Market Overview:

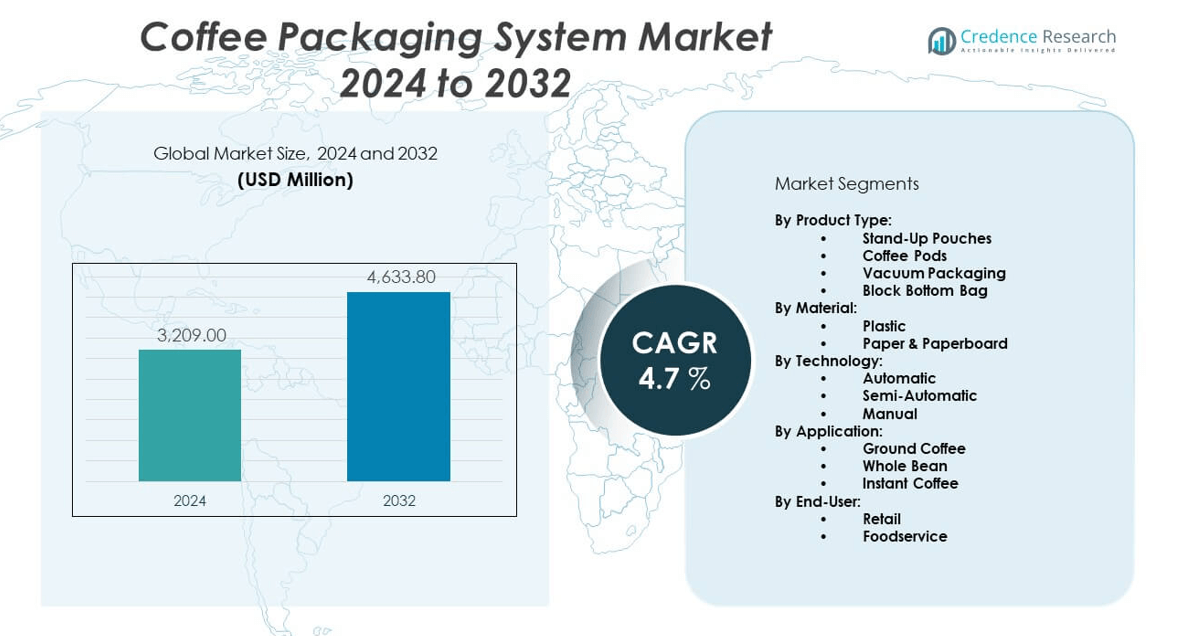

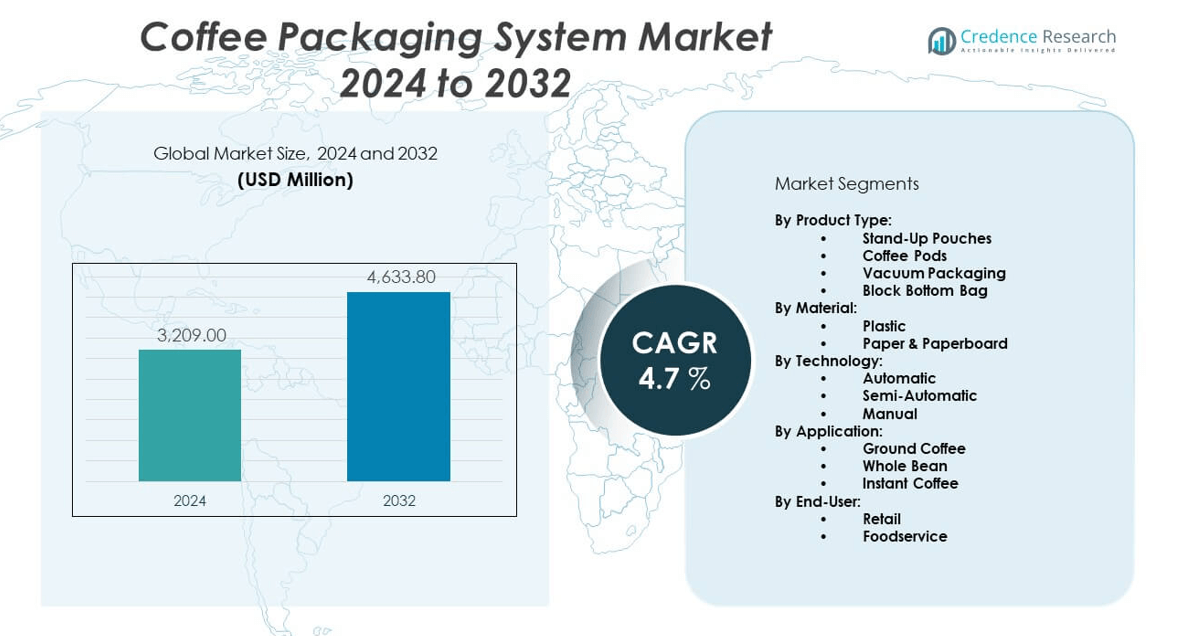

The Coffee Packaging System Market is projected to grow from USD 3,209 million in 2024 to an estimated USD 4,633.8 million by 2032, with a compound annual growth rate (CAGR) of 4.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coffee Packaging System Market Size 2024 |

USD 3,209 million |

| Coffee Packaging System Market, CAGR |

4.7% |

| Coffee Packaging System Market Size 2032 |

USD 4,633.8 million |

The coffee packaging system market experiences steady growth driven by rising global coffee consumption, the premiumization of coffee products, and expanding demand for convenient, shelf-stable, and visually appealing packaging. Manufacturers adopt advanced filling, sealing, and degassing valve technologies to preserve aroma, flavor, and freshness. Innovations in sustainable and recyclable materials further support environmentally conscious branding strategies. Growing urbanization and on-the-go lifestyles prompt demand for single-serve and portion-controlled formats, encouraging investment in automated and flexible packaging lines tailored for small and large-scale coffee producers.

Regionally, North America and Europe lead the coffee packaging system market due to their mature coffee cultures, large consumer base, and strong presence of specialty coffee brands. The Asia Pacific region emerges as a high-growth market, fueled by rapid urbanization, evolving consumer preferences, and increasing café culture in countries like China, India, and South Korea. Latin America, being a major coffee-producing region, also witnesses increased adoption of modern packaging systems to enhance export readiness and meet international quality standards. This global momentum encourages cross-border investments and technology transfer among leading packaging equipment suppliers.

Market Insights:

- The Coffee Packaging System Market is projected to grow from USD 3,209 million in 2024 to USD 4,633.8 million by 2032, registering a CAGR of 4.7% during the forecast period.

- Rising global coffee consumption and premiumization trends fuel demand for advanced packaging systems that ensure freshness and extend shelf life.

- Increasing preference for convenient, single-serve, and portion-controlled formats accelerates adoption of flexible and automated packaging lines.

- High capital investment and complexity in integrating advanced machinery restrain adoption among small and mid-sized coffee producers.

- Technical limitations in handling sustainable and biodegradable materials present challenges in machine compatibility and operational efficiency.

- North America and Europe lead the market due to strong specialty coffee culture and established packaging infrastructure.

- Asia Pacific emerges as a high-growth region driven by evolving consumer preferences, café expansion, and rising disposable incomes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surge in Global Coffee Consumption and Consumer Sophistication Fuels Packaging Demand:

Rising global demand for coffee—both in-home and out-of-home—continues to drive growth in the Coffee Packaging System Market. Consumers increasingly seek fresh, high-quality brews, prompting manufacturers to adopt advanced packaging technologies that preserve aroma, texture, and flavor. Coffee culture is expanding rapidly across emerging markets, particularly in Asia and Latin America, contributing to higher volume production. Premiumization trends in specialty and gourmet coffee intensify the need for premium packaging formats. Packaging now plays a crucial role in conveying brand quality, sustainability, and convenience. Single-serve pods, drip bags, and resealable pouches see strong uptake in both retail and foodservice channels. It becomes essential for packaging systems to align with these evolving demands. Investments in automation and integration of smart technologies further enhance operational efficiency.

- For instance, In March 2025, Amcor launched the AmFiber™ Performance Paper stand-up pouch, a recycle-ready solution specifically engineered for instant coffee and dry beverage refills.

Shift Toward Convenient and Portable Packaging Formats Drives System Upgrades:

Modern consumers favor convenience, which has pushed demand for portable and easy-to-use coffee formats, such as capsules, sticks, and ready-to-drink packs. The Coffee Packaging System Market responds by integrating flexible machinery capable of handling multiple formats with minimal downtime. Increasing urban lifestyles and fast-paced routines fuel the rise of on-the-go coffee consumption. This trend encourages manufacturers to deploy compact and modular packaging systems. Flexible packaging solutions also support portion control and reduce product waste. Coffee producers invest in custom configurations that enable rapid product differentiation across SKUs. Packaging automation minimizes labor dependency while ensuring consistency in product output. This dynamic shift enhances overall packaging throughput and brand agility in response to market shifts.

- For instance, multi-lane stick pack and sachet VFFS (vertical form fill seal) systems offer precise, high-speed dosing—capable of packaging up to 1,000 sticks or sachets per minute depending on configuration. Syntegon’s packaging systems are noted for high accuracy, gentle product handling, and integration with automation, supporting food industry customers worldwide.

Stringent Food Safety Standards and Shelf Life Preservation Accelerate Packaging Innovation:

Regulatory pressure to meet food safety standards and extend product shelf life is a major catalyst in the Coffee Packaging System Market. Packaging systems must ensure contamination-free environments during sealing and filling operations. Manufacturers incorporate hygienic design features and inert gas flushing to safeguard product integrity. Valve-based degassing solutions help release CO₂ from freshly roasted coffee without letting oxygen in, thereby maintaining freshness. Sustainable materials must also comply with regulatory standards while retaining barrier properties. With coffee often transported globally, long shelf life becomes essential. Automated inspection systems embedded in packaging lines improve quality control. It becomes imperative to design systems that align with both regional regulations and global export requirements.

Sustainability Mandates Prompt Rapid Transition to Eco-Friendly Packaging Systems:

The push toward sustainable practices drives significant transformation in the Coffee Packaging System Market. Governments and consumers demand reduction in plastic use and greater adoption of recyclable or compostable materials. This shift compels companies to upgrade or replace legacy systems incompatible with bio-based films or mono-material laminates. It also encourages the use of digital printing for smaller batch production, supporting eco-conscious limited-edition offerings. System manufacturers now incorporate features that minimize energy consumption and reduce material waste. Machine adaptability to thin films, paper-based solutions, and recycled content becomes a competitive differentiator. Brand owners seek full lifecycle packaging solutions, including smart labeling and traceability. These developments reinforce the need for modular, future-ready packaging platforms.

Market Trends:

Integration of Smart Packaging Features Enhances Brand Interaction and Security:

Smart packaging technologies are transforming consumer interaction and supply chain traceability in the Coffee Packaging System Market. Brands incorporate QR codes, NFC tags, and RFID systems directly onto packaging materials. These features allow consumers to verify authenticity, access origin stories, or participate in loyalty programs. System manufacturers develop compatible machines that can print or attach such technologies at high speed. This trend supports brand storytelling and transparency, crucial in the premium and specialty segments. It also helps monitor product movement across geographies and detect tampering. Real-time analytics gathered via smart packaging supports demand planning. It becomes essential for equipment to provide this level of digital integration as brands shift toward omnichannel retail strategies.

- For instance, In May 2025, Constantia Flexibles, in collaboration with Delica AG (Migros Industrie), launched EcoVerHighPlus, a recyclable-ready mono polypropylene (PP) laminate specifically designed for coffee soft bags.

Rise of Customization and Short-Run Production Spurs Demand for Digital Packaging Lines:

Consumer demand for personalized coffee products continues to influence the Coffee Packaging System Market. Brands now run limited-edition blends and custom-labelled variants targeting seasonal or regional preferences. This trend drives the adoption of digital and hybrid printing technologies for fast, cost-effective customization. Packaging systems equipped for short-run flexibility reduce changeover time and increase responsiveness. Small and medium enterprises leverage these capabilities to compete with larger players without high capital outlay. The rise of direct-to-consumer e-commerce supports micro-batch packaging trends. Packaging lines are evolving into multi-format, multi-speed systems with built-in control software. This shift expands the value proposition of packaging systems beyond just speed and volume.

- For instance, HP Indigo’s Pack Ready Lamination technology, designed for use with Indigo 20000, 8000, and WS6800 digital presses, enables immediate, high-strength laminates for digitally printed flexible packaging without adhesives, allowing instant converting of pouches and accelerating short-run, fully customized packaging jobs for emerging and specialty brands.

Adoption of Robotics and AI Drives Process Efficiency and Quality Control:

Automation technologies such as robotics and artificial intelligence play a growing role in the Coffee Packaging System Market. Robotic arms handle tasks including product placement, sorting, and palletizing, reducing human error and improving consistency. AI-driven vision systems inspect seals, fill levels, and material defects in real time. These innovations reduce waste, downtime, and rework costs. Integrated data platforms allow remote monitoring and predictive maintenance, which enhances uptime. Flexible robotics also support high product mix and SKU diversity. Equipment suppliers integrate these features into modular packaging lines. It becomes critical to adopt such technologies to meet throughput requirements while maintaining quality assurance.

E-commerce Growth Fuels Demand for Protective and Compact Packaging Systems:

The expanding e-commerce channel significantly influences packaging requirements in the Coffee Packaging System Market. Products shipped through direct-to-consumer channels require protective packaging that minimizes damage and optimizes logistics costs. Equipment providers develop systems that create compact, tamper-proof, and eco-friendly packaging suited for shipping. Demand for right-sized packaging reduces overuse of materials and enhances consumer satisfaction. Integrated automation enables on-demand packaging, tailored to each order. Packaging systems must also comply with sustainability benchmarks set by e-commerce platforms. It becomes essential to offer solutions that support both retail shelf appeal and transit durability. This dual functionality shapes equipment design and innovation pipelines.

Market Challenges Analysis:

High Capital Investment and Integration Complexity Limit Market Penetration:

The Coffee Packaging System Market faces entry barriers due to high initial capital requirements for advanced machinery. Small and mid-sized enterprises find it challenging to justify the cost of automation amid narrow profit margins. Integration of new systems into existing infrastructure often demands specialized knowledge and technical support. It becomes necessary to align hardware and software across multiple production lines, increasing implementation time and cost. Customization needs across SKUs further complicate system configuration. This challenge restricts broader market adoption among budget-constrained players. Downtime during installation or upgrade phases affects overall throughput. These constraints necessitate modular, scalable systems with user-friendly interfaces to lower the adoption barrier.

Technical Incompatibility with Sustainable Materials Poses Operational Challenges:

Transitioning to sustainable materials introduces friction in the Coffee Packaging System Market. Many conventional machines struggle to process paper-based or bio-film materials due to differences in flexibility, sealing properties, and film thickness. Retrofitting these systems or replacing them entirely requires capital and retraining of staff. Misalignment in machine-material compatibility leads to increased rejection rates and compromised shelf life. It becomes difficult to maintain productivity and quality standards during this shift. Suppliers must redesign components like heat sealers and rollers to handle new substrates. Manufacturers face uncertainty around evolving material standards and recyclability labelling. These technical issues hinder widespread adoption of green packaging practices.

Market Opportunities:

Emerging Markets Offer Untapped Potential for Packaging System Manufacturers:

The Coffee Packaging System Market gains strong momentum in emerging economies where coffee consumption is rising. Rapid urbanization and increasing café culture in regions such as Southeast Asia, Latin America, and the Middle East expand demand for efficient packaging systems. Local producers look to modernize facilities to meet both domestic and export requirements. Equipment suppliers can offer entry-level modular solutions to penetrate these regions. Support for local language interfaces and after-sales services further enhances adoption. These markets provide long-term growth potential and opportunities for localized manufacturing partnerships. It becomes essential to tailor solutions to regional logistics and consumer needs.

Innovation in Compostable and Refillable Packaging Formats Expands Application Scope:

Sustainability-driven innovation opens new pathways for system upgrades in the Coffee Packaging System Market. Brands experiment with compostable films, refill stations, and reusable pouches that require specialized filling and sealing systems. Equipment manufacturers develop adaptable platforms capable of handling next-generation materials. This shift creates demand for R&D collaboration between packaging material developers and machinery suppliers. Companies that deliver compatibility with green substrates gain a competitive edge. It also supports regulatory compliance in eco-conscious regions. These emerging formats extend system applicability across retail, horeca, and refill-on-demand business models.

Market Segmentation Analysis:

By Product Type

The Coffee Packaging System Market is segmented by product type into stand-up pouches, coffee pods, vacuum packaging, block bottom bags, and others. Stand-up pouches lead the segment due to their lightweight, resealable design and high shelf appeal. Coffee pods register strong growth in line with rising single-serve coffee consumption, especially in developed regions. Vacuum packaging remains widely used to preserve aroma and extend shelf life for ground and whole bean coffee. Block bottom bags gain traction among premium and specialty brands for their structural integrity and elegant design. Manufacturers prioritize systems compatible with multiple formats to meet diverse distribution channels, including retail shelves, e-commerce packaging, and foodservice outlets.

- For instance, Viking Masek’s Twin Velocity VFFS continuous-motion bagmaker is capable of speeds up to 540 bags per minute, with a robust construction and quick, no-tool changeovers.

By Material

Material plays a critical role in functionality, sustainability, and regulatory compliance. Plastic dominates the Coffee Packaging System Market due to its barrier properties, affordability, and adaptability across formats. However, paper and paperboard are gaining momentum as eco-conscious consumers and policymakers push for alternatives to single-use plastics. These materials are increasingly used in recyclable and compostable packaging formats. System manufacturers respond by developing machines that can process newer substrates without compromising speed or seal quality. Compatibility with bio-based films and mono-materials becomes a major differentiator. Glass, metal, and other materials retain niche applications, particularly in ready-to-drink (RTD) coffee and premium offerings.

- For instance, ProAmpac’s ProActive Recyclable RP-1000 is a curbside-recyclable, heat-sealable, paper-based packaging solution designed to run on existing filling equipment. It is also designed to be consumer-friendly for recycling at home in curbside bins.

By Technology

Technology segmentation includes automatic, semi-automatic, and manual systems. Automatic systems lead the Coffee Packaging System Market as producers seek speed, efficiency, and consistency in high-volume production. These systems integrate robotics, PLCs, and smart sensors to enable real-time monitoring and reduce human error. Semi-automatic machines remain popular among medium-sized businesses for their balance of cost and performance. Manual systems serve smaller roasters and artisan brands requiring flexibility and low capital investment. Demand for modular, easy-to-clean, and compact equipment grows across all categories. As packaging complexity increases, manufacturers prioritize quick changeovers and reduced downtime across technology platforms.

By Application and End-User

Applications include ground coffee, whole bean, instant coffee, and RTD coffee. Ground coffee holds the largest share due to broad consumer adoption and retail dominance. Whole bean coffee gains traction among coffee enthusiasts seeking fresher brews. Instant coffee maintains a stronghold in emerging markets due to ease of preparation. RTD formats continue to expand, driving demand for rigid and flexible containers. In terms of end-user, retail remains the largest segment, driven by supermarket chains, e-commerce platforms, and private labels. Foodservice applications—such as cafes, hotels, and vending solutions—require durable, bulk-friendly packaging formats. Industrial users focus on high-speed lines and system integration with upstream processing units.

Segmentation:

By Product Type:

- Stand-Up Pouches

- Coffee Pods

- Vacuum Packaging

- Block Bottom Bag

By Material:

- Plastic

- Paper & Paperboard

By Technology:

- Automatic

- Semi-Automatic

- Manual

By Application:

- Ground Coffee

- Whole Bean

- Instant Coffee

By End-User:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Holds Strong Market Leadership with Advanced Infrastructure

North America dominates the Coffee Packaging System Market with a market share of 34.6% in 2024. The region benefits from a deeply rooted coffee culture, widespread consumption of premium and specialty coffee, and strong investments in automated packaging technologies. U.S.-based brands lead innovation in single-serve formats and sustainable packaging designs. The presence of leading packaging system manufacturers and early adoption of smart packaging solutions further strengthens regional performance. Food safety compliance, efficiency in supply chains, and demand for traceable packaging systems drive continued equipment upgrades. The region sets the benchmark for performance, hygiene, and customization in coffee packaging.

Europe Maintains a Competitive Position with Focus on Sustainability

Europe holds 30.7% of the Coffee Packaging System Market in 2024, reflecting strong demand from both large-scale roasters and artisanal producers. The region’s emphasis on circular economy practices fuels the shift toward recyclable and compostable packaging, encouraging system upgrades. Countries such as Germany, Italy, and France lead due to their established coffee industries and high-quality expectations. Automation, product consistency, and flexible format handling remain top priorities for manufacturers. EU regulations push producers to invest in compliant packaging technologies with reduced environmental impact. The market shows strong uptake of machines compatible with mono-materials and digital printing capabilities.

Asia Pacific Emerges as the Fastest Growing Region

Asia Pacific accounts for 23.9% of the Coffee Packaging System Market in 2024 and registers the highest growth rate among all regions. Rising urbanization, growing café culture, and increasing disposable income boost coffee demand in countries such as China, Japan, South Korea, and India. Domestic manufacturers scale operations and upgrade packaging capabilities to meet global quality standards. Multinational coffee brands expand presence in the region, introducing modern packaging systems tailored for regional preferences. E-commerce and on-the-go consumption trends encourage the adoption of compact, protective packaging formats. The market benefits from rising investments in localized manufacturing and smart machinery deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Limited

- Mondi Group

- WestRock Company

- DS Smith Plc

- ProAmpac LLC

- Crown Holdings, Inc.

- Sonoco Products Company

- Smurfit Kappa Group

- Huhtamaki Oyj

- Berry Global Inc.

- International Paper Company

- Syntegon Technology GmbH

Competitive Analysis:

The Coffee Packaging System Market features intense competition among global and regional players focusing on automation, sustainability, and material flexibility. Leading companies such as Amcor, Mondi Group, WestRock, and Syntegon Technology GmbH invest in expanding their packaging portfolios and enhancing machine capabilities. These firms compete on system performance, energy efficiency, and compatibility with sustainable substrates. Companies with modular, high-speed, and digitally integrated packaging solutions gain a competitive edge. It favors suppliers that offer end-to-end technical support, customization, and lifecycle services. Market players also strengthen their presence through joint ventures, capacity expansions, and regional partnerships to access growing coffee markets.

Recent Developments:

- In July 2025, WestRock Company opened a new 525,000-square-foot manufacturing facility in Conway, Arkansas, dedicated to coffee pod production. With 130,000 square feet for manufacturing and the rest for fulfillment, the site is engineered to produce millions of pods daily, substantially expanding WestRock’s capacity to meet growing coffee pod demand for both retail and private-label brands in North America.

- In June 2025, Sonoco Products Company introduced its new Paper Can with a paper bottom in North America. This container is made from 100% recycled fiber, up to 90% from post-consumer sources. Engineered for recyclability and awarded the 2024 PAC Global Best in Class for Sustainable Package Design, it is being adopted by brands seeking easy-to-recycle packaging for coffee and powdered beverages, validated through independent testing.

- In May 2025, ProAmpac LLC showcased its latest fiber-based, sustainable packaging at the IDDBA 2025 Show. Among the innovations spotlighted were premium coffee and food-to-go fiber-based packs aimed at reducing packaging waste and boosting consumer appeal through modern design and automation readiness. ProAmpac’s solutions target both hot and cold applications, offering enhanced barrier properties for shelf-life extension.

- In March 2025, Amcor Limited launched the AmFiber Performance Paper stand-up pouch—a paper-based, recycle-ready refill pack for instant coffee and dry beverage products. The new pouch preserves coffee aroma and taste with excellent seal integrity and is certified recyclable by CEPI and Aticelca. This launch, initially targeting Europe, the Middle East, and Africa, aligns with industry sustainability goals by offering curbside recyclability and reducing packaging’s carbon footprint by up to 73% compared to previous solutions.

Market Concentration & Characteristics:

The Coffee Packaging System Market shows moderate to high concentration, with a few multinational players holding significant market share through diverse product portfolios and strong global distribution. It exhibits characteristics of innovation-driven growth, where automation, digitalization, and sustainability are core competitive levers. The market includes both integrated packaging solution providers and specialized machinery manufacturers. It supports a mix of standardized systems for high-volume production and customizable solutions for niche and specialty coffee producers. Strong after-sales support, compliance with food safety standards, and regional adaptability influence purchasing decisions.

Report Coverage:

The research report offers an in-depth analysis based on product type, material, technology, application, end-user, and geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for single-serve and portion-controlled packaging formats will drive innovations in compact, automated systems.

- The shift toward recyclable and compostable materials will encourage machinery upgrades and new material compatibility.

- Retail brands will prioritize smart packaging features to enhance consumer engagement and improve supply chain transparency.

- Automation and robotics will dominate packaging line investments to improve throughput and reduce labor dependency.

- E-commerce growth will influence the development of tamper-resistant and lightweight shipping-friendly packaging systems.

- Specialty coffee trends will support demand for premium packaging formats with custom branding and improved shelf presence.

- Regional players in Asia Pacific and Latin America will modernize systems to meet export and compliance standards.

- Digital printing and short-run packaging lines will enable rapid customization and faster time-to-market.

- Regulatory mandates on plastic use will reshape material sourcing and system design priorities.

- Global players will form strategic partnerships and expand local footprints to serve emerging markets more effectively.