Market Overview:

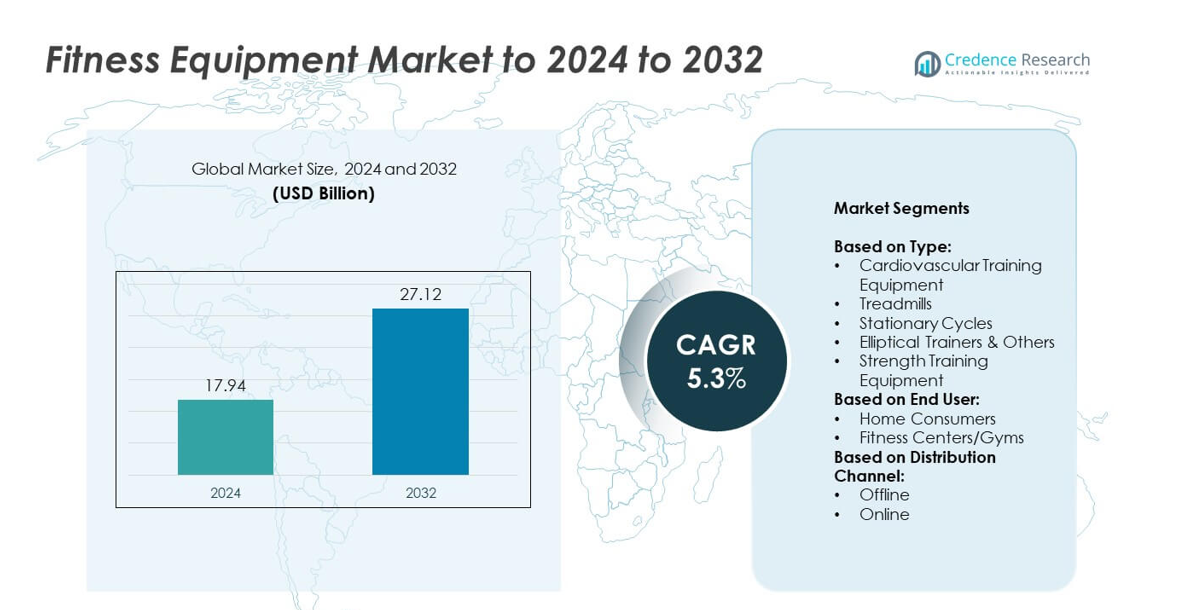

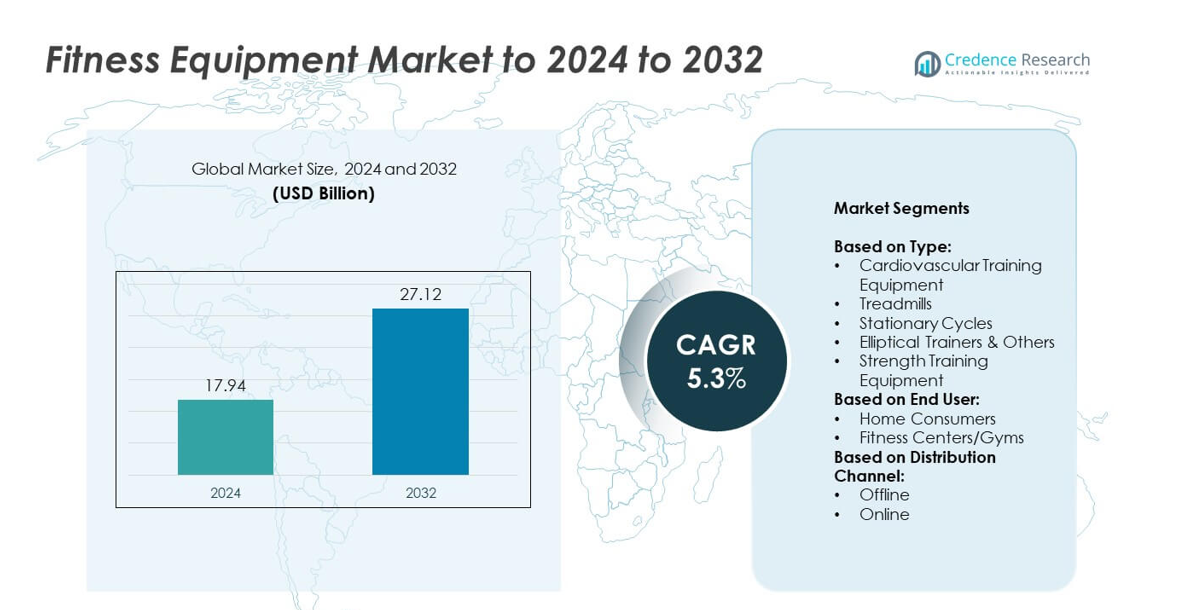

The Fitness Equipment Market size was valued at USD 17.94 billion in 2024 and is anticipated to reach USD 27.12 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fitness Equipment Market Size 2024 |

USD 17.94 billion |

| Fitness Equipment Market, CAGR |

5.3% |

| Fitness Equipment Market Size 2032 |

USD 27.12 billion |

The fitness equipment market is highly competitive, with leading players such as Johnson Health Tech, Technogym, Life Fitness, Nautilus, Icon Health & Fitness, Torque Fitness, TRUE, Core Health & Fitness, Impulse Health Technology, Shandong EM Health Industry Group, and Precor Incorporated driving innovation and global presence. These companies focus on expanding product portfolios, integrating digital technologies, and strengthening partnerships with gyms and wellness platforms to enhance market reach. Regionally, North America led the market with a 38% share in 2024, supported by strong gym networks, high consumer spending, and rapid adoption of connected equipment, while Europe and Asia Pacific followed as key growth regions.

Market Insights

- The fitness equipment market was valued at USD 17.94 billion in 2024 and is projected to reach USD 27.12 billion by 2032, growing at a CAGR of 5.3%.

- Rising health awareness and increasing lifestyle-related diseases are driving demand for both cardiovascular and strength training equipment across commercial gyms and home setups.

- Smart and connected machines integrated with digital platforms are shaping market trends, offering personalized workouts and expanding opportunities in home fitness adoption.

- The market is highly competitive with global leaders focusing on innovation, sustainability, and partnerships, while regional players compete through cost-effective solutions and expanding distribution.

- North America led with 38% share in 2024, followed by Europe at 29% and Asia Pacific at 23%, while Latin America and the Middle East & Africa accounted for 6% and 4% respectively, highlighting balanced growth opportunities across both developed and emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Cardiovascular training equipment dominated the fitness equipment market in 2024, accounting for over 58% share, led by treadmills as the most widely used sub-segment. Treadmills held nearly 32% share due to their versatility, convenience, and suitability for both home and commercial use. The strong adoption stems from rising obesity concerns, increasing emphasis on cardiovascular health, and broader product availability with digital connectivity features. Stationary cycles and elliptical trainers also gained traction, but treadmills remain the preferred choice owing to ease of use and advanced models offering performance tracking and interactive training programs.

- For instance, Technogym reports that its equipment is installed in over 100,000 wellness centers and 500,000 private homes worldwide. The company’s digital ecosystem is part of a global community of over 70 million users who train with Technogym equipment.

By End User

Fitness centers and gyms captured the dominant share of 61% in 2024, driven by growing memberships and rising interest in group training programs. The commercial segment continues to expand as urban populations seek accessible fitness options and employers promote wellness initiatives. Gyms invest heavily in advanced cardiovascular and strength equipment to attract and retain members. Home consumers, while accounting for a smaller share, are increasing adoption due to hybrid fitness trends and digital platforms offering on-demand workouts. However, large-scale equipment installations in gyms keep this segment ahead in revenue contribution.

- For instance, Johnson Health Tech’s brand Matrix announced a 48.3% increase in its U.S. second-quarter sales in 2008 for its commercial segment. The company attributed this growth to factors such as new personnel, expansion of the sales team, and the introduction of new products.

By Distribution Channel

Offline channels held the majority share of 68% in 2024, reflecting consumer preference for in-store trials and consultation before purchasing high-value fitness equipment. Specialty fitness stores and sporting goods retailers provide personalized experiences, product demonstrations, and post-purchase support, strengthening this channel. The dominance of offline sales is also supported by bulk purchases from gyms and fitness centers. Meanwhile, online channels are gaining momentum, fueled by e-commerce expansion, competitive pricing, and digital marketing strategies. Increasing availability of equipment through online platforms is driving steady growth, but offline sales remain the leading revenue contributor.

Key Growth Drivers

Rising Health Awareness and Lifestyle Diseases

Growing awareness of health risks linked to obesity, diabetes, and cardiovascular diseases is driving strong demand for fitness equipment. Consumers are increasingly prioritizing preventive healthcare and physical activity to reduce lifestyle-related illnesses. Governments and health organizations actively promote fitness programs, further accelerating adoption. Treadmills, stationary cycles, and strength training machines are witnessing heightened use across gyms and homes. This factor stands out as a key growth driver, as people shift from reactive treatments toward long-term wellness, fueling sustainable market expansion globally.

- For instance, Planet Fitness reported reaching approximately 19.7 million members globally by the end of 2024, after adding 1 million net members during that fiscal year. This growth reflects ongoing consumer demand for fitness and wellness.

Expansion of Fitness Centers and Gym Memberships

The rapid increase in commercial gyms and boutique fitness studios worldwide has created substantial demand for advanced equipment. Fitness centers account for the largest revenue share, with memberships rising due to urbanization, corporate wellness programs, and social fitness trends. Gym operators invest in smart, durable machines to attract customers with diverse workout options. The commercial focus ensures consistent bulk purchases and repeat upgrades of equipment. This strong reliance on gym infrastructure makes expansion of fitness centers another major growth driver for the industry.

- For instance, Anytime Fitness announced in September 2025 that it had expanded to more than 5,600 clubs across 42 countries, highlighting the growing global footprint of commercial fitness centers.

Digital Integration and Smart Equipment Adoption

Technology-driven equipment adoption is reshaping the market, with connected treadmills, smart bikes, and performance trackers gaining momentum. Integration with apps, virtual coaching, and AI-based analytics allows personalized fitness experiences, attracting both home users and gyms. Consumers value real-time performance insights and interactive training, enhancing motivation and long-term engagement. Manufacturers increasingly design IoT-enabled machines to cater to this demand, bridging the gap between fitness and digital ecosystems. The shift toward connected equipment stands as the third key growth driver shaping the future of the fitness equipment market.

Key Trends and Opportunities

Home Fitness Boom Post-Pandemic

The pandemic accelerated the adoption of home-based fitness, a trend that continues with hybrid workout models. Consumers invest in compact, foldable, and digitally connected equipment to balance convenience with professional-level training. Subscription-based virtual platforms also boost long-term engagement, creating opportunities for equipment makers to bundle devices with digital services. With busy lifestyles and flexible work routines, demand for at-home training equipment presents a key trend and opportunity, particularly in urban households that prioritize accessibility and time efficiency in their fitness routines.

- For instance, NordicTrack’s parent company iFIT has historically reported millions of total members and over 1 million total subscribers across 120 countries. A September 2021 SEC filing noted “over 6.1 million total members and 1.5 million total fitness subscribers” in more than 120 countries, highlighting the significant growth of home-connected fitness.

Sustainability and Eco-Friendly Equipment Designs

Manufacturers are focusing on sustainable materials and energy-efficient designs to align with global environmental goals. Eco-friendly treadmills with self-powered features and recycled material-based machines are gaining traction in both gyms and homes. Growing consumer preference for green products creates opportunities for companies to differentiate offerings in competitive markets. Fitness centers adopting energy-harvesting equipment also highlight the trend. The push toward sustainability and eco-conscious consumption represents another key trend and opportunity shaping product development strategies in the fitness equipment industry.

- For instance, SportsArt introduced its ECO-POWR™ line, where stationary bikes, ellipticals, and rowers can convert up to 74% of a user’s energy output into usable electricity.

Key Challenges

High Cost of Advanced Equipment

The high upfront investment in technologically advanced machines poses a significant challenge for consumers and gym operators. Smart treadmills, connected cycles, and strength machines are priced at premium levels, limiting adoption in price-sensitive markets. Small fitness centers and households often opt for low-cost alternatives, restricting overall revenue growth. Financing options and rental services are emerging to ease affordability, but the cost barrier remains a key challenge hindering large-scale penetration, especially in developing regions where disposable incomes are comparatively lower.

Equipment Maintenance and Wear Issues

Fitness equipment requires regular servicing and maintenance, particularly in high-traffic gyms where usage is intensive. Frequent wear and tear leads to downtime, costly repairs, and replacement demands, impacting operator profitability. Lack of timely after-sales support and availability of spare parts further complicates the issue for smaller players. Consumers also face difficulties with warranty coverage and technical assistance. These operational challenges highlight maintenance as another key challenge, as reliability and durability remain critical factors influencing long-term purchasing decisions in the market.

Regional Analysis

North America

North America held the largest share of 38% in the fitness equipment market in 2024, driven by strong consumer spending power, high gym memberships, and growing adoption of home fitness solutions. The United States leads the region with a robust commercial gym network and rising investments in connected equipment. Corporate wellness programs and government initiatives to promote healthy lifestyles further support demand. The presence of leading equipment manufacturers and early adoption of advanced technologies like AI-based machines strengthen North America’s leadership, with steady growth expected from both commercial and residential fitness segments.

Europe

Europe accounted for 29% of the fitness equipment market in 2024, supported by expanding fitness culture and stringent health awareness campaigns. Countries such as Germany, the United Kingdom, and France lead adoption due to rising gym memberships and government-backed fitness initiatives. Growing demand for eco-friendly and sustainable equipment also shapes the market, with commercial gyms focusing on energy-efficient machines. Home fitness continues to expand in urban areas, driven by compact and connected equipment. Strong infrastructure and consumer awareness keep Europe a key regional market with steady growth across both commercial and household applications.

Asia Pacific

Asia Pacific captured 23% of the fitness equipment market in 2024, making it the fastest-growing regional segment. Rising disposable incomes, urbanization, and increasing health awareness drive adoption across China, India, and Japan. The region benefits from a growing youth population engaging in fitness activities and rapid expansion of gym chains in metropolitan areas. Home fitness demand is surging, supported by affordable equipment options and growing digital fitness platforms. Government initiatives to combat rising obesity and lifestyle diseases further accelerate growth. The combination of affordability, population size, and digital adoption positions Asia Pacific as a key growth hub.

Latin America

Latin America held a 6% share of the fitness equipment market in 2024, supported by rising interest in health and wellness across Brazil, Mexico, and Argentina. Growing urbanization and expanding gym networks contribute to commercial adoption, while a younger population drives demand for cardio and strength machines. Home fitness is gaining attention, although cost sensitivity slows widespread uptake of advanced equipment. International brands are expanding their presence through local partnerships, enhancing availability and awareness. While Latin America remains smaller in market size compared to other regions, rising health consciousness creates steady long-term opportunities for fitness equipment providers.

Middle East and Africa

The Middle East and Africa accounted for 4% of the fitness equipment market in 2024, with growth led by the United Arab Emirates, Saudi Arabia, and South Africa. Expanding premium gym chains, health clubs, and wellness centers are fueling demand for high-end cardio and strength equipment. Rising disposable incomes and growing awareness of fitness benefits also support adoption. Home fitness remains in its early stages but is gradually increasing in urban centers. Government investments in health and sports infrastructure further encourage fitness adoption, though market growth is moderated by cost barriers and limited equipment penetration in rural areas.

Market Segmentations:

By Type:

- Cardiovascular Training Equipment

- Treadmills

- Stationary Cycles

- Elliptical Trainers & Others

- Strength Training Equipment

By End User:

- Home Consumers

- Fitness Centers/Gyms

By Distribution Channel:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The fitness equipment market is shaped by leading players such as Johnson Health Tech, Torque Fitness, TRUE, Shandong EM Health Industry Group Co., Ltd., Nautilus, Inc., Life Fitness (KPS Capital), Icon Health & Fitness, Technogym, Core Health & Fitness, Impulse Health Technology Co., Ltd., and Precor Incorporated. These companies compete through diverse product portfolios, global distribution networks, and continuous innovation. Market competition is fueled by rising demand for smart and connected machines, with companies investing heavily in IoT-enabled solutions and AI-driven training features. Strategic partnerships with gyms, wellness centers, and digital fitness platforms enhance their global reach. Sustainability is also emerging as a differentiating factor, pushing manufacturers to adopt eco-friendly designs and energy-efficient technologies. Competitive intensity remains high, with regional players challenging established brands through cost-effective solutions, while global companies focus on premium product quality, after-sales services, and digital integration to strengthen their positions in both commercial and home fitness segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson Health Tech

- Torque Fitness

- TRUE

- Shandong EM Health Industry Group Co., Ltd.

- Nautilus, Inc.

- Life Fitness (KPS Capital)

- Icon Health & Fitness

- Technogym

- Core Health & Fitness

- Impulse Health Technology Co., Ltd.

- Precor Incorporated

Recent Developments

- In 2025, Precor Incorporated: Introduced its Breakaway™ Treadmill, a commercial slat belt model, which debuted new consoles and features like Push Mode and Cadence Coach.

- In 2024, Precor and EGYM enhanced their existing partnership to provide a more integrated connected cardio experience.

- In 2023, Life Fitness (KPS Capital) Continued to operate under KPS Capital Partners, which had acquired the company in 2019. It continued to serve the commercial fitness market with its various brands, including Life Fitness, Hammer Strength, and Cybex.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by rising health and wellness awareness.

- Smart and connected equipment adoption will accelerate across both home and commercial spaces.

- Fitness centers will continue to dominate demand, supported by expanding memberships worldwide.

- Home fitness solutions will gain stronger traction due to hybrid workout preferences.

- Asia Pacific will emerge as the fastest-growing region with increasing urbanization and incomes.

- Sustainability will shape product innovation with eco-friendly and energy-efficient equipment designs.

- Digital platforms will integrate more with equipment, offering personalized training experiences.

- Premium gyms will invest heavily in advanced cardio and strength equipment.

- Maintenance services and after-sales support will become critical for long-term customer retention.

- Partnerships between fitness equipment makers and digital fitness platforms will expand growth opportunities.