Market Overview

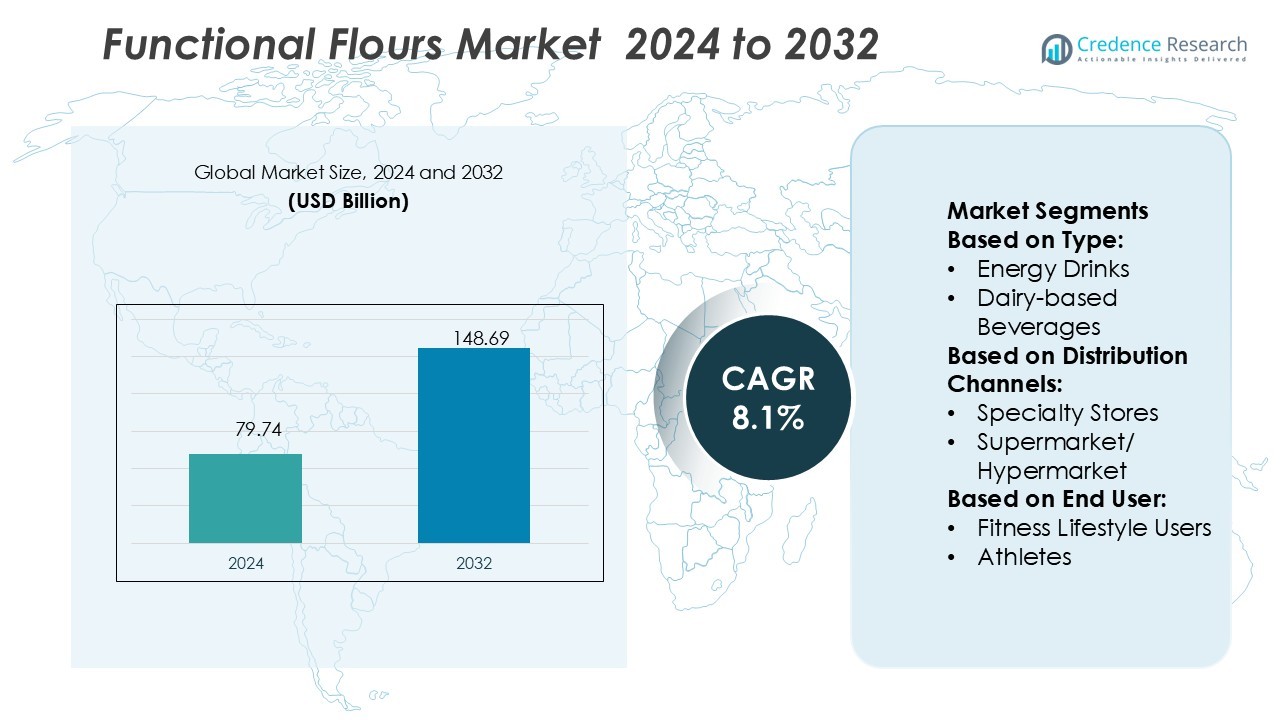

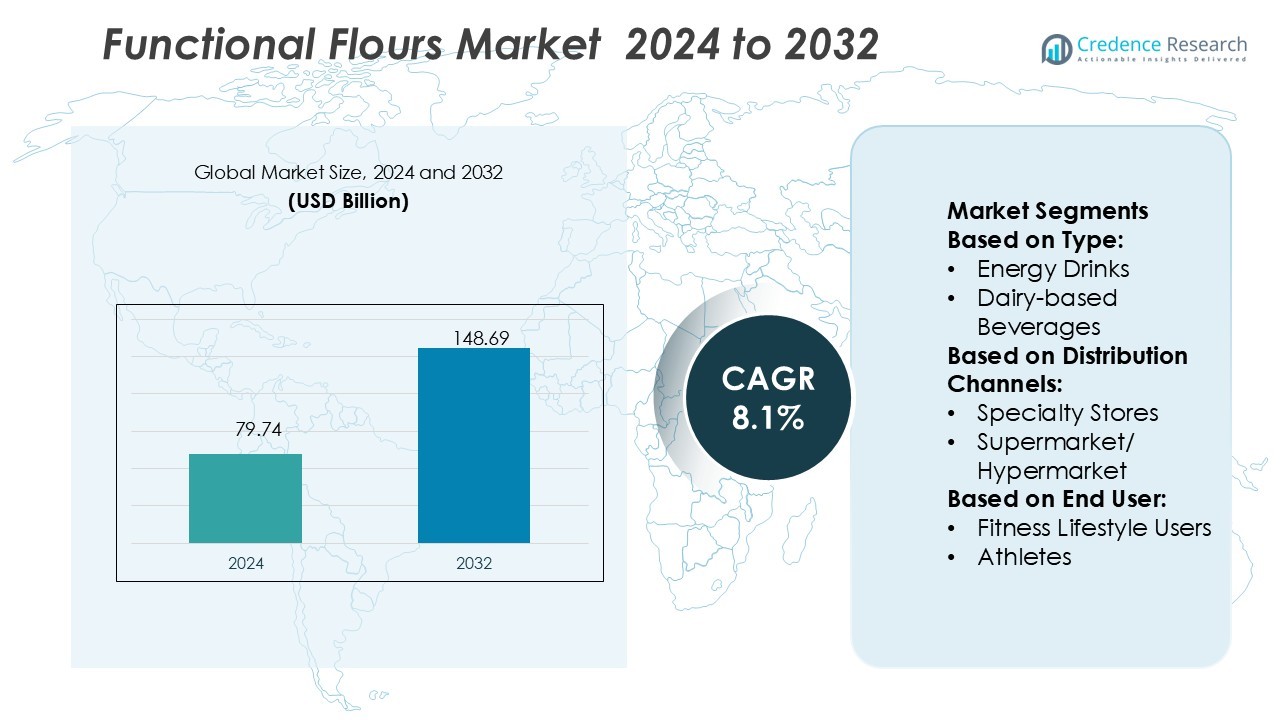

Functional Flours Market size was valued USD 79.74 billion in 2024 and is anticipated to reach USD 148.69 billion by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Flours Market Size 2024 |

USD 79.74 Billion |

| Functional Flours Market, CAGR |

8.1% |

| Functional Flours Market Size 2032 |

USD 148.69 Billion |

The functional flours market is driven by prominent players including Archer Daniels Midland (ADM), Ardent Mills, Bay State Milling Company, Central Milling, General Mills, Giusto’s, Great River Organic Milling, Janie’s Mill, Doves Farm Foods, and Kaizen Food Company. These companies compete through innovation in gluten-free, fortified, and plant-based offerings, while also investing in sustainable sourcing and advanced processing technologies. Strategic expansions across retail and e-commerce channels further strengthen their positions. Regionally, North America leads the functional flours market with a 34% share in 2025, supported by strong consumer demand for clean-label, health-oriented products and the presence of major multinational manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The functional flours market was valued at USD 79.74 billion in 2024 and is projected to reach USD 148.69 billion by 2032, growing at a CAGR of 8.1%.

- Market growth is driven by rising health awareness, increasing demand for gluten-free and fortified products, and expanding adoption of plant-based diets among urban consumers.

- Key trends include clean-label innovations, sustainable sourcing, and the expansion of e-commerce channels, which enhance product visibility and consumer reach across global markets.

- Competitive dynamics are shaped by major players focusing on technological advancements, portfolio diversification, and strategic partnerships, while high production costs and regulatory complexities remain significant restraints.

- Regionally, North America dominates with a 34% share in 2025, supported by strong consumer demand and presence of leading manufacturers, while energy drinks lead the type segment with a 37% share, reflecting strong preference for quick energy and performance-focused products.

Market Segmentation Analysis:

By Type

Within the functional flours market, energy drinks dominate this segment with a 37% share in 2025. Their popularity stems from rising health-consciousness, demand for quick energy, and widespread acceptance among young consumers and working professionals. Dairy-based beverages follow, driven by protein enrichment and digestive health benefits. Sports drinks and juices also capture attention, though their shares remain lower due to intense competition. The “others” category, including plant-based beverages, is gaining traction, fueled by vegan lifestyles and clean-label preferences, which further strengthen diversification within the market landscape.

- For instance, Danone’s Research & Innovation centers hold over 5,000 patents and patent applications globally, underscoring their investment in ingredient innovations and functional formulations.

By Distribution Channels

Supermarkets and hypermarkets hold the largest share at 42% in 2025, reflecting consumer preference for convenience and variety. These outlets provide broad assortments and promotional offers, making them dominant sales channels. Specialty stores remain significant for premium and tailored functional flours, appealing to niche fitness consumers. E-commerce continues to grow rapidly, supported by online subscription models and home delivery services. Other channels, including local stores, still contribute but are less impactful, primarily serving rural areas and value-conscious customers who prioritize accessibility and price sensitivity.

- For instance, Coca-Cola engineered its Freestyle dispenser’s touchless user interface using AWS serverless tech in 150 days, enabling frictionless beverage dispensing and system responsiveness even under high transaction volumes.

By End-User

Athletes lead the end-user segment with a 46% share in 2025, reflecting their consistent reliance on functional flours for energy and performance enhancement. This group values scientifically formulated products and invests heavily in sports nutrition. Fitness lifestyle users account for a growing share, supported by increasing gym memberships and wellness-driven diets among urban populations. The “others” category, including general consumers seeking occasional health boosts, remains smaller but shows gradual expansion. Strong marketing campaigns targeting lifestyle wellness and preventive health trends further support growth across non-athlete demographics.

Key Growth Drivers

Rising Demand for Health and Wellness Products

The functional flours market is expanding due to increasing consumer focus on health and wellness. Consumers actively seek nutrient-rich flours that support digestion, weight management, and overall immunity. The rise in chronic health conditions, coupled with awareness of preventive nutrition, accelerates demand. Functional flours enriched with fibers, proteins, and bioactive compounds align well with these needs. Health-conscious urban populations and younger demographics drive sustained consumption, making health benefits a central factor influencing product innovation, brand positioning, and market growth.

- For instance, AmeriGas, a part of UGI Corporation, operates a vast network across the United States. Recent UGI financial filings confirm a network of approximately 1,360 propane distribution locations serving customers across the country.

Expansion of Functional Food and Beverage Industry

The growing functional food and beverage sector significantly drives the functional flours market. Manufacturers integrate functional flours into bakery, dairy, beverages, and snack products to meet consumer demand for fortified offerings. Product launches highlight clean-label, gluten-free, and plant-based innovations that cater to diverse dietary preferences. The expansion of fortified categories in supermarkets and online platforms also fuels growth. This integration not only enhances product value but also strengthens brand competitiveness, leading to higher adoption rates across both developed and emerging economies.

- For instance, Nutrien’s retail arm markets its Riser® in-furrow nutrition system for row crops, which applies micronutrient blends (e.g., zinc, boron) at a rate of 2.0 to 5.0 gallons (approximately 7.6 to 18.9 liters) per acre along with base fertilizer, ensuring forage or feed crops receive balanced nutrition early in growth.

Technological Advancements in Food Processing

Advancements in food processing technologies strengthen the market by improving quality, texture, and nutritional stability of functional flours. Innovations in extrusion, milling, and enzyme applications enhance flour fortification while retaining natural properties. These developments allow manufacturers to create customized solutions targeting specific health needs such as heart health, gut health, or energy enhancement. Technology also supports shelf-life extension and scalable production, meeting the rising demand across varied regions. Such advancements provide companies with opportunities to diversify offerings and expand market presence.

Key Trends & Opportunities

Growth of Plant-Based and Gluten-Free Products

The surge in plant-based diets and rising gluten intolerance cases present strong opportunities for functional flours. Consumers increasingly choose flours derived from legumes, seeds, and ancient grains for their nutritional value and allergen-free properties. This trend is evident in bakery and snack segments, where gluten-free innovations drive higher shelf visibility. Companies investing in non-wheat functional flours strengthen their market edge, appealing to vegan, vegetarian, and health-conscious buyers. The shift toward plant-forward lifestyles ensures continued expansion of this opportunity.

- For instance, LMK Thermosafe’s Thermosafe Type B Induction Drum Heater warms a 205-liter steel drum using an alternating current power source, such as a 110/120V supply rated at 1,500 watts. Two units can be stacked to cover the full drum height safely in Zone 2 areas.

E-Commerce and Direct-to-Consumer Channels

E-commerce platforms and direct-to-consumer models open new growth avenues for functional flours. Online retail offers greater convenience, diverse product availability, and personalized subscription services. Digital platforms also enable targeted marketing campaigns that highlight nutritional benefits and recipe adaptability, increasing consumer engagement. Smaller brands gain equal visibility, while global players use online strategies to expand reach across emerging markets. The continued shift toward digital retail ensures that e-commerce remains a critical growth driver for sales and consumer connection in the functional flours market.

- For instance, Cochran’s official specification shows that the ST25 delivers an exact steam output range of 500 to 6 500 kg/hr at feed-and-allowance 100 °C .This numeric capacity underlines its ability to sustain continuous steam flow in demanding operational.

Key Challenges

High Production and Processing Costs

The functional flours market faces challenges from elevated production and processing costs. Advanced technologies, ingredient sourcing, and quality assurance raise expenses significantly compared to conventional flours. These costs often translate into higher retail prices, limiting affordability among price-sensitive consumers. Small-scale manufacturers struggle to compete, while larger companies require continuous investments to maintain economies of scale. Balancing innovation with cost-efficiency remains essential, as affordability strongly influences adoption rates, especially in developing economies with limited consumer spending power.

Regulatory and Labeling Complexities

Regulatory and labeling requirements present another challenge in the functional flours market. Governments impose strict guidelines on claims related to health benefits, nutritional composition, and product safety. Companies must navigate complex regional compliance frameworks, leading to higher operational and certification costs. Mislabeling risks damage brand credibility and consumer trust. The need for clear, science-backed product communication further complicates marketing strategies. Addressing these challenges requires investment in R&D, transparent labeling practices, and close alignment with evolving food safety regulations across global markets.

Regional Analysis

North America

North America leads the functional flours market with a 34% share in 2025, supported by high demand for fortified and gluten-free products. Rising health awareness, coupled with the popularity of plant-based diets, drives consistent adoption. The U.S. dominates regional growth due to strong retail penetration, innovation in clean-label products, and the presence of leading food manufacturers. Canada follows with rising consumer preference for natural flours and expanding health-conscious lifestyles. Strategic product launches and investments in research further strengthen North America’s position as a dominant and innovation-driven market in the global landscape.

Europe

Europe holds a 29% share in the functional flours market in 2025, driven by increasing consumption of organic and non-GMO products. Countries like Germany, the UK, and France lead demand due to strong regulatory frameworks promoting healthier diets. The region shows high acceptance of plant-based and gluten-free flours, reflecting shifting consumer preferences. Manufacturers focus on expanding fortified bakery and dairy offerings, aligning with sustainability goals. The presence of multinational players and innovation in ancient grain-based flours position Europe as a mature yet evolving market with stable growth prospects.

Asia-Pacific

Asia-Pacific accounts for 24% of the functional flours market in 2025, emerging as the fastest-growing region. China and India drive significant demand due to rising urbanization, disposable incomes, and increasing adoption of functional foods. Japan and South Korea show strong demand for fortified flours in bakery and snacks. The region benefits from a growing middle class that prioritizes preventive health and nutrition. Expansion of e-commerce platforms further accelerates accessibility. Local and international manufacturers are investing heavily, leveraging cultural dietary preferences to introduce innovative products, strengthening Asia-Pacific’s role as a key growth hub.

Latin America

Latin America represents 7% of the functional flours market in 2025, with Brazil and Mexico as primary contributors. Demand is supported by growing health awareness and the rising popularity of fortified bakery and beverage products. Regional adoption is slower compared to developed markets, constrained by pricing challenges and limited product availability. However, urban consumers are increasingly adopting health-focused diets, fueling gradual growth. Multinational companies expand their presence through partnerships and product launches, while local players focus on cost-effective solutions. Latin America remains an emerging market with untapped potential for functional flour innovation and distribution expansion.

Middle East and Africa

The Middle East and Africa capture 6% of the functional flours market in 2025, showing steady growth from rising urbanization and awareness of nutritional benefits. Countries like the UAE and South Africa lead adoption, driven by demand for fortified flours in bakery and processed foods. Affordability challenges and limited consumer awareness in rural areas restrict wider penetration. However, increasing investments in food innovation and retail modernization support market expansion. International brands, alongside regional companies, target premium health-conscious segments. With gradual lifestyle shifts, MEA holds long-term growth opportunities, especially through e-commerce and tailored product offerings.

Market Segmentations:

By Type:

- Energy Drinks

- Dairy-based Beverages

By Distribution Channels:

- Specialty Stores

- Supermarket/ Hypermarket

By End User:

- Fitness Lifestyle Users

- Athletes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the functional flours market features leading players such as Janie’s Mill, Great River Organic Milling, Kaizen Food Company, Ardent Mills, General Mills, Giusto’s, Archer Daniels Midland (ADM), Central Milling, Doves Farm Foods, and Bay State Milling Company. The competitive landscape of the functional flours market is shaped by continuous innovation, strong distribution strategies, and growing emphasis on health-focused product development. Companies in this sector focus on expanding portfolios with fortified, gluten-free, and plant-based flours to meet rising consumer demand for nutritious and clean-label options. Strategic investments in processing technologies enhance product quality, shelf-life, and scalability, enabling businesses to strengthen their global presence. Partnerships with retailers and e-commerce platforms further improve accessibility and market penetration. Additionally, sustainability initiatives, such as organic sourcing and eco-friendly packaging, remain central to competitive positioning and long-term growth in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Janie’s Mill

- Great River Organic Milling

- Kaizen Food Company

- Ardent Mills

- General Mills

- Giusto’s

- Archer Daniels Midland (ADM)

- Central Milling

- Doves Farm Foods

- Bay State Milling Company

Recent Developments

- In May 2025, Tata Consumers announced plans to expand its food and beverage business with new product launches and acquisitions. With a focus on functional drinks, premium foods, and selective market entry, the FMCG firm targets urban growth and evolving consumer needs to drive future revenue.

- In March 2025, PepsiCo acquired Poppi for to expand into the fast-growing prebiotic soda and functional beverage market. The deal includes USD 300 million in anticipated tax benefits.

- In March 2025, Entertainment icon Snoop Dogg invested in a partnership with Harmony Craft Beverages to release a range of cannabis and functional drinks named Iconic Tonics. As wellness and mindful drinking trends accelerate, the musical artist’s move to release Ikonic Tonics is well-timed for the sector.

- In January 2025, Reliance Consumer Products Ltd (RCPL), a subsidiary of Reliance Industries, launched a new rehydration beverage, RasKik Gluco Energy, priced at an affordable Rs 10 for a single-serve drink. The beverage combines electrolytes, glucose, and real lemon juice, offering a refreshing solution for consumers seeking both hydration and energy.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channels, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The functional flours market will expand with rising demand for health-focused diets.

- Gluten-free and plant-based flours will gain stronger consumer acceptance.

- Advances in food processing will improve quality and nutritional retention.

- E-commerce channels will play a larger role in market growth.

- Clean-label and non-GMO flours will dominate product innovation strategies.

- Emerging economies will drive significant demand due to urbanization and lifestyle shifts.

- Strategic partnerships will enhance product distribution and consumer reach.

- Sustainability and organic sourcing will remain central to competitive differentiation.

- Customized functional flours targeting specific health benefits will increase adoption.

- Strong marketing of nutritional advantages will boost consumer awareness and loyalty.