Market Overview

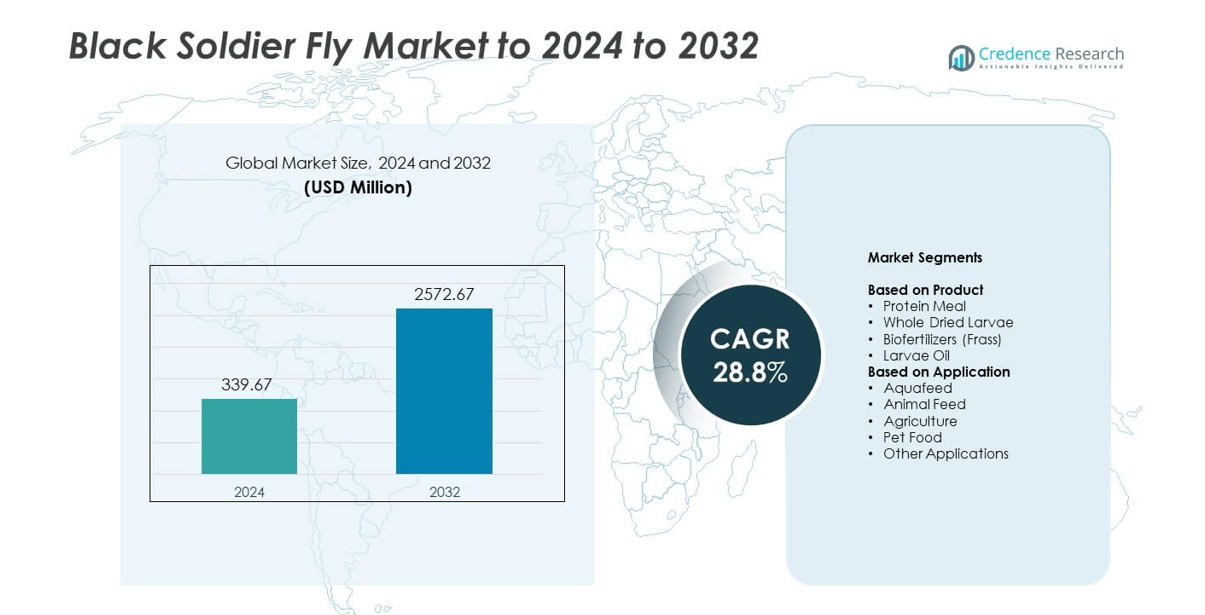

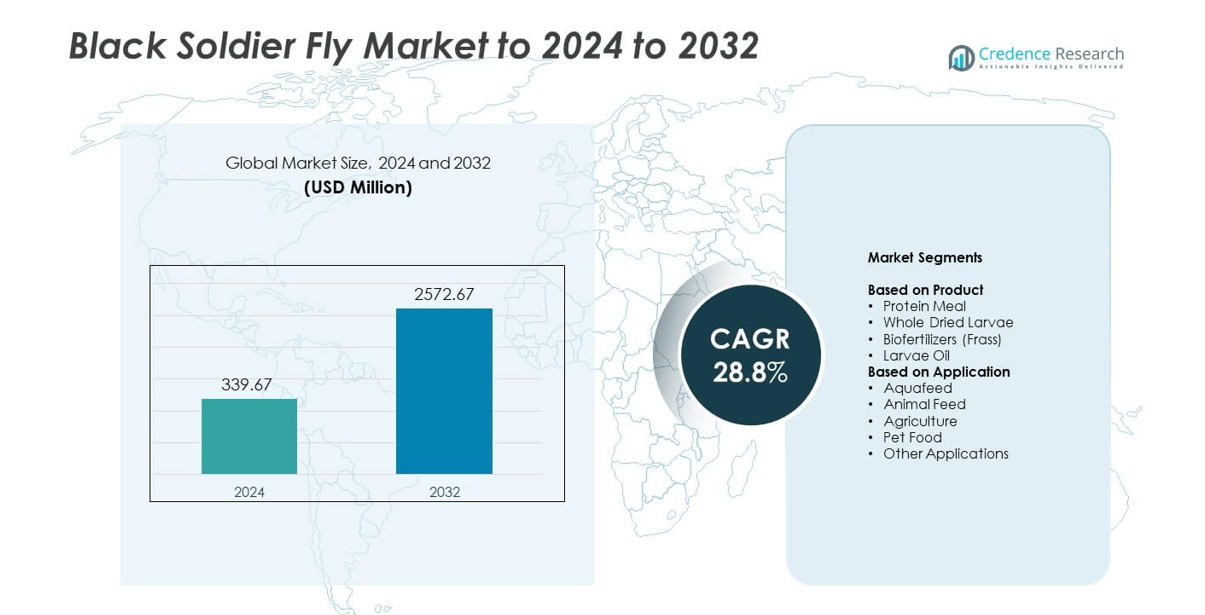

Black Soldier Fly Market size was valued at USD 339.67 million in 2024 and is anticipated to reach USD 2572.67 million by 2032, at a CAGR of 28.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Black Soldier Fly Market Size 2024 |

USD 339.67 million |

| Black Soldier Fly Market, CAGR |

28.8% |

| Black Soldier Fly Market Size 2032 |

USD 2572.67 million |

The Black Soldier Fly Market features leading players such as Hexafly, EnviroFlight LLC, Entofood Sdn Bhd, BioflyTech, InnovaFeed, AgriProtein, SFly Greentech, Protix B.V., Entobel Holding Pte. Ltd., and Enterra Feed Corporation, each expanding capacity to meet rising demand for sustainable protein and biofertilizers. These companies focus on scaling bioconversion facilities, enhancing larvae productivity, and forming partnerships with feed and agriculture industries. North America leads the global market with about 38% share in 2024, supported by strong adoption in aquafeed, pet food, and waste-to-protein systems, followed by Europe with roughly 32% share due to advanced regulations and mature production infrastructure.

Market Insights

- The Black Soldier Fly Market was valued at USD 339.67 million in 2024 and is projected to reach USD 2572.67 million by 2032, growing at a CAGR of 28.8%.

- Strong demand for sustainable protein in aquafeed and poultry feed drives growth, with the protein meal segment holding about 46% share due to high digestibility and reduced reliance on fishmeal.

- Key trends include expansion of large-scale bioconversion plants, rising commercialization of larvae oil, and increasing adoption of insect-based fertilizers in organic farming.

- The market is competitive, with producers scaling automated rearing systems and forming partnerships to secure long-term feed supply channels while improving yield efficiency.

- North America leads with around 38% share in 2024, followed by Europe at nearly 32%, while Asia Pacific grows quickly with about 22% share due to strong aquaculture demand and expanding waste-to-protein initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Protein meal leads this segment with about 46% share in 2024 due to strong demand from aquaculture and poultry producers seeking high-quality, sustainable, and nutrient-dense feed ingredients. Producers adopt protein meal because it offers high amino acid content, better digestibility, and reduced environmental impact compared to fishmeal and soy-based alternatives. Whole dried larvae grow steadily as low-cost feed for poultry and reptiles, while biofertilizers gain traction in organic farming. Larvae oil expands as livestock nutrition programs shift toward energy-rich and antimicrobial feed components.

- For instance, Nutrition Technologies’ plant in Johor produces 3,000 tons of insect meal annually. The same site also outputs 12,000 tons of insect frass for feed and fertilizer markets.

By Application

Aquafeed dominates this segment with nearly 48% share in 2024 driven by rapid growth in fish and shrimp farming and rising demand for high-protein and pathogen-free feed inputs. Black soldier fly protein supports strong feed conversion ratios, reduces reliance on fishmeal, and improves gut health, making it a preferred choice among hatcheries and aqua feed mills. Animal feed adoption grows as livestock producers seek sustainable protein sources, while agriculture and pet food gain traction due to improving regulations and expanding premium pet nutrition trends.

- For instance, Protix’s facility in Bergen op Zoom, Netherlands, now produces around 15,000 metric tonsof live larvae equivalent annually, an increase from the initial 14,000 metric tons stated when the plant opened in 2019.

Key Growth Drivers

Rising demand for sustainable protein sources

Aquaculture, poultry, and livestock producers push demand for black soldier fly products as they seek sustainable protein alternatives to fishmeal and soy. Black soldier fly protein offers high amino acid density, strong digestibility, and a lower environmental footprint, helping producers cut feed-related emissions and reduce pressure on wild fisheries. Rapid expansion in global aquaculture intensifies this shift, with feed formulators adopting insect-based ingredients to improve feed efficiency and meet tightening sustainability requirements. This demand keeps protein meal the primary driver of long-term market growth.

- For instance, InnovaFeed is building an insect protein plant next to ADM’s Decatur complex. The site is planned to deliver 60,000 tons of protein from larvae each year.

Growth of organic and regenerative farming practices

The market benefits from rising adoption of organic farming, compost management, and regenerative agriculture. Farmers prefer black soldier fly frass because the nutrient-rich biofertilizer enhances soil health, boosts microbial activity, and improves crop yields without relying on synthetic inputs. Increasing restrictions on chemical fertilizers across regions strengthen this trend. As governments promote natural soil enhancers and circular agriculture models, biofertilizer demand expands further. This shift supports integrated waste-to-fertilizer systems that position black soldier fly production as a key facilitator of sustainable farming.

- For instance, Entosystem’s Drummondville plant will reach 5,000 tons of protein meal capacity annually. The same facility is designed to produce 15,000 tons of frass fertilizer per year

Expansion of waste management and circular economy initiatives

The market grows as industries and municipalities adopt insect bioconversion to manage organic waste more efficiently. Black soldier fly larvae convert food waste, agricultural residues, and by-products into valuable protein and fertilizer, reducing landfill pressure and methane emissions. This capability aligns with circular economy frameworks that prioritize resource recovery and carbon reduction. Companies invest in mid- and large-scale bioconversion plants to support compliance with regional waste reduction targets. This push strengthens market adoption across food processing, agriculture, and urban waste channels.

Key Trends and Opportunities

Rising commercialization of larvae oil in animal nutrition

Larvae oil emerges as a high-value ingredient in poultry and pet food due to its rich lipid profile and antimicrobial properties. Feed producers explore formulations that use larvae oil to enhance energy density and improve immune response in animals. This creates a new revenue stream for black soldier fly processors and expands the product mix beyond protein meal and frass. Growing demand for premium pet food further accelerates uptake. The trend supports diversified product development and opens opportunities in specialized feed applications.

- For instance, AgriProtein designs its G-series commercial sites to process 250 tons of organic matter each day (approximately 91,000 tons annually). A facility of this capacity is specified to output around 4,000 tons of protein meal and 3,500 tons of insect oil annually.

Technological advancements in large-scale bioconversion

Automation, climate-controlled rearing, and optimized breeding systems reshape efficiency in black soldier fly production. Modern facilities use precision feeding, automated larval separation, and controlled humidity to improve yield consistency and reduce operational costs. These innovations make mass production more scalable and help processors meet rising demand from aquafeed and livestock sectors. As production systems advance, companies secure better margins and achieve faster throughput. Technology adoption also enhances traceability and regulatory compliance, strengthening opportunities for global expansion.

- For instance, Nasekomo’s proprietary Automated Insect Rearing Beds and Bots platform units are specifically designed to be up to 81 meters in lengthand 12 floors in height.

Growing regulatory alignment for insect-based feed

More regions introduce guidelines that formalize the use of insect-based proteins in aquafeed, poultry feed, and pet nutrition. This regulatory clarity encourages investment and helps producers expand commercial operations. Clear safety standards increase acceptance among feed manufacturers and strengthen cross-border trade. As regulations widen across Europe, Asia-Pacific, and North America, market participants gain access to broader certified demand pools. This shift creates significant room for expansion across mainstream feed categories.

Key Challenges

Regulatory limitations in certain feed segments

Some regions still restrict insect-based proteins in swine and ruminant feed, which limits full-scale market penetration. Regulatory uncertainty slows investment and complicates product positioning for feed manufacturers. Companies must comply with strict safety and hygiene standards, requiring costly certification and facility upgrades. These constraints reduce adoption speed and delay broader market access. Until regulations harmonize globally, growth remains uneven across regions and animal nutrition segments, posing a moderate barrier for producers.

High production costs and scalability constraints

Producers face challenges scaling to industrial output due to high energy use, climate control needs, and labor-intensive processes. Maintaining optimal rearing conditions for larvae demands consistent temperature, humidity, and feed supply, which increases operational expenditure. Many small and mid-sized producers struggle to match the cost competitiveness of established feed proteins. Limited access to affordable automation further slows expansion. These factors restrict economies of scale and reduce profit margins, making it difficult for new entrants to compete in large commercial markets.

Regional Analysis

North America

North America holds about 38% share in 2024 due to strong adoption of insect-based protein in aquafeed, poultry feed, and pet nutrition. Producers in the United States expand capacity as sustainability rules tighten and aquaculture businesses seek alternatives to fishmeal. Growth also comes from rising investments in large-scale waste-to-protein plants that convert food waste into larvae-based ingredients. Canada supports the market with favorable regulations for insect-derived feed. Expanding circular economy programs and high consumer interest in eco-friendly pet food strengthen long-term demand across the region.

Europe

Europe accounts for nearly 32% share in 2024 driven by mature regulatory frameworks that permit insect protein use across aquaculture, poultry, and pet food. The region benefits from early commercialization, advanced bioconversion facilities, and strong government support for circular agriculture. Countries such as France, the Netherlands, and Denmark lead industrial-scale production with optimized breeding and processing technologies. Demand rises as feed producers adopt insect protein to meet strict carbon reduction targets. Growing organic farming activity boosts frass consumption, further expanding the region’s market base.

Asia Pacific

Asia Pacific captures about 22% share in 2024 and grows rapidly due to strong aquaculture demand in China, Indonesia, Vietnam, and India. Large fish and shrimp farming operations accelerate adoption of black soldier fly protein because it offers high digestibility and reduces dependence on imported fishmeal. Governments promote waste-to-protein projects to manage food waste streams in major cities. Expanding livestock and poultry industries also support uptake. Increasing interest in natural fertilizers strengthens frass use in regional agriculture. Rising investments in commercial-scale insect farming push the region toward higher future market share.

Latin America

Latin America holds roughly 5% share in 2024 supported by growing adoption in aquaculture and poultry feed. Countries such as Brazil, Chile, and Mexico expand interest in sustainable feed inputs as producers look for affordable alternatives to traditional proteins. Rising organic farming boosts the use of frass as a natural fertilizer, while expanding food processing industries create suitable waste streams for bioconversion. Limited large-scale production capacity slows market acceleration, but improving regulatory clarity and private-sector investment create opportunities for regional expansion in the coming years.

Middle East and Africa

Middle East and Africa account for about 3% share in 2024 with steady growth driven by rising demand for sustainable animal feed solutions. Aquaculture development in Egypt and South Africa supports uptake of larvae-based protein, while poultry producers explore insect meal to improve feed efficiency under high input costs. Several countries encourage waste reduction and alternative protein projects to manage growing urban food waste. Although industrial production remains limited, increasing interest from agriculture and livestock sectors opens new opportunities as regulations evolve and small-scale facilities expand.

Market Segmentations:

By Product

- Protein Meal

- Whole Dried Larvae

- Biofertilizers (Frass)

- Larvae Oil

By Application

- Aquafeed

- Animal Feed

- Agriculture

- Pet Food

- Other Applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Black Soldier Fly Market is shaped by major players such as Hexafly, EnviroFlight LLC, Entofood Sdn Bhd, BioflyTech, InnovaFeed, AgriProtein, SFly Greentech, Protix B.V., Entobel Holding Pte. Ltd., and Enterra Feed Corporation. Companies focus on expanding production capacity, improving larvae yield, and strengthening bioconversion efficiency to meet rising demand from aquafeed, poultry, livestock, and pet food sectors. Many producers invest in automated rearing systems, climate-controlled facilities, and optimized breeding cycles to enhance scalability and cost competitiveness. Firms also emphasize circular economy models by converting organic waste into high-value protein and fertilizer. Strategic partnerships with feed manufacturers, agriculture groups, and waste management companies support market penetration and long-term supply agreements. Increasing regulatory approvals encourage geographic expansion, while sustained R&D investment enables the development of advanced protein meals, larvae oils, and specialized biofertilizers tailored for specific end-use applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hexafly (Ireland)

- EnviroFlight LLC (United States)

- Entofood Sdn Bhd (Malaysia)

- BioflyTech (Spain)

- InnovaFeed (France)

- AgriProtein (South Africa)

- SFly Greentech (France)

- Protix B.V. (Netherlands)

- Entobel Holding Pte. Ltd. (Singapore)

- Enterra Feed Corporation (Canada)

Recent Developments

- In 2024, Entofood (Veolia Bioconversion Malaysia) operates a large BSF farm in Bestari Jaya, commercializing BSF products under brands like Entolipid (insect oil) and Entomeal™ (insect meal)

- In 2023, Protix announced a significant strategic partnership and joint venture with Tyson Foods, one of the world’s largest food companies, to build a full-scale insect protein facility in the US and collaborate on bringing insect-based ingredients to market.

- In 2022, EnviroFlight moved into its new Innovation Centre in Raleigh, North Carolina, focusing on R&D in BSF genetics, biology, nutrition, and product development including animal health and soil nutrition.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as aquafeed and poultry producers increase adoption of insect protein.

- Large-scale bioconversion plants will grow due to rising organic waste management needs.

- Protein meal demand will strengthen as feed formulators seek sustainable and high-digestibility ingredients.

- Larvae oil will gain wider use in poultry and pet food due to its strong lipid profile.

- Biofertilizer use will rise as farmers shift toward organic and regenerative farming practices.

- Advancements in automation will improve production efficiency and reduce operating costs.

- Regulatory approvals for insect-based feed will expand across more regions and species.

- Pet food brands will increase insect protein use to meet premium and eco-friendly product demand.

- Investment in climate-controlled breeding systems will support year-round, consistent production.

- Global sustainability policies will drive long-term adoption of circular waste-to-value systems.