Market Overview:

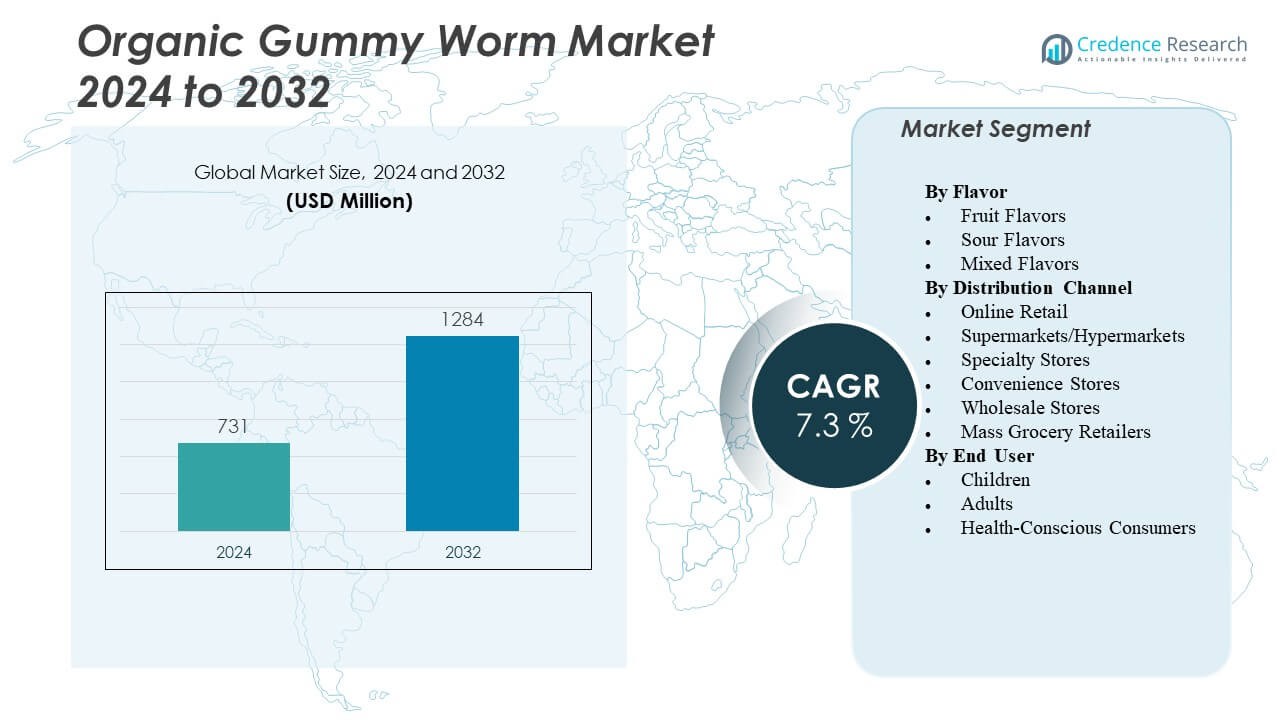

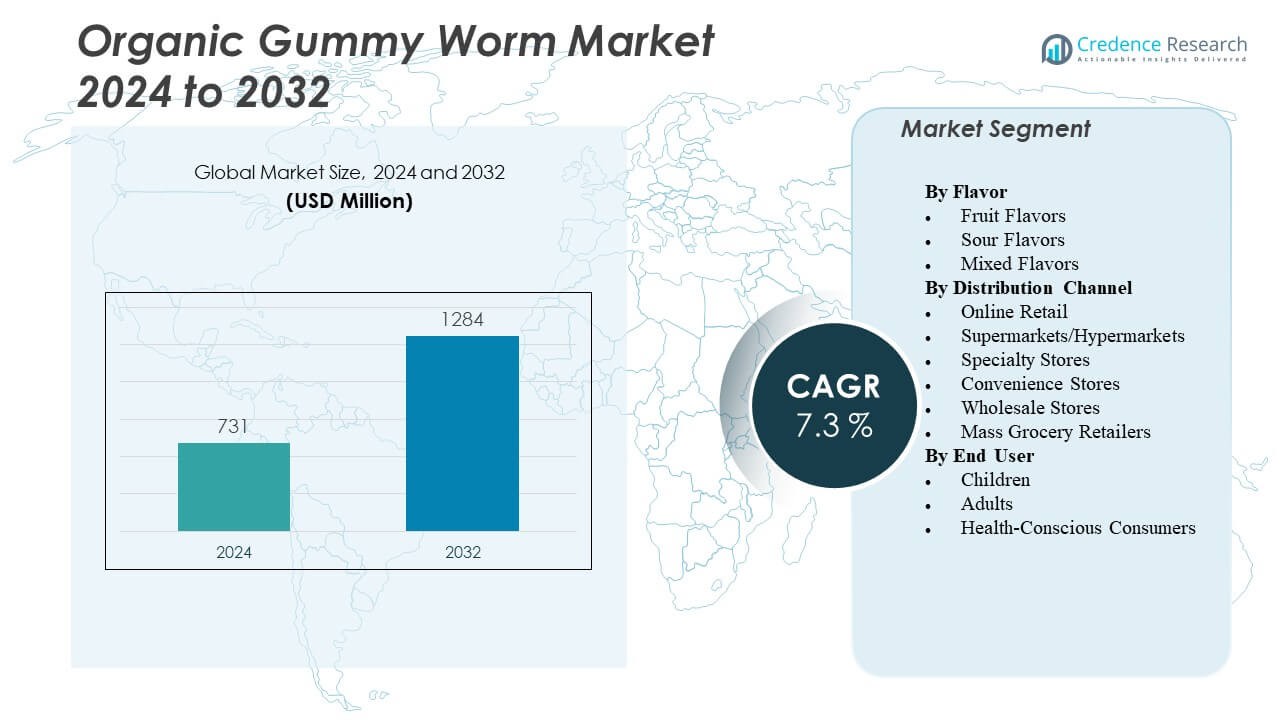

The Organic Gummy Worm Market is projected to grow from USD 731 million in 2024 to an estimated USD 1284 million by 2032, with a compound annual growth rate (CAGR) of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Organic Gummy Worm Market Size 2024 |

USD 731 Million |

| Organic Gummy Worm Market, CAGR |

7.3% |

| Organic Gummy Worm Market Size 2032 |

USD 1284 Million |

The market is gaining momentum due to increasing consumer demand for clean-label, plant-based confectionery products. Rising health consciousness is encouraging a shift away from synthetic ingredients, especially among parents seeking healthier treats for children. Organic gummy worms appeal to a wide demographic, including vegans and allergy-sensitive consumers, thanks to their natural flavors and absence of artificial additives. Moreover, innovative flavor combinations and the availability of fortified variants with vitamins and minerals are driving broader consumer acceptance across age groups.

North America leads the Organic Gummy Worm Market, driven by strong demand for organic snacks, higher disposable income, and well-established retail networks. Europe follows closely, fueled by strict food labeling regulations and growing preference for natural ingredients. Meanwhile, the Asia-Pacific region is emerging as a key growth hub, with expanding middle-class populations, increasing awareness of health-focused diets, and rising urbanization. Latin America and the Middle East & Africa are also witnessing gradual market traction due to evolving dietary preferences and improving distribution infrastructures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Organic Gummy Worm Market was valued at USD 731 million in 2024 and is projected to reach USD 1284 million by 2032, growing at a CAGR of 7.3%.

- Rising consumer preference for clean-label, plant-based, and allergen-free confectionery is a major growth driver for the Organic Gummy Worm Market.

- High production costs and limited availability of certified organic raw materials continue to restrain scalability and pricing competitiveness.

- North America dominates the Organic Gummy Worm Market with a 41.6% share in 2024, supported by advanced retail infrastructure and high health awareness.

- Europe maintains strong demand through its vegan movement and stringent food labeling regulations, capturing 28.3% of the market.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising middle-class incomes, and growing demand for clean-label children’s snacks.

- Limited consumer awareness and weak distribution in emerging markets hinder deeper market penetration despite global growth potential.

Market Drivers:

Rising Consumer Demand for Health-Conscious Confectionery Products

The Organic Gummy Worm Market is expanding in response to heightened consumer awareness about the health risks associated with synthetic additives and artificial colors. Many consumers are choosing organic alternatives that offer clean-label ingredients. This preference shift is more prominent among parents seeking safer and healthier candy options for children. The trend is reinforced by increasing media coverage on food safety and consumer advocacy. Organic gummy worms, made without GMOs, gluten, or high-fructose corn syrup, meet this demand effectively. Retailers and manufacturers are responding by increasing shelf space and launching new organic candy lines. The growing alignment between consumer values and product offerings is accelerating the market’s penetration. It demonstrates how health priorities are shaping the evolution of the confectionery segment.

- For example, SmartSweets specializes in low-sugar, high-fiber gummy worms made with natural sweeteners such as allulose and stevia to appeal to health-conscious consumers. According to the official product page, their gummy worms contain 88% less sugar per 50g compared to traditional candy, with just 3g of sugar per bag and no added sugar or artificial sweeteners. This claim is supported by verified company sources and product specifications.

Expansion of Vegan and Allergen-Free Food Categories

The growth of plant-based and allergen-free product categories directly supports the Organic Gummy Worm Market. Consumers with dietary restrictions, including vegans and individuals with gluten or nut allergies, are finding appealing options in organic gummy worms. It is driving manufacturers to reformulate traditional candy recipes using pectin instead of gelatin and to avoid common allergens. The increasing awareness about animal-derived ingredients in conventional gummies also contributes to this shift. Retailers are now segmenting their offerings to include clear vegan labeling, ensuring higher visibility. Social media advocacy and celebrity endorsements further propel the demand for ethical snacking options. The growth of specialty food stores and e-commerce platforms has widened access to these products. This alignment between ethical food production and consumer preference supports steady demand growth.

Supportive Regulatory Landscape and Organic Certifications

Regulatory support for organic food production and labeling plays a pivotal role in strengthening the Organic Gummy Worm Market. Certifications from USDA, EU Organic, and other regulatory agencies enhance consumer trust and improve product legitimacy. It enables brands to differentiate their offerings from conventional products. Governments in North America and Europe offer subsidies and technical guidance for organic farming, which supports the raw material supply chain. Retailers and manufacturers are using these certifications in marketing campaigns to attract quality-conscious buyers. Strict regulations around synthetic dye and additive use in food products further increase the appeal of organic gummies. The clarity of compliance requirements is helping new entrants streamline market entry. Certified products enjoy faster retail placement and broader market reach.

Increased Focus on Functional Ingredients and Nutritional Add-ons

The Organic Gummy Worm Market benefits from rising demand for functional snacks that go beyond basic indulgence. Consumers are increasingly choosing gummies that offer added health benefits, such as vitamin-infused or mineral-enhanced formulations. It creates a convergence between confectionery and wellness segments, giving rise to functional organic candies. Brands are developing products that incorporate probiotics, collagen, and natural extracts to target niche health concerns. This strategy helps differentiate offerings in a crowded market. Product innovation around functional ingredients also enables premium pricing and broader market appeal. Retailers are creating dedicated shelf space for “better-for-you” candy. The trend supports sustained consumer engagement and brand loyalty, driving value-based growth.

- For example, Biobor produces probiotic gummy bears formulated with 1 billion CFU per serving of Bacillus coagulans BC30, targeting digestive health. These gummies are positioned as functional foods and are internationally available across regions including North America, Europe, Asia, and Australia. They are certified gluten-free, non-GMO, and manufactured under GMP and HACCP standards, ensuring product safety and quality.

Market Trends:

Premiumization of Organic Candy through Artisanal and Gourmet Variants

The Organic Gummy Worm Market is witnessing a rise in premium offerings designed to appeal to adult consumers. Artisanal gummies with exotic flavors like yuzu, hibiscus, or matcha are gaining traction in high-end retail outlets. It reflects a shift from mass-market appeal to experiential snacking preferences. Small-batch, handcrafted gummy worms made with botanical infusions and organic fruit extracts are carving out a niche segment. Manufacturers are introducing gourmet-style packaging and storytelling to elevate brand perception. These products often target gifting and specialty food channels. Higher quality ingredients and creative formats allow brands to charge premium prices. The trend underscores the evolving sophistication in the candy market, where sensory appeal plays a central role.

- For example, Black Forest, part of Ferrara, produces USDA-Certified Organic gummy bears and fruit snacks. Their products are made with certified organic ingredients, real fruit juice, and colors and flavors from real plant sources.

Adoption of Eco-Friendly Packaging and Sustainable Sourcing Practices

Sustainability trends are reshaping the Organic Gummy Worm Market, with brands adopting eco-conscious packaging and ethically sourced ingredients. Compostable wrappers, plant-based inks, and biodegradable pouches are becoming standard in new product launches. It aligns with broader consumer concerns around environmental impact and plastic waste. Transparency in ingredient sourcing, especially from certified organic farms, enhances consumer loyalty. Several companies are integrating blockchain or QR code technology to track ingredient origins. This transparency strengthens brand credibility. Consumers reward brands that align product quality with environmental responsibility. Sustainable packaging also improves positioning in premium and ethical food segments. Retailers are encouraging these practices by giving shelf priority to environmentally responsible brands.

Digital Marketing and Direct-to-Consumer Sales Acceleration

The Organic Gummy Worm Market is capitalizing on digital commerce to reach a wider audience. Startups and legacy brands are investing in e-commerce platforms and social media campaigns to drive consumer engagement. It reduces dependence on traditional retail channels and increases brand agility. Subscription-based models and personalized product bundles are gaining favor among health-conscious consumers. Online reviews and influencer marketing are playing a critical role in shaping purchasing decisions. Customization tools on D2C websites are enabling consumers to select ingredients or flavors. Data-driven targeting helps brands reach specific dietary segments such as keto-friendly or allergen-free consumers. The shift to digital marketing allows quicker product feedback and adaptation. It fosters deeper consumer relationships and rapid market scalability.

Collaboration with Retailers and Wellness Platforms for Brand Positioning

Strategic partnerships between organic candy brands and health-focused retailers are elevating visibility in the Organic Gummy Worm Market. Collaborations with yoga studios, wellness subscription boxes, and organic food chains provide synergistic marketing opportunities. It enhances brand relevance in lifestyle and wellness communities. Cross-promotions with smoothie bars, fitness centers, and nutritional supplement companies are gaining momentum. These alliances help position organic gummy worms not just as snacks, but as part of a healthy lifestyle. Retailers benefit from cross-category promotions and bundled offerings. Brands leverage these partnerships to gain entry into high-traffic locations. These channels offer educational opportunities around ingredient transparency and health benefits. The strategy deepens market penetration among health-aware demographics.

- For example, SmartSweets currently distributes its products in more than 55,000 stores across the U.S. and Canada. Its QVC partnership exemplifies an omnichannel strategy that reinforces presence across both digital and physical retail environments.

Market Challenges Analysis:

High Production Costs and Limited Raw Material Availability

The Organic Gummy Worm Market faces significant cost-related challenges due to the premium nature of organic raw materials. Organic cane sugar, pectin, and natural flavor extracts cost substantially more than synthetic alternatives. It increases the final product price, limiting affordability in price-sensitive regions. Smaller manufacturers often struggle with inconsistent supply chains and sourcing constraints. Seasonality and dependence on certified suppliers affect production continuity. Maintaining strict organic certification standards throughout the supply chain is also resource-intensive. These operational challenges make scalability difficult for emerging brands. It restricts the ability to meet growing demand efficiently and competitively. Cost-sensitive retailers hesitate to stock high-priced organic variants in bulk.

Limited Consumer Awareness in Emerging Economies

Low consumer awareness about the benefits of organic confectionery poses a challenge to market growth in developing regions. The Organic Gummy Worm Market remains concentrated in countries with mature health food industries. In regions like Africa, Southeast Asia, and parts of Latin America, traditional sweets dominate due to lower prices and cultural familiarity. Many consumers perceive organic candies as luxury items. Limited marketing efforts and lower retail availability in these areas further restrict adoption. Retailers focus more on volume-driven conventional candies. Educational gaps around ingredient transparency and clean-label benefits hinder demand expansion. Brands must invest in awareness campaigns and regionalized messaging to drive conversion in these untapped markets.

Market Opportunities:

Expansion into Functional and Personalized Organic Candy Segments

The Organic Gummy Worm Market has strong growth potential in the functional confectionery segment. Consumers seek more than indulgence, preferring products that deliver nutritional or therapeutic benefits. Gummies infused with vitamin C, melatonin, elderberry, or fiber offer added value without compromising taste. Brands can leverage personalization technology to let consumers customize flavors, ingredient profiles, or nutritional goals. It opens new channels for innovation and customer engagement. The merging of nutrition and indulgence appeals to health-conscious millennials and Gen Z buyers. Subscription boxes with wellness gummies are gaining favor. Functional positioning helps differentiate organic products from conventional candies. This trend supports category diversification and premium product development.

Penetration into Institutional and Specialty Retail Channels

There is untapped potential for the Organic Gummy Worm Market in institutional and specialty retail environments. Schools, hospitals, and fitness centers increasingly seek clean-label snacks for vending machines and cafeterias. Brands can develop portion-controlled packaging suitable for institutional distribution. Specialty retailers focused on organic, vegan, or allergy-free products also present expansion opportunities. It allows brands to segment offerings based on demographic or dietary needs. Gummy worms marketed as energy-boosting, calming, or immune-supportive fit well within these channels. Targeted outreach to health professionals and educators can build brand advocacy. Growing partnerships with specialty wellness retailers can extend geographic reach and foster credibility in curated marketplaces.

Market Segmentation Analysis:

By flavor, fruit variants hold the largest share in the Organic Gummy Worm Market due to their broad appeal across age groups. Popular choices such as strawberry, green apple, and mango drive demand through both nostalgia and taste variety. Sour flavors are gaining traction among teenagers and young adults who seek bold, tangy experiences. Mixed flavors create a sensory blend that supports consumer experimentation and brand loyalty.

- For instance, SmartSweets offers gummy worms with dual-fruit flavor pairings like pink lemonade & peach, delivering over 12g of dietary fiber per 50g bag while maintaining just 3g of sugar, aligning with health and taste preferences across age groups

By distribution channel, supermarkets and hypermarkets dominate due to their wide reach and product visibility. Consumers prefer physical inspection of organic goods, making these stores effective sales points. Online retail is expanding rapidly, supported by subscription models, influencer promotions, and access to niche or functional variants. Specialty stores cater to vegan and allergy-sensitive buyers, reinforcing trust through curated offerings. Convenience and wholesale stores serve impulse buyers and bulk consumers, respectively. Mass grocery retailers continue to integrate organic candy into broader health-focused aisles.

By end user, children represent the primary target group due to parental preference for natural and additive-free treats. Adults are increasingly contributing to demand, especially with interest in nostalgic flavors and guilt-free indulgence. Health-conscious consumers seek organic gummy worms with functional benefits, driving innovation in vitamin-fortified and sugar-free formulations. The Organic Gummy Worm Market continues to evolve across segments through targeted offerings and aligned marketing strategies.

- For instance, YumEarth’s fruit snacks and gummy products are certified free from the top 9 allergens including peanut, dairy, and soy are gluten-free and vegan, and are explicitly marketed as classroom-safe and lunchbox suitable, building confidence with parents and health-sensitive buyers.

Segmentation:

By Flavor

- Fruit Flavors (e.g., cherry, grapefruit, watermelon, strawberry, orange, raspberry, lemon, green apple, mango, pineapple, grape)

- Sour Flavors

- Mixed Flavors

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Wholesale Stores

- Mass Grocery Retailers

By End User

- Children

- Adults

- Health-Conscious Consumers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share of the Organic Gummy Worm Market, accounting for 41.6% of the global revenue in 2024. The United States drives the regional dominance through its well-established organic food sector, high disposable incomes, and wide acceptance of clean-label products. Strong retail infrastructure and presence of major organic confectionery brands support widespread product availability. Regulatory clarity and consumer preference for non-GMO and allergen-free snacks contribute to sustained demand. E-commerce growth and consumer education campaigns further accelerate market penetration. It positions North America as a mature and innovation-led region in the organic gummy segment.

Europe captures 28.3% of the Organic Gummy Worm Market share, driven by robust demand in Germany, the UK, and France. The region benefits from stringent food safety regulations and widespread adoption of certified organic foods. Retailers actively promote sustainable, plant-based alternatives, influencing consumer behavior across age groups. Strong vegan movement and awareness of artificial additives’ health risks enhance preference for organic confectionery. Brands in this region emphasize sustainable sourcing and recyclable packaging, aligning with EU green goals. It maintains a balanced growth trajectory supported by both traditional retail and digital channels.

Asia-Pacific holds 18.7% of the market share and is the fastest-growing region in the Organic Gummy Worm Market. Rising health awareness, growing middle-class income, and rapid urbanization are driving product adoption in China, Japan, South Korea, and India. Expansion of organized retail, especially in urban centers, is improving product access and visibility. Increasing focus on children’s nutrition and clean-label snacks encourages trial and repeat purchases. Local players and global entrants are investing in regional customization to meet diverse consumer preferences. It continues to expand due to shifting dietary habits and emerging demand for ethical, health-oriented snacks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- YumEarth

- SmartSweets

- The Organic Candy Factory

- Black Forest Organic (Ferrara)

- Wholesome Sweeteners

- Surf Sweets

- Annie’s Homegrown

- Torie & Howard

- Project 7

- GoOrganic Candy

- Squish Candies

- Little Belgians

- Candy People

- Dylan’s Candy Bar

- HARIBO

- Trolli

- Albanese Candy

- Ferrara Candy Company

Competitive Analysis:

The Organic Gummy Worm Market features a mix of established players and emerging brands competing on quality, certifications, flavor innovation, and ethical sourcing. Leading companies such as YumEarth, SmartSweets, and Wholesome prioritize non-GMO, vegan, and allergen-free formulations to differentiate themselves. Startups are entering with niche offerings targeting functional health and unique taste profiles. It sees active investment in R&D, packaging sustainability, and e-commerce expansion to capture consumer loyalty. Strategic partnerships with health retailers and wellness platforms support deeper market access. Private-label brands are also gaining ground through aggressive pricing and clean-label positioning. Competitive dynamics remain strong, with innovation and branding as key growth drivers.

Recent Developments:

- In July 2024, SmartSweets announced a reformulation across its gummy portfolio, including updates to product sweeteners and flavors. However, new reformulation details primarily mention skus like Sweet Fish and Peach Rings, with some references to continued production of gummy worms.

Market Concentration & Characteristics:

The Organic Gummy Worm Market remains moderately concentrated, with a few key players holding substantial brand recognition and distribution networks. It exhibits characteristics of a niche health-focused segment with high product differentiation. Demand is driven by clean-label trends and ethical consumerism. Companies rely on organic certifications, dietary claims, and unique formulations to strengthen brand identity. Barriers to entry include sourcing standards, regulatory compliance, and premium pricing pressures. The market favors agility and fast product innovation cycles. Growth depends on sustained consumer trust and continuous alignment with evolving dietary preferences. New entrants must invest in transparent marketing and reliable supply chains to compete effectively. Established brands continue to expand through strategic collaborations and diversified product portfolios.

Report Coverage:

The research report offers an in-depth analysis based on Flavor, Distribution Channel and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Organic Gummy Worm Market is expected to witness consistent growth driven by rising demand for clean-label and health-conscious confectionery.

- Increasing adoption of plant-based diets will push manufacturers to innovate with gelatin-free and vegan gummy formulations.

- E-commerce and direct-to-consumer channels will expand market reach, especially among younger, tech-savvy consumers.

- Product diversification with added functional benefits like vitamins and probiotics will enhance market competitiveness.

- Strategic collaborations with wellness brands and organic retailers will strengthen distribution networks and brand positioning.

- Growing awareness in emerging economies will open new regional opportunities for market expansion.

- Advancements in sustainable packaging solutions will become a key differentiator for environmentally conscious consumers.

- Certification standards and transparent labeling will remain critical for building consumer trust and regulatory compliance.

- Premiumization trends will lead to increased demand for artisanal, gourmet, and customized gummy worm offerings.

- Marketing focused on ethical sourcing, allergen safety, and nutritional benefits will shape long-term consumer engagement.