Market Overview

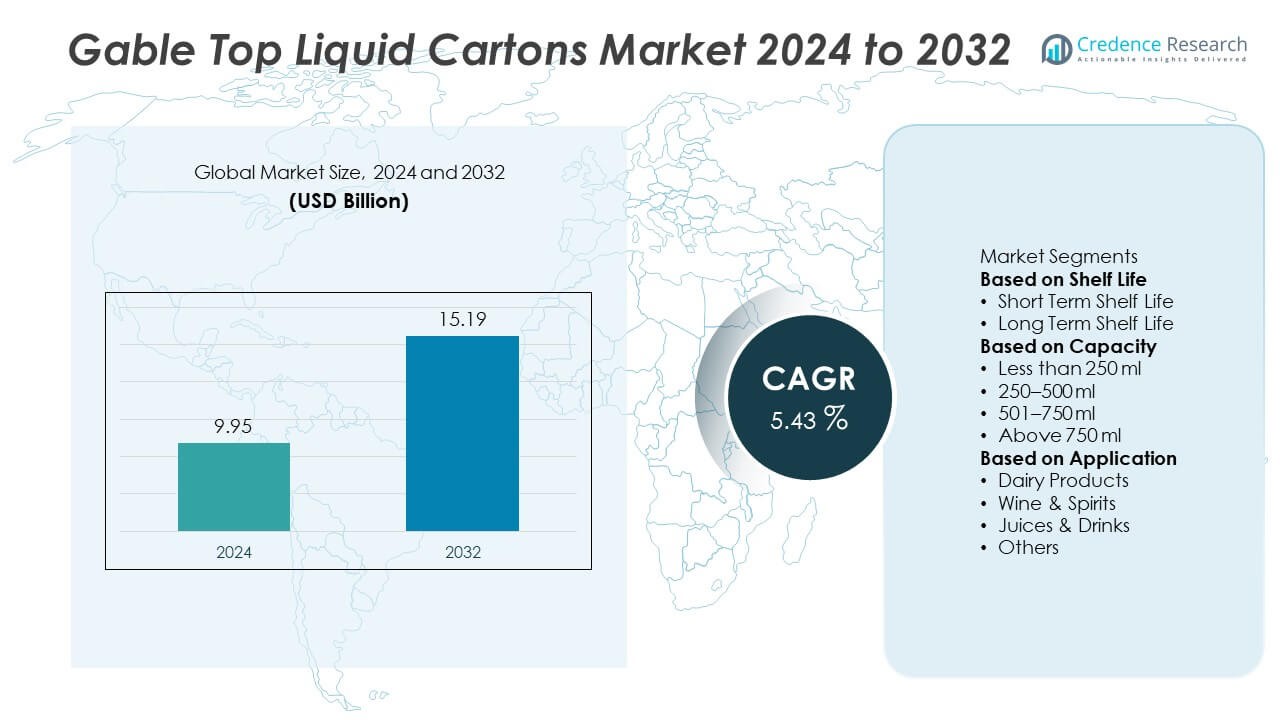

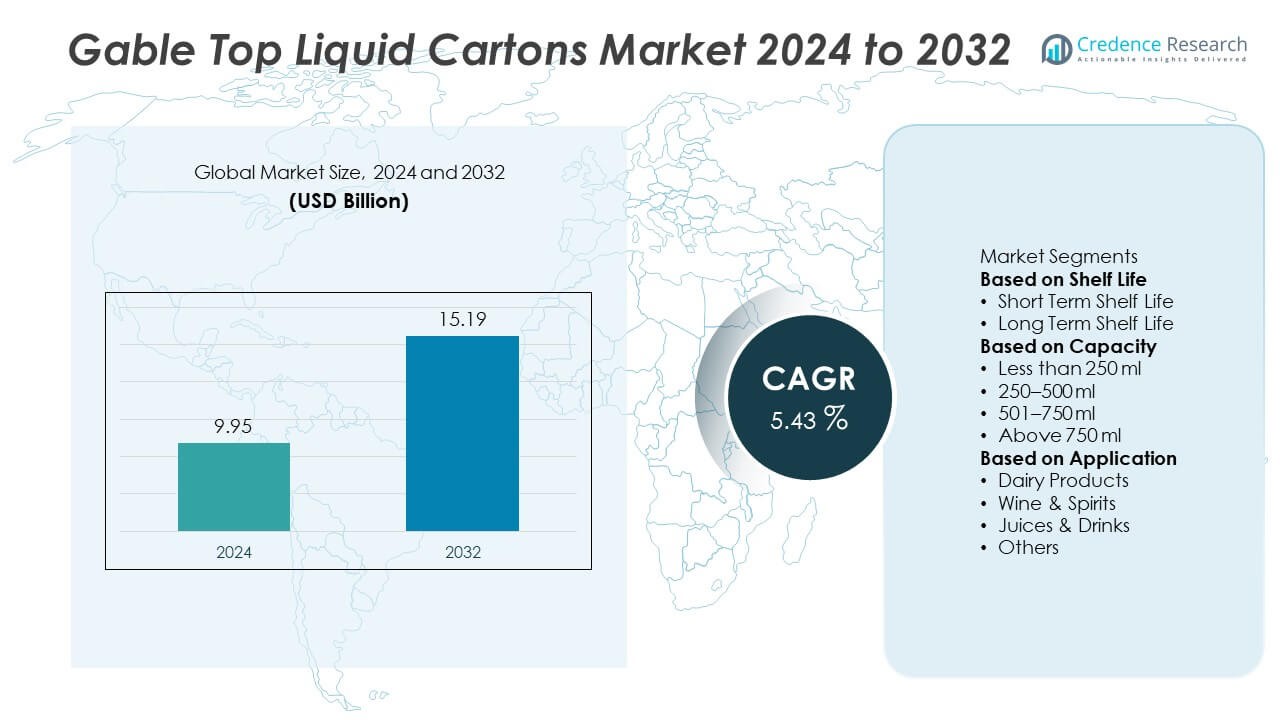

The Gable Top Liquid Cartons Market was valued at USD 9.95 billion in 2024 and is expected to reach USD 15.19 billion by 2032, growing at a CAGR of 5.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gable Top Liquid Cartons Market Size 2024 |

USD 9.95 Billion |

| Gable Top Liquid Cartons Market, CAGR |

5.43% |

| Gable Top Liquid Cartons Market Size 2032 |

USD 15.19 Billion |

The Gable Top Liquid Cartons Market grows with rising demand for sustainable, recyclable, and lightweight packaging for milk, juices, and plant-based beverages. Increasing regulations on single-use plastics push beverage producers toward paperboard-based solutions. It benefits from advancements in barrier coatings that extend shelf life and maintain product quality. North America leads the Gable Top Liquid Cartons Market with strong demand from dairy, juice, and plant-based beverage producers supported by advanced cold chain and recycling infrastructure. Europe follows with strict regulations favoring paper-based and recyclable packaging, encouraging adoption of gable top formats in premium dairy and juice segments. Asia-Pacific shows the fastest growth due to rising disposable incomes, urbanization, and increasing consumption of packaged beverages in China, India, and Japan. Latin America and Middle East & Africa show steady growth with investments in local carton manufacturing and expanding modern retail distribution. Key players shaping the market include Tetra Pak International S.A., SIG, and Elopak AS, which focus on sustainable carton solutions and advanced filling technologies. Companies such as Stora Enso Oyj and Pactiv Evergreen invest in digital printing and barrier innovations, supporting enhanced branding opportunities and improved shelf life for packaged beverages across global markets.

Market Insights

- The Gable Top Liquid Cartons Market was valued at USD 9.95 billion in 2024 and is projected to reach USD 15.19 billion by 2032, growing at a CAGR of 5.43%.

- Rising demand for sustainable and recyclable packaging solutions fuels adoption across dairy, juice, and plant-based beverage segments.

- Advancements in barrier coatings, digital printing, and smart labeling improve product shelf life, branding, and consumer engagement.

- Leading players such as Tetra Pak International S.A., SIG, Elopak AS, Stora Enso Oyj, and Pactiv Evergreen focus on innovative carton designs, filling technologies, and eco-friendly material development.

- High production costs, raw material price fluctuations, and recycling challenges in developing regions act as restraints, impacting market penetration.

- North America leads with advanced cold chain infrastructure and strong sustainability focus, Europe follows with strict regulatory support, while Asia-Pacific shows fastest growth driven by urbanization and packaged beverage consumption.

- Opportunities arise from growing single-serve formats, e-commerce-friendly packaging, and expansion into emerging markets with localized manufacturing capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Sustainable and Recyclable Packaging Solutions

The Gable Top Liquid Cartons Market grows with increasing consumer preference for eco-friendly and renewable packaging. Manufacturers use paperboard sourced from responsibly managed forests to reduce carbon footprint. It supports circular economy initiatives and meets regulatory requirements for sustainable packaging. Beverage producers adopt gable top cartons to replace plastic bottles and reduce waste. Brands highlight recyclability to appeal to environmentally conscious buyers. This shift positions gable top cartons as a preferred solution for liquid food packaging.

- For instance, Elopak converted Hochwald Foods’ Hungen plant to Pure-Pak® cartons, resulting in a 50% plastic reduction compared to the previous packaging and a 10% higher proportion of renewable raw materials across four new filling lines.

Expanding Consumption of Dairy and Plant-Based Beverages

Rising global demand for milk, flavored drinks, and plant-based alternatives drives adoption of gable top cartons. The Gable Top Liquid Cartons Market benefits from its ability to preserve product freshness and ensure secure sealing. It allows easy pouring and resealing, enhancing consumer convenience. Growth in urban populations increases consumption of ready-to-drink beverages, boosting packaging needs. Carton packaging protects liquids from contamination and extends shelf life. These advantages strengthen its role in beverage distribution channels.

- For instance, SIG’s aseptic 1-liter carton packs with Terra Alu-free + Full barrier technology deliver a 12-month shelf life without refrigeration and are installed on filling lines globally, including with major dairy and soy beverage producers in Asia.

Advancements in Printing and Barrier Coating Technologies

Modern printing techniques enable high-quality graphics and customized designs on cartons. The Gable Top Liquid Cartons Market gains from improved branding and product differentiation. It supports the use of digital printing for short runs and promotional campaigns. Advanced barrier coatings enhance resistance to moisture, oxygen, and light, improving product integrity. Manufacturers invest in coatings that support longer shelf life for chilled and ambient beverages. These innovations make gable top cartons competitive with alternative packaging formats.

Supportive Regulations and Retailer Preferences for Paper-Based Formats

Government policies favoring paper-based packaging encourage wider use of gable top cartons. The Gable Top Liquid Cartons Market benefits from restrictions on single-use plastics in many regions. It aligns with retailer initiatives to stock environmentally responsible packaging formats. Large supermarket chains prefer cartons for their stackability and ease of handling. Regulations promoting extended producer responsibility further accelerate adoption. This supportive environment ensures consistent market growth and drives innovation in carton manufacturing.

Market Trends

Shift Toward Renewable and Bio-Based Materials

The Gable Top Liquid Cartons Market shows a clear move toward bio-based and renewable materials. Manufacturers use plant-based polymers and FSC-certified paperboard to lower environmental impact. It supports compliance with global sustainability targets and corporate carbon reduction goals. Consumers prefer packaging that highlights recyclability and renewable content. Companies invest in material innovation to improve carton strength while reducing weight. This trend strengthens the market’s position as a sustainable alternative to plastic bottles.

- For instance, Tetra Pak has been rolling out caps made from sugarcane-based HDPE for years, helping customers to reduce their packaging’s carbon footprint and increase its renewable content. In 2021, the company sold 17.6 billion packages and 10.8 billion caps using plant-based plastic, which saved an estimated 96 kilotons of CO2 compared to fossil-based plastic.

Adoption of Digital and Smart Printing Technologies

High-resolution digital printing enables premium graphics and customized messaging on gable top cartons. The Gable Top Liquid Cartons Market benefits from shorter production runs and faster design changes. It allows brands to launch limited-edition packaging and targeted marketing campaigns. QR codes and smart labels are used to connect consumers to product information. These features improve brand engagement and build consumer loyalty. Digital printing also supports cost efficiency for small and medium beverage producers.

- For instance, Elopak has utilized digital printing technology in partnerships for various initiatives, such as enabling Pure-Pak® cartons with scannable codes for consumer interaction.

Growth of Single-Serve and On-the-Go Packaging Formats

Changing lifestyles drive demand for single-serve cartons in juice, milk, and functional beverages. The Gable Top Liquid Cartons Market adapts by offering smaller sizes that suit on-the-go consumption. It provides resealable closures that improve portability and convenience. Growth in e-commerce also increases demand for lightweight, durable, and tamper-proof packaging. Beverage producers focus on portion control to meet health-conscious consumer preferences. This trend drives innovation in format variety and functional design.

Integration of Advanced Barrier Coatings and Extended Shelf-Life Solutions

New barrier technologies improve product protection from oxygen, moisture, and light. The Gable Top Liquid Cartons Market benefits from extended shelf life for chilled and ambient beverages. It enables distribution to wider geographies without compromising quality. Coatings with renewable content are developed to align with sustainability goals. Manufacturers optimize coating layers to balance recyclability and performance. These innovations expand applications beyond dairy to premium juices, plant-based drinks, and nutraceutical beverages.

Market Challenges Analysis

High Production Costs and Dependence on Raw Material Availability

The Gable Top Liquid Cartons Market faces challenges from fluctuating prices of paperboard, coatings, and renewable polymers. Rising costs impact profit margins for manufacturers and beverage producers. It requires investment in efficient production systems to offset material expenses. Supply chain disruptions can delay delivery and affect consistency in carton quality. Smaller players struggle to compete with large manufacturers that benefit from economies of scale. These factors limit adoption in cost-sensitive regions and create pricing pressure.

Competition from Alternative Packaging Formats and Recycling Barriers

Cartons compete with PET bottles, pouches, and glass packaging that offer durability and lower production costs in some markets. The Gable Top Liquid Cartons Market also faces recycling challenges due to multilayer structures that require specialized facilities. It restricts collection and recycling rates in developing regions. Consumer confusion about recyclability further impacts disposal practices. Beverage brands must invest in awareness campaigns and work with recycling partners to improve recovery rates. These barriers slow market penetration in regions with limited recycling infrastructure.

Market Opportunities

Rising Demand for Sustainable and Premium Beverage Packaging

The Gable Top Liquid Cartons Market holds strong opportunities in meeting demand for eco-friendly and premium packaging. Growing restrictions on single-use plastics create a favorable environment for paperboard-based solutions. It enables beverage brands to highlight sustainability credentials and attract environmentally conscious consumers. Premium graphics and digital printing allow companies to differentiate products on retail shelves. Growth in plant-based drinks, specialty juices, and fortified dairy products drives need for high-quality, shelf-ready packaging. These factors expand the market’s reach across both mass-market and premium segments.

Expansion into Emerging Markets and E-Commerce Channels

Emerging economies present significant growth opportunities with rising disposable incomes and urbanization. The Gable Top Liquid Cartons Market benefits from growing consumption of packaged milk, juices, and functional beverages in these regions. It aligns with the rise of modern retail and online grocery platforms demanding durable and lightweight packaging. Investments in localized manufacturing facilities reduce logistics costs and improve supply reliability. Technological advances in barrier coatings support longer shelf life, enabling wider distribution. These developments create new revenue streams and increase market penetration globally.

Market Segmentation Analysis:

By Shelf Life

The Gable Top Liquid Cartons Market is segmented by shelf life into short-term and long-term shelf life cartons. Short-term shelf life cartons are widely used for fresh milk and chilled beverages that require cold chain distribution. It helps preserve product quality and provides excellent protection against contamination. Long-term shelf life cartons gain traction for UHT milk, flavored drinks, and plant-based beverages that need extended storage without refrigeration. Growing demand for convenience and longer product availability supports this segment’s growth. Manufacturers develop advanced barrier coatings to ensure freshness and extend shelf stability. Both shelf life types remain crucial for catering to diverse distribution and storage needs.

- For instance, SIG’s aseptic gable top solutions can extend the shelf life of UHT milk products for up to 12 months, without refrigeration. The company serves major dairy processors and food and beverage manufacturers in over 100 countries worldwide, including Danone, Arla, and Amul.

By Capacity

Capacity segmentation includes less than 250 ml, 250–500 ml, 501–750 ml, and above 750 ml. Small formats under 250 ml are popular for children’s drinks, single-serve juices, and on-the-go consumption. It appeals to health-conscious consumers seeking portion control and convenience. The 250–500 ml segment sees strong demand for individual milk cartons, premium juices, and flavored beverages. Mid-sized and large formats above 500 ml cater to family consumption and foodservice channels. Growth in e-commerce favors formats that are lightweight and tamper-evident. Manufacturers invest in flexible filling systems to cater to diverse capacity requirements.

By Application

Applications include dairy products, wine & spirits, juices & drinks, and others. The Gable Top Liquid Cartons Market sees maximum use in dairy packaging due to the need for freshness and secure sealing. It ensures safe distribution of milk, flavored milk, and cream products. Juices and drinks form the second-largest application segment, driven by rising demand for fortified and natural beverages. Wine & spirits packaging gains popularity with brands seeking lightweight, recyclable alternatives to glass. The “others” category includes plant-based beverages, soups, and specialty liquid foods. Rising consumer focus on sustainability drives adoption across all applications.

- For instance, Nippon Paper is a leading provider of liquid packaging cartons, including gable top cartons for dairy, in the Japanese market.

Segments:

Based on Shelf Life

- Short Term Shelf Life

- Long Term Shelf Life

Based on Capacity

- Less than 250 ml

- 250–500 ml

- 501–750 ml

- Above 750 ml

Based on Application

- Dairy Products

- Wine & Spirits

- Juices & Drinks

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Gable Top Liquid Cartons Market, accounting for nearly 38% of the global market. The region benefits from high consumption of packaged milk, juices, and plant-based beverages supported by a well-established cold chain infrastructure. It witnesses strong adoption of recyclable and FSC-certified cartons due to stringent regulations on plastic use. Manufacturers focus on developing advanced barrier coatings to extend product shelf life and support long-distance distribution. The U.S. leads the market with major beverage producers partnering with carton suppliers for sustainable packaging solutions. Canada shows growing demand driven by consumer preference for eco-friendly formats and rising plant-based drink consumption. Investments in automated filling lines and digital printing technologies further support market expansion.

Europe

Europe represents about 30% of the global market share, supported by strong demand for sustainable and premium beverage packaging. The region enforces strict recycling targets and extended producer responsibility programs that favor paper-based formats. It experiences rising use of gable top cartons in dairy, juice, and wine packaging segments. Germany, France, and the UK drive innovation with adoption of bio-based coatings and smart printing technologies. Brands invest in eye-catching designs to stand out in competitive retail environments. The European market also benefits from growing consumer awareness about reducing plastic waste. Expansion of foodservice and on-the-go beverage consumption further supports carton demand.

Asia-Pacific

Asia-Pacific accounts for nearly 22% of the global market, driven by rapid urbanization, population growth, and rising consumption of packaged beverages. China, Japan, and India lead adoption with strong demand for milk, flavored drinks, and ready-to-drink teas. It benefits from government initiatives promoting sustainable packaging and reduction of single-use plastics. Local manufacturers invest in capacity expansion to meet the needs of domestic beverage brands and exporters. Increasing disposable incomes and modern retail growth boost demand for convenient and attractive packaging. The region also shows rising adoption of smaller, single-serve formats suitable for school and on-the-go consumption.

Latin America

Latin America holds around 6% of the global market share, supported by growing demand for packaged dairy and juice products. Brazil and Mexico dominate consumption with investments in sustainable production and local carton manufacturing facilities. It faces price sensitivity, which drives demand for cost-effective but recyclable packaging solutions. Partnerships between beverage producers and packaging suppliers focus on expanding access to rural areas. Increasing health awareness fuels consumption of fortified milk and functional beverages, supporting carton growth. Adoption of tamper-evident and resealable closures is rising to meet consumer safety expectations.

Middle East & Africa

The Middle East & Africa region accounts for nearly 4% of the global market share, with growth concentrated in Gulf countries and South Africa. Rising investments in modern retail and dairy processing facilities drive demand for gable top cartons. It supports the packaging needs of long-life milk, flavored beverages, and juices. Government initiatives to diversify food production and reduce imports encourage local filling line installations. Demand grows for recyclable formats as part of sustainability commitments across the region. Expanding middle-class populations and rising urbanization create opportunities for carton packaging adoption in emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SIG

- Pactiv Evergreen

- Stora Enso Oyj

- Adam Pack S.A.

- Parksons Packaging Ltd.

- Elopak AS

- Tetra Pak International S.A.

- Nippon Paper Industries Co., Ltd.

- Italpack Cartons S.r.l.

- Oji Holdings Corporation

Competitive Analysis

Competitive landscape of the Gable Top Liquid Cartons Market features leading players such as Tetra Pak International S.A., SIG, Elopak AS, Stora Enso Oyj, Pactiv Evergreen, Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Adam Pack S.A., Italpack Cartons S.r.l., and Parksons Packaging Ltd. These companies focus on developing sustainable and recyclable paperboard cartons to meet rising demand for eco-friendly beverage packaging. Many invest in advanced barrier coatings to extend shelf life and maintain product quality for dairy, juice, and plant-based beverages. Digital printing and smart labeling solutions are adopted to enhance product visibility and consumer engagement. Strategic collaborations with beverage brands and investments in localized production facilities strengthen supply chain efficiency and market reach. Players continue to expand their portfolios with lightweight, resealable, and tamper-evident designs that cater to single-serve and family-size formats. Innovation, sustainability, and operational efficiency remain key differentiators driving competition in this market.

Recent Developments

- In July 2025, SIG launched the world’s first 1-liter aseptic carton pack made with SIG Terra Alu-free + Full barrier material, removing the aluminium layer. The new pack uses over 80% paper and runs on existing filling lines, offering shelf life up to 12 months.

- In June 2025, Elopak and Kompak opened a D-PAK™ showroom in the Netherlands, featuring Elopak’s filling lines. This supports the “Repackaging Tomorrow” strategy by enabling brands to experience sustainable gable top carton solutions for home and personal care products.

- In 2025, Elopak invested in Blue Ocean Closures AB (BOC), a Swedish company developing fibre-based closures. Elopak secured exclusive global rights for BOC’s moulded fibre caps for its gable-top cartons (Pure-Pak® and D-PAK™).

- In August 2024, Hochwald Foods switched several brands (including Bärenmarke and Hochwald) to Elopak’s Pure-Pak® gable top cartons, reducing plastic content by about 50% and increasing proportion of renewable raw materials. Four Elopak machines were installed at Hochwald’s Hungen plant.

Report Coverage

The research report offers an in-depth analysis based on Shelf Life, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for gable top cartons will grow with rising consumption of dairy and plant-based beverages.

- Adoption of bio-based and recyclable materials will expand to meet sustainability goals.

- Digital printing and smart labeling will improve branding and enable interactive consumer experiences.

- Advanced barrier coatings will support longer shelf life and wider distribution reach.

- Single-serve and on-the-go packaging formats will gain popularity among health-conscious consumers.

- E-commerce growth will drive demand for durable, lightweight, and tamper-evident carton solutions.

- Emerging economies will offer strong opportunities with rising urbanization and modern retail expansion.

- Investments in localized production facilities will reduce logistics costs and improve availability.

- Partnerships between carton manufacturers and beverage producers will drive innovation and market penetration.

- Competition will intensify, encouraging development of cost-efficient, customizable, and premium-quality packaging formats.