Market Overview:

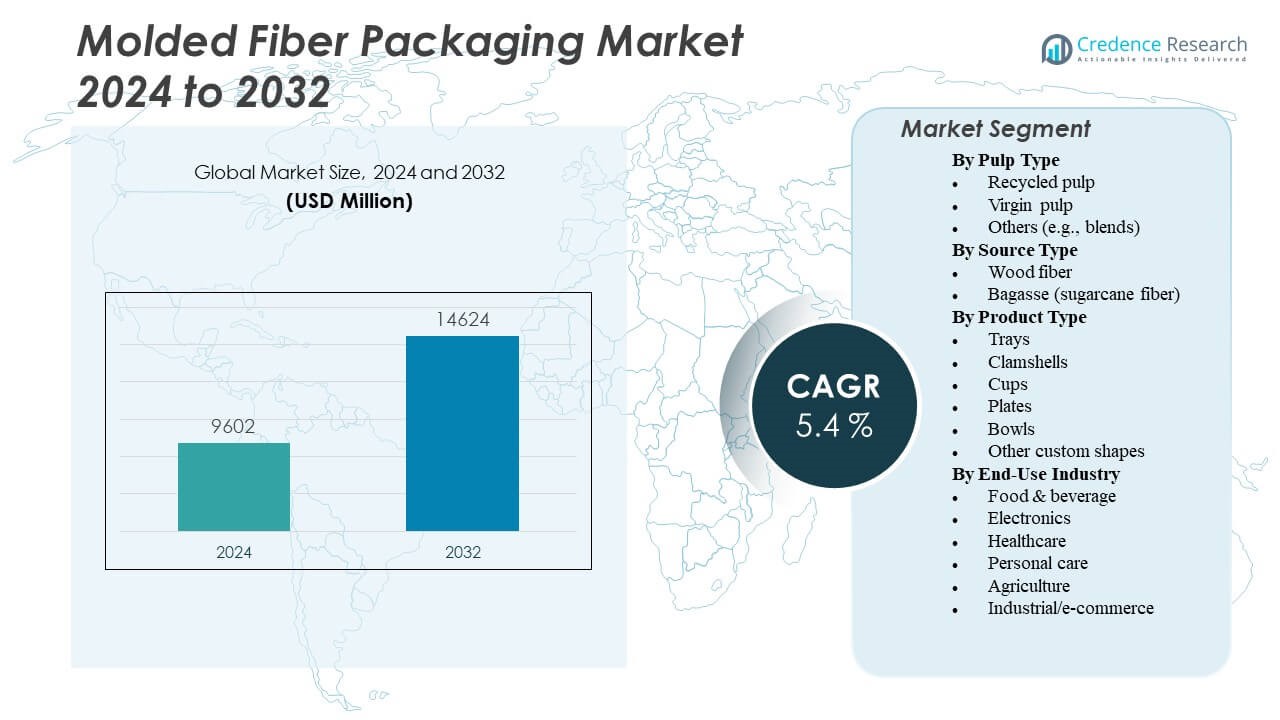

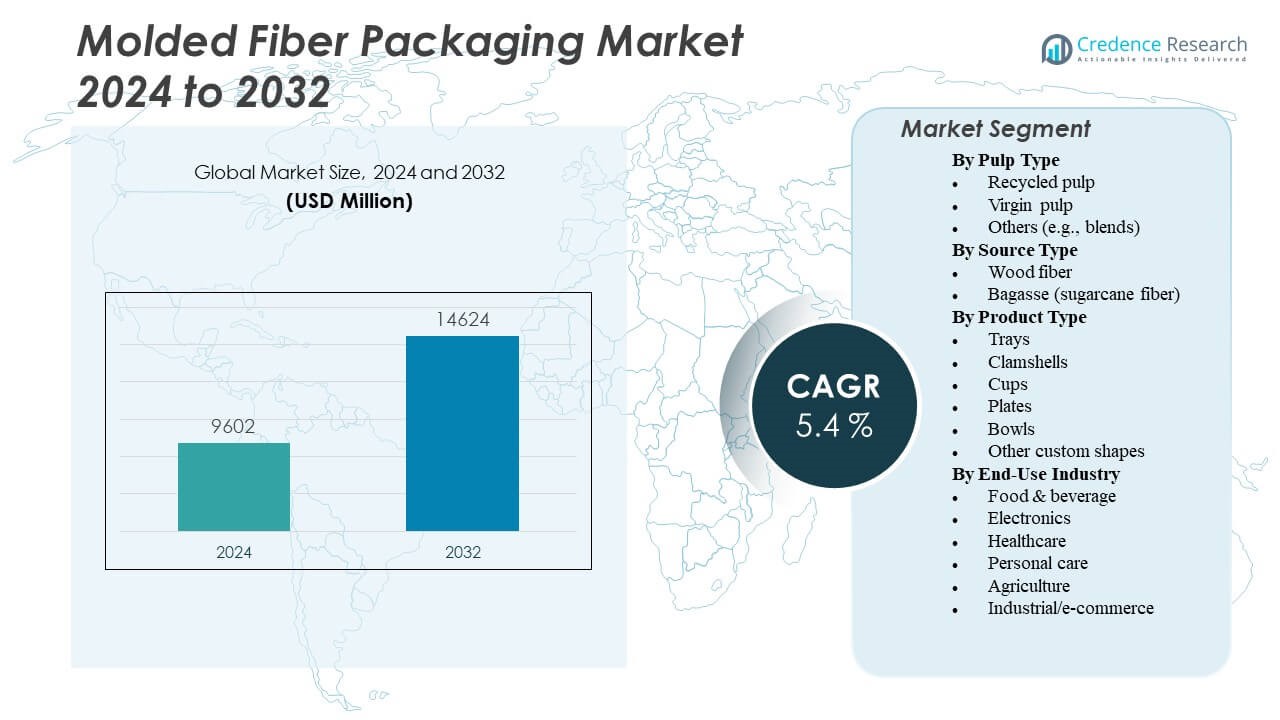

The Molded Fiber Packaging Market is projected to grow from USD 9,602 million in 2024 to an estimated USD 14,624 million by 2032, with a compound annual growth rate (CAGR) of 5.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Molded Fiber Packaging Market Size 2024 |

USD 9,602 Million |

| Molded Fiber Packaging Market, CAGR |

5.4% |

| Molded Fiber Packaging Market Size 2032 |

USD 14,624 Million |

The growth of the molded fiber packaging market is driven by the rising demand for sustainable and eco-friendly packaging alternatives across industries such as food & beverage, electronics, and consumer goods. Increasing regulations against single-use plastics and the shift toward biodegradable packaging are prompting manufacturers to adopt molded fiber solutions. The packaging’s cost-effectiveness, protective cushioning, and recyclability also contribute to its expanding adoption, especially in e-commerce and retail sectors.

Geographically, North America and Europe lead the molded fiber packaging market, supported by strong environmental regulations, advanced recycling infrastructure, and high consumer awareness. The Asia-Pacific region is rapidly emerging due to industrial expansion, urbanization, and rising demand for sustainable packaging in countries like China and India. Latin America and the Middle East & Africa are witnessing gradual market entry, driven by growing export activity and the push for eco-conscious packaging in agricultural and food applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Molded Fiber Packaging Market is projected to grow from USD 9,602 million in 2024 to USD 14,624 million by 2032, registering a CAGR of 5.4%.

- Growing restrictions on single-use plastics and rising demand for biodegradable alternatives are fueling strong market expansion.

- The food and beverage industry remains the dominant end-use sector, accounting for nearly 50% of the market share.

- Inconsistent raw material quality and high production costs are limiting widespread adoption in certain industrial applications.

- Asia Pacific holds the largest regional share at 34%, driven by urbanization, industrial growth, and environmental mandates.

- North America and Europe maintain strong momentum, supported by government policies and well-established recycling infrastructure.

- Advancements in molded fiber technology are expanding applications across electronics, healthcare, and e-commerce sectors.

Market Drivers:

Rising Environmental Concerns and Global Shift Toward Sustainable Packaging Alternatives

Governments and consumers are demanding packaging solutions that minimize environmental impact. Bans on single-use plastics and increasing regulatory pressures are pushing industries to adopt biodegradable alternatives. The Molded Fiber Packaging Market benefits from this shift due to its compostable and recyclable nature. It aligns with circular economy principles, making it an attractive solution for environmentally conscious brands. Companies in the food, beverage, and electronics sectors are adopting molded fiber solutions to meet sustainability targets. Consumer awareness is also encouraging packaging redesign with minimal environmental footprint. Large retailers are emphasizing eco-friendly sourcing from their suppliers. This transformation continues to reinforce the relevance of molded fiber in mainstream packaging portfolios.

- For instance, in 2018, McDonald’s eliminated polystyrene foam packaging from its global supply chain across more than 37,000 restaurants, switching to fiber-based alternatives. This move supported McDonald’s public commitment to ensuring that 100% of its guest packaging will be sourced from renewable, recycled, or certified materials by 2025.

Strong Demand from Foodservice and E-Commerce Sectors Fuels Growth Momentum

The expanding foodservice industry and online delivery platforms are driving consistent demand for sustainable packaging. Molded fiber packaging provides durability, insulation, and product safety for food and beverage applications. Quick-service restaurants and cafes are shifting toward fiber-based trays, plates, and containers to comply with green regulations. The e-commerce sector also plays a crucial role by using molded fiber inserts to ensure product protection during transit. It meets packaging requirements for electronics, cosmetics, and fragile goods. This packaging type minimizes breakage, reduces plastic waste, and enables brand alignment with sustainability goals. Companies are revising their logistics and packaging strategies to include molded fiber components. The Molded Fiber Packaging Market gains steady traction from these trends.

Cost-Effectiveness and Material Versatility Encourage Adoption Across Industries

Molded fiber offers a cost-effective solution for businesses aiming to reduce operational and environmental costs. It uses low-cost raw materials like recycled paper, cardboard, and natural fibers. The technology supports various production methods such as thermoformed, transfer, and processed molded fiber. These enable the design of customizable and robust packaging for a wide array of products. It competes well against plastic and foam in terms of price and performance. Packaging manufacturers are scaling operations to meet rising demand without increasing production expenses. Material innovation continues to enhance strength, moisture resistance, and shelf appeal. The Molded Fiber Packaging Market expands as more industries realize cost and functional advantages.

Supportive Government Policies and Industry Standards Boost Market Confidence

Legislative actions across multiple regions reinforce the adoption of molded fiber packaging. Authorities in North America, Europe, and parts of Asia are offering subsidies, tax breaks, and compliance incentives for sustainable packaging. These policy frameworks accelerate business transitions from plastic to fiber-based solutions. Standards around compostability and recyclability are becoming more defined, guiding procurement choices. The Molded Fiber Packaging Market gains credibility through certification labels that assure compliance and environmental performance. It also supports corporate ESG goals and regulatory alignment. Public-private partnerships promote R&D and pilot projects in biodegradable packaging. This institutional support strengthens long-term market viability.

- For instance, in the United States and Europe, bans on single-use polystyrene packaging (enacted in 12 U.S. states by 2023) have accelerated the adoption of molded fiber solutions in sectors such as foodservice and grocery.

Key Market Trends

Technological Advancements in Manufacturing Processes Improve Efficiency and Customization

Manufacturers are investing in automation and robotics to streamline production and improve consistency. Molded fiber packaging production now involves advanced forming and drying technologies that reduce energy use and cycle time. Computer-aided design (CAD) software enables rapid prototyping of complex structures. Smart sensors monitor quality and minimize material waste during molding. These improvements allow better product customization and dimensional accuracy. It helps manufacturers serve industries requiring exact packaging tolerances. The Molded Fiber Packaging Market is responding to demands for scalable, cost-efficient production that meets high-performance standards. Technology continues to evolve packaging aesthetics and functional properties.

- For example, Zume, a U.S.-based packaging supplier, implemented ABB IRB 6700 robots in its molded‑fiber manufacturing cells. Each cell processes up to two tons of agricultural material daily and produces approximately 80,000 pieces of sustainable packaging. Zume and ABB plan to deploy over 1,000 such manufacturing cells—including up to 2,000 robots—at customer sites worldwide within five years, enabling modular, scalable production of compostable fiber packaging.

Expansion of Premium and Aesthetic Molded Fiber Packaging for Consumer Appeal

Molded fiber packaging is shifting beyond utility to become part of brand identity. Companies are introducing smooth-finish, colored, and embossed fiber packaging to appeal to premium markets. Sectors such as cosmetics, electronics, and luxury goods are using molded fiber for eco-conscious yet visually appealing packaging. Finishing techniques include hot stamping, screen printing, and UV coating for enhanced shelf presence. The Molded Fiber Packaging Market integrates visual branding with functional sustainability. This trend is attracting brand-conscious consumers seeking clean design with environmental responsibility. The packaging now contributes directly to customer experience and brand perception.

- For instance, Huhtamaki invested nearly USD 100 million to expand its Hammond, Indiana facility, which produces molded fiber egg cartons and cup carriers using 100% recycled North American fiber. The site supports growing demand in the U.S., where egg carton usage is expected to reach 4.3 billion packs by 2025 due to the shift away from polystyrene-based packaging.

Integration of Molded Fiber Packaging with Smart and Connected Features

Smart packaging trends are entering the molded fiber segment through QR codes, RFID, and embedded identifiers. These features improve traceability, anti-counterfeiting, and supply chain transparency. It allows retailers and consumers to access information about origin, recyclability, and material composition. Manufacturers are embedding smart tags during the molding process to retain eco-compliance. The Molded Fiber Packaging Market is leveraging this integration to enhance value-added services. Smart features also support inventory control and waste reduction for B2B customers. These innovations align with digital transformation goals across industries.

Expansion into Industrial Applications Beyond Consumer Goods Packaging

While molded fiber packaging is commonly used in retail and food applications, it is entering new industrial segments. It now supports automotive parts, medical devices, and electrical component packaging. These industries value the cushioning, antistatic, and structural protection that molded fiber provides. Custom-molded inserts and trays help reduce damage during storage and transit. It replaces foam and plastic components in environmentally sensitive sectors. The Molded Fiber Packaging Market diversifies into industrial categories where sustainability and performance are both essential. Cross-sector adoption broadens its commercial scope.

Market Challenges

Inconsistent Raw Material Quality and Supply Chain Limitations Affect Production Stability

The Molded Fiber Packaging Market depends heavily on recycled paper and agricultural byproducts. Variability in raw material quality affects product consistency and performance. Supply chains for post-consumer waste remain underdeveloped in many regions. Seasonal changes and contamination risks reduce the reliability of feedstock. It faces procurement challenges, especially during peak demand periods. Fluctuations in global pulp prices also add financial pressure on manufacturers. Standardization across suppliers remains limited, impacting mass production scalability. These constraints make it difficult for companies to maintain competitive margins while meeting quality expectations.

High Capital Investment for Advanced Machinery and Technology Adoption

Transitioning to high-volume molded fiber production requires significant upfront investment. Equipment for thermoforming, drying, and precision cutting comes at a high cost. Small and mid-sized enterprises often lack access to funding for automation and digital upgrades. It creates barriers to entry for new players and restricts innovation among existing firms. Energy-intensive drying processes further increase operational expenses. Companies may hesitate to switch from plastic due to return-on-investment concerns. These financial hurdles slow down market penetration and delay technological transformation in some regions. The Molded Fiber Packaging Market needs more accessible financing and infrastructure support.

Market Opportunities

Emerging Economies Present Growth Avenues through Untapped Industrial Demand

Developing countries in Asia, Latin America, and Africa offer new opportunities for molded fiber packaging. Rising environmental awareness and government mandates are creating early-stage demand. Industries such as agriculture, healthcare, and electronics in these regions seek cost-effective and biodegradable packaging. Local manufacturers are exploring fiber-based alternatives to imported plastic goods. The Molded Fiber Packaging Market can establish regional production hubs to meet domestic needs and export targets. Partnerships with local governments and NGOs can accelerate market entry. Training programs and public awareness campaigns will support long-term demand growth.

Innovation in Biodegradable Additives and Surface Treatments Expands Application Scope

Research into biodegradable coatings and moisture-resistant additives is enhancing the performance of molded fiber packaging. New formulations are extending shelf life and improving resistance to grease and humidity. It allows packaging to meet the functional needs of refrigerated and high-moisture food products. Antimicrobial coatings are also emerging, targeting healthcare and personal care markets. The Molded Fiber Packaging Market is expanding into areas previously dominated by plastic due to these innovations. Companies investing in eco-compatible materials gain first-mover advantage. Product differentiation through functionality and sustainability offers long-term commercial potential.

Market Segmentation Analysis:

The Molded Fiber Packaging Market is segmented by pulp type, source type, product type, and end-use industry.

By pulp type

Recycled pulp leads the market due to its cost-effectiveness and alignment with sustainability goals. Virgin pulp is used where hygiene and material consistency are essential, while blended pulps serve niche and specialized applications.

By source type

Wood fiber remains the primary material due to its widespread availability and recyclability. Bagasse, a sugarcane byproduct, is gaining traction as a renewable and compostable alternative, particularly in food and personal care segments.

- For instance, Eco-Products, Inc., a brand of Novolex, offers molded fiber plates and clamshells made from bagasse certified by the Biodegradable Products Institute (BPI) and meets ASTM D6868 standards for compostability in commercial facilities.

By product type

Trays dominate the product type segment, widely used across foodservice, electronics, and healthcare for their protective and stackable design. Clamshells, cups, plates, and bowls support the growing demand for disposable food containers, while custom shapes cater to branding and unique packaging needs.

- For instance, Genpak, LLC launched its ProView™ molded fiber product line offering durable trays and clamshells with clear lid compatibility, enhancing product visibility and operational efficiency in foodservice packaging.

By end-use industry

the Molded Fiber Packaging Market benefits from strong adoption in the food and beverage industry, which holds the largest end-use share. Electronics, healthcare, and personal care industries utilize molded fiber for protective and sustainable packaging. Agriculture and industrial/e-commerce segments are expanding steadily with the need for biodegradable and durable packaging formats.

Segmentation:

By Pulp Type

- Recycled pulp

- Virgin pulp

- Others (e.g., blends)

By Source Type

- Wood fiber

- Bagasse (sugarcane fiber)

By Product Type

- Trays

- Clamshells

- Cups

- Plates

- Bowls

- Other custom shapes

By End-Use Industry

- Food & beverage

- Electronics

- Healthcare

- Personal care

- Agriculture

- Industrial/e-commerce

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds a significant share of the Molded Fiber Packaging Market, accounting for 29% of the global revenue. The region’s strong environmental policies and rising demand for sustainable packaging across foodservice, electronics, and consumer goods industries drive growth. Major packaging manufacturers in the U.S. and Canada have adopted molded fiber solutions to comply with plastic reduction mandates. The presence of advanced recycling infrastructure and government-backed initiatives supports widespread adoption. E-commerce expansion further increases demand for protective molded fiber inserts. Leading brands continue to innovate to align with sustainability goals, reinforcing regional market strength.

Europe captures 26% of the global Molded Fiber Packaging Market, driven by stringent regulations on plastic usage and strong public awareness about environmental protection. Countries like Germany, France, and the Netherlands have pushed for aggressive targets to reduce single-use plastics, accelerating demand for biodegradable alternatives. The region’s robust waste management systems facilitate the collection and processing of recycled paper, supporting a stable supply chain for molded fiber production. Food and beverage sectors lead application growth, with regulatory mandates requiring compostable packaging in several member states. It continues to benefit from strong R&D capabilities and sustainable packaging innovation.

Asia Pacific leads the market with a 34% share, supported by rapid industrialization, urban population growth, and rising environmental regulations in countries like China, India, and Japan. Government policies to reduce plastic pollution are promoting fiber-based alternatives across food delivery, electronics, and agricultural sectors. The expanding middle-class population increases consumption of packaged goods, fueling demand for eco-friendly solutions. Local manufacturers are scaling up production capacities to meet domestic and export demand. It remains a high-growth region, offering cost advantages in manufacturing and raw material availability. Latin America and the Middle East & Africa collectively account for the remaining 11%, with growing adoption in retail and agriculture segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Huhtamaki Oyj

- UFP Technologies, Inc.

- Brødrene Hartmann A/S

- Sonoco Products Company

- Eco-Products, Inc.

- Henry Molded Products, Inc.

- Cullen Packaging

- Genpak, LLC

- CKF Inc.

- FiberCel Packaging LLC

- Sabert Corporation

- Green Packing Environmental Protection Technology Co., Ltd.

- Pactiv LLC

- EnviroPAK Corporation

- Thermoform Engineered Quality LLC

- Pro-Pac Packaging Limited

- PulPac AB

- Robert Cullen Ltd

Competitive Analysis:

The Molded Fiber Packaging Market features a competitive landscape with the presence of both global and regional players. Key companies include Huhtamaki Oyj, Brødrene Hartmann A/S, UFP Technologies, Inc., Genpak LLC, and Thermoform Engineered Quality LLC. These companies focus on product innovation, capacity expansion, and sustainable packaging solutions to strengthen their market position. Strategic partnerships and acquisitions support geographic expansion and portfolio diversification. It remains highly dynamic, with new entrants exploring niche applications and eco-friendly formulations. Competitive pricing, proprietary molding technologies, and custom design capabilities influence market share. Companies aim to align with environmental regulations and customer sustainability goals.

Recent Developments:

- In July 2025, Huhtamaki Oyj announced the launch of their new compostable ice cream cups, which offer both home and industrial compostability alongside recyclability. This innovation marks a significant stride in the company’s sustainable packaging efforts, as the cups are made from responsibly sourced paperboard with a bio-based coating and contain less than 10% plastic.

- In July 2025, UFP Technologies, Inc. completed the acquisitions of Universal Plastics & Engineering Company, Inc. (UNIPEC) and Techno Plastics Industries, Inc. (TPI). These acquisitions are intended to expand UFP Technologies’ capabilities in medical device manufacturing and thermoplastic molding, strengthening their partnerships with leading medical device OEMs and broadening their engineered packaging solutions offerings.

Market Concentration & Characteristics:

The Molded Fiber Packaging Market demonstrates moderate to high concentration, with leading firms occupying a significant portion of global revenue. It is characterized by growing investment in automation, sustainability-driven innovation, and expanding application across industries. The market favors companies with integrated operations and access to cost-efficient raw materials. Entry barriers include high capital investment and technical expertise in precision molding. Regional players compete by offering customized, low-cost solutions to local industries. Product standardization remains limited due to varying end-use requirements. Competitive advantage depends on design flexibility and scalability of production processes.

Report Coverage:

The research report offers an in-depth analysis based on pulp type, source type, product type, and end-use industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable and biodegradable packaging solutions will continue to drive strong growth, supported by rising consumer awareness and corporate sustainability goals.

- Adoption of molded fiber in premium and luxury packaging is projected to grow, driven by its visual appeal, customizability, and alignment with eco-conscious branding.

- Government regulations targeting plastic waste will further reinforce the shift toward fiber-based alternatives across foodservice, electronics, and consumer goods sectors.

- Advancements in molded fiber technology will enhance structural integrity, water resistance, and thermal insulation, expanding its applicability across high-performance packaging needs.

- Rapid industrialization and urbanization in emerging economies will create new market opportunities, particularly in Asia Pacific, Latin America, and Africa.

- The e-commerce and logistics industries will increase use of molded fiber inserts for sustainable product protection during transit and delivery.

- Global manufacturers will pursue mergers, acquisitions, and strategic alliances to expand production capacity, geographic presence, and product portfolios.

- Investment in dry-molding and energy-efficient production technologies will improve cost competitiveness and operational scalability for high-volume packaging.

- Foodservice and convenience food brands will accelerate adoption of molded fiber trays, lids, and containers to comply with environmental mandates and reduce plastic use.

- Growth in industrial, healthcare, and electronics applications will diversify end-user demand and reinforce the Molded Fiber Packaging Market’s long-term relevance.