Market Overview:

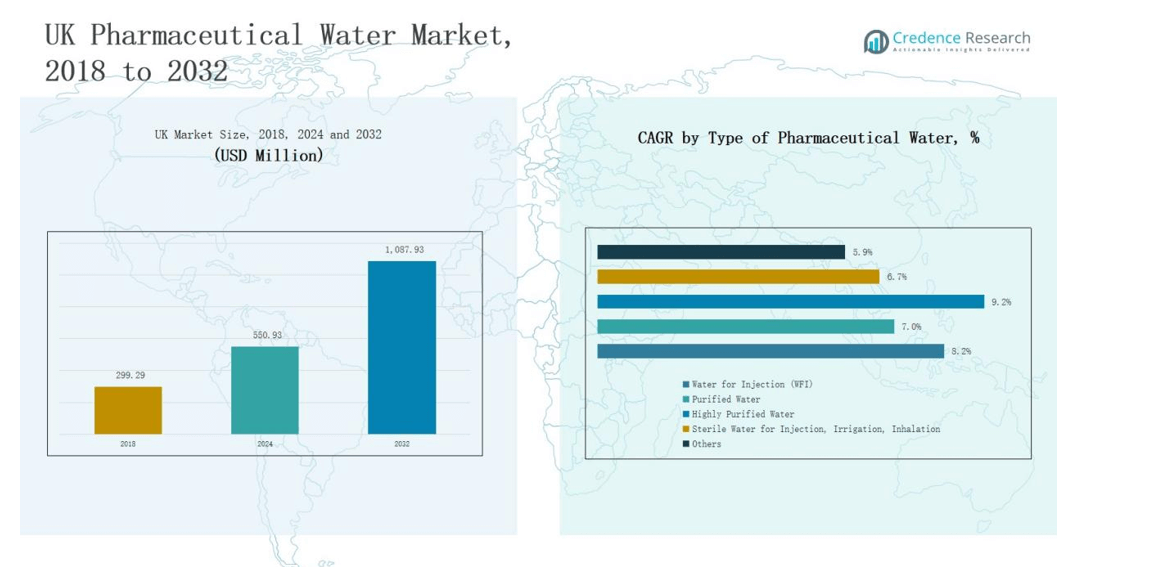

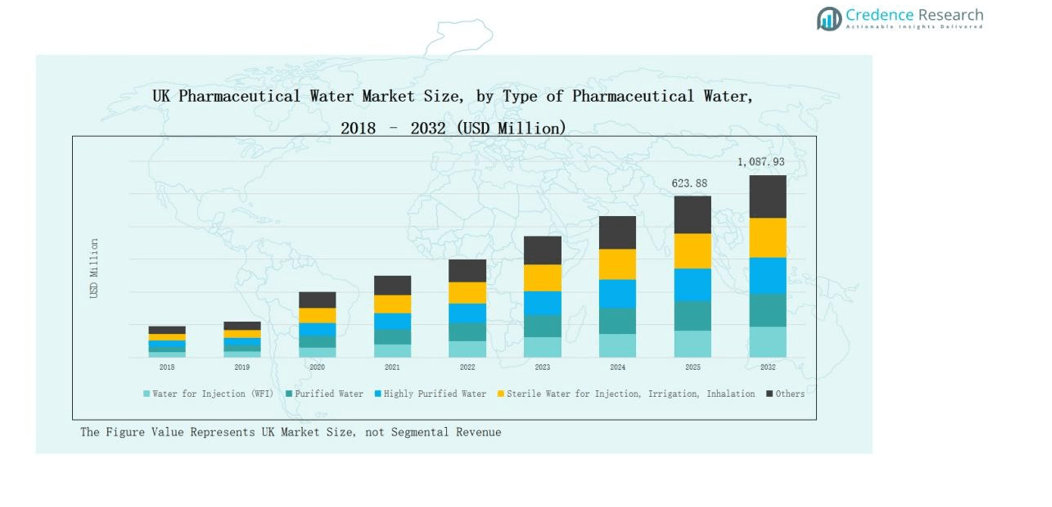

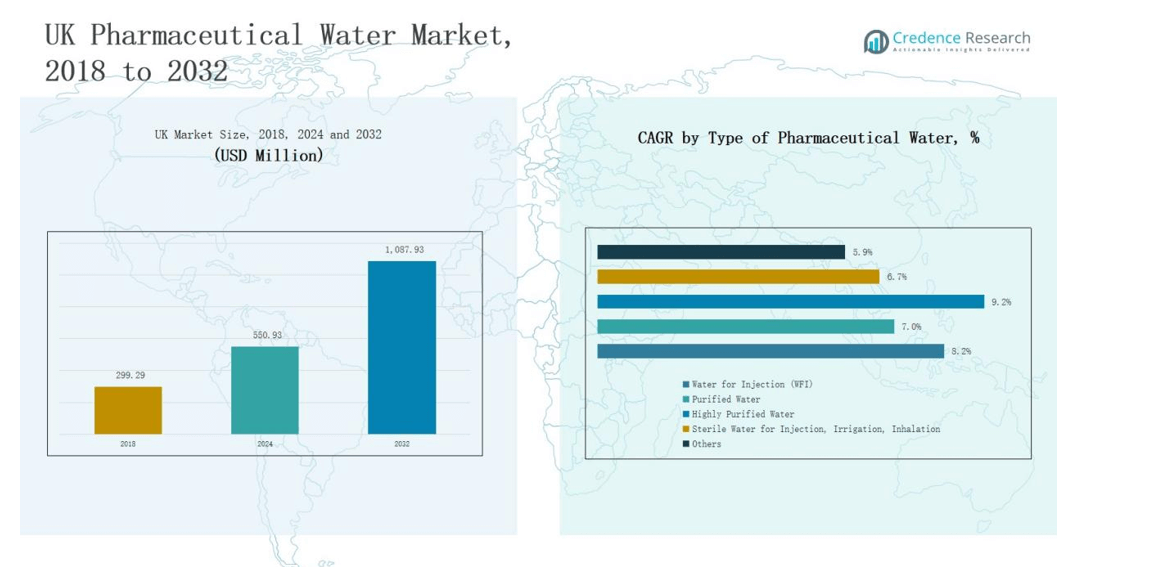

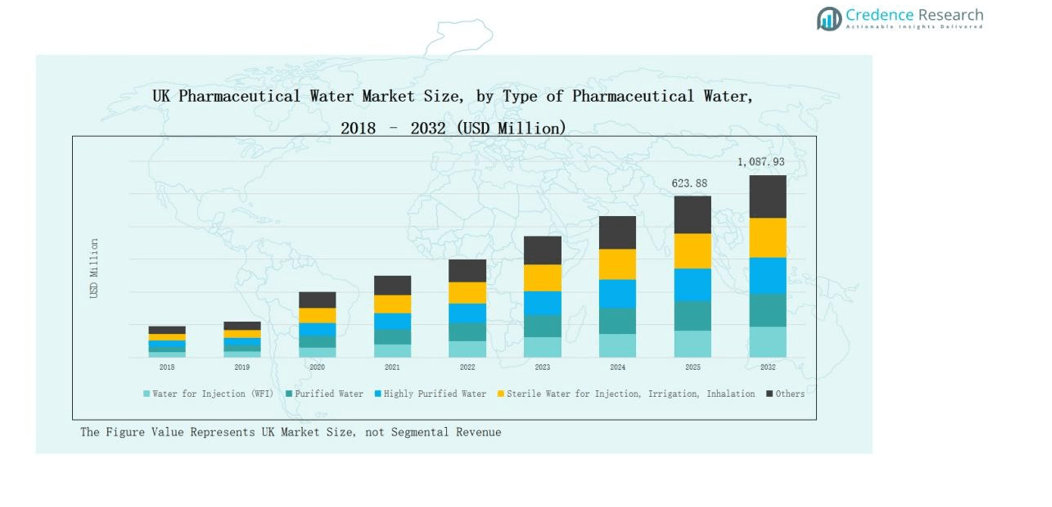

The UK Pharmaceutical Water Market was valued at USD 299.29 million in 2018, increased to USD 550.93 million in 2024, and is projected to reach USD 1,087.93 million by 2032, expanding at a CAGR of 8.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Pharmaceutical Water Market Size 2024 |

USD 550.93 million |

| UK Pharmaceutical Water Market, CAGR |

8.27% |

| UK Pharmaceutical Water Market Size 2032 |

USD 1,087.93 million |

The UK Pharmaceutical Water Market is led by major companies such as Veolia Water Technologies UK, SUEZ Water Purification Systems Ltd., Envirogen Group, BWT Pharma & Biotech UK Ltd., Puretech Process Systems Ltd., and Aqua Solutions Ltd. These players dominate through advanced purification technologies, validated GMP-compliant systems, and strong after-sales service networks. Their focus on automation, energy efficiency, and regulatory compliance enhances product reliability and operational safety across pharmaceutical facilities. England emerged as the leading region in 2024, capturing 58% of the national market share, driven by its dense concentration of pharmaceutical manufacturers, robust research infrastructure, and sustained investments in high-purity water systems.

Market Insights

- The UK Pharmaceutical Water Market grew from USD 299.29 million in 2018 to USD 550.93 million in 2024 and is projected to reach USD 1,087.93 million by 2032, registering a CAGR of 8.27%.

- The Water for Injection (WFI) segment led the market in 2024 with a 43.2% share, driven by its critical role in injectable and biopharmaceutical production.

- Reverse Osmosis (RO) technology accounted for 38.7% of the market, supported by its cost efficiency, scalability, and reliability in meeting GMP standards.

- The Drug Formulation segment held 35.9% of the market share in 2024, propelled by growing sterile drug and vaccine manufacturing activities.

- England dominated the national market with 58% share, followed by Scotland at 19%, reflecting strong industrial concentration, advanced research capabilities, and regulatory compliance infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type of Pharmaceutical Water:

The Water for Injection (WFI) segment dominated the UK Pharmaceutical Water Market in 2024, accounting for 43.2% of the total share. Its leadership stems from its essential use in injectable formulations, sterile drug production, and biopharmaceutical applications. Increasing demand for high-purity water in parenteral drug manufacturing and compliance with MHRA and EMA standards further strengthen WFI’s market position. Expanding biopharma capacity and modernization of purification systems drive continuous investment in this segment across the UK.

By Source Technology:

The Reverse Osmosis (RO) segment led the UK Pharmaceutical Water Market in 2024 with 38.7% share, driven by its cost-efficiency, scalability, and energy savings. RO systems are widely adopted for initial water purification, producing consistent quality that meets GMP standards. Continuous technology upgrades and integration with EDI and UV oxidation improve system performance and monitoring. Growing preference for modular RO systems in pharmaceutical plants reinforces its leading role in maintaining product safety and regulatory compliance.

- For instance, the United States Environmental Protection Agency (EPA) regulations have spurred advanced RO system adoption emphasizing high contaminant rejection and energy efficiency.

By Application:

The Drug Formulation segment held the largest share of 35.9% in the UK Pharmaceutical Water Market during 2024. Demand for high-quality water in sterile and non-sterile drug production supports this dominance. Manufacturers prioritize purified and WFI-grade water to maintain product stability and meet stringent regulatory norms. Expanding pharmaceutical R&D pipelines and growing vaccine production further elevate water quality requirements, making formulation processes the core driver of demand for validated and reliable purification systems in the UK market.

- For instance, GlaxoSmithKline (GSK) implemented high-efficiency reverse osmosis and ultrafiltration systems at its Barnard Castle site to support biopharmaceutical formulation under GMP conditions.

Key Growth Drivers

Rising Biopharmaceutical Production and Injectable Demand

The UK Pharmaceutical Water Market grows strongly due to expanding biopharmaceutical manufacturing and increasing injectable drug production. The rising prevalence of chronic and infectious diseases drives the demand for sterile formulations requiring high-purity Water for Injection (WFI). Companies invest in advanced purification systems to meet MHRA and EMA quality standards. The ongoing shift toward biologics and biosimilars further boosts water system installations across production plants, ensuring process reliability and compliance.

Stringent Regulatory Standards and GMP Compliance

Strict regulatory frameworks established by the MHRA and European Medicines Agency push pharmaceutical manufacturers to adopt validated, high-efficiency water purification technologies. Compliance with Good Manufacturing Practices (GMP) requires continuous monitoring and traceability of pharmaceutical-grade water systems. The enforcement of quality-by-design principles strengthens investments in automated purification and data-logged monitoring systems. This regulatory-driven modernization supports the sustained demand for purified and WFI systems across the UK’s pharmaceutical and biotechnology sectors.

- For instance, Veolia Water Technologies supplied a GMP-compliant purified water generation unit with integrated digital monitoring to a UK-based sterile injectables facility, ensuring 24/7 compliance validation.

Technological Advancements in Water Treatment Systems

Continuous technological advancements in purification technologies enhance operational efficiency and sustainability. The integration of reverse osmosis, deionization, and UV oxidation systems ensures energy savings and high purity. Smart monitoring tools with digital controls enable predictive maintenance and minimize contamination risks. The increasing adoption of modular water systems and real-time data analytics helps manufacturers achieve consistent quality while reducing operational costs. These innovations drive modernization across pharmaceutical facilities in the UK.

- For instance, Puretech offers Genesys and Oasys purified water generation systems that integrate reverse osmosis and continuous electrodeionisation, fully compliant with global pharmaceutical standards, ensuring high purity and reliability in pharmaceutical manufacturing.

Key Trends & Opportunities

Shift Toward Sustainable and Energy-Efficient Systems

A strong focus on sustainability drives the adoption of energy-efficient and eco-friendly water purification systems. Companies integrate low-energy distillation units, reduced-waste RO modules, and heat recovery systems to minimize environmental impact. Green manufacturing initiatives and net-zero commitments across the UK pharmaceutical sector create opportunities for suppliers offering sustainable purification solutions. This trend aligns with national decarbonization goals and promotes long-term investments in environmentally responsible infrastructure.

- For instance, Puretech designs pharmaceutical-grade water systems compliant with FDA and EMA standards, integrating reverse osmosis with continuous electrodeionization and thermal sanitization options to ensure quality while optimizing energy use.

Integration of Automation and Digital Monitoring

Automation and smart monitoring technologies are reshaping pharmaceutical water management in the UK. Advanced SCADA systems, IoT sensors, and real-time analytics optimize performance, reduce downtime, and ensure GMP compliance. Data-driven validation and automated control of temperature, conductivity, and flow improve consistency and reduce human error. These innovations offer strong growth potential for solution providers offering intelligent, validated water systems designed for connected pharmaceutical environments.

- For instance, ELGA LabWater introduced an upgraded PURELAB Pharma Compliance system with automated batch reporting, supporting FDA 21 CFR Part 11 electronic record requirements for pharmaceutical water validation.

Key Challenges

High Capital and Maintenance Costs

Setting up and maintaining pharmaceutical-grade water systems involves significant investment in equipment, validation, and maintenance. The need for continuous compliance testing and periodic calibration increases operational expenses. Smaller manufacturers often face financial strain in adopting advanced technologies. Limited access to cost-effective purification solutions restrains market penetration among mid-tier firms, making cost optimization a major challenge for industry participants in the UK Pharmaceutical Water Market.

Complex Regulatory and Validation Requirements

Meeting stringent MHRA and EMA water quality standards poses challenges for manufacturers. Each purification system must undergo extensive qualification, documentation, and validation before operation. Maintaining audit-ready data logs and adhering to changing regulatory updates increase system complexity. The need for skilled personnel to manage validation and documentation processes adds to compliance costs and operational delays, impacting project timelines and flexibility.

Risk of Microbial Contamination and System Downtime

Ensuring microbial control within water systems remains a major operational challenge. Any deviation in temperature, flow rate, or disinfection efficiency can lead to contamination, resulting in costly production halts. Frequent sanitization cycles and real-time monitoring are essential but increase maintenance demands. Aging infrastructure and inconsistent system upkeep further elevate contamination risks. These issues highlight the need for robust maintenance and monitoring frameworks to ensure continuous compliance and production reliability.

Regional Analysis

England

England dominated the UK Pharmaceutical Water Market in 2024, capturing 58% of the total share. Its leadership is driven by a strong concentration of pharmaceutical manufacturing units, biopharmaceutical research centers, and advanced healthcare infrastructure. The presence of leading players such as Veolia Water Technologies and SUEZ Water Purification Systems strengthens regional capabilities. Government support for GMP-compliant facilities and rapid expansion of contract manufacturing services further boost demand for purified and WFI systems. It remains the central hub for innovation, validation, and large-scale production of high-purity pharmaceutical water.

Scotland

Scotland accounted for 19% of the UK Pharmaceutical Water Market in 2024, supported by its robust biotechnology and life sciences sector. Strong academic collaboration, government incentives, and dedicated industrial clusters in Glasgow and Edinburgh enhance R&D investments. The region shows increasing adoption of reverse osmosis and ultrafiltration systems in bioprocessing and formulation facilities. It benefits from a skilled workforce and growing infrastructure dedicated to sterile production. The rise in biologics and vaccine manufacturing facilities continues to strengthen its regional market position.

Wales

Wales captured 13% share of the UK Pharmaceutical Water Market in 2024, driven by the growing presence of pharmaceutical and medical technology industries. Companies focus on upgrading production units to meet stringent MHRA and EMA regulations. Cardiff and Swansea have become emerging centers for contract research and pharmaceutical manufacturing. Strong emphasis on quality assurance and sustainable purification systems promotes steady market growth. It continues to attract new investments for facility expansion and technology modernization.

Northern Ireland

Northern Ireland held 10% of the UK Pharmaceutical Water Market in 2024, led by its expanding pharmaceutical exports and contract development operations. Belfast serves as a key location for biopharmaceutical process development and water treatment technology integration. The regional market benefits from increased collaboration between government and industry for capacity building. Companies focus on modernizing purification infrastructure to meet GMP compliance. It shows steady growth supported by rising investments in advanced purification, validation, and monitoring technologies.

Market Segmentations:

By Type of Pharmaceutical Water:

- Water for Injection (WFI)

- Purified Water

- Highly Purified Water

- Sterile Water

- Non-compendial Water

By Source Technology:

- Reverse Osmosis (RO)

- Distillation

- Deionization

- Ultrafiltration

- UV Oxidation

By Application:

- Drug Formulation

- API Manufacturing

- Biopharmaceutical Processing

- Laboratory Use

- Cleaning and Sterilization

By End User

- Pharmaceutical Companies

- Biotechnology Firms

- Contract Manufacturing Organizations (CMOs)

- Research Laboratories

- Hospitals & Clinics

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Pharmaceutical Water Market is characterized by moderate concentration, with competition driven by technology innovation, compliance expertise, and after-sales service capabilities. Major participants such as Veolia Water Technologies UK, SUEZ Water Purification Systems Ltd., BWT Pharma & Biotech UK Ltd., and Envirogen Group dominate through validated purification systems, automation, and advanced monitoring solutions. These companies focus on integrating reverse osmosis, ultrafiltration, and UV oxidation systems to meet GMP and MHRA standards. Local players like Puretech Process Systems Ltd. and Aqua Solutions Ltd. strengthen their market presence through turnkey water system projects and customized maintenance contracts. Strategic collaborations with pharmaceutical manufacturers, coupled with investments in sustainable and energy-efficient systems, enhance competitiveness. It continues to evolve toward digitalized operations and modular system design, enabling faster installation and improved validation performance across production facilities in the UK pharmaceutical and biotechnology sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Veolia Water Technologies UK

- SUEZ Water Purification Systems Ltd.

- Envirogen Group

- Puretech Process Systems Ltd.

- BWT Pharma & Biotech UK Ltd.

- Fedegari Group

- Aqua Solutions Ltd.

- Evoqua Water Technologies

- Christ Water Technology

- Aqua Bio Technology ASA

Recent Developments

- In June 2025, Aquatech acquired Century Water to strengthen its global ultrapure and pharmaceutical water solutions portfolio.

- In June 2024, Sartorius introduced the Arium® Mini Extend, a compact ultrapure water system designed to meet Type 1 water standards for pharmaceutical laboratories.

- In September 2023, Veolia Water Technologies UK (VWT UK) launched the PURELAB® Pharma Compliance solution, enhancing water purification and compliance for quality control laboratories in the pharmaceutical sector.

- In August 2025, Rochester Midland Corporation acquired Decon Water Technologies to enhance its water treatment capabilities, strengthening its service presence in global pharmaceutical markets

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmaceutical Water, Source of Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity water will increase with the expansion of biopharmaceutical manufacturing.

- Automation and smart monitoring technologies will become standard across purification systems.

- Sustainable and energy-efficient water treatment solutions will gain higher industry preference.

- Modular and pre-validated systems will reduce installation time for new facilities.

- Investments in digital validation and remote performance tracking will strengthen compliance.

- Growing contract manufacturing activities will expand the need for WFI and purified water units.

- Technological partnerships between equipment suppliers and pharmaceutical companies will increase.

- Integration of AI-driven predictive maintenance tools will improve operational reliability.

- Expansion of vaccine and injectable production will drive consistent demand for sterile water.

- Continuous regulatory alignment with EU and MHRA standards will guide future technology adoption.