Market Overview

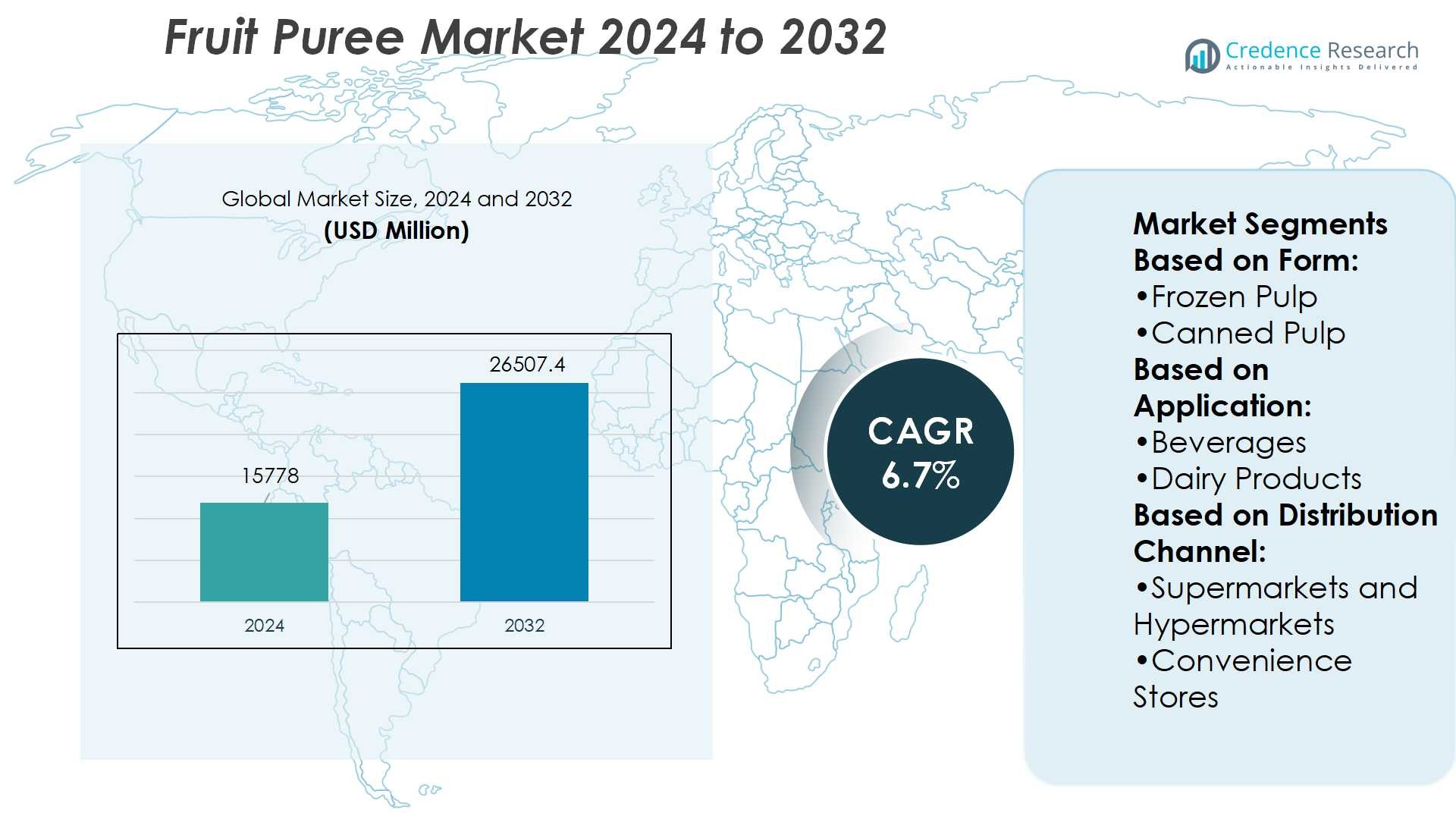

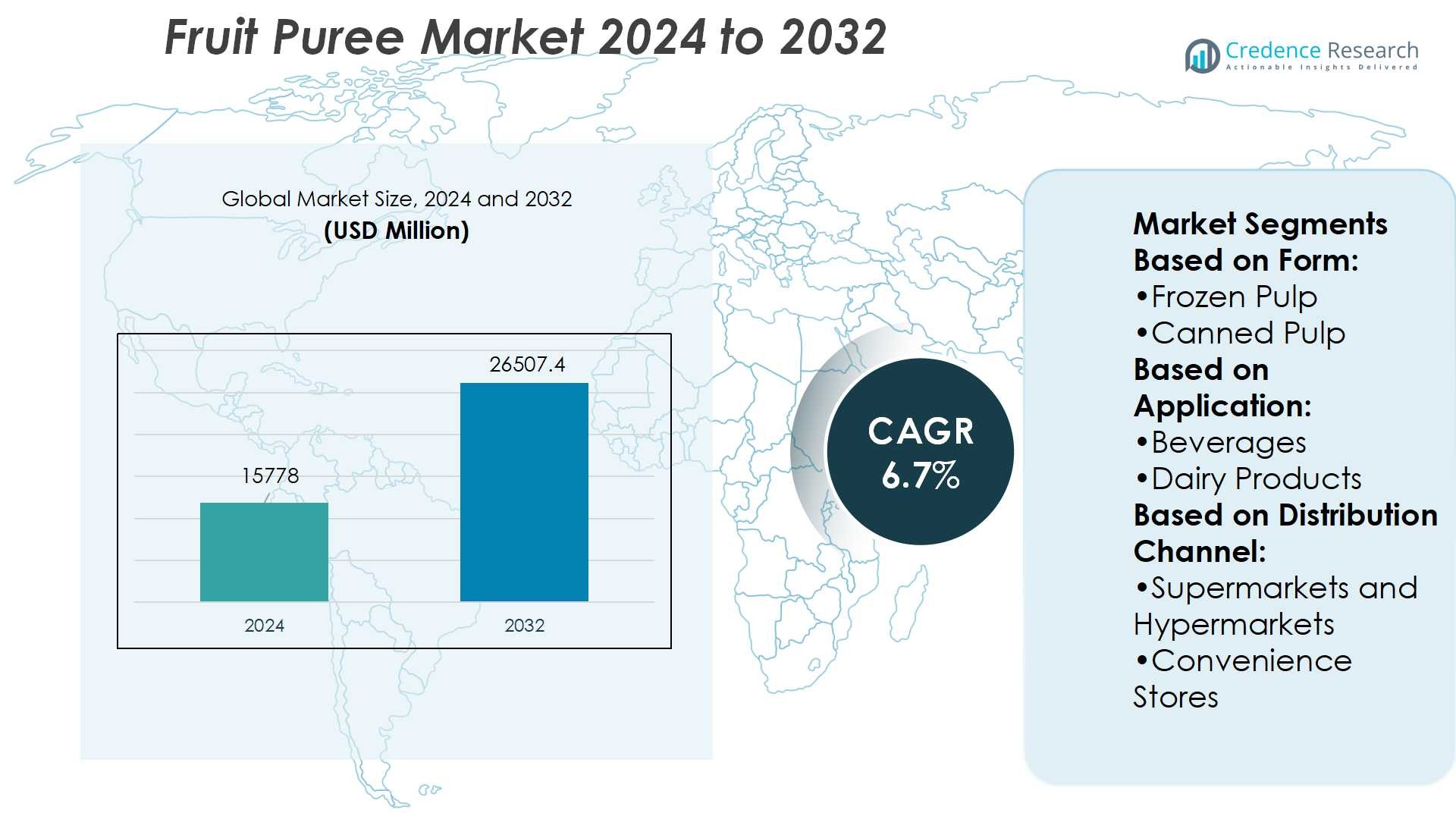

Fruit Puree Market size was valued at USD 15778 million in 2024 and is anticipated to reach USD 26507.4 million by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fruit Puree Market Size 2024 |

USD 15778 Million |

| Fruit Puree Market, CAGR |

6.7% |

| Fruit Puree Market Size 2032 |

USD 26507.4 Million |

The Fruit Puree Market is driven by rising consumer preference for natural, clean label, and organic products, supported by strong demand in baby food, beverages, and dairy-based applications. Health-conscious consumers value fruit puree for its nutritional content, positioning it as a substitute for artificial sweeteners and additives. Expanding applications in bakery, confectionery, and sauces further support growth. Key trends include the adoption of exotic fruit blends, increasing integration into functional and fortified foods, and growing popularity of convenient packaging formats. Plant-based diets and sustainability-focused innovations continue to shape product development, reinforcing fruit puree’s role in global food and beverage markets.

The Fruit Puree Market shows strong regional presence, with Asia Pacific leading due to abundant fruit production and rising demand in beverages and baby food, while North America and Europe follow with high adoption of organic and clean label products. Latin America serves as a major exporter of tropical fruit purees, and the Middle East & Africa expand steadily through imports. Key players include Döhler GmbH, AGRANA Beteiligungs-AG, Tree Top, Uren Food Group, and The Perfect Purée of Napa Valley.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Fruit Puree Market size was USD 15778 million in 2024 and will reach USD 26507.4 million by 2032 at a CAGR of 6.7%.

- Rising consumer demand for natural, clean label, and organic products drives steady market growth.

- Increasing adoption of exotic fruit blends and fortified formulations shapes new product innovation.

- Strong competition exists as companies expand portfolios, improve sourcing, and launch premium offerings.

- Supply chain disruptions, seasonal dependency, and quality standardization challenges act as restraints.

- Asia Pacific leads with high fruit availability, while North America and Europe follow with strong organic adoption.

- Latin America grows as a tropical fruit exporter, and the Middle East & Africa expand through imports.

Market Drivers

Rising Consumer Preference for Natural and Healthy Ingredients

The Fruit Puree Market is driven by consumers prioritizing natural food options. Shoppers look for products free from artificial flavors and preservatives. Growing awareness of nutrient-rich diets strengthens demand across beverages, baby food, and confectionery. Fruit puree serves as a healthier substitute for refined sugar in many recipes. It delivers vitamins, minerals, and fiber without added processing. Health-focused consumers associate puree-based products with transparency and clean labeling, further boosting acceptance.

- For instance, AGRANA production sites held ISO 50001 certification. AGRANA utilises process water derived from raw materials at high rates: its sugar factories cover about 75 % of their process water needs, and its apple juice concentrate plants about 85 %, via internal recovery and treatment.

Expanding Applications Across Food and Beverage Segments

The Fruit Puree Market benefits from increasing use in diverse applications. It supports innovation in smoothies, dairy-based drinks, baked goods, and frozen desserts. Food companies rely on puree to enhance flavor, texture, and visual appeal. It offers a flexible base for new product development across global markets. Demand from premium and organic segments continues to strengthen adoption. The versatility of fruit puree ensures steady expansion across both mass-market and specialty products.

- For instance, The Perfect Purée’s Tastecraft freeze-dried fruit line includes seven flavors shelf life of up to 24 months for most flavors, and size variation in crumbles ranging from 2-6 mm in freeze-dried state.

Strong Growth Supported by Rising Demand in Baby Food

The Fruit Puree Market records strong demand in baby food formulations. Parents prefer fruit puree due to its natural composition and easy digestibility. Convenience packs and pouches drive growth in developed and emerging markets. It helps manufacturers meet evolving safety standards and nutritional requirements. Trust in puree-based products supports brand loyalty among health-conscious families. Expansion in infant nutrition further secures steady growth for suppliers.

Rising Popularity of Plant-Based and Vegan Diets

The Fruit Puree Market gains momentum from the global shift toward plant-based diets. Consumers adopt vegan and vegetarian lifestyles, increasing reliance on fruit-based ingredients. Puree aligns with sustainability values by reducing food waste through fruit processing. It supports innovation in dairy alternatives, plant-based desserts, and energy snacks. Demand is further strengthened by younger demographics favoring eco-friendly products. Growing integration into vegan-friendly formulations positions fruit puree as a strategic growth driver.

Market Trends

Growing Focus on Organic and Clean Label Offerings

The Fruit Puree Market reflects rising demand for organic and clean label products. Consumers prefer purees without artificial additives, colors, or preservatives. It strengthens trust in brands committed to natural formulations. Organic certifications play a vital role in purchasing decisions across developed markets. Clean labeling also appeals to parents seeking safe options for children. This trend drives food companies to reformulate portfolios and expand premium offerings.

- For instance, Döhler explicitly states it uses more than 50 technologies to process more than 5,000 natural raw materials. This extensive range allows for innovation and customization in food and beverage products.

Increasing Integration into Functional and Fortified Foods

The Fruit Puree Market benefits from rising use in functional food products. Manufacturers blend purees with probiotics, vitamins, or plant proteins to enhance nutrition. It supports the growing consumer shift toward wellness-oriented diets. Fortified fruit-based snacks, beverages, and yogurts highlight this trend. Companies adopt fruit puree to balance taste with health-focused innovation. This integration secures greater visibility in competitive health and wellness categories.

- For instance, Kunyu offers “puree concentrate” products such as apricot, white peach, yellow peach, apple, pineapple etc., all from 100 % fresh fruit, with “no color added. Their packaging / loading capability: for one product line, they specify “Loadability/ 20ft container: 2200 cartons”.

Expanding Popularity in On-the-Go and Convenient Formats

The Fruit Puree Market aligns with demand for portable and convenient formats. Pouches and single-serve packs gain strong traction among busy consumers. It appeals to working professionals and parents seeking easy nutrition. Shelf-stable packaging technology extends product reach in retail channels. The combination of convenience and natural appeal boosts adoption in both mature and emerging regions. Companies continue to launch travel-friendly fruit puree offerings to capture wider audiences.

Rising Role in Plant-Based and Dairy Alternatives

The Fruit Puree Market supports growth in plant-based and dairy-alternative products. Purees are widely used in smoothies, yogurts, and frozen desserts. It provides natural sweetness and texture without artificial ingredients. Plant-based trends encourage experimentation with tropical and exotic fruit varieties. Consumers welcome innovative blends that align with sustainability values and vegan diets. This trend positions fruit puree as a core ingredient in next-generation product innovation.

Market Challenges Analysis

Supply Chain Disruptions and Seasonal Dependency

The Fruit Puree Market faces challenges from supply chain disruptions and reliance on seasonal crops. Limited availability of certain fruits during off-season periods creates price volatility. It impacts production consistency and affects long-term supplier agreements. Transportation delays and rising freight costs further disrupt timely delivery to manufacturers. Climate change also influences crop yields, increasing uncertainty for producers. Companies must invest in diversified sourcing and advanced storage solutions to mitigate these risks.

Quality Standardization and Rising Competition from Alternatives

The Fruit Puree Market also struggles with quality standardization across regions. Variations in fruit origin, processing methods, and preservation techniques lead to inconsistent product profiles. It complicates international trade and limits consumer trust in certain categories. Rising competition from concentrates, powders, and synthetic flavorings adds further pressure. These alternatives often offer lower costs and longer shelf life, attracting cost-sensitive buyers. Ensuring consistent quality while maintaining natural attributes remains a critical challenge for producers.

Market Opportunities

Rising Demand for Premium and Exotic Fruit Blends

The Fruit Puree Market presents opportunities through increasing demand for premium and exotic blends. Consumers seek unique flavor profiles from tropical fruits such as mango, passion fruit, and guava. It enables food and beverage brands to create differentiated offerings in competitive markets. Premiumization trends in desserts, smoothies, and baby food open space for innovative formulations. The shift toward gourmet and natural taste experiences expands potential across both retail and foodservice channels. Partnerships with growers in emerging regions can further strengthen supply diversity and brand positioning.

Expansion into Functional Nutrition and Emerging Economies

The Fruit Puree Market also gains opportunities from functional nutrition and rising health awareness. Purees enriched with fiber, antioxidants, and plant proteins appeal to wellness-focused consumers. It positions fruit-based products as convenient solutions for balanced lifestyles. Growing middle-class populations in Asia Pacific, Latin America, and Africa increase demand for affordable nutritious options. Emerging economies represent strong potential for packaged fruit puree adoption in beverages and snacks. Companies investing in localized flavors and tailored marketing strategies can capture long-term growth in these regions.

Market Segmentation Analysis:

By Form

The Fruit Puree Market is segmented into frozen pulp, canned pulp, concentrated pulp, and fresh pulp. Frozen pulp secures high demand due to its extended shelf life and preserved nutritional content. Canned pulp holds relevance in regions with strong distribution networks and high consumption of packaged goods. Concentrated pulp attracts manufacturers because it reduces storage and transportation costs while maintaining flavor intensity. Fresh pulp caters to premium categories and consumers seeking natural taste, though it faces challenges in storage and logistics. Each form plays a strategic role in meeting diverse consumer and industrial requirements.

- For instance, Fénix produces apple purée in three different Brix levels: 12-16°, 30-32°, and 36-38° Brix, enabling tailored forms like fresh pulp (lower Brix), concentrated pulp (higher Brix), and canned/preserved formats.

By Application

The Fruit Puree Market finds applications in beverages, dairy products, desserts and confectionery, bakery and snacks, baby food, sauces and dressings, ice cream and sorbets, and others. Beverages dominate consumption, with smoothies, juices, and flavored drinks incorporating fruit puree for taste and nutrition. Dairy products such as yogurts and flavored milk continue to expand their reliance on puree-based formulations. Baby food records strong growth due to rising demand for safe, natural, and easy-to-digest products. Desserts, confectionery, and bakery items benefit from puree’s ability to enhance flavor and texture. Sauces, dressings, ice creams, and sorbets further diversify applications, ensuring broad market penetration.

- For instance, Its portfolio includes 25 process-technology platforms and 22 core technologies, which are integrated in food applications. Technologies include extrusion, fermentation, spray drying, ultrafiltration, enzymes, and bio-preservation.

By Distribution Channel

The Fruit Puree Market is distributed through supermarkets and hypermarkets, convenience stores, online retailers, and foodservice providers. Supermarkets and hypermarkets remain key due to wide product availability and consumer preference for bulk purchases. Convenience stores appeal to urban buyers seeking quick access to packaged puree. Online retailers demonstrate rapid growth, supported by e-commerce expansion and consumer preference for doorstep delivery. Foodservice providers including restaurants and cafes utilize puree for beverages, desserts, and specialty dishes. Each channel supports the market by addressing unique purchasing behaviors across developed and emerging regions.

Segments:

Based on Form:

Based on Application:

Based on Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

Based on the Geography:

o U.S.

o Canada

o Mexico

o UK

o France

o Germany

o Italy

o Spain

o Russia

o Belgium

o Netherlands

o Austria

o Sweden

o Poland

o Denmark

o Switzerland

o Rest of Europe

o China

o Japan

o South Korea

o India

o Australia

o Thailand

o Indonesia

o Vietnam

o Malaysia

o Philippines

o Taiwan

o Rest of Asia Pacific

o Brazil

o Argentina

o Peru

o Chile

o Colombia

o Rest of Latin America

o UAE

o KSA

o Israel

o Turkey

o Iran

o Rest of Middle East

o Egypt

o Nigeria

o Algeria

o Morocco

o Rest of Africa

Regional Analysis

North America

North America holds 29.5% of the Fruit Puree Market, led by the U.S. with its strong demand in baby food, functional beverages, and health-focused snacks. The region benefits from advanced food processing technologies and strict regulatory standards that guarantee high quality. Consumers favor clean label and organic products, which drive continuous product innovation. Canada supports growth with rising demand for tropical and exotic fruit varieties. Supermarkets and online retail platforms boost accessibility, while convenience packaging such as pouches attracts busy families. The focus on healthier eating habits and plant-based diets keeps North America a stable and mature market with steady expansion.

Europe

Europe represents 26.3% of global revenue, with Germany, France, and the U.K. leading consumption. The region emphasizes sustainability, organic production, and transparent labeling, which strengthen consumer trust. Demand for fruit puree is high in bakery, desserts, and premium beverages. Regulatory compliance drives higher quality standards, compelling companies to maintain strict sourcing and production processes. Growing interest in exotic fruits such as mango, passion fruit, and guava has diversified applications. The strong presence of multinational food companies ensures constant product launches. Europe’s focus on natural and functional nutrition supports long-term growth.

Asia Pacific

Asia Pacific dominates with 34.7% share and shows the highest growth potential. China and India lead the region with rising demand in baby food, dairy-based drinks, and juices. Local fruit abundance, including mangoes, bananas, and guavas, reduces raw material costs and strengthens supply chains. Expanding cold storage facilities and logistics infrastructure improve shelf life and product reach. Urbanization and income growth encourage wider adoption of packaged puree products. Manufacturers target affordability and nutrition to meet diverse consumer needs. The region’s growing health-conscious middle class and rising e-commerce penetration drive rapid expansion, making it the most dynamic regional market.

Latin America

Latin America accounts for 7% of the global Fruit Puree Market. Brazil and Mexico dominate consumption while also acting as major exporters of mango, papaya, guava, and passion fruit purees. Local fruit availability provides the region with a competitive advantage. Rising demand for natural juices, smoothies, and baby food supports domestic growth. Limited cold storage and processing infrastructure remain challenges but also attract investment from international companies. Partnerships with global players help enhance supply chain efficiency and export capacity. Latin America’s tropical climate and agricultural base position it as a strategic sourcing hub for global puree suppliers.

Middle East & Africa

The Middle East & Africa hold 2.5% of the global market. Gulf countries and South Africa lead demand, largely driven by imports. Rising disposable incomes and younger demographics create opportunities for packaged fruit-based products. Foodservice outlets, including cafes and quick-service restaurants, use purees for desserts, juices, and sauces. Infrastructure constraints such as cold storage and distribution networks limit growth but also open doors for investment. Government initiatives to diversify food imports and promote healthier diets support gradual market expansion. With rising interest in exotic and natural foods, the region offers long-term potential despite its small current share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tree Top

- AGRANA Beteiligungs-AG

- The Perfect Purée of Napa Valley

- Döhler GmbH

- Uren Food Group Limited

- CHINA KUNYU INDUSTRIAL CO., LIMITED

- Fénix

- Brothers International Food Holdings, LLC.

- Grünewald International

- Kerr by Ingredion

Competitive Analysis

The Fruit Puree Market players including Fénix, Döhler GmbH, Kerr by Ingredion, AGRANA Beteiligungs-AG, Brothers International Food Holdings LLC, CHINA KUNYU INDUSTRIAL CO., LIMITED, Grünewald International, Tree Top, Uren Food Group Limited, and The Perfect Purée of Napa Valley. The Fruit Puree Market demonstrates strong competition, with companies focusing on innovation, sustainability, and global expansion. Producers emphasize organic-certified ranges, clean label offerings, and convenient packaging formats to meet evolving consumer preferences. Investments in advanced processing technologies support consistent quality and extended shelf life. Strategic sourcing from tropical regions strengthens supply chains and ensures year-round availability. Many firms also expand their presence in emerging economies, targeting rising demand for baby food, beverages, and dairy-based applications. Continuous product differentiation and alignment with health-focused consumer trends remain vital for maintaining competitiveness in this market.

Recent Developments

- In April 2025, Oregon Fruit Products introduced Our limited edition Sicilian Lemon aseptic fruit puree brings a new level of sophistication to the table with its muted yellow hue, soft yet intense lemon this portfolio addition is one of the newly available citrus ingredients for seasonal brewing applications.

- In October 2023, iTi Tropicals formulated both a puree and a concentrate from acerola fruit, also known as the Barbados cherry or West-Indian cherry. This product innovation was highlighted for its high vitamin C content and its ability to replace added ascorbic or citric acid, reduce pH, potentially extend shelf life, and impart a tart flavor.

- In October 2023, Okanagan Specialty Fruits opened a new apple processing facility on a 42.5-acre site in Moses Lake, Washington. The plant was built to process, slice, and pack the company’s Arctic apple products and is located near their orchards to enhance operational efficiency, quality, and minimize transportation.

- In March 2023, PepsiCo announced multi-year investment in long-term, strategic partnership agreements with three of the most well-known farmer-facing organizations – Practical Farmers of Iowa (PFI), Soil and Water Outcomes Fund (SWOF), and the Illinois Corn Growers Association (ICGA) – to drive adoption of regenerative agriculture practices across the United States.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic and clean label fruit purees will continue to rise globally.

- Companies will invest in sustainable sourcing and eco-friendly packaging solutions.

- Functional nutrition will drive innovation in fortified fruit-based snacks and beverages.

- Emerging markets will see stronger adoption due to urbanization and rising incomes.

- Premium and exotic fruit blends will gain popularity in desserts and beverages.

- Baby food formulations will remain a major growth driver for fruit puree demand.

- Online retail channels will expand distribution and improve consumer accessibility.

- Foodservice providers will increase usage of fruit purees in menus and specialty items.

- Technological advancements in cold storage and processing will reduce supply chain risks.

- Plant-based and vegan product launches will strengthen reliance on fruit purees.