Market Overview

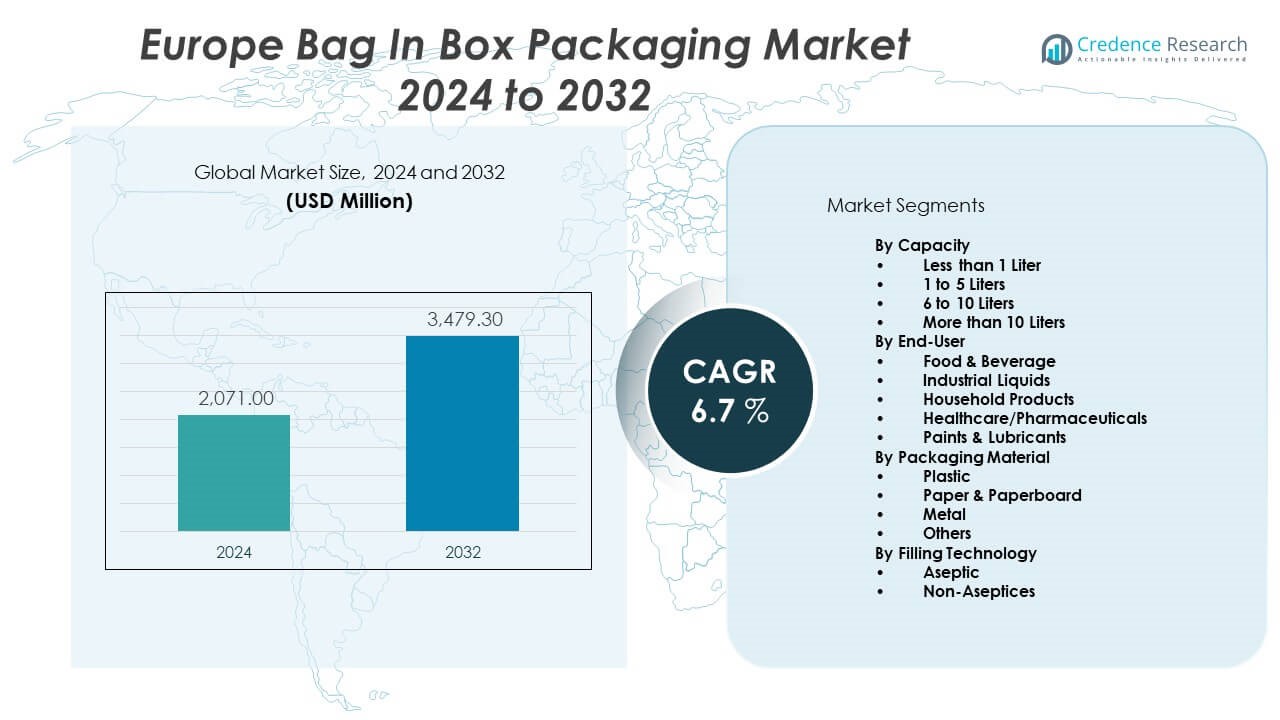

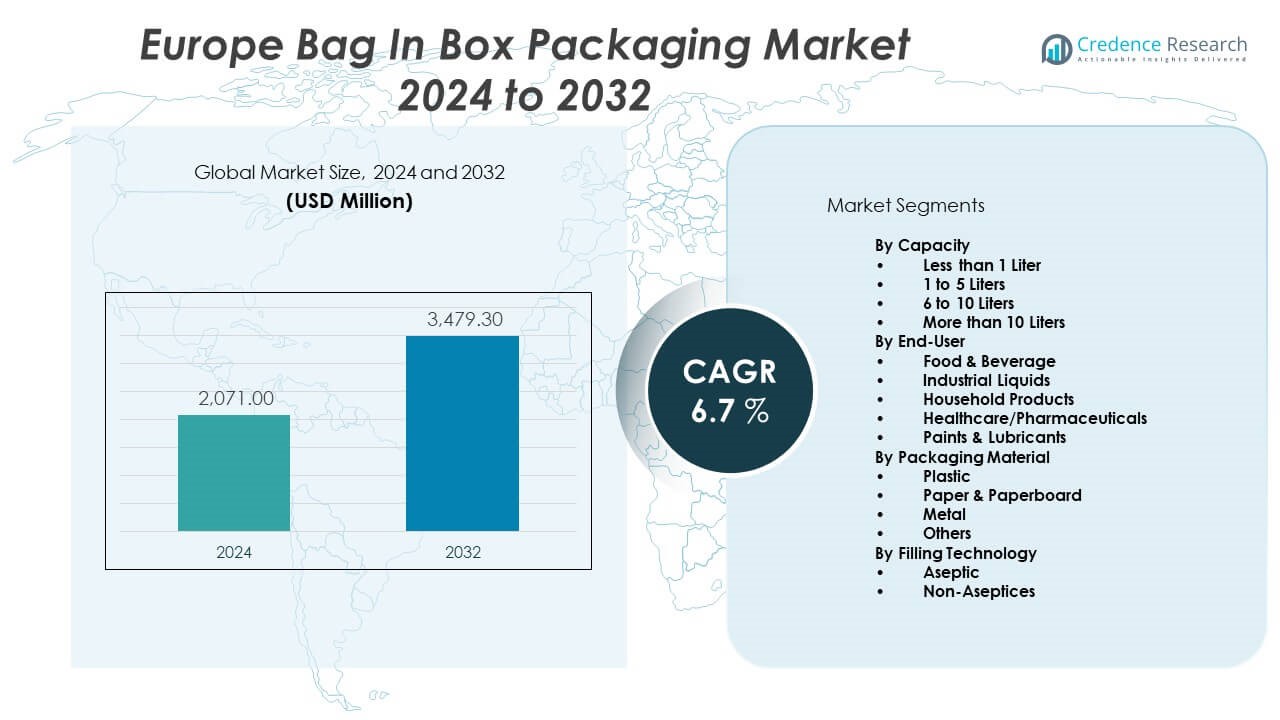

The Europe Bag In Box Packaging Market is projected to grow from USD 2,071 million in 2024 to an estimated USD 3,479.3 million by 2032, with a compound annual growth rate (CAGR) of 6.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Europe Bag in Box Market Size 2024 |

USD 2,071 Million |

| Europe Bag in Box Market, CAGR |

6.7% |

| Europe Bag in Box Market Size 2032 |

USD 3,479.3 Million |

The market is experiencing strong demand due to its sustainable format, efficient liquid handling, and extended shelf life benefits. Beverage manufacturers are increasingly adopting bag-in-box packaging for wine, juices, and dairy due to lower carbon footprint and convenience. Growing preference for e-commerce-friendly, space-saving formats across food service and industrial applications further supports adoption. Innovation in barrier films and dispensing taps enhances product freshness and usability, while rising environmental regulations push both brands and retailers to switch to recyclable, lightweight alternatives.

Western Europe dominates the Europe Bag In Box Packaging Market, with countries like Germany, France, and the UK leading due to advanced food and beverage industries and stringent sustainability mandates. Northern European countries are also witnessing consistent growth owing to high environmental awareness. On the other hand, Eastern and Southern Europe represent emerging regions where market penetration is rising as packaging modernization and retail sector upgrades continue. Increasing local production capabilities and export-oriented food processing in these areas are expected to boost future market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Bag In Box Packaging Market is projected to grow from USD 2,071 million in 2024 to USD 3,479.3 million by 2032, registering a CAGR of 6.7% from 2024 to 2032.

- Growing demand from wine, juice, and dairy producers is driving adoption due to longer shelf life, reduced spillage, and lower transportation costs.

- Strict environmental regulations across Europe are accelerating the shift toward recyclable and low-carbon packaging solutions.

- Limited recycling infrastructure for multilayer films and plastic liners remains a key challenge, affecting circularity and sustainability efforts.

- High raw material costs and pricing pressures in cost-sensitive sectors hinder widespread adoption among small and medium-sized enterprises.

- Western European countries like Germany, France, and the UK lead the market due to mature beverage industries and eco-regulatory frameworks.

- Eastern and Southern Europe are emerging markets driven by rising retail modernization, export-led food production, and improving logistics infrastructure.

Market Drivers:

Rising Adoption in Beverage and Dairy Industries Enhances Packaging Demand:

Beverage producers across Europe are shifting toward bag-in-box formats for wine, juices, and dairy products due to reduced storage and transportation costs. These packages provide better product preservation by minimizing oxygen exposure, which extends shelf life. The Europe Bag In Box Packaging Market benefits from increasing preference for portion control and convenience among consumers. It supports large-volume packaging for foodservice and retail, which enables efficient dispensing. Dairy and juice manufacturers rely on bag-in-box systems for maintaining hygiene and freshness. The demand is also reinforced by growing health-conscious consumption of natural beverages. Changing lifestyles and urbanization trends have created strong demand for flexible and durable packaging. Companies are also leveraging bag-in-box for product differentiation and shelf visibility.

- For instance, Smurfit Kappa’s Bag-in-Box packaging can extend the shelf life of wine for up to 8 weeks after opening due to its high oxygen barrier films. The design prevents air from entering during dispensing, ensuring that products like wine and juice remain fresh for several weeks post-opening, a feature particularly valuable to beverage and dairy producers.

Shift Toward Sustainable and Lightweight Packaging Drives Market Expansion:

Governments across Europe are enforcing strict regulations on single-use plastic, encouraging the adoption of recyclable and low-carbon alternatives. Bag-in-box formats use less plastic per unit volume compared to rigid containers, supporting sustainability goals. The structure reduces packaging waste and simplifies recycling due to its collapsible design. The format meets evolving environmental standards, including EU directives on circular packaging. The Europe Bag In Box Packaging Market aligns with eco-label initiatives and carbon reduction targets across the food and beverage sector. Brands prefer this packaging to improve sustainability credentials and appeal to eco-conscious consumers. It also lowers carbon emissions during logistics due to its compact and lightweight format. Retailers and distributors value the reduced footprint and stackability for better supply chain efficiency.

- For instance, DS Smith, focusing on sustainability, has introduced fiber-based box solutions that are 100% recyclable. Their packaging has helped replace more than 170 million pieces of single-use plastic globally with fiber-based packaging as of late 2021, aiming for 1 billion replacements by 2025. This aligns with EU directives to move away from hard-to-recycle plastics.

Increased Use in Industrial and Institutional Applications Fuels Market Growth:

Bag-in-box solutions are increasingly applied in non-food sectors, such as chemicals, cleaning fluids, and industrial lubricants. Their tamper-proof design, ease of dispensing, and hygienic storage make them ideal for bulk applications. The Europe Bag In Box Packaging Market is gaining momentum in B2B environments where safety, handling, and cost-efficiency are critical. Industrial users benefit from reduced container cleaning and disposal efforts, leading to lower operational costs. Commercial kitchens and catering services adopt the format to simplify ingredient handling and reduce spillage. It supports automation and compatibility with dispensing equipment, enhancing workflow efficiency. Governments and municipalities are adopting these systems for institutional needs in schools and healthcare. Rising awareness about hygiene and contamination control drives demand across commercial applications.

Innovation in Barrier Films and Dispensing Systems Strengthens Market Position:

Ongoing material innovation is supporting performance improvements in bag-in-box packaging, especially for sensitive liquids. High-barrier films extend shelf life, preserve flavor, and prevent microbial contamination. The Europe Bag In Box Packaging Market benefits from advanced taps and valves that allow air-free dispensing and user-friendly operation. New multilayer film technologies maintain structural integrity under pressure, enhancing suitability for carbonated or temperature-sensitive products. Manufacturers are developing recyclable film laminates that meet food safety standards while reducing environmental impact. Smart dispensing systems also reduce product wastage and enhance end-user satisfaction. These features make the format appealing for brands focused on operational efficiency and premium packaging. The growing demand for functional packaging solutions continues to accelerate innovation investment.

Market Trends:

Emergence of Premium Packaging Aesthetics for Shelf Appeal and Brand Identity:

Brand owners are incorporating creative design elements and premium finishes in bag-in-box packaging to differentiate their offerings. The Europe Bag In Box Packaging Market is witnessing demand for visually appealing and customizable exterior cartons. Companies are using high-quality printing, embossing, and specialty coatings to enhance consumer appeal. Beverage brands in particular are launching limited-edition formats that combine sustainability with luxury design. Retailers are also demanding packaging that fits high-end product positioning and aligns with branding strategies. This aesthetic enhancement does not compromise recyclability, which keeps sustainability intact. It helps attract younger demographics who prefer visually distinctive and environmentally responsible choices. Packaging as a marketing tool continues to reshape retail strategies.

- For instance, a Spanish packaging company offers original hexagonal bag-in-box solutions made from up to 70% recycled plastics and biodegradable components, specifically designed for premium wine and spirits brands.

Integration of Smart Packaging Technologies for Consumer Engagement and Tracking:

Smart packaging adoption is increasing across Europe with the integration of QR codes, NFC tags, and digital watermarks. These technologies allow consumers to access product origin, storage tips, and authenticity verification. The Europe Bag In Box Packaging Market is evolving through digitization of packaging that supports transparency and traceability. It helps brands collect consumer data and optimize the supply chain through real-time tracking. Retailers benefit from enhanced inventory visibility and better loss prevention mechanisms. This trend is gaining traction in the wine and specialty beverage sectors, where provenance and quality assurance are critical. Smart elements also allow manufacturers to communicate sustainability credentials. It reinforces consumer trust and boosts interactive brand experiences.

- For instance, France’s pharmaceutical sector has implemented bag-in-box systems equipped with temperature monitoring sensors and IoT-enabled tags, improving traceability and quality control by 30% and ensuring regulatory compliance for sensitive products.

E-commerce Growth Accelerates Demand for Durable and Space-Saving Packaging:

The rapid expansion of e-commerce and direct-to-consumer models is driving demand for packaging that is compact, secure, and efficient in transit. Bag-in-box solutions fulfill these needs with their protective outer carton and flexible inner bladder. The Europe Bag In Box Packaging Market is experiencing growth due to its compatibility with postal and courier systems. E-retailers prefer the format for non-breakability, leakage resistance, and ease of stacking. It reduces damages during shipping and simplifies return logistics with its collapsible design. Start-ups and digital-native brands are adopting this packaging to optimize fulfillment and lower shipping costs. The format aligns with e-commerce sustainability goals by reducing void fill and secondary packaging. These features support the growing shift in purchasing behavior.

Customization and SKU Flexibility Align with Retail and Foodservice Needs:

Pack format versatility allows brands to introduce multiple SKUs tailored to household, retail, and industrial needs. The Europe Bag In Box Packaging Market supports small to large volume packaging without changing production lines significantly. Manufacturers can adjust size, branding, and functional components to suit end-use applications. Retailers benefit from format standardization, which simplifies shelf stocking and display. Foodservice providers demand custom valve systems and bulk packaging to support portion control and reduce waste. This customization ability supports seasonal promotions, new product trials, and customer-specific packaging requests. It also enhances brand agility in response to fluctuating demand. The packaging flexibility supports ongoing SKU rationalization and inventory optimization efforts.

Market Challenges Analysis:

Recycling Infrastructure Limitations Hinder Circular Adoption Efforts:

The Europe Bag In Box Packaging Market faces challenges due to limited recycling infrastructure for multilayer films and plastic liners. Most municipal systems cannot efficiently separate and process composite materials, leading to landfill disposal. While the outer cardboard is easily recyclable, the plastic components require specialized facilities. Brands aiming for 100% recyclable packaging struggle to meet their goals due to system incompatibilities. Consumers often find it difficult to disassemble and segregate materials correctly, reducing recovery rates. This recycling complexity affects sustainability claims and brand credibility. Governments are pressuring producers to address design-for-recycling flaws, which increases R&D and compliance costs. The lack of uniform recycling policies across countries further complicates market progress.

Price Sensitivity and Material Cost Volatility Affect Profit Margins:

Raw material cost fluctuations, especially for barrier films, adhesives, and plastic liners, impact overall production expenses. The Europe Bag In Box Packaging Market depends on stable material inputs to maintain price competitiveness. Currency variations, resin shortages, and energy price spikes create unpredictability in cost structures. Price-sensitive sectors like institutional catering and industrial chemicals demand affordable packaging, limiting premium material adoption. High costs also hinder adoption by small producers or niche beverage brands. Brands face pressure to absorb cost increases without passing them to end users, which compresses margins. Competitive pricing in traditional rigid packaging formats also restricts conversion. This challenge slows large-scale transitions and long-term contract adoption.

Market Opportunities:

Expansion into Ready-to-Drink and Non-Alcoholic Beverage Segments Creates New Growth Avenues:

The growing demand for ready-to-drink and health-oriented beverages presents a strong opportunity for market expansion. The Europe Bag In Box Packaging Market can tap into this trend by offering lightweight, portable, and freshness-preserving formats. Consumers are increasingly opting for functional drinks, herbal infusions, and cold brews, all of which benefit from air-free dispensing. Emerging brands are adopting bag-in-box formats for cost-effective trial launches and promotional SKUs. This application diversity expands the use cases beyond traditional wine and juice.

Private Label and Co-Packaging Partnerships Expand Market Reach:

Retailers across Europe are scaling up private label offerings, creating opportunities for contract packaging and customization services. The Europe Bag In Box Packaging Market can benefit from this trend through collaboration with store brands and regional suppliers. Co-packing companies are investing in flexible filling lines to meet short-run demands and seasonal variations. These partnerships reduce overhead costs and improve product availability across formats. It also allows packaging providers to strengthen regional distribution networks and enhance supply chain integration.

Market Segmentation Analysis:

By Capacity

The 1 to 5 Liters segment holds the largest share due to widespread use in beverages, edible oils, and household cleaning liquids. The 6 to 10 Liters segment supports bulk usage in catering, foodservice, and institutional setups where efficient dispensing is key. More than 10 Liters capacity suits industrial applications such as lubricants and chemicals that require high-volume packaging. Less than 1 Liter capacity is mostly used in pharmaceuticals, cosmetics, and sample packs for personal care.

- For instance, Higher capacities over 10 liters are widely applied by industrial liquid producers for lubricants and chemicals that benefit from space-saving, durable packaging. Sub-1 liter formats have seen adoption in pharmaceutical and cosmetics packaging, leveraging portion control and tamper-evidence for sensitive products.

By End-User / Application

Food & Beverage remains the leading application segment in the Europe Bag In Box Packaging Market, driven by demand for wine, dairy, juices, and oils. Industrial Liquids utilize bag-in-box packaging for its safety, storage ease, and leak prevention in chemical handling. Household Products, including detergents and cleaners, prefer compact packaging with controlled dispensing. Healthcare/Pharmaceuticals rely on sterile, tamper-evident formats for fluids and sanitation products. Paints & Lubricants benefit from large-capacity options that allow clean, controlled flow.

- The healthcare and pharmaceuticals sector in France, for instance, utilizes smart bag-in-box systems for fluids and sanitation products, integrating quality monitoring and ensuring safety and compliance.

By Packaging Material

Plastic dominates due to its barrier properties, flexibility, and compatibility with both aseptic and non-aseptic processes. Paper & Paperboard support sustainability goals, especially in outer boxes for retail display and protection. Metal plays a minor role, mainly in industrial applications requiring reinforced components. Others include experimental and bio-based materials under consideration for eco-design compliance and recycling performance.

By Filling Technology

Aseptic filling supports long shelf life and food safety, particularly in juice, dairy, and wine applications. It enables product preservation without refrigeration or additives. Non-Aseptic filling serves shorter distribution cycles and temperature-controlled supply chains. It provides cost benefits and is widely used in household, industrial, and personal care products.

Segmentation:

By Capacity

- Less than 1 Liter

- 1 to 5 Liters

- 6 to 10 Liters

- More than 10 Liters

By End-User / Application

- Food & Beverage (includes wine, juices, dairy, edible oils)

- Industrial Liquids

- Household Products (cleaning chemicals, personal care)

- Healthcare/Pharmaceuticals

- Paints & Lubricants

By Packaging Material

- Plastic

- Paper & Paperboard

- Metal

- Others

By Filling Technology

By Region

- Western Europe

- Northern Europe

- Eastern Europe

- Southern Europe

Regional Analysis:

Western Europe Holds Dominant Share Due to Strong Industrial and Regulatory Ecosystem

Western Europe commands the largest share of the Europe Bag In Box Packaging Market, accounting for 48% of the regional market. Countries such as Germany, France, the UK, and the Netherlands drive demand with their mature beverage, dairy, and foodservice sectors. The region benefits from advanced recycling infrastructure and stringent sustainability mandates under EU regulations. Brand owners in Western Europe prioritize circular packaging and invest in automated filling systems for efficiency. The presence of leading packaging manufacturers and high private-label penetration supports ongoing market growth. High consumer awareness of eco-friendly packaging drives product adoption across retail channels. Western Europe remains the central hub for innovation, exports, and sustainable practices in this market.

Northern Europe Demonstrates Steady Growth with Emphasis on Environmental Performance

Northern Europe contributes 22% to the Europe Bag In Box Packaging Market and continues to grow steadily. Countries such as Sweden, Finland, Denmark, and Norway promote high environmental standards and green procurement policies. Bag-in-box solutions align with national goals on plastic waste reduction and climate neutrality. It is gaining popularity in institutional catering and food delivery due to its low-carbon footprint and ease of disposal. Retailers in the region support lightweight formats that reduce logistical costs and material waste. The consumer base shows strong preference for reusable and recyclable options, which supports adoption. Innovation in smart packaging and refill formats further enhances market appeal in Northern Europe.

Emerging Regions in Eastern and Southern Europe Offer Long-Term Growth Potential

Eastern and Southern Europe collectively represent 30% of the Europe Bag In Box Packaging Market. These regions are experiencing rising adoption driven by improving food processing capabilities, growing beverage exports, and expanding retail infrastructure. Countries like Poland, Romania, Spain, and Italy show increasing demand for cost-effective, flexible packaging formats. Local producers are investing in automation and scaling operations to meet export and domestic demand. Awareness about hygiene and product preservation is rising, particularly in institutional and catering applications. While recycling systems remain underdeveloped in some areas, ongoing government efforts support gradual infrastructure upgrades. The market holds strong long-term potential as regional players modernize and align with EU sustainability targets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Smurfit Kappa

- LiquiBox

- Optopack Ltd.

- Amcor plc

- Montibox

- DS Smith

- Aran Packaging

- Peak Liquid Packaging

Competitive Analysis:

The Europe Bag In Box Packaging Market features a mix of multinational corporations and regional specialists competing on sustainability, innovation, and application-specific customization. Smurfit Kappa and DS Smith lead in fiber-based packaging with advanced recycling infrastructure and strong regional networks. LiquiBox and Amcor plc dominate flexible liquid packaging with a focus on aseptic systems and food-grade compliance. Optopack Ltd. and Aran Packaging offer niche expertise in high-barrier films and industrial-grade formats. Companies compete through investments in automated filling technologies, lightweight materials, and tailored dispensing systems. It remains innovation-driven, with players enhancing value through cost-efficiency and low-carbon packaging formats.

Recent Developments:

- In April 2025, Amcor plc received unconditional approval from the European Commission to acquire Berry Global Group, Inc. The transaction is scheduled to close at the end of April 2025, marking a substantial expansion of Amcor’s presence and operational capacity within the European bag-in-box packaging sector.

- In November 2024, Peak Liquid Packaging (Peak Packaging UK) secured a supply partnership with Britvic Soft Drinks. Beginning in 2025, Peak will provide Britvic’s Leeds facility with advanced bag-in-box packaging, focusing on more recyclable and high-performance materials to enhance Britvic’s operational efficiency and sustainability.

- In February 2024, DS Smith signed its second consecutive five-year agreement to be the sole supplier of corrugated packaging for Mondelēz International’s European operations. This extension builds on a decade-long partnership and introduces new sustainable fiber-based packaging and joint innovation projects throughout the region.

Market Concentration & Characteristics:

The Europe Bag In Box Packaging Market is moderately consolidated, with top players holding a significant share through regional manufacturing bases and advanced supply chains. It is highly application-specific, with strong concentration in food and beverage sectors. Companies differentiate by investing in sustainability, automation, and compatibility with aseptic technologies. Innovation cycles are fast, and regional demand varies by environmental regulations and consumer preferences. It shows steady growth with increasing private-label penetration and e-commerce-driven packaging demand.

Report Coverage:

The research report offers an in-depth analysis based on Capacity, End-User, Packaging Material, Filling Technology, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable packaging formats will increase, driven by stricter EU environmental regulations.

- Adoption in non-alcoholic beverages and functional drinks will expand as consumer health trends grow.

- Foodservice and institutional sectors will accelerate uptake of high-volume dispensing systems.

- Technological improvements in aseptic filling and barrier films will enhance shelf stability and usability.

- E-commerce and direct-to-consumer models will fuel growth in compact, damage-resistant formats.

- Investment in recyclable and mono-material solutions will reshape product innovation pipelines.

- Regional manufacturers will scale production to meet rising export and private-label packaging demand.

- Customization and SKU flexibility will remain key for brand differentiation and seasonal promotions.

- Market penetration in Eastern and Southern Europe will grow as infrastructure and retail channels modernize.

- Competitive intensity will rise with new entrants offering smart dispensing and refillable packaging models.