Market Overview:

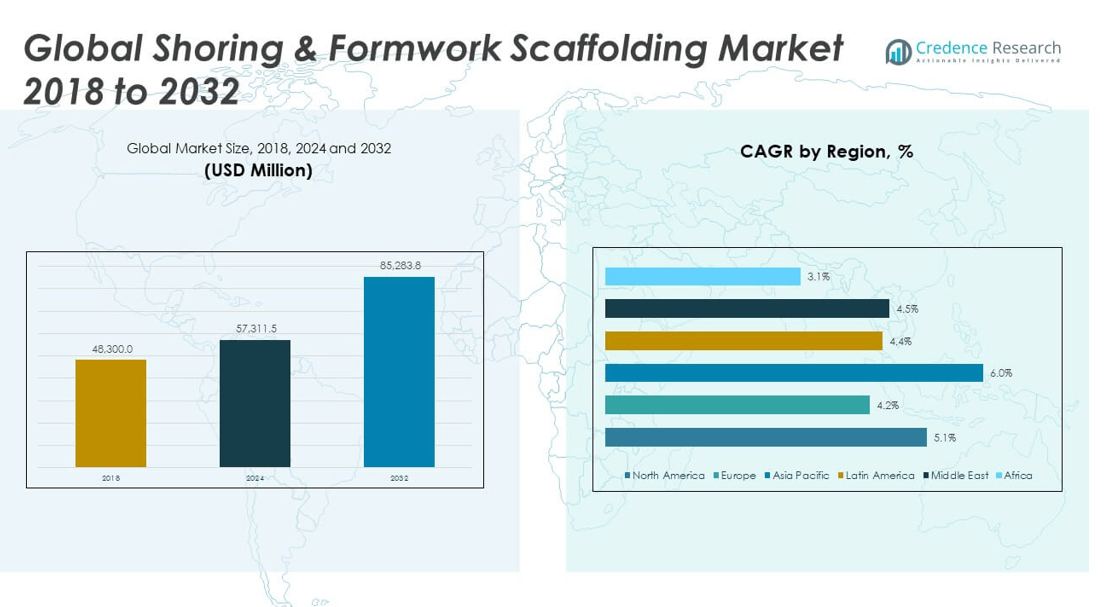

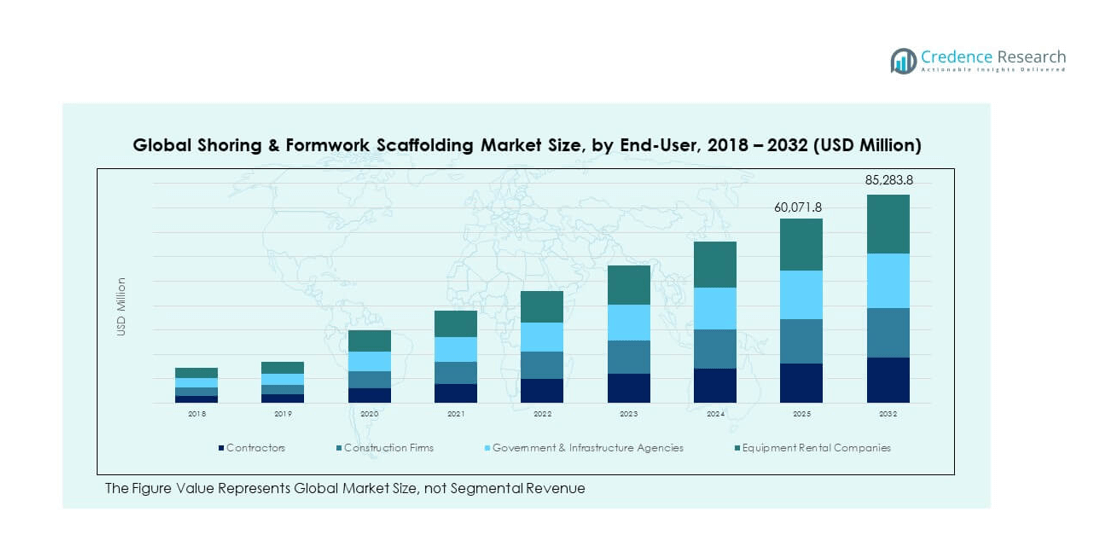

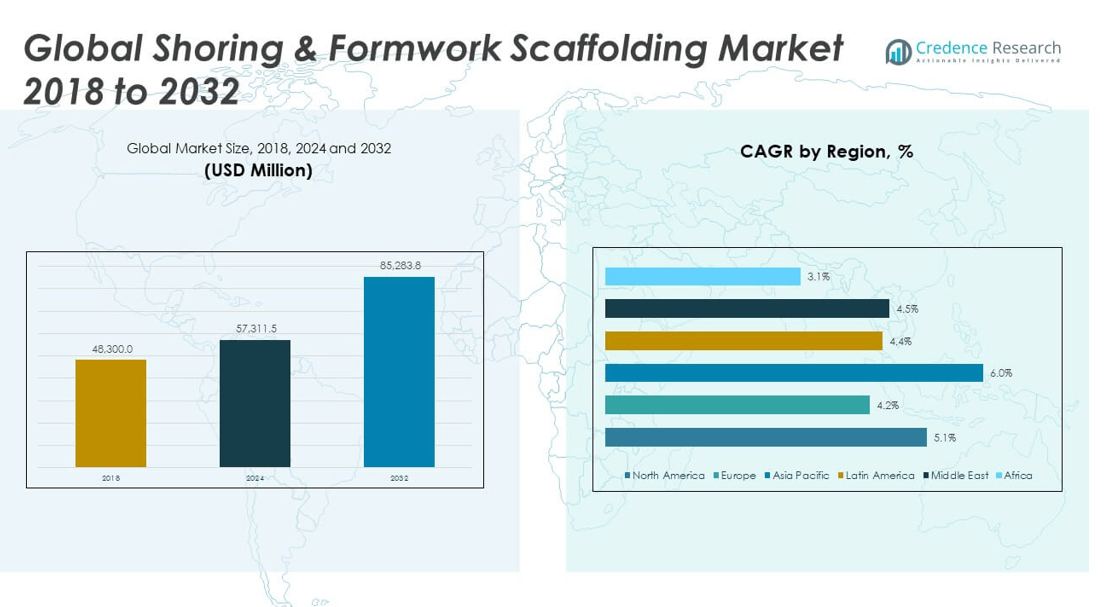

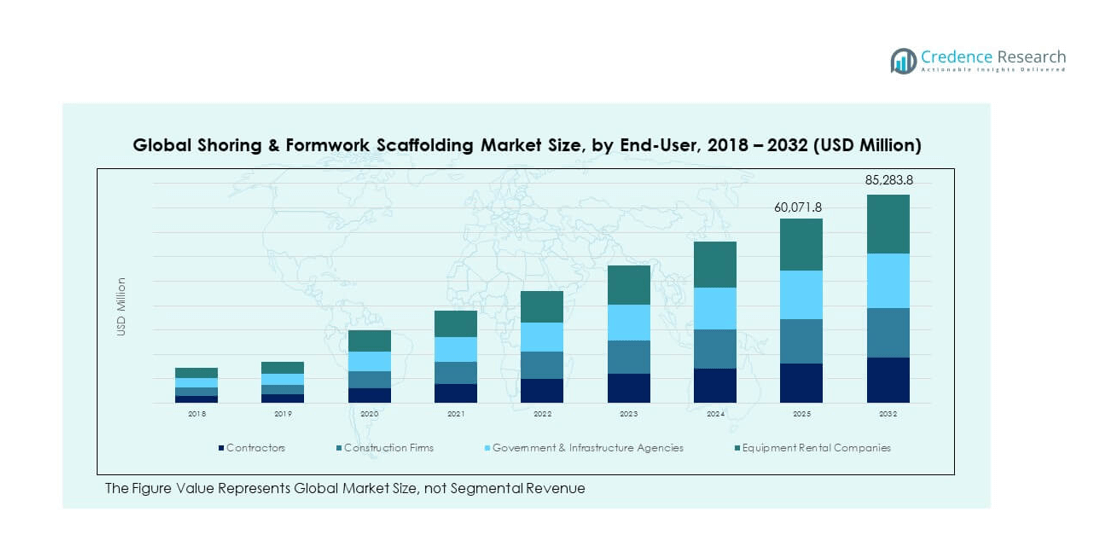

The Global Shoring and Formwork Scaffolding Market size was valued at USD 48,300.0 million in 2018 to USD 57,311.5 million in 2024 and is anticipated to reach USD 85,283.8 million by 2032, at a CAGR of 5.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shoring and Formwork Scaffolding Market Size 2024 |

USD 57,311.5 million |

| Shoring and Formwork Scaffolding Market , CAGR |

5.13% |

| Shoring and Formwork Scaffolding Market Size 2032 |

USD 85,283.8 million |

The market is driven by increasing construction activities in residential, commercial, and infrastructure projects, coupled with the growing demand for durable and cost-effective scaffolding solutions. Technological advancements in shoring and formwork systems are enhancing efficiency, safety, and ease of installation. Rapid urbanization, government investments in public infrastructure, and the expansion of high-rise construction projects are fueling market growth, while stricter safety regulations are encouraging adoption of modern, engineered scaffolding solutions across industries.

Regionally, Asia-Pacific leads the market due to rapid infrastructure development, urban expansion, and large-scale government projects in China, India, and Southeast Asia. North America maintains a strong position driven by industrial maintenance, urban redevelopment, and advanced construction technologies. Europe shows steady demand, supported by stringent safety standards and sustainable building practices. Emerging markets in Latin America and the Middle East & Africa are witnessing growth due to increased investment in transport infrastructure, urban housing, and energy sector construction projects.

Market Insights:

- The Global Shoring & Formwork Scaffolding Market was valued at USD 48,300.0 million in 2018, reached USD 57,311.5 million in 2024, and is projected to attain USD 85,283.8 million by 2032, growing at a CAGR of 5.13% during the forecast period.

- Demand is driven by rapid urbanization, large-scale infrastructure projects, and high-rise construction in both developed and emerging economies.

- Adoption of advanced materials such as aluminum and high-strength steel is enhancing durability, safety, and reusability in scaffolding systems.

- Rising raw material prices and supply chain disruptions are impacting manufacturing costs and profit margins for industry players.

- Stringent safety regulations are pushing contractors toward certified, engineered systems, boosting premium product adoption.

- Asia-Pacific dominates due to massive infrastructure development in China, India, and Southeast Asia, supported by government investment.

- North America and Europe maintain steady demand driven by urban redevelopment, safety compliance, and adoption of modern modular systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expanding Infrastructure Development Across Urban and Semi-Urban Regions:

The Global Shoring & Formwork Scaffolding Market is benefiting from large-scale infrastructure expansion in both developed and emerging economies. Governments are investing heavily in transportation, energy, and public utility projects, driving sustained demand for advanced shoring and formwork systems. Urban population growth is pushing cities to upgrade roads, bridges, metro lines, and high-rise buildings. These projects require safe, durable, and cost-efficient scaffolding solutions to meet strict timelines and quality standards. Contractors are increasingly favouring modular and pre-engineered systems for faster assembly and reduced labor costs. Industrial construction in oil, gas, and power sectors also boosts market activity. The demand for equipment with higher load-bearing capacities and adaptability to complex designs is increasing. This expansion in construction activities directly strengthens the adoption rate of engineered scaffolding solutions globally.

- For instance, PERI has provided specialist formwork and scaffolding systems to multiple multistorey projects, including a high-rise development in the UK where modular PERI UP scaffolding enabled a 30% reduction in installation time compared to traditional systems, while meeting demanding safety and load requirements.

Rising Adoption of Advanced Materials and Engineering Techniques:

The shift from traditional timber and steel scaffolding to advanced materials is significantly shaping the Global Shoring & Formwork Scaffolding Market. Lightweight aluminum, high-strength steel alloys, and composite materials are gaining preference for their enhanced safety, corrosion resistance, and reusability. Engineering innovations in adjustable props, modular frames, and hydraulic shoring systems are improving on-site productivity. These advancements reduce assembly time, minimize material waste, and improve worker safety. Industrial users are focusing on systems that can withstand extreme weather conditions and maintain stability during complex structural work. High precision in manufacturing allows these systems to cater to diverse construction applications, from small-scale residential projects to mega-infrastructure works. The integration of engineered safety features further strengthens compliance with stringent regulatory standards. This technological progression sustains long-term demand for high-performance scaffolding systems.

- For instance, Allmarc Industries offers the Allform Formwork system, manufactured from top-quality aluminum. The system features panels with an average weight of 22.5kg/m², which is notably lighter than traditional steel formwork, promoting ease of assembly and transport. The modular system supports various dimensions—panel heights from 1.20m to 1.80m and widths from 300mm to 900mm—enabling precise solutions for complex shapes and reducing onsite labor requirements.

Stricter Safety Regulations and Compliance Requirements:

Stringent construction safety regulations worldwide are driving adoption of standardized shoring and formwork systems. The Global Shoring & Formwork Scaffolding Market benefits from contractors seeking solutions that meet or exceed compliance benchmarks. Governments and industry bodies are enforcing mandatory safety inspections, worker training, and certified equipment use on construction sites. This shift discourages the use of outdated or makeshift scaffolding, encouraging investment in modern, engineered systems. Manufacturers are designing products with anti-slip platforms, guardrails, and locking mechanisms to meet safety norms. The liability risks associated with workplace accidents are pushing contractors toward premium-quality scaffolding products. Demand for systems with integrated load monitoring and structural stability features is growing. Safety-focused purchasing decisions are reinforcing steady market expansion.

Surge in Commercial and Residential High-Rise Construction:

Global demand for high-rise residential towers, commercial complexes, and mixed-use developments is strengthening the Global Shoring & Formwork Scaffolding Market. Rapid urbanization and limited land availability in metropolitan areas are pushing vertical construction. Projects with complex architectural designs require highly adaptable and load-bearing scaffolding solutions. Developers are prioritizing systems that offer easy mobility, modular flexibility, and long-term durability. Premium real estate projects often demand advanced shoring systems capable of supporting multi-level concrete works. Contractors are selecting solutions that minimize downtime between floor cycles to meet tight delivery schedules. The focus on improving construction speed without compromising safety is fueling market uptake. These trends are particularly strong in emerging economies undergoing rapid urban transformation.

Market Trends:

Integration of Digital Technologies for Project Efficiency:

Digital technology adoption is transforming the Global Shoring & Formwork Scaffolding Market by enabling smarter planning, monitoring, and execution. BIM (Building Information Modelling) integration allows precise design, load calculation, and clash detection before physical installation. Contractors are leveraging digital tools to track inventory, schedule equipment delivery, and manage on-site logistics. IoT-enabled sensors embedded in scaffolding systems provide real-time data on load, alignment, and structural stability. These insights help prevent accidents and optimize maintenance schedules. Digital documentation ensures regulatory compliance and improves communication between stakeholders. The use of augmented reality (AR) in training enhances worker competence and reduces assembly errors. Companies investing in digital solutions are improving operational efficiency and project profitability. This trend is gaining momentum across both developed and high-growth markets.

- For instance, SIMLAB integrated BIM and IoT-based solutions for a Tokyo hospital modernization project, enabling 50% fewer on-site supervisory visits due to efficient remote monitoring with digital twins and BIM-linked construction progress tracking.

Growing Preference for Sustainable and Reusable Scaffolding Solutions:

Sustainability concerns are reshaping procurement decisions in the Global Shoring & Formwork Scaffolding Market. Contractors are opting for materials with high recyclability, longer life cycles, and minimal environmental impact. Manufacturers are producing scaffolding systems from aluminum and high-strength steel with low embodied energy. Designs now focus on reusability, allowing multiple project applications without compromising structural integrity. Eco-friendly coatings and anti-corrosion treatments extend product life while reducing maintenance needs. Green building certifications encourage the use of environmentally compliant scaffolding solutions. The reduction of waste during dismantling and transport further supports sustainability goals. Public and private sector projects increasingly include environmental performance criteria in tender requirements. This trend is aligning with global carbon reduction commitments.

- For instance, in high-profile restoration projects such as Elizabeth Tower (Big Ben), 80% of the cast iron roof tiles were retained or recycled, emphasizing sustainability and long product life cycles in modern scaffolding projects.

Customization and Modular System Innovations:

The demand for highly adaptable scaffolding designs is driving innovation in the Global Shoring & Formwork Scaffolding Market. Modular systems that can be easily reconfigured for different structural layouts are gaining traction. Manufacturers are offering adjustable props, quick-lock couplers, and integrated lifting mechanisms to suit diverse applications. This flexibility allows contractors to use the same system across residential, commercial, and infrastructure projects. Standardized components reduce storage requirements and simplify transportation. Advanced manufacturing techniques improve precision, making assembly safer and faster. Contractors benefit from systems that require fewer tools and less labor during setup. The ability to customize height, load capacity, and configuration is becoming a key competitive differentiator. This modularity is supporting higher returns on investment for construction companies.

Expansion of Rental and Leasing Models:

The Global Shoring & Formwork Scaffolding Market is seeing rapid growth in rental and leasing services, particularly among small and medium-sized contractors. High upfront costs for advanced scaffolding systems encourage businesses to rent equipment instead of purchasing. Rental providers offer maintenance, inspection, and transportation services, reducing operational burdens for contractors. The availability of diverse system types in rental fleets allows flexibility in meeting specific project requirements. Seasonal construction cycles further drive demand for temporary access to scaffolding systems. Technological upgrades by rental companies ensure clients access the latest, safest solutions. Flexible rental terms cater to both short-term and long-term projects. This trend is making advanced scaffolding technology accessible to a broader range of users globally.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Disruptions:

The Global Shoring & Formwork Scaffolding Market faces cost pressure from fluctuating prices of steel, aluminum, and composite materials. Volatile commodity markets and geopolitical tensions disrupt supply chains, increasing procurement costs for manufacturers. Transportation delays, port congestion, and labor shortages exacerbate these challenges, particularly for large-scale projects with tight schedules. Contractors are forced to balance between affordability and quality when selecting equipment. Price-sensitive markets may opt for lower-grade materials, risking safety and compliance. Manufacturers must secure stable supply agreements and diversify sourcing to mitigate risks. Competitive pricing pressure also limits the ability to pass increased costs to customers. This volatility remains a key challenge to sustainable market growth.

Labor Skill Gaps and Regulatory Compliance Barriers:

The Global Shoring & Formwork Scaffolding Market is hindered by shortages of skilled labor capable of handling advanced modular and hydraulic systems. Incorrect installation or dismantling increases the risk of accidents, regulatory violations, and project delays. Contractors face rising training costs to ensure compliance with stringent safety standards. Regulatory variations across countries complicate product standardization for manufacturers. Some regions have limited enforcement capacity, allowing unsafe practices that undermine the adoption of certified systems. Smaller companies struggle with documentation and inspection requirements, affecting competitiveness. Bridging the skills gap and harmonizing regulations across key markets remain critical for long-term industry development.

Market Opportunities:

Infrastructure Modernization in High-Growth Economies:

The Global Shoring & Formwork Scaffolding Market can capitalize on infrastructure modernization programs in rapidly growing economies. Urban expansion in Asia-Pacific, the Middle East, and Africa creates strong demand for advanced scaffolding systems. Governments are allocating significant budgets for transport networks, energy facilities, and smart city projects. Modern shoring and formwork systems help contractors meet quality and safety targets for these large-scale developments. Companies with localized manufacturing and distribution networks can secure competitive advantages. The push for rapid project completion strengthens demand for modular and pre-engineered solutions. Emerging economies offer untapped opportunities for rental and leasing service expansion. Partnerships with local contractors can accelerate market penetration.

Technological Advancements in Safety and Efficiency:

The Global Shoring & Formwork Scaffolding Market has growth potential through adoption of next-generation safety and efficiency technologies. Manufacturers are developing systems with integrated load sensors, anti-fall mechanisms, and automated alignment features. These innovations reduce accident risks, minimize downtime, and enhance structural reliability. Digital integration through IoT and BIM creates opportunities for smarter project management. Solutions that combine high performance with ease of assembly appeal to both large and small contractors. Governments promoting safer construction practices will accelerate adoption of such technologies. The growing preference for premium, technology-enabled scaffolding presents a lucrative segment for market players.

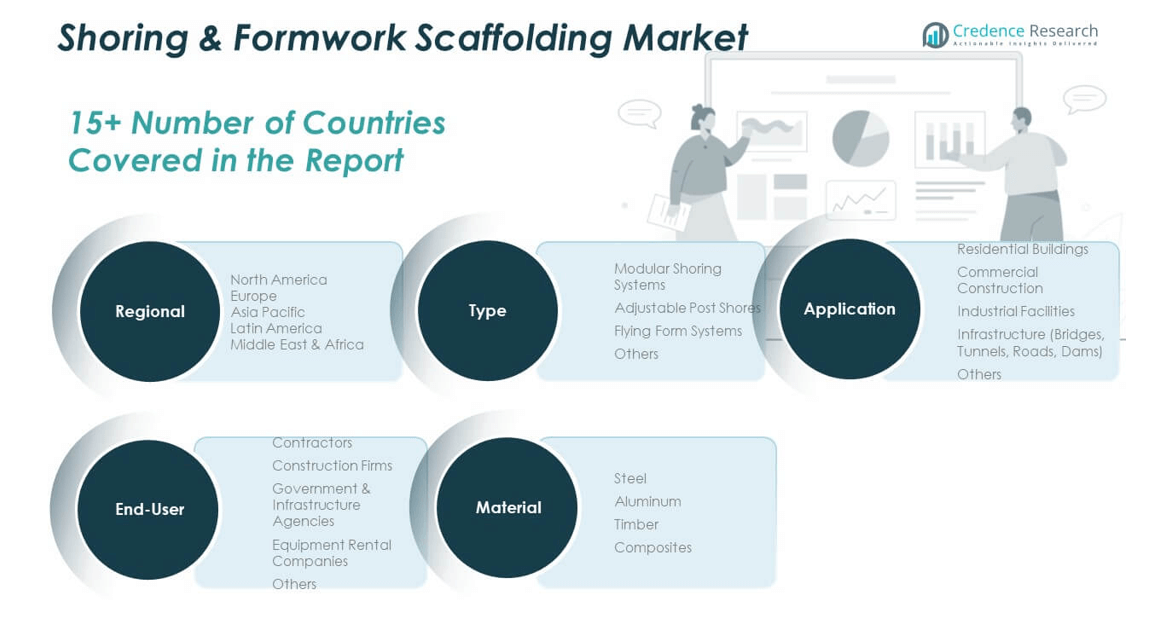

Market Segmentation Analysis:

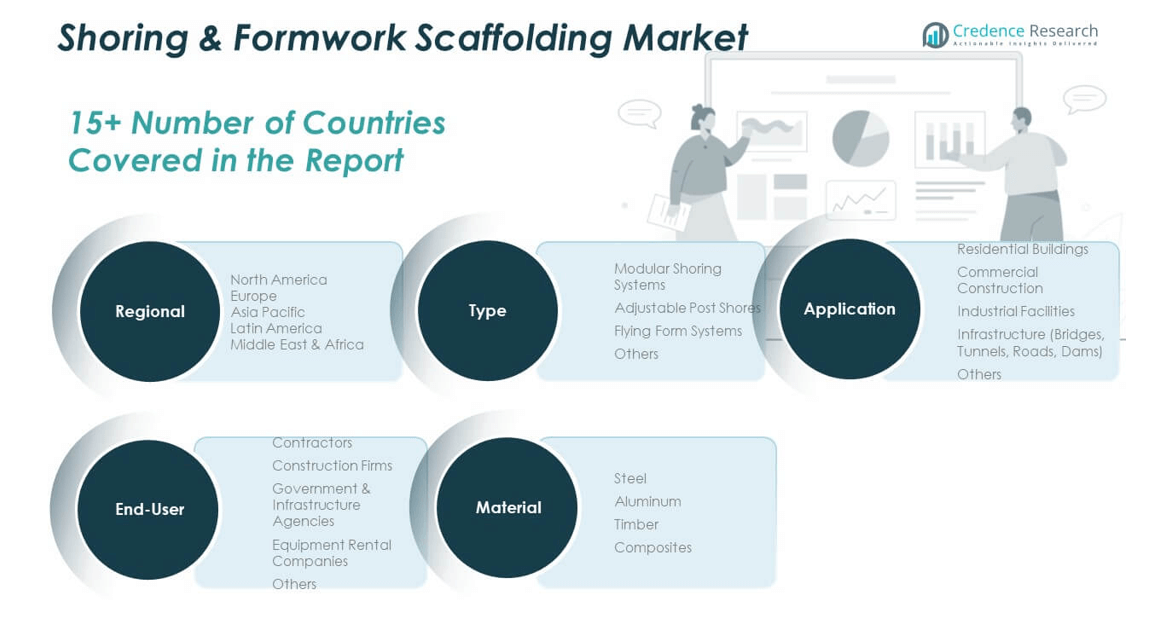

By Type

The Global Shoring & Formwork Scaffolding Market by type is led by modular shoring systems, valued for adaptability, rapid assembly, and suitability for high-rise and large-scale developments. Adjustable post shores remain a cost-effective choice for projects requiring height flexibility. Flying form systems are increasingly used in repetitive floor construction, especially in commercial and multi-story residential projects. The “others” segment includes specialized and custom systems tailored for unique engineering requirements.

- For instance, HI-LITE supplied 25K Modular Shoring Frames to a North American commercial project, supporting high-rise deck loads with versatile frame adjustability for varying floor heights and speeding up floor cycle times by over 15% compared to previous approaches.

By Application

Residential buildings account for consistent demand, driven by ongoing urban housing developments. Commercial construction emphasizes high-capacity and durable systems to support complex architectural designs. Industrial facilities require robust shoring to handle heavy loads and challenging layouts. Infrastructure projects such as bridges, tunnels, roads, and dams demand large-scale deployment for stability and safety. The “others” category includes temporary and special-purpose structures.

- For instance, PERI’s engineered scaffolding was key to the restoration of London’s Elizabeth Tower, utilizing a 98m high freestanding scaffold made of 24,000 separate elements, erected in six months and involving 320 logistical vehicle movements, all managed to minimize load impact on the historical structure—a logistical and engineering milestone.

By End-user

Contractors hold the largest share due to their direct involvement in construction execution. Construction firms follow, managing turnkey and large-scale developments. Government and infrastructure agencies contribute significantly through investments in public projects and urban development. Equipment rental companies are expanding their reach, offering cost-effective access to advanced systems. The “others” segment includes specialized engineering and maintenance service providers.

By Material

Steel dominates for its superior strength, durability, and load-bearing capacity. Aluminum is preferred where lightweight, portable, and corrosion-resistant systems are essential. Timber maintains demand for low-cost and small-scale applications. Composites are emerging with high strength-to-weight ratios and extended service life, appealing to projects prioritizing performance and longevity.

Segmentation:

By Type

- Modular Shoring Systems

- Adjustable Post Shores

- Flying Form Systems

- Others

By Application

- Residential Buildings

- Commercial Construction

- Industrial Facilities

- Infrastructure (Bridges, Tunnels, Roads, Dams)

- Others

By End-user

- Contractors

- Construction Firms

- Government & Infrastructure Agencies

- Equipment Rental Companies

- Others

By Material

- Steel

- Aluminum

- Timber

- Composites

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Shoring & Formwork Scaffolding Market size was valued at USD 12,495.2 million in 2018 to USD 14,574.0 million in 2024 and is anticipated to reach USD 21,544.2 million by 2032, at a CAGR of 5.1% during the forecast period. North America accounts for approximately 25.4% of the global market share. Strong demand is driven by robust commercial construction, infrastructure modernization, and high-rise residential projects. It benefits from stringent safety regulations and a mature construction equipment rental industry. Major cities are witnessing redevelopment and large-scale public infrastructure upgrades, fueling adoption of advanced modular systems. Contractors favor engineered solutions that meet OSHA standards and offer efficiency in complex builds. Growth is also supported by government funding for transport, energy, and public facility projects. The presence of leading global manufacturers and suppliers strengthens product availability and innovation. The region’s focus on sustainable and reusable scaffolding systems is also increasing its market potential.

Europe

The Europe Global Shoring & Formwork Scaffolding Market size was valued at USD 9,833.9 million in 2018 to USD 11,082.5 million in 2024 and is anticipated to reach USD 15,299.3 million by 2032, at a CAGR of 4.2% during the forecast period. Europe holds about 19.3% of the global market share. The region’s growth is supported by a strong emphasis on sustainable construction practices and strict compliance with safety regulations. Renovation and restoration of historical structures remain significant demand drivers. Public investment in transport and renewable energy infrastructure is expanding opportunities for advanced shoring systems. Northern and Western Europe lead adoption due to high labor costs, prompting preference for time-efficient modular systems. Southern Europe shows gradual growth driven by urban redevelopment and tourism-related projects. Innovation in lightweight, corrosion-resistant materials is aligning with EU environmental directives. The rental market is strong, offering flexible access to premium equipment for both small and large projects.

Asia Pacific

The Asia Pacific Global Shoring & Formwork Scaffolding Market size was valued at USD 18,788.7 million in 2018 to USD 22,915.8 million in 2024 and is anticipated to reach USD 36,342.0 million by 2032, at a CAGR of 6.0% during the forecast period. Asia Pacific accounts for approximately 40% of the global market share, making it the largest regional segment. Rapid urbanization, industrialization, and massive government infrastructure programs in China, India, and Southeast Asia are key growth drivers. Mega-projects in transport, energy, and housing demand high-capacity and adaptable scaffolding systems. Local manufacturing capabilities support cost-effective supply and customization. Foreign investment in construction is boosting demand for premium engineered systems. High-rise residential and commercial developments in metropolitan areas fuel modular system adoption. Governments are implementing stricter safety standards, driving the shift from traditional bamboo or timber scaffolding to engineered solutions. The region is also witnessing strong growth in equipment rental services.

Latin America

The Latin America Global Shoring & Formwork Scaffolding Market size was valued at USD 3,810.9 million in 2018 to USD 4,486.9 million in 2024 and is anticipated to reach USD 6,291.4 million by 2032, at a CAGR of 4.4% during the forecast period. Latin America holds around 7.1% of the global market share. Infrastructure development and urban expansion in Brazil, Mexico, and Argentina are driving demand. Large-scale public projects in transport, energy, and urban housing are key contributors. Contractors are adopting modular and adjustable systems for faster and safer construction. Economic volatility and fluctuating investment cycles create variability in demand. Foreign companies are entering the rental segment to serve mid-scale contractors. Growth in commercial construction, especially in hospitality and retail sectors, is boosting product uptake. Adoption of advanced materials remains gradual but is increasing due to safety awareness and performance benefits.

Middle East

The Middle East Global Shoring & Formwork Scaffolding Market size was valued at USD 2,173.5 million in 2018 to USD 2,441.1 million in 2024 and is anticipated to reach USD 3,436.4 million by 2032, at a CAGR of 4.5% during the forecast period. The Middle East represents about 3.9% of the global market share. Ongoing mega-projects in Saudi Arabia, the UAE, and Qatar, particularly in infrastructure and commercial real estate, are driving demand. The region’s push for tourism and mixed-use developments boosts high-rise construction. Contractors favor premium systems for large-scale, high-specification builds. Extreme weather conditions require durable and corrosion-resistant materials, increasing demand for aluminum and advanced steel systems. Government investment in smart city projects and transport infrastructure fuels steady growth. The rental market is expanding to meet the short-term needs of contractors handling multiple large projects. High safety standards in flagship projects encourage adoption of engineered scaffolding solutions.

Africa

The Africa Global Shoring & Formwork Scaffolding Market size was valued at USD 1,197.8 million in 2018 to USD 1,811.3 million in 2024 and is anticipated to reach USD 2,370.4 million by 2032, at a CAGR of 3.1% during the forecast period. Africa accounts for about 4.3% of the global market share. Growth is supported by increasing infrastructure investment in South Africa, Egypt, and Nigeria. Road, bridge, and port construction projects are major contributors to demand. Limited local manufacturing capacity creates reliance on imports from Asia and Europe. The mining and energy sectors drive specialized demand for heavy-duty shoring systems. Adoption of advanced modular systems is slower due to budget constraints but is gradually increasing through rental services. International contractors play a key role in introducing high-specification solutions. Urban expansion in major cities is driving housing and commercial development, creating opportunities for modern scaffolding products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- PERI SE

- Doka GmbH

- ULMA Construction

- MEVA Formwork Systems

- Acrow Formwork and Scaffolding

- RMD Kwikform

- Alsina Formwork Solutions

- Layher Group

- Paschal-Werk G. Maier GmbH

- Waco International

Competitive Analysis:

The Global Shoring & Formwork Scaffolding Market is highly competitive, with a mix of global leaders and strong regional players competing on product quality, safety compliance, and cost efficiency. Leading companies such as PERI SE, Doka GmbH, ULMA Construction, and Layher Group maintain a strong foothold through advanced modular systems, innovative materials, and tailored engineering solutions. It is marked by frequent technological upgrades, robust R&D investment, and strategic expansions into emerging markets. Equipment rental service providers are gaining market share by offering flexible access to premium systems. Partnerships with contractors and government agencies strengthen long-term supply agreements. Competitive differentiation is increasingly driven by customization, durability, and ease of installation. Market leaders are also leveraging digital tools such as BIM integration to enhance project efficiency and customer value.

Recent Developments:

- In July 2025, ULMA Construction announced a €45 million loan agreement with the European Investment Bank. The investment will support ULMA’s ongoing efforts in innovation and sustainability, focusing on advanced manufacturing technologies, facility upgrades, and the development of new, sustainable building materials targeting greater energy efficiency. This step reinforces ULMA’s leadership in sustainable construction solutions.

- In July 2025, Alsina Formwork Solutions USA actively engaged with the Texas construction market by participating in the RHCA Golf Classic. This initiative aimed to build strategic partnerships and strengthen Alsina’s presence in the U.S. market through community engagement and networking.

- In April 2025, PERI SE introduced the Vario Box and several next-generation formwork and scaffolding solutions at bauma 2025. Notable launches included the PERI UP Public modular stair and access system designed for rapid assembly in public infrastructure, the MAXIMO next-generation panel formwork emphasizing sustainability and single-sided operation, and the SKYFLEX imperial grid beam formwork system for efficient slab construction. PERI also presented innovative digital tools and sensor integrations, including VEMAVENTURI’s concrete monitoring technology at the event.

- In April 2025, Layher Group launched the Steel Deck Lightweight (LW), offering a 10% weight reduction over traditional steel decks without sacrificing strength. Layher also commenced operations at its new “Plant 3” production facility in Germany. The facility’s highly automated, energy-efficient processes support increased production capacity and reinforce Layher’s market-leading standards for quality and sustainability in scaffolding systems.

Market Concentration & Characteristics:

The Global Shoring & Formwork Scaffolding Market demonstrates moderate to high concentration, with a few multinational companies holding significant market share alongside numerous regional manufacturers. It is characterized by high entry barriers due to capital-intensive production, stringent safety regulations, and strong brand loyalty among established players. Global leaders maintain dominance through product innovation, strategic partnerships, and expanded service offerings, while regional firms compete on pricing and localized solutions. The market favors companies capable of delivering versatile, durable, and safety-compliant systems that meet diverse construction needs.

Report Coverage:

The research report offers an in-depth analysis based on type, application, end-user, and material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising infrastructure investments will continue to drive large-scale adoption of advanced shoring and formwork systems.

- Urbanization trends will fuel demand for modular and adjustable systems in high-rise residential and commercial projects.

- Technological integration, including BIM and IoT-enabled safety monitoring, will enhance efficiency and compliance.

- Demand for lightweight, corrosion-resistant materials like aluminum and composites will expand.

- Rental and leasing services will gain traction, especially among small to mid-sized contractors.

- Governments will enforce stricter safety regulations, boosting adoption of certified, engineered solutions.

- Emerging economies will present significant growth opportunities through mega-projects in transport and energy.

- Sustainability initiatives will push manufacturers to develop reusable and eco-friendly scaffolding solutions.

- Product customization for complex architectural designs will become a competitive differentiator.

- Strategic collaborations between global and regional players will accelerate market penetration.