Market Overview:

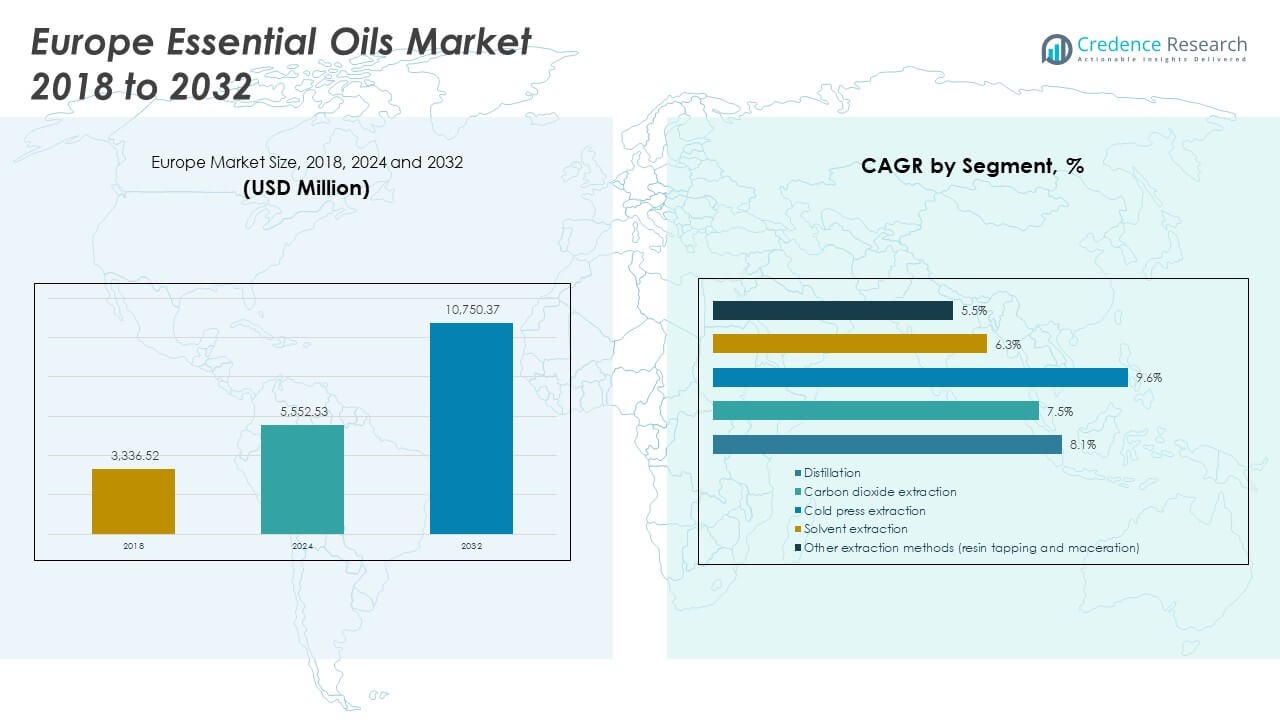

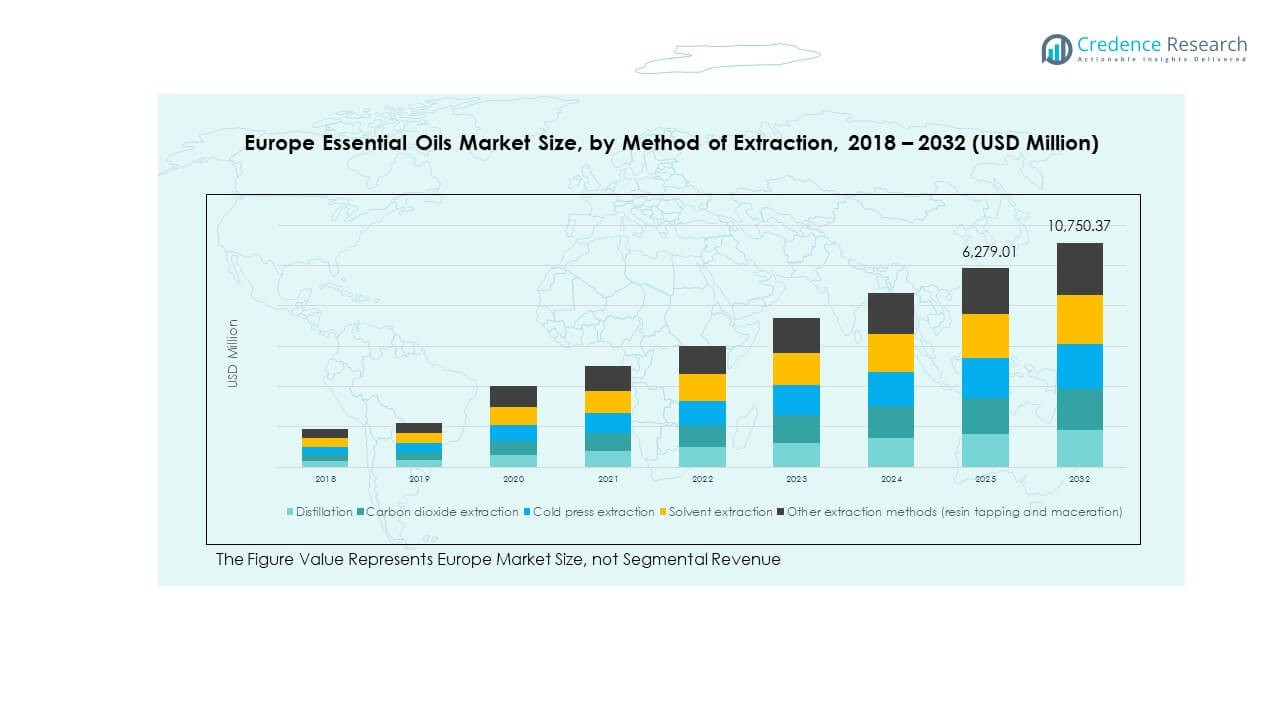

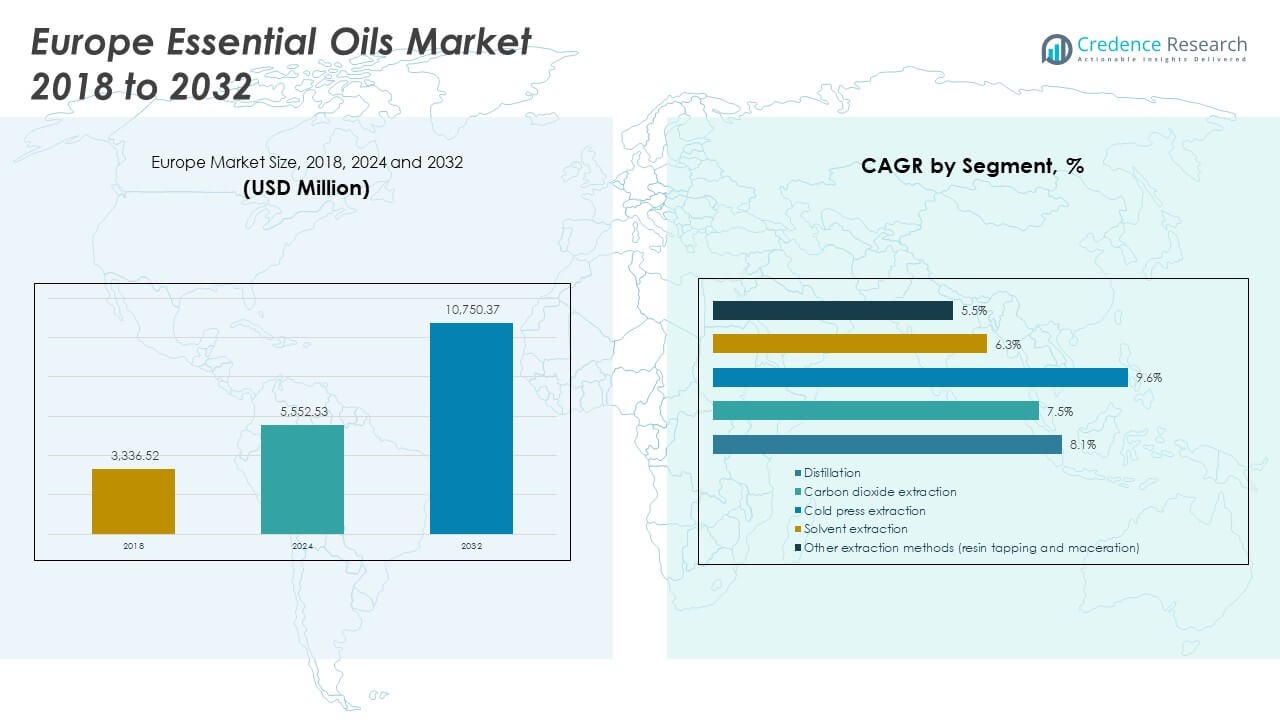

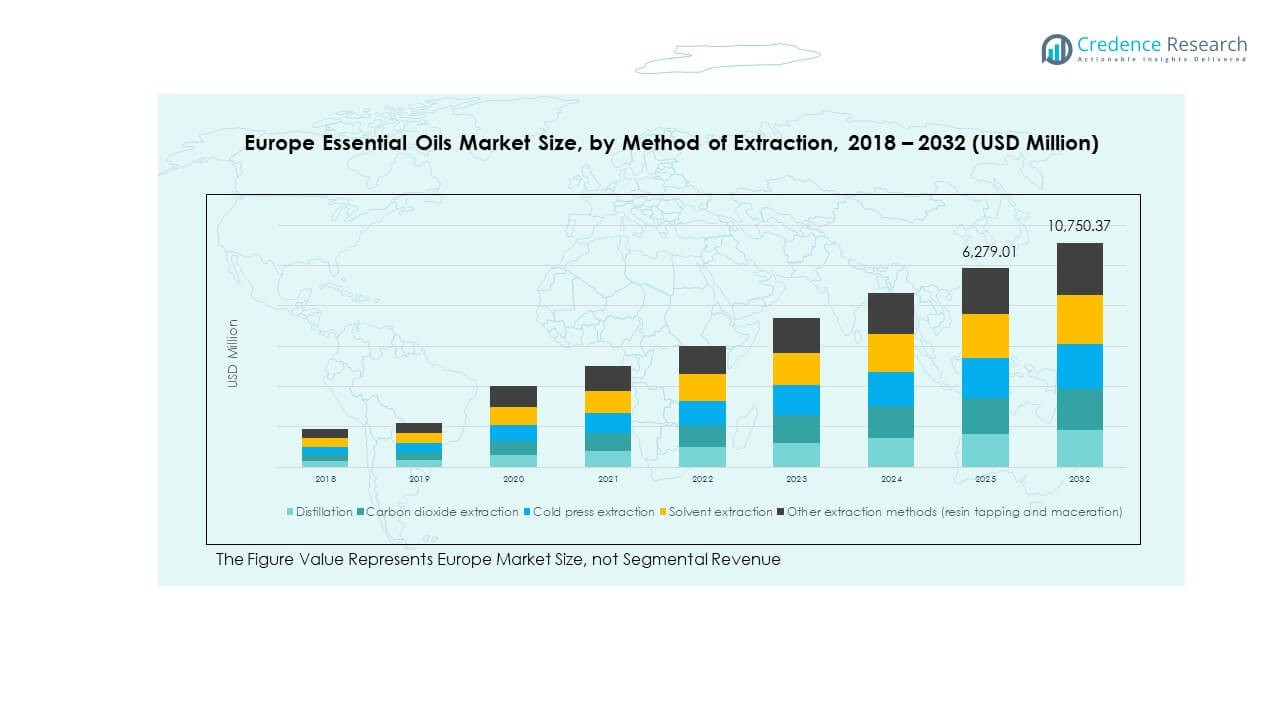

The Europe Wood Essential Oils Market size was valued at USD 3,336.52 million in 2018, reached USD 5,552.53 million in 2024, and is anticipated to reach USD 10,750.37 million by 2032, at a CAGR of 8.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Wood Essential Oils Market Size 2024 |

USD 5,552.53 Million |

| Europe Wood Essential Oils Market, CAGR |

8.00% |

| Europe Wood Essential Oils Market Size 2032 |

USD 10,750.37 Million |

The market is experiencing steady growth driven by rising consumer awareness about natural health and sustainable living. Growing demand for chemical-free personal care, aromatherapy, and household products has expanded its adoption. Consumers are also turning to natural remedies for stress relief, immunity boosting, and lifestyle wellness. Strong retail networks and increasing product accessibility through e-commerce further support expansion. The industry benefits from innovation in extraction techniques and wider applications in pharmaceuticals and cosmetics, helping companies strengthen market presence and consumer trust.

Geographically, Western Europe leads the market with its advanced wellness industry and strong consumer spending on premium natural products. Germany, France, and the UK dominate due to higher awareness and established distribution networks. Southern and Eastern Europe are emerging regions, driven by rising demand for sustainable solutions and growing adoption of aromatherapy in urban centers. Local production capabilities and traditional uses in countries like Italy and Spain also enhance growth prospects, while Eastern European countries present untapped opportunities for expansion.

Market Insights:

- The Europe Wood Essential Oils Market was valued at USD 3,336.52 million in 2018, reached USD 5,552.53 million in 2024, and is projected to reach USD 10,750.37 million by 2032, expanding at a CAGR of 8.0%.

- Western Europe leads with 41% share due to advanced wellness industries, strong consumer demand, and robust retail networks. Germany (18%) and France (14%) dominate further, driven by cultural adoption and premium product consumption.

- Eastern Europe is the fastest-growing region with 11% share, supported by rising disposable incomes, wellness tourism, and increasing awareness of natural products.

- By extraction method, distillation dominates with 38% share in 2024, supported by its widespread adoption in large-scale production for pharmaceuticals and cosmetics.

- Carbon dioxide extraction holds 25% share, driven by demand for high-purity oils in luxury personal care and therapeutic applications.

Market Drivers:

Rising Demand for Natural and Sustainable Wellness Products:

The Europe Wood Essential Oils Market is strongly driven by consumer preference for natural alternatives to synthetic solutions. Growing awareness about the benefits of chemical-free products is shaping purchasing behavior across personal care, aromatherapy, and household applications. Consumers are choosing essential oils for stress management, sleep improvement, and overall wellness. It benefits from the rising shift toward sustainable and eco-friendly lifestyles across Europe. Widespread marketing campaigns and retail presence highlight therapeutic advantages. Online platforms and direct sales are expanding product accessibility. The market continues to attract new users who value clean-label and plant-based options.

- For instance, according to a 2024 report by Revieve, a “93% engagement rate” was found in eco-friendly product categories, indicating strong consumer alignment with sustainability, rather than 93% of all European consumers exclusively preferring these products. This reflect the growing awareness of wellness benefits and environmental concerns in the European market.

Expanding Use in Pharmaceuticals and Cosmetics Industries:

Pharmaceutical and cosmetic sectors are fueling growth through rising applications of wood essential oils. Their antimicrobial, anti-inflammatory, and antioxidant properties make them desirable for product formulations. It is increasingly integrated into topical creams, ointments, and personal hygiene products. Cosmetic companies are incorporating oils in skincare, haircare, and fragrance lines. Demand is reinforced by consumers preferring natural ingredients over synthetic chemicals. Regulatory encouragement for herbal and botanical formulations also supports growth. Rising R&D investments by leading companies enhance product quality and performance. Partnerships between oil producers and cosmetic brands further strengthen industry momentum.

- For instance, Regulatory encouragement for herbal and botanical ingredients supports the trend, while rising R&D investments by key companies enhance product quality and efficacy. Partnerships between essential oil producers and cosmetic brands augment market momentum, especially in countries known for premium personal care such as Germany and France.

Strong Retail Network and E-Commerce Growth:

Distribution networks are vital in promoting market expansion across Europe. The Europe Wood Essential Oils Market benefits from established specialty stores, pharmacies, and wellness outlets. Retailers actively promote premium organic oil brands through in-store promotions and education programs. E-commerce growth has accelerated product accessibility across developed and emerging regions. Online platforms allow consumers to explore diverse oil varieties and compare product benefits. Digital marketing and influencer promotions boost awareness of therapeutic properties. Subscription models and direct-to-consumer sales improve affordability and regular usage. It gains broader reach as cross-border e-commerce expands across Europe.

Government Support and Cultural Adoption:

Government initiatives supporting natural wellness and herbal products strengthen the market. Policies encouraging organic farming and sustainable sourcing enhance raw material availability. It also gains traction due to Europe’s deep cultural association with herbal remedies. Traditional use of essential oils in countries like France, Italy, and Germany provides historical acceptance. Wellness tourism and spa culture integrate wood oils into treatments and therapies. Educational campaigns by health authorities encourage alternatives to synthetic drugs. National standards for quality assurance improve consumer confidence in natural products. Certification schemes highlight product safety and sustainability, building long-term demand.

Market Trends:

Growing Popularity of Premium and Luxury Essential Oils:

Premiumization is shaping consumption patterns in the Europe Wood Essential Oils Market. Affluent consumers are willing to pay higher prices for certified organic and rare oil types. Luxury brands are launching exclusive blends targeting niche segments. The trend is reinforced by rising disposable incomes in Western Europe. Marketing strategies focus on purity, origin, and authenticity. High-end spas and wellness centers integrate premium oils into therapies. It also benefits from gifting culture, where luxury oils are marketed as premium lifestyle products. This trend drives margins and strengthens brand positioning.

- For instance, Marketing efforts focus on purity, origin transparency, and authenticity, while high-end spas and wellness centers integrate these oils into exclusive therapies. The gifting culture further boosts demand for luxury oils as premium lifestyle products, positively impacting margins and brand positioning.

Increasing Focus on Research and Clinical Validation:

Scientific validation of essential oil benefits is gaining importance across Europe. Academic and clinical studies are providing evidence for therapeutic effectiveness. Pharmaceutical companies use validated results to develop natural health products. It strengthens consumer trust and accelerates adoption in wellness practices. Research institutions collaborate with manufacturers to test efficacy in respiratory, dermatological, and mental health applications. Clinical backing enhances credibility in healthcare markets. Consumers are becoming more selective, demanding proven safety and efficiency. The trend increases investments in laboratories and testing facilities across Europe.

- For instance, Collaboration between research institutions and manufacturers drives investments in advanced laboratories and testing facilities, ensuring proven safety and efficacy. Consumers increasingly demand such validated benefits, reinforcing the market’s emphasis on evidence-based wellness.

Integration with Smart and Personalized Wellness Solutions:

Digitalization is transforming wellness practices and product use. The Europe Wood Essential Oils Market is seeing integration with smart devices like diffusers linked to mobile apps. Personalized wellness solutions allow users to customize oil blends based on health needs. Companies are developing subscription boxes that recommend oils using AI-driven data. It is further supported by wellness apps guiding aromatherapy routines. Rising adoption of IoT-enabled diffusers enhances consumer convenience. Tech-enabled personalization caters to younger, digital-native consumers. This trend is expanding across urban markets where digital adoption is higher.

Expansion into Industrial and Commercial Applications:

Industrial and commercial sectors are creating new opportunities for essential oil adoption. The Europe Wood Essential Oils Market is expanding into cleaning, disinfection, and air purification solutions. Offices, hotels, and public spaces are adopting oils for fragrance and hygiene purposes. It is replacing chemical-based fresheners with sustainable alternatives. Airlines and wellness tourism operators are adopting oils for customer experience enhancement. Growth in eco-friendly packaging solutions also supports demand for natural ingredients. Commercial adoption broadens usage beyond traditional retail. This trend diversifies revenue streams for manufacturers and distributors.

Market Challenges Analysis:

High Costs and Supply Chain Disruptions:

The Europe Wood Essential Oils Market faces challenges due to high production costs and limited raw material supply. Sustainable extraction methods and organic certifications increase expenses. Price volatility in raw materials affects profitability for manufacturers. It is also exposed to disruptions in global trade and logistics. Seasonal variations influence yield, creating irregular supply patterns. Small producers struggle with maintaining consistency in quality and pricing. Rising operational costs from energy and labor shortages create additional strain. Supply chain fragmentation delays delivery to retailers and consumers.

Regulatory Hurdles and Market Competition:

Strict regulatory standards present another challenge for manufacturers. European Union rules on labeling, safety, and sustainability require significant compliance investments. It increases barriers for smaller and new entrants. Competition among established brands intensifies as they focus on innovation and pricing strategies. Counterfeit products and unverified oils reduce consumer trust. Fragmentation of the market makes brand differentiation difficult. Companies must balance cost efficiency with quality assurance to remain competitive. Market consolidation may occur as smaller firms exit due to compliance and pricing pressures.

Market Opportunities:

Expansion Across Emerging Eastern and Southern Europe:

Untapped regions present strong opportunities for future growth. The Europe Wood Essential Oils Market is set to expand across Eastern and Southern Europe. Rising disposable incomes and urbanization support higher demand. Consumers in these regions are becoming more aware of natural wellness benefits. Local distributors are expanding retail and e-commerce presence. Wellness tourism in Mediterranean countries provides new product application opportunities. It also benefits from increasing integration into spa and personal care industries. Companies entering these regions can secure long-term market presence.

Innovation in Product Development and Applications:

Innovation is a major driver of future opportunities. The Europe Wood Essential Oils Market benefits from advanced extraction technologies and product diversification. Companies are developing multifunctional blends catering to stress relief, skincare, and air purification. Rising demand for organic and vegan-certified oils presents new niches. Partnerships with pharmaceutical and cosmetic brands open avenues for co-branded products. It is also supported by innovation in eco-friendly packaging and sustainable sourcing. Developing hybrid offerings, such as oils combined with supplements, attracts new consumer groups. The opportunity lies in catering to health-conscious and eco-friendly demographics.

Market Segmentation Analysis:

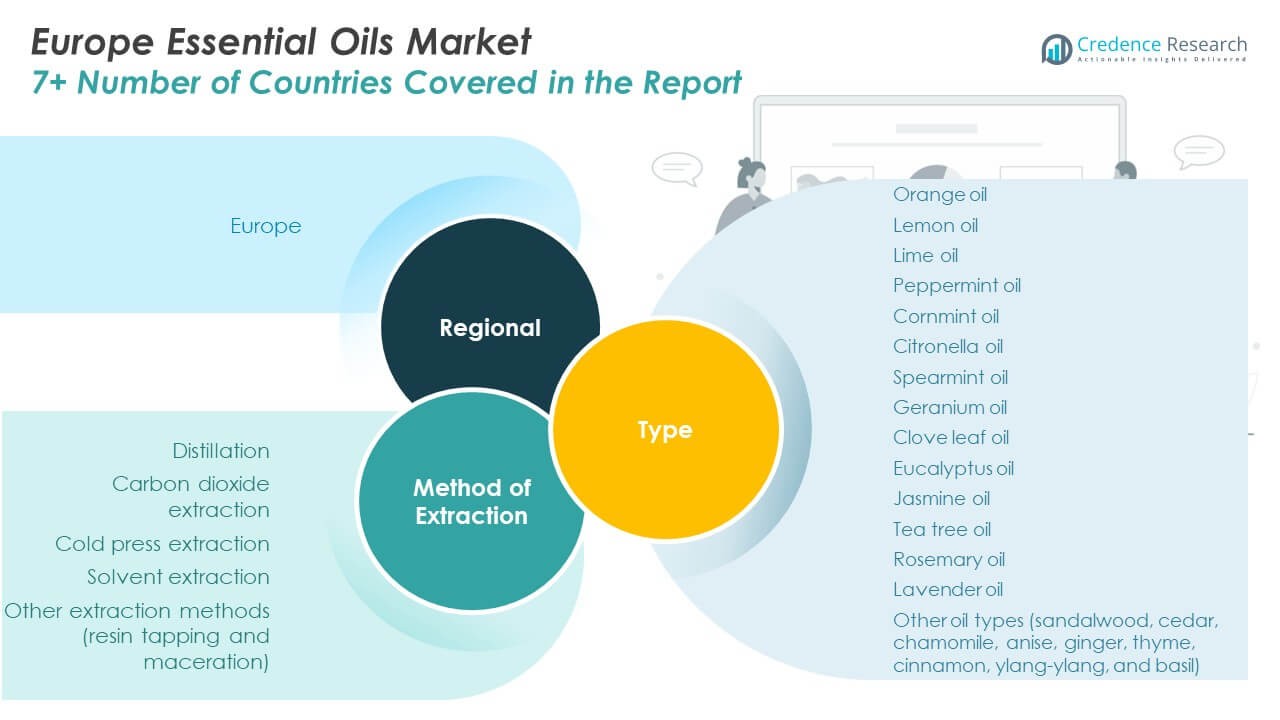

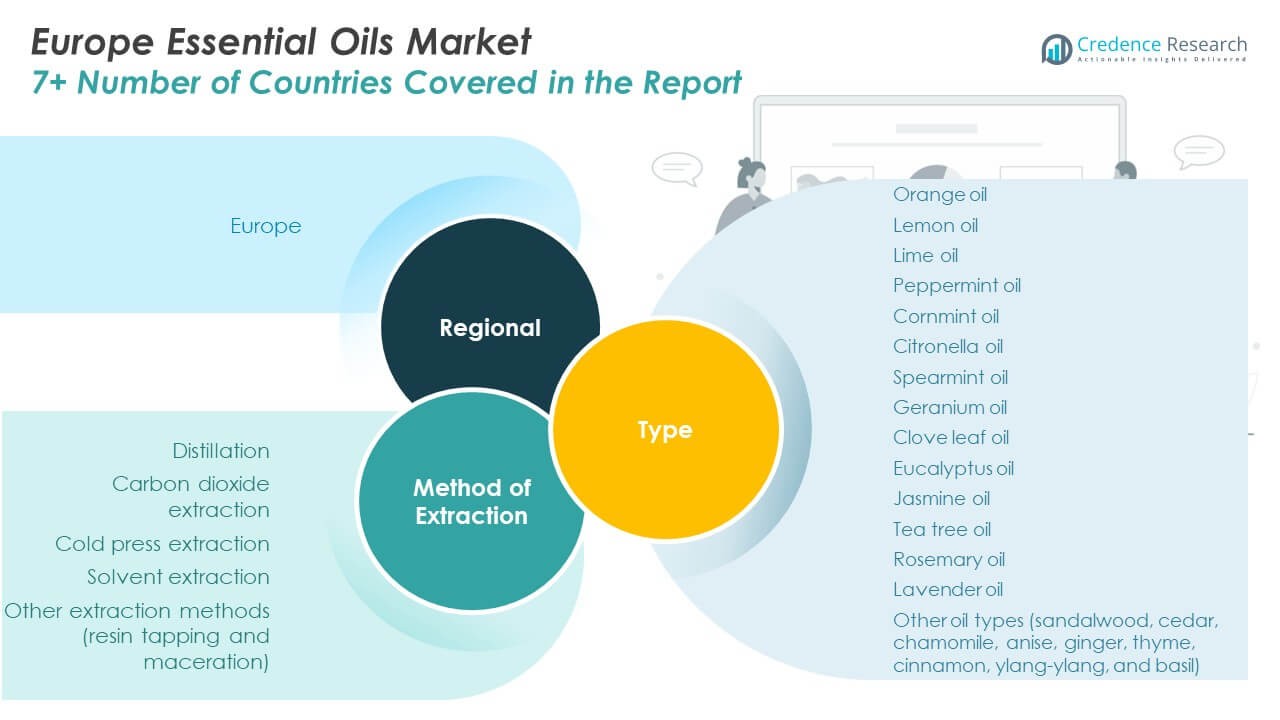

By Type

The Europe Wood Essential Oils Market is segmented by a wide range of oil types that serve diverse applications across personal care, aromatherapy, food, and pharmaceuticals. Orange oil, lemon oil, and lime oil dominate due to strong demand in flavors, fragrances, and household products. Peppermint and cornmint oils remain essential in oral care and therapeutic uses, while citronella and spearmint oils are widely adopted in insect repellents and wellness solutions. Geranium and clove leaf oils contribute to skincare and medicinal products. Eucalyptus, jasmine, and tea tree oils gain traction in pharmaceutical and cosmetic applications. Rosemary and lavender oils are popular in aromatherapy and relaxation solutions, supported by rising consumer interest in stress management. Other oil types such as sandalwood, cedar, chamomile, anise, ginger, thyme, cinnamon, ylang-ylang, and basil enhance market diversity with niche applications in luxury and specialized care products.

- For instance, the market is diverse with orange, lemon, and lime oils dominating due to strong demand in flavors, fragrances, and household products. Cornmint oil commands a significant market share given its therapeutic properties for insomnia, headaches, and digestive issues.

By Method of Extraction

The Europe Wood Essential Oils Market is categorized by extraction methods that influence quality, cost, and applications. Distillation holds the largest share, supported by its widespread use and ability to process bulk volumes efficiently. Carbon dioxide extraction is gaining ground due to its ability to produce high-purity oils suited for premium and therapeutic uses. Cold press extraction remains important in citrus-based oils, where natural fragrance retention is vital. Solvent extraction is used in delicate oils like jasmine, where traditional methods may reduce yield. Other methods such as resin tapping and maceration cater to specialized oils, offering producers flexibility in addressing unique demands.

- For instance, Regarding extraction methods, distillation holds the largest market share due to its efficiency and scalability in processing bulk oils. Carbon dioxide extraction is gaining popularity for producing high-purity oils suited to premium therapeutic applications.

Segmentation:

By Type

- Orange oil

- Lemon oil

- Lime oil

- Peppermint oil

- Cornmint oil

- Citronella oil

- Spearmint oil

- Geranium oil

- Clove leaf oil

- Eucalyptus oil

- Jasmine oil

- Tea tree oil

- Rosemary oil

- Lavender oil

- Other oil types (sandalwood, cedar, chamomile, anise, ginger, thyme, cinnamon, ylang-ylang, basil)

By Method of Extraction

- Distillation

- Carbon dioxide extraction

- Cold press extraction

- Solvent extraction

- Other extraction methods (resin tapping and maceration)

By Country

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Major Western European Economies Driving Growth

Germany leads the Europe Wood Essential Oils Market with nearly 18% share, supported by a robust pharmaceutical and cosmetic industry that heavily incorporates natural ingredients. France follows closely with 14% share, driven by its long-standing traditions in perfumery and aromatherapy. The UK contributes about 9% share, reflecting strong consumer demand for organic and sustainable products across retail and e-commerce platforms. These three markets form the backbone of European consumption due to their advanced distribution networks, regulatory support for natural wellness, and cultural acceptance of plant-based remedies. It benefits from innovation and product diversification targeted at premium consumers in these countries.

Southern European Countries Strengthening Supply and Consumption

Italy accounts for approximately 7% share, supported by both production and consumption of essential oils such as lavender, rosemary, and citrus-based oils. Spain represents nearly 6% share, where growth is fueled by household applications and integration into wellness tourism services. Both countries hold advantages in raw material availability due to favorable climatic conditions. Traditional uses of essential oils in Mediterranean lifestyles further enhance demand across personal care and household cleaning products. Local producers also export to wider European markets, strengthening their role in the value chain. It continues to expand as cultural adoption and tourism-driven consumption grow.

Eastern and Northern Europe Offering Emerging Potential

Russia holds about 5% share, reflecting increasing awareness of aromatherapy and natural wellness solutions in urban areas. Scandinavian countries, including Sweden, Norway, and Denmark, collectively contribute nearly 10% share, shaped by high consumer focus on sustainability and holistic health. Eastern Europe is still developing but is projected to witness the fastest growth due to rising disposable incomes, urbanization, and expanding e-commerce. Rest of Europe, with around 17% share, includes smaller but growing markets that are adopting essential oils through cross-border retail platforms. It offers long-term growth potential as wellness practices spread to underserved regions and local distribution networks improve.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Symrise AG

- Givaudan SA

- Firmenich International SA

- Robertet Group

- Mane SA

- BASF SE

- Kerry Group plc

- Biolandes SAS

- Flavex Naturextrakte GmbH

- Ungerer Limited

Competitive Analysis:

The Europe Wood Essential Oils Market is highly competitive, with leading global and regional players focusing on innovation, partnerships, and product diversification. Companies such as Symrise AG, Givaudan SA, Firmenich International SA, Robertet Group, Mane SA, and BASF SE dominate with strong portfolios and distribution networks. It benefits from continuous investments in sustainable sourcing and advanced extraction technologies to maintain quality and meet consumer expectations. Smaller firms strengthen their presence by offering organic and niche oils targeting wellness and personal care applications. Market competition is shaped by pricing strategies, branding efforts, and strategic collaborations across industries.

Recent Developments:

- In June 2023, Mane inaugurated a new flavor production plant in Pinghu, China, and during the same year, opened multiple new spice extraction and innovation facilities in India.

- In July 2023, BASF partnered with Vivagro to distribute Essen’ciel, a biological fungicide and insecticide based on sweet orange essential oil approved for organic use, in Italy and Spain, supporting sustainable agriculture.

- In September 2022, the Robertet Group launched e-Robertet, a new e-commerce platform dedicated to organic essential oils for professionals, aiming to simplify access to sustainably sourced natural products globally. Robertet continues to focus on natural raw materials and sustainable practices in essential oils, aromatherapy, flavors, and fragrances as of April 2024.

Report Coverage:

The research report offers an in-depth analysis based on type, method of extraction, region, and country-level segmentation. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing integration of wood essential oils into wellness tourism across Southern Europe.

- Rising demand for premium oils in luxury cosmetics and personal care products.

- Expansion of e-commerce channels strengthening access in Eastern and Northern Europe.

- Increasing investments in sustainable sourcing and organic certifications.

- Wider use of carbon dioxide extraction for high-purity premium oils.

- Stronger adoption in pharmaceuticals for antimicrobial and anti-inflammatory benefits.

- Partnerships between producers and cosmetic brands enhancing product reach.

- Rising demand for oils in aromatherapy and relaxation solutions across urban markets.

- Technology integration with smart diffusers and personalized wellness solutions.

- Emergence of Eastern Europe as a high-growth market due to disposable income rise.