Market Overview:

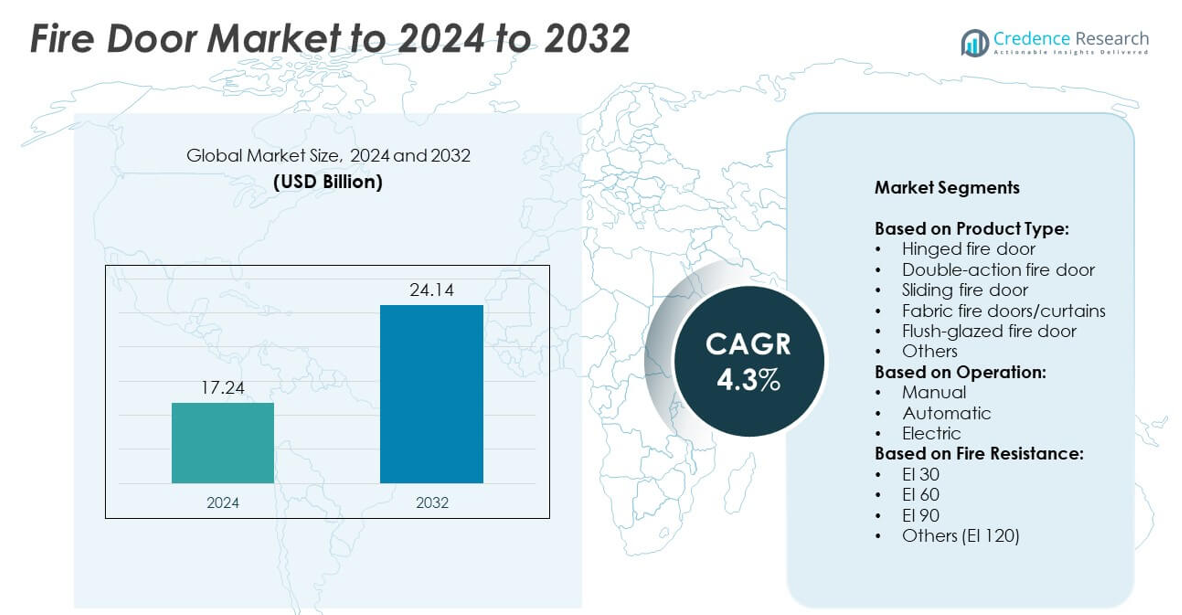

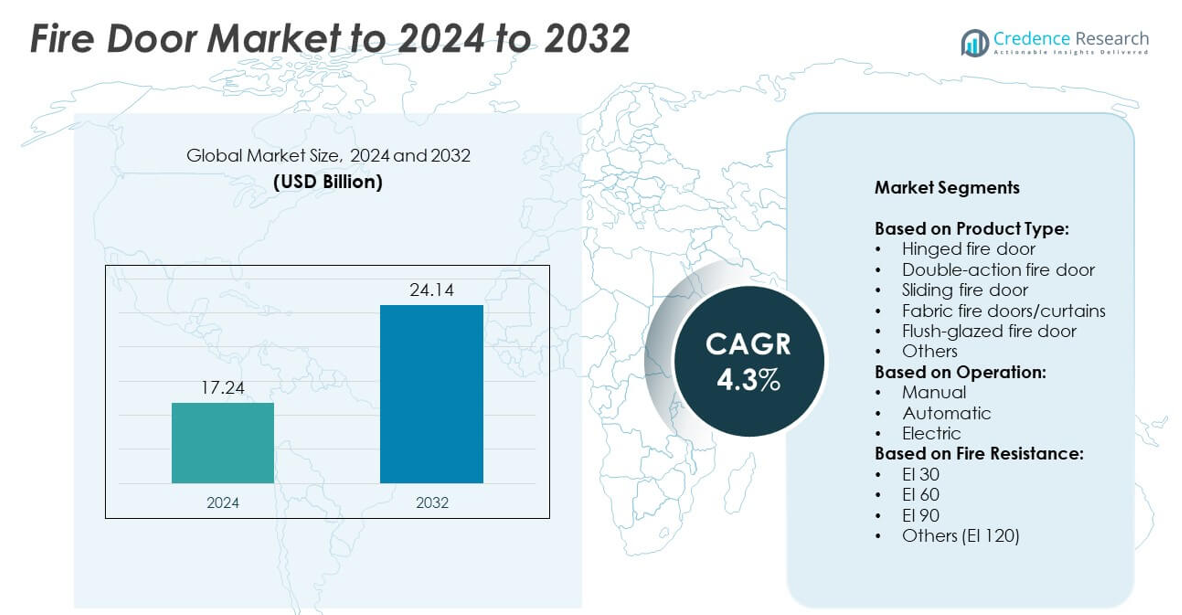

Fire Door Market size was valued USD 17.24 Billion in 2024 and is anticipated to reach USD 24.14 Billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fire Door Market Size 2024 |

USD 17.24 billion |

| Fire Door Market, CAGR |

4.3% |

| Fire Door Market Size 2032 |

USD 24.14 Billion |

The fire door market is shaped by prominent players such as ASSA ABLOY, Allegion plc, Hormann Beteiligungs, Republic Doors and Frames, and Agta Record, who focus on enhancing fire resistance ratings, sustainable materials, and automated solutions to meet stringent safety regulations. These companies emphasize product innovation and global expansion strategies to strengthen their market presence. North America emerged as the leading region in 2024, commanding 34% of the global share, driven by strict regulatory enforcement, high construction activity, and widespread adoption of fire-rated doors across commercial, residential, and industrial infrastructure projects.

Market Insights

- The fire door market was valued at USD 17.24 Billion in 2024 and is projected to reach USD 24.14 Billion by 2032, growing at a CAGR of 4.3%.

- Growth is fueled by strict fire safety regulations, rising construction of high-rise buildings, and increasing awareness of fire protection solutions in both developed and developing regions.

- Market trends highlight the adoption of automatic and smart fire doors with IoT integration, along with the rising use of eco-friendly and sustainable materials to meet green building standards.

- The competitive landscape is moderately fragmented, with global players investing in product innovation, mergers, and regional expansion to strengthen presence, while regional firms compete on cost and regulatory compliance.

- North America led with 34% share in 2024, followed by Europe at 28% and Asia Pacific at 24%, while Latin America held 8% and the Middle East & Africa accounted for 6%, showing balanced global demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The hinged fire door segment dominated the fire door market in 2024 with a share of 41%. These doors are widely adopted across commercial and residential buildings due to their durability, easy installation, and compliance with stringent fire safety codes. Their reliability in compartmentalizing fire and smoke, along with lower maintenance requirements, makes them the preferred option. Demand is further supported by government regulations mandating fire-rated solutions in high-rise and institutional facilities. Sliding fire doors and fire curtains are gaining ground in industrial and large-space applications, but hinged doors remain the leading sub-segment.

- For instance, Teckentrup supplied almost 2,000 steel doors for the London Elizabeth Line project across multiple stations, including Whitechapel and Liverpool Street. The doors covered areas like platforms, tracks, and station bridges, demonstrating large-scale deployment.

By Operation

Manual fire doors held the largest share of 55% in 2024, reflecting their extensive use in residential and small commercial structures. Their cost-effectiveness, simple design, and low maintenance requirements drive widespread preference. These doors are particularly suitable in retrofit projects and settings where automated systems are not economically viable. However, the automatic segment is expanding rapidly in airports, malls, and hospitals due to enhanced safety, accessibility, and integration with building management systems. Despite this growth, manual fire doors remain the dominant segment, supported by affordability and regulatory compliance in mainstream construction.

- For instance, Allegion (Briton) hinges were fire-tested on a single-leaf 120 kg steel door, confirming manual door suitability for heavy, fire-rated assemblies.

By Fire Resistance

The EI 60 segment accounted for the highest share of 38% in 2024, positioning it as the dominant fire resistance rating in the market. EI 60 doors provide up to 60 minutes of fire containment, making them the standard requirement in commercial and institutional buildings. Their balance between safety, cost, and compliance with international standards has driven widespread adoption. Increasing installation in office spaces, hospitals, and public facilities continues to strengthen this category. While EI 30 doors are common in residential use and EI 90 in critical infrastructure, EI 60 remains the preferred industry benchmark.

Key Growth Drivers

Stringent Fire Safety Regulations

Regulatory compliance is the primary growth driver of the fire door market. Governments worldwide have enforced strict fire safety standards for commercial, residential, and industrial buildings. Building codes such as the International Building Code (IBC) and EN standards in Europe mandate the installation of fire-rated doors in critical infrastructure. This legal obligation fuels consistent demand across sectors. The growing emphasis on occupant safety, coupled with insurance requirements for fire protection, further strengthens market growth, making regulatory enforcement the most influential driver.

- For instance, Intertek performs field labeling and inspection for fire doors, applying certification on door assemblies annually to enforce compliance under NFPA 80.

Urbanization and Infrastructure Development

Rapid urbanization and increasing construction of high-rise buildings significantly boost the fire door market. Large-scale infrastructure projects in emerging economies demand enhanced fire protection systems to meet modern safety benchmarks. Growing investments in residential complexes, shopping malls, airports, and hospitals have raised the need for reliable fire containment solutions. Hinged and automatic fire doors are increasingly installed to meet the safety requirements of dense urban structures. The expanding global construction industry ensures a steady pipeline of demand for fire doors in both new projects and retrofits.

- For instance, UL Solutions certifies fire door assemblies at the manufacturing level based on performance standards such as UL 10B and UL 10C. These certifications help ensure the products can meet the requirements of building codes like NFPA and the IBC. While NFPA 80 mandates that the installed fire door assemblies undergo an inspection and testing at least annually, this is a separate requirement from the initial product certification and is typically performed by qualified inspection services, not a new UL certification each year.

Rising Awareness of Fire Safety

Growing public awareness about fire safety is driving adoption beyond regulatory needs. Educational campaigns, workplace training, and increased media coverage of fire incidents highlight the importance of fire prevention systems. Consumers and businesses are now more proactive in investing in certified fire doors to protect lives and assets. Demand is particularly strong in healthcare facilities, schools, and manufacturing plants where risk is higher. This shift from compliance-driven to safety-conscious buying behavior has emerged as a critical driver, pushing manufacturers to develop innovative and high-performance fire door solutions.

Key Trends and Opportunities

Smart and Automated Fire Doors

The adoption of smart fire doors integrated with IoT and automated systems is a growing trend. Automatic fire doors with sensors, remote monitoring, and integration with building management systems enhance operational safety and convenience. These doors are particularly valuable in airports, hospitals, and data centers where quick, seamless fire containment is essential. Manufacturers are increasingly developing products with advanced access control, smoke detection, and emergency response features. This technological innovation presents significant opportunities for premium product adoption and is shaping the future of the fire door industry.

- For instance, FAAC’s A952 swing operator is TÜV-certified for emergency exits and EN 16005 compliant. It has been spring-tested for over 1,000,000 cycles, and the unit also supports remote connectivity through Simply Connect.

Sustainable and Innovative Materials

The industry is witnessing a strong shift toward eco-friendly and innovative fire door materials. Manufacturers are using recyclable metals, low-VOC coatings, and composite cores to comply with green building standards. Rising adoption of LEED-certified projects and sustainable construction practices has accelerated demand for environmentally responsible fire doors. Lightweight yet high-performance designs are also emerging to support architectural flexibility. These advancements present a key opportunity for companies to differentiate in competitive markets while aligning with global sustainability goals and expanding their reach in eco-conscious construction projects.

- For instance, Halspan’s Prima Plus FD60 door blank is 54 mm thick and FSC-certified. Halspan cores are listed for fire resistance ratings from 20 to 120 minutes across product families.

Key Challenges

High Installation and Maintenance Costs

The high cost of installation and maintenance continues to limit fire door adoption in cost-sensitive markets. Premium fire doors with advanced fire ratings and automation features often involve significant upfront investment. Maintenance and compliance inspections add recurring expenses, which are burdensome for small enterprises and residential buyers. These financial constraints can delay or restrict fire door adoption in developing regions. Balancing cost-effectiveness with performance remains a key challenge for manufacturers aiming to expand penetration across diverse income segments.

Low Awareness in Developing Markets

Limited awareness of fire safety standards and benefits poses a challenge in emerging economies. Many residential builders and small businesses prioritize cost over safety, leading to inadequate installation of fire-rated doors. The absence of strict enforcement of fire safety codes further reduces adoption rates in these regions. This lack of awareness not only increases fire risks but also constrains market potential. Companies face the challenge of investing in education and awareness campaigns to drive adoption and establish compliance in less-regulated markets.

Regional Analysis

North America

North America held the largest share of 34% in the fire door market in 2024. Strong enforcement of fire safety regulations by the National Fire Protection Association (NFPA) and the International Building Code drives widespread adoption across commercial, industrial, and residential buildings. High construction activity in the U.S. and Canada, combined with renovation of aging infrastructure, continues to boost demand. Growing use of automatic and smart fire doors in airports, hospitals, and high-rise buildings further supports market expansion. The region benefits from established manufacturers and early adoption of advanced safety technologies.

Europe

Europe accounted for 28% of the fire door market in 2024, supported by stringent fire safety standards such as EN 1634 and widespread compliance across industries. High adoption rates in Germany, the UK, and France are driven by regulatory enforcement, especially in institutional and public infrastructure. The rising focus on sustainable and recyclable materials in fire doors further strengthens demand, aligning with the EU Green Deal objectives. Increasing renovation of historical structures to meet modern safety requirements also contributes to market growth, with strong demand from both commercial and residential segments.

Asia Pacific

Asia Pacific captured 24% of the global fire door market in 2024, driven by rapid urbanization and infrastructure development. Countries such as China, India, and Japan are witnessing significant demand for fire-rated solutions in high-rise buildings, airports, and shopping complexes. Growing enforcement of local building codes and rising awareness of fire safety in densely populated cities support market expansion. The region is also benefiting from large-scale government investments in smart cities and public infrastructure projects. Strong growth potential exists due to increasing adoption of both hinged and automatic fire doors in new developments.

Latin America

Latin America represented 8% of the fire door market in 2024, with growth concentrated in Brazil, Mexico, and Argentina. Rising construction activities in commercial spaces such as shopping malls, hotels, and offices have increased fire safety product demand. However, limited enforcement of fire safety regulations in some countries restrains faster adoption. Cost-sensitive buyers often prioritize affordability, boosting demand for manual fire doors. Still, growing investments in urban infrastructure and rising awareness of workplace safety are expected to create opportunities for expansion, particularly in modern high-rise buildings and large public facilities.

Middle East and Africa

The Middle East and Africa accounted for 6% of the fire door market in 2024. Market growth is supported by large infrastructure and commercial projects in countries such as the UAE, Saudi Arabia, and South Africa. Rising investments in airports, hotels, and healthcare facilities are increasing the demand for fire-rated doors. However, adoption remains uneven due to varying regulatory frameworks across the region. Growing emphasis on fire safety in high-density developments and ongoing urban expansion are expected to support future growth, with demand shifting toward automatic and high-resistance fire door solutions.

Market Segmentations:

By Product Type:

- Hinged fire door

- Double-action fire door

- Sliding fire door

- Fabric fire doors/curtains

- Flush-glazed fire door

- Others

By Operation:

- Manual

- Automatic

- Electric

By Fire Resistance:

- EI 30

- EI 60

- EI 90

- Others (EI 120)

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the fire door market is shaped by established global and regional players such as Nihon Funen, Republic Doors and Frames, Esserford Joinery Works, Taotao Group, Vista Panels, Hormann Beteiligungs, Chase Doors, Rapp Bomek, China Buyang, Fusim Group, UK Fire Doors, Allegion plc, Mesker Openings Group, Agta Record, National Firefighting Manufacturing, and ASSA ABLOY. These companies compete on factors such as product innovation, fire resistance ratings, material quality, and compliance with international safety standards. The market is increasingly driven by rising demand for sustainable, smart, and automated fire door solutions integrated with advanced safety systems. Players are focusing on expanding their global reach through mergers, partnerships, and distribution networks to strengthen market presence. Investment in research and development remains critical to meet evolving regulatory requirements and customer expectations. The competition is further intensified by growing emphasis on eco-friendly materials and advanced fire-rated technologies across all regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nihon Funen

- Republic Doors and Frames

- Esserford Joinery Works

- Taotao Group

- Vista Panels

- Hormann Beteiligungs

- Chase Doors

- Rapp Bomek

- China Buyang

- Fusim Group

- UK Fire Doors

- Allegion plc

- Mesker Openings Group

- Agta Record

- National Firefighting Manufacturing

- ASSA ABLOY

Recent Developments

- In 2025, ASSA ABLOY Acquired Door System, a Danish firm specializing in high-performance doors, including fire-rated products, in April.

- In 2025, Allegion plc Continued to offer comprehensive door and security solutions, including fire-rated hardware, to both domestic and international markets.

- In 2024, Hörmann (including Shakti Hörmann) Began operations at its new Jaipur facility in March (for wooden doors) and July (for steel doors).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Operation, Fire Resistance and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The fire door market will grow steadily with stronger global fire safety regulations.

- Rising construction of high-rise buildings will boost demand for certified fire doors.

- Automatic and smart fire doors will see wider adoption in commercial projects.

- Sustainable and recyclable fire door materials will gain preference in green buildings.

- Asia Pacific will emerge as the fastest-growing region due to rapid urbanization.

- Manual fire doors will continue to dominate in cost-sensitive residential markets.

- Hospitals, airports, and data centers will drive adoption of advanced fire-rated doors.

- EI 60 fire doors will remain the standard rating across most applications.

- Renovation of older infrastructure will create opportunities for fire door retrofitting.

- Growing awareness campaigns will encourage wider fire safety compliance in developing regions.