Market Overview

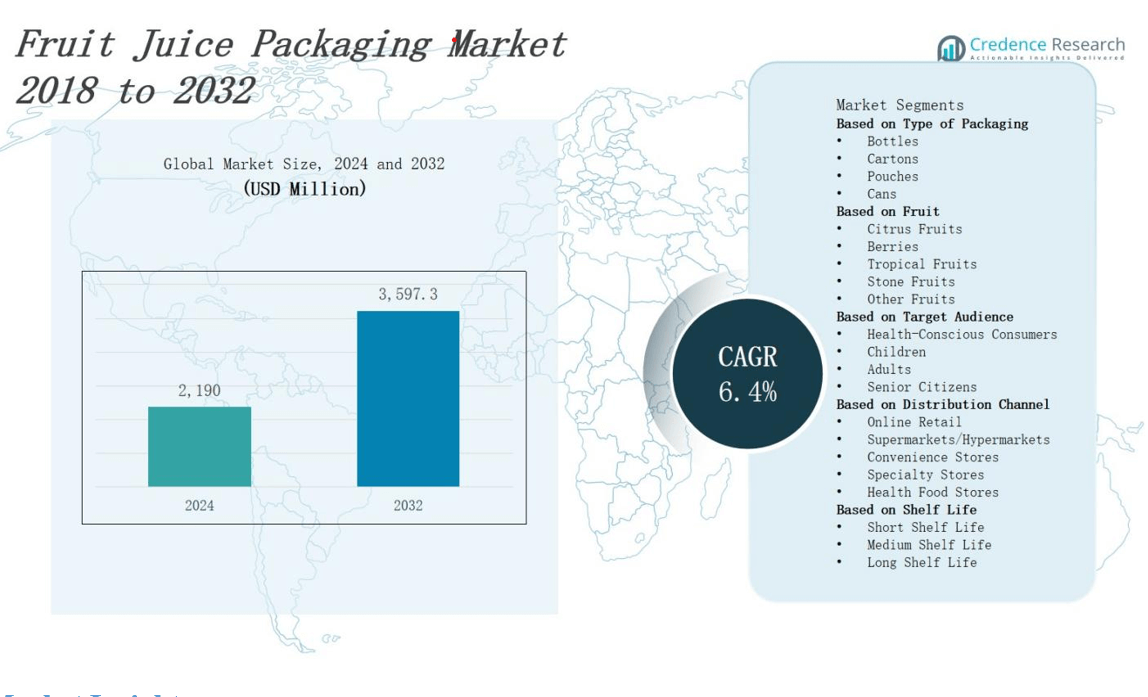

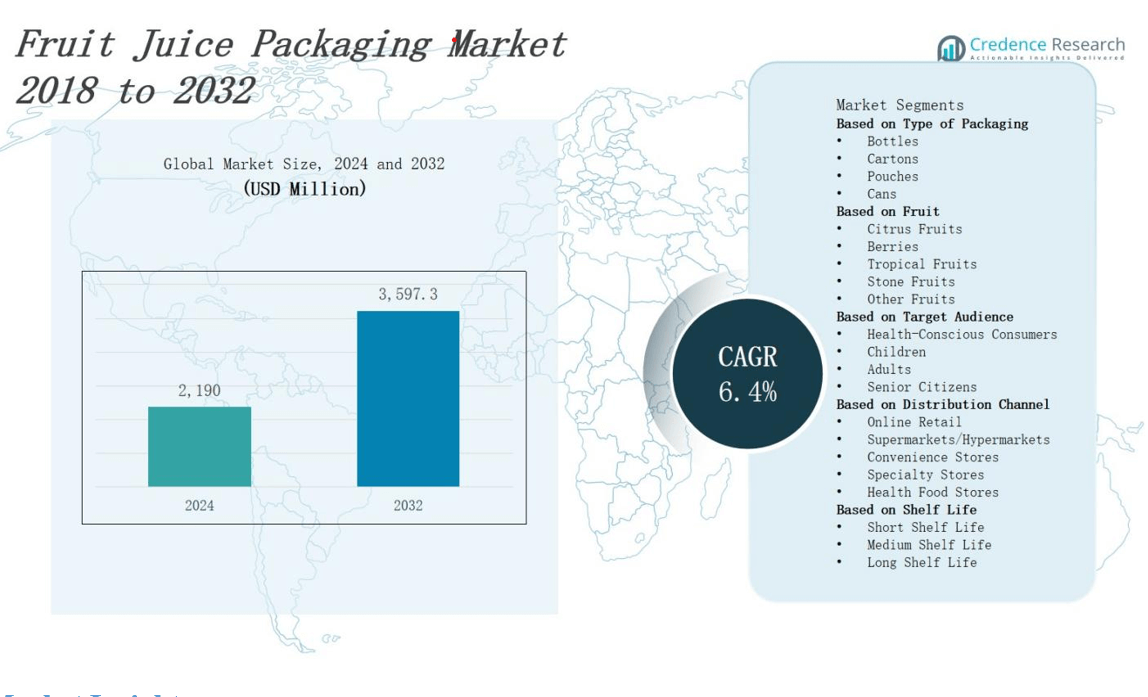

The fruit juice packaging market is projected to expand from USD 2,190 million in 2024 to USD 3,597.3 million by 2032, growing at a CAGR of 6.4%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fruit Juice Packaging Market Size 2024 |

USD 2,190 million |

| Fruit Juice Packaging Market, CAGR |

6.4% |

| Fruit Juice Packaging Market Size 2032 |

USD 3,597.3 million |

The fruit juice packaging market advances as consumers demand convenient, on‑the‑go formats and sustainable materials. Manufacturers innovate by adopting recyclable plastics, biodegradable films, and plant‑based cartons to meet environmental regulations and sustainability goals. Rising e‑commerce and direct‑to‑consumer sales prompt development of tamper‑evident containers that extend shelf life and reduce spoilage. Technological progress in aseptic packaging and high‑barrier coatings enhances product safety and preserves nutritional quality. Growing health consciousness supports fortified juice blends in resealable bottles. Strategic collaborations between packaging and juice producers accelerate adoption of smart labels and interactive printing for consumer engagement and brand differentiation.

The fruit juice packaging market exhibits regional diversity across North America, Europe, Asia Pacific, Latin America and Middle East & Africa, driven by varied consumption habits and regulatory frameworks. Key players such as DS Smith, CCL Industries, Can‑Pack, Tetra Laval, Ardagh Group, Smurfit Kappa, Evergreen Packaging, Crown Holdings, Amcor, Ball, CKS Packaging, Genpak and Bemis compete via localized production and tailored materials. It leverages region‑specific formats—from PET bottles in North America to cartons in Europe and pouches in Asia Pacific—to address logistics challenges and consumer preferences, strengthening global supply chains.

Market Insights

- The fruit juice packaging market will grow from USD 2,190 million in 2024 to USD 3,597.3 million by 2032 at a 6.4% CAGR.

- Consumers drive demand for on‑the‑go formats and sustainable materials, prompting adoption of recyclable plastics, biodegradable films, and plant‑based cartons.

- E‑commerce and direct‑to‑consumer channels accelerate development of tamper‑evident containers that extend shelf life and reduce spoilage.

- Aseptic filling and high‑barrier coatings preserve flavor and nutrients, deliver extended ambient shelf life, and cut refrigeration needs.

- Smart labels, QR codes, and NFC tags enhance transparency, share origin and nutritional data, and boost consumer engagement.

- Resin cost swings and evolving EPR regulations force producers to invest in forecasting, alternative sourcing, and compliance testing.

- North America holds 35% share, Europe 25%, Asia Pacific 30%, Latin America 7%, and Middle East & Africa 3%, reflecting varied infrastructure and consumer preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Regulatory Standards and Environmental Policies

The fruit juice packaging market responds to strict regulations on single‑use plastics and chemical leachates. Producers adopt recyclable PET, biodegradable films, and paperboard cartons. It prioritizes compliance with extended producer responsibility (EPR) and waste reduction mandates. Brands design lightweight structures to reduce material consumption and logistics emissions. Stakeholders collaborate with certification bodies to validate compostability and recyclability. Regulatory pressure drives continuous improvement in sustainable packaging solutions. Market adoption accelerates innovation.

- For instance, THIMM offers fruit packaging made from environmentally friendly corrugated cardboard that is sturdy, fully recyclable, and certified for food safety, providing a plastic-free alternative that supports waste reduction.

Consumer Convenience and Packaging Functionality

Focusing on convenience, the fruit juice packaging market introduces resealable bottles and single‑serve pouches. It ensures portability through lightweight designs and spill‑proof closures. Manufacturers integrate ergonomic shapes for comfortable handling and storage. Brands embed tamper‑evident caps to enhance consumer trust. Retailers favor shelf‑stable formats with extended ambient shelf life. Collaborative ventures promote integrated beverage systems with modular packaging, boosting consumer satisfaction and repeat purchases. Product personalization features meet unique preferences.

- For instance, GoGo squeeZ, offers single-serve pouches that are lightweight, portable, and easy to open, catering to consumers seeking portion-controlled juice options suitable for active lifestyles.

Technological Advancements and Shelf Life Enhancement

The fruit juice packaging market leverages aseptic filling and high‑barrier laminates to preserve flavor and nutrients. It accelerates shelf life without refrigeration and reduces spoilage. Manufacturers adopt ultrahigh‑pressure processing (UHP) compatible containers to ensure safety. Brands test nanocomposite films for oxygen and moisture control. Industry partnerships fund research in active packaging with oxygen scavengers. Continuous technology upgrades deliver improved quality and reduced waste. It fosters sustainable resource utilization strategies globally.

Digital Engagement and Smart Label Integration

The fruit juice packaging market integrates QR codes and NFC tags to share origin data and nutritional facts. It enhances transparency and fosters consumer trust. Brands implement interactive labels with dynamic promotions and traceability features. Stakeholders leverage augmented reality experiences to educate users on sustainability practices. Retailers analyze label scans to optimize marketing strategies. Digital engagement tools drive brand loyalty and differentiate products in competitive marketplaces. Market insights guide innovation.

Market Trends

Sustainable Material Adoption

The fruit juice packaging market emphasizes recyclable PET, compostable films, and plant‑based polymers to reduce environmental impact. It shifts from multi‑layer laminates to mono‑material structures that simplify recycling processes. Brands partner with material scientists to develop bio‑derived barriers. Producers test cellulose‑based coatings for moisture resistance. Certification programs validate material claims to gain consumer trust. Regulatory compliance and consumer pressure drive rapid global adoption initiatives.

Customized Premium Packaging Designs

Brands differentiate products in the fruit juice packaging market with unique shapes and embossed logos that appeal to upscale consumers. It targets premium segments with tailored labeling. Producers invest in modular closures that support multiple serving sizes in elegant formats. Retailers favor collectible packaging collaborations with lifestyle brands. Design studios integrate consumer insights to guide label aesthetics. This customization boosts perceived value and repeat purchases.

- For instance, Paper Boat incorporates pastel shades and nostalgic aesthetics in their packaging to attract urban consumers seeking both elegance and familiarity.

E‑commerce and Omnichannel Strategies

The fruit juice packaging market optimizes containers for direct‑to‑consumer shipments and subscription boxes. It structures packaging to resist compression and temperature fluctuations during transit. Brands implement standardized carton dimensions to reduce shipping costs and simplify logistics. Producers test lightweight protective inserts that minimize product movement. Retailers integrate durable tamper‑evident seals to assure safety. Data analytics inform package size and material choices to improve customer satisfaction.

- For instance, Tetra Pak employs standardized carton sizes designed to resist temperature fluctuations and compression during transit, ensuring product integrity.

Smart and Connected Labels

The fruit juice packaging market embraces QR codes and NFC‑enabled labels to deliver traceability and nutritional information. It links packaging to digital platforms that streamline loyalty programs. Brands explore augmented reality experiences that showcase sourcing and production methods. Producers monitor scanning metrics to refine marketing tactics. Retailers use connected labels to verify authenticity via blockchain. Consumer engagement tools strengthen brand loyalty and guide future packaging design.

Market Challenges Analysis

Price Volatility and Regulatory Compliance Burdens

The fruit juice packaging market faces unpredictable resin and aluminum foil cost swings that erode profit margins. It must align production with evolving EPR and single‑use plastic bans in key regions. Meeting migration limits for adhesives and inks demands rigorous testing and recertification. Tightening chemical and food safety rules heighten audit frequency and compliance expenses. Small producers struggle to allocate funds for validation processes. Brands negotiate trade‑offs between cost and compliance. Stakeholders invest in forecasting and alternative sourcing to mitigate risk.

Supply Chain Disruptions and Consumer Trust Issues

Global supply chain fragmentation causes delays in resin and carton deliveries to packaging lines. The fruit juice packaging market must maintain consistent quality amid transportation bottlenecks and port congestion. It negotiates with multiple suppliers to secure contingency inventory. Quality lapses during transit trigger recalls and reputational damage. Limited recycling infrastructure undermines sustainability claims and provokes consumer skepticism. Producers adopt traceability protocols to build transparency and regain confidence. Industry alliances strengthen logistics resilience and safeguard supply continuity.

Market Opportunities

Expansion into Premium and Plant‑Based Packaging Solutions

The fruit juice packaging market can capture higher margins by offering premium formats that emphasize natural and organic credentials. It can leverage plant‑based polymers and post‑consumer recycled (PCR) content to meet consumer demand for eco‑friendly materials. Brands gain advantage by collaborating with bioplastic innovators to create compostable cartons and seals. Producers can introduce limited‑edition collectible designs to engage health‑conscious millennials. Retailers benefit from flexible formats that support small‑batch and subscription models. Stakeholders secure competitive edge by integrating transparent sourcing labels. This shift drives differentiation and stimulates trial among discerning purchasers.

Integration of Digital Platforms and Circular Economy Partnerships

The fruit juice packaging market can unlock new value streams by embedding QR codes and blockchain links into labels. It can deliver interactive content on sourcing, nutritional data, and loyalty rewards. Packaging suppliers strengthen sustainability claims through alliances with material recovery facilities and refill station networks. Producers reduce waste by piloting returnable bottle programs in urban centers. Brands foster trust by showcasing real‑time recycling metrics via mobile apps. Retailers streamline restocking through smart shelf technology. These strategies bolster engagement, reinforce environmental leadership, and support long‑term growth.

Market Segmentation Analysis:

By Packaging Type

The fruit juice packaging market divides into bottles, cartons, pouches, and cans to address diverse use cases. It favors PET and glass bottles for premium on‑the‑go servings. Cartons deliver lightweight, shelf‑stable formats that suit multipacks and bulk purchases. Pouches offer flexible, space‑efficient solutions for single servings and children’s lunchboxes. Cans provide robust protection for carbonated and fortified blends. Manufacturers optimize material choice to balance cost, protection, and recycling efficiency.

- For instance, Amcor launched lightweight, low-carbon PET bottles in 2024, enhancing premium on-the-go consumption with sustainable, durable packaging.

By Fruit Category

By fruit category, the fruit juice packaging market segments into citrus fruits, berries, tropical fruits, stone fruits, and other fruits. It matches barrier properties to acidity levels in citrus variants. Berries require high‑barrier films to preserve delicate flavors. Tropical blends demand robust seals to contain pulp and prevent leakage. Stone fruit juices benefit from carton packs that maintain freshness over longer distribution networks. Other fruit mixes leverage versatile formats based on targeted shelf‑life and branding strategies.

- For instance, stone fruit juices such as peach juices often use carton packs designed to preserve freshness over extended distribution, as implemented by brands like Dole, which rely on multi-layered carton packaging to maintain quality during longer shelf lives.

By Target Audience

By target audience, the fruit juice packaging market addresses health‑conscious consumers, children, adults, and senior citizens. It uses resealable bottles and clear labels to appeal to fitness‑focused buyers. Child‑oriented pouches feature colorful graphics and easy‑twist caps. Adults favor sleek carton multipacks for home convenience. Senior citizens benefit from ergonomic handles and large‑print nutritional panels. Brands tailor package size, closure type, and graphic design to meet each segment’s ergonomic and informational needs.

Segments:

Based on Type of Packaging

- Bottles

- Cartons

- Pouches

- Cans

Based on Fruit

- Citrus Fruits

- Berries

- Tropical Fruits

- Stone Fruits

- Other Fruits

Based on Target Audience

- Health-Conscious Consumers

- Children

- Adults

- Senior Citizens

Based on Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Health Food Stores

Based on Shelf Life

- Short Shelf Life

- Medium Shelf Life

- Long Shelf Life

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The fruit juice packaging market benefits from robust cold chain infrastructure and advanced recycling systems that support large‑scale PET and carton operations. It leverages PET bottle dominance to meet on‑the‑go demands and premium segments. Producers invest in aseptic carton lines to extend shelf life and reduce spoilage. Retailers adopt multipacks to optimize shelf space and drive bulk sales. Sustainability incentives encourage adoption of recycled content and compostable films. Partnerships between packagers and juice brands strengthen innovation. Market shares: North America 35%; Europe 25%; Asia Pacific 30%; Latin America 7%; Middle East & Africa 3%.

Europe

The fruit juice packaging market leverages strict environmental policies to accelerate use of recyclable PET and paperboard cartons. It connects with consumers through transparent labels detailing recycled content and carbon footprint. Manufacturers adapt lightweight mono‑material laminates to meet recycling targets. Retailers prefer sustainable multipacks and local sourcing to support circular economy goals. Industry alliances fund development of biodegradable coatings. Innovation centers in key countries test active packaging that maintains quality. Market shares: North America 35%; Europe 25%; Asia Pacific 30%; Latin America 7%; Middle East & Africa 3%.

Asia Pacific

The fruit juice packaging market experiences rapid growth driven by expanding urban populations and rising disposable incomes. It integrates flexible pouches and cans to meet diverse consumption patterns and price points. Producers scale up PET bottle capacities to support modern retail and e‑commerce channels. Governments encourage reduced packaging waste and local recycling initiatives. Brands emphasize attractive graphics and ergonomic closures to appeal to digital‑first shoppers. Joint ventures accelerate technology transfer for shelf life enhancement. Market shares: North America 35%; Europe 25%; Asia Pacific 30%; Latin America 7%; Middle East & Africa 3%.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DS Smith

- CCL Industries

- Can-Pack

- Tetra Laval

- Ardagh Group

- Smurfit Kappa

- Evergreen Packaging

- Crown Holdings

- Amcor

- Ball

- CKS Packaging

- Genpak

- Bemis

Competitive Analysis

The fruit juice packaging market includes players such as Amcor, Ball, Bemis, Crown Holdings, Smurfit Kappa, Tetra Laval, Ardagh Group, Can‑Pack, CCL Industries, CKS Packaging, DS Smith, Evergreen Packaging, and Genpak. It emphasizes sustainability to differentiate brands, driving investment in recyclable PET, mono‑material cartons, and plant‑based films. Key participants pursue strategic partnerships with material innovators to develop biodegradable barriers and active packaging solutions. Companies compete on cost efficiency through lightweight designs and economies of scale in high‑demand regions. Firms expand regional footprint through joint ventures and acquisitions, securing local resin supply and production capacity. They integrate digital printing and smart label technologies to enhance branding and traceability. Continuous process improvements lower production costs and speed time‑to‑market. Custom packaging design and technical support strengthen client relationships. Robust R&D pipelines ensure pipeline renewal, enabling quick adaptation to regulatory changes and shifting consumer preferences, and ensure competitive advantage in a dynamic market.

Recent Developments

- In April 30, 2025, Amcor completed its all‑share combination with Berry Global, forming a broader packaging portfolio and enhancing innovation capabilities.

- In June 2025, CCL Label launched EcoShear®, a residue‑free adhesive technology for single‑use glass bottles, enabling nearly complete label removal during recycling.

- In March 2025, Tetra Pak & Schoeller Allibert partnered to launch a polyAl transport crate made from used beverage cartons, showcased at the Plastics Recycling Show in Amsterdam.

- In July 2025, CANPACK Group announced a PLN 440 million investment to expand its beverage can factory in Bydgoszcz, boosting capacity for aluminum cans.

Market Concentration & Characteristics

The fruit juice packaging market demonstrates moderate concentration with a handful of global leaders commanding majority share. Top companies such as Amcor, Tetra Laval, Smurfit Kappa, Crown Holdings and Ardagh Group hold combined share close to 55 percent due to extensive production capacity and broad geographic reach. It also features regional specialists like DS Smith and CCL Industries that secure niche segments. Leading players pursue strategic acquisitions and joint ventures to expand capacity in emerging markets. They leverage scale to negotiate raw material contracts and maintain cost leadership. Smaller innovators focus on specialized formats and sustainable materials to differentiate offerings. High barriers to entry arise from strict regulatory approvals and large capital investment requirements. Intense competition drives continuous improvement in packaging design and material science. Balanced concentration fosters dynamic environment with opportunities for collaboration and new entrants that offer unique value propositions. Market analysis underscores stable growth across regions

Report Coverage

The research report offers an in-depth analysis based on Type of Packaging, Fruit, Traget Audience, Distribution Channel, Shelf-Life and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Widespread adoption of bio-based polymers across packaging formats will improve environmental sustainability and reduce waste.

- High-resolution digital printing enables personalized packaging designs that meet evolving brand requirements and consumer preferences.

- Smart labels featuring real-time traceability and interactive capabilities enhance consumer engagement and brand transparency effectively.

- Advanced barrier technologies extend freshness and reduce spoilage without reliance on refrigeration, ensuring quality preservation.

- Direct-to-consumer and subscription-based delivery models rely on durable, user-friendly packaging that safeguards product integrity efficiently.

- Lightweight mono-material structures minimize transportation costs and carbon footprint while maintaining packaging strength and performance.

- Partnerships with local distribution networks drive refillable and returnable container initiatives to expand urban adoption.

- Simplified material compositions streamline recycling processes and improve end-of-life handling through standardized labeling guidelines efficiently.

- Augmented reality features on packaging deliver immersive consumer education and experiences that support brand loyalty.

- Collaborations between packaging suppliers and juice producers drive innovation through joint R&D and sustainability objectives.