Market Overview

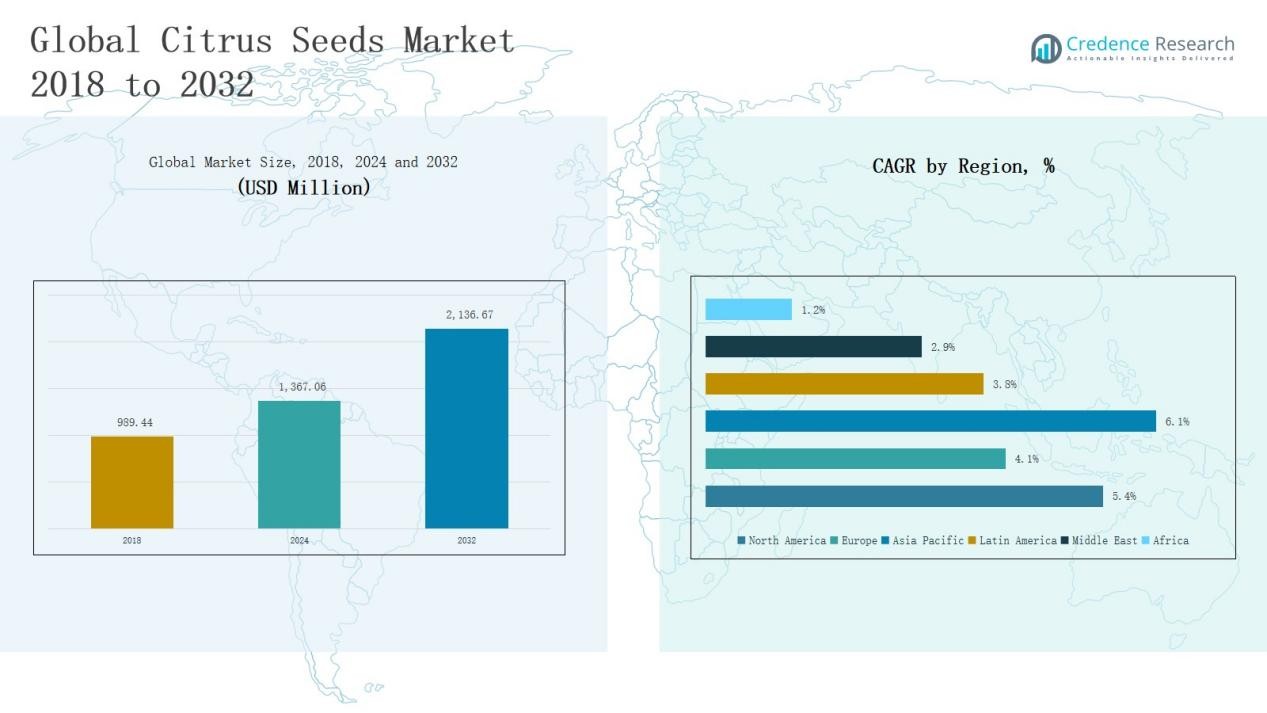

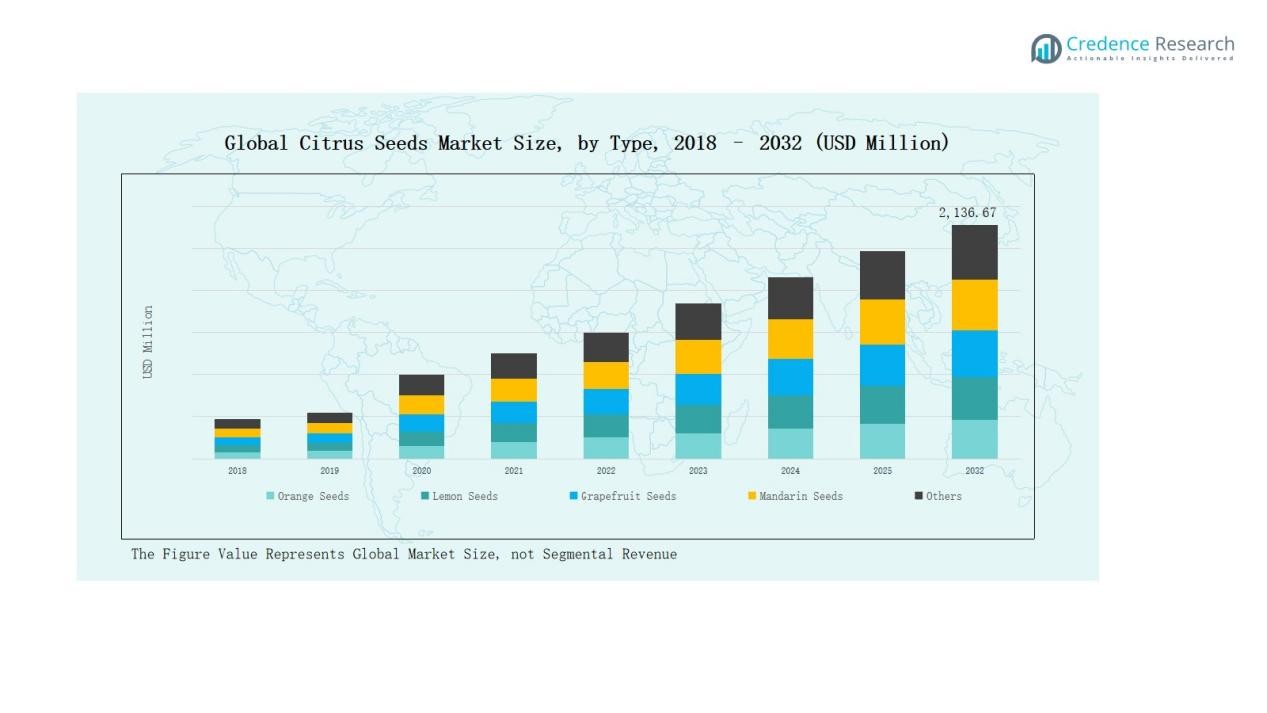

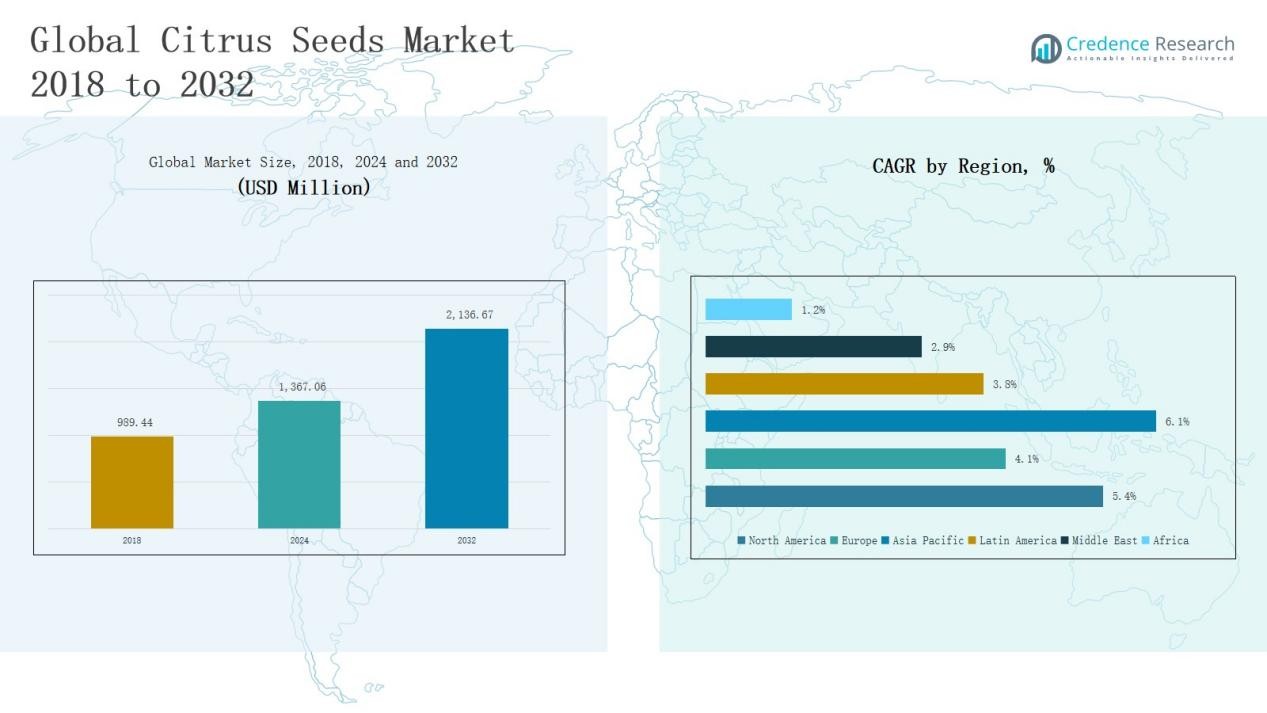

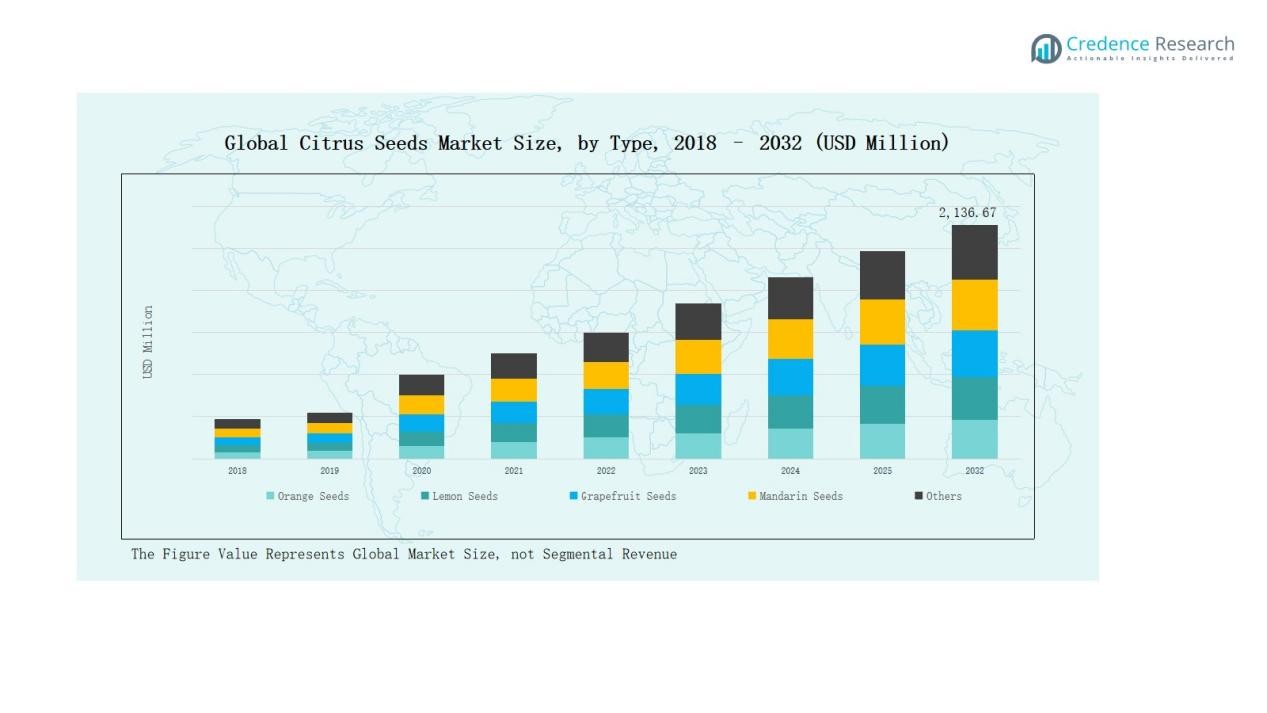

Citrus Seeds Market size was valued at USD 989.44 million in 2018 to USD 1,367.06 million in 2024 and is anticipated to reach USD 2,136.67 million by 2032, at a CAGR of 5.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Citrus Seeds Market Size 2024 |

USD 1,367.06 Million |

| Citrus Seeds Market, CAGR |

5.34% |

| Citrus Seeds Market Size 2032 |

USD 2,136.67 Million |

In the global citrus seeds market, prominent participants include Louis Dreyfus Company B.V., Dole Food Company Inc., Citrosuco S.A., Sun Pacific Inc., Citrofrut, Yantai North Andre Juice Co. Ltd., Sunkist Growers Inc., Gless Ranch Inc., Sun Orchard LLC, and Alico Inc. North America emerged as the leading region in 2022, with the United States alone accounting for 73.5% of the regional share. Strong demand for citrus-based products, coupled with advanced processing facilities, extensive distribution networks, and a robust agricultural base, continues to strengthen the region’s dominance. Key players focus on product quality, supply chain optimization, and expanding their global reach to maintain competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Citrus Seeds Market grew from USD 989.44 million in 2018 to USD 1,367.06 million in 2024 and is expected to reach USD 2,136.67 million by 2032, at a CAGR of 5.34%.

- Expanding demand for natural ingredients, rising functional food and nutraceutical consumption, and increasing use in cosmetics drive market growth, supported by clean-label trends and regulatory encouragement.

- Seasonal supply dependency, high processing costs, and competition from synthetic alternatives present key challenges, impacting production consistency and pricing in global markets.

- Asia Pacific leads with a 40.0% share in 2024, followed by North America at 25.4% and Europe at 15.4%, with Asia Pacific also recording the fastest growth rate.

- Leading companies, including Louis Dreyfus Company, Dole Food Company Inc., Citrosuco S.A., and Sunkist Growers Inc., focus on product quality, supply chain efficiency, and expanding global reach to maintain competitiveness.

Market Segment Insights

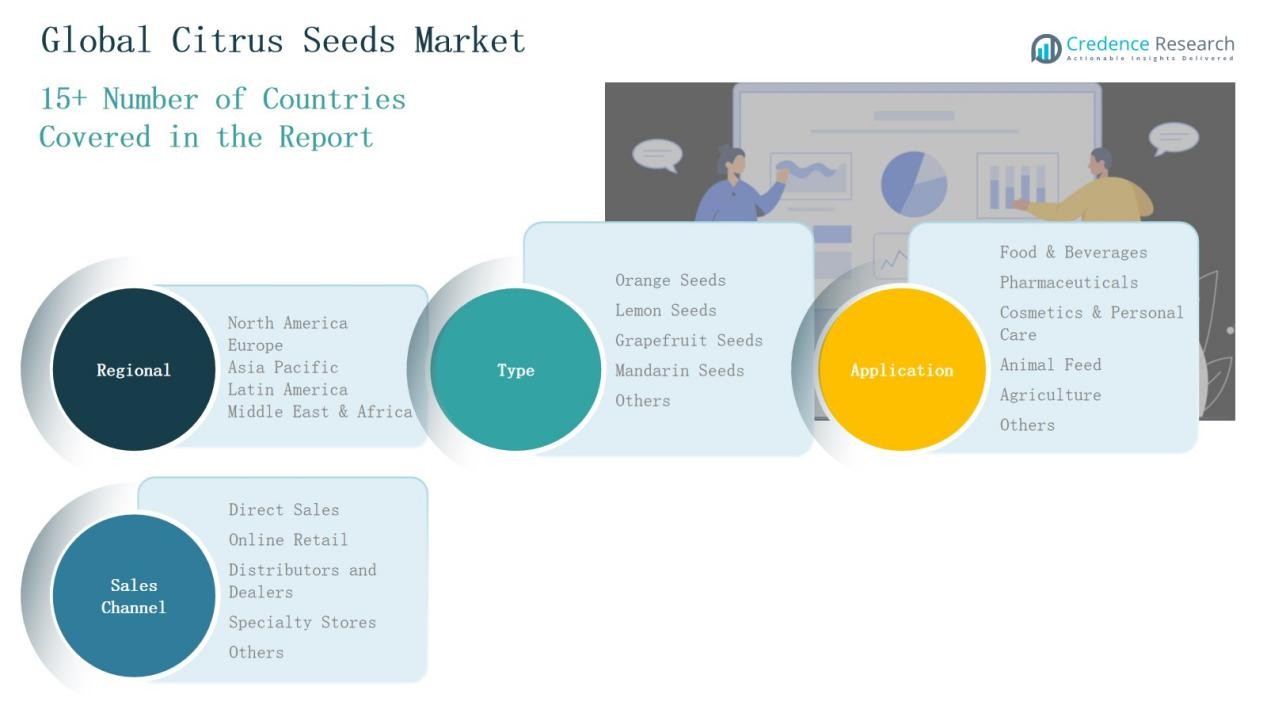

By Type

In the citrus seeds market, orange seeds represent the dominant sub-segment, accounting for the largest market share due to their extensive use in juice production, essential oils, and dietary supplements. Their high content of antioxidants, flavonoids, and natural oils drives demand across food, pharmaceutical, and cosmetic industries. Strong global consumption of orange-based products, supported by large-scale citrus cultivation in key producing countries, reinforces the segment’s leadership. Rising awareness of functional foods and natural health remedies further enhances market growth for orange seeds.

- For instance, orange essential oil extracted from the rind is widely used not only in flavoring foods and beverages but also in cosmetics and stress-relief products, leveraging its antioxidant and natural oil content.

By Application

The food and beverages segment leads the citrus seeds market, holding the largest share driven by the growing demand for natural flavoring agents, nutritional additives, and cold-pressed oils. Citrus seeds are increasingly incorporated into bakery, confectionery, and beverage formulations for their flavor-enhancing and health-boosting properties. Expanding consumer preference for clean-label and plant-based products, coupled with the rising use of citrus seed extracts in health drinks and fortified foods, sustains strong market momentum in this application category.

- For instance, Lebermuth Company offers a range of citrus oils, including cold-pressed seed oils, for incorporation into bakery and fortified food products that enhance flavor and nutritional value.

By Sales Channel

Direct sales dominate the citrus seeds market, capturing the highest market share as manufacturers and large-scale processors prefer direct procurement to ensure quality consistency and cost efficiency. This channel supports strong supplier–buyer relationships, bulk purchasing, and customized delivery schedules, which are essential for industries such as food processing and pharmaceuticals. The growth of direct sales is further supported by established distribution agreements, traceable sourcing practices, and the rising demand for certified, high-quality citrus seeds in both domestic and export markets.

Key Growth Drivers

Expanding Demand for Natural Ingredients

The rising consumer preference for natural and plant-based ingredients is a significant growth driver for the citrus seeds market. Citrus seeds, rich in essential oils, antioxidants, and nutrients, are increasingly used in food, beverages, cosmetics, and pharmaceuticals. This shift is reinforced by the growing clean-label movement and regulatory encouragement for natural additives. Manufacturers are leveraging this demand by introducing minimally processed and eco-friendly products, which enhance both market penetration and premium pricing potential.

- For instance, Louis Dreyfus Company manages 25,000 hectares of citrus groves in Brazil, producing citrus fruit products and by-products rich in essential oils and nutrients used across food and beverage sectors.

Rising Functional Food and Nutraceutical Consumption

The growing global emphasis on preventive healthcare is boosting the demand for functional foods and nutraceuticals, in which citrus seeds play a key role. Their bioactive compounds, including flavonoids and polyphenols, offer benefits such as improved digestion, cardiovascular health, and immune support. This has encouraged manufacturers to incorporate citrus seed extracts into dietary supplements, fortified foods, and wellness beverages. The trend is particularly strong in health-conscious urban markets, where consumers actively seek nutrient-rich, natural formulations.

- For instance, NutriBiotic offers a grapefruit seed extract capsule rich in antioxidants and polyphenols designed to support immune health and overall well-being.

Increased Utilization in Cosmetics and Personal Care

Citrus seeds are gaining traction in cosmetics and personal care applications due to their natural oil content and antioxidant properties, which support skin nourishment and anti-aging benefits. Cosmetic manufacturers are increasingly replacing synthetic ingredients with citrus seed oils and extracts to cater to the clean beauty trend. The segment benefits from expanding product lines in skincare, haircare, and aromatherapy, supported by growing disposable incomes and heightened awareness of sustainable, plant-derived cosmetic formulations.

Key Trends & Opportunities

Growth in Sustainable and Organic Farming Practice

Sustainable and organic farming of citrus fruits presents a strong opportunity for the citrus seeds market. Consumers are willing to pay a premium for products derived from pesticide-free and eco-friendly farming practices. This shift aligns with the global sustainability movement, encouraging producers to adopt organic cultivation methods and obtain certifications that enhance product value. Such practices not only strengthen brand reputation but also ensure compliance with increasingly stringent international trade regulations on agricultural imports.

- For instance, Olsen Organic Farm in California has successfully grown 15 acres of certified organic citrus such as Gold Nugget mandarins and Clementines, using beneficial insect habitats to control pests naturally without pesticides.

Expansion of Value-Added Citrus Seed Products

The market is witnessing growing opportunities in value-added processing, where citrus seeds are converted into high-margin products such as cold-pressed oils, protein powders, and dietary supplements. These diversified applications allow manufacturers to cater to multiple industries, from food and beverages to pharmaceuticals and cosmetics. Advanced extraction technologies and innovative packaging solutions further enable product differentiation, helping companies expand their customer base while optimizing profitability through premium offerings.

- For instance, DoTERRA International LLC integrates cold-pressed citrus seed oils into wellness supplements and essential oil blends, leveraging the oils’ verified antioxidant and antimicrobial properties to differentiate products globally.

Key Challenges

Seasonal Dependency and Supply Volatility

Citrus seed production is inherently dependent on seasonal fruit harvests, creating supply fluctuations that can affect pricing and availability. Climatic variations, diseases such as citrus greening, and unpredictable weather patterns further exacerbate supply chain instability. This poses challenges for manufacturers in maintaining consistent production schedules and fulfilling long-term contracts with buyers, particularly in export markets where continuity of supply is critical.

High Processing and Extraction Costs

The extraction of oils, bioactive compounds, and other derivatives from citrus seeds requires advanced equipment and energy-intensive processes. These operational costs can be high, particularly for small and medium-scale enterprises. Additionally, maintaining quality standards and meeting regulatory requirements adds to production expenses. Such cost pressures may limit the competitiveness of smaller producers, especially in price-sensitive markets where synthetic alternatives are cheaper.

Market Competition from Synthetic Alternatives

Citrus seeds face competition from synthetic flavoring agents, preservatives, and oils, which often offer lower costs and longer shelf life. In industries where price sensitivity is high, such as mass-market food processing, synthetic substitutes can limit the adoption of natural citrus seed derivatives. Overcoming this challenge requires strong marketing efforts to educate consumers on the health benefits and superior quality of natural products, as well as innovations that enhance product stability and cost-effectiveness.

Regional Analysis

North America

North America holds a 25.4% share of the global citrus seeds market in 2024, driven by high consumption of citrus-based food and beverage products, advanced processing infrastructure, and established export channels. The market is projected to grow from USD 391.94 million in 2024 to USD 615.15 million by 2032, registering a CAGR of 5.4%. The United States dominates regional demand, supported by strong health-conscious consumer trends and the use of citrus seed derivatives in pharmaceuticals and cosmetics. Strategic investments in sustainable farming and high-quality seed extraction processes further strengthen North America’s competitive position.

Europe

Europe accounts for 15.4% of the global citrus seeds market in 2024, with market size increasing from USD 238.32 million in 2024 to USD 338.30 million by 2032 at a CAGR of 4.1%. The region benefits from robust demand for clean-label and organic products, with significant utilization of citrus seeds in nutraceuticals, functional foods, and personal care formulations. Key markets such as Germany, France, and Italy lead adoption, driven by strong consumer awareness of natural health ingredients and government support for sustainable agriculture practices, fostering consistent market growth.

Asia Pacific

Asia Pacific dominates the global citrus seeds market with a 40.0% share in 2024, reflecting its role as the largest citrus-producing and consuming region. The market is set to expand from USD 621.30 million in 2024 to USD 1,030.12 million by 2032, at the fastest CAGR of 6.1%. China, India, and Japan drive regional growth through high domestic demand for citrus-derived oils, food ingredients, and cosmetic applications. Expanding agricultural investments, rising disposable incomes, and increasing adoption of functional foods contribute to strong market performance, while export-oriented production strengthens Asia Pacific’s global supply position.

Latin America

Latin America represents 4.2% of the global citrus seeds market in 2024, projected to grow from USD 65.29 million in 2024 to USD 90.59 million by 2032 at a CAGR of 3.8%. Brazil and Argentina dominate regional production, supported by favorable climatic conditions and large-scale citrus farming. Citrus seeds are widely used in both domestic processing industries and export markets, particularly for essential oils and food additives. The region’s growth is supported by expanding processing capacity, trade agreements, and the adoption of modern agricultural practices to improve yield and quality.

Middle East

The Middle East holds a 2.1% share of the global citrus seeds market in 2024, increasing from USD 32.72 million in 2024 to USD 42.59 million by 2032 at a CAGR of 2.9%. Growth is driven by rising demand for natural food ingredients, cosmetics, and nutraceuticals, particularly in GCC countries. The region’s citrus seed market benefits from expanding food processing industries and an increasing shift toward health-oriented consumer products. However, limited domestic citrus cultivation leads to reliance on imports, creating opportunities for international suppliers to strengthen their presence.

Africa

Africa accounts for 1.1% of the global citrus seeds market in 2024, growing from USD 17.50 million in 2024 to USD 19.92 million by 2032 at a CAGR of 1.2%. South Africa leads the regional market, supported by its citrus export industry and growing domestic processing capacity. The application of citrus seeds in animal feed, essential oils, and small-scale food processing supports modest growth. Limited processing infrastructure and agricultural challenges constrain the market, but increasing interest in value-added citrus seed products offers potential for gradual expansion in key economies.

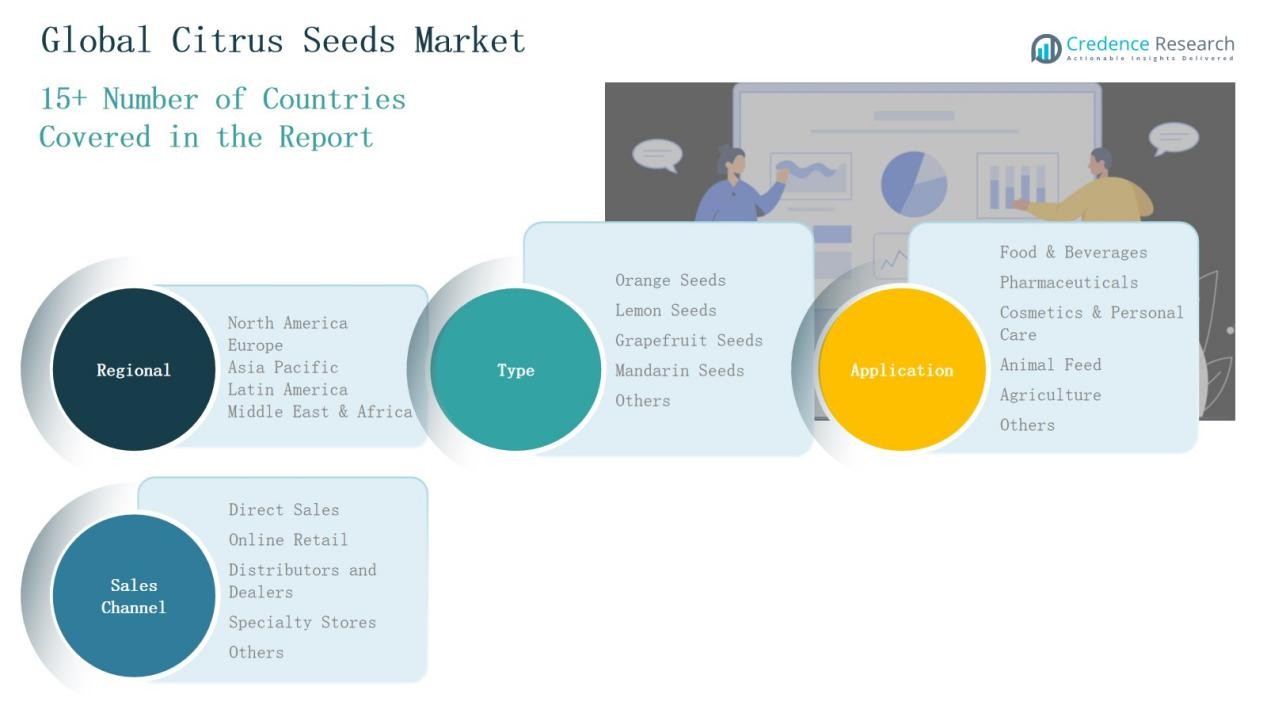

Market Segmentations:

By Type

- Orange Seeds

- Lemon Seeds

- Grapefruit Seeds

- Mandarin Seeds

- Others

By Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Animal Feed

- Agriculture

- Others

By Sales Channel

- Direct Sales

- Online Retail

- Distributors and Dealers

- Specialty Stores

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the citrus seeds market is characterized by a mix of global agribusiness corporations, specialized ingredient suppliers, and regional producers competing on product quality, supply reliability, and diversified applications. Key players such as Louis Dreyfus Company, Parchem Trading, Vita-Pakt Citrus Products, Citrus World Ltd., PMCA Group, Food Ingredients Corporation, A&A Ingredients Inc., Bio-Botanica Inc., and Frutarom Industries Ltd. maintain strong market positions through integrated supply chains, established grower networks, and advanced processing capabilities. Companies focus on expanding their portfolios to include value-added derivatives such as cold-pressed oils, protein-rich seed powders, and nutraceutical-grade extracts. Strategic partnerships with food, beverage, cosmetics, and pharmaceutical manufacturers strengthen market reach, while investment in sustainable sourcing and organic certification aligns with shifting consumer preferences. Competition is also shaped by technological advancements in extraction and processing, enabling improved yield and quality. Regional producers leverage proximity to cultivation zones to provide cost-effective and timely supply to domestic and export markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Louis Dreyfus Company

- Parchem Trading

- Vita-Pakt Citrus Products

- Citrus World Ltd.

- PMCA Group

- Food Ingredients Corporation

- A&A Ingredients Inc.

- Bio-Botanica Inc.

- Frutarom Industries Ltd.

Recent Developments

- In June 2025, GrubMarket completed the acquisition of Coast Citrus Distributors, enhancing its tropical produce portfolio, including citrus varieties, and strengthening its integrated supply chain and technology capabilities.

- In April 2025, Florida Foundation Seed Producers signed a licensing agreement with New Varieties Development and Management Corp (NVDMC) to introduce six citrus-greening tolerant varieties—including Hamlin and Mandarin hybrids—aimed at restoring resilience in Florida’s citrus industry.

- In September 2024, Perricone Farms acquired Natalie’s Orchid Island Juice Company, expanding its footprint in the citrus-based beverage market and strengthening its production and distribution capabilities.

- In June 2025, Dole Food Company partnered with UK ag-tech firm AgriSound to launch a pilot study in Kent. They are testing how growing materials influence bumblebee pollination and fruit yield, aiming to strengthen sustainable citrus production .

Market Concentration & Characteristics

The Citrus Seeds Market exhibits a moderately fragmented structure, with competition distributed among global agribusiness leaders, mid-sized processors, and regional suppliers. It features a diverse product range serving multiple industries, including food and beverages, pharmaceuticals, cosmetics, animal feed, and agriculture. The market is driven by consistent demand for natural and functional ingredients, supported by expanding applications in value-added products such as oils, protein powders, and nutraceuticals. It benefits from established supply chains in major citrus-producing regions, where proximity to raw materials ensures cost efficiency and quality control. Companies differentiate through product purity, extraction efficiency, and adherence to international quality standards. Technological innovation in seed processing enhances yield and broadens application scope, while sustainable sourcing practices gain importance to meet evolving consumer preferences. The competitive environment fosters strategic alliances, capacity expansions, and targeted product innovation to strengthen market positioning and capture emerging growth opportunities.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for citrus seed-derived oils and extracts will grow across food, cosmetics, and pharmaceutical industries.

- Adoption of sustainable and organic citrus cultivation will strengthen premium product positioning.

- Technological advancements in seed extraction will improve yield and product quality.

- Expansion of functional food and nutraceutical applications will support market penetration.

- Rising consumer preference for clean-label and plant-based ingredients will drive product innovation.

- Strategic partnerships between processors and end-use industries will enhance distribution efficiency.

- Growth in value-added citrus seed products will increase profitability for manufacturers.

- Emerging markets in Asia Pacific and Latin America will offer new growth opportunities.

- Investments in supply chain optimization will improve global market accessibility.

- Focus on health benefits of bioactive compounds will boost consumer awareness and product adoption.