Market Overviews

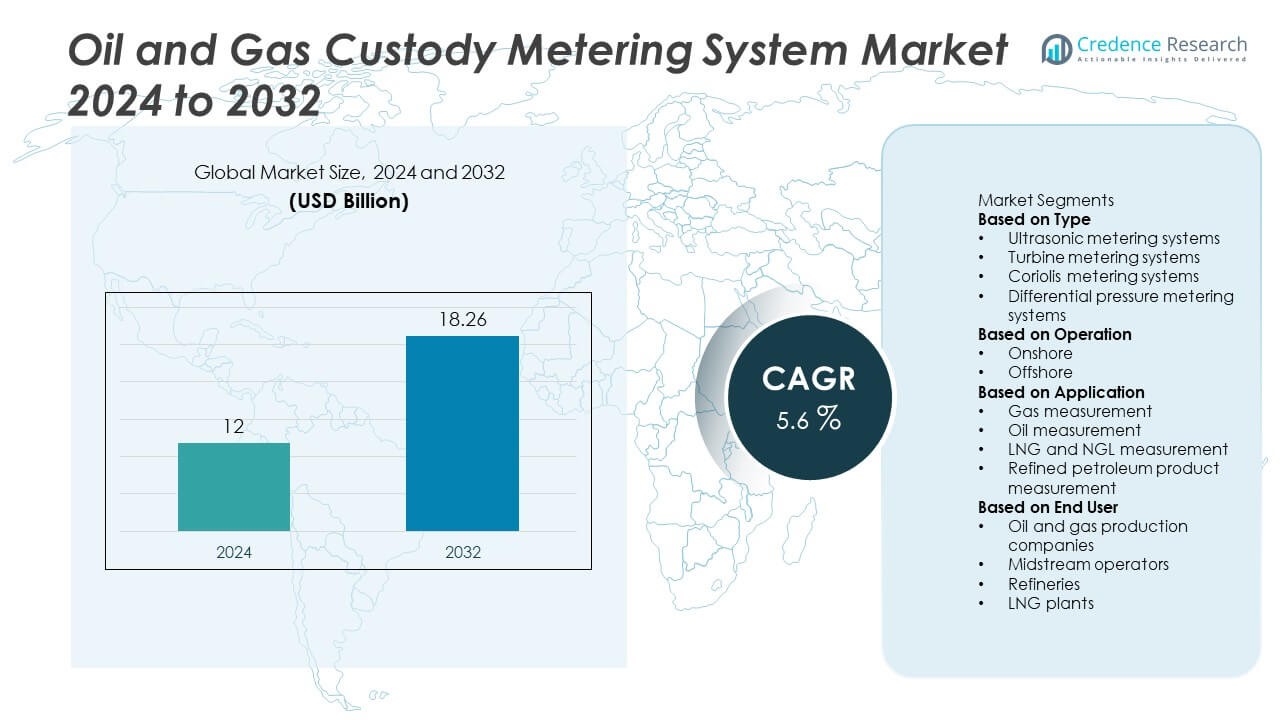

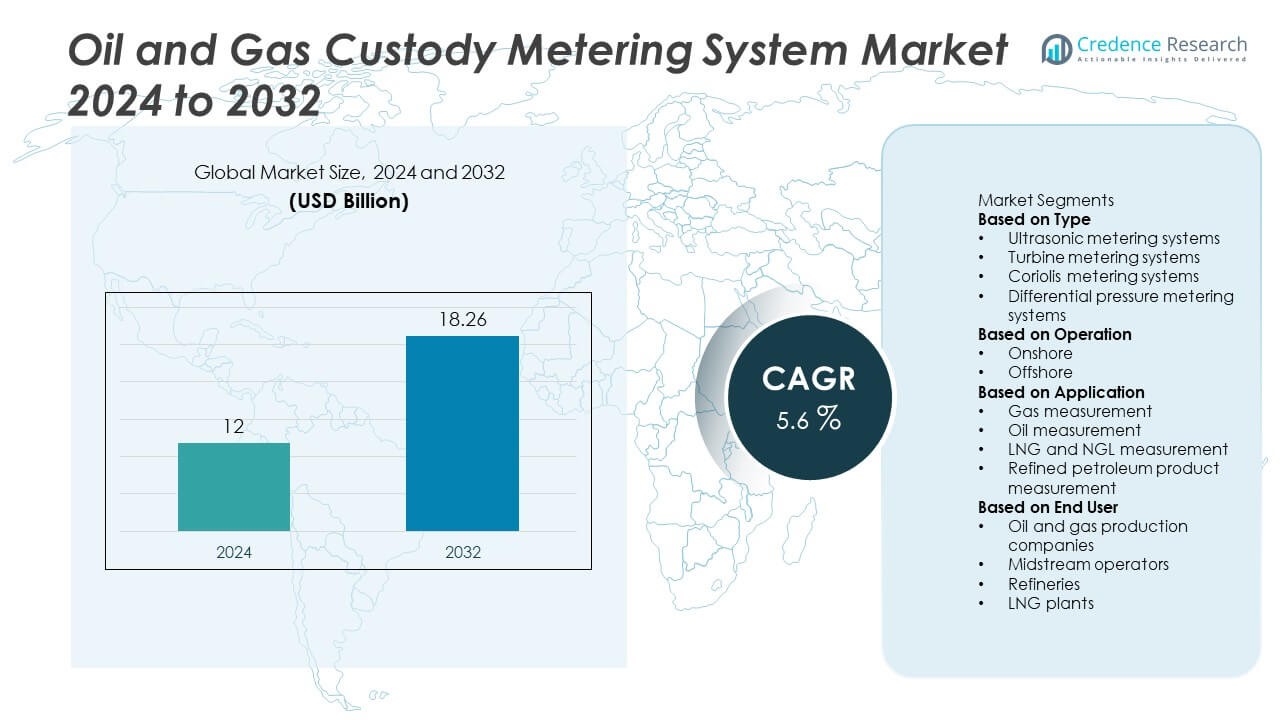

Oil and Gas Custody Metering System market size reached USD 12 billion in 2024 and is expected to reach USD 18.26 billion by 2032, registering a 5.6% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil and Gas Custody Metering System Market Size 2024 |

USD 12 Billion |

| Oil and Gas Custody Metering System Market, CAGR |

5.6% |

| Oil and Gas Custody Metering System Market Size 2032 |

USD 18.26 Billion |

Top players in the Oil and Gas Custody Metering System market include Emerson Electric, Honeywell International, ABB, Schneider Electric, Yokogawa Electric, Endress+Hauser, KROHNE, TechnipFMC, Cameron, and Thermo Fisher Scientific. These companies strengthen their positions by offering high-accuracy ultrasonic, Coriolis, and turbine metering technologies designed for reliable custody transfer across pipelines, refineries, and export terminals. Their focus on digital diagnostics, remote monitoring, and automated proving enhances operational efficiency for major operators. North America leads the market with a 34% share, supported by strong midstream infrastructure, advanced regulatory standards, and rapid adoption of next-generation metering systems across large oil and gas networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Oil and Gas Custody Metering System market reached USD 12 billion in 2024 and will grow at a 5.6% CAGR through the forecast period.

- Strong growth comes from rising demand for accurate flow measurement, driven by stricter regulatory audits and the need for transparent hydrocarbon trade across pipelines, terminals, and refining networks.

- Key trends include fast adoption of digital metering, automated proving, and smart diagnostics, while ultrasonic systems lead the type segment with a 38% share due to high accuracy and low maintenance.

- Competitive activity remains strong as top players expand portfolios with advanced ultrasonic and Coriolis technologies; however, high installation costs and complex calibration rules continue to restrain adoption.

- North America dominates regional demand with a 34% market share, followed by Europe at 27% and Asia Pacific at 23%, supported by expanding midstream infrastructure and growing LNG and refined product measurement needs.

Market Segmentation Analysis:

By Type

Ultrasonic metering systems hold the leading share of the type segment, registering a market share of 38% due to strong accuracy and low maintenance needs. These systems support high-flow conditions and manage varying pressures without mechanical wear. Turbine meters remain relevant in legacy facilities, while Coriolis units gain traction for density-based measurement demands. Differential pressure systems stay common in mature plants that favor established calibration practices. The rising shift toward digital flow diagnostics and real-time monitoring continues to push operators toward ultrasonic platforms, strengthening their dominance across new midstream and downstream installations.

- For instance, Honeywell’s ultrasonic flow meters are increasingly adopted in the midstream oil and gas sector for real-time digital flow diagnostics, reflecting the market’s shift toward advanced technologies that minimize operational costs and downtime.

By Operation

Onshore facilities account for the dominant portion of the operation segment with a market share of 62%, driven by widespread pipeline networks, storage hubs, refineries, and metering skid installations. Onshore operators invest in system upgrades to meet stricter custody transfer accuracy rules and enhance loss-control performance. Offshore units show steady growth as deepwater projects adopt robust metering technologies that withstand harsh conditions. The increasing deployment of automated flow verification, leak detection tools, and digital calibration functions helps onshore systems maintain strong adoption across both established and expanding production regions.

- For instance, TechnipFMC provides measurement technologies and complete skid systems for both onshore and offshore applications, with over 80 years of experience in custody transfer solutions, to enhance accuracy and operational efficiency.

By Application

Oil measurement leads the application segment with a market share of 41%, supported by high transfer volumes across upstream, midstream, and refining infrastructure. Accurate oil custody metering reduces reconciliation errors and improves revenue assurance for operators. Gas measurement follows as natural gas trading expands, and LNG and NGL measurement gains importance as liquefaction plants scale export activities. Refined product measurement remains essential for distribution terminals. Rising demand for precise mass-flow tracking, better viscosity compensation, and digital meter diagnostics drives oil measurement’s strong position in custody transfer operations.

Key Growth Drivers

Rising Need for Accurate Flow Measurement

Growing demand for precise flow tracking strengthens the adoption of high-accuracy custody metering systems. Operators aim to reduce measurement errors, prevent revenue leakage, and meet strict inspection standards. Real-time diagnostics help limit manual intervention and improve reconciliation across producing, transporting, and refining stages. This driver gains momentum as companies prioritize transparent hydrocarbon trade and seek reliable validation of transfer quantities across complex supply networks.

- For instance, Emerson’s Daniel™ 3808 and 3810 mass flow computers offer advanced real-time diagnostics that provide accurate measurement and validation of hydrocarbon flow in critical pipeline operations, minimizing manual intervention.

Expansion of Midstream Infrastructure Networks

New pipelines, storage facilities, and export terminals continue to expand global midstream capacity, driving strong demand for custody metering upgrades. Operators invest in advanced systems that maintain stable accuracy under changing operating conditions. These systems support continuous monitoring and automated proving across large transport corridors. Rising crude and gas movement across regional trade routes further encourages modernization of older metering assets, reinforcing this driver’s impact on long-term market growth.

- For instance, KROHNE’s OPTIMASS 7400 Coriolis flow meters are designed for demanding process and custody transfer (CT) applications (fiscal metering), providing highly accurate measurement of gases and liquids, including crude, even under variable operating conditions.

Shift Toward Digital and Automated Metering

Digital tools reshape metering operations as companies integrate smart sensors, remote dashboards, and predictive analytics. Automated calibration reduces human error and improves operational consistency. Cloud-enabled platforms allow teams to access flow data instantly, supporting faster decision-making and reducing downtime. This shift enhances transparency across custody transactions and helps firms maintain strong measurement integrity across onshore and offshore networks.

Key Trends & Opportunities

Adoption of Multiphase and High-Performance Metering

A major trend involves increasing preference for multiphase meters that measure oil, gas, and water without separation. These systems cut operational costs and minimize footprint requirements in offshore and remote facilities. High-performance ultrasonic and Coriolis meters also gain traction due to their strong accuracy and minimal maintenance. The opportunity grows as operators look for compact, efficient technologies suited for dynamic flow environments.

- For instance, Schlumberger’s Raptor multiphase flow meters are used in offshore operations to reduce operational costs and space requirements while maintaining high measurement accuracy under challenging conditions.

Integration of Advanced Data and Cloud Platforms

Integration of digital data layers creates new opportunities for enhanced monitoring, compliance, and reporting. Cloud-based platforms centralize flow records, diagnostics, and historical logs, improving transparency during audit processes. Remote access tools help detect irregularities quickly and support preventive maintenance. Growing interest in automated alerts and secure data chains increases adoption of software-driven custody metering solutions.

- For instance, Endress+Hauser’s Netilion platform provides secure, cloud-based access to flow measurement data, enabling operators to monitor equipment performance remotely and detect irregularities quickly.

Upgrades Aligned with ESG and Emission Reduction Goals

Companies now replace older metering assets to reduce leaks, improve efficiency, and support environmental commitments. Modern systems offer better precision with lower energy use, helping operators limit unaccounted hydrocarbons. Digital upgrades also support leak-detection workflows and optimize flow conditions. This trend encourages investment in compact, low-emission metering solutions that align with sustainability strategies across global oil and gas operations.

Key Challenges

Complex Calibration and Compliance Requirements

Custody metering systems must meet strict calibration and verification rules, creating operational complexity. Operators perform regular proving and maintain detailed documentation to stay compliant. Variations across international and regional standards add further challenges. Insufficient calibration accuracy may cause disputes, penalties, or shutdowns. Smaller firms often face high costs and limited expertise to manage these compliance-heavy workflows.

High Installation and Modernization Costs

Advanced custody metering systems require significant investment in precision equipment, digital proving platforms, and integration engineering. Retrofitting legacy facilities increases design and installation complexity. Offshore sites demand rugged and highly specialized systems, raising project costs further. These financial barriers slow adoption in emerging regions and delay modernization cycles for operators with restricted capital budgets.

Regional Analysis

North America

North America leads the market with a market share of 34%, supported by strong pipeline networks, advanced midstream infrastructure, and strict regulatory frameworks that emphasize accurate custody transfer. Operators invest in high-performance ultrasonic and Coriolis meters to improve flow verification and limit losses across large transport corridors. Growth in shale production and expansion of export terminals sustain steady demand for advanced metering skids. The region also benefits from rapid adoption of digital diagnostics and automated proving systems, reinforcing its leadership in high-accuracy measurement technology across upstream, midstream, and refining operations.

Europe

Europe holds a market share of 27%, driven by strict compliance standards, strong technological adoption, and mature oil and gas transport networks. The region’s operators prioritize system upgrades to meet stringent measurement accuracy rules and enhance audit transparency. Expansion of cross-border gas trade and LNG import facilities drives further investment in premium metering systems. European firms also deploy digital monitoring tools to strengthen flow assurance and improve operational integrity. Transition toward low-carbon operations encourages modernization of older metering units, supporting continued demand across pipeline grids, terminals, and refined product distribution networks.

Asia Pacific

Asia Pacific accounts for a market share of 23%, fueled by growing energy consumption, rapid infrastructure development, and increasing investment in LNG terminals and cross-country pipeline projects. National oil companies and private operators deploy advanced custody metering systems to support expanding crude imports and refined product movement. Rising adoption of digital measurement platforms and smart sensors enhances flow management across large and diverse networks. Emerging demand for metering upgrades in offshore fields also contributes to steady growth. The region’s expanding refining capacity further strengthens the need for accurate, high-reliability measurement technologies.

Latin America

Latin America captures a market share of 9%, supported by expanding upstream activity, new pipeline developments, and rising export volumes in key producing countries. Operators focus on improving measurement accuracy to reduce losses and strengthen trade transparency. Investments in modern ultrasonic and Coriolis meters grow as firms replace older mechanical units. National reforms in energy markets and rising offshore developments drive additional demand for reliable custody transfer solutions. Growing interest in digital monitoring and automated calibration tools helps improve operational efficiency across midstream and refining networks in emerging markets.

Middle East & Africa

The Middle East & Africa region holds a market share of 7%, driven by strong crude production volumes and expanding export infrastructure. National oil companies adopt advanced custody metering systems to support large pipeline networks, storage hubs, and export terminals. Investments focus on enhancing accuracy and reducing unaccounted losses in high-capacity flow environments. Offshore expansion and new gas monetization projects increase demand for durable, high-performance meters. The region also sees rising interest in digital diagnostics and remote monitoring to improve efficiency and meet international trade standards across complex production zones.

Market Segmentations:

By Type

- Ultrasonic metering systems

- Turbine metering systems

- Coriolis metering systems

- Differential pressure metering systems

By Operation

By Application

- Gas measurement

- Oil measurement

- LNG and NGL measurement

- Refined petroleum product measurement

By End User

- Oil and gas production companies

- Midstream operators

- Refineries

- LNG plants

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features leading companies such as Emerson Electric, Honeywell International, ABB, Schneider Electric, Yokogawa Electric, Endress+Hauser, KROHNE, Thermo Fisher Scientific, TechnipFMC, and Cameron. These firms compete by offering advanced custody metering solutions that enhance accuracy, reduce operational losses, and support digital integration across pipeline networks and terminal operations. Most companies focus on expanding product portfolios with high-performance ultrasonic, Coriolis, and turbine meters designed for demanding flow conditions. Strategic moves include partnerships with midstream operators, investments in automated proving systems, and upgrades in smart diagnostics. Players also emphasize remote monitoring capabilities, cybersecurity features, and data-driven measurement platforms to strengthen operational reliability. Continuous innovation in metering skids, sensor technologies, and cloud-enabled data systems helps these companies maintain strong market positions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Emerson Electric Co.

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric

- Yokogawa Electric Corporation

- Endress+Hauser Group

- Thermo Fisher Scientific

- KROHNE Group

- TechnipFMC

- Cameron (a Schlumberger Company)

Recent Developments

- In August 2024, Honeywell International Inc. announced its Emissions Management Suite became Hazardous‑Location (HazLoc) and marine certified, enabling deployment in offshore oil & gas custody transfer and monitoring applications.

- In November 2023, Emerson published guidance emphasising periodic calibration of marine custody‑transfer systems using radar technology to maintain measurement accuracy.

- In October 2023, ABB announced a partnership with ODS Metering Systems to integrate ABB’s Flow‑X computers into custody‑transfer measurement systems and enhance digitalisation in oil & gas metering.

Report Coverage

The research report offers an in-depth analysis based on Type, Operation, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-accuracy ultrasonic and Coriolis meters will rise as operators target stronger flow reliability.

- Digital diagnostics and predictive maintenance will become central to reducing downtime and improving asset performance.

- Automated proving systems will gain wider adoption to streamline calibration and support regulatory compliance.

- Cloud-based monitoring platforms will expand as companies centralize custody data across large pipeline networks.

- Integration of advanced sensors will improve real-time detection of flow irregularities and operational losses.

- High-capacity metering skids will see increased use in growing LNG and refined product export terminals.

- Remote monitoring will transform measurement workflows in offshore developments and isolated production sites.

- Replacement of aging mechanical meters will accelerate as operators shift toward maintenance-free technologies.

- Cybersecure metering systems will gain importance as digital data flows increase across the supply chain.

- ESG commitments will drive adoption of low-leakage, energy-efficient metering designs in global operations.