Market Overview

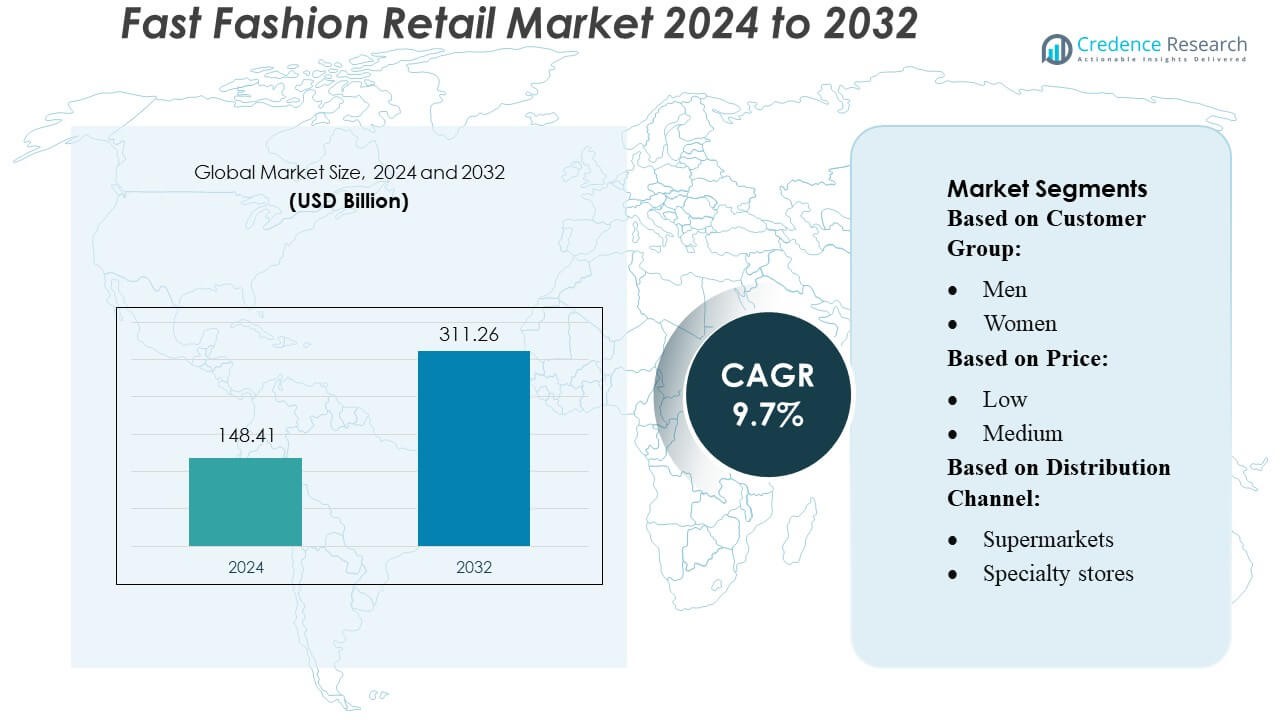

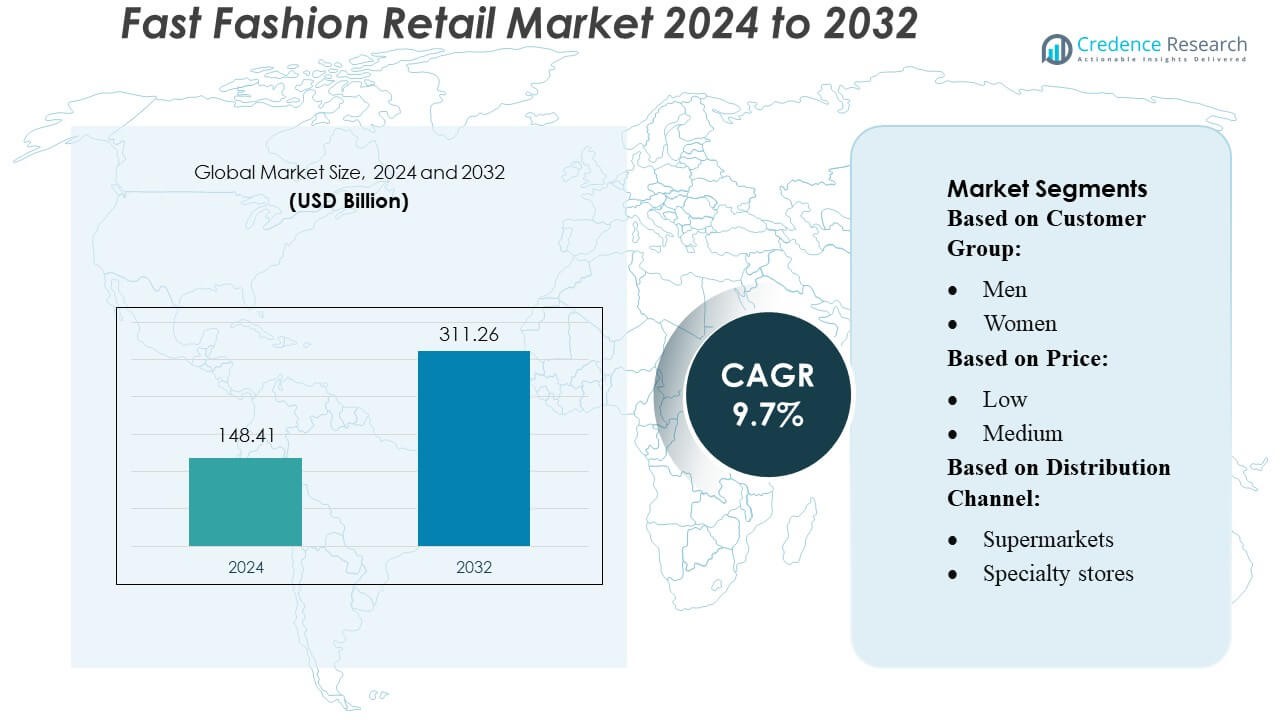

Fast Fashion Retail Market size was valued USD 148.41 billion in 2024 and is anticipated to reach USD 311.26 billion by 2032, at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fast Fashion Retail Market Size 2024 |

USD 148.41 Billion |

| Fast Fashion Retail Market, CAGR |

9.7% |

| Fast Fashion Retail Market Size 2032 |

USD 311.26 Billion |

The fast fashion retail market is highly competitive, with dominant players such as KERING, PVH Corp., Adidas AG, LVMH, Puma SE, VF Corporation, NIKE Inc., Burberry Group plc, INDITEX, and H & M Hennes & Mauritz AB setting the tone for innovation and expansion. These companies vigorously compete across design speed, supply chain agility, and digital engagement. INDITEX and H&M particularly lead in rapid inventory turnover and global footprint, leveraging both brick-and-mortar stores and robust online platforms. Regionally, Asia-Pacific emerges as the largest market, commanding 34.67 % of global market share, driven by an expanding middle class, strong manufacturing capabilities, and widespread e-commerce adoption.

Market Insights

- The Fast Fashion Retail Market reached USD 148.41 billion in 2024 and is projected to hit USD 311.26 billion by 2032, expanding at a CAGR of 9.7%, supported by rising global demand for trend-driven, affordable apparel.

- Market growth is driven by rapid product turnaround, digital-first shopping behavior, and strong adoption of AI-driven design, forecasting, and inventory optimization across major brands.

- Key trends include expanding omnichannel ecosystems, sustainability-focused collections, recycled materials, and increasing influence of social commerce among younger consumers.

- Competitive intensity remains high as leading players enhance supply-chain agility, accelerate micro-collection launches, and leverage data analytics to maintain speed and differentiation in a fragmented market.

- Regionally, Asia-Pacific leads with 34.67% market share, driven by strong production hubs and rising consumption, while the apparel segment dominated overall sales due to fast replacement cycles and high-volume purchasing patterns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Customer Group

Women constitute the dominant customer group in the fast fashion retail market, accounting for an estimated 55–60% market share. This segment leads due to rapid trend cycles, high purchase frequency, and strong demand for style variety across apparel, footwear, and accessories. Retailers increasingly prioritize women’s collections with faster design-to-shelf cycles and broader SKU depth. Growth is further supported by influencer-driven fashion adoption, social-commerce engagement, and rising demand for affordable trend replication. Meanwhile, men and children’s segments grow steadily as brands expand athleisure, basics, and schoolwear assortments but remain smaller in overall contribution.

- For instance, PVH has integrated 3D design via its proprietary Stitch Hub platform, which it initially rolled out across 80% of its Tommy Hilfiger design workflow, reducing physical sample creation and accelerating collection cycles.

By Price

The low-price segment dominates with around 50–55% market share, driven by high consumer demand for affordability, rapid wardrobe turnover, and value-centric purchasing behavior. Fast fashion brands scale this segment using cost-efficient sourcing, globalized supply chains, and high-volume production models that enable quick replenishment. The medium-price segment grows as consumers seek better quality-to-price ratios, while the high-price segment remains niche, led by premium fast-fashion lines and limited-edition designer collaborations. However, the low-price tier continues to lead as budget-conscious shoppers prioritize accessible fashion aligned with fast-changing trends.

- For instance, Adidas did utilize automated “Speedfactory” technology featuring robotic cutting and 4D-printed midsoles to accelerate manufacturing. The original goal for each of the two Speedfactories (in Germany and the U.S.) was an annual production capacity of up to 500,000 pairs of footwear.

By Distribution Channel

Online channels dominate with nearly 60% market share, supported by expanding e-commerce penetration, mobile shopping adoption, and aggressive digital marketing strategies. Company websites and dedicated apps drive strong conversion through personalized recommendations, rapid checkout, and frequent collection drops. E-commerce marketplaces amplify reach through wider assortment visibility and discount-led traffic. Offline channels—supermarkets, specialty stores, and big-box retailers—remain relevant for fit trials and impulse purchases but lag in growth due to rising preference for convenience, wider online inventories, and faster delivery models adopted by leading fast-fashion players.

Key Growth Drivers

- Rapid Product Turnover and Shortened Fashion Cycles

Fast fashion retailers continue to grow as they rapidly convert runway and social-media trends into low-cost collections delivered in weeks. This accelerated design-to-shelf model increases purchase frequency and encourages impulse buying, especially among younger consumers. Retailers leverage agile supply chains, flexible manufacturing, and real-time sales analytics to launch new styles quickly and retire underperforming items. This continuous refresh cycle strengthens customer engagement, drives high store traffic, and enhances revenue velocity across both online and offline channels.

- For instance, AutoStore technology at its Phoenix, Arizona distribution centre—achieving 99% order-fulfillment accuracy, reducing energy consumption by up to 85%, and increasing warehouse capacity by tenfold during peak periods.

- Expansion of E-Commerce and Omnichannel Retailing

The fast fashion market benefits significantly from expanding e-commerce penetration and integrated omnichannel models. Retailers invest in mobile apps, AI-driven product recommendations, and seamless digital payment systems that simplify discovery and purchase. Same-day pickup, click-and-collect, and flexible return options further enhance convenience, boosting conversion rates. By combining online visibility with physical store accessibility, brands achieve broader market reach, improved customer retention, and operational efficiencies that support faster product distribution and higher sales volumes globally.

- For instance, VF’s fiscal 2024 report shows that 42% of its direct-to-consumer business came from e-commerce, which contributed 20% of total revenues, reflecting the scale of its digital operations.

- Cost-Efficient Manufacturing and Globalized Supply Networks

Growth accelerates as fast fashion companies maintain cost advantages through global sourcing, lean production methods, and offshore manufacturing. Retailers rely on large-scale supplier networks across Asia, Latin America, and Eastern Europe to reduce production expenses and keep retail prices highly competitive. Continuous optimization of procurement, logistics, and materials management helps brands streamline workflows and shorten lead times. These cost efficiencies allow companies to introduce frequent collections without significant price increases, strengthening market competitiveness and expanding accessibility for mass-market consumers.

Key Trends & Opportunities

1. Rise of Sustainable and Circular Fashion Models

Sustainability has emerged as a major trend, prompting fast fashion retailers to adopt eco-friendly materials, closed-loop recycling programs, and traceable supply chains. Consumers increasingly prioritize ethically produced garments, creating opportunities for brands to integrate organic fabrics, water-efficient dyeing, and waste-reduction initiatives. Companies investing in garment take-back programs, repair services, and recycled polyester collections gain differentiation and regulatory alignment. This shift toward circularity supports brand reputation while opening new revenue streams around environmentally responsible product lines.

- For instance, NIKE reports that 78% of all its products now contain some recycled material, while its recycled-polyester usage — derived from plastic bottles — has helped it pull 112 million bottles out of landfills via its Tempo Short line.

2. Growth of AI-Driven Personalization and Predictive Merchandising

Artificial intelligence presents significant opportunities for product personalization and inventory optimization. Retailers use AI to analyze browsing behavior, forecast demand patterns, and adjust assortments dynamically, reducing overstock and markdown losses. Virtual try-on tools and style-matching algorithms enhance online shopping experiences and increase customer satisfaction. Predictive merchandising also supports more efficient production planning by identifying early trend signals. As digital engagement deepens, AI-enabled capabilities strengthen brand loyalty and help retailers align supply with rapidly shifting fashion preferences.

- For instance, H & M Hennes & Mauritz AB the company reported that 89% of its materials were recycled or sustainably sourced, with 29.5% coming from recycled sources—achieving its 2025 recycling target a year early.

3. Expansion into Emerging Markets Through Digital-First Strategies

Emerging markets in Asia, Africa, and the Middle East create strong growth opportunities due to rising disposable incomes and increasing internet penetration. Fast fashion brands adopt digital-first entry strategies, leveraging localized online platforms, influencer partnerships, and region-specific micro-collections. Affordable pricing, flexible payment options, and mobile-optimized retail experiences drive rapid adoption among young consumer groups. As urbanization accelerates, retailers gain access to large, underpenetrated customer bases, strengthening global footprint and driving long-term revenue expansion.

Key Challenges

1. Growing Regulatory Pressure and Sustainability Compliance

Fast fashion companies face rising regulatory scrutiny related to waste generation, labor conditions, and environmental impacts. Governments worldwide are tightening rules on textile recycling, carbon emissions, and supply chain transparency. Compliance increases operational complexity and may elevate production costs, especially for brands dependent on low-cost offshore manufacturing. Failure to meet updated standards risks fines, reputational damage, and loss of consumer trust. Retailers must invest in greener materials, responsible sourcing, and improved reporting systems to remain competitive under stricter regulatory frameworks.

2. Intensifying Competition and Margin Compression

The industry experiences strong competitive pressure from global players, online-only brands, and ultra-fast fashion platforms offering extremely low prices and rapid product turnover. As companies invest heavily in digital marketing, logistics, and customer acquisition, operating costs rise and margins tighten. Additionally, frequent discounting and promotional campaigns erode profitability. To sustain growth, brands must differentiate through design innovation, advanced analytics, and customer experience enhancements while maintaining cost discipline. Balancing speed, affordability, and quality becomes increasingly challenging in a crowded market landscape.

Regional Analysis

North America

North America represents roughly 22–23% of the global market, fueled by high purchasing power, a strong preference for trend-oriented clothing, and advanced digital retail ecosystems. The U.S. remains the region’s core market, with fast fashion brands investing heavily in mobile apps, AI-based recommendations, and fast delivery logistics. Consumers favor convenience and rapid trend adoption, supporting strong online sales growth. However, increasing scrutiny on sustainability and labor practices encourages brands to refine sourcing frameworks and introduce more eco-friendly product lines.

Asia-Pacific

Asia-Pacific holds the largest share of the fast fashion market at around 35%, driven by strong manufacturing capabilities, rising disposable incomes, and rapid urbanization. Countries such as China, India, and Bangladesh play key roles in production, while growing youth populations fuel constant demand for trend-driven apparel. The expansion of e-commerce platforms and mobile shopping further accelerates growth, enabling fast delivery and wider product access. Global brands are strengthening presence across key cities, while local digital-native retailers compete aggressively with low-priced, frequently updated collections.

Europe

Europe accounts for approximately 30% of the global fast fashion market, supported by a mature retail landscape and long-standing fashion culture. Major markets including the UK, Spain, France, and Germany drive high consumption, with strong store networks and advanced omnichannel systems. However, sustainability regulation is reshaping the region, compelling brands to adopt recycled textiles, transparent sourcing, and circular business models. Despite rising compliance costs, innovation in eco-friendly materials and digital retail experiences helps maintain Europe’s strong competitive position and consumer engagement.

Latin America

Latin America holds a smaller but expanding share of the fast fashion market at approximately 7–8%. Growth is driven by increasing urbanization, rising middle-class incomes, and strong demand from younger consumers seeking affordable fashion. Brazil, Mexico, Chile, and Colombia are key markets where both international brands and local retailers are scaling operations. E-commerce adoption is accelerating quickly due to broader smartphone penetration, allowing digital-first fast fashion entrants to capture market share. While economic volatility presents challenges, demand for accessible, trend-driven apparel continues to rise.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for around 5–6% of the global market but shows strong growth potential due to expanding retail infrastructure and rising disposable incomes. Markets such as the UAE, Saudi Arabia, and South Africa lead regional demand, supported by a young, fashion-conscious population. International brands are strengthening presence through malls and digital platforms, while regional players introduce fast-fashion-inspired collections tailored to local preferences. Increasing internet penetration and cross-border e-commerce are further boosting accessibility, making MEA a growing hotspot for future expansion.

Market Segmentations:

By Customer Group:

By Price:

By Distribution Channel:

- Supermarkets

- Specialty stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Fast Fashion Retail Market features major global players such as KERING, PVH Corp., Adidas AG, LVMH, Puma SE, VF Corporation, NIKE Inc., Burberry Group plc, INDITEX, and H & M Hennes & Mauritz AB. The Fast Fashion Retail Market remains highly dynamic, driven by rapid trend cycles, aggressive pricing strategies, and growing digital integration. Companies compete intensely on speed-to-market, expanding their design-to-shelf timelines to meet constantly shifting consumer preferences. Retailers increasingly adopt omnichannel models, leveraging e-commerce, mobile applications, and social-commerce platforms to enhance accessibility and engagement. Sustainability has become a key differentiator, prompting brands to invest in recycled fibers, eco-efficient production methods, and transparent sourcing practices. At the same time, technological advancement—particularly in AI-driven forecasting, automated manufacturing, and inventory optimization—enables greater operational agility. Marketing strategies centered on influencer collaborations, micro-collections, and real-time demand analytics help retailers capture younger, trend-sensitive demographics. Despite rising competition from ultra-fast fashion platforms, established brands continue to strengthen their supply chains, expand global footprints, and optimize logistics networks. Ultimately, innovation, responsiveness, and responsible production practices define competitive success in this rapidly evolving market.

Key Player Analysis

- KERING

- PVH Corp.

- Adidas AG

- LVMH

- Puma SE

- VF Corporation

- NIKE Inc.

- Burberry Group plc

- INDITEX

- H & M Hennes & Mauritz AB

Recent Developments

- In April 2025, Gap and DOEN announced the launch of their second collection, inspired by California’s vintage classics and celebrating timeless femininity. This new collection introduces fresh silhouettes and prints, while also expanding into baby and men’s apparel. Significantly, it marks DOEN’s debut in offering men’s products, highlighting the brand’s evolving portfolio.

- In March 2025, NIKE, Inc. partnered with TOGETHXR Inc. to launch the Everyone Watches Women’s Sports apparel collection. The collection features T-shirts, hoodies, and caps and reinforces NIKE’s commitment to encouraging women’s sports through innovation, investment, improved visibility, and inspiration.

- In October 2024, Siyaram Silk Mills launched its new fast-fashion brand, ZECODE, which targets Gen Z consumers with trendy and affordable apparel, as reported by scanx.trade, NewsVoir, and JM Financial Services. The company announced the launch alongside a significant investment, with initial stores opening in Bangalore.

- In July 2024, H&M opened its eighth store in Mumbai, located on the Linking Road in Bandra. The 2,020 square meter store offers a wide selection of clothing and accessories for men, women, and children, and was inaugurated by actor Aditya Roy Kapur.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Customer Group, Price, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt AI and predictive analytics to enhance product design, demand forecasting, and inventory efficiency.

- Sustainability initiatives will accelerate as brands invest in recycled materials, circular production, and transparent sourcing practices.

- Ultra-fast online retailers will intensify competition, pushing traditional brands to shorten development cycles even further.

- Digital-first retail models will expand, supported by stronger e-commerce platforms and mobile-driven customer engagement.

- Emerging markets will contribute significantly to future growth as disposable incomes and fashion adoption rise.

- Brands will introduce more region-specific micro-collections to cater to localized consumer preferences.

- Automation and nearshoring will become strategic priorities to improve speed and reduce supply chain risks.

- Social commerce will play a larger role in shaping buying decisions, especially among younger consumers.

- Secondhand, rental, and resale platforms will gain traction as sustainability awareness increases.

- Customer experience innovations, including virtual try-ons and personalized styling, will strengthen brand loyalty.