Market Overview:

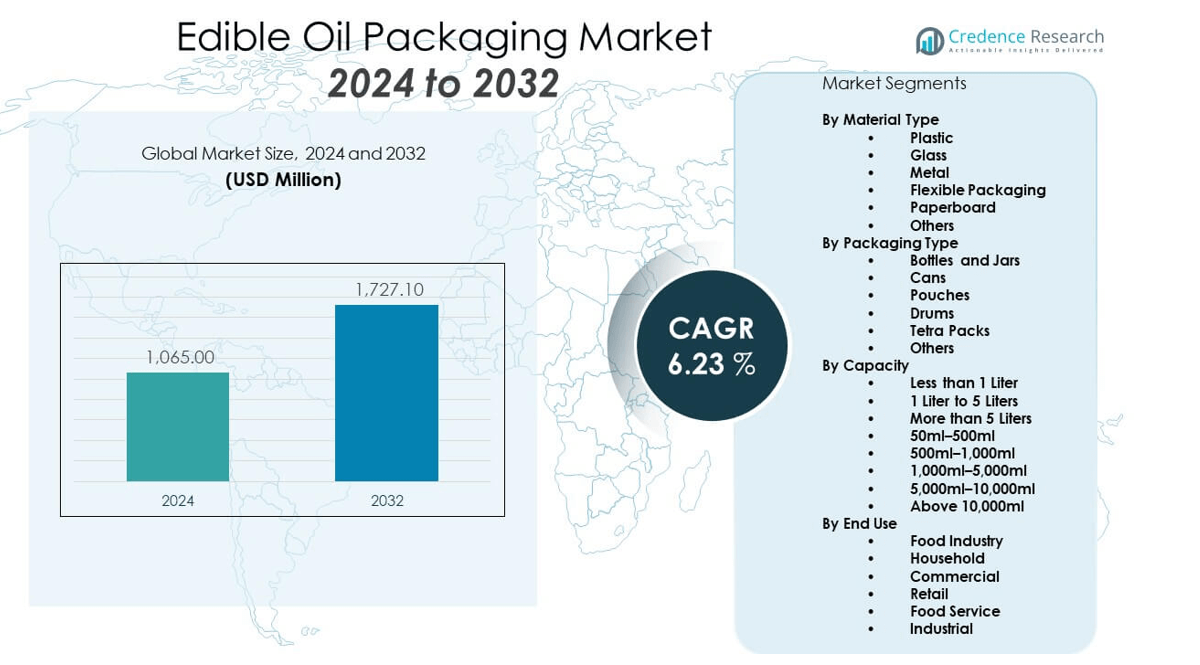

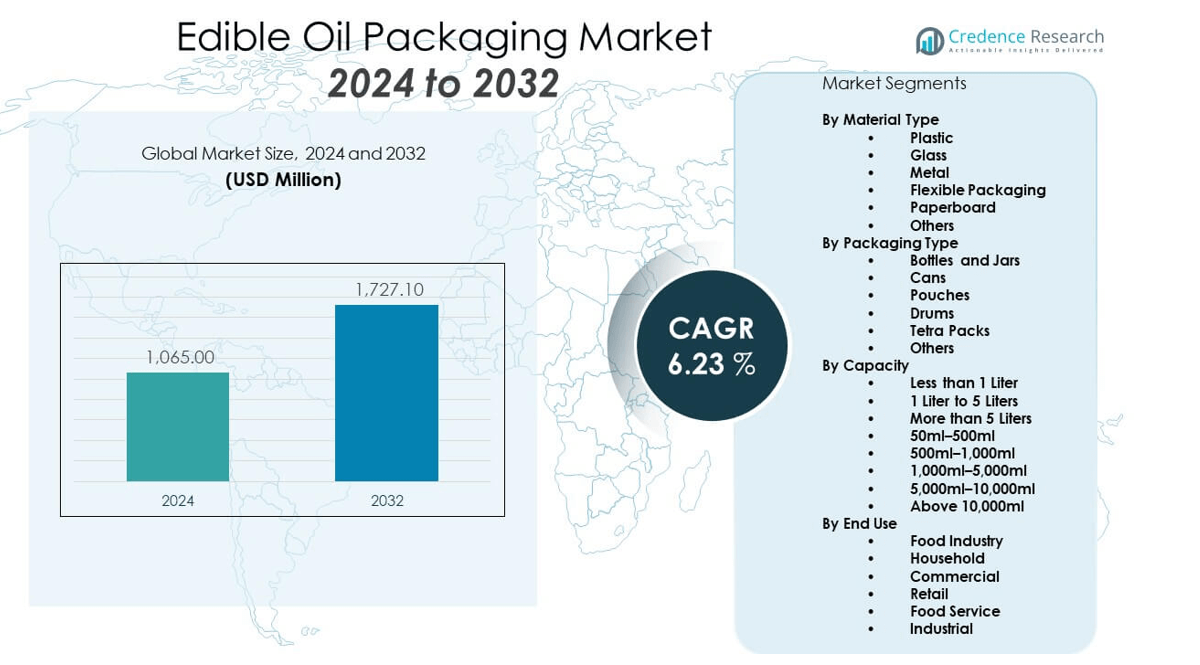

The Edible Oil Packaging Market is projected to grow from USD 1,065 million in 2024 to an estimated USD 1,727.1 million by 2032, with a compound annual growth rate (CAGR) of 6.23% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Edible Oil Packaging Market Size 2024 |

USD 1,065 million |

| Edible Oil Packaging Market, CAGR |

6.23% |

| Edible Oil Packaging Market Size 2032 |

USD 1,727.1 million |

The edible oil packaging market is expanding due to increasing demand for healthier cooking oils, rising disposable incomes, and growing urbanization. Manufacturers are focusing on advanced, sustainable packaging materials such as PET, glass, and biodegradable films to improve shelf life and reduce environmental impact. Convenience in storage, tamper resistance, and extended product preservation are driving innovation in flexible and rigid packaging formats. Branding and label clarity are also essential, as consumers demand transparency and quality assurance, prompting companies to enhance visual appeal and informative packaging designs.

Geographically, Asia Pacific dominates the edible oil packaging market due to high consumption in India, China, and Southeast Asia, driven by large populations and dietary preferences. North America and Europe show steady demand, supported by a preference for premium and sustainable packaging. The Middle East and Africa are emerging markets, fueled by rapid urbanization, a shift toward packaged foods, and growing retail infrastructure. Local manufacturing growth and investments in automation also boost regional competitiveness and adoption of innovative packaging technologies.

Market Insights:

- The Edible Oil Packaging Market is projected to grow from USD 1,065 million in 2024 to USD 1,727.1 million by 2032, registering a CAGR of 6.23% during the forecast period.

- Rising health consciousness and preference for premium oils such as olive and sunflower are driving demand for tamper-proof, protective packaging solutions.

- Innovations in biodegradable and recyclable packaging materials are accelerating due to tightening environmental regulations and corporate ESG commitments.

- High production costs and volatility in raw material prices, including PET and HDPE, are restraining profit margins and challenging smaller manufacturers.

- Asia Pacific dominates the market, led by India and China, due to large-scale edible oil consumption and expanding retail distribution.

- Europe shows strong demand for sustainable and premium packaging formats, while Africa and Southeast Asia emerge as high-growth regions.

- Government mandates around food safety, plastic use, and labelling are pushing manufacturers to invest in compliance-driven packaging upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Convenient and Safe Packaging Across Urban Households:

Urbanization has significantly shifted consumer preference toward conveniently packaged edible oil products. The Edible Oil Packaging Market benefits from this change as manufacturers design leak-proof, lightweight, and user-friendly containers. Busy lifestyles prompt consumers to favor bottles and pouches that simplify pouring and storage. It supports single-use formats and tamper-evident seals to improve safety and hygiene. Consumer trust rises with clear labeling and transparent packaging. The market experiences steady growth due to the reliability and durability of PET bottles and multilayer pouches. Brands utilize ergonomic designs to enhance functionality. Convenience continues to influence packaging choices across global urban centers.

- For instance, Amcor developed the AmLite Ultra Recyclable pouch, which provides up to 50% reduced carbon footprint compared to traditional oil packaging, and is used by multiple edible oil brands across Europe and Asia for its lightweight and leak-proof properties. Tata SmartFoodz in India launched edible oil bottles with 100% tamper-evident caps and ergonomic handles, resulting in a 25% reduction in consumer-reported spillage incidents within the first year of adoption.

Rising Health Awareness and Premium Oil Adoption Supporting Market Growth:

Consumers are adopting healthier edible oils such as olive, canola, and sunflower oils, creating new requirements in packaging. The Edible Oil Packaging Market responds with solutions that preserve the nutritional quality and extend shelf life. UV-protective bottles, vacuum seals, and oxygen-barrier materials maintain oil freshness. Premium oils demand superior presentation, encouraging brands to invest in aesthetically appealing formats. It facilitates differentiation through matte finishes, embossed logos, and printed QR codes for traceability. As health-conscious consumers increase spending, premium packaging standards strengthen. Nutritional labeling on the pack builds brand credibility. Safe packaging becomes a critical factor in product selection.

- For instance, Research published on PET wrapping films shows that certain films effectively block light and significantly reduce photo-oxidation in extra virgin olive oil stored in clear glass bottles.

Sustainability Initiatives Driving Material Innovation and Replacement:

Sustainability has emerged as a central driver influencing packaging decisions in the Edible Oil Packaging Market. Government regulations and consumer preference drive companies to reduce plastic usage. It accelerates the transition to recyclable, biodegradable, and compostable alternatives. Manufacturers develop eco-friendly pouches using bio-based films and adopt refillable packaging models. Brands pursue circular economy strategies through take-back programs and material reuse. The demand for transparent sustainability claims pushes companies toward certified materials. Light weighting initiatives reduce transportation costs and carbon emissions. Corporate ESG goals prioritize environmentally sound packaging practices. Retailers and producers align with sustainability benchmarks for competitive advantage.

Growth in Retail Chains and E-Commerce Expanding Packaged Oil Availability:

Expansion of modern retail and online grocery platforms increases the visibility of branded edible oils. The Edible Oil Packaging Market gains from the growing shelf space dedicated to packaged oils in hypermarkets and supermarkets. Compact and durable packaging enhances stacking and display efficiency. It enables efficient logistics and damage-free deliveries for e-commerce orders. Multipacks and stand-up pouches suit bulk purchasing behavior. Online sales allow personalized packaging through digital print-on-demand models. Strong branding elements boost consumer recall and loyalty. Retail partnerships influence the demand for standardized, space-saving formats. Packaging innovation aligns with omnichannel retail expansion.

Market Trends:

Adoption of Smart Packaging Technologies to Enhance Traceability and Engagement:

Smart packaging has gained traction across food sectors, including edible oils. The Edible Oil Packaging Market incorporates QR codes, NFC tags, and temperature indicators to monitor freshness and improve consumer interaction. It allows real-time tracking from origin to shelf, ensuring transparency. Consumers scan packages to access product origin, expiry details, and nutritional content. This interactivity builds trust and supports brand loyalty. Companies integrate blockchain to authenticate sourcing and reduce counterfeiting. Smart caps with tamper sensors offer added protection. Packaging evolves into a communication tool, not just a container. These technologies promote informed purchase decisions.

- For instance, Cargill introduced advanced anti-counterfeit technology in its Gemini brand edible oils in India, deploying 3D holograms and app-based batch verification to ensure product authenticity.

Premiumization Trend Driving Aesthetic and Functional Packaging Redesign:

Rising disposable income fuels demand for premium edible oils. The Edible Oil Packaging Market evolves by emphasizing design aesthetics and functional sophistication. Elegant glass bottles, textured finishes, and metallic foils elevate shelf appeal. It combines luxury with utility through easy-pour spouts and anti-drip designs. Brands introduce limited-edition packaging to boost exclusivity. Custom shapes and embossed branding improve differentiation. Consumer experience plays a central role in packaging strategy. Upscale formats support giftability and higher price positioning. Premium packaging becomes a marketing asset for health and wellness-conscious buyers.

- For instance, Filippo Berio introduced a custom-molded glass bottle for its Extra Virgin Olive Oil, winning the Pentawards bronze award and increasing direct sales in the year following launch. Sovena Group in Portugal launched metallic foil-embossed Christmas edition olive oil bottles, which sold out their entire 100,000-unit run within two weeks of release.

Focus on Portion-Controlled and Single-Serve Packaging Formats:

Changing consumption habits influence packaging configuration. The Edible Oil Packaging Market addresses these shifts with portion-controlled sachets and small bottles. It supports on-the-go use, especially in hospitality and foodservice. Single-serve packs reduce waste and improve freshness retention. Brands cater to nuclear families and solo households through compact formats. It enables better inventory control and easier product trials. Travel-friendly sizes meet regulatory limits and convenience expectations. Portion packs also align with health guidelines and dietary restrictions. Manufacturers benefit from lower material usage per unit.

Growth of Refill Models and Bulk Packaging Solutions:

Refill and bulk packaging models emerge in response to sustainability and cost-saving goals. The Edible Oil Packaging Market embraces these solutions in both retail and institutional segments. Bulk packs reduce unit cost and minimize packaging waste. It enables centralized dispensing in hotels, restaurants, and catering services. Refill pouches complement durable primary containers in households. Retailers offer in-store refill stations to reduce single-use plastic consumption. Brands partner with zero-waste stores for direct-to-container filling. Large-format packaging supports supply chain efficiency. Consumers perceive bulk and refill models as both economical and eco-conscious.

Market Challenges Analysis:

Regulatory Pressure and Rising Compliance Costs Constraining Packaging Innovation:

The edible oil sector faces evolving global packaging regulations that require rapid adjustments in design and material use. The Edible Oil Packaging Market must comply with food safety laws, plastic bans, and labeling norms. It faces difficulty in balancing cost, compliance, and innovation simultaneously. Companies investing in sustainable solutions experience higher operational expenses. Certification processes and traceability requirements lengthen development cycles. Material suppliers struggle to meet fluctuating standards across regions. Limited access to approved biodegradable materials further restricts flexibility. Non-compliance risks brand reputation and market entry delays. Packaging producers must constantly adapt to stay ahead of legal mandates.

Material Supply Instability and Price Volatility Impacting Profit Margins:

Raw material availability significantly affects packaging output and profitability. The Edible Oil Packaging Market suffers from fluctuations in PET, HDPE, and multilayer film costs. It struggles to manage pricing amidst global supply chain disruptions and geopolitical tensions. Surging freight rates and resin shortages create delays and cost inflation. Small-scale manufacturers face greater challenges in securing consistent material supply. Sudden input cost spikes limit competitiveness and scalability. Sourcing sustainable materials adds complexity and procurement risk. Volatile raw material markets hinder long-term strategic planning. Cost-sensitive regions feel amplified pressure on packaging affordability.

Market Opportunities:

Expansion into Emerging Economies Creating New Growth Potential:

Emerging markets in Africa, Southeast Asia, and Latin America offer strong growth prospects. The Edible Oil Packaging Market taps into rising demand in these regions driven by urbanization and dietary transitions. It benefits from expanding retail networks and consumer education. Local manufacturing improves supply chain efficiency and affordability. Government nutrition programs boost demand for packaged oil. Rising middle-class income supports premium product penetration. Packaging suppliers scale operations in untapped markets to gain early mover advantage. Economic development directly contributes to packaged food consumption growth.

Innovation in Recyclable and Bio-Based Materials Boosting Differentiation:

Sustainable innovation opens opportunities in material engineering. The Edible Oil Packaging Market leverages advances in compostable films, plant-based polymers, and recycled content. It offers brands a platform for environmental positioning. Packaging differentiation becomes a driver for shelf visibility. Investment in R&D creates proprietary solutions. Strategic collaborations with bio-material startups support innovation pipelines. Certifications and eco-labels influence purchase behavior. Adoption of green packaging earns stakeholder trust and regulatory goodwill.

Market Segmentation Analysis:

By Material Type

Plastic leads the Edible Oil Packaging Market due to its affordability, flexibility, and strength across various formats. Flexible packaging continues to grow, supported by demand for refill packs and sustainable film-based solutions. Glass is preferred for high-end oils and provides shelf appeal and reusability. Paperboard is used in secondary or bulk packaging for branding and stacking efficiency. Metal remains limited to industrial use cases where durability and long shelf life are essential. Other materials, including bio-based options, are emerging as sustainability gains priority.

- For instance, Dow developed technologies that enable difficult-to-recycle PE-EVOH barrier structures to become recyclable through the store drop-off stream. Flexible mono-PE structures using Dow’s polymers have been widely adopted in food packaging for improved recyclability and compliance with North American collection systems.

By Packaging Type

Bottles and jars dominate due to their widespread use in retail and household applications. Pouches are gaining popularity for their portability, ease of storage, and material efficiency. Cans and drums serve the needs of industrial kitchens and food processors requiring larger volumes. Tetra packs are expanding in retail channels offering aseptic packaging for long shelf life. Each format meets different functional, logistical, and branding needs. Others include customized formats for regional preferences and niche retail strategies.

- For instance, Refresco partnered with Tetra Pak to offer edible oils in aseptic cartons for Dutch supermarkets. This move is documented to have reduced spoilage and improved shelf-life in comparison to previous plastic bottle use.

By Capacity

The 1 liter to 5 liters segment holds the largest share due to daily household consumption patterns. The 500ml–1,000ml category supports premium and trial-size offerings. Larger formats like 5,000ml to 10,000ml and above cater to industrial and commercial end users. Small capacities below 500ml meet convenience-driven and travel-size demands. Brands optimize capacity strategies based on pricing tiers, shelf appeal, and end-use environment.

By End Use

The food industry segment drives the Edible Oil Packaging Market due to its widespread requirement in manufacturing, cooking, and food preparation. Household usage follows, sustained by retail shelf expansion and packaged product accessibility. Commercial and food service sectors demand bulk, tamper-resistant, and cost-efficient packaging formats. Retail end use emphasizes brand visibility and consumer convenience. Industrial applications require high-capacity, durable, and compliant packaging for operational continuity.

Segmentation:

By Material Type

- Plastic

- Glass

- Metal

- Flexible Packaging

- Paperboard

- Others

By Packaging Type

- Bottles and Jars

- Cans

- Pouches

- Drums

- Tetra Packs

- Others

By Capacity

- Less than 1 Liter

- 1 Liter to 5 Liters

- More than 5 Liters

- 50ml–500ml

- 500ml–1,000ml

- 1,000ml–5,000ml

- 5,000ml–10,000ml

- Above 10,000ml

By End Use

- Food Industry

- Household

- Commercial

- Retail

- Food Service

- Industrial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Leads with Strong Consumption and Expanding Retail Networks

Asia Pacific dominates the Edible Oil Packaging Market with a market share of 43%, driven by high edible oil consumption in populous countries such as India, China, and Indonesia. It benefits from urbanization, rising disposable incomes, and the expansion of modern retail infrastructure. Governments in the region support packaged food adoption through food safety campaigns and nutritional labeling regulations. Manufacturers invest in localized production facilities to meet volume demand and reduce logistics costs. The growing middle class prefers packaged oils with quality assurance and convenience. The market also sees rising demand for flexible pouches and tamper-evident PET bottles across rural and urban areas.

North America Benefits from Premiumization and Sustainable Packaging Preferences

North America holds a 23% share in the Edible Oil Packaging Market, driven by consumer demand for premium edible oils and sustainable packaging solutions. The region favors high-quality packaging formats such as glass bottles and recyclable PET containers. Health-conscious consumers influence packaging designs that emphasize ingredient transparency and freshness preservation. It experiences steady adoption of smart packaging technologies like QR codes and NFC tags for traceability. Manufacturers collaborate with sustainability-focused material suppliers to align with regulatory and consumer expectations. E-commerce growth also fuels demand for durable, tamper-proof packaging suited for direct-to-consumer delivery models.

Europe Maintains Sustainability Leadership While Latin America and MEA Emerge

Europe accounts for 19% of the Edible Oil Packaging Market, supported by strong regulatory frameworks and widespread adoption of eco-friendly packaging. The region enforces strict recycling mandates and favors glass and biodegradable materials. Brands in Europe use packaging to signal sustainability credentials and differentiate premium products. Latin America and the Middle East & Africa (MEA) collectively represent 15% market share, with 9% from Latin America and 6% from MEA. These regions show high growth potential due to increasing urbanization, changing dietary habits, and expanding organized retail. It gains momentum as local producers upgrade packaging standards to compete with global brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Plc

- Tetra Pak International S.A.

- Cargill

- Crown Holdings, Inc.

- Berry Global Group Inc.

- Mondi Group

- Smurfit Kappa Group

- WestRock Company

- Sealed Air Corporation

- Uflex Ltd

Competitive Analysis:

The Edible Oil Packaging Market features a mix of global packaging giants and regional specialists competing on sustainability, innovation, and customization. Leading players such as Amcor Plc, Tetra Pak International, Mondi Group, and Berry Global invest in recyclable materials, lightweight designs, and automated filling systems to gain competitive edge. It sees active product development in flexible pouches, spouted caps, and high-barrier packaging films. Market participants prioritize brand partnerships with edible oil manufacturers to offer integrated packaging and distribution solutions. Companies focus on regional expansions and smart packaging technologies to strengthen market position. Intense competition drives price sensitivity, especially in emerging economies.

Recent Developments:

- In June 2025, Amcor Plc launched a new Perflex® shrink bag for Butterball’s turkey breast products. This packaging innovation features a built-in handle, reducing packaging material and streamlining production efficiency. The design achieves a 22% reduction in carbon footprint compared to previous packaging solutions and exemplifies Amcor’s commitment to responsible packaging within the food and edible oil segment.

- In May 2025, Cargill was recognized as the top company in the inaugural Edible Oil Supplier Index 2025 by the Access to Nutrition Initiative (ATNi), following its industry-leading removal of industrially produced trans-fatty acids from its edible oils portfolio. This achievement reflects Cargill’s consistent innovation and quality upgrades in edible oil supply, benefiting both consumers and manufacturing partners.

- In April 2025, Amcor completed a high-profile combination with Berry Global, enhancing Amcor’s global capabilities in consumer and food packaging through shared material science and innovation strengths.

Market Concentration & Characteristics:

The Edible Oil Packaging Market is moderately concentrated, with a few global players holding significant share across regions. It includes both integrated packaging companies and niche flexible packaging specialists. The market emphasizes durability, sustainability, cost-efficiency, and regulatory compliance. Companies differentiate through R&D, packaging aesthetics, and material innovation. It reflects strong competition in retail-ready formats, growing demand for eco-friendly alternatives, and rapid adoption of automation in filling and sealing technologies.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Packaging Type, Capacity, End Use, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for flexible packaging formats will rise, driven by convenience and storage efficiency in urban households.

- Manufacturers will invest more in recyclable and bio-based materials to meet sustainability targets.

- Premium edible oils will boost demand for glass and high-end packaging with aesthetic branding.

- Automation in filling and sealing processes will reduce labor costs and increase production efficiency.

- E-commerce growth will drive innovation in tamper-proof and durable shipping-friendly packaging formats.

- Smart packaging technologies like QR codes and sensors will enhance traceability and consumer engagement.

- Regional players will expand in emerging markets through cost-effective and localized packaging solutions.

- Food safety regulations will influence material choices, labeling standards, and traceability integration.

- Partnerships between oil producers and packaging firms will enable customized, brand-aligned solutions.

- Bulk and refillable packaging formats will gain traction in foodservice and commercial sectors.