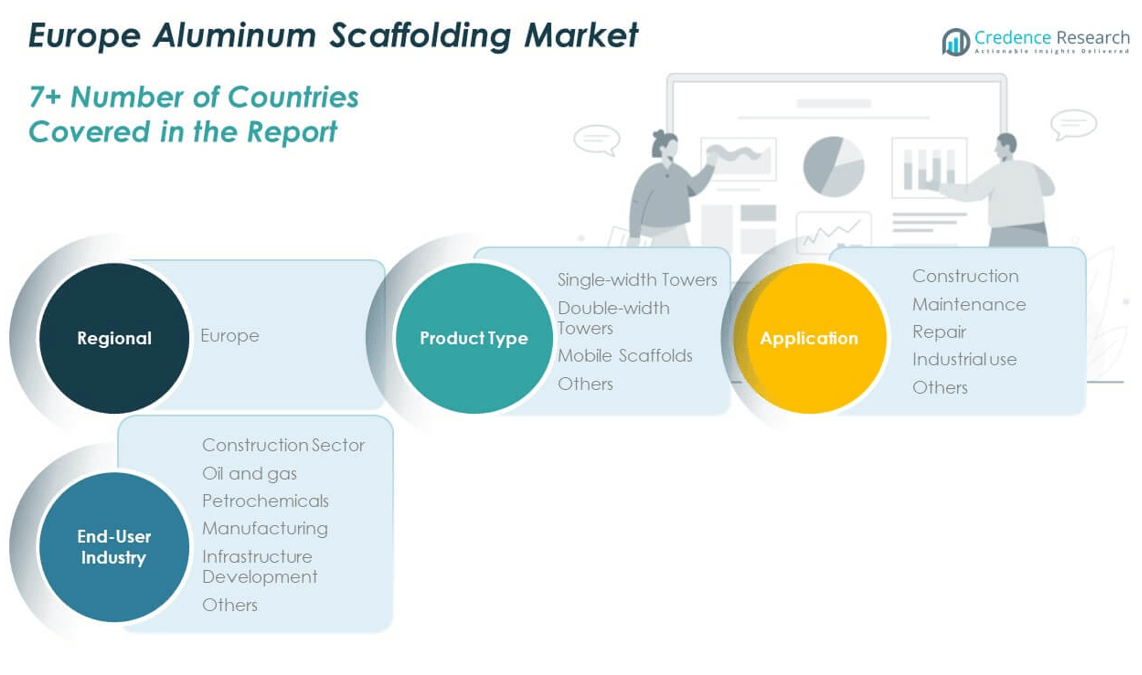

The Europe Aluminum Scaffolding Market is segmented

By product type, application, and end-user industry. By product type, mobile scaffolds lead the market due to their portability, ease of assembly, and suitability for fast-paced urban projects. Single-width towers gain traction in confined spaces, particularly for indoor use, while double-width towers remain preferred in larger construction environments for enhanced stability and worker mobility. The “others” segment includes customized and hybrid scaffold systems used in niche settings.

- For example, Layher’s Uni Standard Aluminum Mobile Tower meets DIN EN 1004 and TÜV/GS certifications, offering snap‑fit, tool‑free assembly that two trained workers can complete quickly. It delivers excellent stability and maneuverability, making it a popular choice for maintenance and low‑height construction access.

By application, the construction segment holds the largest share, driven by ongoing urbanization and infrastructure upgrades across Europe. Maintenance activities in public buildings and industrial facilities also contribute significantly, where lightweight aluminum scaffolding ensures efficiency and safety. Repair and industrial use segments are steadily growing due to the frequent need for safe access systems in operational environments. The others category captures short-term and non-conventional uses, including exhibitions and stage setups.

By end-user industry, the construction sector dominates due to continued demand for scaffolding in residential, commercial, and institutional projects. Infrastructure development projects are expanding across both developed and emerging European economies, supporting growth. Oil and gas, petrochemicals, and manufacturing sectors rely on aluminum scaffolding for maintenance and inspection tasks in hazardous environments. It supports easy relocation and reduces downtime. The “others” segment includes facilities management, aviation, and event management sectors that require temporary yet reliable access solutions.

- For example, in the industrial sector, Altrex’s Aluminum Rolling Towers are commonly used for maintenance and inspection tasks due to their lightweight, corrosion-resistant design and compliance with European safety standards.

Segmentation:

By Product Type

- Single-width Towers

- Double-width Towers

- Mobile Scaffolds

- Others

By Application

- Construction

- Maintenance

- Repair

- Industrial Use

- Others

By End-User Industry

- Construction Sector

- Oil and Gas

- Petrochemicals

- Manufacturing

- Infrastructure Development

- Others

By Region

- Western Europe

- Northern Europe

- Southern Europe

- Eastern Europe

Regional Analysis:

Western Europe dominates the Europe Aluminum Scaffolding Market, accounting for 48% of the total market share in 2024. Countries such as Germany, France, and the United Kingdom lead the adoption due to their advanced construction sectors and strict regulatory compliance. High investments in infrastructure renewal, urban development, and commercial real estate support the continued demand for modern scaffolding systems. Construction firms in this region prefer aluminum for its durability, safety, and ease of handling. Governments have set stringent safety and sustainability guidelines that favor certified aluminum scaffold usage. The presence of major market players and established distribution networks further strengthens Western Europe’s leadership position.

Northern Europe holds a 22% share of the Europe Aluminum Scaffolding Market, driven by growing demand in countries like Sweden, Norway, and Finland. These markets value environmentally sustainable construction materials, making aluminum a preferred choice. Public sector infrastructure investments and green building programs create consistent demand. The region’s cold climate conditions also contribute to the use of corrosion-resistant materials like aluminum. It benefits from well-organized construction ecosystems that support rapid adoption of modern scaffolding solutions. Companies operating here often prioritize safety certifications and material efficiency to align with local building standards.

Southern and Eastern Europe collectively account for 30% of the market share in 2024, with steady growth projections over the forecast period. Southern Europe, including Italy and Spain, is witnessing a rise in residential renovation and tourism-related construction projects. Eastern European countries such as Poland, Romania, and Hungary are experiencing infrastructure development supported by EU funding and private investment. The Europe Aluminum Scaffolding Market is expanding in these regions as contractors transition from traditional wooden and steel scaffolding to lightweight, reusable aluminum systems. Growth in logistics, retail, and industrial facilities construction further drives scaffold adoption. Local manufacturers are entering the market with competitively priced solutions tailored for regional needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Layher Ltd

- Zarges

- Svelt SpA

- ALFIX GmbH

- GBM

- ADTO Industrial Group

- Altrad Group

- ULMA Construction

- Aluminium Scaffold Towers Limited

- Euroscaffold Nederland

Competitive Analysis:

The Europe Aluminum Scaffolding Market features a mix of global brands and regional manufacturers competing on safety, durability, and ease of deployment. Key players such as Altrex, Instant UpRight, Layher, and BoSS dominate the landscape through advanced product portfolios and strong distribution networks. These companies invest in R&D to develop modular, lightweight, and smart-enabled scaffolding systems that meet European safety standards. Smaller regional firms compete by offering cost-effective solutions tailored to local construction needs. It remains a highly competitive market, with emphasis on innovation, customization, and compliance. Strategic partnerships and acquisitions continue to shape the competitive dynamics, allowing major players to expand into new markets and strengthen their service capabilities.

Recent Developments:

- In February 2025, Svelt SpA reaffirmed its strong partnership with construction sector operators at the prominent Kyiv Build 2025 fair in Ukraine. Amid ongoing regional challenges, Svelt’s presence focused on offering advanced, highly safe solutions for work at height. Their commitment to innovation and support for customers in demanding environments underlines Svelt’s reputation for reliability and quality in the aluminum scaffolding sector.

- In February 2023, Doka completed the acquisition of scaffolding manufacturer AT‑PAC, consolidating formwork and scaffolding expertise under one roof. This move extends its global reach and integrated solutions offering within the Europe Aluminum Scaffolding Market.

Market Concentration & Characteristics:

The Europe Aluminum Scaffolding Market shows moderate concentration, with leading firms holding significant but not monopolistic shares. It is characterized by product innovation, strict regulatory alignment, and rising demand from both rental and direct purchase segments. Market participants focus on lightweight, reusable, and safety-certified systems that appeal to diverse end-users. The presence of both global and niche regional players fosters pricing flexibility and customization. Urbanization, worker safety priorities, and green construction practices influence product development and adoption across the region. Digital integration and smart scaffolding features are becoming key differentiators for premium market segments. Companies are also exploring circular economy strategies by promoting recyclable designs and refurbishment services.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for aluminum scaffolding will continue rising due to increased infrastructure modernization across Europe.

- Regulatory emphasis on worker safety will drive adoption of certified and advanced scaffolding systems.

- Sustainable construction practices will encourage the use of recyclable and lightweight aluminum materials.

- Growth in urban renovation and high-rise building projects will fuel the need for modular and mobile scaffolding solutions.

- Advancements in digital scaffolding technologies, including sensor integration, will enhance safety and site monitoring.

- Expansion of rental services will support wider access to aluminum scaffolding for small contractors and DIY users.

- Market competition will intensify as regional players introduce cost-effective, localized scaffold solutions.

- Investment in R&D will lead to the development of foldable, compact, and customizable scaffolding designs.

- Cross-border infrastructure projects and EU-backed funding will support growth in emerging Eastern European markets.

- Strategic partnerships among manufacturers, construction firms, and safety bodies will shape product innovation and compliance.