Market Overview

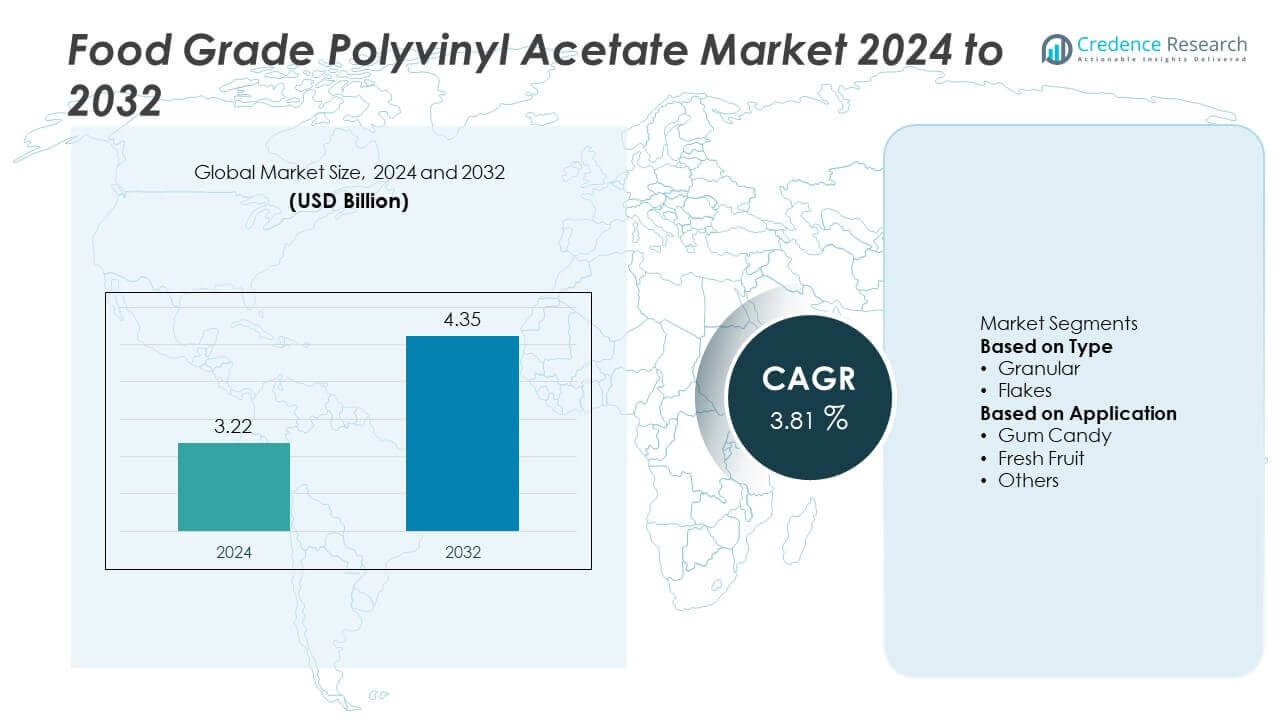

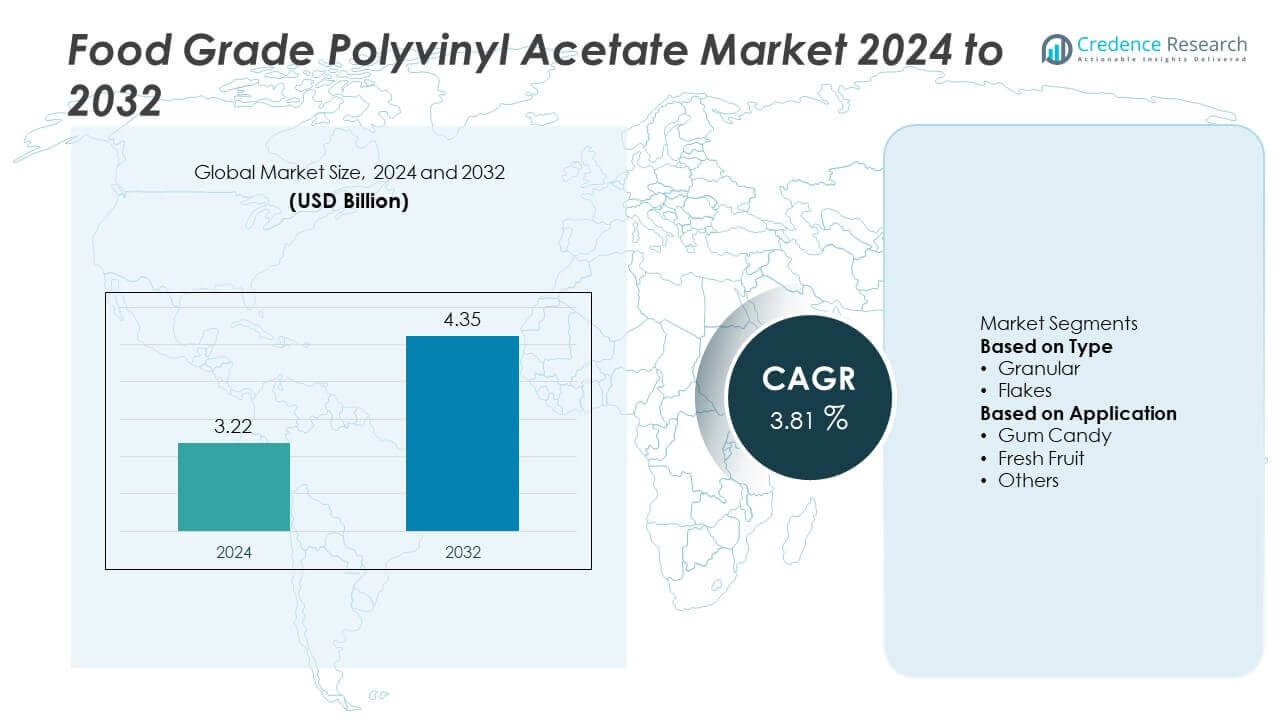

Food Grade Polyvinyl Acetate Market size was valued at USD 3.22 billion in 2024 and is projected to reach USD 4.35 billion by 2032, growing at a CAGR of 3.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Grade Polyvinyl Acetate Market Size 2024 |

USD 3.22 Billion |

| Food Grade Polyvinyl Acetate Market, CAGR |

3.81% |

| Food Grade Polyvinyl Acetate Market Size 2032 |

USD 4.35 Billion |

Key players in the Food Grade Polyvinyl Acetate market include Celanese, Wacker, VINAVIL, Brenntag Specialties, Jiangsu Yinyang Gumbase Materials, Shuanghui Rubber Nantong Co., LTD, Foreverest Resources Ltd., Nacalai, Synthomer PLC, and Eastman Chemical Company. These companies focus on producing high-purity grades, expanding production capacity, and strengthening distribution networks to meet growing demand from confectionery and fruit coating applications. Asia-Pacific leads the market with 38% share, driven by strong chewing gum consumption in China and India and rising adoption of fruit coatings across ASEAN exporters. Europe follows with 25% share, supported by established confectionery production and strict EFSA regulations, while North America accounts for 20% share, led by innovation in sugar-free gum and functional snacks.

Market Insights

- Food Grade Polyvinyl Acetate market was valued at USD 3.22 billion in 2024 and is projected to reach USD 4.35 billion by 2032, growing at a CAGR of 3.81% during the forecast period.

- Rising demand for chewing gum and confectionery drives market growth, with gum candy applications holding over 55% share and granular type leading with more than 60% share due to its superior processing efficiency.

- Clean-label movement and innovation in high-purity, food-safe formulations are major trends, encouraging adoption of low-residue polymers and sustainable coating solutions.

- Competition is moderately consolidated with players like Celanese, Wacker, VINAVIL, and Jiangsu Yinyang Gumbase Materials focusing on R&D, capacity expansion, and strategic distribution partnerships to strengthen market presence.

- Asia-Pacific leads with 38% share, followed by Europe at 25% and North America at 20%, driven by confectionery production, fresh fruit exports, and automation in food processing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Food Grade Polyvinyl Acetate market by type is led by granular form, accounting for over 60% share. Its free-flowing nature supports consistent dosing and better process efficiency in large-scale food production. Granular form is widely used in chewing gum manufacturing, where uniformity and stability are critical. Flake form caters to niche uses requiring slower dissolution and customized formulations. Growing adoption of automated production lines and demand for consistent quality in confectionery continue to strengthen the dominance of granular polyvinyl acetate in the market.

- For instance, Wacker Chemie AG’s VINNAPAS® B 500/20 VL and B 500/40 VL vinyl acetate-vinyllaurate copolymers (used in gum base) are permitted in chewing-gum base at levels up to about 26% of the gum base weight.

By Application

Gum candy dominates the application segment with more than 55% share, driven by its use as a key base polymer in chewing gum. Polyvinyl acetate enhances chewability, flavor retention, and shelf life, making it essential for major gum brands. Fresh fruit applications are growing rapidly as exporters adopt coatings to preserve appearance and reduce spoilage. The “others” segment, including bakery and snack coatings, benefits from clean-label trends and safer food-grade solutions. Rising demand for functional and innovative gum products continues to support strong growth in this application segment.

- For instance, an HPLC-ELSD study of commercial chewing gum samples found PVAc content up to 13.8 g/kg in some samples.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Chewing Gum and Confectionery

The Food Grade Polyvinyl Acetate market grows with increasing consumption of chewing gum and sugar confectionery worldwide. Manufacturers rely on polyvinyl acetate for its elasticity, flavor retention, and stability, which enhance chewing experience. Demand for sugar-free and functional gum varieties also boosts polymer usage. Emerging markets with rising disposable incomes, such as India and Brazil, further drive production volumes. Confectionery brands invest in advanced formulations to meet changing consumer preferences, reinforcing steady growth in this segment and solidifying its position as a core driver for the market.

- For instance, a patented bubble gum base formula uses a blend of low molecular weight PVAc (≈ 12,000-16,000 mean average molecular weight) and medium molecular weight PVAc (≈ 35,000-55,000) in amounts up to 14% and 35% by weight of the gum base respectively.

Growing Adoption in Fresh Fruit Coatings

The market benefits from the expanding use of polyvinyl acetate as a coating for fresh fruits. The edible film preserves moisture, improves shelf life, and maintains visual appeal during transport. Rising global exports of perishable fruits, particularly from Latin America and Asia, strengthen this demand. Exporters seek reliable coating materials that meet regulatory standards and reduce post-harvest losses. The trend aligns with sustainability goals by minimizing food waste. Increasing consumer demand for fresh, high-quality fruits accelerates adoption, making fresh fruit coatings a major contributor to market expansion.

- For instance, a 2011 study in Revista Chapingo Serie Horticultura on green-stage ‘Gabriela’ tomatoes found that a polyvinyl acetate (PVA) coating provided some protective effects during ambient storage for up to 14 days, though the effects on luminosity, weight loss, and respiration rate were not statistically significant under the experimental conditions used.

Advancements in Food-Grade Polymer Technology

Technological innovation in food-grade polymer production supports market growth by offering improved purity and performance. Manufacturers develop low-residue, high-quality polyvinyl acetate grades that meet stringent food safety regulations. New formulations enhance solubility, processing efficiency, and compatibility with automated systems. These innovations enable consistent production of chewing gum bases and coatings, reducing variability and improving product quality. Investments in research and development drive continuous improvement, allowing companies to cater to evolving consumer expectations and regulatory requirements. This focus on innovation helps expand market opportunities globally.

Key Trends & Opportunities

Shift Toward Clean-Label and Natural Ingredients

Consumers increasingly prefer products with safe, traceable, and natural ingredients, encouraging producers to use food-grade polyvinyl acetate that meets strict compliance standards. Clean-label confectionery and coatings require high-purity polymers with minimal additives. This trend creates opportunities for manufacturers to develop eco-friendly, bio-based alternatives while maintaining functional properties. Brands promoting transparency and health benefits are likely to see stronger adoption of certified materials. The clean-label movement is particularly strong in Europe and North America, offering a favorable environment for producers to differentiate through safer and sustainable formulations.

- For instance, in the study Determination of Polyvinyl Acetate in Chewing Gum the content of PVAc in commercial chewing gum samples ranged from not detected up to 13.8 g per kilogram of gum.

Expansion in Emerging Markets

Emerging economies present significant opportunities due to rising urbanization, income levels, and demand for packaged food products. Chewing gum consumption is growing in Asia-Pacific and Latin America, creating demand for polyvinyl acetate as a key raw material. Expansion of modern retail and cold-chain logistics further supports market penetration in these regions. Local producers and multinationals invest in capacity expansion to meet demand. These markets also encourage innovation in low-cost formulations tailored to regional preferences, opening new growth avenues for food-grade polyvinyl acetate suppliers.

- For instance, a product listing from a Chinese supplier of food-grade PVA (which is closely related in use to PVAc adhesives/coatings) specifies molecular weights (degree of polymerization) in the range of 13,000 to 23,000 for low-molecular weight PVA.

Key Challenges

Fluctuating Raw Material Prices

The market faces challenges due to volatility in vinyl acetate monomer prices, a key raw material for polyvinyl acetate. Price fluctuations affect production costs and profit margins for manufacturers. Dependency on petrochemical feedstocks exposes the industry to crude oil price variations. Sudden cost increases can disrupt supply contracts and reduce competitiveness, particularly for smaller producers. Companies are focusing on supply chain optimization and exploring alternative sourcing to mitigate risks. Stable pricing strategies are essential to maintain profitability in a price-sensitive food industry environment.

Regulatory Compliance and Food Safety Standards

Strict food safety regulations across regions require producers to maintain high-quality standards, which can increase production costs. Meeting compliance with frameworks like FDA, EFSA, and Codex Alimentarius involves continuous testing and certification. Any contamination or deviation can lead to recalls, damaging brand reputation. Frequent regulatory updates demand constant monitoring and process adjustments. This creates pressure on manufacturers to invest in advanced production technologies and robust quality control systems. Compliance complexity may hinder market entry for small players and limit operational flexibility for established companies.

Regional Analysis

North America

North America holds 20% market share. The United States drives demand through large confectionery production. Chewing gum brands favor granular grades for dosing accuracy. Clean-label pressure supports high-purity, low-residue formulations. Fresh fruit coatings grow with longer domestic supply chains. Retail private labels expand functional gum lines. Regulatory compliance with FDA standards shapes specifications and audits. Automation in mixing and extrusion boosts polymer consistency needs. Canada adds steady demand from snack and bakery coatings. Cross-border sourcing strategies reduce raw material volatility. Sustainability programs encourage waste reduction and tighter process control.

Europe

Europe accounts for 25% market share. Germany, Italy, and the U.K. lead confectionery output. Brands emphasize texture stability and flavor retention in sugar-free gum. EFSA requirements drive strict purity and migration limits. Fresh produce exporters adopt coatings for shelf-life gains. Northern Europe prioritizes traceability and certified inputs. Western Europe modernizes legacy plants with automated dosing. Eastern Europe adds capacity for regional private labels. Energy management initiatives favor efficient processing aids. Circular packaging efforts push cleaner auxiliary materials. Premium formulations support long-lasting chew performance and consistent sensory profiles.

Asia-Pacific

Asia-Pacific commands 38% market share, the largest region. China and India anchor chewing gum and candy growth. Rising incomes and urban retail boost packaged confectionery sales. ASEAN fruit exporters use coatings to protect high-value shipments. Local producers scale automated lines for dosing precision. Japan and South Korea demand high-purity specialty grades. Regional players tailor formulations for tropical climates. E-commerce snacking trends lift gum innovations. Supply proximity to vinyl acetate improves cost agility. Multinationals expand joint ventures and technical centers to meet regulatory and performance needs.

Latin America

Latin America holds 10% market share. Mexico and Brazil lead gum base consumption. Fruit exporters adopt coatings to cut moisture loss in transit. Retail expansion supports impulse confectionery categories. Producers invest in reliable granular grades for throughput gains. Regulatory frameworks align with Codex and major import markets. Currency swings highlight the need for stable sourcing. Contract manufacturers serve multinational brand requirements. Seasonal fruit peaks require flexible coating supply. Training on process control improves batch uniformity and flavor carry. Sustainability programs target food waste reduction across the cold chain.

Middle East & Africa

Middle East & Africa represents 7% market share. GCC countries import gum and confectionery at scale. Local plants focus on heat-stable, clean-label grades. North African fruit exporters use coatings for EU shipments. Modern trade grows premium gum formats in urban centers. Temperature extremes require robust storage and handling practices. Standards harmonization supports cross-border sales. Regional distributors favor granular form for fewer line stoppages. Investments target quality labs and migration testing. Education on shelf-life benefits expands coating adoption. Logistics upgrades improve consistency from plant to retail display.

Market Segmentations:

By Type

By Application

- Gum Candy

- Fresh Fruit

- Others

By Geography

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Food Grade Polyvinyl Acetate market features a moderately consolidated competitive landscape with global and regional players focusing on product quality, compliance, and innovation. Companies such as Celanese, Wacker, VINAVIL, and Brenntag Specialties lead with well-established supply chains and advanced manufacturing capabilities. Asian players like Jiangsu Yinyang Gumbase Materials and Shuanghui Rubber Nantong Co., LTD cater to the growing demand for chewing gum bases in high-volume markets. Firms invest in R&D to develop high-purity, food-safe grades with improved solubility and consistency for automated production lines. Strategic partnerships and distribution agreements help expand market reach, particularly in emerging regions. Sustainability and regulatory compliance remain key differentiators, driving adoption of cleaner formulations and environmentally responsible production processes. Competitors also focus on capacity expansion and localization to ensure cost efficiency and stable supply, positioning themselves to meet rising demand from confectionery, fruit coating, and specialty food applications worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Celanese

- Foreverest Resources Ltd.

- Jiangsu Yinyang Gumbase Materials

- Shuanghui Rubber Nantong CO., LTD

- Wacker

- VINAVIL

- Nacalai

- Brenntag Specialties

- Synthomer PLC

- Eastman Chemical Company

Recent Developments

- In May 2025, Vinavil announced a price increase on all its vinylic polymers.

- In May 2025, Wacker declared a price rise for dispersions and dispersible polymer powders, which includes materials used in vinyl acetate based coatings and adhesives.

- In March 2025, Celanese announced an increase in prices for Vinyl Acetate Monomer (VAM) and derivatives in the Western Hemisphere.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chewing gum bases will continue to drive consistent consumption of food grade polyvinyl acetate.

- Growth in sugar-free and functional gum products will boost adoption of high-purity grades.

- Automation in food processing will increase the need for granular forms with better flow properties.

- Rising fresh fruit exports will expand the use of edible coatings to reduce spoilage.

- Innovation in bio-based and sustainable polymers will gain traction to meet clean-label demands.

- Capacity expansion by leading producers will ensure stable supply for global confectionery brands.

- Regulatory compliance will remain a focus, pushing investment in quality control systems.

- Emerging markets in Asia and Latin America will see faster consumption growth from rising incomes.

- Strategic collaborations between suppliers and food manufacturers will enhance product innovation.

- Technological advancements in polymer processing will improve consistency and performance in end applications.

Key Growth Drivers

Key Growth Drivers