Market Overview:

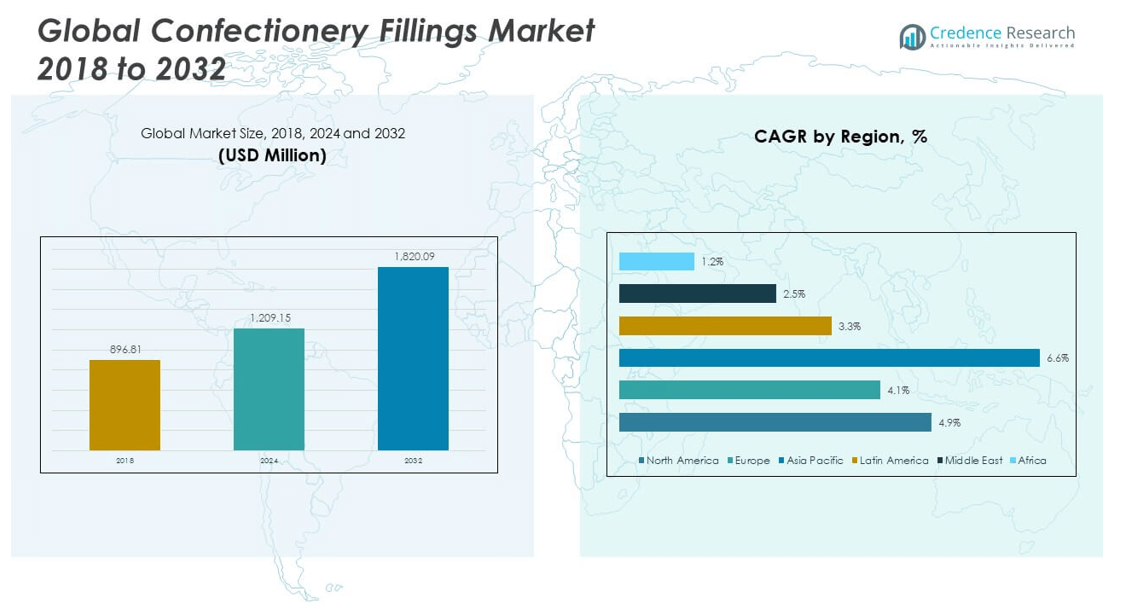

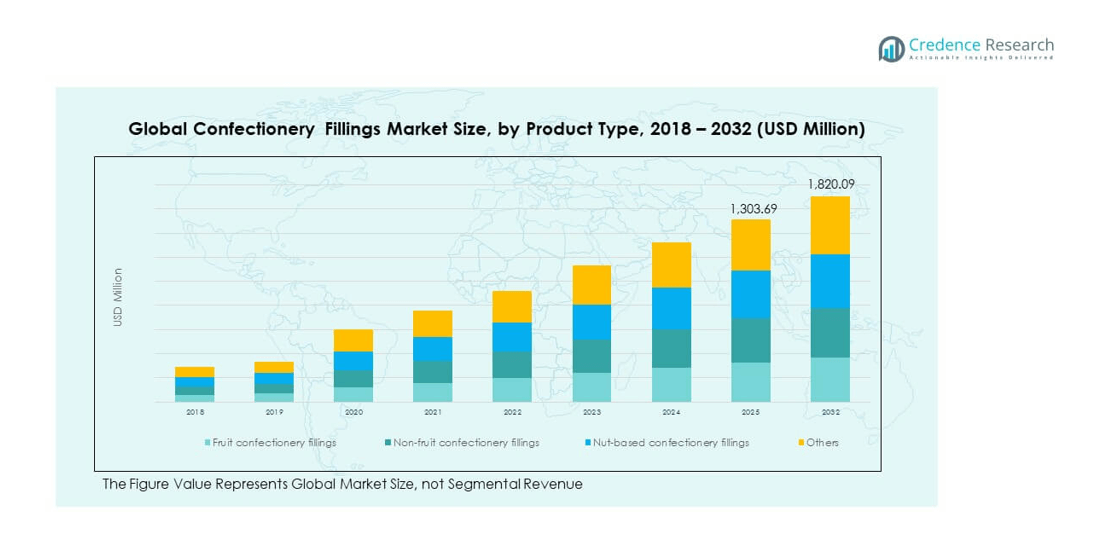

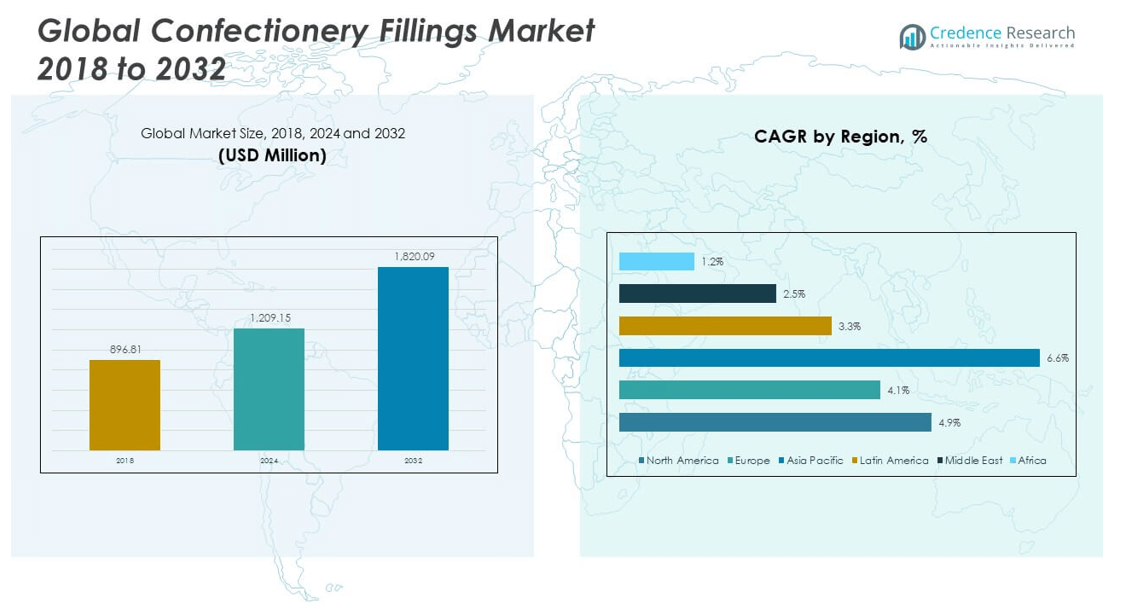

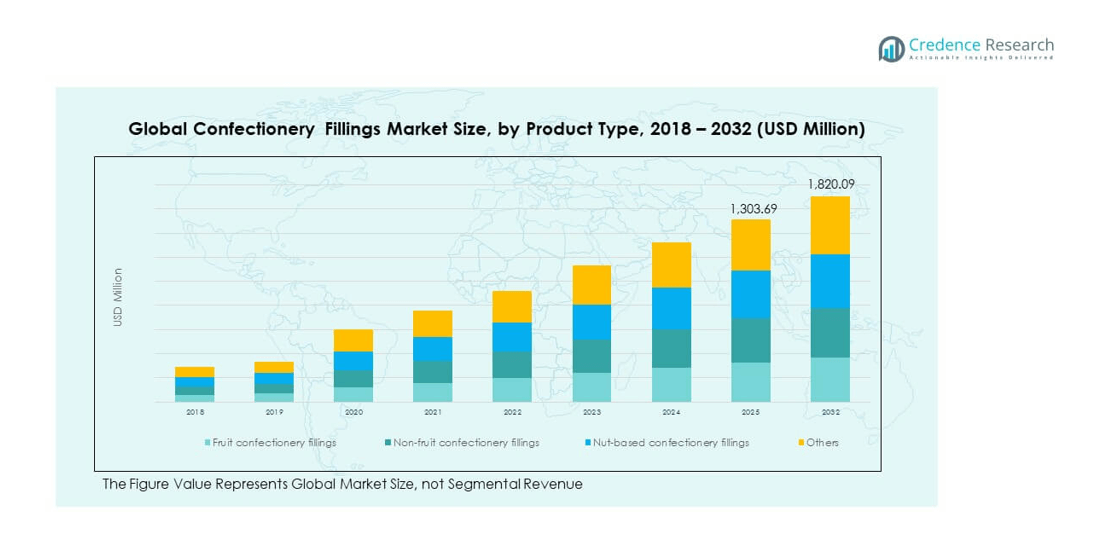

The Global Confectionery Fillings Market size was valued at USD 896.81 million in 2018 to USD 1,209.15 million in 2024 and is anticipated to reach USD 1,820.09 million by 2032, at a CAGR of 4.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Confectionery Fillings Market Size 2024 |

USD 1,209.15 million |

| Confectionery Fillings Market, CAGR |

4.88% |

| Confectionery Fillings Market Size 2032 |

USD 1,820.09 million |

The market growth is driven by rising consumer demand for innovative and premium confectionery products, supported by advancements in flavor, texture, and nutritional enhancements in fillings. Manufacturers are focusing on clean-label, natural, and functional ingredients to align with health-conscious trends while catering to indulgence preferences. Increasing applications of confectionery fillings in bakery, dairy, and snack products are expanding the market scope, while product diversification and seasonal launches help brands capture niche segments and enhance consumer engagement.

Regionally, Europe leads the market due to its strong confectionery tradition, established brands, and innovation in artisanal and premium segments. North America follows with steady demand, driven by a preference for indulgent and convenient products. The Asia-Pacific region is emerging rapidly, fueled by rising disposable incomes, Westernization of diets, and growing interest in premium sweets. Latin America and the Middle East & Africa are witnessing gradual growth supported by expanding retail networks and increasing exposure to global confectionery trends.

Market Insights:

- The Global Confectionery Fillings Market was valued at USD 896.81 million in 2018, reached USD 1,209.15 million in 2024, and is projected to attain USD 1,820.09 million by 2032, registering a CAGR of 4.88% during the forecast period.

- Rising demand for premium and indulgent confectionery products, coupled with innovation in flavors, textures, and functional ingredients, is driving market growth.

- Increasing consumer preference for clean-label, natural, and health-oriented fillings is influencing product development and marketing strategies.

- Technological advancements in processing and packaging are improving shelf life, product stability, and application versatility across categories.

- High raw material costs, supply chain disruptions, and stringent food safety regulations pose significant challenges for manufacturers.

- Europe leads the market due to its strong confectionery heritage and established brands, while North America maintains steady demand through premium and convenience products.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising disposable incomes, urbanization, and increasing adoption of Western-style desserts and snacks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Premium and Indulgent Confectionery Products Across Multiple Consumer Segments:

The Global Confectionery Fillings Market is witnessing strong growth due to heightened consumer interest in premium, artisanal, and indulgent treats. Increasing disposable incomes and evolving lifestyles are influencing purchasing patterns, leading consumers to seek rich flavors, unique textures, and high-quality ingredients. Manufacturers are investing in innovative formulations that balance indulgence with health-conscious features, catering to both traditional and modern tastes. Seasonal and limited-edition offerings are boosting brand visibility and encouraging repeat purchases. The market benefits from cross-category usage, where fillings are used in bakery, snacks, and dairy products. Premiumization strategies are enabling brands to charge higher margins while differentiating their offerings. Consumers are increasingly associating fillings with enhanced product experience, creating opportunities for value-added solutions. The premium segment is projected to maintain momentum with continued investments in innovation and branding.

- For instance, Barry Callebaut has accelerated its innovation pipeline by advancing fermentation and fat technologies, enabling the production of chocolate with customized flavor profiles and enhanced creaminess, and partnering with the Zurich University of Applied Sciences on scalable cocoa cell culture technology for supply chain resilience.

Growing Consumer Shift Toward Natural, Clean-Label, and Health-Focused Ingredients:

Rising awareness about health and wellness is influencing purchasing decisions, with consumers preferring fillings made from natural, non-GMO, and minimally processed ingredients. The market is responding with products free from artificial additives, colors, and preservatives, meeting clean-label requirements. Plant-based and allergen-free variants are gaining traction, especially among vegan and lactose-intolerant consumers. The demand for reduced-sugar and high-protein fillings is expanding, supported by advancements in formulation technology. The Global Confectionery Fillings Market is capitalizing on this trend by aligning with transparent sourcing and ethical production practices. Brands are leveraging packaging to highlight ingredient integrity and sustainability credentials. Partnerships with local farmers and certified suppliers are enhancing authenticity and consumer trust. The clean-label movement is reshaping competitive strategies across multiple market segments.

- For instance, AAK has invested SEK 400million (approx. $37.6million) in its European facilities through 2025–2026 to support advanced manufacturing of clean-label and specialty fat solutions, enabling improved operational efficiency and the rollout of healthier product lines. This strategic investment impacts over 300 specialty products manufactured across the UK and Sweden, including oils and fillings for the confectionery sector.

Product Innovation Through Diverse Flavor Profiles and Functional Enhancements:

Continuous product innovation is a critical driver, with manufacturers introducing a wider range of flavors, from classic chocolate and fruit to exotic and fusion blends. The incorporation of functional ingredients such as probiotics, vitamins, and antioxidants is adding a health dimension to indulgence. The Global Confectionery Fillings Market is experiencing an influx of region-specific flavors catering to local palates, improving relevance in diverse geographies. Texture innovation, including crunchy inclusions and layered combinations, is enhancing sensory appeal. Collaboration with flavor houses and ingredient suppliers is accelerating development timelines. Product lines tailored for both retail and foodservice are broadening market reach. Innovative packaging formats that extend shelf life and improve convenience are supporting adoption. The integration of premium and functional attributes is enabling brands to target multiple consumer needs simultaneously.

Expansion of Foodservice and Industrial Applications Driving Volume Growth:

The expansion of the foodservice industry is significantly contributing to the increased demand for confectionery fillings. Bakeries, cafés, restaurants, and dessert chains are incorporating premium fillings into their offerings to enhance taste and presentation. The Global Confectionery Fillings Market benefits from strong demand in the industrial segment, where manufacturers use fillings for large-scale production of biscuits, pastries, and frozen desserts. Rising popularity of ready-to-eat and frozen confectionery products is creating consistent demand for stable, long-lasting fillings. Collaborations between filling suppliers and foodservice operators are leading to custom solutions tailored for specific applications. Growth in e-commerce platforms is enabling wider product availability for small-scale and artisanal producers. Technological advancements in filling production are improving cost efficiency and consistency. The synergy between retail, foodservice, and industrial demand is expected to sustain market expansion.

Market Trends:

Adoption of Plant-Based and Dairy-Free Confectionery Fillings for Expanding Consumer Base:

The Global Confectionery Fillings Market is seeing a notable trend toward plant-based and dairy-free alternatives, driven by veganism, lactose intolerance, and sustainability awareness. Manufacturers are replacing traditional dairy with oat, almond, coconut, and soy-based ingredients to capture emerging consumer segments. This shift is broadening product accessibility and supporting ethical positioning. Plant-based fillings are gaining presence in both premium and mass-market offerings. The trend aligns with environmental concerns, as plant-based production typically has a lower carbon footprint. Flavor and texture innovations are ensuring parity with dairy-based counterparts. Major brands are rebranding existing lines or launching dedicated plant-based ranges to strengthen market positioning. The trend is likely to deepen as regulatory and consumer pressure for sustainable products intensifies.

- For instance, Barry Callebaut’s research partnership with Zurich University of Applied Sciences is exploring cocoa cell culture technology, which supports the development of vegan-friendly chocolate fillings with potential for tailored nutritional profiles and a significantly reduced environmental footprint—enhancing product accessibility for the vegan and lactose-intolerant consumer segments.

Integration of Advanced Processing Technologies for Enhanced Product Quality and Shelf Life:

Advancements in processing technology are reshaping the competitive landscape by enabling longer shelf life, improved texture stability, and better flavor retention. The Global Confectionery Fillings Market is adopting vacuum processing, aseptic packaging, and controlled crystallization methods to enhance product consistency. These innovations allow fillings to perform well in frozen and high-temperature applications, expanding their usability across food categories. Automation and precision mixing are reducing batch variability, improving efficiency in large-scale production. Enhanced processing capabilities are also enabling the inclusion of delicate ingredients like fresh fruit pieces without compromising safety or texture. Brands are using these technological advantages to market premium-quality products with reduced wastage. Technology-driven differentiation is becoming a strategic focus for forward-looking manufacturers.

- For instance, Zentis North America established the largest fully automated popping boba production line in the US in March 2025, at its Plymouth, Indiana facility. The investment created over 110 new jobs and enabled a production output increase sufficient to meet surging domestic demand for boba and fruit fillings, with the facility capable of manufacturing flavored boba pearls in customizable sizes (6–9mm) using state-of-the-art automation that ensures batch uniformity and superior texture stability.

Customization and Co-Creation with Foodservice Operators and Artisanal Producers:

Customization is emerging as a major trend, with suppliers offering fillings tailored to specific customer needs in terms of flavor, viscosity, and application. The Global Confectionery Fillings Market is witnessing partnerships with bakeries, chocolatiers, and dessert brands for exclusive, co-created products. This collaborative approach allows for innovation aligned with brand identity and target audience preferences. Small-batch production for limited-edition flavors is gaining traction, particularly in premium and seasonal offerings. Co-branding initiatives are enhancing market reach and consumer engagement. Customization also extends to packaging, where portion sizes and dispensing methods are optimized for end-user convenience. The flexibility to adapt formulations for different climatic and storage conditions is a competitive advantage in global markets. This trend fosters loyalty and repeat business in B2B relationships.

Expansion of E-Commerce and Direct-to-Consumer Channels for Wider Market Access:

E-commerce is transforming how confectionery fillings reach both consumers and businesses. The Global Confectionery Fillings Market is leveraging online platforms to offer a wider variety of SKUs and packaging sizes, catering to home bakers, small businesses, and industrial buyers. Direct-to-consumer models allow brands to showcase their full portfolio without retail space limitations. Online sales are facilitating market entry in regions with limited physical distribution. Digital marketing campaigns, social media promotions, and influencer collaborations are driving product discovery. Subscription-based models and bundle offerings are encouraging repeat purchases. Data analytics from online sales are informing targeted product development and promotional strategies. The integration of e-commerce is enabling faster adaptation to changing market demand patterns.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Disruptions Affecting Profit Margins:

The Global Confectionery Fillings Market faces significant challenges from fluctuating raw material prices, particularly cocoa, dairy, and specialty fruit ingredients. Weather-related disruptions, geopolitical tensions, and global demand shifts contribute to cost volatility. Supply chain constraints, including freight delays and rising transportation costs, are adding pressure to manufacturers. Smaller producers face higher vulnerability due to limited purchasing power and storage capacity. Currency fluctuations impact import and export pricing, affecting competitiveness in certain regions. Maintaining product affordability without compromising quality is becoming more complex. Manufacturers are exploring alternative ingredients and local sourcing to mitigate risks. Strategic inventory management is emerging as a key operational necessity.

Stringent Food Safety Regulations and Compliance Requirements Across Markets:

Compliance with diverse food safety and labeling regulations across different countries presents operational challenges. The Global Confectionery Fillings Market must meet varying standards for additives, allergens, and nutritional disclosures. Adhering to these regulations requires significant investment in quality control systems and documentation. Frequent updates to food safety legislation necessitate ongoing monitoring and adaptation. Non-compliance risks include financial penalties, product recalls, and reputational damage. Manufacturers operating across multiple geographies face the added burden of customizing formulations and packaging to meet local legal requirements. The need for traceability and transparency is increasing, requiring robust supply chain visibility. This regulatory complexity can slow market entry and product launches.

Market Opportunities:

Expansion into Emerging Markets with Rising Disposable Incomes and Changing Lifestyles:

The Global Confectionery Fillings Market holds strong potential in emerging economies where urbanization, rising incomes, and Westernized dietary habits are creating demand for premium and diverse confectionery products. Increasing exposure to global food trends through media and travel is influencing consumer preferences. Local manufacturers and international brands can collaborate to tailor products to regional tastes while maintaining global quality standards. The expansion of modern retail and e-commerce platforms is improving accessibility. Flexible pricing and portioning strategies can help tap into varied consumer segments. Targeted marketing campaigns highlighting innovation and indulgence can drive market penetration. The demand for convenience-oriented products in urban centers supports sustained growth prospects.

Leveraging Sustainability and Ethical Sourcing for Brand Differentiation:

Growing consumer awareness about environmental and ethical issues presents an opportunity for brands to position themselves as responsible and transparent. The Global Confectionery Fillings Market can gain competitive advantage by sourcing certified sustainable cocoa, palm oil alternatives, and fair-trade ingredients. Eco-friendly packaging innovations can enhance appeal among environmentally conscious consumers. Partnerships with ethical suppliers reinforce brand credibility. Storytelling around sourcing practices can create emotional connections with consumers. Investments in waste reduction and energy-efficient production can align with corporate sustainability goals. Brands demonstrating measurable environmental impact are likely to attract both consumers and retail partners. This alignment with sustainability trends can foster long-term brand loyalty.

Market Segmentation Analysis:

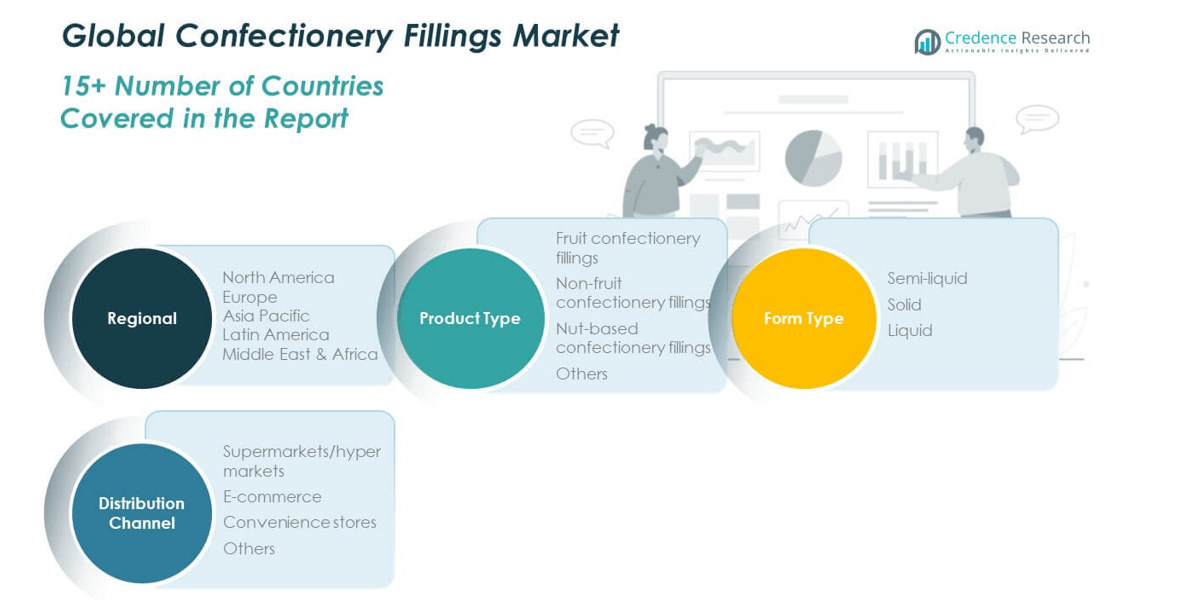

By Product Type

The Global Confectionery Fillings Market is segmented into fruit, non-fruit, nut-based, and other fillings. Fruit confectionery fillings hold a substantial share due to their versatility in bakery, pastry, and dairy applications, supported by demand for natural and refreshing flavors. Non-fruit fillings, including chocolate, caramel, and cream varieties, maintain strong appeal in indulgence-driven segments. Nut-based fillings are gaining traction for their premium positioning and nutritional value, appealing to health-conscious and gourmet consumers. The others category, comprising specialty and hybrid flavors, addresses niche preferences and seasonal demand.

- For instance, Zentis leverages advanced fruit processing to create tailored fillings with stable flavor retention that are widely adopted in bakery and dairy, supporting increased demand for fruit-based, clean-label pastries and snacks in both retail and foodservice channels.

By Form Type

The market is divided into semi-liquid, solid, and liquid fillings. Semi-liquid fillings dominate due to their adaptability in industrial and artisanal production, offering balance between ease of application and texture stability. Solid fillings cater to confectionery products requiring defined shapes and inclusions, while liquid fillings serve high-moisture desserts, frozen treats, and specialty chocolates. Each form type targets distinct manufacturing needs, enhancing product diversity and functionality.

- For instance, the Zentis automated production facility delivers high-throughput manufacturing of semi-liquid and liquid fillings, supporting innovation in dessert and beverage categories. Their ability to continuously produce customized fillings ensures consistent quality and expands product functionality to meet the needs of industrial and artisanal manufacturers.

By Distribution Channel

The market includes supermarkets/hypermarkets, e-commerce, convenience stores, and others. Supermarkets/hypermarkets lead with wide assortments and strong brand visibility, driving bulk and impulse purchases. E-commerce is expanding rapidly, offering direct access to diverse product ranges and enabling small-scale buyers to source specialized fillings. Convenience stores sustain steady demand through ready-to-consume confectionery products, while the others category includes specialty stores and B2B distribution for foodservice and manufacturing. This segmentation enables manufacturers to tailor strategies across consumer and industrial markets, ensuring competitive presence in both established and emerging channels.

Segmentation:

By Product Type

- Fruit confectionery fillings

- Non-fruit confectionery fillings

- Nut-based confectionery fillings

- Others

By Form Type

By Distribution Channel

- Supermarkets/Hypermarkets

- E-commerce

- Convenience stores

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Confectionery Fillings Market size was valued at USD 395.80 million in 2018 to USD 528.16 million in 2024 and is anticipated to reach USD 797.21 million by 2032, at a CAGR of 4.9% during the forecast period. North America accounts for approximately 43.7% of the global market share, driven by strong consumer demand for premium, innovative, and indulgent confectionery products. The region benefits from advanced manufacturing capabilities, a mature retail infrastructure, and a well-established network of leading brands. Product innovation focuses on clean-label ingredients, reduced sugar, and functional benefits to align with evolving health trends. Seasonal and limited-edition launches stimulate consumer interest and encourage repeat purchases. The foodservice sector, particularly bakeries, cafés, and dessert chains, contributes significantly to product uptake. E-commerce is expanding, enabling direct-to-consumer sales and broader product accessibility. Strategic partnerships between suppliers and retail chains strengthen market penetration and brand visibility.

Europe

The Europe Global Confectionery Fillings Market size was valued at USD 263.17 million in 2018 to USD 342.47 million in 2024 and is anticipated to reach USD 486.38 million by 2032, at a CAGR of 4.1% during the forecast period. Europe represents around 28.3% of the global market share, supported by a strong confectionery heritage and consumer preference for artisanal, high-quality products. The region leads in flavor innovation, premium positioning, and adoption of sustainable sourcing practices. Consumers exhibit strong loyalty to traditional flavors while showing interest in contemporary variations and limited editions. Regulations encouraging clean-label and allergen-free formulations influence product development. Premium chocolate-based and fruit fillings dominate demand, with bakery and patisserie segments being major end-users. The growth of private label offerings in retail supports competitive pricing strategies. Sustainability in packaging and ethical ingredient sourcing is a key competitive factor. Export-oriented production further strengthens Europe’s role in the global supply chain.

Asia Pacific

The Asia Pacific Global Confectionery Fillings Market size was valued at USD 159.04 million in 2018 to USD 233.95 million in 2024 and is anticipated to reach USD 402.46 million by 2032, at a CAGR of 6.6% during the forecast period. Asia Pacific holds about 19.4% of the global market share, with growth driven by rising disposable incomes, urbanization, and the adoption of Western-style confectionery. The region shows increasing demand for innovative flavors blending local and global tastes. E-commerce platforms are a critical growth channel, especially in emerging economies. Premiumization is gaining momentum, with consumers seeking indulgent and aesthetically appealing products. Foodservice expansion, particularly in urban centers, fuels demand for high-quality fillings. Local manufacturers are investing in capacity expansion and partnering with global brands to enhance market presence. Convenience and on-the-go products are gaining popularity, especially among younger demographics. Seasonal festivals and cultural events create opportunities for themed product launches.

Latin America

The Latin America Global Confectionery Fillings Market size was valued at USD 44.05 million in 2018 to USD 58.69 million in 2024 and is anticipated to reach USD 78.58 million by 2032, at a CAGR of 3.3% during the forecast period. Latin America accounts for about 4.9% of the global market share, supported by growing middle-class populations and expanding retail access. Chocolate-based and fruit fillings dominate due to their versatility in bakery and confectionery products. Regional flavor preferences influence product development, with tropical fruits and caramel variants showing strong demand. The rise of artisanal bakeries and specialty cafés contributes to niche market growth. E-commerce is emerging but remains secondary to physical retail formats. Economic fluctuations and currency volatility present challenges to stable growth. Manufacturers are adopting localized sourcing strategies to reduce costs and maintain quality. Seasonal and holiday-themed products gain traction during festive periods, enhancing brand recognition.

Middle East

The Middle East Global Confectionery Fillings Market size was valued at USD 23.53 million in 2018 to USD 28.81 million in 2024 and is anticipated to reach USD 36.09 million by 2032, at a CAGR of 2.5% during the forecast period. The Middle East represents approximately 2.4% of the global market share, driven by demand for premium confectionery in urban centers. Consumers in the region favor rich, indulgent flavors, often inspired by traditional desserts. High-end retail and specialty outlets remain key distribution channels. The tourism and hospitality sectors play a vital role in expanding demand for premium bakery and dessert offerings. Halal-certified products are essential for market acceptance, influencing sourcing and production. Price sensitivity limits rapid expansion in certain sub-segments, particularly in lower-income areas. E-commerce adoption is growing, supported by urban digital infrastructure. Seasonal demand spikes occur during cultural and religious festivals, creating opportunities for limited-edition product launches.

Africa

The Africa Global Confectionery Fillings Market size was valued at USD 11.21 million in 2018 to USD 17.08 million in 2024 and is anticipated to reach USD 19.37 million by 2032, at a CAGR of 1.2% during the forecast period. Africa holds around 1.3% of the global market share, with growth concentrated in urban regions with higher disposable incomes. Demand is primarily for affordable products, with chocolate and fruit fillings being most popular. Limited cold chain infrastructure poses challenges for premium and perishable variants. The bakery sector is expanding, particularly in metropolitan areas, creating opportunities for fillings in pastries and cakes. E-commerce penetration is low but shows potential in major cities. Local production is limited, leading to reliance on imports for specialized fillings. Currency instability and import costs constrain market expansion. Brands targeting the region often adapt packaging sizes and pricing to cater to value-conscious consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Confectionery Fillings Market is characterized by the presence of multinational corporations and specialized regional players competing on product innovation, quality, and distribution reach. Leading companies such as Barry Callebaut, Cargill, AAK, Parker Products, and Fuji Oil Europe leverage extensive R&D capabilities to develop diverse flavor profiles, clean-label formulations, and functional ingredient blends. It remains a moderately concentrated market, where established brands dominate premium segments while smaller firms focus on niche offerings and artisanal quality. Competitive differentiation is achieved through technological advancements in processing, strategic partnerships with foodservice operators, and expansion into emerging markets. Price competitiveness and regulatory compliance further shape competitive positioning.

Recent Developments:

- In April 2025, Barry Callebaut announced key innovations focused on fermentation and fat technologies to deliver new taste experiences for confectionery brands. The company released its “Top Chocolate Trends in 2025” report and showcased advanced solutions for multi-flavor and environmentally conscious chocolate consumption, reinforcing a leadership position in the global confectionery fillings market.

- In June 2025, Parker Products (Parker Hannifin Corporation) entered an agreement to acquire Curtis Instruments for $1 billion in cash, with the deal expected to close by year-end. This acquisition brings advanced motor speed controller and electrification solutions to Parker’s global offerings, improving system capabilities for customers in industrial applications, including the food and confectionery segments.

- In July 2025, Cargill and PepsiCo launched a strategic partnership to advance regenerative agriculture practices across 240,000 acres in Iowa. This partnership aims to enhance supply chain resilience and support sustainable ingredient sourcing, benefitting their joint food ingredient chains, including confectionery applications. In June 2025, Cargill also expanded its feed production via a new partnership with Biotech Farms in the Philippines, enhancing supply chain capabilities and sustainability.

- In early 2025, Fuji Oil Europe continued to innovate with specialty fats, chocolate fillings, and coatings. The company’s advances in sustainable and functional confectionery ingredients were highlighted in industry events, demonstrating a strong commitment to tailor-made, environmentally responsible confectionery fillings solutions.

- In March 2025, Zentis North America unveiled the largest fully automated popping boba production line in the US at its Plymouth, Indiana site. This significant expansion positions Zentis as a major supplier of innovative confectionery fillings for the US market and marks the largest North American investment by Zentis in over 15 years.

Market Concentration & Characteristics:

The Global Confectionery Fillings Market demonstrates moderate concentration, with leading global players controlling significant market share through brand strength, scale, and distribution efficiency. It is highly competitive, driven by innovation in flavors, textures, and health-oriented formulations. Regional players contribute to diversity by catering to local tastes and preferences. The market shows strong adaptability to consumer trends, with clean-label, plant-based, and sustainable solutions gaining prominence. Competition is shaped by the balance between large-scale industrial production and artisanal, specialty offerings that cater to premium and niche demand segments.

Report Coverage:

The research report offers an in-depth analysis based on product type, form type, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for premium, indulgent products will drive innovation in flavors and textures.

- Expansion of plant-based and allergen-free fillings will broaden consumer appeal.

- Technological advancements in processing will enhance product stability and shelf life.

- Clean-label and natural ingredient formulations will gain greater market traction.

- Growth in e-commerce and direct-to-consumer sales will diversify distribution channels.

- Collaborations between filling manufacturers and foodservice brands will boost customized offerings.

- Emerging markets will see rapid growth fueled by urbanization and rising disposable incomes.

- Seasonal and limited-edition launches will increase brand engagement and repeat purchases.

- Sustainability in sourcing and packaging will become a key competitive differentiator.

- Consolidation through mergers and acquisitions will strengthen market leadership positions.