Market Overview

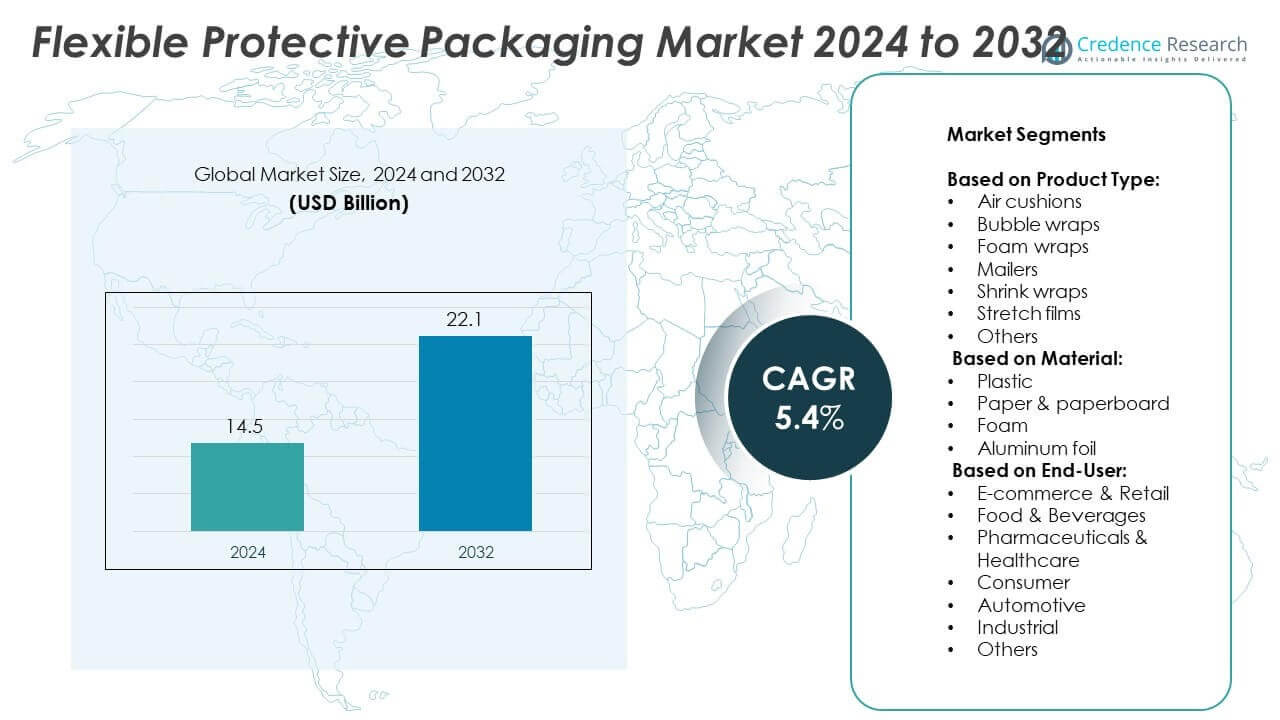

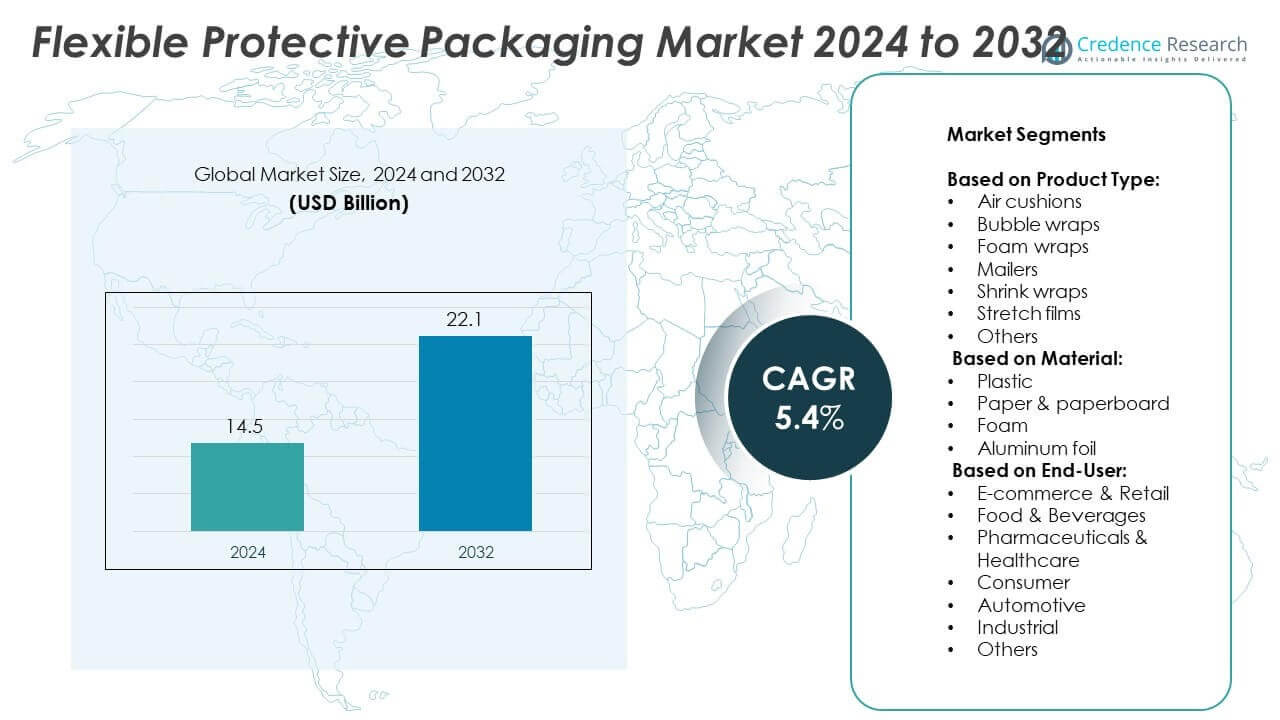

The Flexible Protective Packaging Market size was valued at USD 14.5 billion in 2024 and is projected to reach USD 22.1 billion by 2032, registering a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible Protective Packaging Market Size 2024 |

USD 14.5 Billion |

| Flexible Protective Packaging Market, CAGR |

5.4% |

| Flexible Protective Packaging Market Size 2032 |

USD 22.1 Billion |

The Flexible Protective Packaging market grows with rising demand from e-commerce, food, and healthcare industries. Drivers include lightweight formats that reduce shipping costs, customizable designs that improve consumer experience, and protective features that ensure product safety. Trends emphasize sustainability, with increasing adoption of recyclable and bio-based materials across industries. Companies also integrate smart packaging features such as freshness indicators and tracking codes. Continuous innovation in material science and digital printing supports efficiency, enhances brand identity, and strengthens market adoption globally.

North America leads with strong e-commerce and healthcare adoption, while Europe emphasizes sustainable materials under strict regulations. Asia-Pacific emerges as the fastest-growing hub, driven by expanding retail, food, and pharmaceutical sectors. Latin America and Middle East & Africa show steady growth supported by modernization in retail and industrial applications. Key players shaping the market include Sealed Air, Smurfit Kappa, DS Smith, and WestRock Company, all investing in innovation, sustainability, and tailored solutions to strengthen their regional and global presence.

Market Insights

- The Flexible Protective Packaging market was valued at USD 14.5 billion in 2024 and is expected to reach USD 22.1 billion by 2032, at a CAGR of 5.4%.

- Strong demand from e-commerce and retail sectors drives adoption of lightweight and protective packaging formats.

- Rising focus on sustainability fuels innovation in recyclable, biodegradable, and bio-based packaging materials.

- Competitive strategies emphasize product innovation, digital printing, and smart features to enhance value and differentiation.

- Environmental concerns, regulatory pressures, and raw material price volatility act as key restraints.

- North America shows strong growth driven by advanced logistics and healthcare needs, while Europe prioritizes eco-friendly solutions supported by regulatory frameworks.

- Asia-Pacific emerges as the fastest-growing region supported by large-scale consumption, retail expansion, and rising healthcare infrastructure, while Latin America and Middle East & Africa show steady but smaller contributions.

Market Drivers

Rising Demand from E-commerce and Retail Sectors

The growth of online shopping drives the adoption of flexible protective packaging. E-commerce companies need secure and lightweight solutions to protect products during transit. Flexible options such as bubble wraps, air cushions, and mailers provide durability while reducing shipping costs. It supports diverse product categories including electronics, clothing, and fragile goods. Retailers also benefit from customizable formats that enhance brand visibility and consumer experience. Growing consumer expectations for safe and intact deliveries continue to boost demand in this sector.

- For instance, In 2021, Sealed Air Corporation reported strong sales performance, with full-year net sales reaching $5.5 billion, a 13% increase from the previous year.

Increasing Adoption in Food and Beverage Industry

The food and beverage industry relies heavily on flexible protective packaging to maintain product safety and shelf life. Lightweight and adaptable solutions prevent contamination and damage during storage and transportation. It supports a wide range of items including perishable goods, ready-to-eat meals, and beverages. The industry benefits from packaging that combines barrier properties with convenience features like resealability. Rising urbanization and lifestyle changes further increase consumption of packaged food products. Strong regulatory focus on food safety also supports market expansion.

- For instance, Amcor, a leading global packaging company, develops and produces a wide range of flexible packaging solutions for food, beverage, and other applications, integrating high-barrier films and resealable closures to extend freshness and safety. Amcor’s net sales for fiscal year 2024, ending June 30, 2024, totaled $13.64 billion, with the flexible packaging segment specifically accounting for $10.332 billion. This represented a 7% decrease in net sales for both the overall company and the flexible segment compared to the previous fiscal year.

Healthcare and Pharmaceutical Sector Growth

The healthcare industry creates significant demand for flexible protective packaging due to its need for sterile and reliable solutions. Pharmaceuticals, medical devices, and diagnostic kits require packaging that ensures safety and integrity. It helps in protecting sensitive materials against moisture, light, and handling risks. Packaging innovations enable easy storage, distribution, and disposal while meeting compliance standards. Growing demand for vaccines, biologics, and personal protective equipment strengthens adoption. Healthcare providers and manufacturers prioritize packaging that safeguards quality and patient safety.

Sustainability and Innovation Driving Market Expansion

Sustainability has become a central factor influencing buyer decisions in the flexible protective packaging market. Companies invest in recyclable, biodegradable, and compostable materials to reduce environmental impact. It aligns with regulatory frameworks and corporate sustainability goals. New technologies enhance performance by combining lightweight structures with strong protective properties. Innovations in material science expand applications across multiple sectors. Consumer awareness of eco-friendly products also encourages producers to shift toward sustainable packaging models. This trend creates long-term opportunities for market participants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Trends

Shift Toward Sustainable and Eco-Friendly Packaging Solutions

The Flexible Protective Packaging market is witnessing a clear shift toward sustainable solutions. Companies are developing recyclable, compostable, and bio-based materials to meet consumer and regulatory expectations. It reduces dependency on conventional plastics and addresses environmental concerns. Brands highlight eco-friendly packaging as a key differentiator to build trust and loyalty. Governments enforce stricter waste management policies, encouraging adoption of green materials. This trend strengthens the position of sustainable packaging in both developed and emerging markets.

- For instance, Mondi, a global leader in packaging and paper, develops and produces a wide range of paper-based packaging, including mailers and pouches for e-commerce and food sectors, actively replacing traditional plastic formats with recyclable alternatives. In 2022, 82% of Mondi’s revenue came from products that were either reusable, recyclable, or compostable. During the same year, the company invested €280 million to expand its capacity in corrugated packaging, helping to meet the rising demand for sustainable solutions.

Rising Customization and Personalization in Packaging Design

Manufacturers are focusing on customizable packaging to enhance consumer experience. Flexible formats allow personalized sizes, branding, and messaging across diverse industries. It enables companies to differentiate products and create stronger brand recognition. Digital printing technologies support on-demand production with reduced waste. The trend gains traction in food, beverage, and e-commerce sectors that require unique presentation. Growing demand for user-friendly and visually appealing packaging reinforces investment in customized protective solutions.

- For instance, Huhtamaki offers digital printing solutions for flexible packaging, enabling unlimited design freedom for brands to create personalized and unique engagement with end-consumers, along with small-batch customization and fast turnaround times. The company’s capabilities include using an HP Indigo 20000 wide-web digital press to print high-resolution graphics and variable data on flexible packaging like pouches and laminates.

Integration of Smart and Functional Packaging Features

Smart packaging technologies are increasingly integrated to improve safety and convenience. The Flexible Protective Packaging market benefits from features such as QR codes, freshness indicators, and anti-counterfeiting tags. It ensures product traceability and enhances customer confidence. Smart solutions improve interaction between brands and consumers through digital engagement. Companies explore sensors and nanotechnology to monitor conditions like temperature or humidity. These advancements create new opportunities for packaging to deliver more than protection.

Expansion of Lightweight and Cost-Efficient Materials

Lightweight protective materials continue to gain importance in logistics and distribution. Companies prefer packaging that reduces shipping costs without compromising durability. It supports global supply chains where cost efficiency remains critical. Foam wraps, shrink films, and stretch wraps achieve performance with less material use. Advances in polymer technology make packaging stronger yet thinner. This trend ensures competitive advantage for producers offering solutions that balance performance, sustainability, and affordability.

Market Challenges Analysis

Environmental Concerns and Regulatory Pressures

The Flexible Protective Packaging market faces growing challenges from environmental concerns and strict regulations. Rising plastic waste and landfill issues put pressure on producers to adopt alternatives. It requires companies to invest in recyclable or biodegradable solutions, often at higher costs. Meeting regional compliance standards adds complexity for global suppliers. Governments implement bans and restrictions on single-use plastics, forcing manufacturers to innovate quickly. Balancing performance, affordability, and eco-compliance remains a significant hurdle for industry participants.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating costs of raw materials such as polymers create uncertainty for packaging manufacturers. It impacts profit margins and increases operational risks for businesses. Global supply chain disruptions further strain availability and delivery timelines. Dependence on petrochemical-based inputs makes companies vulnerable to price shifts in crude oil markets. Rising transportation costs and trade restrictions intensify these challenges. Companies must develop resilient supply strategies while managing cost efficiency in a competitive environment.

Market Opportunities

Growth Potential in Emerging Economies and Expanding Industries

The Flexible Protective Packaging market holds strong opportunities in emerging economies with rising consumption patterns. Expanding retail, e-commerce, and food sectors in Asia-Pacific and Latin America fuel demand. It creates avenues for manufacturers to deliver cost-effective and durable solutions. Healthcare and pharmaceutical growth in these regions further strengthens adoption of protective materials. Infrastructure development and urbanization increase the need for efficient packaging across multiple industries. Companies entering these markets gain access to large and growing customer bases.

Innovation in Materials and Smart Packaging Solutions

Technological advancements in material science create opportunities for high-performance packaging solutions. The Flexible Protective Packaging market benefits from innovations in recyclable polymers, bio-based films, and functional coatings. It enables manufacturers to design lighter yet stronger packaging options. Integration of smart features such as tracking codes and freshness indicators also expands value. These developments improve safety, enhance user experience, and support sustainability goals. Companies that invest in innovative technologies secure long-term growth and stronger market positions.

Market Segmentation Analysis:

By Product Type:

The Flexible Protective Packaging market includes diverse product categories designed for multiple applications. Air cushions are preferred in e-commerce for lightweight protection of fragile goods. Bubble wraps remain widely used for electronics, glassware, and sensitive consumer items due to their cushioning strength. Foam wraps provide superior shock absorption for automotive and industrial applications. Mailers find demand in retail and courier services, offering secure delivery in compact formats. Shrink wraps dominate bulk packaging in food and beverage sectors by ensuring product stability during storage and transport. Stretch films gain traction in logistics for pallet wrapping and load securing, while other protective solutions support specialized industries with tailored formats.

- For instance, Pregis, a global manufacturer of protective packaging, provides air cushions and other inflatable protective solutions to e-commerce and logistics companies worldwide. In its 2023 Sustainability Report, the company highlighted that it achieved 51% of its revenue from products that were paper-based, bio-based, or contained a minimum of 30% recycled content.

By Material:

Materials play a critical role in defining performance, sustainability, and cost efficiency. Plastic remains the most widely used material due to its strength, flexibility, and cost advantages. It serves across e-commerce, industrial, and healthcare applications, although rising regulations push companies toward recyclable options. Paper and paperboard gain adoption as eco-friendly alternatives, especially in retail and food service packaging. Foam materials continue to provide lightweight yet resilient protection for industrial and automotive segments. Aluminum foil ensures barrier protection for pharmaceuticals and sensitive food items by preventing moisture and contamination. Material innovation and sustainability-focused development shape the future adoption trends across industries.

- For instance, As a leading international packaging company, DS Smith utilizes a circular business model, recycling and managing over 6 million tonnes of recyclable materials annually.

By End-User:

End-user industries drive strong demand through evolving requirements. E-commerce and retail remain major consumers, with flexible formats reducing shipping costs and enhancing customer experience. Food and beverage companies rely on protective solutions to maintain freshness, extend shelf life, and safeguard goods during distribution. Pharmaceuticals and healthcare sectors require sterile, tamper-proof packaging to meet strict safety standards. Consumer markets use flexible wraps and mailers for convenience and cost-effective storage. Automotive applications demand durable foam and film solutions for component protection during transport. Industrial users employ shrink wraps and stretch films for large-scale load securing and warehouse efficiency. Other sectors adopt tailored solutions to meet niche protection and compliance needs, expanding the overall market potential.

Segments:

Based on Product Type:

- Air cushions

- Bubble wraps

- Foam wraps

- Mailers

- Shrink wraps

- Stretch films

- Others

Based on Material:

- Plastic

- Paper & paperboard

- Foam

- Aluminum foil

Based on End-User:

- E-commerce & Retail

- Food & Beverages

- Pharmaceuticals & Healthcare

- Consumer

- Automotive

- Industrial

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 32% share of the Flexible Protective Packaging market in 2024. The region benefits from strong e-commerce growth, driven by companies such as Amazon and Walmart that continue to expand distribution networks and require protective solutions at scale. It is also supported by rising adoption of sustainable packaging formats, particularly paper-based mailers and recyclable films, reflecting both consumer demand and regulatory requirements. Food and beverage companies in the United States and Canada use flexible wraps and films to ensure product safety, freshness, and efficient transportation. Pharmaceuticals remain a key driver, with manufacturers seeking tamper-resistant and sterile packaging solutions. The industrial sector contributes through large-scale use of shrink and stretch films for logistics and warehousing. Continuous innovation, supported by advanced material producers in the region, strengthens its competitive position while encouraging sustainable practices across multiple end-user industries.

Europe

Europe represented 27% share of the Flexible Protective Packaging market in 2024. The region’s growth is influenced by strict regulatory policies that push adoption of recyclable and compostable materials. It benefits from advanced retail and food distribution systems that require lightweight and durable packaging to reduce costs and carbon footprint. E-commerce growth in markets such as Germany, the United Kingdom, and France increases demand for protective mailers, bubble wraps, and stretch films. The healthcare sector in Europe also strengthens its contribution, with pharmaceutical companies using protective packaging for sensitive drugs and vaccines. Innovation in material science and a strong shift toward circular economy principles create opportunities for local manufacturers. Packaging producers in the region invest in new technologies to meet sustainability goals while addressing high-performance needs across consumer and industrial sectors.

Asia-Pacific

Asia-Pacific held 29% share of the Flexible Protective Packaging market in 2024, making it the fastest-growing regional segment. Rapid expansion of e-commerce platforms such as Alibaba and Flipkart generates significant demand for air cushions, bubble wraps, and mailers. It benefits from large-scale food and beverage production and rising consumption of packaged goods across China, India, and Southeast Asia. Pharmaceutical growth also contributes, with countries expanding healthcare infrastructure and requiring sterile, reliable packaging for medicines and diagnostic kits. Industrial applications such as automotive and electronics use foam and stretch films to safeguard components during transport. Local manufacturers in Asia-Pacific benefit from cost-efficient production, yet they increasingly invest in recyclable materials to align with global sustainability requirements. Strong growth potential makes the region a key focus for international players entering or expanding in emerging markets.

Latin America

Latin America captured 7% share of the Flexible Protective Packaging market in 2024. Growth is supported by increasing modernization in retail and e-commerce, with demand rising in countries such as Brazil and Mexico. The food and beverage sector plays an essential role, as producers adopt flexible wraps and films to preserve product integrity across long supply chains. Pharmaceuticals and healthcare providers also expand adoption of protective packaging, particularly in urban centers with growing medical needs. Industrial use is visible in automotive and manufacturing hubs, where foam and stretch films support logistics efficiency. It remains a developing market where companies focus on balancing affordability with sustainability. Regional packaging producers explore bio-based and recyclable materials to meet environmental goals while addressing local cost constraints.

Middle East & Africa

Middle East & Africa accounted for 5% share of the Flexible Protective Packaging market in 2024. The region’s growth is driven by expanding retail and food distribution sectors, particularly in Gulf countries where urbanization accelerates packaged food consumption. Pharmaceuticals and healthcare create steady demand for protective solutions, especially in large markets such as Saudi Arabia and South Africa. Industrial applications including construction and automotive further support usage of shrink and stretch films. It faces challenges from limited recycling infrastructure, but growing government initiatives promote sustainable material adoption. Local players gradually increase investment in modern packaging formats to serve expanding e-commerce and consumer markets. The region offers opportunities for international firms willing to provide cost-effective, eco-friendly solutions aligned with future regulatory developments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huhtamaki

- Pregis LLC

- EcoEnclose

- WestRock Company

- Intertape Polymer Group (IPG)

- Point Five Packaging

- Sonoco Products Company

- Universal Protective Packaging, Inc.

- Sealed Air

- DS Smith

- Smurfit Kappa

- Pro-Pac Packaging Limited

- Dow

- Storopack Hans Reichenecker Gmbh

- International Paper Company

Competitive Analysis

The leading players in the Flexible Protective Packaging market include Sealed Air, Sonoco Products Company, Smurfit Kappa, WestRock Company, Huhtamaki, DS Smith, Pregis LLC, Pro-Pac Packaging Limited, Dow, Intertape Polymer Group (IPG), Storopack Hans Reichenecker Gmbh, International Paper Company, EcoEnclose, Point Five Packaging, and Universal Protective Packaging, Inc. These companies compete by focusing on innovation, sustainability, and cost efficiency. Many invest in recyclable and bio-based materials to address environmental concerns and meet regulatory requirements. Strong distribution networks and advanced manufacturing capabilities allow them to serve diverse end-user industries, including food, beverages, e-commerce, and healthcare. Several players strengthen their positions by offering tailored solutions such as customizable mailers, advanced bubble wraps, and high-performance films that cater to evolving consumer expectations. Partnerships, acquisitions, and expansions into emerging economies further enhance their market reach and growth prospects. Companies also emphasize technology integration, such as digital printing and smart packaging features, to increase product value and differentiate themselves in a competitive landscape. The balance between affordability, performance, and sustainability defines their strategic direction. Competition remains intense, with global leaders leveraging scale and regional players focusing on innovation and cost-effective solutions.

Recent Developments

- In 2025, Sonoco completed the sale of its thermoformed and flexible packaging (TFP) business to Toppan Holdings, finalizing a strategic shift to focus on sustainable fiber and metal packaging.

- In 2024, DS Smith collaborated with Versuni (Philips Baristina) for a new recycled fiber-based packaging solution, showcasing circular design metrics and anti-scratch coatings for consumer electronics.

- In 2023, Huhtamaki launched blueloop™ mono-material flexible packaging technology, enhancing recyclability and advancing their sustainable packaging portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising e-commerce demand for lightweight and secure packaging.

- Sustainability will remain central, driving adoption of recyclable and bio-based materials.

- Food and beverage industries will continue to increase reliance on protective wraps and films.

- Healthcare and pharmaceuticals will boost demand for sterile, tamper-proof solutions.

- Digital printing and customization will enhance consumer engagement and brand identity.

- Smart packaging with tracking and freshness indicators will gain stronger adoption.

- Industrial users will prefer cost-efficient stretch and shrink films for logistics.

- Regional players will invest in eco-friendly innovations to meet regulatory standards.

- Asia-Pacific will strengthen its role as the fastest-growing market hub.

- Global companies will focus on balancing performance, sustainability, and affordability.