Market overview

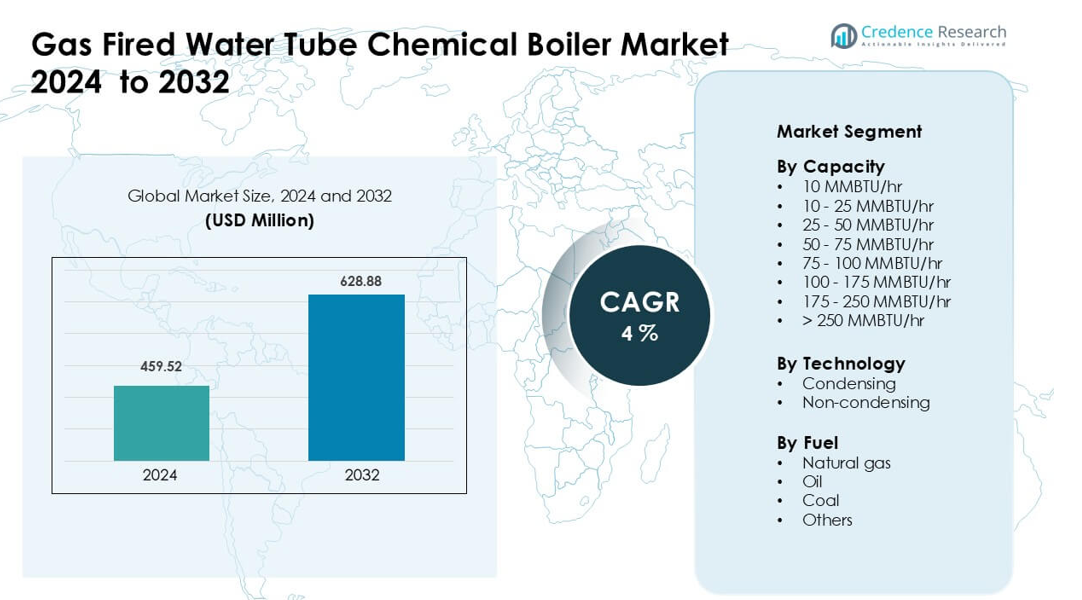

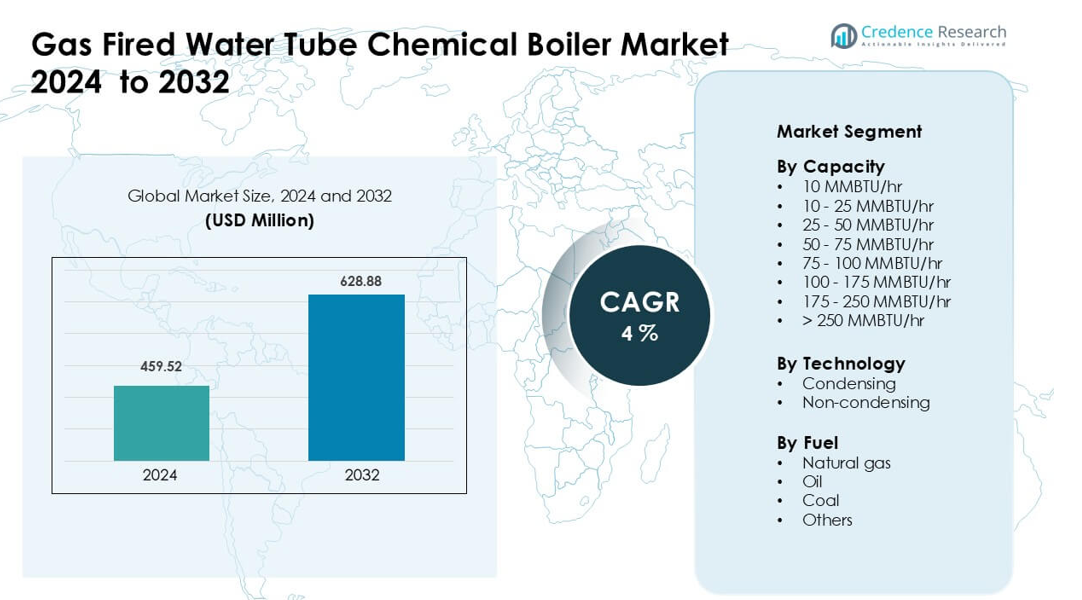

Gas Fired Water Tube Chemical Boiler Market was valued at USD 459.52 million in 2024 and is anticipated to reach USD 628.88 million by 2032, growing at a CAGR of 4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Water Tube Chemical Boiler Market Size 2024 |

USD 459.52 million |

| Gas Fired Water Tube Chemical Boiler Market, CAGR |

4% |

| Gas Fired Water Tube Chemical Boiler Market Size 2032 |

USD 628.88 million |

The Gas Fired Water Tube Chemical Boiler Market is shaped by leading players such as Cochran, Bosch Industriekessel, Clayton Industries, Babcock Wanson, Ariston Holding, Bryan Steam, BM GreenTech, Cleaver-Brooks, Babcock and Wilcox, and Alfa Laval. These manufacturers compete through high-efficiency boiler designs, low-NOx combustion systems, modular configurations, and advanced heat-recovery technologies tailored for chemical processing demands. Their focus on automation, durability, and compliance with emission standards strengthens global adoption. Asia-Pacific leads the market with about 37% share in 2024, supported by rapid chemical sector expansion, large-scale petrochemical investments, and strong transition toward natural-gas-based steam systems.

Market Insights

- The Gas Fired Water Tube Chemical Boiler Market reached USD 459.52 million in 2024 and is projected to hit USD 628.88 million by 2032, growing at a 4% CAGR.

- Demand rises as chemical plants require high-pressure, stable steam systems for distillation, polymerization, and heat-intensive operations, pushing adoption of mid-capacity boilers, with the 25–50 MMBTU/hr segment holding about 33% share.

- Condensing technology gains traction due to strong fuel savings and emission reduction, supported by wider use of low-NOx burners and automated combustion controls.

- Competition intensifies as vendors enhance efficiency, expand modular boiler lines, and integrate digital monitoring; leading players include Cochran, Bosch Industriekessel, Clayton Industries, and Babcock Wanson.

- Asia-Pacific leads with nearly 37% share, driven by petrochemical and specialty chemical capacity expansion, while North America (31%) grows through modernization and natural-gas adoption across large integrated chemical clusters.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

The 25–50 MMBTU/hr range dominates the Gas Fired Water Tube Chemical Boiler Market with about 33% share in 2024. Chemical plants prefer this range because it supports steady steam loads for distillation, stripping, solvent recovery, and reactor heating. Mid-range units also offer strong thermal efficiency and lower operational strain during continuous production cycles. Adoption grows as chemical producers expand batch-processing lines and replace outdated fire-tube models to meet tighter emission norms and efficiency targets. Rising investment in specialty chemicals and polymer plants further supports demand across this capacity band.

- For instance, Miura’s LX-300 high-pressure gas-fired water-tube boiler delivers a maximum heat input of 10.043 MMBTU/hr.

By Technology

The condensing technology segment leads with nearly 58% share in 2024, driven by its higher fuel efficiency and strong heat-recovery performance. Chemical processors choose condensing boilers because these systems reduce stack losses and help plants reach stricter decarbonization goals. Adoption accelerates as producers integrate energy-optimization programs targeting lower thermal costs and lower CO₂ output. Non-condensing units remain relevant in facilities handling high-temperature process loops, but demand shifts toward condensing models due to reduced lifecycle costs, improved burner controls, and compliance requirements in modern chemical complexes.

- For instance, Viessmann’s Vitomax HS series designed for chemical-industry use delivers up to 31.5 t/h of steam at high pressure and achieves thermal efficiency of over 95.5%, largely thanks to its integral economizer and water-cooled burner design.

By Fuel

Natural gas dominates the fuel segment with about 62% share in 2024, supported by its cleaner combustion profile and stable supply across major chemical clusters. Chemical manufacturers prefer natural-gas-fired water-tube boilers because they provide consistent heat release, lower particulate emissions, and lower maintenance loads. Growth accelerates as producers phase out coal and oil units due to rising carbon-control policies and operational safety standards. Expanding access to pipeline networks and rising adoption of low-NOx burners also strengthen the shift toward natural gas, while alternative fuels remain limited to niche or legacy facilities.

Key Growth Drivers

Rising Demand for High-Efficiency Steam Generation

Chemical manufacturers need reliable steam for distillation, evaporation, polymerization, and heat-transfer applications. Gas fired water tube boilers address this need by offering higher thermal efficiency, faster steam response, and better load-handling than fire tube units. The shift toward continuous processing and larger batch operations pushes plants to adopt boilers with strong output stability and lower fuel waste. Stricter energy-performance standards in major chemical hubs accelerate the replacement of older, low-efficiency units. Adoption also grows as producers integrate heat-recovery systems, low-NOx burners, and digital combustion controls that enhance efficiency and lower emissions during round-the-clock operations.

- For instance, Kenuo Boiler’s PGS Series condensing steam boilers for chemical use may report a heat-efficiency rating of 102% (based on the fuel’s Lower Heating Value, or LHV), while maintaining ultra-low NOₓ emissions of ≤ 30 mg/m³. This efficiency figure is a common industry measurement, but the actual maximum thermal efficiency relative to the total energy available in the fuel (Higher Heating Value) is typically around 90-98.5%.

Expansion of Specialty Chemicals and Petrochemical Facilities

The specialty chemicals sector grows rapidly due to strong demand from pharmaceuticals, agrochemicals, electronics chemicals, and performance materials. These facilities require high-pressure, consistent steam supply, which strengthens the need for advanced water tube boilers. Many petrochemical complexes also expand cracking, reforming, and extraction capacities, leading to higher thermal-energy needs. Growing investments in polymer, resin, and chemical intermediates production encourage adoption of boilers that support stable output and high temperature control. New capacity additions across Asia-Pacific and the Middle East further boost demand for gas fired water tube boilers, as regional governments support large-scale chemical manufacturing zones and integrated industrial clusters.

- For instance, Thermax secured an order for 3 oil- & gas-fired water-tube boilers for a refinery and petrochemical complex in western India, underscoring the rising steam demand in expanding petrochemical hubs.

Shift Toward Cleaner and Low-Emission Fuel Choices

Chemical producers face strong pressure to meet environmental compliance requirements and reduce carbon output. Gas fired water tube boilers support this shift by offering clean combustion, lower particulate release, and reduced sulphur and nitrogen emissions compared to oil or coal-based units. As countries introduce tighter emission caps, plants accelerate the transition to natural-gas-based systems. Many facilities also incorporate low-NOx and ultra-low-NOx burners to meet regional air-quality norms. Rising carbon-pricing policies and corporate sustainability commitments drive long-term investments in gas-based boilers, making them preferred choices for modernization programs and greenfield chemical projects.

Key Trend & Opportunity

Growth of Condensing Technology in Chemical Processing

Condensing boilers gain strong traction due to their ability to capture latent heat from exhaust gases, delivering higher fuel utilization and meaningful reductions in operating costs. Chemical plants increasingly replace non-condensing systems to enhance thermal performance and comply with emission standards. The opportunity expands as producers integrate flue-gas recovery systems and digital monitoring tools that optimize combustion in real time. Rising need for energy savings in high-steam-demand units supports wider use of condensing models, particularly in regions implementing aggressive decarbonization targets. This shift creates new opportunities for suppliers offering high-efficiency, corrosion-resistant heat-exchanger designs suitable for chemical steam operations.

- For instance, Viessmann offers a Vitotrans 300 flue gas/water heat exchanger (economizer) as an accessory for their Vitomax and Vitoplex industrial/commercial boilers.

Adoption of Automation and Smart Boiler Control Systems

Advanced automation tools improve safety, reliability, and fuel-to-steam conversion rates. Chemical manufacturers adopt smart controls to manage variable steam loads, adjust burner output, and monitor operational health. IoT-enabled sensors track temperature, pressure, and flue composition, enabling predictive maintenance and reducing downtime risks. This creates strong opportunities for vendors offering intelligent boiler management systems compatible with distributed control systems (DCS) used in chemical plants. Digital platforms also support remote performance monitoring and better compliance tracking. As plants move toward Industry 4.0 integration, demand for automated, data-driven boiler systems grows significantly across both new and retrofit installations.

- For instance, Miura equips its boilers with a BL Micro Controller, which continuously monitors key parameters like steam pressure, water level, feedwater temperature, and exhaust temperature and can detect faults, pinpoint their source, and recommend corrective actions in real time.

Rising Preference for Modular and Skid-Mounted Boiler Systems

Chemical facilities increasingly prefer modular, skid-mounted water tube boilers because they reduce installation time, simplify layout integration, and support rapid scaling of steam capacity. Modular designs also enhance flexibility during plant expansion or process reconfiguration. The trend gains momentum as chemical producers deploy temporary or supplemental boilers during maintenance shutdowns or seasonal demand spikes. Suppliers offering compact, high-output modular systems gain an advantage in markets requiring fast deployment. This shift presents significant opportunities for boiler manufacturers to supply customizable, high-efficiency modules that meet strict safety and emission standards in diverse chemical processing environments.

Key Challenge

Compliance with Stringent Emission Regulations

Boiler operators must meet strict emission limits for NOx, SOx, particulate matter, and CO₂. While natural gas reduces emissions, compliance still requires advanced burner technologies, optimized combustion control, and high-efficiency heat-recovery systems. Plants using older infrastructure struggle to justify upgrades due to high capital and integration costs. Variation in regulatory frameworks across regions adds complexity for boiler suppliers and end users. Achieving low-emission performance in high-pressure chemical environments also demands corrosion-resistant materials and robust safety systems, raising procurement and maintenance costs. These regulatory burdens pose major challenges for small and mid-scale chemical plants.

High Installation and Operational Costs for Advanced Boiler Systems

Water tube boilers require significant upfront investment due to complex construction, pressure-rated components, and advanced control systems. Chemical plants often face budget constraints, especially when installing high-capacity or dual-fuel models. Operational costs increase further with the need for skilled operators, frequent maintenance, and continuous performance monitoring. Fuel-price volatility adds uncertainty to long-term operational planning. Integrating new boilers into existing chemical plant layouts can require piping redesign, upgraded feedwater systems, and enhanced safety controls, further increasing costs. These financial and operational pressures slow adoption for cost-sensitive chemical producers.

Regional Analysis

North America

North America holds about 31% share in 2024, driven by strong adoption across petrochemical, specialty chemical, and polymer production facilities. Chemical clusters in the U.S. Gulf Coast invest in high-efficiency gas fired water tube boilers to meet strict emission norms and reduce operational costs. The region benefits from abundant natural gas supply, which supports stable fuel pricing and higher conversion efficiency. Replacement of aging coal and oil units accelerates modernization programs. Growth strengthens as producers expand capacity in resins, solvents, and performance chemicals, increasing demand for reliable high-pressure steam systems across large industrial sites.

Europe

Europe accounts for nearly 24% share in 2024, supported by strict decarbonization policies and rapid replacement of legacy boiler systems. Chemical producers in Germany, France, Italy, and the Netherlands adopt condensing and ultra-low-NOx gas fired water tube boilers to comply with EU emission directives. High energy prices increase interest in fuel-efficient models that reduce thermal losses. Growth also comes from investments in high-value chemicals, coatings, and intermediates that require stable steam supply. Expansion of green chemical projects and circular-economy initiatives further drives adoption of cleaner gas-based steam solutions in modern facilities.

Asia-Pacific

Asia-Pacific dominates the market with about 37% share in 2024, driven by massive expansion of petrochemical, specialty chemical, and fertilizer plants. China, India, South Korea, and Japan lead installations due to rising production capacity in polymers, dyes, pharmaceuticals, and intermediates. Governments support natural-gas-based industrial boilers to lower emissions and enhance energy efficiency. Rapid industrialization increases steam demand across continuous-process chemical facilities. Large greenfield projects and modernization of older steam systems strengthen long-term growth. The region’s strong manufacturing base makes it the fastest-growing market for high-capacity and condensing water tube boiler systems.

Latin America

Latin America holds close to 5% share in 2024, with growth concentrated in Brazil, Mexico, and Chile. Chemical producers upgrade steam-generation systems to support expansion in agrochemicals, plastics, and industrial chemicals. Availability of natural gas improves through new LNG terminals and pipeline expansions, encouraging a shift from oil-based boilers to gas fired water tube models. Adoption rises as companies seek efficient solutions for continuous processing lines. However, slow regulatory implementation and investment constraints limit wider penetration. Increasing demand for high-efficiency boilers in polymer and specialty chemical projects gradually strengthens the regional outlook.

Middle East & Africa

The Middle East & Africa region captures around 3% share in 2024, driven by petrochemical expansion in Saudi Arabia, the UAE, and Qatar. Large integrated chemical complexes adopt gas fired water tube boilers to support high-pressure steam needs in cracking, reforming, and processing units. Abundant natural gas supply encourages investment in efficient and low-emission steam systems. Africa sees gradual adoption in South Africa, Egypt, and Nigeria as chemical producers modernize outdated boiler fleets. Despite strong potential, growth is limited by capital barriers and slower industrial diversification outside core petrochemical hubs.

Market Segmentations:

By Capacity

- 10 MMBTU/hr

- 10 – 25 MMBTU/hr

- 25 – 50 MMBTU/hr

- 50 – 75 MMBTU/hr

- 75 – 100 MMBTU/hr

- 100 – 175 MMBTU/hr

- 175 – 250 MMBTU/hr

- > 250 MMBTU/hr

By Technology

- Condensing

- Non-condensing

By Fuel

- Natural gas

- Oil

- Coal

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gas Fired Water Tube Chemical Boiler Market features strong competition among global and regional manufacturers that focus on efficiency, emission control, and high-capacity steam solutions. Key companies such as Cochran, Bosch Industriekessel, Clayton Industries, Babcock Wanson, Ariston Holding, Bryan Steam, BM GreenTech, Cleaver-Brooks, Babcock and Wilcox, and Alfa Laval strengthen their presence through product innovations, low-NOx burner systems, and advanced heat-recovery designs. Many suppliers expand their portfolios with modular and skid-mounted boilers to support rapid installation in chemical facilities. Digital monitoring, predictive maintenance tools, and automation-enabled combustion systems also enhance competitiveness. Strategic partnerships with EPC contractors and chemical plant integrators improve market reach, while manufacturers invest in R&D to meet rising demand for high-efficiency, condensing, and corrosion-resistant boiler models tailored to chemical processing environments

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cochran

- Bosch Industriekessel

- Clayton Industries

- Babcock Wanson

- Ariston Holding

- Bryan Steam

- BM GreenTech

- Cleaver-Brooks

- Babcock and Wilcox

- Alfa Laval

Recent Developments

- In April 2025, Cochran launched a new electric industrial boiler at the All-Energy exhibition. The launch supports hybrid boiler rooms that combine gas-fired and electric steam generation for chemical plants.

- In February 2025, Bosch Industriekessel (Bosch Industrial Heat): Bosch presented its new ELHB electric boiler at ISH Frankfurt as a power-to-heat solution for industrial and district heating networks. The ELHB is designed to integrate with existing gas and water-tube boiler systems to decarbonize process steam and hot water

Report Coverage

The research report offers an in-depth analysis based on Capacity, Technology, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as chemical producers expand continuous processing and high-pressure steam needs.

- Adoption of condensing boilers will increase as plants target stronger energy savings.

- Low-NOx and ultra-low-NOx burner integration will accelerate to meet tighter emission norms.

- Modular and skid-mounted systems will see faster deployment in new chemical complexes.

- Automation and IoT-based controls will gain traction for real-time performance optimization.

- Natural-gas-based units will remain preferred as plants phase out coal and oil boilers.

- Replacement of aging boiler fleets will drive steady retrofit opportunities worldwide.

- Corrosion-resistant materials will become more important for harsh chemical process conditions.

- Asia-Pacific will continue leading growth due to large petrochemical and specialty chemical expansions.

- Manufacturers will invest more in digital monitoring, predictive maintenance, and high-efficiency heat-recovery solutions.