Market Overview

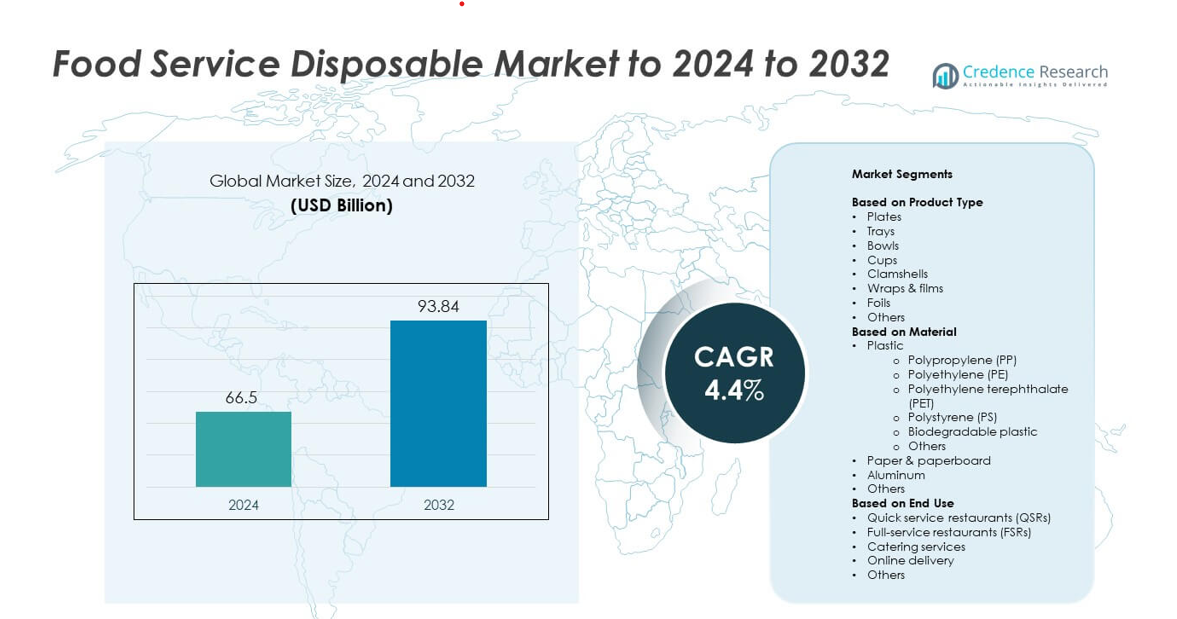

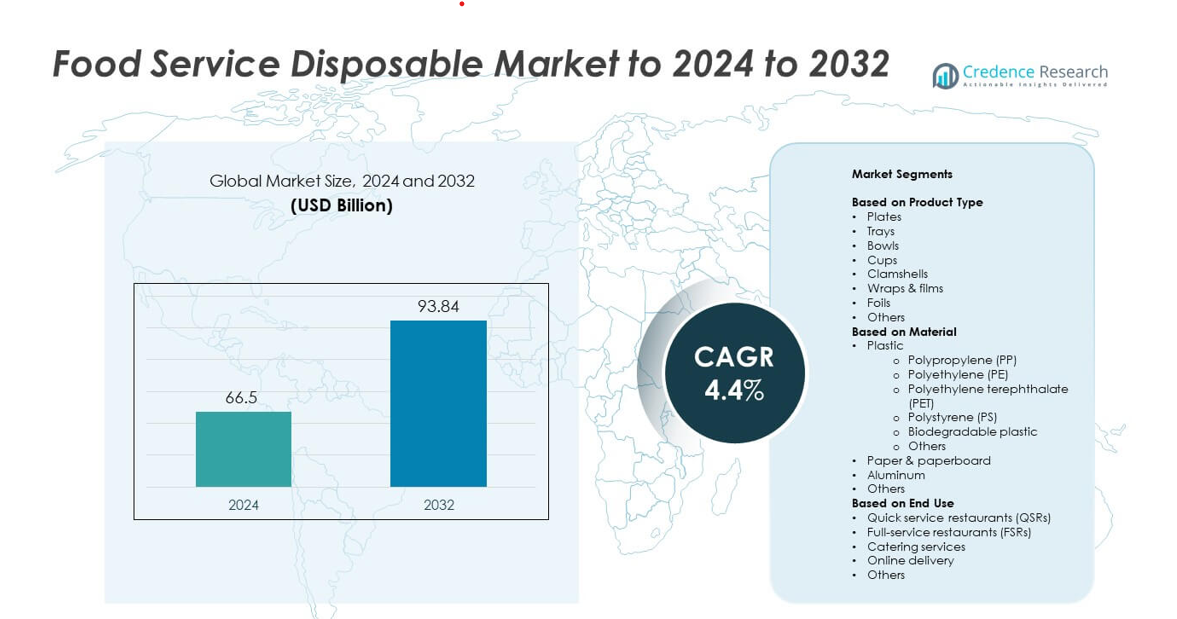

The Food Service Disposable Market size was valued at USD 66.5 billion in 2024 and is anticipated to reach USD 93.84 billion by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Service Disposable Market Size 2024 |

USD 66.5 billion |

| Food Service Disposable Market, CAGR |

4.4% |

| Food Service Disposable Market Size 2032 |

USD 93.84 billion |

The food service disposable market is led by major players such as Amcor and Berry Global, Huhtamaki Food Service, Pactiv LLC, Sabert Corp., Genpak LLC, and Hinojosa Packaging Group. These companies focus on innovation, sustainable material development, and partnerships with quick service restaurants and delivery platforms to enhance market presence. North America emerged as the leading region, accounting for 36% of the global market share in 2024, driven by strong demand from fast-food chains and online food delivery services. Europe and Asia Pacific followed, supported by sustainability initiatives and expanding urban food service sectors.

Market Insights

- The food service disposable market was valued at USD 66.5 billion in 2024 and is projected to reach USD 93.84 billion by 2032, growing at a CAGR of 4.4%.

- Rising demand from quick service restaurants and online delivery platforms drives consistent product consumption across global markets.

- Increasing use of biodegradable and compostable materials marks a major trend as sustainability becomes central to packaging innovation.

- The market is competitive with players focusing on eco-friendly materials, automation, and partnerships with major food chains to strengthen global presence.

- North America led with a 36% share in 2024, followed by Europe at 28% and Asia Pacific at 24%, while plates dominated the product segment with 27% of total market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Plates held the largest share of 27% in the food service disposable market in 2024. Their dominance is driven by the growing demand from quick service restaurants and catering businesses for lightweight, cost-effective, and easy-to-dispose options. The expansion of takeaway and outdoor dining further supports the need for durable and grease-resistant plates. Manufacturers are introducing compostable and biodegradable variants to meet sustainability goals. The rising preference for single-use convenience items across institutional and commercial food chains continues to fuel the growth of the plates segment globally.

- For instance, Huhtamaki scaled SMF capacity to 3.5 billion fiber products annually.

By Material

Plastic accounted for the largest market share of 42% in 2024, supported by its versatility, low cost, and durability. Among plastics, polypropylene (PP) led the sub-segment due to its heat resistance and suitability for microwavable containers. The ongoing innovation in biodegradable plastics is helping address environmental concerns while maintaining performance standards. Paper and paperboard products are also growing rapidly as eco-friendly alternatives gain acceptance. The shift toward sustainable materials and circular packaging systems is driving transformation within the plastic-based disposable segment.

- For instance, Novolex’s Duro brand holds 100+ BPI-certified compostable SKUs.

By End Use

Quick service restaurants (QSRs) dominated the market with a 35% share in 2024. This segment benefits from the rise of fast-paced lifestyles and increased consumption of ready-to-eat meals. Global expansion of QSR chains like McDonald’s and KFC has significantly boosted demand for cost-efficient disposable packaging. The growth of online delivery platforms further supports high-volume usage of disposable items for safe, hygienic, and branded food packaging. Sustainability efforts by leading QSRs to adopt recyclable materials also contribute to steady long-term growth within this segment.

Key Growth Drivers

Rising Demand from Quick Service Restaurants (QSRs)

The rapid growth of QSRs and fast-casual dining outlets is a major driver of the food service disposable market. Increasing consumer preference for on-the-go meals and convenient packaging boosts demand for disposable plates, cups, and trays. Chains are investing in eco-friendly and custom-branded disposables to improve sustainability and brand visibility. Expanding delivery and takeaway services across developing regions further support consistent volume growth, making QSR demand a central force in market expansion.

- For instance, KFC opened ~2,700 restaurants in 2023, surpassing 30,000 locations globally.

Shift Toward Sustainable and Biodegradable Materials

The rising global focus on sustainability has accelerated the adoption of biodegradable and compostable disposables. Consumers and regulatory authorities are pushing for alternatives to single-use plastics, encouraging manufacturers to innovate using paper, bamboo, and bioplastics. Companies are developing cost-efficient materials that meet environmental standards without compromising strength and safety. This shift supports long-term market growth by aligning with global green packaging trends and helping brands enhance eco-friendly credentials.

- For instance, Vegware products compost in under 12 weeks in industrial facilities.

Expansion of Online Food Delivery Services

The surge in online food delivery platforms has become a critical growth catalyst for disposable food packaging. Growing use of digital ordering apps and meal delivery services has increased the need for secure, spill-resistant, and temperature-controlled packaging. Restaurants rely on disposable containers, wraps, and cutlery to ensure hygiene and convenience. This expansion has led to rising innovation in tamper-evident and recyclable packaging solutions, sustaining strong demand across urban markets worldwide.

Key Trends & Opportunities

Adoption of Smart and Customized Packaging

Food service brands are adopting smart disposable packaging integrated with QR codes, freshness indicators, and branding elements. Customization enhances consumer engagement and allows businesses to communicate sustainability commitments. Manufacturers are focusing on high-quality printing and biodegradable materials to attract eco-conscious customers. This trend presents opportunities for premiumization and brand differentiation within the competitive food service packaging sector.

- For instance, Avery Dennison opened a large RFID plant employing 600 workers.

Growing Use of Circular Economy Practices

Companies are shifting toward circular production models emphasizing material recovery and reuse. Recycling partnerships and government initiatives are promoting closed-loop systems in disposable packaging. This trend opens new opportunities for innovation in recyclable polymers and bio-based composites. The adoption of such models not only reduces waste but also aligns with evolving corporate sustainability goals and global environmental policies.

- For instance, in 2021, TerraCycle’s Loop announced a worldwide in-store expansion, aiming for around 200 locations across its partners by early 2022.

Key Challenges

Environmental Regulations and Plastic Bans

Stringent government policies banning single-use plastics present a major challenge for the market. Manufacturers face pressure to comply with varying regional standards while maintaining affordability and product quality. Transitioning to biodegradable materials often increases production costs and requires technological adaptation. Companies must balance sustainability goals with profitability, creating challenges in scaling eco-friendly alternatives efficiently.

Volatility in Raw Material Prices

Fluctuations in the prices of key raw materials, such as paper, polymers, and aluminum, affect profit margins. The rising cost of sustainable materials also limits adoption among smaller players. Supply chain disruptions further impact production and distribution efficiency. To remain competitive, manufacturers are increasingly focusing on localized sourcing and material innovation to reduce dependency and mitigate cost pressures.

Regional Analysis

North America

North America held the largest market share of 36% in the food service disposable market in 2024. The dominance is supported by the strong presence of fast-food chains, catering services, and online delivery platforms. Rising consumer demand for convenient, single-use packaging drives steady product consumption across the U.S. and Canada. The region is also witnessing increased adoption of biodegradable and compostable disposables due to strict environmental regulations. Ongoing innovation in eco-friendly materials and expansion of sustainable QSR operations continue to strengthen North America’s leading position in the global market.

Europe

Europe accounted for a 28% market share in 2024, driven by its strong sustainability focus and stringent plastic waste regulations. The region’s food service industry increasingly relies on paper-based and compostable materials, replacing conventional plastics. Demand from quick-service and catering sectors remains strong, particularly in the UK, Germany, and France. Manufacturers are investing in recyclable packaging solutions to comply with EU environmental directives. The growing popularity of eco-conscious dining and government-led initiatives promoting circular economy practices further boost Europe’s contribution to global market growth.

Asia Pacific

Asia Pacific captured a 24% share in the food service disposable market in 2024, supported by the expanding food delivery ecosystem and rapid urbanization. Rising disposable income and growth in quick-service chains across China, India, and Japan drive significant consumption of disposable packaging. The region’s manufacturers benefit from low production costs and a wide consumer base. However, increasing environmental concerns are pushing for sustainable material innovation. Growing adoption of online food delivery platforms and eco-friendly packaging initiatives ensures Asia Pacific remains a key growth hub.

Latin America

Latin America represented 7% of the global food service disposable market share in 2024. The region is witnessing growing demand from quick-service restaurants, street food vendors, and catering providers. Economic growth and rising consumer preference for convenient meal options drive market expansion in Brazil, Mexico, and Argentina. Manufacturers are gradually introducing paper and biodegradable alternatives to meet sustainability goals. Although adoption of eco-friendly materials remains limited compared to developed regions, ongoing investments in packaging infrastructure are improving the region’s long-term growth outlook.

Middle East & Africa

The Middle East & Africa accounted for a 5% share of the food service disposable market in 2024. Rapid urbanization and expanding tourism industries in the UAE, Saudi Arabia, and South Africa support increased demand for single-use packaging. The rise of international food chains and catering services boosts consumption of trays, cups, and wraps. However, limited recycling infrastructure and import dependency for raw materials pose challenges. Efforts to promote sustainable packaging and local manufacturing capabilities are gradually improving market penetration across the region.

Market Segmentations:

By Product Type

- Plates

- Trays

- Bowls

- Cups

- Clamshells

- Wraps & films

- Foils

- Others

By Material

- Plastic

- Polypropylene (PP)

- Polyethylene (PE)

- Polyethylene terephthalate (PET)

- Polystyrene (PS)

- Biodegradable plastic

- Others

- Paper & paperboard

- Aluminum

- Others

By End Use

- Quick service restaurants (QSRs)

- Full-service restaurants (FSRs)

- Catering services

- Online delivery

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The food service disposable market is characterized by the presence of major players such as Amcor and Berry Global, Genpak LLC, Huhtamaki Food Service, Hinojosa Packaging Group, Pactiv LLC, R+R Packaging Ltd., Contital Srl, Go Pak Group, Sabert Corp., Graphic Packaging International LLC, Interplast Group, and Sonoco Products Company. These companies compete through product innovation, material diversification, and sustainable packaging solutions. The market is witnessing growing investments in biodegradable and recyclable materials to address environmental regulations. Firms are emphasizing operational efficiency, automation, and localized manufacturing to reduce production costs and lead times. Strategic collaborations with quick service restaurants and online food delivery platforms strengthen market presence and ensure stable demand. Branding through customized, tamper-proof, and eco-friendly packaging designs is also gaining importance. Continuous R&D efforts and expansion into emerging economies are key to sustaining competitiveness and meeting global demand for sustainable, safe, and high-quality food service disposables.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor and Berry Global

- Genpak LLC

- Huhtamaki Food Service

- Hinojosa Packaging Group

- Pactiv LLC

- R+R Packaging Ltd.

- Contital Srl

- Go Pak Group

- Sabert Corp.

- Graphic Packaging International LLC

- Interplast Group

- Sonoco Products Company

Recent Developments

- In 2024, Genpak Launched its Harvest® Fiber packaging line, featuring containers made from renewable fibers that are commercially compostable, microwavable, and PFAS-free. This development was a direct response to rising legislation against PFAS.

- In 2023, the Hinojosa Packaging Group launched a new line of packaging called Foodservice, which is entirely recyclable and compostable, targeting the food service industry and reducing single use plastic consumption.

- In 2023, Sabert Corporation Launched its new EcoEdgeTM Paper Cutlery line in June, offering a viable, recyclable, and compostable alternative to plastic cutler

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing focus on biodegradable and compostable materials will shape future product innovation.

- Expansion of online food delivery platforms will continue driving packaging demand.

- Quick service restaurants will remain the largest consumers of disposable products.

- Manufacturers will invest more in recyclable and reusable packaging technologies.

- Government regulations on single-use plastics will accelerate the shift to sustainable materials.

- Automation in packaging production will improve efficiency and reduce costs.

- Brand differentiation through customized and smart packaging will gain importance.

- Emerging economies will see rapid adoption due to urbanization and lifestyle changes.

- Circular economy initiatives will influence material sourcing and waste management.

- Partnerships between food chains and packaging firms will foster innovation in eco-friendly disposables.