Market Overview

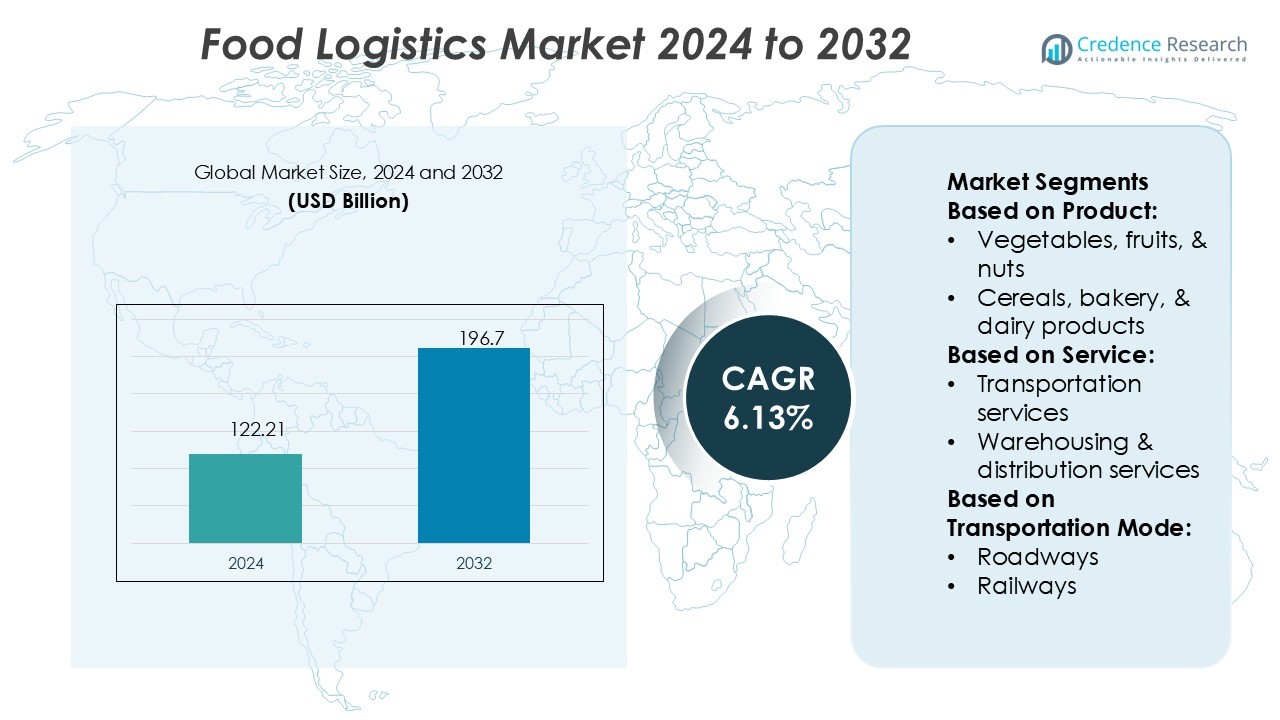

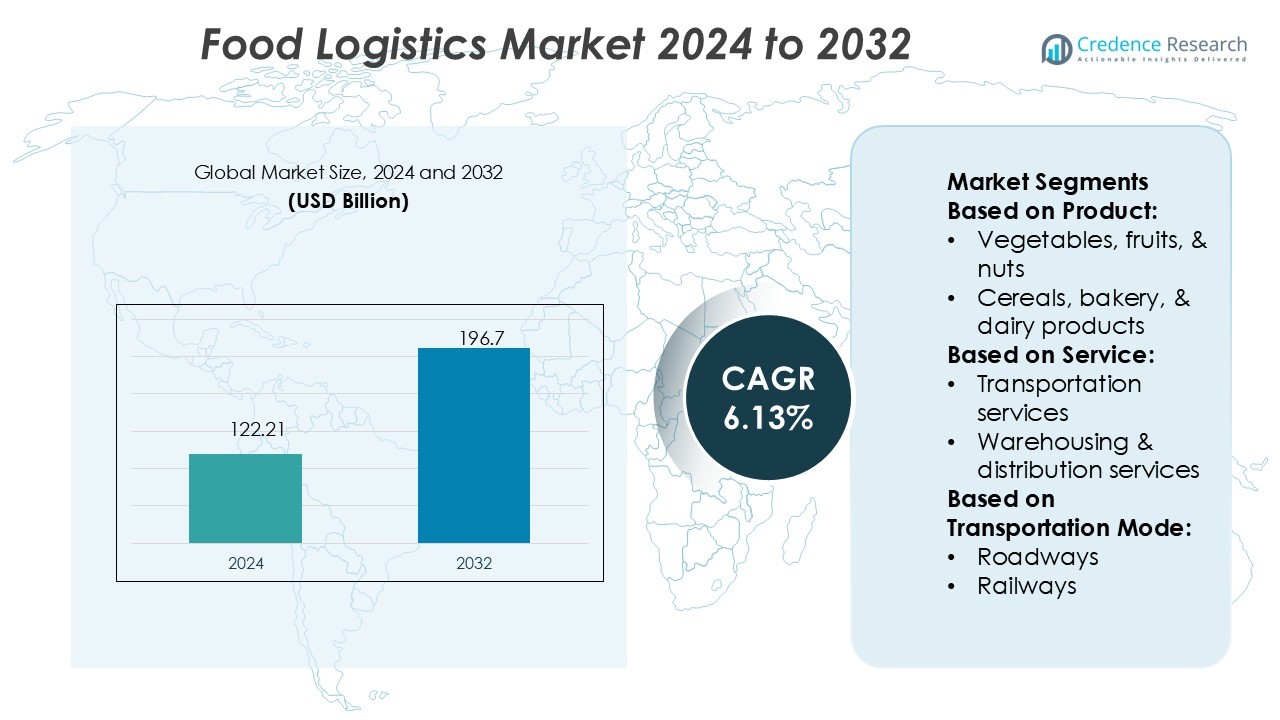

Food Logistics Market size was valued USD 122.21 billion in 2024 and is anticipated to reach USD 196.7 billion by 2032, at a CAGR of 6.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Logistics Market Size 2024 |

USD 122.21 Billion |

| Food Logistics Market, CAGR |

6.13% |

| Food Logistics Market Size 2032 |

USD 196.7 Billion |

The Food Logistics Market is driven by major players such as Americold Logistics, LLC, FedEx Corporation, DB Schenker, XPO Logistics, Inc., C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc., United Parcel Service (UPS), Kuehne + Nagel International AG, Hellmann Worldwide Logistics, and DHL Supply Chain & Global Forwarding. These companies compete through advanced cold chain solutions, multimodal transport, digital tracking, and sustainability initiatives. North America leads the global Food Logistics Market with a 34% share, supported by robust infrastructure, strong e-commerce grocery penetration, and stringent food safety regulations. This leadership highlights the region’s dominance in efficient supply chain management and technology adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Logistics Market size was valued at USD 122.21 billion in 2024 and is projected to reach USD 196.7 billion by 2032, growing at a CAGR of 6.13% during the forecast period.

- Rising demand for perishable products and the growth of e-commerce grocery services are key drivers, supported by investments in cold chain infrastructure and advanced supply chain technologies.

- Sustainability and green logistics remain strong trends, with companies adopting energy-efficient fleets, eco-friendly packaging, and digital tracking platforms to enhance transparency and reduce carbon impact.

- Intense competition defines the market, with major players focusing on multimodal logistics, automation, and value-added services, while high infrastructure and operational costs act as significant restraints.

- North America leads with a 34% regional share, while roadways dominate transportation with a 51% share, reflecting strong last-mile connectivity; Europe follows with 28%, supported by strict food safety regulations and sustainability-focused logistics practices.

Market Segmentation Analysis:

By Product

In the Food Logistics Market, fish, shellfish, and meat hold the dominant share at 32%. High global demand for protein-rich diets, strict temperature control needs, and short shelf life make this category the most logistics-intensive. Cold chain infrastructure and advanced monitoring systems drive its leadership, ensuring freshness and compliance with food safety regulations. Rising exports of meat and seafood further increase dependency on efficient logistics services. The segment’s growth is strongly supported by expanding international trade routes and consumer preference for high-quality animal protein products.

- For instance, Corbion expanded lactic acid capacity at its Blair, Nebraska plant by about 40%, while simultaneously cutting the cradle-to-gate carbon footprint per ton by 9%, all using 100% renewable electricity at the site.

By Service

Transportation services dominate the Food Logistics Market with a 47% share. The segment leads due to the critical need for timely delivery of perishable products, which require continuous movement under temperature-controlled conditions. Trucks and reefer fleets form the backbone of this service, meeting short-haul and long-haul demand. Growth is fueled by increasing e-commerce grocery deliveries and cross-border trade expansion. The focus on faster turnaround and compliance with food safety standards ensures transportation services remain the most vital component of food logistics operations worldwide.

- For instance, Brenntag Nutrition developed a plant-based spreadable cheese mix that delivers a low carbon footprint of just 2.15 kg CO₂e per kilogram of product, compared to 12.51 kg CO₂e per kilogram from conventional dairy cheese, as verified by TÜV Rheinland and calculated using Brenntag’s proprietary CO2Xplorer tool.

By Transportation Mode

Roadways hold the leading position in the Food Logistics Market with a 51% share. Road transport dominates due to its flexibility, last-mile connectivity, and ability to handle frequent short-distance deliveries, which are crucial for perishable goods. The expansion of refrigerated truck fleets and GPS-enabled tracking systems further strengthens this mode’s dominance. Roadways also benefit from extensive infrastructure in developed regions and rising investments in cold chain trucking in emerging markets. The segment’s reliability in delivering food products quickly to retailers, restaurants, and consumers secures its leadership.

Key Growth Drivers

Rising Demand for Perishable Food Products

The growing global consumption of fresh fruits, vegetables, dairy, seafood, and meat strongly drives the Food Logistics Market. These categories require strict cold chain management to preserve quality and safety during transport and storage. Expanding urban populations and consumer preference for fresh and organic products increase dependency on efficient logistics networks. Additionally, higher imports and exports of perishables reinforce the demand for temperature-controlled infrastructure. Logistics providers are expanding reefer fleets and advanced storage facilities to meet the rising supply chain requirements of perishable goods.

- For instance, Kemin partners with U.S. growers on more than 1,100 acres to sustainably cultivate rosemary, supporting traceable extract production for food ingredients at six auditable global sites.

Expansion of E-Commerce and Online Grocery Platforms

The surge in e-commerce and online grocery retail has created strong demand for reliable food logistics services. Consumers increasingly expect rapid doorstep delivery of fresh and packaged food, requiring optimized distribution channels and last-mile solutions. Retailers and food aggregators rely on logistics providers for real-time tracking, cold chain management, and quick turnaround times. This growth is supported by investments in automated warehouses and smart routing technologies. As online grocery penetration expands globally, logistics providers gain opportunities to develop advanced systems for handling perishable and bulk food orders.

- For instance, BASF’s Nutrition & Health division offers specific vitamin A and E ingredients whose product carbon footprints (PCFs) are at least 20% lower than the global market average, as certified by TÜV Rheinland.

Technological Advancements in Supply Chain Management

The integration of technologies such as IoT sensors, GPS tracking, blockchain, and AI-driven route optimization drives efficiency in the Food Logistics Market. These solutions provide end-to-end visibility, real-time temperature monitoring, and predictive maintenance for reefer fleets. Blockchain improves transparency and traceability, supporting compliance with stringent food safety regulations. Automation in warehousing and robotics for sorting and packaging enhance productivity and reduce operational costs. As companies adopt digital platforms for logistics management, efficiency and reliability improve, positioning technology as a major growth enabler for food logistics.

Key Trends & Opportunities

Sustainability and Green Logistics

Sustainability has emerged as a core trend, with logistics firms adopting eco-friendly practices to meet regulatory and consumer expectations. Companies are deploying electric trucks, biofuel-powered fleets, and energy-efficient cold storage facilities to reduce emissions. Green packaging and optimized delivery routes also lower carbon footprints. This shift presents opportunities for providers to attract environmentally conscious clients and secure government incentives. As food companies align with global sustainability goals, green logistics services become a competitive differentiator and open new partnerships in the evolving food supply chain.

- For instance, Roquette’s new Food Innovation Center in Lestrem, France offers the press release confirms the center occupies 5,000+ sqm of applications laboratories and pilots globally, with the new Lestrem center accounting for over 2,500 m² of that total.

Regional Trade Expansion and Globalization

The expansion of cross-border food trade and globalization of supply chains create significant opportunities for logistics providers. Emerging markets are witnessing rising food imports, while developed economies rely on exports of premium products. This trend increases demand for multimodal transport networks, customs handling, and international cold chain infrastructure. Trade agreements and regulatory harmonization further ease cross-border movement of food products. Logistics companies that invest in global networks and partnerships can capture growth by ensuring timely and safe delivery across diverse geographies and market segments.

- For instance, Tate & Lyle repowered its Brazilian Guarani site powered by 100% renewable energy. Tate & Lyle announced that its manufacturing facility in Guarani, Brazil, had become the first company site to be powered entirely by renewable energy.

Key Challenges

High Operational and Infrastructure Costs

Food logistics requires continuous investment in cold chain infrastructure, reefer fleets, and advanced monitoring technologies. The costs of fuel, maintenance, and energy-intensive refrigeration systems significantly increase operating expenses. Small and mid-sized logistics providers often struggle to match these capital requirements. Rising inflation and fluctuating fuel prices add further pressure. Maintaining affordability while meeting safety and quality standards remains a critical challenge, forcing companies to balance cost efficiency with service reliability in a competitive market environment.

Regulatory Compliance and Food Safety Standards

The Food Logistics Market faces strict regulations regarding storage, handling, and transport of perishable goods. Compliance with diverse global and regional food safety standards increases complexity in cross-border logistics. Failure to maintain proper temperature or hygiene can result in spoilage, product recalls, and reputational damage. Additionally, governments continue to tighten rules around traceability, labeling, and sustainable practices. Logistics providers must invest in training, monitoring systems, and certification processes to remain compliant, adding to operational challenges and increasing pressure on profitability.

Regional Analysis

North America

North America leads the Food Logistics Market with a 34% share, supported by advanced cold chain infrastructure and strong e-commerce penetration. The region benefits from high demand for perishable food, especially meat, seafood, and dairy, which require efficient transport and storage solutions. The presence of major logistics players with robust distribution networks further strengthens market growth. Increasing adoption of automation, IoT-enabled tracking, and sustainable transport solutions also drives efficiency. Rising consumer preference for online grocery services accelerates last-mile delivery investments. Regulatory emphasis on food safety and traceability ensures continued development of sophisticated logistics systems across the region.

Europe

Europe accounts for 28% of the Food Logistics Market, driven by strict food safety regulations and high consumer awareness. The region has well-developed road and rail networks that support efficient distribution across borders. Countries like Germany, France, and the UK are key hubs due to their strong food trade and retail sectors. Demand for fresh fruits, vegetables, and bakery products sustains reliance on cold chain solutions. Sustainability initiatives, such as the adoption of electric delivery fleets and energy-efficient warehouses, are gaining traction. E-commerce grocery expansion and regional trade agreements strengthen Europe’s position in the global food logistics sector.

Asia-Pacific

Asia-Pacific holds a 25% share of the Food Logistics Market, fueled by rapid urbanization, growing middle-class populations, and rising food consumption. China, India, and Japan are major contributors, supported by expanding cold chain investments and government initiatives. High demand for fresh produce, seafood, and packaged food drives logistics infrastructure upgrades. The region’s booming e-commerce and quick-commerce platforms accelerate demand for efficient last-mile delivery solutions. Ongoing improvements in road, port, and rail networks support large-scale food trade across the region. With rising exports and imports, Asia-Pacific is emerging as one of the fastest-growing markets for food logistics worldwide.

Latin America

Latin America commands a 7% share of the Food Logistics Market, primarily supported by exports of meat, seafood, coffee, and fresh produce. Brazil, Mexico, and Argentina serve as regional leaders with strong agricultural output. However, underdeveloped cold chain infrastructure and uneven transport networks remain barriers to efficiency. Investments in modern warehousing and refrigerated fleets are gradually improving operations. Growing consumer preference for packaged and processed foods also contributes to market expansion. Cross-border trade within the region and with North America provides growth opportunities. Strategic investment in infrastructure modernization remains essential to strengthen Latin America’s logistics capabilities.

Middle East & Africa

The Middle East & Africa hold a 6% share of the Food Logistics Market, with growth supported by rising food imports and distribution needs. Gulf countries such as the UAE and Saudi Arabia depend heavily on international supply chains for food security. Investments in advanced warehousing, port facilities, and cold chain logistics are expanding in the region. Africa shows potential due to increasing urbanization and retail growth, though infrastructure challenges persist. Demand for packaged and frozen foods continues to rise, creating opportunities for logistics providers. Regional governments emphasize food safety compliance and digital tracking to improve supply chain efficiency.

Market Segmentations:

By Product:

- Vegetables, fruits, & nuts

- Cereals, bakery, & dairy products

By Service:

- Transportation services

- Warehousing & distribution services

By Transportation Mode:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Food Logistics Market is highly competitive, with leading players including Americold Logistics, LLC, FedEx Corporation, DB Schenker, XPO Logistics, Inc., C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc., United Parcel Service (UPS), Kuehne + Nagel International AG, Hellmann Worldwide Logistics, and DHL Supply Chain & Global Forwarding. The Food Logistics Market is characterized by intense competition, with companies striving to enhance efficiency, sustainability, and customer satisfaction. Market participants focus on expanding cold chain infrastructure, improving last-mile delivery, and integrating advanced technologies such as IoT, blockchain, and AI-driven route optimization. Investments in temperature-controlled fleets, automated warehousing, and digital tracking platforms strengthen supply chain transparency and reliability. Sustainability remains a central strategy, with firms adopting eco-friendly packaging, alternative fuel vehicles, and energy-efficient storage solutions. The competitive landscape is further shaped by globalization of food trade, rising e-commerce grocery demand, and increasing regulatory emphasis on food safety and traceability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Americold Logistics, LLC

- FedEx Corporation

- DB Schenker

- XPO Logistics, Inc.

- H. Robinson Worldwide, Inc.

- B. Hunt Transport Services, Inc.

- United Parcel Service (UPS)

- Kuehne + Nagel International AG

- Hellmann Worldwide Logistics

- DHL Supply Chain & Global Forwarding

Recent Developments

- In July 2025, Maersk by Launched was new packing and cold chain logistics center in Olmos, Peru, a strategic move to support the country’s booming agro-expert sector was officially launched by Maersk. Strategically positioned in the heart of northern Peru’s agriculture corridor, the Olmos site is newly developed multi-product fruit logistics center designed to streamline the region’s export capabilities.

- In July 2024, DACHSER announced its acquisition of Brummer Logistik GmbH in Germany and Brummer Logistic Solutions GmbH & Co KG in Austria, enhancing its food logistics network in Europe. This acquisition encompasses the entire operational business of the Brummer Group, a notable player in temperature-controlled food transport.

- In May 2024, Candor Expedite launched a new cold chain division called Candor Food Chain. It combines its national shipping services with an innovative reusable cold packaging solution that maintains frozen and refrigerated shipments at controlled temperatures for up to nine days using regular transport.

- In January 2024, Snowman Logistics expanded its operations at a newly leased multi-temperature-controlled warehouse in Guwahati, Assam. The total capacity of the warehouse is 5,152 pallets, and this facility features eight chambers and four loading bays that are equipped with the latest infrastructure.

Report Coverage

The research report offers an in-depth analysis based on Product, Service, Transportation Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Food Logistics Market will expand with rising demand for perishable products.

- Cold chain infrastructure will strengthen through investments in storage and transportation.

- E-commerce growth will drive demand for faster last-mile delivery solutions.

- Technology adoption like IoT, AI, and blockchain will enhance supply chain visibility.

- Sustainability initiatives will push companies to adopt green fleets and energy-efficient warehouses.

- Cross-border trade will increase reliance on multimodal transport networks.

- Automation in warehousing will improve efficiency and reduce operational costs.

- Regulatory compliance will intensify, requiring advanced tracking and monitoring systems.

- Emerging markets will offer strong growth potential with rising food consumption.

- Strategic partnerships will shape competitive advantages in global food logistics.