Market overview

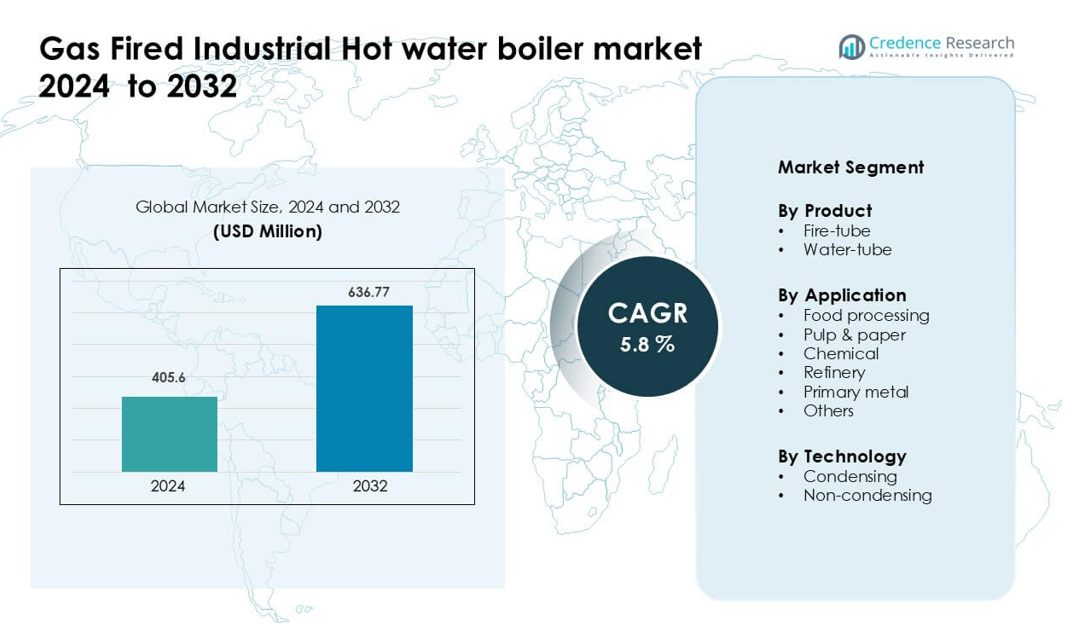

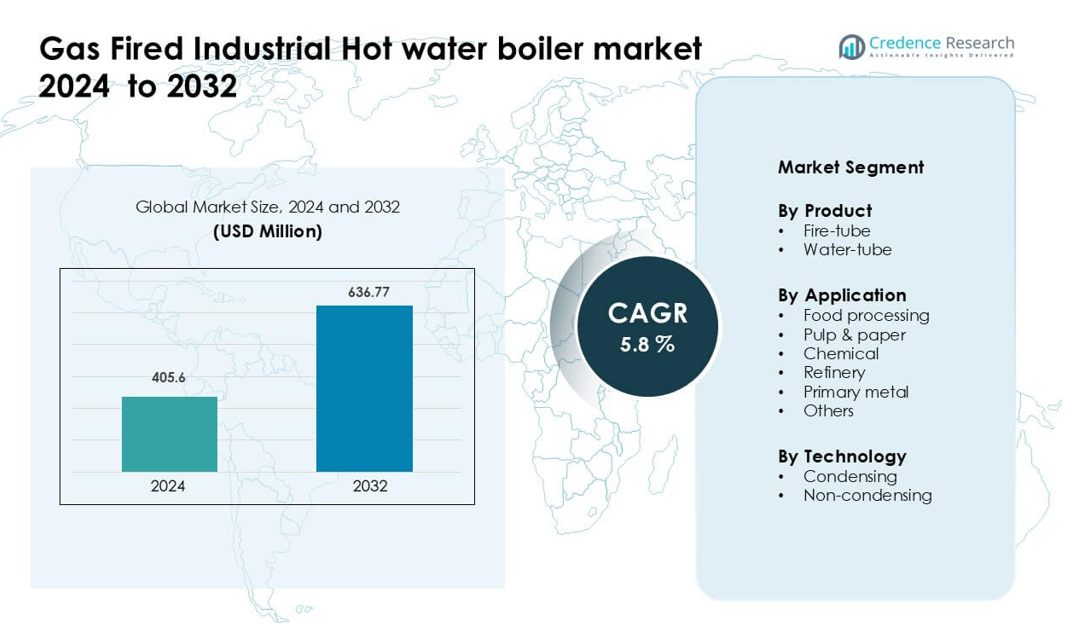

Gas Fired Industrial Hot water boiler market was valued at USD 405.6 million in 2024 and is anticipated to reach USD 636.77 million by 2032, growing at a CAGR of 5.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Industrial Hot Water Boiler Market Size 2024 |

USD 405.6 million |

| Gas Fired Industrial Hot Water Boiler Market, CAGR |

5.8% |

| Gas Fired Industrial Hot Water Boiler Market Size 2032 |

USD 636.77 million |

North America leads the Gas Fired Industrial Hot Water Boiler Market with about 33% share in 2024, driven by strong upgrades in food, chemical, and pulp processing facilities. Key players such as Danstoker, California Boiler, Hoval, Cochran, Bosch Industriekessel, Fulton, HKB, Cleaver-Brooks, Ecotherm Austria, and Babcock Wanson strengthen their position through high-efficiency designs, condensing technology, and advanced control systems. These companies focus on reliability, low-NOx performance, and modular configurations that support fast installation across industrial plants. Growing replacement demand and strict energy regulations continue to push market consolidation around technology-driven boiler manufacturers.

Market Insights

- The Gas Fired Industrial Hot Water Boiler Market reached USD 405.6 million in 2024 and is projected to hit USD 636.77 million by 2032, growing at a 5.8% CAGR.

- Demand rises as food processing, chemical, and metals industries expand heat-intensive operations, with fire-tube boilers holding the largest product share due to simple operation and strong thermal stability.

- Condensing technology gains traction as industries prioritize higher efficiency and low-NOx performance to meet tightening emission norms across major economies.

- Key players such as Danstoker, California Boiler, Hoval, Cochran, Bosch Industriekessel, Fulton, HKB, Cleaver-Brooks, Ecotherm Austria, and Babcock Wanson compete through modular systems, digital controls, and high-efficiency burner designs.

- North America leads the market with 33% share in 2024, followed by Europe at 29%, while food processing remains the dominant application segment due to high sanitation and heating requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Fire-tube boilers lead this segment with about 57% share in 2024. Buyers in food, chemical, and small industrial plants prefer the fire-tube design because it offers simple operation, low maintenance needs, and strong heat transfer efficiency. Growth rises as manufacturers introduce compact and skid-mounted units that cut installation time for mid-scale facilities. Water-tube models gain traction in high-pressure environments, but adoption grows slower due to higher upfront cost and complex handling requirements in continuous-duty systems.

- For instance, Cleaver‑Brooks’ CBEX‑3W firetube boiler, offered in sizes from 250 HP to 800 HP, can generate steam up to 300 psig, and its integral economizer and advanced EX‑tube design enable it to maintain 3% O₂ across a 10:1 turndown range, plus deliver 9 ppm NOₓ emissions without SCR.

By Application

Food processing dominates this segment with around 34% share in 2024. Demand grows because food plants require stable hot water for cleaning, blanching, and heat treatment. Gas-fired systems appeal to processors due to fast response, lower emissions, and strict hygiene standards. Chemical and refinery users increase uptake for process heating, but adoption remains smaller because these sectors often shift toward high-pressure steam systems. Interest in primary metal facilities grows as firms aim for efficient heat supply during finishing and washing lines.

- For instance, Thermax’s 6 TPH UltraPac biomass boiler was deployed at a major food processing facility, using wood‑chip fuel and fully automated fuel handling, thus reducing fossil fuel dependency.

By Technology

Condensing boilers hold the dominant position with nearly 61% share in 2024. Users choose condensing units because the design recovers latent heat, which raises thermal efficiency above non-condensing systems. Growth strengthens as emission rules encourage low-NOx operation and energy-saving upgrades across industrial plants. Non-condensing boilers remain relevant in older factories where return-water temperatures stay high, but demand increases slowly due to rising fuel-cost pressure and stricter compliance norms favoring high-efficiency heating solutions.

Key Growth Drivers

Rising Industrial Heat Demand Across Food and Chemical Processing

Growing heat requirements in food, chemical, and beverage plants fuel strong adoption of gas-fired industrial hot water boilers. Many processors expand washing, sterilization, blanching, and CIP systems, which rely on steady and high-capacity hot water. Gas-fired designs provide fast heat recovery, stable output, and simple handling, which suits continuous production cycles. Companies also prefer gas systems because they offer cleaner combustion than coal or oil units and reduce downtime tied to soot buildup. Expanding FMCG output in Asia and Europe further pushes replacement of outdated boilers with efficient hot water systems that deliver safe, consistent, and controlled heating for sanitation-heavy operations.

- For instance, Thermax also markets coil‑type gas boilers that offer instant steam generation in very compact footprints.

Shift Toward High-Efficiency Heating and Low-NOx Requirements

Industrial users move toward high-efficiency boilers as energy costs rise and emission norms tighten across the U.S., EU, and Asia. Condensing systems attract stronger interest because they recover latent heat and deliver efficiency levels that cut fuel use. Many plants upgrade legacy units to meet NOx limits enforced in chemical, refinery, and metals processing zones. Gas-fired systems align well with compliance goals since they release fewer particulates than solid fuels. Government incentives for clean industrial heating accelerate this shift, especially in regions encouraging carbon-cutting technologies. As industries modernize, demand grows for boilers that pair automated control with lower emissions and strong thermal performance.

Expansion of Automation and Smart Control Systems in Industrial Utilities

Manufacturers adopt automated and digitally controlled hot water boilers to reduce energy waste and maintain operational stability. New gas-fired models integrate real-time monitoring, flue-gas tracking, predictive maintenance, and remote supervision, which help factories prevent unplanned downtime. Automated modulation allows boilers to match load fluctuations in food, textile, and pulp operations more accurately. This boosts efficiency and reduces operational errors tied to manual adjustments. The rise of Industry 4.0 pushes utilities teams to choose boilers with integrated sensors, IoT connectivity, and intelligent safety logic, enabling data-driven decisions and smoother workflow in multi-line production plants.

Key Trend & Opportunity

Growing Shift Toward Condensing Technology Across Industries

Condensing boilers gain traction as industries prioritize fuel savings and tighter emission compliance. The ability to extract latent heat gives these systems a clear efficiency edge, making them attractive for long-running processes in food, chemical, and metals facilities. Many industrial plants also redesign return-water systems to enable low-temperature operation, unlocking maximum efficiency from condensing units. Manufacturers see an opportunity to expand high-capacity condensing models tailored for heavy-duty segments that previously relied on non-condensing designs. Countries setting stricter energy-efficiency standards create a favorable market for advanced condensing units with optimized burners and enhanced heat-recovery features.

- For instance, a condensing fire-tube boiler model listed on international industrial marketplaces 2 ton gas-fired condensing fire‑tube boiler — is designed for industrial users (e.g., garment or food-processing units), offering a compact footprint with efficient latent heat recovery.

Rising Adoption of Hybrid and Renewable-Ready Boiler Systems

Industrial users explore hybrid heating systems that combine gas-fired boilers with solar thermal, heat pumps, or waste-heat recovery modules. This creates opportunities for manufacturers offering flexible, integration-ready units. Many facilities seek to cut fuel use while maintaining reliability, making hybrid gas systems appealing. Companies developing control platforms that balance multiple heat sources stand to gain as industries pursue lower carbon footprints. Renewable-ready boilers also attract attention because factories plan long-term decarbonization pathways. This trend opens new growth for vendors offering adaptable designs supporting future hydrogen, biogas, or blended gaseous fuels for industrial operations.

- For instance, Bosch offers hybrid process combinations where a condensing boiler is paired with solar thermal pre-heating: its HRSB heat-recovery boiler modules can be coupled with solar heat collectors to pre-warm feed water, improving overall system efficiency.

Replacement of Aging Boiler Infrastructure in Emerging Markets

Developing economies experience rising industrial output, prompting firms to replace older heating systems with efficient gas-fired hot water boilers. Many of these plants previously used coal-based equipment with poor efficiency and high maintenance needs. Replacement activity grows as companies seek stable output, automated control, and reduced fuel waste. Suppliers gain new opportunities by offering mid-capacity and modular configurations suited for constrained industrial layouts. Expanding food processing, textile, and chemical production in Asia, the Middle East, and Latin America strengthens the shift toward modern gas-fired designs that align with new safety and emission rules.

Key Challenge

High Upfront Costs and Installation Complexity for Modern Boiler Systems

Upgrading to advanced gas-fired hot water boilers often requires high capital outlay, which slows adoption in small and mid-scale industries. Condensing systems, automation tools, and NOx-compliant burners add to installation and commissioning costs. Many older facilities must also upgrade piping, venting, and return-water systems, increasing project time and expense. The financial burden limits adoption in cost-sensitive sectors such as textiles and small food processors. Manufacturers face pressure to offer financing support, modular configurations, and retrofit-friendly designs to address this challenge and widen market acceptance.

Volatility in Natural Gas Prices and Fuel Supply Constraints

Fluctuating natural gas prices affect long-term cost planning for industries relying on gas-fired heating. Regions facing seasonal shortages or pipeline limitations often see inconsistent supply, which makes some buyers hesitant to shift entirely to gas systems. Industrial users fear spikes that raise operating expenses and reduce projected efficiency gains. This challenge is more evident in emerging markets where gas infrastructure remains underdeveloped. Manufacturers respond by promoting hybrid systems, renewable-gas compatibility, and load-modulation technologies, but fuel dependency remains a major barrier to faster market expansion.

Regional Analysis

North America

North America leads the Gas Fired Industrial Hot Water Boiler Market with about 33% share in 2024. Growth strengthens as food, chemicals, and pulp industries upgrade to high-efficiency systems that meet strict NOx and energy-efficiency rules. The U.S. drives most installations due to modernization programs in processing plants and the rapid shift toward condensing designs. Canada supports demand through expansions in food processing and cold-region industrial facilities that require stable hot-water output. Replacement of aging boiler rooms across mid-sized factories continues to push steady market adoption across the region.

Europe

Europe accounts for nearly 29% share in 2024, driven by strong regulatory pressure to reduce industrial emissions and fuel consumption. Germany, Italy, and France adopt advanced condensing boilers to comply with energy directives that mandate efficiency improvements in industrial utilities. Food processing and specialty chemicals remain the most influential buyers due to continuous process-heating needs. Modernization of small and mid-scale factories supports growth, while district-level heat recovery programs further encourage gas-fired upgrades. European industries also prioritize automated control systems, boosting adoption of high-performance, low-carbon boiler designs.

Asia Pacific

Asia Pacific holds the dominant growth outlook with about 28% share in 2024 and rising demand from food, textile, chemical, and metals processing facilities. China and India lead installations due to increasing industrial output and replacement of coal-based boilers with cleaner gas-fired systems. Southeast Asia expands adoption as manufacturers invest in cost-efficient condensing units to lower operating expenses. Rapid expansion of FMCG plants and export-oriented processing clusters boosts hot-water demand across the region. Infrastructure development and wider pipeline gas availability also support accelerated switching to gas-fired boiler fleets.

Latin America

Latin America represents close to 5% share in 2024, supported by steady uptake in food processing, beverage manufacturing, and light chemical production. Brazil and Mexico dominate growth as factories modernize utilities to improve reliability and cut fuel waste. Demand rises for mid-capacity systems suited for regional agro-processing clusters. Adoption remains moderate due to varying gas infrastructure, but industrial plants increasingly prefer gas-fired units over diesel-based systems because of cleaner combustion and lower maintenance needs. Government-led efficiency programs further encourage gradual upgrades across the region.

Middle East & Africa

The Middle East & Africa hold roughly 5% share in 2024, driven by expanding industrial activity in chemicals, refining, food processing, and metals. Gulf countries adopt gas-fired hot water systems due to abundant natural gas and strong emission targets in industrial hubs. Africa shows slower adoption because infrastructure gaps restrict large-scale gas availability, though South Africa and Egypt lead regional installations. Industrial modernization, rising manufacturing investment, and the shift toward high-efficiency heating solutions support steady demand. Increasing interest in automated and condensing boiler designs also drives future market growth across MEA.

Market Segmentations:

By Product

By Application

- Food processing

- Pulp & paper

- Chemical

- Refinery

- Primary metal

- Others

By Technology

- Condensing

- Non-condensing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gas Fired Industrial Hot Water Boiler Market features strong competition among key players such as Danstoker, California Boiler, Hoval, Cochran, Bosch Industriekessel, Fulton, HKB, Cleaver-Brooks, Ecotherm Austria, and Babcock Wanson. These companies focus on energy-efficient designs, automated controls, and low-NOx combustion systems to address rising industrial efficiency and emission demands. Many manufacturers expand condensing boiler portfolios to offer higher thermal performance for food, chemical, and metals processing industries. Firms also invest in modular and skid-mounted systems that reduce installation time and support plant modernization programs. Strategic partnerships with industrial contractors, digital monitoring upgrades, and after-sales service networks further strengthen competitiveness. As industries replace aging boiler infrastructure, vendors emphasize reliability, heat-recovery features, and integration-ready platforms that support hybrid and renewable-compatible heating systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Danstoker replaced gas-fired units with electric steam boilers at a Danish carpet manufacturing plant, signalling a shift from gas for industrial process heat.

- In September 2023, Babcock Wanson Group completed a turnkey steam and hot-water project for the U.K.’s largest centralised kitchen

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as industries modernize utility systems and replace aging boiler fleets.

- Adoption of condensing designs will increase due to stronger efficiency and emission rules.

- Digital monitoring and smart controls will become standard in new industrial boiler installations.

- Hybrid heating systems will rise as factories integrate solar thermal and heat-pump support.

- Manufacturers will expand renewable-ready boilers compatible with biogas and hydrogen blends.

- Modular and skid-mounted systems will gain traction for faster installation in tight industrial spaces.

- Growth in food, chemical, and metals processing will continue to drive hot-water demand.

- Service-based models and predictive maintenance will strengthen after-sales revenue streams.

- Emerging markets will invest more in natural-gas infrastructure, accelerating boiler uptake.

- Companies will focus on low-NOx combustion and advanced heat-recovery features to meet future compliance needs.