Market Overview

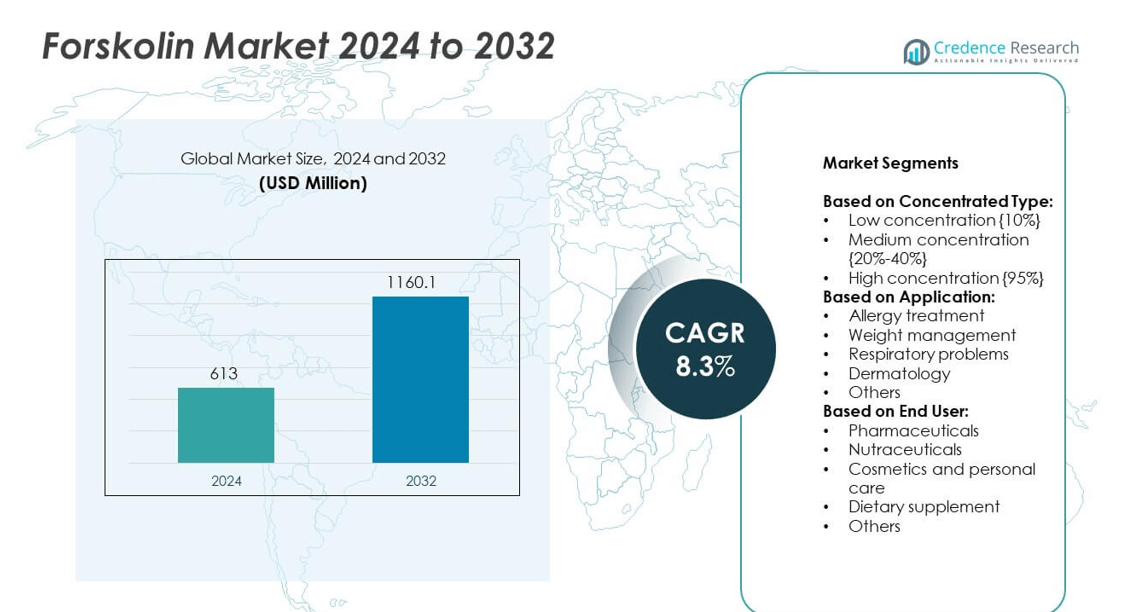

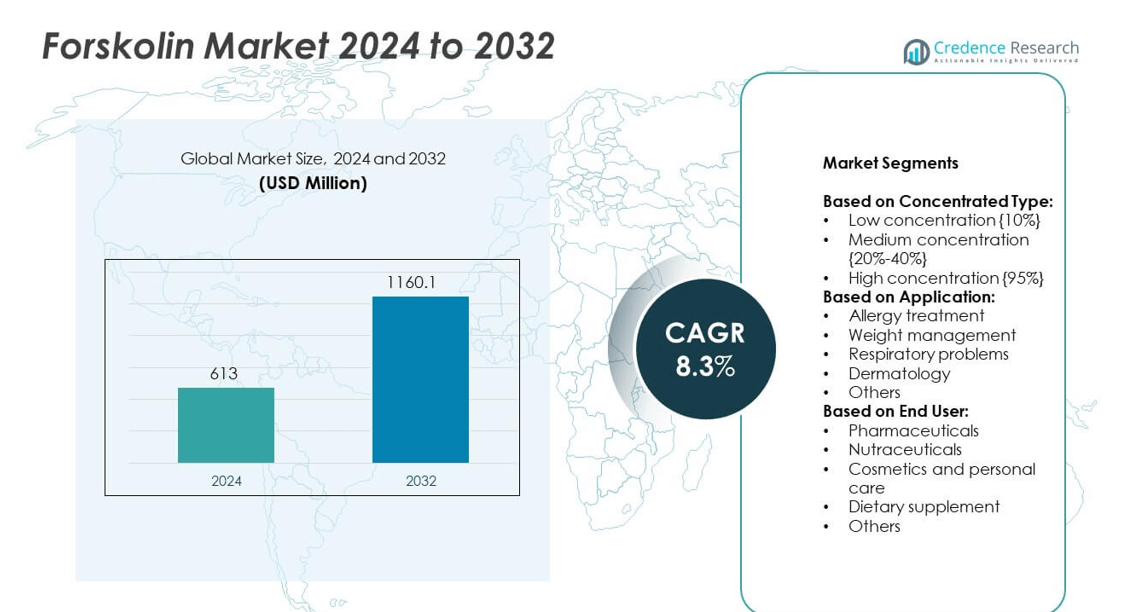

The Forskolin market size was valued at USD 613 Million in 2024 and is expected to reach USD 1160.1 Million by 2032, registering a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Forskolin Market Size 2024 |

USD 613 Million |

| Forskolin Market, CAGR |

8.3% |

| Forskolin Market Size 2032 |

USD 1160.1 Million |

The Forskolin market is driven by rising demand for natural weight management supplements and growing use in respiratory and cardiovascular treatments. Consumers seek plant-based solutions supported by clinical research, boosting adoption in pharmaceuticals and nutraceuticals. The market trends include a shift toward high-purity standardized extracts, integration into multi-ingredient formulations, and strong growth in e-commerce distribution. Clean-label and vegan-friendly product demand continues to influence innovation, while emerging economies contribute to expanding consumer bases through rising health awareness and improved product availability.

North America leads the Forskolin market due to strong consumer awareness and established supplement distribution networks. Europe follows with demand for clean-label and plant-based products supported by strict regulatory standards. Asia Pacific shows rapid growth driven by local cultivation and rising health-conscious populations. Key players shaping the market include Swanson Health Products, NUTRALIE, NutraBio Labs, and Sabinsa Corporation. These companies focus on high-quality extracts, product innovation, and expanding global reach through partnerships and e-commerce channels to strengthen their market presence.

Market Insights

- Forskolin market was valued at USD 613 Million in 2024 and is expected to reach USD 1160.1 Million by 2032, growing at a CAGR of 8.3%.

- Rising demand for natural weight management solutions and therapeutic use in respiratory and cardiovascular health fuels growth.

- Market trends include a shift toward standardized high-purity extracts, integration into multi-ingredient formulations, and growth in clean-label supplements.

- Competitive landscape features key players like Swanson Health Products, NUTRALIE, NutraBio Labs, and Sabinsa Corporation focusing on product innovation and regulatory compliance.

- Major restraints include inconsistent product quality among suppliers, limited large-scale clinical trials, and varying regulatory frameworks across regions.

- North America leads due to strong consumer awareness and advanced distribution, while Europe emphasizes plant-based products and strict safety standards.

- Asia Pacific shows fastest growth driven by local cultivation, sustainable sourcing, and expanding e-commerce channels, with Latin America and MEA gradually increasing adoption through improved retail access

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Natural Weight Management Solutions

Forskolin market growth is driven by rising consumer preference for natural weight loss solutions. It is widely recognized for supporting fat metabolism and promoting lean body mass. Increasing cases of obesity encourage consumers to seek plant-based supplements. Pharmaceutical and nutraceutical companies are introducing high-quality forskolin extracts to meet this demand. Clinical studies linking forskolin to improved metabolic health enhance product credibility. This trend supports the expansion of dietary supplement applications globally.

- For instance, A single-blind clinical trial compared oral forskolin (10 mg daily for two months) with an inhaled steroid (beclomethasone) in 60 adult patients with mild to moderate persistent asthma.

Expanding Applications in Respiratory and Cardiovascular Health

Forskolin market benefits from its therapeutic role in managing asthma, allergies, and cardiovascular conditions. It supports smooth muscle relaxation, which helps reduce airway resistance. Medical research highlights its role in improving heart muscle function and regulating blood pressure. Pharmaceutical firms integrate forskolin into treatments for chronic respiratory disorders. Rising awareness among healthcare providers encourages its inclusion in prescription and OTC formulations. Broader clinical use strengthens demand across multiple therapeutic areas.

- For instance, a study by Kamohara et al. recruited 29 healthy volunteers who got escalating oral doses from 250 mg up to 1000 mg of a Coleus forskohlii formulation over 4 weeks, showing safety and tolerability.

Growing Use in Cosmetics and Personal Care Products

Forskolin market gains traction in the cosmetics sector due to its antioxidant and skin-conditioning properties. It is incorporated into formulations for anti-aging creams, skin-brightening products, and hair care solutions. Rising consumer focus on natural beauty products drives higher adoption. Cosmetic manufacturers invest in research to enhance product stability and efficacy. Brands highlight forskolin’s plant origin to appeal to clean-label buyers. Expanding e-commerce distribution accelerates access to these innovative products worldwide.

Supportive Regulatory and Research Initiatives

Forskolin market is supported by increasing scientific validation and favorable regulations. Research institutions study its effects on metabolic disorders, respiratory function, and cardiovascular health. Regulatory agencies approve standardized extract concentrations for safe consumption. Industry players focus on compliance with international quality standards to improve market access. This regulatory clarity encourages investments in production capacity and clinical trials. Growing collaborations between academia and industry strengthen the knowledge base and accelerate innovation.

Market Trends

Increasing Focus on High-Purity and Standardized Extracts

Forskolin market is witnessing a shift toward high-purity and standardized products. It allows manufacturers to ensure consistent potency across batches. Standardization helps brands meet global regulatory requirements and win consumer trust. Companies invest in advanced extraction technologies to maintain bioactive compound stability. This focus supports product differentiation in a competitive nutraceutical market. Rising awareness among consumers about product quality drives demand for certified extracts.

- For instance, Hello Bio supplies forskolin with >98% purity by HPLC for research-grade applications.

Integration into Multi-Ingredient Formulations

Forskolin market benefits from its growing use in combination products. It is often blended with vitamins, minerals, and herbal extracts to enhance overall effectiveness. Multi-ingredient supplements attract consumers seeking holistic health solutions. Formulators leverage synergistic effects to improve weight management and metabolic support. This trend increases product innovation across pharmaceuticals and nutraceuticals. Expanding retail availability boosts consumer adoption of these advanced formulations.

- For instance, BPS Bioscience provides forskolin as a white solid, with >98% purity, molecular weight 410.51 Da, stable for one year under specified storage.

Rising Popularity of Clean-Label and Plant-Based Supplements

Forskolin market aligns with the global move toward clean-label and vegan-friendly products. It appeals to health-conscious consumers avoiding synthetic additives. Brands promote forskolin’s natural origin to strengthen their sustainability image. Growing demand for herbal and ayurvedic supplements supports market expansion. Transparent labeling and ethical sourcing practices enhance consumer confidence. This trend encourages companies to invest in traceability and responsible supply chains.

Expansion Through Online and Direct-to-Consumer Channels

Forskolin market is expanding rapidly through digital commerce platforms. It benefits from increasing online health and wellness product sales. Direct-to-consumer brands offer detailed product information and clinical data online. This approach improves customer engagement and brand loyalty. Subscription models and personalized recommendations enhance repeat purchases. The convenience of home delivery fuels consistent demand in developed and emerging markets.

Market Challenges Analysis

Regulatory Complexity and Quality Concerns

Forskolin market faces challenges due to varying regulatory standards across regions. It must meet strict quality and safety guidelines to gain approvals. Inconsistent purity levels among suppliers raise concerns about product reliability. Adulteration risks affect consumer trust and brand reputation. Companies invest heavily in quality control systems to maintain compliance. Regulatory delays can slow down product launches and reduce market competitiveness.

Limited Clinical Evidence and Awareness Gaps

Forskolin market growth is hindered by limited large-scale clinical studies. It requires more scientific validation to strengthen health claims. Healthcare professionals remain cautious about recommending products without robust data. Low consumer awareness in emerging economies reduces adoption rates. Misleading marketing claims by unregulated players create confusion in the market. Industry leaders focus on educational campaigns to address these gaps and build confidence.

Market Opportunities

Expansion into Functional Foods and Beverages

Forskolin market presents strong opportunities in the functional food and beverage sector. It can be incorporated into health drinks, fortified snacks, and nutrition bars. Rising demand for convenient wellness products supports this diversification. Food manufacturers explore formulations that retain bioactivity during processing. Partnerships between supplement brands and food companies accelerate product development. This trend helps expand the consumer base beyond traditional dietary supplements.

Growth Potential in Emerging Economies

Forskolin market has significant room for expansion in Asia Pacific, Latin America, and Middle East. It benefits from rising disposable incomes and growing health awareness. Increasing availability of herbal products in pharmacies and online channels drives sales. Governments support nutraceutical adoption through favorable health policies. Companies investing in localized production gain a competitive edge. Strong distribution networks in these regions enhance long-term market penetration.

Market Segmentation Analysis:

By Concentrated Type:

Forskolin market is divided into low concentration (10%), medium concentration (20%-40%), and high concentration (95%). Low concentration extracts are preferred in basic dietary supplements for general wellness support. Medium concentration is widely used in weight management products and therapeutic formulations due to balanced potency. High concentration extracts are in demand for clinical research and pharmaceutical-grade applications where efficacy is critical. It is expected that manufacturers will continue to focus on developing standardized high-purity products to meet global quality norms. Growing awareness about dosage accuracy supports the shift toward higher concentration variants.

- For instance, Nature’s Answer furnishes a forskolin capsule with 250 mg of Coleus forskohlii extract standardized to 20%, giving about 50 mg of pure forskolin per capsule.

By Application:

Forskolin market applications include allergy treatment, weight management, respiratory problems, dermatology, and others. Weight management dominates due to growing consumer focus on fat reduction and metabolic health. Allergy treatment and respiratory applications benefit from forskolin’s smooth muscle relaxation properties. Dermatology uses include skin-conditioning and anti-inflammatory solutions in creams and gels. It is expected that demand from respiratory and dermatology segments will rise with increasing clinical validation. Broader therapeutic use will enhance product adoption across healthcare and wellness sectors.

- For instance, Sami Labs Limited (India) supplied forskolin 1% eye-drop formulation for a clinical trial with 90 adult open-angle glaucoma patients

By End User:

Forskolin market end users include pharmaceuticals, nutraceuticals, cosmetics and personal care, dietary supplements, and others. Pharmaceuticals use forskolin in formulations for cardiovascular and respiratory health support. Nutraceuticals leverage it for natural metabolic boosters and weight-loss products. Cosmetics and personal care companies integrate forskolin into skin and hair care lines. It finds strong demand in dietary supplements, which remain the largest distribution channel worldwide. Growing participation of contract manufacturers supports cost-effective production for multiple end-user segments.

Segments:

Based on Concentrated Type:

- Low concentration {10%}

- Medium concentration {20%-40%}

- High concentration {95%}

Based on Application:

- Allergy treatment

- Weight management

- Respiratory problems

- Dermatology

- Others

Based on End User:

- Pharmaceuticals

- Nutraceuticals

- Cosmetics and personal care

- Dietary supplement

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Forskolin market, accounting for 38% of global revenue in 2024. Strong consumer awareness of natural supplements supports significant demand across the U.S. and Canada. Weight management products represent the key revenue contributor, driven by rising obesity rates and interest in herbal solutions. Major pharmaceutical and nutraceutical brands operate advanced manufacturing facilities and focus on product standardization to meet FDA guidelines. It benefits from established retail networks, including pharmacies, supermarkets, and online health platforms. Rising investments in clinical studies and research collaborations with universities strengthen credibility and encourage adoption. The presence of leading contract manufacturers also enables cost-efficient production and innovation.

Europe

Europe contributes around 28% of the global Forskolin market, with Germany, the UK, and France leading consumption. Consumers in this region prefer clean-label and plant-based products, which drives demand for certified high-quality extracts. Regulatory frameworks like EFSA approvals ensure that products meet strict safety and labeling standards. Pharmaceutical companies are incorporating forskolin into respiratory and cardiovascular treatments, creating new growth opportunities. It benefits from government initiatives promoting herbal medicine and natural wellness solutions. Expanding distribution through online pharmacies and specialty health stores helps brands reach a broader audience. Growing R&D activities in botanical research further reinforce the market’s future potential in this region.

Asia Pacific

Asia Pacific accounts for 22% of the global Forskolin market and is the fastest-growing region. India and China serve as major producers and exporters of coleus forskohlii, the plant source of forskolin. Rising disposable incomes and health-conscious populations fuel supplement consumption across emerging economies. Companies invest in local cultivation and sustainable sourcing to meet international demand. It benefits from traditional use of herbal remedies in Ayurveda and Traditional Chinese Medicine, which boosts acceptance. The rapid growth of e-commerce platforms expands consumer access to dietary supplements. Rising awareness campaigns and urbanization further drive the adoption of nutraceutical products.

Latin America

Latin America represents about 7% of the global Forskolin market, with Brazil and Mexico driving most of the demand. Increasing focus on preventive health and weight management encourages supplement purchases. Local distributors collaborate with global manufacturers to expand product availability. It benefits from a growing middle-class population willing to spend on natural health solutions. Regulatory approvals for herbal products are improving, which helps in faster product launches. Expanding retail pharmacy chains and online platforms support wider consumer access. Rising fitness culture and gym memberships in urban areas create additional opportunities for weight-loss supplements.

Middle East & Africa

Middle East & Africa holds nearly 5% of the Forskolin market share and shows steady growth potential. Demand is rising due to increasing health awareness and growing interest in plant-based solutions. Gulf countries are witnessing higher supplement imports to meet consumer demand. It benefits from rising healthcare spending and government initiatives supporting alternative medicine. Distribution networks are expanding, especially in urban centers with higher purchasing power. Companies targeting this region focus on education campaigns to build trust among first-time users. Long-term growth is expected as regulatory clarity improves and e-commerce penetration rises.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Swanson Health Products, Inc.

- NUTRALIE

- NutraBio Labs, Inc.

- Sabinsa Corporation

- Life Extension

- Herbal Nutrition LLC

- BioGanix

- ChromaDex Corp.

- Sabinsa Europe GmbH

- Himalaya Wellness

- Nature’s Way Products, LLC

- Indena S.p.A.

Competitive Analysis

The leading players in the Forskolin market include Swanson Health Products, Inc., NUTRALIE, NutraBio Labs, Inc., Sabinsa Corporation, Life Extension, Herbal Nutrition LLC, BioGanix, ChromaDex Corp., Sabinsa Europe GmbH, Himalaya Wellness, Nature’s Way Products, LLC, and Indena S.p.A. These companies compete on product quality, standardized extract concentrations, distribution reach, and brand reputation. Strong focus is placed on manufacturing high-purity forskolin extracts that meet international safety standards and regulatory requirements. Companies invest in research to validate health benefits and strengthen product positioning in weight management and therapeutic categories. Strategic partnerships with distributors and e-commerce platforms improve global access to products. Innovation plays a key role in maintaining competitive advantage, with several players developing multi-ingredient formulations to cater to consumer demand for comprehensive health solutions. Pricing strategies are optimized to balance affordability and premium positioning, targeting both mass-market and niche segments. Marketing campaigns highlight natural origin, clinical research, and clean-label credentials to attract health-conscious buyers. Expansion into emerging economies remains a priority, with localized production and sourcing strategies reducing costs and ensuring supply chain stability. Competitive intensity is expected to remain high, driving continuous product development, certification efforts, and geographic diversification among these key players.

Recent Developments

- In 2025, Nature’s Way launched its Innovation Challenge, a program to support emerging scientific innovators in health & wellness.

- In 2025, ChromaDex (which rebranded to Niagen Bioscience on March 19, 2025) reported strong financial results for fiscal year 2024, with total net sales reaching $99.6 million, up 19% from 2023. This growth was driven by significant increases in both the Tru Niagen® consumer product and Niagen® ingredient sales, including food-grade and the new pharmaceutical-grade Niagen®.

- In 2024, Sabinsa showcased its range of scientifically validated ingredients, including ForsLean®, BioPerine®, and LactoSpore®, at the CPHI Korea Expo in Seoul

Report Coverage

The research report offers an in-depth analysis based on Concentrated Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Forskolin market will see rising demand for standardized high-purity extracts across supplements.

- Weight management products will remain the primary growth driver globally.

- Pharmaceutical applications will expand with new clinical studies on respiratory and cardiovascular health.

- Demand for clean-label and plant-based products will boost natural forskolin adoption.

- E-commerce channels will drive higher sales through direct-to-consumer models.

- Emerging economies will experience faster growth due to rising health awareness.

- Companies will invest in sustainable cultivation and traceable sourcing practices.

- Research collaborations will focus on proving efficacy and building clinical credibility.

- Product innovation will increase through multi-ingredient formulations targeting metabolic health.

- Global regulatory alignment will support faster approvals and wider product availability