CHAPTER NO. 1 : INTRODUCTION 30

1.1. Report Description 30

Purpose of the Report 30

USP & Key Offerings 30

1.2. Key Benefits for Stakeholders 31

1.3. Target Audience 31

CHAPTER NO. 2 : EXECUTIVE SUMMARY 32

CHAPTER NO. 3 : POWER PLANTS HEAVY DUTY GAS TURBINE MARKET FORCES & INDUSTRY PULSE 34

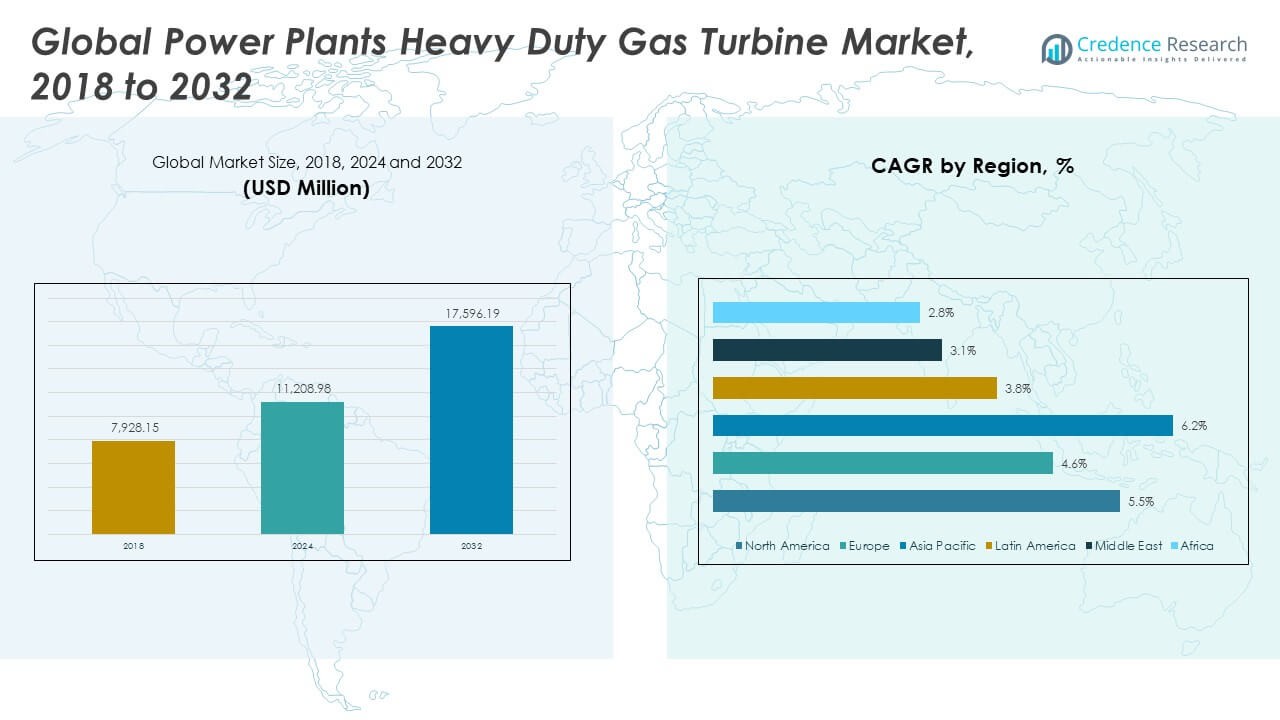

3.1. Foundations of Change – Market Overview 34

3.2. Catalysts of Expansion – Key Market Drivers 36

3.3. Momentum Boosters – Growth Triggers 37

3.4. Innovation Fuel – Disruptive Technologies 37

3.5. Headwinds & Crosswinds – Market Restraints 38

3.6. Regulatory Tides – Compliance Challenges 39

3.7. Economic Frictions – Inflationary Pressures 39

3.8. Untapped Horizons – Growth Potential & Opportunities and Strategic Navigation – Industry Frameworks 40

3.9. Market Equilibrium – Porter’s Five Forces 41

3.10. Ecosystem Dynamics – Value Chain Analysis 43

3.11. Macro Forces – PESTEL Breakdown 45

3.12. Price Trend Analysis 47

3.12.1. Regional Price Trend 48

3.12.2. Price Trend by Product 48

3.13. Buying Criteria 49

CHAPTER NO. 4 : COMPETITION ANALYSIS 50

4.1. Company Market Share Analysis 50

4.1.1. Global Power Plants Heavy Duty Gas Turbine Market Company Volume Market Share 50

4.1.2. Global Power Plants Heavy Duty Gas Turbine Market Company Revenue Market Share 52

4.2. Strategic Developments 54

4.2.1. Acquisitions & Mergers 54

4.2.2. New Product Launch 55

4.2.3. Agreements & Collaborations 56

4.3. Competitive Dashboard 57

4.4. Company Assessment Metrics, 2024 58

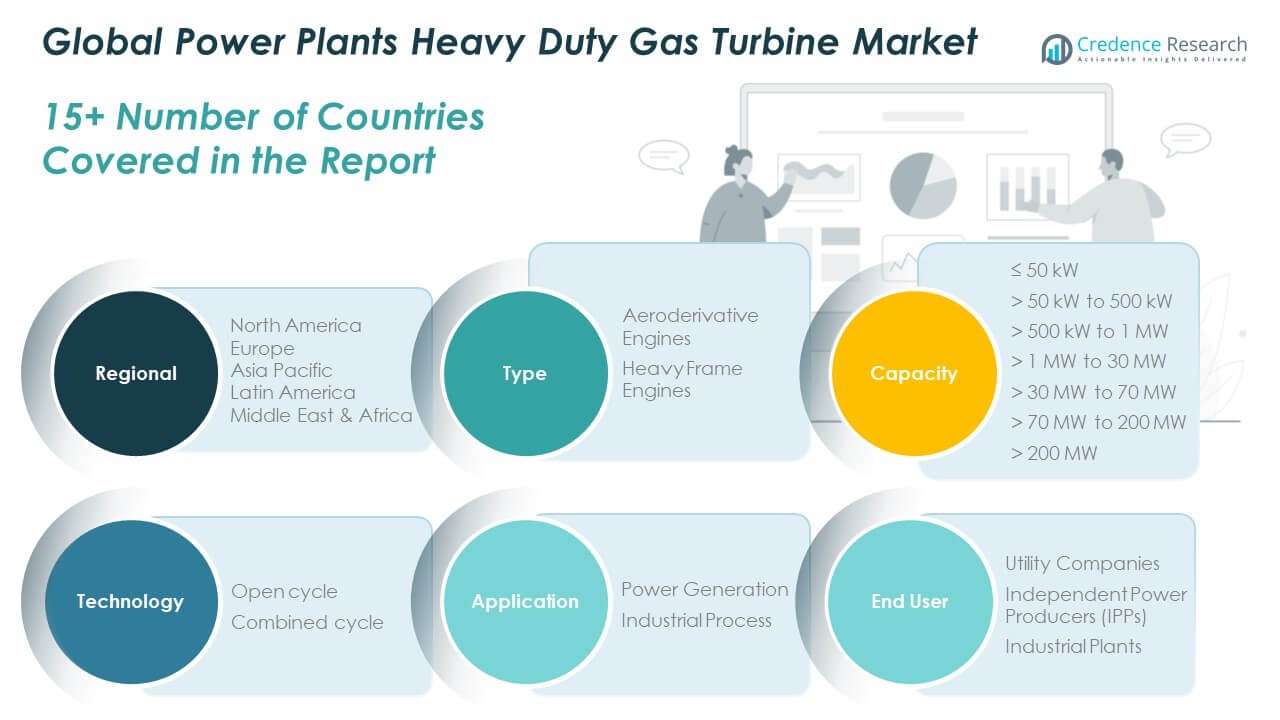

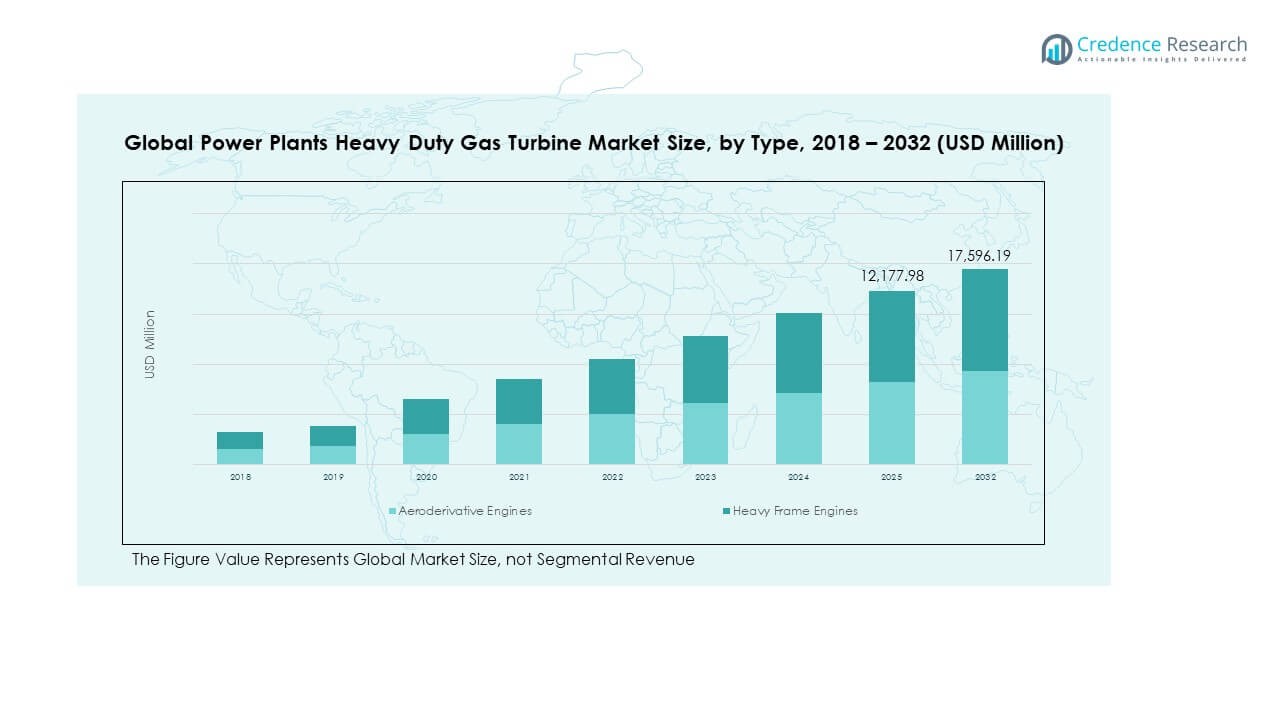

CHAPTER NO. 5 : GLOBAL MARKET ANALYSIS, INSIGHTS & FORECAST, BY TYPE 59

CHAPTER NO. 6 : GLOBAL MARKET ANALYSIS, INSIGHTS & FORECAST, BY CAPACITY 64

CHAPTER NO. 7 : GLOBAL MARKET ANALYSIS, INSIGHTS & FORECAST, BY TECHNOLOGY 69

CHAPTER NO. 8 : GLOBAL MARKET ANALYSIS, INSIGHTS & FORECAST, BY APPLICATION 74

CHAPTER NO. 9 : GLOBAL MARKET ANALYSIS, INSIGHTS & FORECAST, BY END USER 79

CHAPTER NO. 10 : GLOBAL MARKET ANALYSIS, INSIGHTS & FORECAST, BY REGION 84

CHAPTER NO. 11 : NORTH AMERICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY COUNTRY 91

11.1. North America Market Analysis, Insights & Forecast, by Type 94

11.2. North America Market Analysis, Insights & Forecast, by Capacity 96

11.3. North America Market Analysis, Insights & Forecast, by Technology 98

11.4. North America Market Analysis, Insights & Forecast, by Application 100

11.5. North America Market Analysis, Insights & Forecast, by End User 102

CHAPTER NO. 12 : EUROPE MARKET ANALYSIS, INSIGHTS & FORECAST, BY COUNTRY 104

12.1. Europe Market Analysis, Insights & Forecast, by Type 109

12.2. Europe Market Analysis, Insights & Forecast, by Capacity 111

12.3. Europe Market Analysis, Insights & Forecast, by Technology 113

12.4. Europe Market Analysis, Insights & Forecast, by Application 115

12.5. Europe Market Analysis, Insights & Forecast, by End User 117

CHAPTER NO. 13 : ASIA PACIFIC MARKET ANALYSIS, INSIGHTS & FORECAST, BY COUNTRY 119

13.1. Asia Pacific Market Analysis, Insights & Forecast, by Type 124

13.2. Asia Pacific Market Analysis, Insights & Forecast, by Capacity 126

13.3. Asia Pacific Market Analysis, Insights & Forecast, by Technology 128

13.4. Asia Pacific Market Analysis, Insights & Forecast, by Application 130

13.5. Asia Pacific Market Analysis, Insights & Forecast, by End User 132

CHAPTER NO. 14 : LATIN AMERICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY COUNTRY 134

14.1. Latin America Market Analysis, Insights & Forecast, by Type 139

14.2. Latin America Market Analysis, Insights & Forecast, by Capacity 141

14.3. Latin America Market Analysis, Insights & Forecast, by Technology 143

14.4. Latin America Market Analysis, Insights & Forecast, by Application 145

14.5. Latin America Market Analysis, Insights & Forecast, by End User 147

CHAPTER NO. 15 : MIDDLE EAST MARKET ANALYSIS, INSIGHTS & FORECAST, BY COUNTRY 149

15.1. Middle East Market Analysis, Insights & Forecast, by Type 152

15.2. Middle East Market Analysis, Insights & Forecast, by Capacity 154

15.3. Middle East Market Analysis, Insights & Forecast, by Technology 156

15.4. Middle East Market Analysis, Insights & Forecast, by Application 158

15.5. Middle East Market Analysis, Insights & Forecast, by End User 160

CHAPTER NO. 16 : AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY COUNTRY 162

16.1. Africa Market Analysis, Insights & Forecast, by Type 165

16.2. Africa Market Analysis, Insights & Forecast, by Capacity 167

16.3. Africa Market Analysis, Insights & Forecast, by Technology 169

16.4. Africa Market Analysis, Insights & Forecast, by Application 171

16.5. Africa Market Analysis, Insights & Forecast, by End User 173

CHAPTER NO. 17 : COMPANY PROFILE 175

17.1. GE Vernova 175

17.2. Ansaldo Energia 178

17.3. Baker Hughes 178

17.4. Siemens Energy 178

17.5. Mitsubishi Power 178

17.6. Kawasaki Heavy Industries 178

17.7. Company 7 178

17.8. Company 8 178

17.9. Company 9 178

17.10. Company 10 178

17.11. Company 11 178

17.12. Company 12 178

17.13. Company 13 178

17.14. Company 14 178

List of Figures

FIG NO. 1. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Type, 2024 & 2032 59

FIG NO. 2. Market Attractiveness Analysis, By Type 60

FIG NO. 3. Incremental Revenue Growth Opportunity by Type, 2024 – 2032 61

FIG NO. 4. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Capacity, 2024 & 2032 64

FIG NO. 5. Incremental Revenue Growth Opportunity by Capacity, 2024 – 2032 65

FIG NO. 6. Incremental Revenue Growth Opportunity by Capacity, 2024 – 2032 66

FIG NO. 7. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Technology, 2024 & 2032 69

FIG NO. 8. Market Attractiveness Analysis, By Technology 70

FIG NO. 9. Incremental Revenue Growth Opportunity by Technology, 2024 – 2032 71

FIG NO. 10. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Application, 2024 & 2032 74

FIG NO. 11. Market Attractiveness Analysis, By Application 75

FIG NO. 12. Incremental Revenue Growth Opportunity by Application, 2024 – 2032 76

FIG NO. 13. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By End User, 2024 & 2032 79

FIG NO. 14. Market Attractiveness Analysis, By End User 80

FIG NO. 15. Incremental Revenue Growth Opportunity by End User, 2024 – 2032 81

FIG NO. 16. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Region, 2024 & 2032 84

FIG NO. 17. Market Attractiveness Analysis, By Region 85

FIG NO. 18. Incremental Revenue Growth Opportunity by Region, 2024 – 2032 86

FIG NO. 19. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Country, 2024 & 2032 91

FIG NO. 20. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Country, 2024 & 2032 104

FIG NO. 21. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Country, 2024 & 2032 119

FIG NO. 22. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Country, 2024 & 2032 134

FIG NO. 23. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Country, 2024 & 2032 149

FIG NO. 24. Power Plants Heavy Duty Gas Turbine Market Revenue Share, By Country, 2024 & 2032 162

List of Tables

TABLE NO. 1. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2018 – 2024 (USD Million) 62

TABLE NO. 2. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2025 – 2032 (USD Million) 62

TABLE NO. 3. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2018 – 2024 (Units) 63

TABLE NO. 4. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2025 – 2032 (Units) 63

TABLE NO. 5. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2018 – 2024 (USD Million) 67

TABLE NO. 6. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2025 – 2032 (USD Million) 67

TABLE NO. 7. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2018 – 2024 (Units) 68

TABLE NO. 8. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2025 – 2032 (Units) 68

TABLE NO. 9. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology, 2018 – 2024 (USD Million) 72

TABLE NO. 10. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2025 – 2032 (USD Million) 72

TABLE NO. 11. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2018 – 2024 (Units) 73

TABLE NO. 12. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2025 – 2032 (Units) 73

TABLE NO. 13. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2018 – 2024 (USD Million) 77

TABLE NO. 14. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Application , 2025 – 2032 (USD Million) 77

TABLE NO. 15. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Application , 2018 – 2024 (Units) 78

TABLE NO. 16. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Application , 2025 – 2032 (Units) 78

TABLE NO. 17. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2018 – 2024 (USD Million) 82

TABLE NO. 18. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2025 – 2032 (USD Million) 82

TABLE NO. 19. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2018 – 2024 (Units) 83

TABLE NO. 20. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2025 – 2032 (Units) 83

TABLE NO. 21. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Region, 2018 – 2024 (USD Million) 87

TABLE NO. 22. : Global Power Plants Heavy Duty Gas Turbine Market Revenue, By Region, 2025– 2032 (USD Million) 88

TABLE NO. 23. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Region, 2018 – 2024 (Units) 89

TABLE NO. 24. : Global Power Plants Heavy Duty Gas Turbine Market Volume, By Region, 2025– 2032 (Units) 90

TABLE NO. 25. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2018 – 2024 (USD Million) 92

TABLE NO. 26. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2025– 2032 (USD Million) 92

TABLE NO. 27. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2018 – 2024 (Units) 93

TABLE NO. 28. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2025– 2032 (Units) 93

TABLE NO. 29. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2018 – 2024 (USD Million) 94

TABLE NO. 30. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2025 – 2032 (USD Million) 94

TABLE NO. 31. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2018 – 2024 (Units) 95

TABLE NO. 32. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2025 – 2032 (Units) 95

TABLE NO. 33. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2018 – 2024 (USD Million) 96

TABLE NO. 34. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2025 – 2032 (USD Million) 96

TABLE NO. 35. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2018 – 2024 (Units) 97

TABLE NO. 36. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2025 – 2032 (Units) 97

TABLE NO. 37. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2018 – 2024 (USD Million) 98

TABLE NO. 38. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2025 – 2032 (USD Million) 98

TABLE NO. 39. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2018 – 2024 (Units) 99

TABLE NO. 40. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2025 – 2032 (Units) 99

TABLE NO. 41. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2018 – 2024 (USD Million) 100

TABLE NO. 42. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2025 – 2032 (USD Million) 100

TABLE NO. 43. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2018 – 2024 (Units) 101

TABLE NO. 44. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2025 – 2032 (Units) 101

TABLE NO. 45. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2018 – 2024 (USD Million) 102

TABLE NO. 46. : North America Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2025 – 2032 (USD Million) 102

TABLE NO. 47. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2018 – 2024 (Units) 103

TABLE NO. 48. : North America Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2025 – 2032 (Units) 103

TABLE NO. 49. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2018 – 2024 (USD Million) 105

TABLE NO. 50. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2025– 2032 (USD Million) 106

TABLE NO. 51. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2018 – 2024 (Units) 107

TABLE NO. 52. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2025– 2032 (Units) 108

TABLE NO. 53. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2018 – 2024 (USD Million) 109

TABLE NO. 54. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2025 – 2032 (USD Million) 109

TABLE NO. 55. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2018 – 2024 (Units) 110

TABLE NO. 56. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2025 – 2032 (Units) 110

TABLE NO. 57. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2018 – 2024 (USD Million) 111

TABLE NO. 58. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2025 – 2032 (USD Million) 111

TABLE NO. 59. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2018 – 2024 (Units) 112

TABLE NO. 60. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2025 – 2032 (Units) 112

TABLE NO. 61. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2018 – 2024 (USD Million) 113

TABLE NO. 62. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2025 – 2032 (USD Million) 113

TABLE NO. 63. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2018 – 2024 (Units) 114

TABLE NO. 64. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2025 – 2032 (Units) 114

TABLE NO. 65. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2018 – 2024 (USD Million) 115

TABLE NO. 66. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2025 – 2032 (USD Million) 115

TABLE NO. 67. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2018 – 2024 (Units) 116

TABLE NO. 68. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2025 – 2032 (Units) 116

TABLE NO. 69. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2018 – 2024 (USD Million) 117

TABLE NO. 70. : Europe Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2025 – 2032 (USD Million) 117

TABLE NO. 71. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2018 – 2024 (Units) 118

TABLE NO. 72. : Europe Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2025 – 2032 (Units) 118

TABLE NO. 73. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2018 – 2024 (USD Million) 120

TABLE NO. 74. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2025– 2032 (USD Million) 121

TABLE NO. 75. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2018 – 2024 (Units) 122

TABLE NO. 76. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2025– 2032 (Units) 123

TABLE NO. 77. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2018 – 2024 (USD Million) 124

TABLE NO. 78. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2025 – 2032 (USD Million) 124

TABLE NO. 79. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2018 – 2024 (Units) 125

TABLE NO. 80. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2025 – 2032 (Units) 125

TABLE NO. 81. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2018 – 2024 (USD Million) 126

TABLE NO. 82. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2025 – 2032 (USD Million) 126

TABLE NO. 83. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2018 – 2024 (Units) 127

TABLE NO. 84. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2025 – 2032 (Units) 127

TABLE NO. 85. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2018 – 2024 (USD Million) 128

TABLE NO. 86. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2025 – 2032 (USD Million) 128

TABLE NO. 87. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2018 – 2024 (Units) 129

TABLE NO. 88. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2025 – 2032 (Units) 129

TABLE NO. 89. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2018 – 2024 (USD Million) 130

TABLE NO. 90. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2025 – 2032 (USD Million) 130

TABLE NO. 91. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2018 – 2024 (Units) 131

TABLE NO. 92. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2025 – 2032 (Units) 131

TABLE NO. 93. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2018 – 2024 (USD Million) 132

TABLE NO. 94. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2025 – 2032 (USD Million) 132

TABLE NO. 95. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2018 – 2024 (Units) 133

TABLE NO. 96. : Asia Pacific Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2025 – 2032 (Units) 133

TABLE NO. 97. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2018 – 2024 (USD Million) 135

TABLE NO. 98. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2025– 2032 (USD Million) 136

TABLE NO. 99. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2018 – 2024 (Units) 137

TABLE NO. 100. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2025– 2032 (Units) 138

TABLE NO. 101. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2018 – 2024 (USD Million) 139

TABLE NO. 102. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2025 – 2032 (USD Million) 139

TABLE NO. 103. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2018 – 2024 (Units) 140

TABLE NO. 104. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2025 – 2032 (Units) 140

TABLE NO. 105. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2018 – 2024 (USD Million) 141

TABLE NO. 106. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2025 – 2032 (USD Million) 141

TABLE NO. 107. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2018 – 2024 (Units) 142

TABLE NO. 108. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2025 – 2032 (Units) 142

TABLE NO. 109. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2018 – 2024 (USD Million) 143

TABLE NO. 110. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2025 – 2032 (USD Million) 143

TABLE NO. 111. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2018 – 2024 (Units) 144

TABLE NO. 112. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2025 – 2032 (Units) 144

TABLE NO. 113. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2018 – 2024 (USD Million) 145

TABLE NO. 114. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2025 – 2032 (USD Million) 145

TABLE NO. 115. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2018 – 2024 (Units) 146

TABLE NO. 116. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2025 – 2032 (Units) 146

TABLE NO. 117. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2018 – 2024 (USD Million) 147

TABLE NO. 118. : Latin America Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2025 – 2032 (USD Million) 147

TABLE NO. 119. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2018 – 2024 (Units) 148

TABLE NO. 120. : Latin America Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2025 – 2032 (Units) 148

TABLE NO. 121. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2018 – 2024 (USD Million) 150

TABLE NO. 122. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2025– 2032 (USD Million) 150

TABLE NO. 123. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2018 – 2024 (Units) 151

TABLE NO. 124. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2025– 2032 (Units) 151

TABLE NO. 125. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2018 – 2024 (USD Million) 152

TABLE NO. 126. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2025 – 2032 (USD Million) 152

TABLE NO. 127. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2018 – 2024 (Units) 153

TABLE NO. 128. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2025 – 2032 (Units) 153

TABLE NO. 129. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2018 – 2024 (USD Million) 154

TABLE NO. 130. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2025 – 2032 (USD Million) 154

TABLE NO. 131. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2018 – 2024 (Units) 155

TABLE NO. 132. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2025 – 2032 (Units) 155

TABLE NO. 133. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2018 – 2024 (USD Million) 156

TABLE NO. 134. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2025 – 2032 (USD Million) 156

TABLE NO. 135. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2018 – 2024 (Units) 157

TABLE NO. 136. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2025 – 2032 (Units) 157

TABLE NO. 137. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2018 – 2024 (USD Million) 158

TABLE NO. 138. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2025 – 2032 (USD Million) 158

TABLE NO. 139. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2018 – 2024 (Units) 159

TABLE NO. 140. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2025 – 2032 (Units) 159

TABLE NO. 141. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2018 – 2024 (USD Million) 160

TABLE NO. 142. : Middle East Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2025 – 2032 (USD Million) 160

TABLE NO. 143. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2018 – 2024 (Units) 161

TABLE NO. 144. : Middle East Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2025 – 2032 (Units) 161

TABLE NO. 145. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2018 – 2024 (USD Million) 163

TABLE NO. 146. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Country, 2025– 2032 (USD Million) 163

TABLE NO. 147. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2018 – 2024 (Units) 164

TABLE NO. 148. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Country, 2025– 2032 (Units) 164

TABLE NO. 149. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2018 – 2024 (USD Million) 165

TABLE NO. 150. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Type, 2025 – 2032 (USD Million) 165

TABLE NO. 151. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2018 – 2024 (Units) 166

TABLE NO. 152. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Type, 2025 – 2032 (Units) 166

TABLE NO. 153. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2018 – 2024 (USD Million) 167

TABLE NO. 154. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Capacity, 2025 – 2032 (USD Million) 167

TABLE NO. 155. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2018 – 2024 (Units) 168

TABLE NO. 156. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Capacity, 2025 – 2032 (Units) 168

TABLE NO. 157. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2018 – 2024 (USD Million) 169

TABLE NO. 158. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Technology , 2025 – 2032 (USD Million) 169

TABLE NO. 159. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2018 – 2024 (Units) 170

TABLE NO. 160. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Technology , 2025 – 2032 (Units) 170

TABLE NO. 161. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2018 – 2024 (USD Million) 171

TABLE NO. 162. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By Application, 2025 – 2032 (USD Million) 171

TABLE NO. 163. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2018 – 2024 (Units) 172

TABLE NO. 164. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By Application, 2025 – 2032 (Units) 172

TABLE NO. 165. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2018 – 2024 (USD Million) 173

TABLE NO. 166. : Africa Power Plants Heavy Duty Gas Turbine Market Revenue, By End User, 2025 – 2032 (USD Million) 173

TABLE NO. 167. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2018 – 2024 (Units) 174

TABLE NO. 168. : Africa Power Plants Heavy Duty Gas Turbine Market Volume, By End User, 2025 – 2032 Units) 174