Market Overview

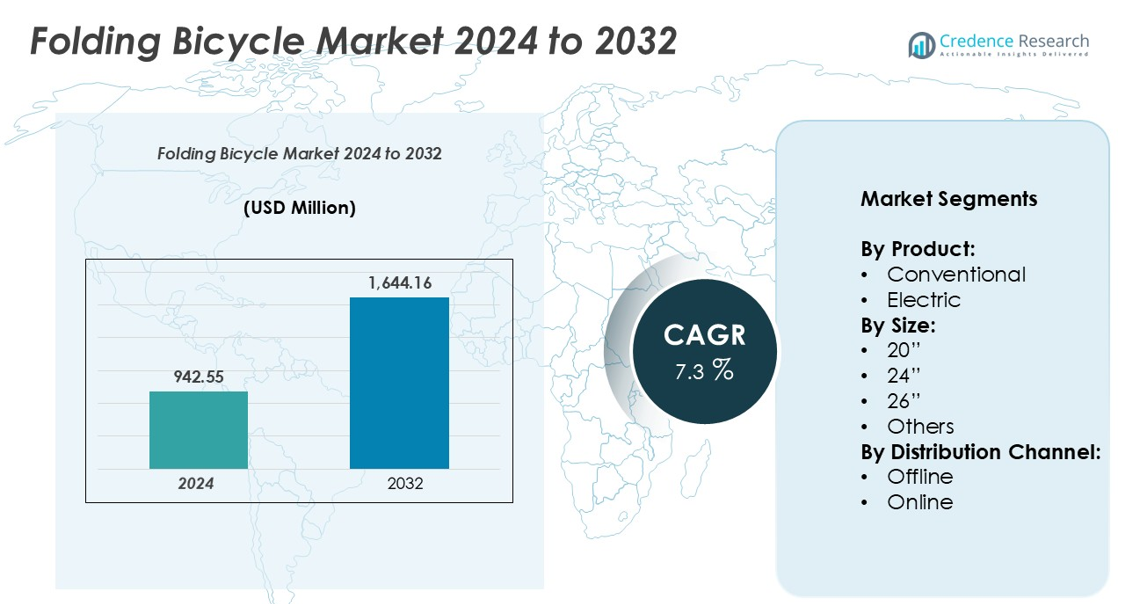

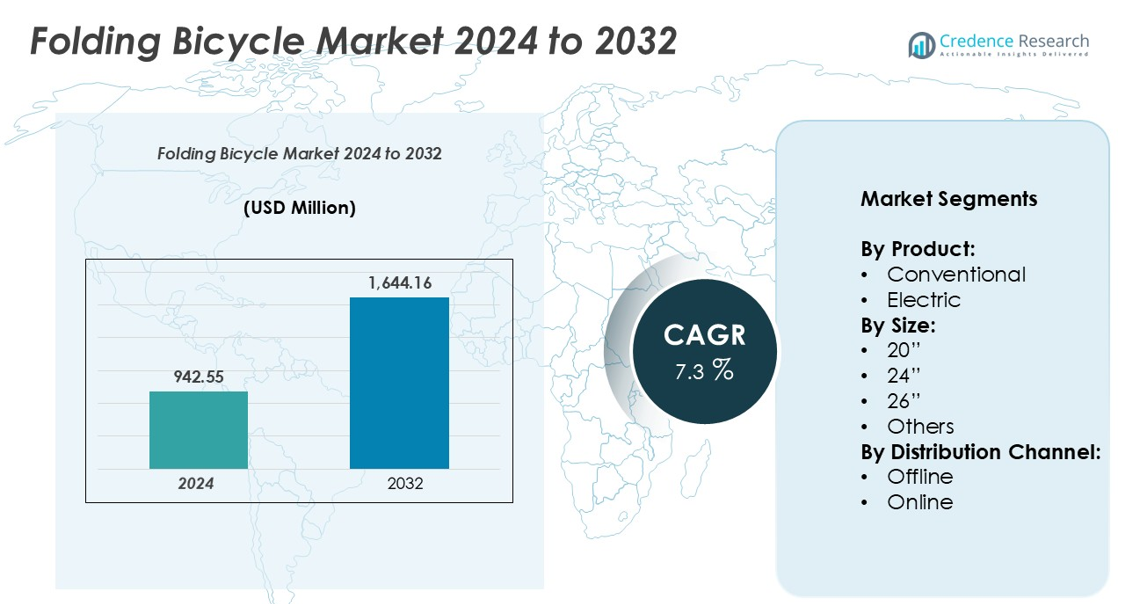

The Folding Bicycle market size was valued at USD 942.55 million in 2024 and is anticipated to reach USD 1,644.16 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Folding Bicycle market Size 2024 |

USD 942.55 million |

| Folding Bicycle market, CAGR |

7.3% |

| Folding Bicycle market Size 2032 |

USD 1,644.16 million |

The folding bicycle market is dominated by key players including Dahon, Brompton Bicycle, Giant Bicycles, Bike Friday, Montague Bike, A-bike, Helix, Birdy Bike, GOGOBIKE, and FOREVER Bicycle. Dahon and Brompton Bicycle lead the global market through innovation in lightweight frames, compact folding mechanisms, and electric variants, strengthening their position in North America and Europe, which together account for approximately 58% of the global market share. Giant Bicycles and Bike Friday further consolidate presence in Asia-Pacific, particularly in China and Japan, capturing 25% of regional demand. Emerging players like FOREVER Bicycle and GOGOBIKE target affordability-focused segments in Latin America and MEA. Strategic investments in R&D, product diversification, and e-commerce distribution enable these companies to maintain competitiveness while addressing growing urban mobility needs across multiple regions.

Market Insights

- The folding bicycle market was valued at USD 942.55 million in 2024 and is expected to reach USD 1,644.16 million by 2032, growing at a CAGR of 7.3% during the forecast period.

- Growth is driven by rising urbanization, increasing traffic congestion, and demand for compact, portable transportation solutions, as well as the rising popularity of electric folding bicycles and health-conscious commuting.

- Key trends include the integration of smart technologies, growing adoption of electric-assisted models, expansion of e-commerce channels, and rising focus on sustainable and eco-friendly urban mobility.

- Competitive landscape is dominated by companies like Dahon, Brompton Bicycle, Giant Bicycles, Bike Friday, Montague Bike, A-bike, Helix, Birdy Bike, GOGOBIKE, and FOREVER Bicycle, with North America and Europe capturing the largest regional shares of approximately 30% and 28%, respectively.

- Market restraints include high cost of electric folding bicycles and limited infrastructure in emerging regions, which can slow adoption despite growing urban mobility demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

In the folding bicycle market, the conventional segment dominates, capturing the largest share due to its affordability and widespread availability. Conventional folding bicycles accounted for a majority of sales in 2024, driven by urban commuters seeking cost-effective, compact transportation solutions. However, the electric sub-segment is gaining traction as consumers increasingly prioritize convenience and longer travel ranges without exertion. Innovations in battery efficiency, lightweight frames, and motor integration are fueling the adoption of electric folding bicycles, particularly in metropolitan areas where last-mile connectivity and sustainable mobility are key considerations.

- For instance, Brompton launched in October 2025 as part of an electric range overhaul, the Brompton Electric T Line features a lightweight titanium and carbon frame, a new e-Motiq rear hub motor system, a detachable 345Wh battery, and a claimed range of up to 90 km.

By Size:

Among folding bicycles, the 20-inch variant holds the dominant market share, favored for its portability, maneuverability, and ease of storage in urban apartments and public transport settings. The 24-inch and 26-inch models are preferred for performance-oriented riders seeking greater stability and riding comfort, while the “others” category addresses niche requirements like cargo or hybrid designs. The growth of compact city living and increasing adoption of micro-mobility solutions are driving demand for smaller-sized folding bicycles, making 20-inch models the preferred choice for daily commuting and short-distance travel.

- For instance, Dahon’s MU D11 model, equipped with 20-inch wheels and an 11-speed drivetrain, exemplifies the compact and efficient design favored by urban commuters.

By Distribution Channel:

Offline distribution remains the leading channel for folding bicycle sales, accounting for the largest market share due to consumers’ preference for in-store trial, expert guidance, and after-sales support. Specialty bicycle stores and large retail chains offer hands-on experience, personalized fitting, and maintenance services, reinforcing consumer confidence. Meanwhile, online sales are expanding rapidly, propelled by e-commerce convenience, broader model selection, and home delivery. The shift toward digital channels is supported by targeted online marketing, virtual demonstrations, and flexible return policies, encouraging first-time buyers and tech-savvy consumers to explore folding bicycle options online.

Key Growth Drivers

Rising Urbanization and Demand for Compact Mobility Solutions

Rapid urbanization and increasing traffic congestion are driving demand for compact and portable transportation alternatives, positioning folding bicycles as an ideal solution for last-mile connectivity. Urban commuters prefer folding bicycles due to their space-saving design, ease of storage in apartments or offices, and compatibility with public transport. The convenience of carrying a lightweight, foldable bike on buses, trains, or subways enhances daily mobility while reducing reliance on conventional vehicles. Additionally, city planners and policymakers increasingly support micro-mobility initiatives, promoting sustainable and efficient urban transport solutions. These factors collectively stimulate growth, particularly in densely populated metropolitan regions, where commuting efficiency and environmental considerations play a significant role in consumer purchasing decisions.

- For instance, the Dahon 2024 Unio E20 model features a 200W mid-drive motor and a 342Wh (36V/9.5Ah) seat-post battery. This combination offers a responsive ride thanks to a central-axis torque sensor that adjusts power based on pedaling effort, and it provides flexibility with nine mechanical gears.

Growing Popularity of Electric Folding Bicycles

The integration of electric-assisted propulsion in folding bicycles is a significant growth driver, expanding their appeal to a wider audience. Electric folding bicycles reduce physical exertion, enabling longer commutes and easier navigation through hilly terrains, attracting working professionals and recreational riders alike. Technological advancements, such as lightweight lithium-ion batteries, efficient motors, and improved folding mechanisms, enhance user convenience and reliability. The adoption of electric models is further accelerated by rising awareness of eco-friendly alternatives to motorized transport, government incentives for sustainable mobility, and an increasing number of urban charging stations. Consequently, the electric segment is contributing to overall market expansion and reshaping consumer preferences within the folding bicycle market.

- For instance, Brompton’s Electric T Line model uses a 345 Wh battery and a rear-hub motor that enables up to 90 km of range in city riding.

Increasing Health and Fitness Awareness

Rising health consciousness and the growing trend of fitness-oriented lifestyles are boosting demand for folding bicycles globally. Consumers are increasingly opting for bicycles as a convenient and sustainable way to incorporate physical activity into daily routines, particularly in urban environments where time and space constraints limit outdoor exercise options. Folding bicycles, with their portability and ease of storage, provide an accessible solution for both commuting and recreational cycling. Fitness-conscious users appreciate the flexibility of integrating short cycling sessions into their workday, contributing to overall wellness. Market growth is reinforced by social media campaigns, urban cycling clubs, and corporate wellness initiatives, which collectively highlight the health benefits of cycling and drive adoption of folding bicycles among diverse age groups.

Key Trends & Opportunities

Integration of Smart Technologies

The folding bicycle market is witnessing a surge in smart technology adoption, creating significant opportunities for product differentiation. Features such as GPS tracking, Bluetooth connectivity, smart locking systems, and digital performance monitoring enhance user convenience, safety, and experience. Some models now include integrated mobile applications to track ride statistics, battery life, and maintenance schedules. These innovations appeal to tech-savvy consumers seeking connected, high-functionality mobility solutions. Moreover, partnerships between bicycle manufacturers and tech companies are enabling continuous software updates and data-driven improvements, which further enhance product value. The integration of smart technologies not only attracts younger urban populations but also provides manufacturers with opportunities to develop subscription-based services, maintenance programs, and value-added digital offerings.

- For instance, Brompton Electric T Line’s e-Motiq system learns a rider’s style over the first 100 km and then fine-tunes its performance every 6 km. This feature was announced in October 2025 as part of an update to the Brompton Electric range.

Expansion of E-Commerce and Online Retail Channels

The growth of online retail platforms is transforming folding bicycle distribution and presenting new opportunities for market expansion. Consumers increasingly prefer e-commerce for its convenience, wider model selection, and doorstep delivery, including foldable and electric variants. Online platforms also allow manufacturers to offer customization options, virtual product demonstrations, and detailed reviews, facilitating informed purchase decisions. Digital marketing strategies, social media campaigns, and influencer endorsements further enhance product visibility and reach. Additionally, direct-to-consumer online sales reduce dependency on traditional retail, lowering costs and improving profit margins. The expanding online ecosystem offers manufacturers a scalable, global distribution channel, enabling them to penetrate new markets and tap into emerging urban mobility demands efficiently.

Rising Focus on Sustainable Transportation

Growing environmental awareness and concerns over carbon emissions are driving interest in eco-friendly transportation alternatives, positioning folding bicycles as a sustainable solution. Urban consumers increasingly seek mobility options that reduce their carbon footprint while remaining practical and efficient for daily commutes. Government initiatives promoting green transport, incentives for non-motorized vehicles, and the development of bicycle-friendly infrastructure are further supporting market growth. Folding bicycles, particularly electric-assisted models, enable longer commutes without contributing to traffic congestion or pollution. This trend not only encourages adoption among environmentally conscious individuals but also provides manufacturers with opportunities to promote their products as part of sustainable urban mobility solutions.

Key Challenges

High Cost of Electric Folding Bicycles

The relatively high price of electric folding bicycles remains a key challenge for market growth. Advanced components, such as lithium-ion batteries, motors, and smart integrations, increase manufacturing costs, limiting affordability for price-sensitive consumers. While conventional folding bicycles remain accessible, electric variants often require a significant investment, which may restrict adoption in emerging markets or among lower-income segments. Additionally, maintenance and battery replacement costs can further deter potential buyers. Manufacturers must balance technological innovation with cost-effective production and explore financing options, subsidies, or leasing models to overcome this barrier and expand the consumer base.

Limited Awareness and Infrastructure in Emerging Markets

In many emerging markets, low awareness of folding bicycles and inadequate supporting infrastructure pose growth challenges. Potential consumers may lack knowledge of the convenience, portability, and environmental benefits of folding bicycles. Additionally, insufficient cycling lanes, secure parking, and repair facilities reduce usability and discourage adoption. In regions with poor public transport integration, folding bicycles cannot fully address commuting challenges, limiting their appeal. Market expansion in such areas requires targeted awareness campaigns, collaboration with local governments to improve infrastructure, and promotional initiatives highlighting the advantages of folding bicycles as practical, eco-friendly, and cost-effective urban mobility solutions.

Regional Analysis

North America:

North America holds a significant share of the folding bicycle market, driven by high urbanization, eco-conscious consumers, and established cycling infrastructure. The U.S. and Canada lead adoption, with urban commuters favoring folding bicycles for last-mile connectivity and public transport integration. The market is further supported by government incentives promoting sustainable mobility, rising fitness awareness, and increasing popularity of electric folding bicycles. Specialty bicycle retailers and e-commerce platforms enhance accessibility, while tech-savvy consumers are drawn to models with smart features. North America accounted for approximately 30% of global market share in 2024, reflecting strong consumer adoption and mature infrastructure.

Europe:

Europe represents a dominant region in the folding bicycle market, capturing a substantial 28% market share in 2024. Countries such as Germany, the Netherlands, and France lead adoption due to extensive cycling infrastructure, urban congestion challenges, and a strong emphasis on green transport initiatives. Folding bicycles are widely used for commuting and recreational purposes, with electric variants gaining popularity for longer distances. Supportive government policies, cycling-friendly urban planning, and high environmental awareness drive growth. Additionally, Europe’s robust retail networks and e-commerce penetration facilitate consumer access, enabling manufacturers to offer a diverse range of models and innovative features to meet evolving urban mobility needs.

Asia-Pacific:

The Asia-Pacific region is emerging as a high-growth market for folding bicycles, accounting for an estimated 25% market share in 2024. Rapid urbanization, traffic congestion, and increasing disposable income are driving demand, particularly in China, Japan, India, and South Korea. Urban commuters favor compact folding bicycles for ease of storage and integration with public transport. Electric folding bicycles are gaining traction due to technological advancements and convenience for longer commutes. Market growth is further supported by e-commerce expansion, government initiatives promoting eco-friendly mobility, and rising health consciousness. Asia-Pacific presents substantial opportunities for manufacturers to capture untapped urban and semi-urban markets.

Latin America:

Latin America holds a growing share in the folding bicycle market, estimated at 10% in 2024, driven by urban population growth, traffic congestion, and increased interest in eco-friendly commuting options. Brazil, Mexico, and Argentina are key markets where folding bicycles are used for short-distance commuting and recreational cycling. Rising awareness of health and fitness, coupled with the expansion of e-commerce and retail networks, supports market growth. However, limited infrastructure, such as dedicated cycling lanes and parking facilities, poses challenges. Manufacturers are focusing on cost-effective models and targeted promotional campaigns to expand adoption among urban consumers seeking practical and sustainable mobility solutions.

Middle East & Africa (MEA):

The MEA region accounts for approximately 7% of the global folding bicycle market, with growth driven by urbanization, increasing disposable income, and a focus on alternative mobility solutions. Countries like the UAE, Saudi Arabia, and South Africa are witnessing rising interest in folding bicycles for last-mile connectivity and leisure purposes. Government initiatives promoting sustainable transport and cycling-friendly urban planning are encouraging adoption. While high import costs and limited local manufacturing present challenges, expanding e-commerce platforms and growing awareness of fitness and eco-friendly transport are creating opportunities. The region is gradually emerging as a niche market with potential for expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product:

By Size:

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The folding bicycle market is highly competitive, characterized by the presence of both global and regional players striving to differentiate through innovation, design, and technology. Leading manufacturers such as Dahon, Brompton Bicycle, Giant Bicycles, and Bike Friday focus on product diversification, including electric folding bicycles, lightweight materials, and smart connectivity features, to cater to evolving urban mobility needs. Companies are increasingly investing in R&D to enhance portability, battery efficiency, and riding comfort, while strategic partnerships and collaborations with e-commerce platforms strengthen market reach. Brand reputation, after-sales service, and customization options remain critical factors influencing consumer preference. Smaller regional players, including FOREVER Bicycle and GOGOBIKE, compete by offering cost-effective solutions targeting emerging markets. Overall, continuous innovation, technological advancement, and strategic marketing initiatives drive competitive dynamics, enabling companies to capture market share and meet growing demand in urban and semi-urban segments.

Key Player Analysis

Recent Developments

- In February 2024, Gocycle, the British e-bike company, launched a new line of innovative electric cargo bikes for families. The new CX series of longtail electric bicycles are foldable. The new foldable electric bicycle weighs 23kg and can support 220kg

- In October 2023, Bastille, a new French company, introduced a new design of folding bicycles. The design of the folding bike includes a tire size of 27.5”, which is one of the biggest in the folding bicycle industry. The bicycle has minimum electronic parts and is easier and cheaper to maintain than other folding bikes.

Report Coverage

The research report offers an in-depth analysis based on Product, Size, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for folding bicycles will continue to grow with rising urbanization and traffic congestion.

- Electric folding bicycles are expected to gain higher adoption due to convenience and longer travel ranges.

- Integration of smart technologies, such as GPS tracking and app connectivity, will become more common.

- Manufacturers will focus on lightweight and durable materials to enhance portability and riding comfort.

- E-commerce and online retail channels will drive wider market reach and consumer access.

- Urban planning and government initiatives promoting sustainable transport will support market expansion.

- Health-conscious consumers will increasingly choose folding bicycles for commuting and recreational purposes.

- Competitive differentiation through design innovation and customization options will intensify.

- Emerging markets in Asia-Pacific, Latin America, and MEA will present significant growth opportunities.

- Collaboration between manufacturers and technology providers will create value-added solutions for riders.