Market Overview

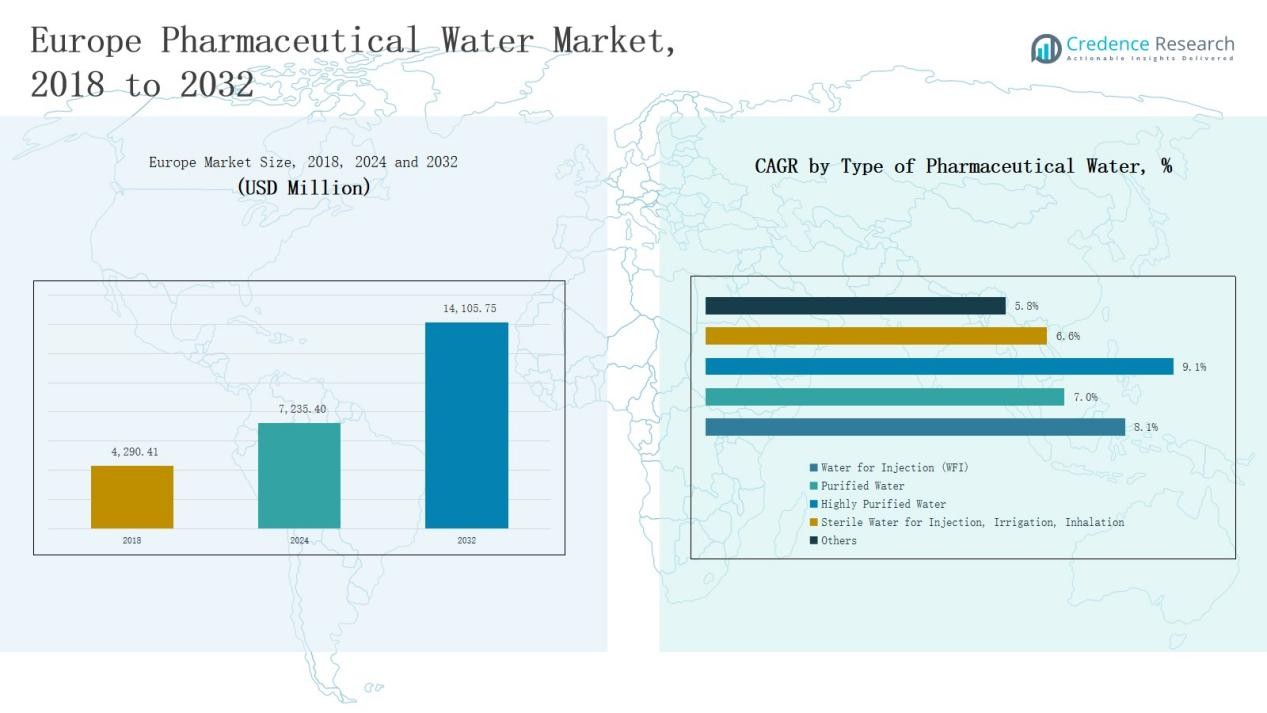

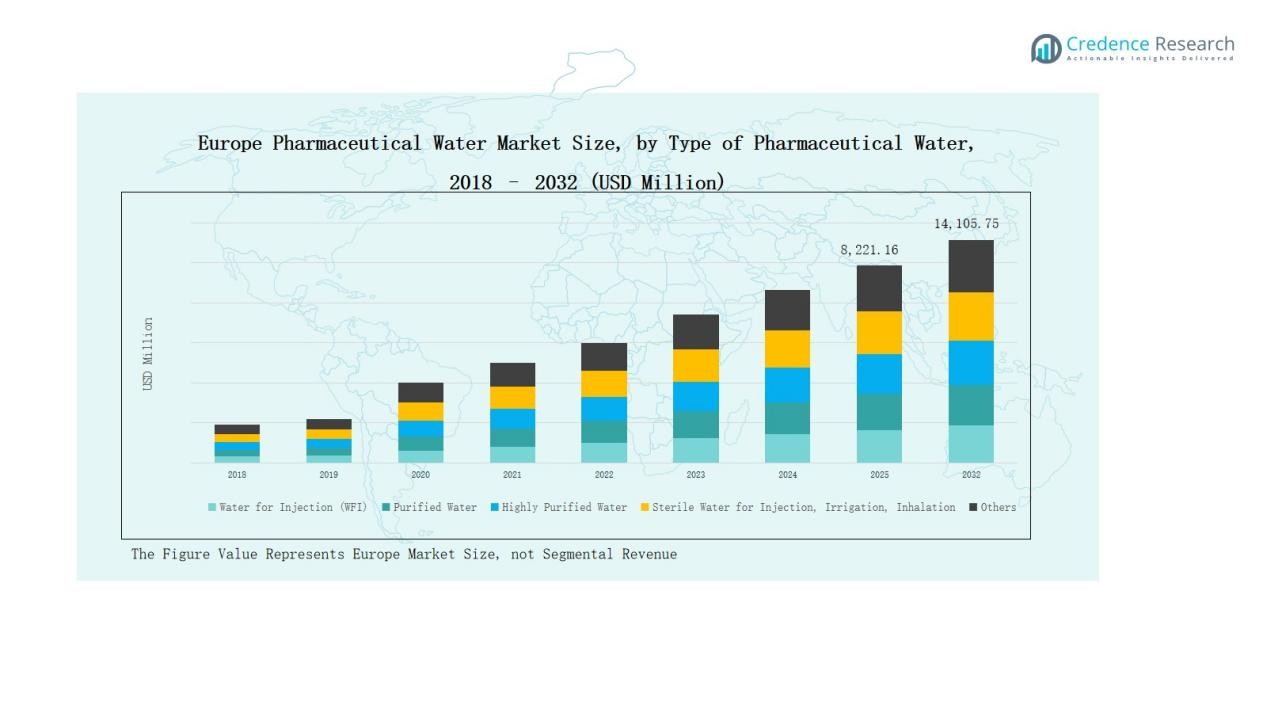

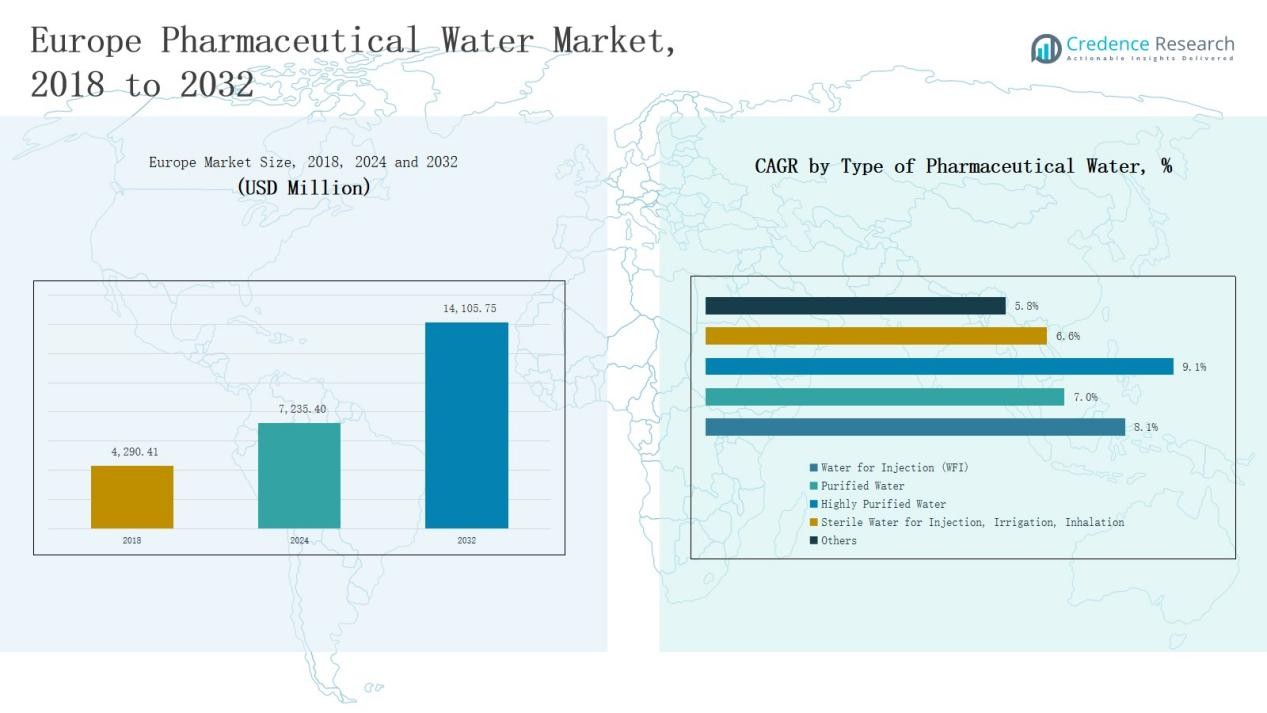

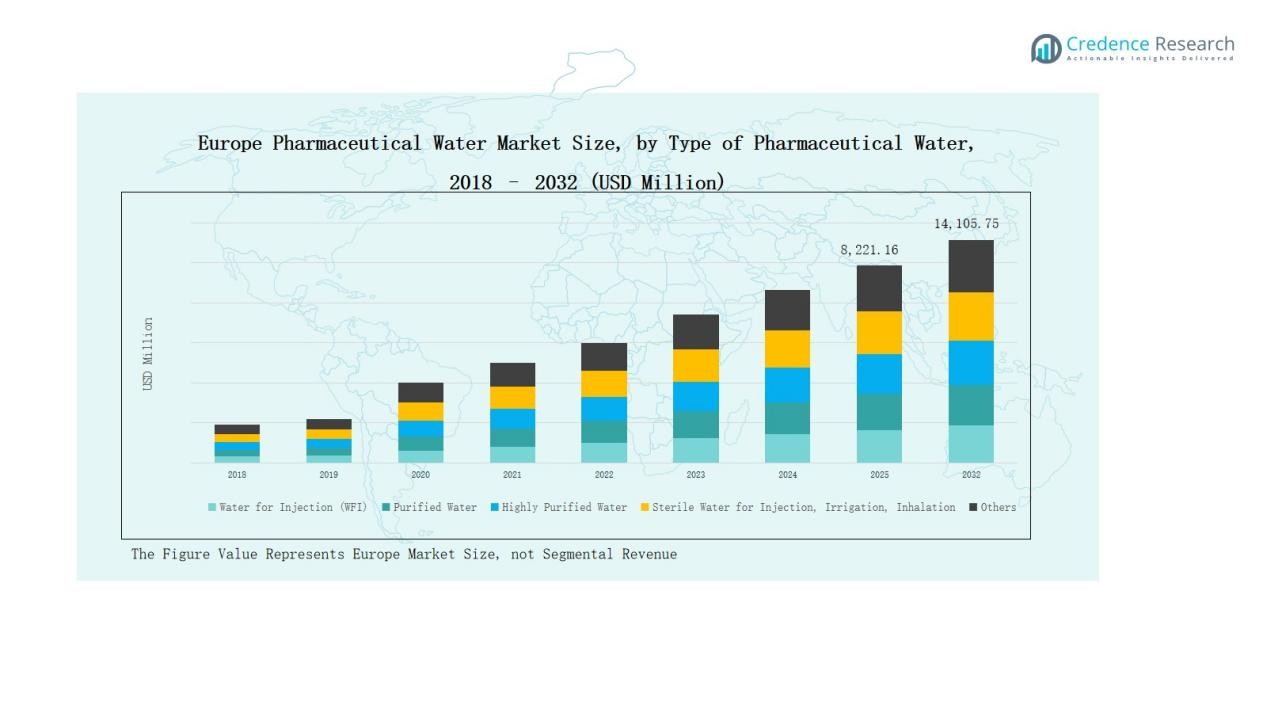

The Europe Pharmaceutical Water Market was valued at USD 4,290.41 million in 2018, grew to USD 7,235.40 million in 2024, and is anticipated to reach USD 14,105.75 million by 2032, expanding at a CAGR of 8.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Pharmaceutical Water Market Size 2024 |

USD 7,235.40 Million |

| Europe Pharmaceutical Water Market, CAGR |

8.0% |

| Europe Pharmaceutical Water Market Size 2032 |

USD 14,105.75 Million |

The Europe Pharmaceutical Water Market features strong competition among leading players such as Ecolab Inc., Veolia Water Technologies, Thermo Fisher Scientific Inc., Danaher Corporation, B. Braun Medical Inc., Merck KGaA, SteriCare Solutions, Baldwin Technology Company, Sigma-Aldrich (Merck KGaA), and Corning Incorporated. These companies dominate through advanced purification technologies, GMP-compliant water systems, and continuous innovation in automation and digital monitoring. They focus on sustainability, energy efficiency, and real-time validation to meet strict EMA and GMP standards. The United Kingdom emerged as the leading regional market in 2024, capturing a 24% share, supported by a strong pharmaceutical manufacturing base, advanced biopharmaceutical production, and ongoing investments in high-purity water infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Pharmaceutical Water Market grew from USD 4,290.41 million in 2018 to USD 7,235.40 million in 2024, and will reach USD 14,105.75 million by 2032, growing at 0% CAGR.

- Water for Injection (WFI) led the market with a 42% share in 2024, driven by strict EMA standards, sterile drug production, and expanding biopharmaceutical manufacturing across the region.

- Reverse Osmosis (RO) technology dominated with a 39% share, supported by efficiency, regulatory compliance, and widespread adoption for high-purity and WFI water generation.

- Pharmaceutical & Biotechnology Manufacturing remained the largest application segment with a 58% share, propelled by biologics expansion, sterile injectable production, and advanced GMP-compliant facilities.

- The United Kingdom led the regional market with a 24% share, followed by Germany (21%) and France (17%), supported by strong pharmaceutical infrastructure, regulatory compliance, and continuous investments in water purification systems.

Market Segment Insights

By Type of Pharmaceutical Water

Water for Injection (WFI) dominated the Europe Pharmaceutical Water Market in 2024 with a 42% share. Its leadership stems from strict regulatory demands for parenteral drug production and biopharmaceutical formulations. WFI systems ensure the highest purity level, meeting EMA and GMP standards. Rising investments in sterile manufacturing, vaccine development, and biologics production further boost adoption. Purified and highly purified water also show steady demand across formulation and cleaning processes in pharmaceutical facilities.

By Treatment Technology

Reverse Osmosis (RO) led the market in 2024 with a 39% share, supported by its efficiency, cost-effectiveness, and compliance with European Pharmacopeia standards. RO systems are widely used for removing dissolved impurities and achieving high-purity levels essential for both purified and WFI production. Continuous advancements in membrane technology, automation, and validation systems drive their adoption. Ultraviolet (UV) disinfection and distillation technologies also play key roles in microbial control and sterile water generation.

- For instance, Merck KGaA upgraded its Milli-Q IQ 7003/7005 systems with advanced RO pre-treatment modules to enhance production of ultrapure water for life science applications.

By Application

Pharmaceutical & Biotechnology Manufacturing accounted for the largest market share of 58% in 2024. The segment benefits from increased biologics production, sterile injectable manufacturing, and stringent EU GMP water quality requirements. Continuous expansion of drug formulation plants and biologics R&D facilities sustains demand for high-purity water systems. Research laboratories, academic institutes, and contract manufacturing organizations (CMOs) also contribute significantly through their growing reliance on validated water systems for experimental and outsourced pharmaceutical operations.

- For instance, Thermo Fisher Scientific expanded its biologics development facility in St. Louis , incorporating high-purity water processing units to enhance sterile injectable production.

Key Growth Drivers

Rising Biopharmaceutical Production and Sterile Drug Manufacturing

Europe’s growing focus on biopharmaceuticals and sterile injectables is a major growth driver. Increasing demand for vaccines, biosimilars, and biologic therapies has elevated the need for high-purity water systems. Pharmaceutical companies are investing heavily in advanced WFI and purified water units to meet stringent EMA and GMP quality standards. The expanding biopharma infrastructure across Germany, France, and the UK further supports installation of automated water purification technologies that ensure contamination-free operations and process reliability.

- For instance, Veolia Water Technologies’ Orion™ system is widely adopted across Europe, integrating reverse osmosis and continuous electrodeionization to produce purified water meeting stringent USP and European Pharmacopoeia standards, while supporting energy reduction by up to 50%.

Stringent Regulatory Compliance and Quality Standards

The market benefits from Europe’s strict regulatory framework for water used in drug manufacturing. Agencies such as EMA and national GMP authorities mandate precise quality levels for purified and injectable water. These rules drive pharmaceutical companies to adopt advanced purification, monitoring, and validation systems. Compliance requirements for microbiological and chemical limits have prompted large-scale investments in automated and validated water treatment infrastructure across both established and emerging pharmaceutical hubs in the region.

- For instance, Sartorius AG introduced an enhanced water filtration validation module designed to help European pharmaceutical manufacturers meet EMA and EU GMP Annex 1 sterility requirements.

Increasing Investments in Pharmaceutical Infrastructure

Rising capital expenditure in pharmaceutical and biotechnology facilities fuels market expansion. Ongoing projects focused on capacity expansion, modernization, and automation of production plants increase the need for reliable pharmaceutical water systems. Growing investments in contract manufacturing and R&D laboratories across the UK, France, and Italy enhance demand for customized purification setups. This infrastructure development supports higher output efficiency, improved regulatory compliance, and consistent quality in water-dependent manufacturing processes across the region.

Key Trends & Opportunities

Integration of Automation and Digital Monitoring Systems

Automation and digital water management are emerging as key trends in the market. Smart sensors, IoT-enabled monitoring, and AI-based control systems enhance process accuracy and reduce human intervention. These technologies improve traceability, energy efficiency, and predictive maintenance, helping facilities maintain compliance with GMP and European Pharmacopeia standards. Vendors focusing on digital integration gain a strong competitive edge by offering real-time performance tracking and remote monitoring solutions for pharmaceutical water operations.

- For instance, Netafim, a global leader in irrigation solutions, uses IoT-enabled smart irrigation systems with sensors that adjust watering schedules based on real-time soil moisture and weather data, effectively enhancing water efficiency and crop yields.

Growing Shift Toward Sustainable Water Treatment Solutions

Sustainability-focused innovation presents a major opportunity for market growth. Manufacturers increasingly adopt energy-efficient RO systems, waste reduction units, and water recovery technologies to align with Europe’s environmental goals. Green manufacturing initiatives across the pharmaceutical sector encourage investment in low-energy distillation and hybrid purification methods. Companies emphasizing resource optimization and eco-friendly purification gain favor among regulatory bodies and end users seeking reduced operational costs and environmental footprints.

- For instance, Aquature, another UK-based company, offers a green hydrogen-powered bio-electric refinery that converts wastewater chemical energy into green hydrogen with over 85% conversion efficiency, integrating AI and IoT for remote monitoring.

Key Challenges

High Capital and Operational Costs

Implementing pharmaceutical-grade water systems requires substantial initial investment and maintenance expenses. Costs related to installation, validation, and periodic compliance audits limit adoption among small and mid-sized manufacturers. Energy-intensive processes such as distillation and multi-stage purification further add to operational costs. The need for continuous system upgrades to meet evolving GMP standards adds financial pressure, posing a challenge for organizations with limited technical or capital resources.

Complexity in Compliance and Validation Processes

Adhering to Europe’s stringent water quality standards is technically challenging. Pharmaceutical companies must ensure full compliance with EU GMP, EMA, and European Pharmacopeia guidelines. Each production stage demands validated documentation, continuous monitoring, and periodic system requalification. This complexity often delays plant commissioning and increases regulatory costs. Smaller players lacking in-house validation expertise face difficulties maintaining consistent compliance across multi-country operations.

Limited Skilled Workforce and Technical Expertise

The shortage of skilled technicians capable of managing and validating complex purification systems poses a major challenge. Advanced pharmaceutical water systems require expertise in automation, validation, and regulatory documentation. Many facilities rely on external service providers, increasing dependency and operational risks. The talent gap slows system optimization and technology adoption, especially among mid-tier pharmaceutical companies striving to modernize production and meet strict European regulatory expectations.

Regional Analysis

United Kingdom

The United Kingdom led the Europe Pharmaceutical Water Market in 2024 with a 24% share. Strong pharmaceutical manufacturing, biopharmaceutical research, and a well-established regulatory framework support market expansion. The country’s emphasis on sterile injectable production and biologics increases demand for Water for Injection (WFI) and purified water systems. Investments in GMP-compliant infrastructure and automation strengthen operational reliability. Leading players continue to upgrade purification technologies to meet MHRA and EMA requirements. Continuous growth in contract manufacturing and R&D centers sustains long-term demand.

Germany

Germany captured a 21% share in 2024, driven by its strong pharmaceutical base and technological innovation. It remains a hub for pharmaceutical engineering and process automation, ensuring high-quality water purification systems. The presence of global pharmaceutical manufacturers encourages adoption of advanced RO and distillation systems. High regulatory standards and strict quality audits promote consistent upgrades to validated water systems. Continuous funding for research and cleanroom expansion boosts demand for high-purity water applications.

France

France accounted for a 17% share in 2024, supported by a growing biologics and vaccine manufacturing sector. Pharmaceutical companies continue investing in sustainable and energy-efficient water purification units. It benefits from well-structured regulatory oversight and widespread use of automated control systems in sterile manufacturing. Expansion of biopharmaceutical facilities and clinical production sites enhances water treatment system installation. Increasing collaboration between domestic and multinational firms accelerates adoption of high-performance purification technologies.

Italy

Italy held a 14% share in 2024, supported by its rising production of generic drugs and sterile formulations. The pharmaceutical sector’s modernization initiatives create strong demand for high-purity water systems. It has shown steady adoption of distillation and reverse osmosis solutions to meet EMA quality benchmarks. The country’s investments in manufacturing expansion and export-oriented drug production encourage water infrastructure growth. Ongoing upgrades to meet EU GMP standards strengthen market penetration among regional producers.

Spain

Spain represented a 12% share in 2024, backed by its growing pharmaceutical exports and manufacturing base. The focus on biosimilars, vaccines, and R&D activities promotes adoption of validated water treatment systems. It benefits from national initiatives supporting technological innovation in pharmaceutical production. Continuous development of modular purification systems supports cost efficiency and process flexibility. Collaborations with global technology providers further improve reliability and system integration.

Rest of Europe

The Rest of Europe region accounted for a 12% share in 2024, encompassing emerging markets such as Russia, Poland, and the Netherlands. Expanding pharmaceutical manufacturing capacity and favorable regulatory reforms support regional growth. Governments promote investments in GMP-compliant infrastructure and water treatment upgrades. Adoption of advanced RO and UV disinfection technologies continues to rise across these markets. It benefits from growing demand for contract manufacturing and rising export potential within Eastern and Northern Europe.

Market Segmentations:

By Type of Pharmaceutical Water

- Water for Injection (WFI)

- Purified Water

- Highly Purified Water

- Sterile Water for Injection, Irrigation, and Inhalation

- Other

By Treatment Technology

- Reverse Osmosis (RO)

- Ultraviolet (UV) Disinfection

- Distillation

- Deionization

- Others

By Application

- Pharmaceutical & Biotechnology Manufacturing

- Research Laboratories & Academic Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

By Region

- United Kingdom (UK)

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Pharmaceutical Water Market is highly competitive, driven by technological innovation, strict regulatory standards, and expanding pharmaceutical manufacturing. Leading companies such as Ecolab Inc., Veolia Water Technologies, Thermo Fisher Scientific Inc., Danaher Corporation, and B. Braun Medical Inc. dominate through comprehensive purification portfolios and validated GMP-compliant systems. These firms focus on automation, membrane innovation, and real-time water quality monitoring to maintain compliance and operational efficiency. Mid-tier players like SteriCare Solutions, Baldwin Technology Company, and Sigma-Aldrich (Merck KGaA) strengthen regional presence through customized solutions for research and production facilities. Strategic partnerships, R&D collaborations, and sustainability-focused upgrades enhance market competitiveness. The ongoing transition toward digital monitoring and modular purification systems encourages both established and emerging suppliers to differentiate through energy-efficient and scalable water treatment technologies that meet evolving European Pharmacopeia and EMA requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Ecolab Inc.

- Veolia Water Technologies

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Braun Medical Inc.

- Merck KGaA

- SteriCare Solutions

- Baldwin Technology Company

- Sigma-Aldrich (Merck KGaA)

- Corning Incorporated

Recent Developments

- In December 2024, Veolia Water Technologies launched mobile water services to support pharmaceutical and life science companies across Europe.

- In September 2025, LuminUltra completed the acquisition of French microbial-testing firm GL Biocontrol, strengthening its position in Europe’s pharmaceutical and industrial water diagnostics market.

- In October 2025, Nijhuis Saur Industries (NSI) acquired Grünbeck Waterbehandeling, a Dutch water treatment firm specialising in industrial process water.

- In November 2023, BW Water completed an asset acquisition of H+E Pharma GmbH and S-Tec GmbH in Germany, strengthening its pharma water treatment capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmaceutical Water, Treatment Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity water systems will rise with growing biologics and vaccine production

- Automation and digital monitoring will become standard in new water treatment installations.

- Pharmaceutical companies will invest more in sustainable and energy-efficient purification systems.

- Expansion of contract manufacturing organizations will drive continuous system upgrades.

- Regulatory alignment with evolving EMA and GMP standards will shape equipment design.

- Adoption of modular and hybrid purification technologies will improve operational flexibility.

- Increased focus on validation and quality assurance will strengthen supplier partnerships.

- Emerging European markets will witness higher adoption of advanced water purification systems.

- Strategic collaborations between global and regional technology providers will accelerate innovation.

- Continuous R&D in filtration and distillation technologies will enhance reliability and water purity standards.