Market Overview

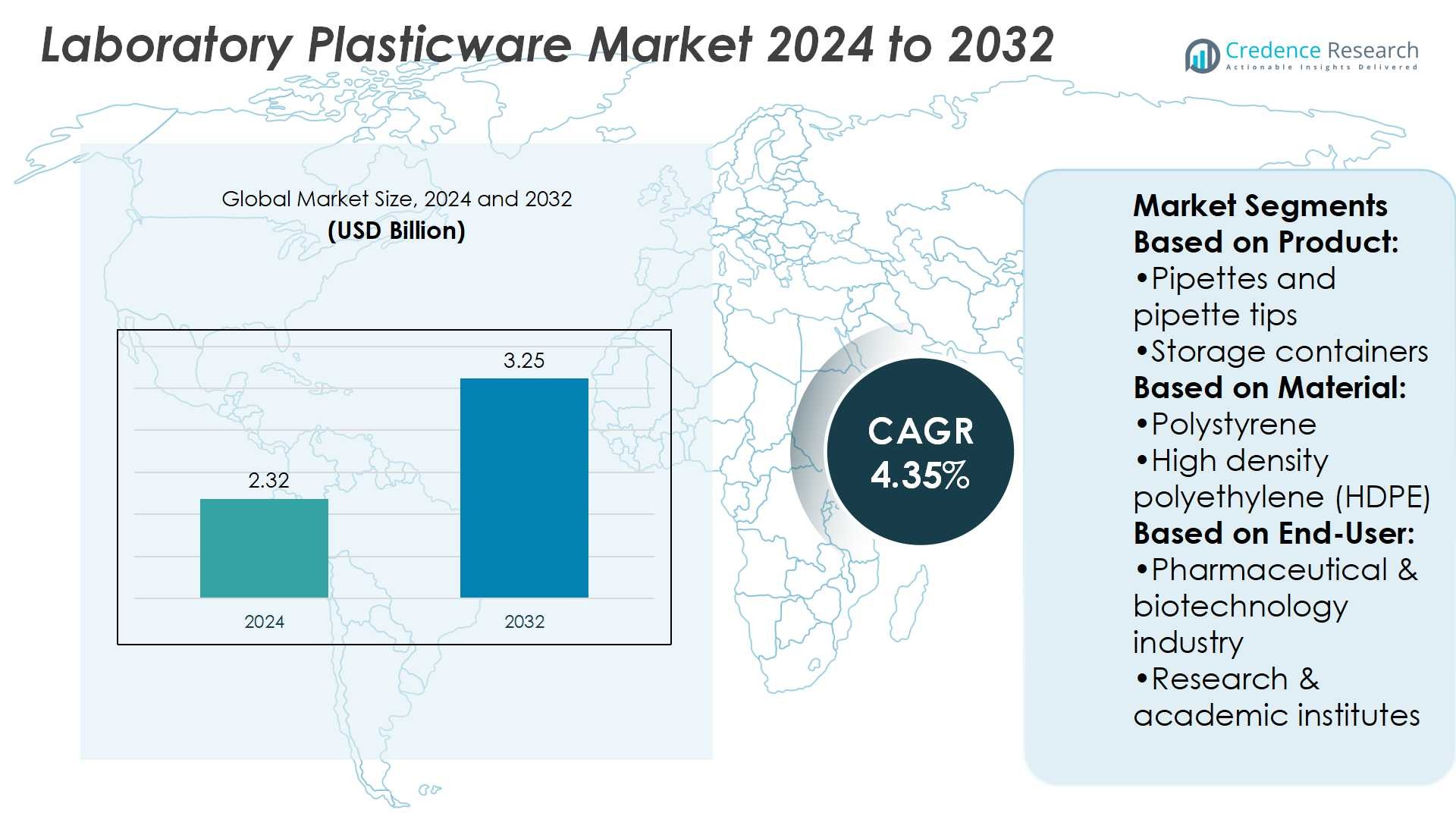

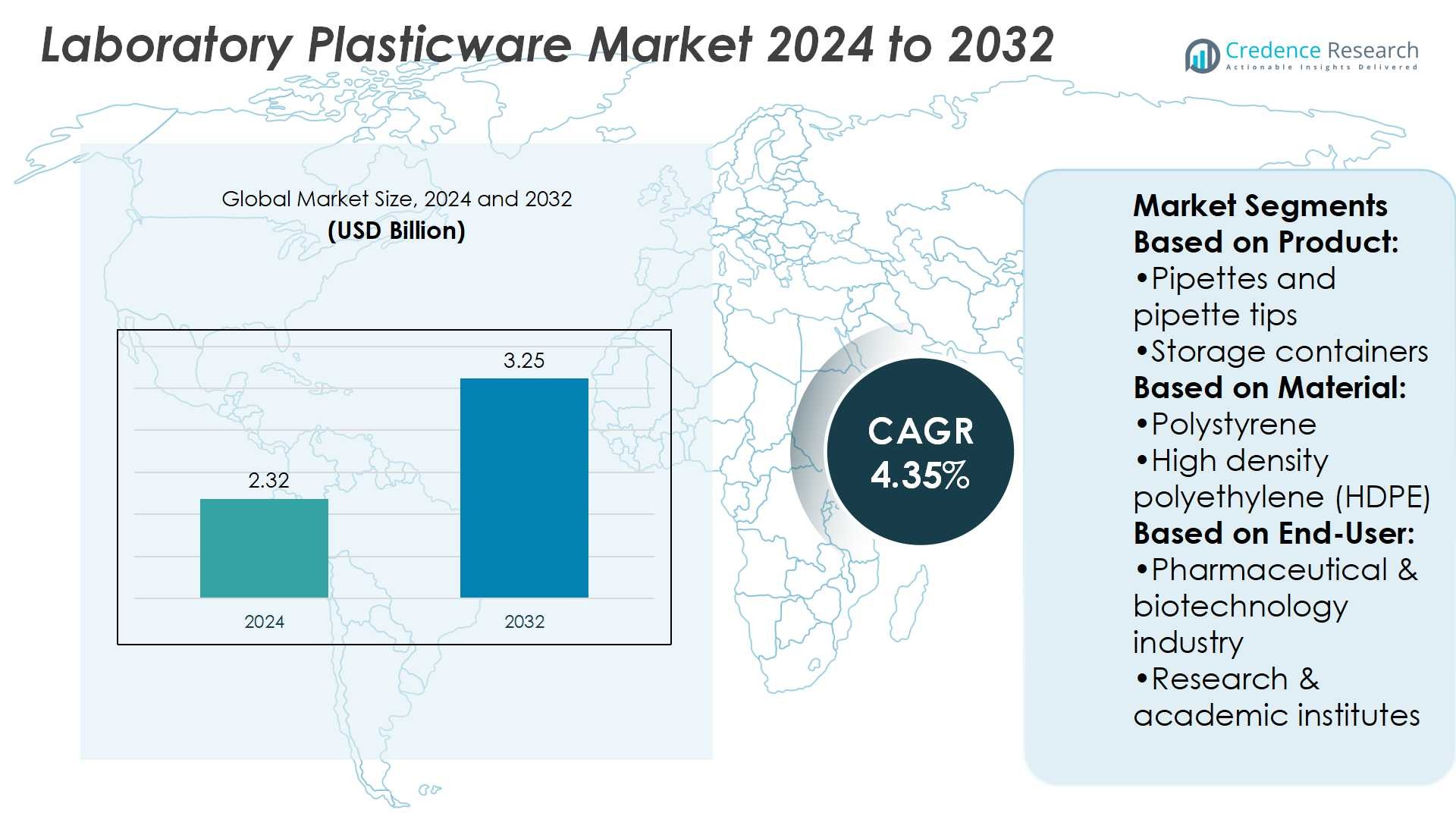

Laboratory Plasticware Market size was valued at USD 2.32 billion in 2024 and is anticipated to reach USD 3.25 billion by 2032, at a CAGR of 4.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laboratory Plasticware Market Size 2024 |

USD 2.32 Billion |

| Laboratory Plasticware Market, CAGR |

4.35% |

| Laboratory Plasticware Market Size 2032 |

USD 3.25 Billion |

The Laboratory Plasticware Market grows through strong drivers such as rising demand for safe, disposable consumables, expanding pharmaceutical and biotechnology research, and increasing diagnostic testing needs. It benefits from the shift toward cost-effective, contamination-free solutions that replace traditional glassware in laboratories. The market trends highlight rapid adoption of automation-compatible plasticware, growing preference for eco-friendly and recyclable materials, and rising customization for specialized applications. Expanding online procurement channels and strong investments in healthcare infrastructure further accelerate adoption. Together, these drivers and trends reinforce the market’s role in supporting accuracy, efficiency, and sustainability across global research and clinical environments.

The Laboratory Plasticware Market shows strong geographical presence, with Asia-Pacific leading due to rapid healthcare expansion, followed by North America and Europe with advanced research infrastructure and strict quality standards. Latin America and the Middle East & Africa present emerging opportunities through growing diagnostic and academic investments. The market remains competitive, with key players such as Corning Inc., Thermo Fisher Scientific, Eppendorf AG, VITLAB GmbH, Duran Group, Gerresheimer, Eurofins, ISOLAB, Peninsula Plastics, and Technosklo Ltd. focusing on innovation and global reach.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Laboratory Plasticware Market was valued at USD 2.32 billion in 2024 and will reach USD 3.25 billion by 2032 at a CAGR of 4.35%.

- Rising demand for safe, disposable, and contamination-free consumables drives steady market growth.

- Expanding pharmaceutical and biotechnology research increases the need for high-quality laboratory plasticware.

- Growing adoption of automation-compatible products and eco-friendly materials defines key market trends.

- Strong competition exists, with global players focusing on innovation, product range, and sustainable solutions.

- Regulatory pressure on single-use plastics and raw material cost fluctuations restrain market expansion.

- Asia-Pacific leads growth, followed by North America and Europe, while Latin America and MEA show emerging potential.

Market Drivers

Rising Demand for Advanced Research and Diagnostic Capabilities

The Laboratory Plasticware Market experiences strong growth due to the expansion of academic, clinical, and pharmaceutical research. The rising need for efficient sample storage and accurate testing drives demand for reliable plastic consumables. Research institutions and diagnostic centers depend on it to support faster, safer, and cost-effective laboratory operations. Governments and private entities continue to fund life sciences research, strengthening product adoption. The consistent increase in disease testing, genetic research, and biotechnology applications reinforces the need for high-quality plasticware. This demand positions manufacturers to innovate and expand production capacity.

- For instance, Peninsula Plastics operates over 35 injection molding machines within a 65,000-square-foot facility, producing thousands of molded parts daily for clients in various industries, including laboratory, automotive, and industrial sectors.

Shift Toward Cost-Effective and Disposable Laboratory Solutions

The Laboratory Plasticware Market benefits from the growing preference for disposable and cost-efficient alternatives to glassware. Single-use items reduce contamination risks and eliminate time-consuming sterilization, which makes them highly suitable for high-volume labs. Hospitals and diagnostic laboratories rely on it to improve hygiene and operational efficiency. The cost advantages offered by disposable plasticware appeal to resource-constrained facilities. Rapid testing requirements in pandemic preparedness also underscore the importance of affordable and sterile solutions. This shift sustains long-term growth momentum across healthcare and research sectors.

- For instance, VITLAB uses its own production facility in Großostheim to deliver high-precision plastic labware with over 94% availability for standard items.The company produces VITLAB® UV-protect volumetric flasks using pigmented PMP plastic, shielding light-sensitive substances from UV damage.

Expansion of Biotechnology and Pharmaceutical Industries

The Laboratory Plasticware Market gains significant traction from the expansion of pharmaceutical and biotechnology sectors worldwide. Drug discovery and vaccine development rely on durable plasticware for reproducible outcomes. It supports complex processes such as cell culture, molecular testing, and sample preservation. Global pharmaceutical investments continue to rise, fueling large-scale laboratory infrastructure development. Biopharmaceutical innovations increase the adoption of advanced plasticware with specialized properties. The strong link between R&D growth and laboratory consumables ensures steady market expansion.

Technological Innovations and Material Advancements in Plasticware

The Laboratory Plasticware Market is advancing with material innovations that improve durability, transparency, and chemical resistance. Manufacturers are introducing plastics that withstand extreme temperatures and harsh reagents. It strengthens the usability of plasticware in complex testing environments. Advanced polymers provide accuracy comparable to glass while offering lightweight benefits. Automation in laboratory workflows further increases demand for precision-molded plastic products. Continuous innovation secures the role of plasticware as a cornerstone in modern laboratory practices.

Market Trends

Growing Adoption of Eco-Friendly and Sustainable Plasticware Solutions

The Laboratory Plasticware Market is witnessing a rising trend toward eco-friendly and recyclable products. Sustainability concerns push manufacturers to develop bio-based plastics that reduce environmental impact. It addresses increasing regulations on single-use plastics in research and healthcare sectors. Laboratories prefer solutions that balance functionality with lower waste generation. Companies invest in new materials that provide durability while supporting recycling initiatives. This transition reflects a broader industry shift toward environmentally responsible laboratory operations.

- For instance, Eurofins’ microplastic testing service can detect particles as small as 20 micrometers using Fourier-Transform Infrared (FTIR) spectroscopy. Their laboratories use advanced analytical methods, including pyrolysis-GC/MS, to accurately verify and quantify recycled content in plastics for industries like textiles and apparel.

Integration of Automation-Compatible Plasticware in Laboratory Workflows

The Laboratory Plasticware Market benefits from the growing demand for automation-compatible consumables. Automated testing systems require standardized and precision-molded plasticware for reliable performance. It improves throughput in laboratories handling large volumes of samples. Robotics in sample preparation and diagnostic testing relies on plasticware designed for consistent dimensions. High adoption in pharmaceutical, clinical, and academic labs drives this trend further. The need for seamless integration with automated platforms strengthens demand for innovative designs.

- For instance, Technosklo Ltd. uses borosilicate glass tubes rated to ISO 3585 (3.3 thermal resistance), matching Pyrex durability – vital for automation accuracy during thermal changes.

Rising Demand for Customization and Specialized Plasticware Products

The Laboratory Plasticware Market shows an increasing trend of customization to meet specific research requirements. Laboratories seek specialized products tailored for niche applications such as molecular biology or cell culture. It supports unique experimental workflows that require precise measurements and material compatibility. Manufacturers respond with product lines designed for specialized assays and research segments. The growing complexity of research projects amplifies demand for tailored solutions. Customization enhances usability, efficiency, and accuracy in laboratory practices.

Expansion of Online Distribution Channels and Digital Procurement Platforms

The Laboratory Plasticware Market experiences a shift toward online platforms and digital procurement solutions. Research institutions and healthcare facilities increasingly purchase consumables through e-commerce and vendor portals. It simplifies bulk ordering, reduces procurement time, and offers transparent pricing. Online platforms provide access to a wider product range with real-time availability. Digital solutions also enable better inventory management for laboratories with high consumption rates. This trend strengthens market accessibility and accelerates adoption across global regions.

Market Challenges Analysis

Environmental Concerns and Regulatory Pressure on Plastic Usage

The Laboratory Plasticware Market faces significant challenges from rising environmental concerns and strict regulations on single-use plastics. Governments and regulatory bodies are imposing restrictions to minimize plastic waste in research and healthcare. It creates pressure on manufacturers to shift toward eco-friendly alternatives without compromising performance. Developing sustainable materials that match the durability and chemical resistance of traditional plastics remains costly and complex. Laboratories dependent on disposable items for sterility and convenience struggle to adapt to these constraints. Compliance with evolving regulations increases production costs and slows product innovation.

Supply Chain Volatility and Rising Raw Material Costs

The Laboratory Plasticware Market encounters obstacles linked to supply chain disruptions and volatile raw material pricing. Dependence on petrochemical-based polymers exposes manufacturers to global oil price fluctuations. It leads to inconsistent production costs and reduced profit margins across the industry. Supply chain interruptions during global crises highlight the vulnerability of laboratory operations relying on steady consumable supplies. Smaller laboratories face difficulties managing budget constraints while ensuring continuous access to essential plasticware. Manufacturers must balance affordability with quality while navigating unstable global supply networks. This challenge intensifies competition and creates uncertainty in long-term growth planning.

Market Opportunities

Expansion Potential in Emerging Healthcare and Research Markets

The Laboratory Plasticware Market holds strong opportunities in emerging economies with expanding healthcare infrastructure and research capacity. Rising investments in hospitals, diagnostic centers, and life sciences research facilities increase demand for reliable consumables. It supports advanced testing, sample handling, and clinical operations across rapidly developing regions. Growing awareness of infection control and safety standards fuels adoption of disposable plasticware. Governments and private investors in Asia-Pacific, Latin America, and Africa continue to prioritize laboratory modernization. This momentum creates long-term opportunities for global and regional manufacturers to establish a stronger presence.

Innovation in Smart, Sustainable, and High-Performance Plasticware

The Laboratory Plasticware Market benefits from opportunities in material innovation and technology integration. Manufacturers are developing smart consumables embedded with traceability features to support automation and digital workflows. It aligns with the increasing adoption of laboratory information management systems and robotic platforms. Advances in biodegradable and recyclable plastics open new growth pathways for eco-conscious buyers. Customization for specialized research applications further drives product differentiation. Companies that deliver sustainable, high-performance, and technology-enabled solutions are positioned to capture significant growth in the coming years.

Market Segmentation Analysis:

By Product

The Laboratory Plasticware Market is segmented into pipettes and pipette tips, storage containers, flasks, beakers, and others. Pipettes and tips dominate due to their essential role in sample preparation, accurate liquid handling, and molecular biology research. It remains critical for both routine diagnostics and advanced biotechnological applications. Storage containers record steady demand with increasing focus on safe sample preservation in pharmaceuticals and diagnostics. Flasks and beakers continue to serve fundamental roles in academic and industrial research, offering versatility for chemical and biological processes. The “others” category, including trays and racks, supports workflow efficiency across laboratories.

- For instance, Gerresheimer operates more than 350 injection-molding machines across a 120,000 m² production area (with approx. 60,000 m² of ISO-class clean rooms), enabling mass production of custom lab disposables like pipette tips and cuvettes.

By Material

The Laboratory Plasticware Market is categorized into polystyrene, high density polyethylene (HDPE), low density polyethylene (LDPE), polyvinyl chloride (PVC), polymethylpentene (PMP), and others. Polystyrene accounts for strong demand due to its clarity and cost-effectiveness, making it suitable for disposable items. HDPE is valued for chemical resistance and durability in storage applications. LDPE offers flexibility and finds use in squeeze bottles and tubing. PVC is widely adopted in fluid handling applications for its strength and adaptability. PMP holds relevance in high-temperature testing due to excellent heat resistance. It highlights how material innovation expands usability across varied research and clinical environments.

- For instance, ISOLAB offers polystyrene cuvettes sized 12.5 × 12.5 × 45 mm, with a 10 mm light path and a 340–900 nm wavelength range, sold as 100 pieces per pack.Their HDPE bottles hold 2.5 liters, feature thick walls and crush-resistant corners to avoid deformation under vacuum, and use GL45 caps with a PTFE insert for a hermetic seal.

By End-User

The Laboratory Plasticware Market includes pharmaceutical and biotechnology industries, research and academic institutes, diagnostic centers, and hospitals. The pharmaceutical and biotechnology industry leads due to large-scale consumption in drug discovery and vaccine development. Research and academic institutes adopt plasticware for teaching, experimental work, and innovation projects. Diagnostic centers rely on it to support high-volume testing, particularly in molecular diagnostics and disease screening. Hospitals drive demand through routine clinical testing and patient safety protocols requiring sterile consumables. Each end-user segment underscores the diverse role of laboratory plasticware in supporting healthcare, education, and scientific advancement.

Segments:

Based on Product:

- Pipettes and pipette tips

- Storage containers

Based on Material:

- Polystyrene

- High density polyethylene (HDPE)

Based on End-User:

- Pharmaceutical & biotechnology industry

- Research & academic institutes

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 24% of the Laboratory Plasticware Market. The region benefits from advanced healthcare systems, strong pharmaceutical research, and leading biotechnology companies. It relies heavily on high-quality plasticware for diagnostic testing, drug development, and clinical workflows. Growth is supported by automation adoption in laboratories and continuous government funding for life sciences. Hospitals and diagnostic centers account for major demand. The market is steady and innovation-focused, with emphasis on durable and precise consumables.

Europe

Europe accounts for about 25% of the Laboratory Plasticware Market. Strong pharmaceutical manufacturing and large-scale academic research institutions drive regional demand. The market emphasizes compliance with strict safety and environmental regulations, supporting sustainable plasticware adoption. Research labs and diagnostic centers depend on reliable plastic consumables for accuracy and sterility. Rising investments in healthcare innovation and biotechnology projects strengthen regional growth. Manufacturers focus on eco-friendly solutions to align with regulatory frameworks.

Asia-Pacific

Asia-Pacific leads with 32% of the Laboratory Plasticware Market. Expanding healthcare infrastructure, rapid growth in diagnostic centers, and rising pharmaceutical investments drive demand. Countries such as China, India, and Japan dominate usage due to large patient populations. Laboratories prefer cost-effective, disposable plasticware for large-scale testing. The region shows the fastest growth rate, supported by increasing government spending on research facilities. Local and international manufacturers expand capacity to meet strong demand.

Latin America

Latin America holds around 10% of the Laboratory Plasticware Market. Growth is linked to expanding diagnostic testing, medical research, and improving healthcare infrastructure. Universities and clinical laboratories adopt plastic consumables for routine and advanced testing. Rising demand for affordable and sterile products creates opportunities for manufacturers. Countries such as Brazil and Mexico lead regional consumption. The market shows steady growth as healthcare investments increase.

Middle East & Africa

The Middle East & Africa represents 6% of the Laboratory Plasticware Market. Healthcare modernization and rising government spending drive demand in hospitals and research centers. Laboratories face budget and supply chain constraints but continue adopting cost-effective consumables. Growth opportunities exist in countries expanding healthcare and education sectors. International suppliers dominate, though local production is gaining momentum. The market remains small but shows promising long-term expansion potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Peninsula Plastics

- VITLAB GmbH

- Eurofins

- Technosklo Ltd.

- Gerresheimer

- ISOLAB

- Thermo Fisher Scientific

- Duran Group

- Eppendorf AG

- Corning Inc.

Competitive Analysis

The competitive landscape of the Laboratory Plasticware Market players include Corning Inc., Duran Group, Eppendorf AG, Eurofins, Gerresheimer, ISOLAB, Peninsula Plastics, Technosklo Ltd., Thermo Fisher Scientific, and VITLAB GmbH. The Laboratory Plasticware Market is highly competitive, driven by innovation, product reliability, and cost efficiency. Companies focus on developing advanced consumables that support automation, improve accuracy, and ensure sterility in research and diagnostics. Sustainability remains a central theme, with rising demand for recyclable and eco-friendly materials to comply with global regulations. Market players strengthen their positions through continuous investment in research and product design, expanding distribution networks, and targeting emerging regions with growing healthcare and research infrastructure. Competition also centers on digital procurement channels and customized solutions tailored for pharmaceutical, diagnostic, and academic laboratories. This dynamic environment encourages consistent innovation and strategic expansion to capture market growth.

Recent Developments

- In November 2024, Greiner Bio-One’s subsidiary Mediscan began construction/opening of a new sterilization facility (Kremsmünster), investing to scale sterilization for medical and plastic products.

- In August 2024, Calibre Scientific acquired U.S.-based Industrial Glassware, a manufacturer of caps, vials, bottles, and related laboratory consumables. This acquisition strengthens Calibre Scientific I.S. manufacturing operations and broadens its global portfolio of laboratory products.

- In December 2023, Eppendorf SE Hamburg established a collaboration with Neste to enhance the development of laboratory products manufactured from plastic renewable raw materials. The strategic relationship enabled the development of a new range of renewable plastic lab consumables called Eppendorf consumables BioBased.

- In October 2023, Berry introduced the first 20 and 25 liter containers comprising 35% recycled material, which have received UN approval for the transport of hazardous commodities for five of the six model liquids in the UN assessment. The addition of these additional containers to the company’s famous Optimum range will help businesses accomplish their sustainability goals while also meeting customer demand for more sustainable packaging alternatives.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, End-User and Geography. It details leading market players, providing an overview of their business,product offerings, investments, revenue streams, and key applications. Additionally, the reportincludes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing demand for disposable and sterile consumables.

- Research and academic institutions will continue driving adoption of cost-effective plasticware.

- Automation-compatible plasticware will see rising usage in modern laboratory workflows.

- Sustainable and recyclable materials will gain higher acceptance across global markets.

- Pharmaceutical and biotechnology industries will increase consumption for drug discovery and testing.

- Digital procurement platforms will streamline supply chains and boost accessibility.

- Customization of products for specialized research will strengthen manufacturer competitiveness.

- Emerging regions will contribute significantly through healthcare infrastructure expansion.

- Innovations in advanced polymers will improve durability and chemical resistance.

- Strategic partnerships and global expansions will shape future industry growth.