Market Overview

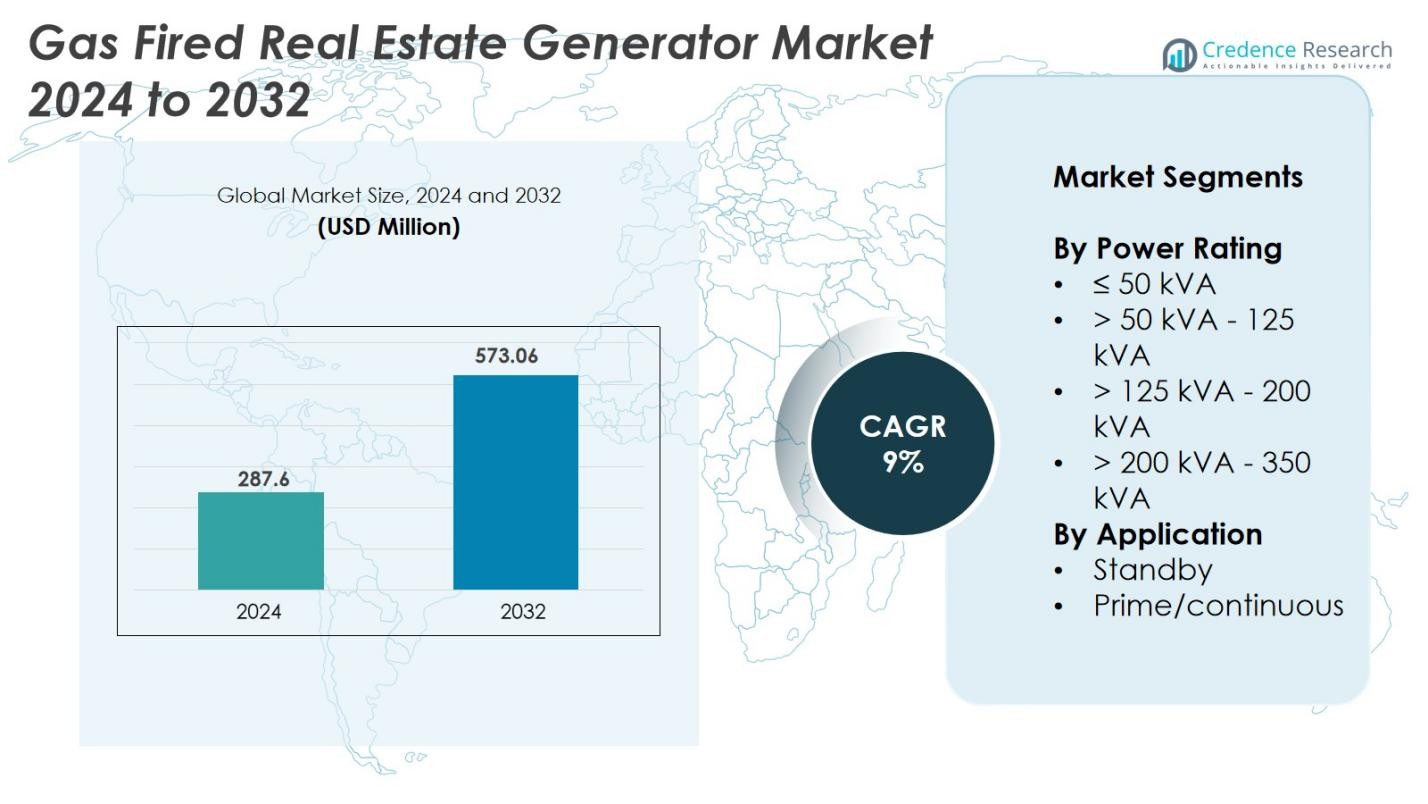

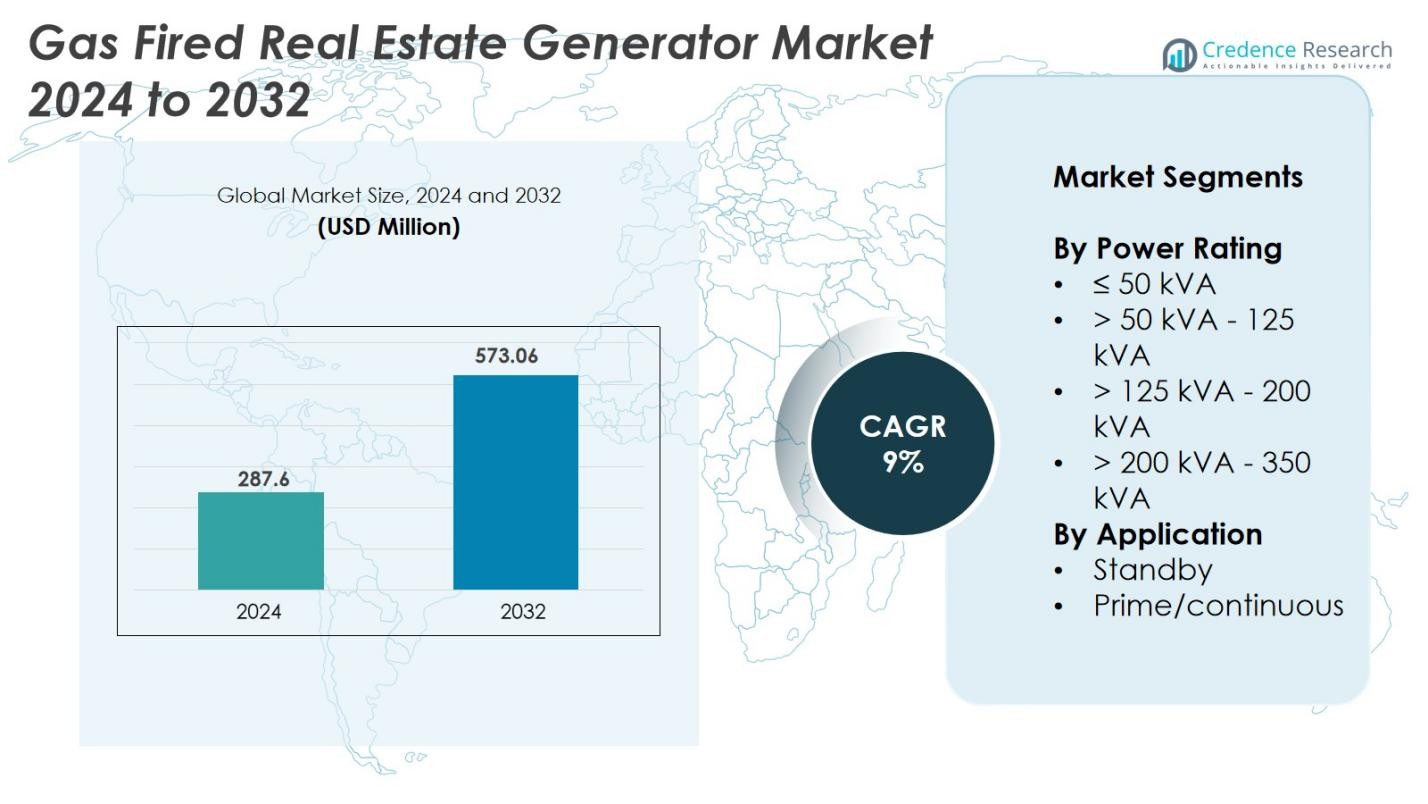

Gas Fired Real Estate Generator Market size was valued at USD 287.6 million in 2024 and is anticipated to reach USD 573.06 million by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Real Estate Generator Market Size 2024 |

USD 287.6 Million |

| Gas Fired Real Estate Generator Market, CAGR |

9% |

| Gas Fired Real Estate Generator Market Size 2032 |

USD 573.06 Million |

Gas Fired Real Estate Generator Market is dominated by key players such as Caterpillar, Cummins, Aggreko, Atlas Copco, Generac Power Systems, HIMOINSA, and Kirloskar, who lead the industry through advanced product offerings and reliable backup power solutions tailored for real estate applications. These companies emphasize fuel efficiency, emissions compliance, and smart integration capabilities, keeping pace with evolving real estate infrastructure needs. North America leads the market with a 34% share in 2024, driven by robust commercial construction and grid reliability challenges. Asia Pacific follows closely with a 29% share, supported by urban expansion and increasing investment in gas-based power systems for modern real estate developments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Gas Fired Real Estate Generator Market size was valued at USD 287.6 million in 2024 and is projected to reach USD 573.06 million by 2032, at a CAGR of 9%.

- The market is driven by increasing demand for cleaner backup power solutions in real estate, especially in high-density commercial and residential projects, owing to stricter emission norms and rising urbanization.

- Growing integration of smart energy management systems and hybrid solutions combining gas generators with renewable sources is reshaping market trends and enhancing system efficiency.

- Key players such as Caterpillar, Cummins, Aggreko, and Generac Power Systems dominate through innovation, fuel-flexible systems, and strong service networks, while regional companies strengthen local presence.

- North America leads with a 34% regional share, followed by Asia Pacific at 29%; the >50 kVA – 125 kVA segment accounts for the largest share (42.5%) due to its suitability for mid-sized commercial real estate applications.

Market Segmentation Analysis

By Power Rating

In the Gas Fired Real Estate Generator Market, the >50 kVA – 125 kVA segment dominates with a 42.5% market share in 2024. This segment leads due to its widespread deployment in mid-sized commercial properties and multi-unit residential buildings, where demand for uninterrupted power supply is rising. The growing emphasis on energy efficiency and lower emissions compared to diesel alternatives also drives preference for this capacity range. Additionally, the segment benefits from government incentives promoting clean energy solutions in real estate, boosting adoption across urban developments.

- For instance, Kirloskar offers CPCB IV+ compliant gas generators in the 125 kVA range, equipped with electric start and semi-automatic features for continuous backup power, widely adopted in commercial real estate projects.

By Application

The standby application segment holds the largest share at 68% in 2024, driven by the necessity for reliable backup power during grid failures, especially in high-rise residential and commercial buildings. With increasing urban infrastructure and growing sensitivity to power disruptions, developers are prioritizing gas-fired solutions for their scalability and lower operational costs. The segment’s growth is further supported by heightened regulatory standards for power resilience in critical real estate, including hospitals, data centers, and office complexes, favoring cleaner standby power systems.

- For instance, GE Vernova’s HA gas turbines are engineered for flexible power generation with reduced emissions, supporting critical real estate including hospitals and office complexes.

Key Growth Drivers

Rising Demand for Reliable and Clean Backup Power

The rising need for reliable and clean backup power solutions is a primary growth driver for the Gas Fired Real Estate Generator Market. With increasing urbanization and frequent power outages in emerging economies, property developers and facility managers are prioritizing efficient backup systems to ensure uninterrupted operations. Gas-fired generators offer a cleaner alternative to diesel systems, aligning with environmental regulations and sustainability objectives. Their reduced emissions, lower noise levels, and longer lifespan make them attractive for residential complexes, commercial buildings, and retail centers.

- For instance, Cummins highlights gas-fired generators with extended runtimes and seamless load management, making them preferred for residential and commercial properties where power reliability is critical.

Expansion of Real Estate and Commercial Infrastructure

The rapid growth of modern commercial infrastructure and real estate developments significantly drives demand for gas-fired generators. With the construction of mixed-use developments, hotels, shopping complexes, and urban residential towers, the need for dependable, scalable power generation solutions has increased. Gas-fired generators are preferred due to their operational efficiency, lower fuel costs, and ability to comply with green building codes. As smart building technologies gain traction, the integration of power monitoring systems and hybrid power configurations further accelerates adoption.

- For instance, Schneider Electric’s deployment of smart microgrid systems in commercial complexes, integrating gas generators with power monitoring and hybrid configurations to enhance efficiency and sustainability.

Regulatory Push for Emission Reduction and Energy Efficiency

Stricter emission norms and policies promoting energy-efficient alternatives drive the shift toward gas-fired generators in the real estate sector. Regulatory authorities in multiple regions are mandating reduced carbon emissions from backup power systems, creating opportunities for low-NOx and ultra-low emission gas generators. These systems not only meet compliance requirements but also lower operational costs by using cleaner-burning natural gas or biogas. The global movement towards decarbonization and net-zero targets has influenced facility managers to replace diesel generators with cleaner technologies. Ongoing developments in fuel-flexible generator models also enable adaptation to evolving energy landscapes.

Key Trends & Opportunities

Integration with Smart Energy Management Systems

The integration of gas-fired generators with smart energy management systems is emerging as a key trend, offering real-time monitoring, load optimization, and seamless grid-to-generator transitions. Smart systems enhance generator efficiency, reduce fuel consumption, and allow predictive maintenance. With the growing focus on building automation and intelligent infrastructure, real estate developers are adopting IoT-enabled power systems that support demand response and energy resilience. This trend opens opportunities for manufacturers to offer advanced controller technologies and energy management software along with generator hardware.

- For instance, Turkcell’s SYNERGY platform integrates batteries with generators to automate load management, cutting fuel use by 7% and improving overall energy resilience in complex infrastructures.

Growing Adoption of Hybrid Energy Solutions

The emergence of hybrid energy solutions combining gas-fired generators with renewable sources such as solar panels and battery storage is creating new opportunities in the market. These systems provide greater flexibility, reduce fuel dependency, and support peak shaving during high-demand periods. The integration of renewables with gas-fired systems ensures continuous power availability while maintaining sustainability goals. Real estate developers are increasingly opting for hybrid systems to lower energy costs and meet eco-friendly building standards. This trend also aligns with the rising deployment of microgrids in urban and remote properties, offering enhanced resilience against grid instability.

- For instance, Siemens Energy developed hybrid power systems integrating gas engines with solar and battery storage to optimize energy use and maintain continuous supply in commercial facilities.

Key Challenges

High Initial Investment and Infrastructure Requirements

One of the major challenges in the Gas Fired Real Estate Generator Market is the high initial investment associated with installation and setup. Unlike diesel generators that require minimal infrastructure, gas-fired units need access to natural gas pipelines or storage systems, which may not be readily available in all regions. The cost of connection, regulatory approvals, and compliance with safety standards can significantly increase upfront expenses. This limits adoption in smaller real estate projects or developing regions with limited gas infrastructure.

Competition from Renewable Energy and Energy Storage Systems

The growing popularity of renewable energy and advanced energy storage technologies presents a significant challenge to gas-fired generator adoption. Solar and wind solutions, paired with high-capacity batteries, offer a clean and increasingly cost-effective alternative for backup power. As battery prices decline and renewable technologies improve, many residential and commercial developments are shifting toward fully renewable or hybrid systems that eliminate fossil fuel dependency. Moreover, regulatory incentives and subsidies for solar and storage systems further erode the competitive edge of gas-fired generators. To remain relevant, gas generator manufacturers must innovate through fuel-flexible or hybrid-compatible models and emphasize lower emissions and higher efficiency to appeal to sustainability-driven buyers.

Regional Analysis

North America

North America dominates the Gas Fired Real Estate Generator Market with a market share of 34% in 2024. The region’s lead is driven by a mature real estate infrastructure, frequent grid reliability issues, and increasing adoption of cleaner backup power solutions over diesel-based systems. The U.S. particularly drives demand through commercial office spaces, large housing complexes, and data centers seeking low-emission, cost-efficient generators. Regulatory incentives promoting natural gas usage and strong pipeline networks further support market growth. Canada’s urban expansion and sustainability-driven building codes also contribute to the region’s steady demand for gas-fired generators.

Europe

Europe holds 27% market share in 2024, backed by stringent environmental regulations and a strong shift toward sustainable energy systems in real estate. Countries like Germany, the U.K., and France are witnessing rising adoption of gas-fired generators in commercial and residential settings due to their compatibility with decarbonization goals and EU emission targets. Integration with smart building technologies and energy-efficient backup systems is growing. Investments in hybrid power systems combining gas generators and renewables, along with modernizing real estate assets, drive market penetration. However, reliance on energy imports and volatile gas prices could pose future challenges.

Asia Pacific

Asia Pacific accounts for 29% of the market share in 2024, emerging as the fastest-growing region due to rapid urbanization, construction of commercial real estate, and increasing concerns over power reliability. Nations like China, India, Japan, and Southeast Asia are expanding their gas network infrastructure, making gas-fired generators more accessible. High-rise developments, business parks, and mixed-use buildings are leading end users. Government initiatives supporting cleaner energy adoption and investments in smart cities further fuel growth. However, unequal access to gas supply and higher upfront costs compared to diesel alternatives may hinder wider adoption in developing countries.

Latin America

Latin America captures 6% of the Gas Fired Real Estate Generator Market in 2024, showing moderate growth driven by urban infrastructure upgrades and grid stability issues in parts of Brazil, Mexico, and Colombia. The shift from diesel to gas-fired systems is influenced by environmental pressures and rising natural gas availability. Real estate developers in major metropolitan areas are adopting gas generators to enhance operational efficiency and meet sustainability targets. However, limited pipeline networks and economic volatility pose constraints on large-scale adoption, particularly in smaller urban developments and rural areas.

Middle East & Africa

The Middle East & Africa region accounts for 4% of the global market share in 2024, largely driven by the GCC’s premium commercial real estate and hospitality sectors. Countries like the UAE and Saudi Arabia favor gas-fired generators to support luxury projects, malls, and smart city initiatives, relying on abundant natural gas reserves. In Africa, emerging urbanization and growing commercial hubs in South Africa and Nigeria create niche demand. Despite the potential, infrastructural limitations, political instability, and limited gas access in several African markets restrict wider adoption of gas-fired generation systems.

Market Segmentations

By Power Rating

- ≤ 50 kVA

- > 50 kVA – 125 kVA

- > 125 kVA – 200 kVA

- > 200 kVA – 350 kVA

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gas Fired Real Estate Generator Market features a moderately consolidated landscape, dominated by global giants and established regional players focused on product reliability, efficiency, and emission compliance. Key players such as Caterpillar, Cummins, Aggreko, Atlas Copco, Generac Power Systems, and HIMOINSA lead the market with advanced generator solutions tailored for real estate applications, integrating IoT-based monitoring and smart control systems. These companies emphasize strategic collaborations, product innovations, and portfolio diversification to strengthen market presence. Additionally, players like Kirloskar, J.C. Bamford Excavators, Ashok Leyland, and Rehlko cater to regional demand through cost-effective systems and strong distribution networks. The increasing preference for hybrid and fuel-flexible models also encourages companies to innovate in emission control and performance optimization. Expansion into emerging markets, particularly in Asia Pacific and Latin America, is a strategic focus area. Competitive differentiation is often driven by customer service, customization capabilities, and after-sales support.

Key Player Analysis

- HIMOINSA

- Caterpillar

- Kirloskar

- Rehlko

- Ashok Leyland

- Atlas Copco

- Cummins

- J.C. Bamford Excavators

- Aggreko

- Generac Power Systems

Recent Developments

- In July 2025, PPL Corporation and Blackstone Infrastructure formed a joint venture to build, own and operate new gas‑fired combined‑cycle generation stations to power data centres in Pennsylvania under long‑term energy services agreements.

- In June 2025, Cummins Inc. announced the launch of its new 17‑litre engine platform generator set – the S17 Centum genset – capable of producing up to 1 megawatt, designed for compact footprint applications including commercial properties and real‑estate backup power projects.

- In June 2025, Baseline Energy Services launched the “NexGen 400”, a new 400 kW mobile natural‑gas‑fueled generator built with sensors to adapt for higher BTU gas and meet power‑constrained markets (though primarily oil & gas, the technology could extend to built‑environment backup power).

- In January 2025, Generac Holdings Inc. unveiled its most powerful air‑cooled home standby generator (10 kW to 28 kW models) which further expands their portfolio of gas‑fired standby solutions for residential / real‑estate settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for gas-fired generators will grow as real estate developers prioritize low-emission backup power solutions.

- Integration with smart building systems and IoT-based controls will become standard for efficiency and monitoring.

- Hybrid power solutions combining gas generators with renewable energy and battery storage will gain traction.

- Increased adoption in smart cities and high-density urban projects will drive market expansion.

- Technological advancements will improve fuel efficiency and reduce maintenance costs, enhancing value.

- Regulatory pressure to reduce carbon emissions will accelerate the shift from diesel to gas-based systems.

- Emerging markets in Asia Pacific and Latin America will offer new growth opportunities as infrastructure develops.

- Manufacturers will focus on scalable, modular generator systems to meet diverse property needs.

- Service-based business models, including long-term maintenance and performance contracts, will become more common.

- Fuel-flexible generators capable of running on biogas or hydrogen blends will attract sustainability-focused buyers.