Market Overview

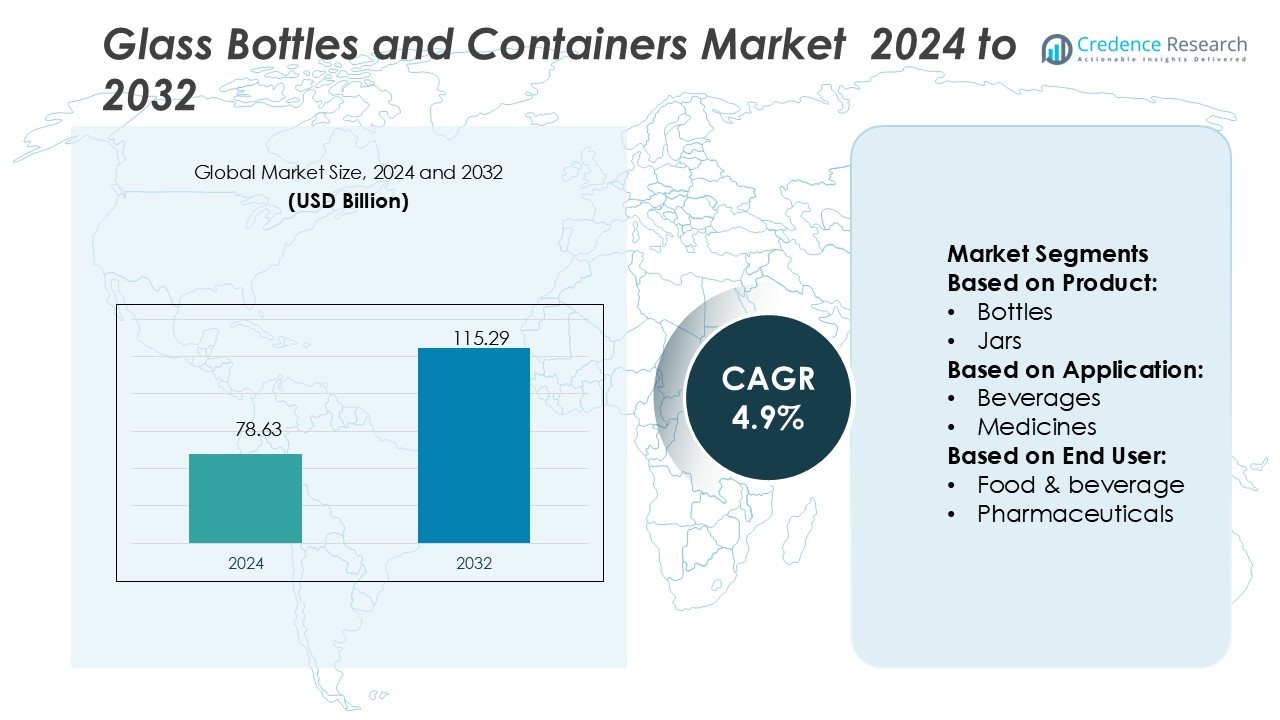

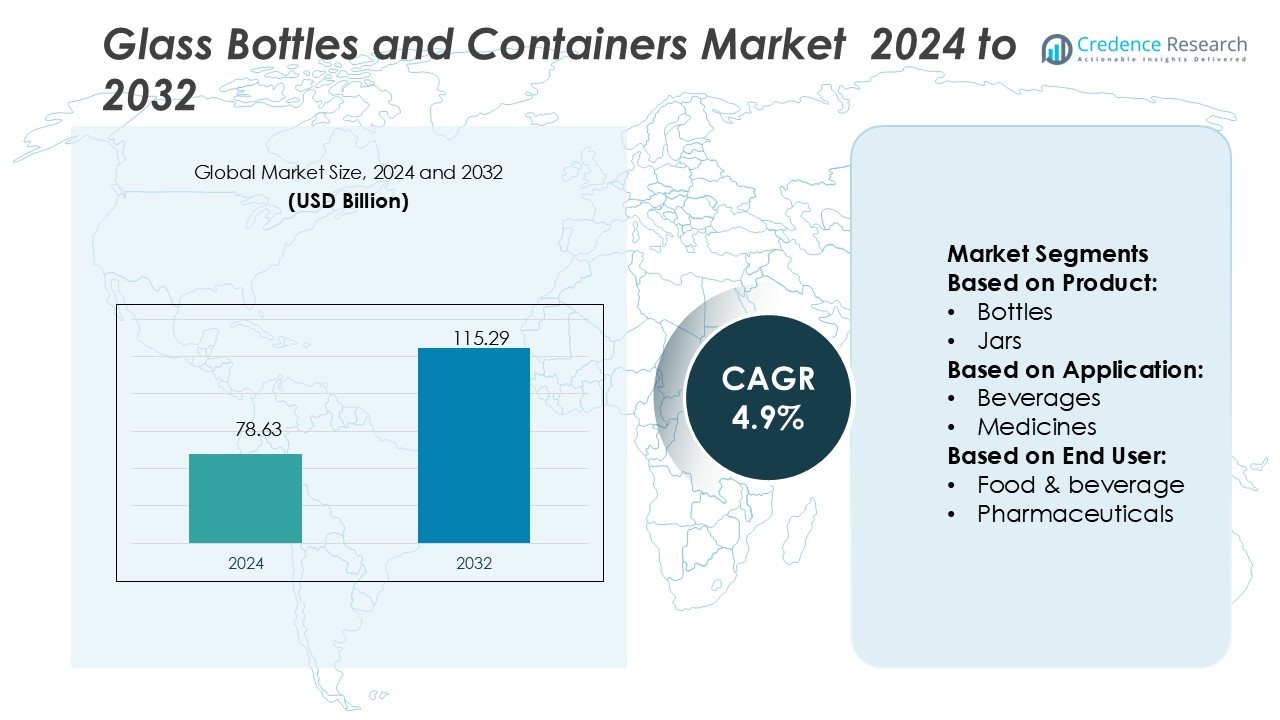

Glass Bottles and Containers Market size was valued USD 78.63 billion in 2024 and is anticipated to reach USD 115.29 billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass Bottles and Containers Market Size 2024 |

USD 78.63 Billion |

| Glass Bottles and Containers Market, CAGR |

4.9% |

| Glass Bottles and Containers Market Size 2032 |

USD 115.29 Billion |

The glass bottles and containers market features strong competition from leading players such as Encirc, Glassworks International, Ardagh Group, Croxons, Gerresheimer, Anchor Glass Container, BPL Offset, AGI Glaspac, Glaspack, and Ameri Glass. These companies focus on sustainability, lightweight glass innovation, and premium packaging solutions to strengthen their global presence. Europe emerges as the leading region, holding 32% of the global market share, supported by advanced recycling infrastructure, strict regulations against plastic use, and strong demand for premium beverages and luxury cosmetics. The combination of regulatory support and consumer preference reinforces Europe’s dominant position in this market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Glass Bottles and Containers Market was valued at USD 78.63 billion in 2024 and is expected to reach USD 115.29 billion by 2032, growing at a CAGR of 4.9% during the forecast period.

- Rising demand for sustainable and recyclable packaging, particularly as alternatives to plastics, drives steady growth across beverages, pharmaceuticals, and cosmetics.

- Lightweight glass innovation and premiumization trends in cosmetics and beverages define market dynamics, with key players focusing on eco-friendly manufacturing and design differentiation.

- High production and energy costs, coupled with competition from alternative packaging materials like plastics and aluminum, remain major restraints impacting profitability.

- Europe leads with 32% market share due to advanced recycling infrastructure and strict regulations, while North America holds 28% and Asia-Pacific accounts for 27%; among segments, bottles dominate with 55% share, driven by beverage consumption growth and strong brand preference for glass packaging.

Market Segmentation Analysis:

By Product

Bottles dominate the glass bottles and containers market, holding a 55% share in 2025. Their leadership stems from rising demand in beverages, particularly soft drinks, alcoholic beverages, and premium mineral water. Glass bottles are valued for recyclability, product preservation, and premium branding appeal. Jars remain important for packaged foods and condiments, while vials and ampoules play a critical role in pharmaceuticals. However, bottles continue to lead due to their large-scale adoption in the food and beverage industry and ongoing innovation in lightweight glass technology.

- For instance, Encirc reduced the weight of its 750 ml and 330 ml glass water bottles by 20 g through new techniques, saving 850,000 kg of glass annually. Encirc’s new hydrogen-powered hybrid furnace (to be operational in 2027) aims to produce up to 200 million net zero bottles per year.

By Application

Beverages account for the largest share at 48% in 2025, making them the leading application segment. Increasing consumption of beer, wine, spirits, and non-alcoholic drinks drives this dominance. Brand owners prefer glass packaging for its premium image, flavor retention, and sustainability credentials. Medicines hold significant demand, especially with the growth of biologics and vaccines requiring secure vials and ampoules. Packaged foods, perfumes, skincare, and other applications add diversity, but beverages remain the key growth engine for the glass container industry worldwide.

- For instance, Ardagh commissioned its NextGen hybrid furnace in Obernkirchen, achieving a 64 % reduction in emissions per bottle at that line.It built a hydrogen electrolyser in Limmared (Sweden) to feed low-carbon hydrogen into its glass melting system.

By End User

The food and beverage industry leads with a 57% share in 2025, reflecting its reliance on glass containers for product safety and shelf appeal. Rising consumer preference for sustainable packaging and premium branding supports this dominance. Pharmaceuticals are the second-largest end user, driven by sterile packaging needs for drugs, vaccines, and injectables. Cosmetics and personal care companies also increasingly favor glass for perfumes and skincare due to luxury positioning. Despite emerging uses in chemicals and other sectors, food and beverage remains the primary driver of market growth.

Key Growth Drivers

Rising Demand for Sustainable Packaging

Growing consumer awareness of environmental sustainability drives adoption of glass bottles and containers. Unlike plastics, glass is infinitely recyclable without losing quality, making it a preferred eco-friendly packaging solution. Governments and regulators also support sustainability through strict restrictions on single-use plastics, further encouraging businesses to shift toward glass. Major beverage, food, and cosmetics brands invest heavily in sustainable glass packaging to strengthen brand reputation and meet green targets. This collective momentum makes eco-friendly packaging one of the strongest growth drivers in the market.

- For instance, Gerresheimer’s Lohr site now uses an oxy-hybrid furnace that can operate with up to 50% electricity input, reducing CO₂ emissions by up to 40% compared to conventional furnace technology.

Expanding Beverage Consumption Globally

The beverage industry, particularly alcoholic drinks, soft drinks, and premium bottled water, significantly fuels market growth. Consumers associate glass packaging with purity, product safety, and premium appeal. Emerging markets in Asia-Pacific and Latin America are experiencing rapid growth in middle-class populations, leading to higher consumption of premium beverages. Craft beer, artisanal spirits, and health-focused drinks increasingly favor glass packaging due to flavor preservation and brand differentiation. The consistent expansion of beverage consumption ensures a strong and sustained demand for glass bottles globally.

- For instance, Anchor Glass’s catalog lists a 12 fl oz long-neck bottle (model 812V6A) with a weight of 198.45 g and height of 228.60 mm. The company’s New Product Development (NPD) team designs custom bottles and utilizes its in-house mold-making facility to streamline the process from design to pilot samples.

Pharmaceutical and Healthcare Sector Growth

Rising demand for medicines, vaccines, and injectable drugs strengthens the glass containers market. Vials and ampoules made of borosilicate and other high-strength glass offer excellent chemical resistance, ensuring safe drug storage. With the expansion of biologics and injectable therapies, pharmaceutical companies rely on glass packaging for sterility and product integrity. The COVID-19 pandemic highlighted the critical role of glass vials in vaccine distribution, further boosting long-term demand. As healthcare spending continues to rise globally, the pharmaceutical sector provides a stable growth driver.

Key Trends & Opportunities

Lightweight Glass Innovation

Advancements in lightweight glass technology present a major trend in the industry. Manufacturers are producing thinner yet durable glass containers that reduce material costs, improve transport efficiency, and lower carbon footprints. This innovation aligns with sustainability targets while maintaining strength and product safety. Lightweight glass is increasingly adopted in beverages, food packaging, and cosmetics. Companies investing in these technologies gain opportunities to enhance competitiveness and meet customer demand for eco-friendly, cost-effective packaging solutions. This trend continues to reshape production and market dynamics.

- For instance, BPL Offset offers a variety of glass bottles, including round, clear 300 ml juice bottles and 500 ml transparent water bottles suitable for freezer use. As a manufacturer and retailer, the company offers customizable printing and sources materials that meet the needs of food and beverage applications.

Premiumization in Cosmetics and Beverages

The shift toward premium and luxury products creates strong opportunities for glass containers. Cosmetics brands use glass packaging to enhance perceived value and aesthetic appeal, especially in perfumes and skincare products. Beverage companies also adopt glass bottles to differentiate premium lines of wine, spirits, and mineral water. Consumers associate glass with sophistication and quality, boosting brand loyalty. This trend is particularly strong in urban markets, where disposable incomes are rising. Premiumization provides glass packaging producers with opportunities for higher margins and market expansion.

- For instance, AGI Greenpac’s Bhongir plant utilizes a colouring forehearth line, which enables the production of a variety of glass colors for specialized container segments. The company manufactures a wide range of container sizes, from 5 ml pharmaceutical vials to 4,000 ml liquor bottles.

Key Challenges

High Production and Energy Costs

Glass manufacturing involves energy-intensive processes such as melting raw materials at high temperatures, driving up production costs. Rising energy prices, especially in Europe and Asia, increase the overall expense of producing glass containers. Compared to alternatives like plastics and aluminum, glass remains costlier to manufacture and transport due to its weight. These factors pressure profit margins for producers and limit affordability for smaller brands. Addressing energy efficiency and exploring renewable energy sources remain key strategies to overcome this challenge.

Competition from Alternative Packaging Materials

The rise of lightweight plastics, aluminum cans, and paper-based packaging poses a challenge to glass container adoption. These alternatives offer lower costs, easier handling, and wider applicability in fast-moving consumer goods. For instance, flexible packaging dominates in food products due to convenience and portability. While glass maintains an edge in premium appeal and sustainability, strong competition restricts its penetration in mass-market applications. Producers must innovate and emphasize recyclability, durability, and consumer safety benefits to remain competitive against alternative packaging materials.

Regional Analysis

North America

North America holds a 28% share in the global glass bottles and containers market, driven by strong demand from the food and beverage sector. The U.S. leads with high consumption of alcoholic beverages, premium water, and soft drinks packaged in glass. Sustainability initiatives and bans on single-use plastics further strengthen glass adoption. Pharmaceutical demand for vials and ampoules also contributes significantly, especially with the presence of leading biotech and vaccine producers. Manufacturers in the region focus on lightweight glass innovation and recycling infrastructure, positioning North America as a mature yet steadily growing market.

Europe

Europe accounts for 32% of the global market, making it the leading regional contributor. Countries such as Germany, France, Italy, and the UK emphasize sustainability and recycling, creating strong demand for glass containers. Premium beverages, including wine and spirits, significantly boost glass bottle adoption. The European cosmetics and personal care industry further supports growth, with luxury perfumes and skincare relying heavily on glass packaging. Advanced recycling systems and strict regulations against plastic packaging strengthen the dominance of glass. Europe continues to lead in technological advancements in lightweight and eco-friendly glass production, ensuring long-term market leadership.

Asia-Pacific

Asia-Pacific holds 27% of the global market and represents the fastest-growing region. Rapid urbanization, rising disposable incomes, and changing consumption patterns drive demand for glass packaging in beverages, food, and cosmetics. China and India are major growth hubs, with expanding pharmaceutical sectors adding to demand for vials and ampoules. Alcoholic beverage consumption, particularly beer and spirits, also supports market expansion. Despite infrastructure challenges, growing environmental awareness and government-led recycling initiatives enhance the region’s glass packaging outlook. Asia-Pacific offers significant opportunities for manufacturers due to its large population base and increasing preference for sustainable packaging solutions.

Latin America

Latin America represents a 7% share of the global market, supported by strong beverage consumption, particularly beer and soft drinks. Brazil and Mexico are key contributors, with major breweries and soft drink manufacturers driving demand for glass bottles. The region’s cosmetics sector also favors glass for perfumes and skincare packaging. However, limited recycling infrastructure and higher production costs create challenges for manufacturers. Despite these constraints, rising consumer preference for sustainable packaging and brand investments in premium beverages sustain growth. Latin America remains an emerging market with strong potential, especially in urban and middle-class segments.

Middle East & Africa

The Middle East & Africa account for 6% of the global market, led by rising demand for bottled beverages and expanding pharmaceutical needs. Countries such as the UAE and Saudi Arabia experience growing demand for premium water, juices, and perfumes packaged in glass containers. Africa contributes through increasing demand for medicines and packaged foods. However, high energy costs for production and weaker recycling networks challenge growth in the region. Despite this, the luxury goods and cosmetics sector provides steady opportunities, while government sustainability initiatives are gradually improving prospects for glass packaging adoption.

Market Segmentations:

By Product:

By Application:

By End User:

- Food & beverage

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the glass bottles and containers market players such as Encirc, Glassworks International, Ardagh Group, Croxons, Gerresheimer, Anchor Glass Container, BPL Offset, AGI Glaspac, Glaspack, and Ameri Glass. The glass bottles and containers market is characterized by intense rivalry, with manufacturers focusing on sustainability, innovation, and cost efficiency. Companies are increasingly investing in lightweight glass technologies to reduce material usage and improve transportation efficiency while maintaining durability and product safety. Rising demand from beverages, pharmaceuticals, and cosmetics drives firms to diversify portfolios with premium and customized packaging solutions. Sustainability remains a central strategy, with emphasis on recycling infrastructure and eco-friendly manufacturing processes. Competitive differentiation also stems from design innovation, regional expansions, and strategic partnerships to meet evolving consumer and regulatory demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Encirc

- Glassworks International

- Ardagh Group

- Croxons

- Gerresheimer

- Anchor Glass Container

- BPL Offset

- AGI Glaspac

- Glaspack

- Ameri Glass

Recent Developments

- In August 2024, Leading premium bottle maker Saverglass announced the addition of the MALTY glass bottle to its spirits portfolio. Designed specifically for whiskey and brown spirits, this new design is set to enhance product presentation while meeting the latest demands of eco-design.

- In July 2024, AGI Greenpac announced a strategic investment of ₹230 crores to modernize its existing furnaces, implement cutting-edge technologies, and optimize production. This initiative will enable the company to better serve the growing demand for high-quality glass packaging solutions.

- In March 2024, Ardagh Glass Packaging-North America entered into a new supply agreement with Stevens Point Brewery to locally provide glass beer bottles. This collaboration connects the brewery to AGP-North America’s Burlington, Wisconsin, manufacturing facility, aligning with the brewery’s commitment to sourcing local products and supporting sustainable practices in its operations.

- In February 2024, O-I Glass, Inc. launched a lightweight glass wine bottle. This new bottle, part of O-I’s commitment to its Science Based Targets Initiative (SBTi) goal to reduce greenhouse gas emissions by 25% by 2030, has been validated by the Carbon Trust.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for sustainable and recyclable packaging solutions.

- Beverage consumption growth will continue to strengthen demand for glass bottles globally.

- Pharmaceutical sector reliance on vials and ampoules will ensure steady market opportunities.

- Innovation in lightweight glass will reduce costs and enhance transport efficiency.

- Premiumization trends in cosmetics and beverages will boost luxury glass packaging demand.

- Recycling infrastructure improvements will increase adoption across developed and emerging regions.

- Emerging economies will drive market growth with rising disposable incomes and urbanization.

- Strategic partnerships will enhance technological innovation and global supply chain reach.

- Competition from alternative packaging will push firms to highlight glass durability and safety.

- Sustainability regulations will further position glass containers as a preferred eco-friendly choice.