Market Overview

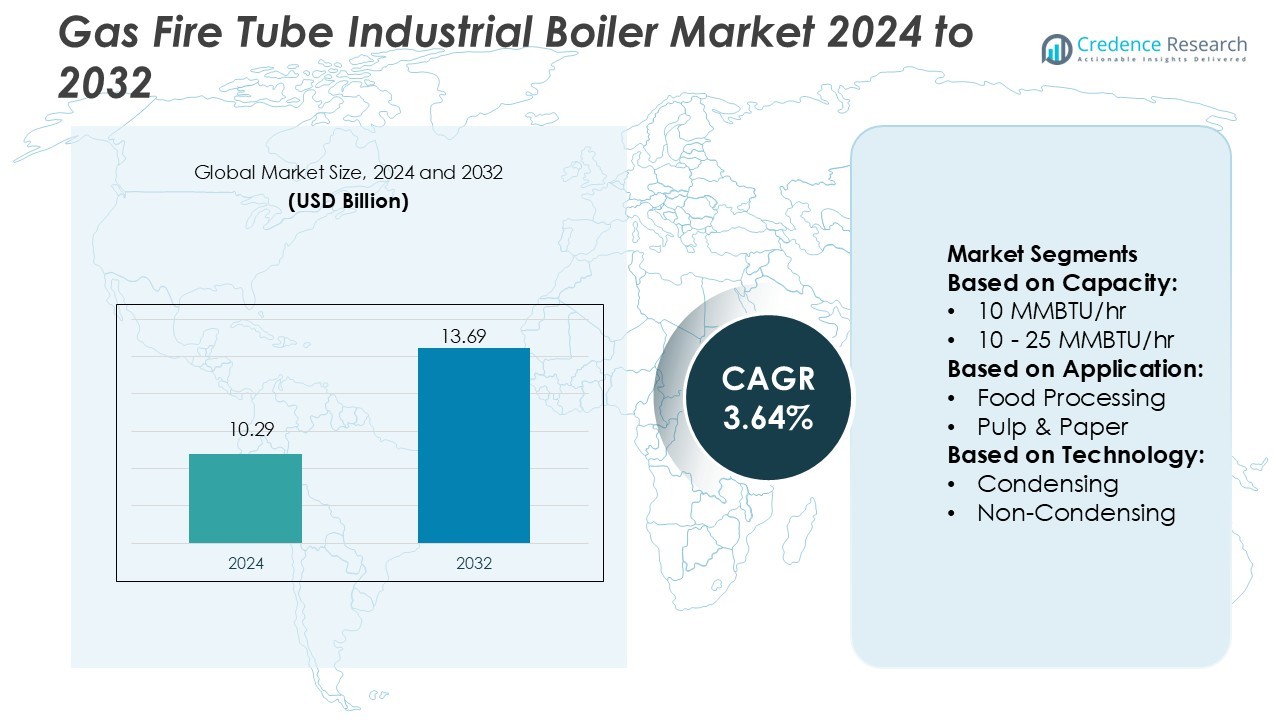

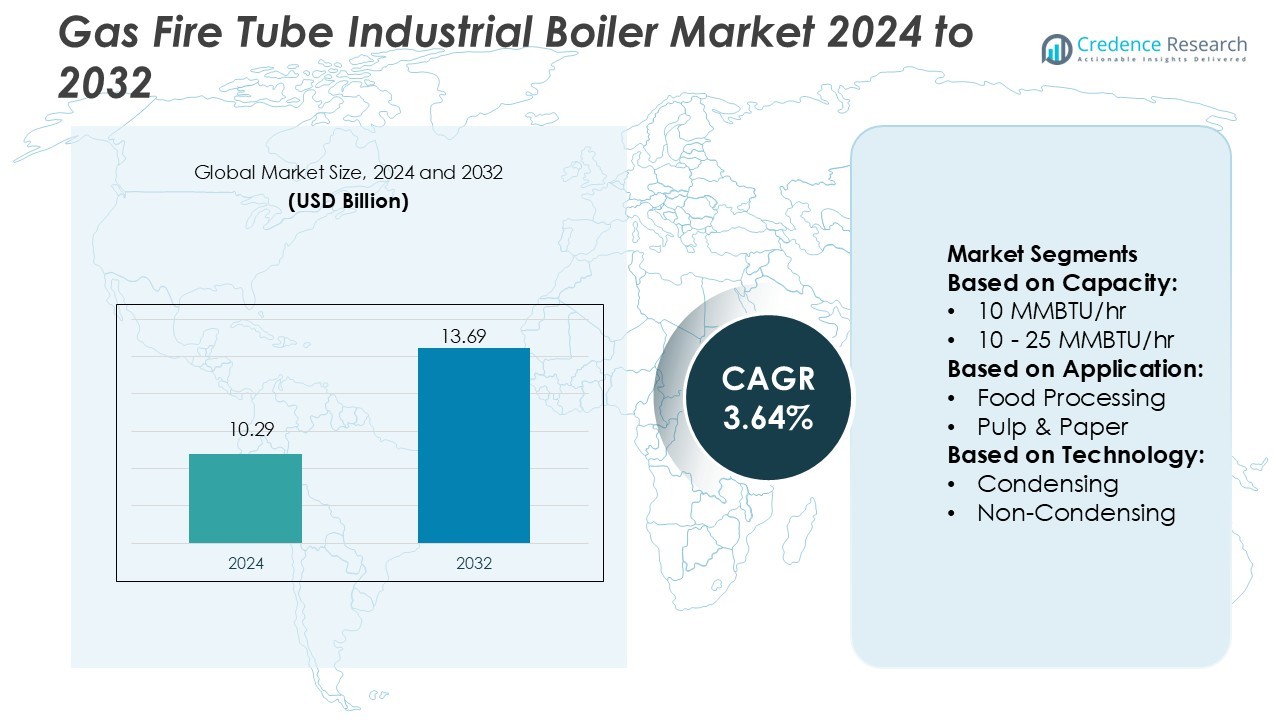

Gas Fire Tube Industrial Boiler Market size was valued USD 10.29 billion in 2024 and is anticipated to reach USD 13.69 billion by 2032, at a CAGR of 3.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fire Tube Industrial Boiler Market Size 2024 |

USD 10.29 Billion |

| Gas Fire Tube Industrial Boiler Market, CAGR |

3.64% |

| Gas Fire Tube Industrial Boiler Market Size 2032 |

USD 13.69 Billion |

The gas fire‑tube industrial boiler market such as Siemens AG, Mitsubishi Heavy Industries Ltd., Thermax Ltd., Cheema Boilers Limited, Bharat Heavy Electricals Ltd., IHI Corporation, Dongfang Oil Corporation Ltd., AC Boilers, Forbes Marshall and Harbin Oil Corporation are actively enhancing their technological portfolios and global footprint. These companies focus on high‑efficiency condensing boilers, service expansion and digital controls to strengthen market position. The leading region is Asia‑Pacific, which commands approximately 43.3 % of the global market share, driven by robust industrial growth in China, India and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Gas Fire Tube Industrial Boiler Market was valued at USD 10.29 billion in 2024 and is expected to reach USD 13.69 billion by 2032, growing at a CAGR of 3.64% during the forecast period.

- The market is driven by increasing industrial steam demand, rising need for energy‑efficient systems, and tighter emission regulations pushing adoption of gas‑fired boilers.

- Key trends include the shift toward condensing boiler technology, integration of smart controls, and growing use of modular designs for flexibility and quick installation.

- Competitive dynamics are shaped by top players such as Siemens AG, Mitsubishi Heavy Industries Ltd., and Thermax Ltd., which are expanding their portfolios with high‑efficiency and IoT‑enabled solutions.

- Asia‑Pacific leads the market with a 43.3% share, supported by rapid industrialisation in China, India, and Southeast Asia, followed by Europe and North America with significant shares.

Market Segmentation Analysis:

By Capacity

The capacity segment for the global gas fire‑tube industrial boiler market is divided into 10 MMBtu/hr; 10‑25 MMBtu/hr; 25‑50 MMBtu/hr; 50‑75 MMBtu/hr; and >75 MMBtu/hr. Research shows the 50‑75 MMBtu/hr band stands out as the dominant sub‑segment, capturing about 35 % share of total capacity demand. This segment benefits from its suitability in mid‑sized industrial plants that require substantial steam output but avoid the higher capital investment of larger systems. Drivers include increasing demand in manufacturing facilities, shift from smaller utilities toward higher‑capacity units, and regulatory push for higher‑efficiency mid‑range boilers.

- For instance, Siemens AG’s boiler control solution for industrial fire-tube applications incorporates a burner management system (BMS) built on a PLC platform, which supports features such as flame-scanner redundancy, applications up to SIL 3 safety rating, and real-time diagnostics via HMI with remote access.

By Application

In terms of application, the market is segmented into Food Processing; Pulp & Paper; Chemical; Refinery; Primary Metal; and Others. The Chemical application segment leads, accounting for roughly 35 % share of boiler installations driven by its heavy use of steam in processing, reaction heating and utilities. Growth is propelled by stricter emission norms in chemical plants, rising requirement for quality steam in chemical reactions, and retrofits of older systems to comply with efficiency mandates. Secondary drivers include expansion of the chemicals sector in Asia‑Pacific and replacement demand in mature markets.

- For instance, MHI-INC’s industrial electric steam generator line features standard units capable of producing superheated steam at 1,300 °C with flow rates up to 200 kg/h in specialized configurations.

By Technology

Technology‑wise, the market is divided into Condensing and Non‑Condensing fire‑tube boilers. The Condensing sub‑segment holds dominant share—approaching 60 %—thanks to its higher thermal efficiency and lower emissions profile. Adoption is being accelerated by environmental regulation, incentives for energy‑efficient equipment, and replacement of legacy non‑condensing units. Key drivers include the capability of condensing boilers to recover latent heat from flue gases, reduce fuel consumption and operating costs, and their growing acceptance in regions with strong emissions control frameworks.

Key Growth Drivers

Regulatory push for cleaner energy systems

Tightened emission standards across many regions are pushing industries toward boilers with lower NOₓ and CO₂ outputs. The shift from coal or oil‑fired systems toward gas fire‑tube boilers stems from their ability to meet stricter environmental mandates. Many manufacturing, chemical, and food processing facilities are upgrading to take advantage of this regulatory environment and ensure long‑term compliance and energy strategy alignment.

- For instance, Thermax Ltd. supplied a packaged firetube boiler with a working pressure of 10.54 kg/cm² and steam temperature range of 184–215 °C, specifically for chemical‑industry use on natural gas, enabling improved combustion control and reduced emissions under stringent norms.

Surging industrial steam demand

Rapid industrial expansion in sectors such as food processing, chemicals, and metals is driving higher demand for reliable steam generation systems. As factories and processing units scale up, they require efficient boilers that can deliver continuous steam supply. The gas fire‑tube boiler segment benefits from this trend because its design suits mid‑capacity applications where steam usage is intense and reliability matters.

- For instance, Cheema Boilers Limited offers a range of high-capacity “Gas PAC” and “Oil PAC” process boilers with operating capacities from 1 TPH (1,000 kg/hr) up to 16 TPH, designed to run on gas (LPG/CNG) or liquid fuels.

Efficiency and operating cost advantages

The longstanding focus on energy cost control has highlighted fire‑tube boilers as cost‑efficient solutions for many users. Gas‑fired units, particularly those with condensing technology, reduce fuel consumption and minimise downtime compared to outdated models. This has made them a more attractive replacement option for facilities seeking quicker return‑on‑investment through lower operational expenses and higher uptime.

Key Trends & Opportunities

Digitalisation and smart boiler control

Integration of IoT sensors, remote monitoring, and advanced control algorithms is gaining momentum in the boiler market. These technologies enable predictive maintenance, performance tracking, and optimisation of fuel usage, opening opportunities for OEMs and service providers. As plants look to reduce lifecycle costs and enhance reliability, smart boiler solutions offer a differentiator and growth avenue.

- For instance, BHEL’s distributed digital control, monitoring & information system (DDCMIS) enables boiler ramp‑up at a rate of 3% per minute for loads between 70‑100% TMCR, and 2% per minute for 55‑70% TMCR.

Transition to condensing technology and modular designs

Condensing gas fire‑tube boilers are emerging as the preferred option as users prioritise thermal efficiencies and lower emissions. Coupled with modular configurations, manufacturers can offer faster installation, scalable capacity and improved flexibility. This trend gives equipment players the chance to cater to both new installations and retrofits across industrial segments.

- For instance, IHI Corporation’s “KM Series” fire-tube boiler line incorporates an economizer and a built-in air heater system to preheat incoming combustion air, which significantly enhances thermal efficiency and reduces fuel consumption. The addition of an air heater can boost overall boiler efficiency from a standard of approximately 88% to as high as 92%, depending on the specific model and operating conditions.

Emerging‑market expansion and retrofit potential

Rapid industrialisation in Asia‑Pacific, Latin America and parts of Africa presents a strong opportunity for boiler suppliers. Many operational plants in these regions still use older systems and face pressure to upgrade for energy efficiency and compliance. The retrofit market, in particular, offers scope for providers to replace non‑condensing units with modern fire‑tube boilers at mid‑capacity levels.

Key Challenges

High capital expenditure and installation complexity

Initial costs for advanced gas fire‑tube boilers, especially those incorporating condensing technology and smart controls, remain a barrier for some end‑users. Smaller plants may delay upgrades due to budget constraints or complex installation requirements. This slows adoption rates, particularly in cost‑sensitive segments or emerging markets where upfront investment matters.

Fuel supply and infrastructure limitations

While natural gas is often the preferred fuel for modern fire‑tube boilers, many regions still lack the necessary pipeline or distribution infrastructure. Interruptions in gas supply or limited access can force operators to rely on alternative fuels, reducing the appeal of gas‑fired systems. This supply risk hampers market growth in areas without robust natural gas networks.

Regional Analysis

North America

North America holds a significant share of the market—around 30 % of global installations. Established manufacturing, metals and food processing sectors drive demand for fire‑tube boilers. Aging boiler fleets are being replaced with modern gas‑fired models, and strict emission regulations favour high‑efficiency units. The U.S. and Canada benefit from strong gas infrastructure, which makes fuel supply reliable. Suppliers also focus on retrofits and service contracts, helping growth. The region’s mature market means growth is moderate but steady.

Europe

Europe accounts for about 25 % of the global market share in the fire‑tube boiler segment. Demand is strong among chemical, pulp & paper and food‑processing plants where strict carbon‑emission laws and efficiency targets apply. Countries such as Germany, France and the UK lead with early boiler upgrades and condensing gas‑fired models. The region’s focus on decarbonisation and energy transition drives retrofit activity of older boilers. While growth is slower than emerging regions, the share remains high due to regulatory push and industrial replacement cycles.

Asia‑Pacific

Asia‑Pacific is the fastest‑growing region and commands roughly 28 % of market share. Rapid industrialisation in China, India, Southeast Asia and Japan fuels strong demand for fire‑tube boilers in sectors like food‑processing, manufacturing and chemicals. Many new plants are built with gas‑fired units to align with sustainability targets and to replace older coal‑or oil‑fired systems. Government policies support gas infrastructure and industrial thermal‑equipment upgrades. Due to large volume opportunities and low baseline penetration, the region drives global growth.

Latin America

Latin America holds about 7 % of market share in the gas fire‑tube boiler market. Growth is centred in Brazil, Mexico and Argentina where food processing, mining and refinery sectors require steam and heat. However, weaker gas distribution infrastructure and economic volatility slow uptake of high‑efficiency gas boilers. Retrofit demand in older plants offers opportunity, and modular gas boilers are gaining interest for their flexibility. The market remains smaller but offers scope for expansion as infrastructure improves.

Middle East & Africa (MEA)

The Middle East & Africa region captures around 10 % of the market share and exhibits promising growth prospects. Major drivers include large‑scale desalination, petrochemical and power‑project investments in GCC countries and South Africa. Many plants adopt gas‑fired fire‑tube boilers to support industrial parks and high‑capacity steam requirements. Challenges remain in fuel‑supply consistency and logistic complexity across some African nations. Still, state‑led infrastructure development and efficiency mandates support long‑term demand.

Market Segmentations:

By Capacity:

- 10 MMBTU/hr

- 10 – 25 MMBTU/hr

By Application:

- Food Processing

- Pulp & Paper

By Technology:

- Condensing

- Non-Condensing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Gas Fire Tube Industrial Boiler Market includes key players such as Siemens AG, Mitsubishi Heavy Industries Ltd., Thermax Ltd., Cheema Boilers Limited, Bharat Heavy Electricals Ltd., IHI Corporation, Dongfang Oil Corporation Ltd., AC Boilers, Forbes Marshall, and Harbin Oil Corporation. The Gas Fire Tube Industrial Boiler Market is characterized by a diverse range of companies offering a variety of technological solutions to meet the increasing demand for energy-efficient and low-emission heating systems. Companies in this market focus on innovation, with many introducing advanced control systems, digital monitoring features, and enhanced fuel efficiency. The market is also witnessing a shift towards condensing boilers, which offer improved thermal efficiency and reduced operational costs. In addition, players are investing in research and development to optimize boiler performance and extend the lifecycle of their products. Strategic partnerships, acquisitions, and service expansions are commonly used to strengthen market position, while companies are also focusing on custom solutions tailored to the specific needs of industries such as food processing, chemicals, and power generation. This competitive environment is driven by the growing demand for reliable and sustainable steam generation solutions across various industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, Thermax Energy Solutions secured about contract from a prominent industrial conglomerate to deliver two 550-ton circulating fluidized bed combustion boilers for a key energy project in Botswana. TBWES oversaw the design, testing, manufacturing, engineering, and supervision of the project.

- In May 2024, Miura acquired Cleaver-Brooks. This acquisition strengthened Cleaver-Brooks’ capability to provide sustainable boiler solutions and enhance customer service. Miura’s expertise supported the company’s expansion in heat-intensive industries, emphasizing energy efficiency and environmental sustainability.

- In February 2024, Siemens AG announced that its Smart Infrastructure business would present a wide range of innovative and sustainable building technologies at the Mostra Convegno Expocomfort (MCE) trade show in Milan.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing global pressure to reduce carbon emissions will drive higher adoption of gas‑fire‑tube boilers in industrial facilities.

- Rising industrial steam demand from food‑processing, chemical and metal sectors will boost boiler installations.

- Technological upgrades such as condensing designs and IoT‑enabled controls will improve efficiency and lifecycle value for users.

- Growth in emerging markets across Asia‑Pacific and Latin America presents new opportunities for mid‑capacity boiler units.

- Governments introducing incentives for energy‑efficient thermal equipment will encourage industries to replace older boilers.

- Integration of renewable energy systems with gas‑fired boilers in hybrid setups will expand use cases and appeal.

- Shift from diesel or heavy‑oil boilers to natural‑gas fire‑tube units will increase as gas infrastructure develops.

- Service and maintenance business models around remote monitoring and predictive maintenance will gain traction.

- Modular and compact fire‑tube boiler solutions that reduce installation time will benefit retrofit markets.

- Heightened focus on operational cost savings and fuel efficiency will prompt more facilities to transition to modern systems.