Market Overview:

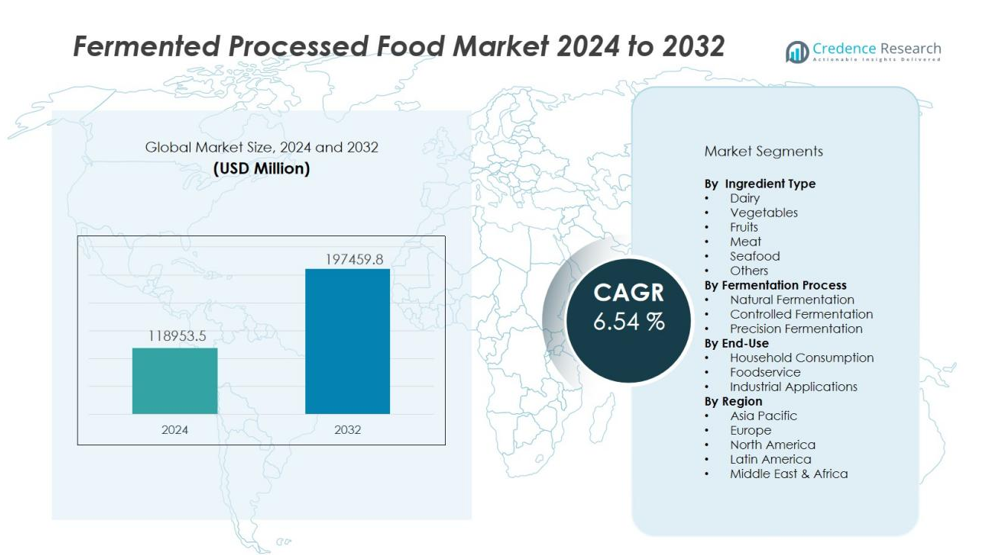

The fermented processed food market size was valued at USD 118953.5 million in 2024 and is anticipated to reach USD 197459.8 million by 2032, at a CAGR of 6.54 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fermented Processed Food Market Size 2024 |

USD 118953.5 million |

| Fermented Processed Food Market , CAGR |

6.54% |

| Fermented Processed Food Market Size 2032 |

USD 197459.8 million |

Market growth is driven by rising consumer health consciousness, with increasing preference for probiotic-rich foods that promote gut health, digestion, and immunity. The demand for natural, functional, and convenient food options is accelerating product innovation in dairy, plant-based alternatives, beverages, and condiments. Busy lifestyles are fueling interest in ready-to-eat fermented products, while clean-label and plant-based dietary trends are encouraging manufacturers to expand offerings with minimal additives and high nutritional value.

North America currently holds a dominant share, with an estimated value near USD 30 billion in 2023, driven by high consumer awareness and strong retail distribution networks. Asia Pacific is the fastest-growing region, benefiting from cultural familiarity with fermented foods, rising urbanization, and increasing disposable incomes, particularly in China, Japan, and South Korea. Europe and other regions continue to show steady growth supported by established consumption patterns and ongoing product innovation.

Market Insights:

- The fermented processed food market was valued at USD 118,953.5 million in 2024 and is projected to reach USD 197,459.8 million by 2032, registering a CAGR of 6.54% during 2024–2032.

- Rising health consciousness and preference for probiotic-rich foods are boosting demand, with products like yogurt, kimchi, kefir, and sauerkraut gaining prominence.

- Clean-label and plant-based product innovations are expanding consumer reach, supported by ethical, sustainable, and transparent ingredient sourcing.

- Growing urbanization and busy lifestyles are fueling interest in ready-to-eat fermented items with convenient packaging and extended shelf life.

- Innovation in flavors and adaptation of regional specialties such as kombucha, miso, and tempeh are driving global appeal and market expansion.

- North America holds 28% market share, Asia Pacific leads with 34% market share as the fastest-growing region, and Europe accounts for 25% market share with steady growth.

- Regulatory compliance, quality standardization challenges, and cold chain logistics requirements remain key hurdles, while consumer education and targeted marketing present growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Probiotic-Rich and Functional Foods:

The fermented processed food market benefits from a growing consumer preference for probiotic-rich and functional foods that support digestive health and immunity. Scientific evidence linking fermented products to gut microbiome balance is influencing purchasing decisions. Consumers are increasingly aware of the nutritional advantages offered by products such as yogurt, kimchi, sauerkraut, and kefir. Food companies are responding with targeted formulations that highlight probiotic content. This trend is fostering premiumization and differentiation across product portfolios.

- For instance, Lifeway Foods achieved 2024 net sales of $186.8 million, representing 17% year-over-year growth and marking their 21st consecutive quarter of growth.

Expansion of Clean-Label and Plant-Based Product Offerings:

Clean-label and plant-based movements are reshaping the fermented processed food market. Shoppers expect transparency in ingredients and production methods, leading to the removal of artificial preservatives, colors, and flavors. Manufacturers are introducing plant-based fermented alternatives to traditional dairy and meat items, appealing to vegans, vegetarians, and flexitarians. It supports environmental sustainability goals while meeting ethical consumption preferences. This shift is widening the appeal of fermented products beyond traditional consumer bases.

- For instance, If U.S. food makers , switched entirely to making their products with Perfect Day animal-free whey protein, we could avoid 246 million tonnes of CO2e emissions, with 91–97% lower in greenhouse gas emissions than conventional bovine whey protein.

Urbanization and Shift Toward Convenient Ready-to-Eat Formats:

Urban lifestyles and higher disposable incomes are driving demand for ready-to-eat and easy-to-store fermented products. The fermented processed food market is leveraging convenience-oriented packaging, portion control, and extended shelf life to target busy consumers. Retailers are increasing the availability of these items in supermarkets, online stores, and specialty outlets. It strengthens penetration into markets where traditional fermentation practices are less common. This distribution flexibility enhances accessibility and accelerates market adoption.

Innovation in Flavors and Cross-Cultural Product Adaptation:

Innovation in flavor profiles and cross-cultural adaptation is enhancing the global appeal of the fermented processed food market. Manufacturers are blending traditional fermentation techniques with novel ingredients to attract adventurous consumers. Regional specialties such as miso, kombucha, and tempeh are being adapted to local tastes and dietary norms. It creates opportunities for brand diversification and market expansion. Strategic product localization is helping brands capture both emerging and mature markets.

Market Trends:

Integration of Advanced Fermentation Technologies and Sustainable Practices:

The fermented processed food market is witnessing the integration of advanced fermentation technologies aimed at improving product consistency, safety, and scalability. Automation, precision fermentation, and controlled microbial cultures are enabling manufacturers to deliver uniform quality while reducing production time. It is also promoting sustainable practices by lowering energy use and minimizing waste. Companies are focusing on sourcing local raw materials and adopting eco-friendly packaging to align with environmental goals. The incorporation of biotechnology is expanding the range of ingredients that can be fermented, creating new flavor profiles and nutritional enhancements. This technological shift is positioning fermentation as both a traditional craft and a modern food production method.

- For instance, Cauldron, an Australian biotech, has implemented continuous “hyper fermentation” processes at a 10,000-liter scale.

Diversification of Product Portfolios and Expansion into Emerging Markets:

The fermented processed food market is diversifying beyond traditional dairy and vegetable-based products to include beverages, plant-based proteins, and functional snacks. It is enabling brands to target multiple consumer segments with tailored health and flavor propositions. The popularity of global cuisines is encouraging the adaptation of regional fermented specialties for mainstream retail channels. E-commerce growth is providing direct access to emerging markets, where rising urbanization and middle-class expansion are driving demand. Manufacturers are also leveraging limited-edition and seasonal launches to maintain consumer interest and build brand loyalty. This diversification strategy is strengthening the competitive landscape and opening long-term growth opportunities.

- For instance, Fermented Food Holdings increased its sauerkraut production capacity by 20% in 2024 after expanding its Bear Creek facility to process 20 million more pounds of cabbage per year, shipping its products to all 50 U.S. states and internationally.

Market Challenges Analysis:

Regulatory Compliance and Quality Standardization Issues:

The fermented processed food market faces challenges related to diverse regulatory frameworks and quality standardization across regions. Variations in food safety laws, labeling requirements, and probiotic health claims create complexity for global manufacturers. It must address the risk of inconsistent microbial compositions, which can affect product efficacy and safety. Smaller producers often struggle with the high costs of compliance testing and certification. Cross-border trade becomes more difficult when regulatory interpretations differ. This situation can slow market entry and limit international expansion potential.

Supply Chain Constraints and Consumer Perception Barriers:

The fermented processed food market encounters supply chain vulnerabilities due to reliance on specific raw materials and controlled production environments. It can face disruptions from seasonal availability, transportation delays, or fluctuations in input costs. Maintaining consistent cold chain logistics remains critical for product safety and shelf life. Some consumers remain skeptical about the taste or safety of certain fermented items, limiting adoption in unfamiliar markets. Education and marketing efforts are required to build trust and awareness. These constraints demand strategic sourcing, investment in infrastructure, and targeted consumer engagement to sustain growth.

Market Opportunities:

Expansion into Functional and Personalized Nutrition Segments:

The fermented processed food market holds significant potential in functional and personalized nutrition. Rising demand for gut health, immunity-boosting, and nutrient-rich foods is creating opportunities for targeted product development. It can leverage advances in microbiome research to design formulations tailored to specific health needs. Personalized probiotic blends, fortified fermented beverages, and low-sugar alternatives are attracting health-conscious consumers. Collaborations with healthcare professionals and nutritionists can enhance credibility and brand differentiation. This segment is positioned for strong growth as consumers seek products that align with individual wellness goals.

Growth Potential in Emerging Markets and Digital Commerce Channels:

The fermented processed food market can expand its footprint in emerging economies where rising disposable incomes, urbanization, and dietary diversification are driving demand. It can adapt traditional fermentation techniques to modern, convenient formats that appeal to younger consumers. E-commerce platforms offer direct access to new customer bases, enabling brands to bypass traditional retail limitations. Strategic partnerships with local distributors and influencers can accelerate market penetration. Innovative packaging and regional flavor adaptations can further boost acceptance. This approach supports long-term growth by blending cultural authenticity with modern consumer expectations.

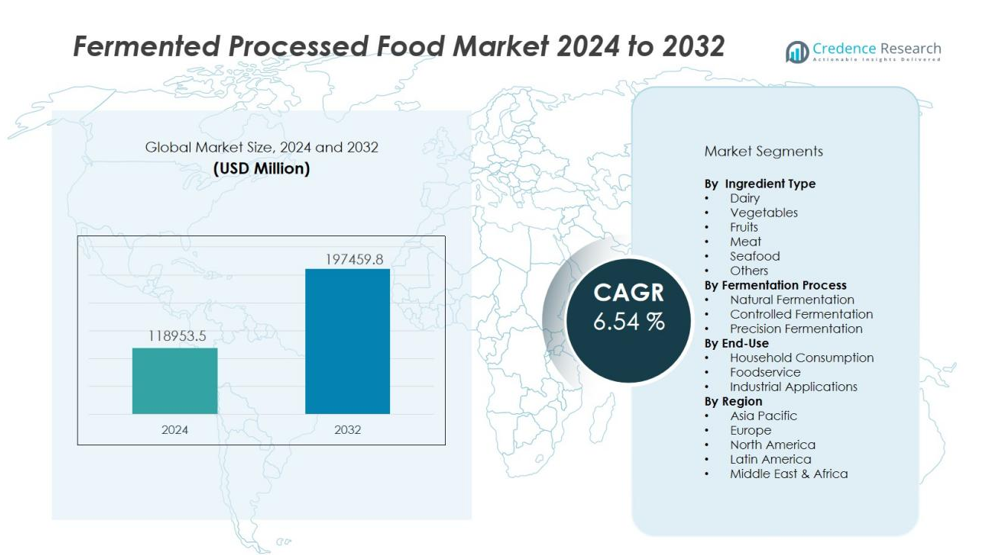

Market Segmentation Analysis:

By Ingredient Type:

The fermented processed food market is segmented into dairy, vegetables, fruits, meat, seafood, and others. Dairy-based fermented products such as yogurt, kefir, and cheese dominate due to widespread consumption and high probiotic content. Vegetable-based options like kimchi and sauerkraut are gaining traction among health-conscious and plant-based consumers. It is also witnessing growth in fruit-based fermented beverages and meat or seafood fermentations in niche cultural markets. This diversity allows manufacturers to target multiple dietary preferences and regional tastes.

- For instance, The Better Meat Co. unveiled a 13,000square.foot. mycoprotein fermentation plant to produce meat analog ingredients, marking one of the world’s largest whole biomass fermentation facilities and expanding options for niche markets.

By Fermentation Process:

Key processes include natural fermentation, controlled fermentation, and precision fermentation. Natural fermentation remains prevalent in traditional and artisanal products, offering authentic taste and texture. Controlled fermentation is expanding due to its ability to ensure product safety, consistency, and scalability. Precision fermentation, supported by biotechnology, is emerging as a growth area for producing functional ingredients and plant-based alternatives. It enables innovation while maintaining high nutritional value.

By End-Use:

End-use segments include household consumption, foodservice, and industrial applications. Household consumption leads the market, supported by retail availability and growing awareness of health benefits. Foodservice adoption is increasing, particularly in restaurants and cafes offering global and fusion cuisines. Industrial applications focus on using fermented ingredients in processed foods, beverages, and dietary supplements. It reflects the versatility of fermentation in both direct and indirect consumption channels.

- For instance, the omega-3 fatty acid market has grown significantly, with a global market from an estimated USD 2.10 billion in 2020 to a predicted nearly USD 3.61 billion in 2028.

Segmentations:

By Ingredient Type:

- Dairy

- Vegetables

- Fruits

- Meat

- Seafood

- Others

By Fermentation Process:

- Natural Fermentation

- Controlled Fermentation

- Precision Fermentation

By End-Use:

- Household Consumption

- Foodservice

- Industrial Applications

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America :

North America holds 28% market share in the global fermented processed food market, supported by high consumer awareness of probiotic and functional food benefits. The region benefits from advanced manufacturing capabilities and widespread retail penetration across supermarkets, specialty stores, and online platforms. It is driven by strong demand for yogurt, kombucha, kefir, and plant-based fermented alternatives. Regulatory frameworks that ensure product safety and labeling transparency reinforce consumer trust. The trend toward clean-label, organic, and fortified products is accelerating innovation. Major brands are investing in new flavors and formats to sustain competitive advantage. Cross-category diversification is further strengthening regional growth prospects.

Asia Pacific:

Asia Pacific accounts for 34% market share in the fermented processed food market, driven by cultural familiarity with fermented diets and increasing urbanization. It benefits from deep-rooted consumption of traditional products such as kimchi, miso, natto, tempeh, and fermented dairy beverages. Rising disposable incomes and expanding middle-class populations are creating new demand for premium and convenience-oriented formats. It is also experiencing rapid adoption of international fermented products through retail and foodservice channels. Regional producers are combining traditional fermentation methods with modern packaging and distribution strategies. Government initiatives promoting functional and health-oriented foods are further enhancing market adoption.

Europe:

Europe holds 25% market share in the fermented processed food market, supported by established consumption of dairy-based and vegetable-based fermented items. Strong quality standards and strict regulatory frameworks ensure consistency and consumer safety. It benefits from a growing preference for plant-based, organic, and low-sugar alternatives. Innovation in flavor profiles and incorporation of superfoods are expanding product appeal. The region is witnessing increased interest in Eastern European fermented specialties in mainstream retail channels. Strategic marketing and investment in sustainable production practices are reinforcing Europe’s position as a key contributor to global market stability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The fermented processed food market is moderately competitive, with global players and regional specialists competing across diverse product categories. Key companies include Cargill, Inc., Archer Daniels Midland Company, BASF SE, Dupont De Nemours and Company, Koninklijke DSM N.V., Fonterra Co-Operative Group Limited, and Danone SA. It is characterized by strong brand positioning, extensive distribution networks, and continuous investment in product innovation. Leading firms focus on expanding probiotic-rich and functional product lines, integrating clean-label formulations, and developing plant-based alternatives to meet evolving consumer preferences. Strategic initiatives such as mergers, acquisitions, and partnerships are common to enhance market presence and portfolio diversity. Companies also invest in advanced fermentation technologies to improve quality control, scalability, and sustainability. Competitive differentiation relies on health-focused marketing, regional flavor adaptation, and leveraging digital channels to strengthen consumer engagement.

Recent Developments:

- In July 2025, Cargill announced a partnership with PepsiCo to advance regenerative agriculture across 240,000 acres in Iowa by 2030, focusing on sustainable grain sourcing practices.

- In April 2025, BASF’s Personal Care business in the United States moved to a sole distributor arrangement, optimizing its distribution and supply chain for North American customers.

- In May 2024, Nestlé introduced the “Vital Pursuit” brand in the U.S., catering to individuals using GLP-1 weight loss medications.

Market Concentration & Characteristics:

The fermented processed food market exhibits moderate to high concentration, with a mix of global corporations and strong regional players competing across diverse product categories. It is characterized by brand loyalty, product differentiation, and continuous innovation in flavor, formulation, and packaging. Leading companies leverage advanced fermentation technologies, extensive distribution networks, and strong marketing capabilities to maintain market presence. Niche and artisanal producers contribute to diversity by offering authentic, region-specific products that appeal to health-conscious and culturally driven consumers. Strategic mergers, acquisitions, and partnerships are common, enabling companies to expand portfolios and enter new markets. The industry’s competitive landscape is shaped by regulatory compliance, quality assurance, and the ability to adapt to evolving consumer preferences for clean-label, functional, and sustainable products.

Report Coverage:

The research report offers an in-depth analysis based on Ingredient Type, Fermentation Process, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for probiotic-rich and functional fermented foods will continue to expand, driven by increasing focus on gut health and immunity.

- Innovation in fermentation technology will enhance product consistency, safety, and scalability across multiple food categories.

- Plant-based and dairy-alternative fermented products will gain greater traction among vegan, vegetarian, and flexitarian consumers.

- Premiumization of fermented products will accelerate through unique flavor profiles, fortified nutrition, and clean-label formulations.

- E-commerce and direct-to-consumer channels will play a larger role in global distribution, improving accessibility to niche and specialty products.

- Regional and traditional fermentation techniques will inspire global product adaptation, creating cross-cultural appeal.

- Sustainable sourcing, eco-friendly packaging, and waste reduction initiatives will strengthen brand positioning.

- Strategic partnerships between food manufacturers, biotech firms, and research institutions will foster advanced probiotic and functional ingredient development.

- Marketing campaigns focused on health education and taste familiarity will help overcome consumer perception barriers in emerging markets.

- Expansion into untapped geographies with rising urbanization and middle-class growth will create new revenue opportunities for industry participants.