Market Overview

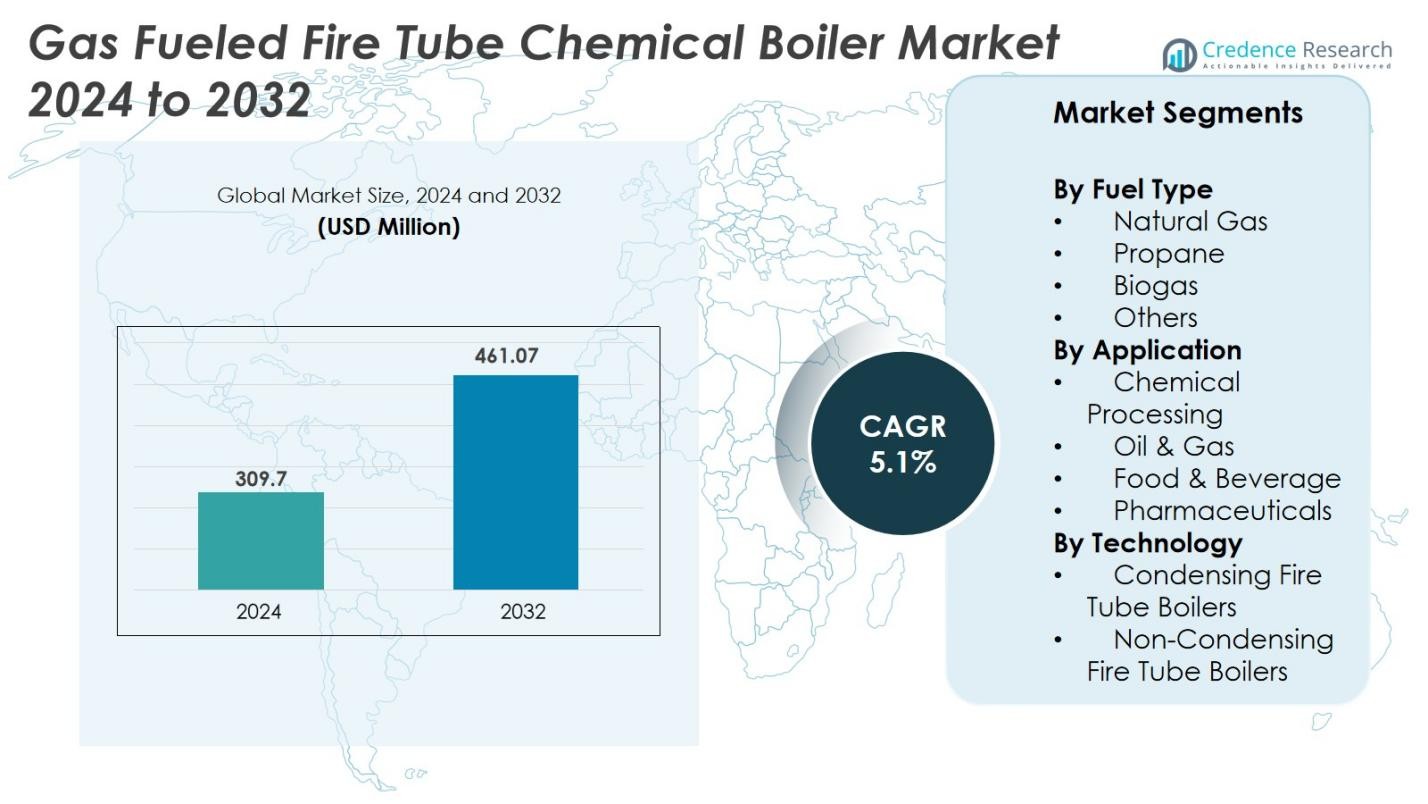

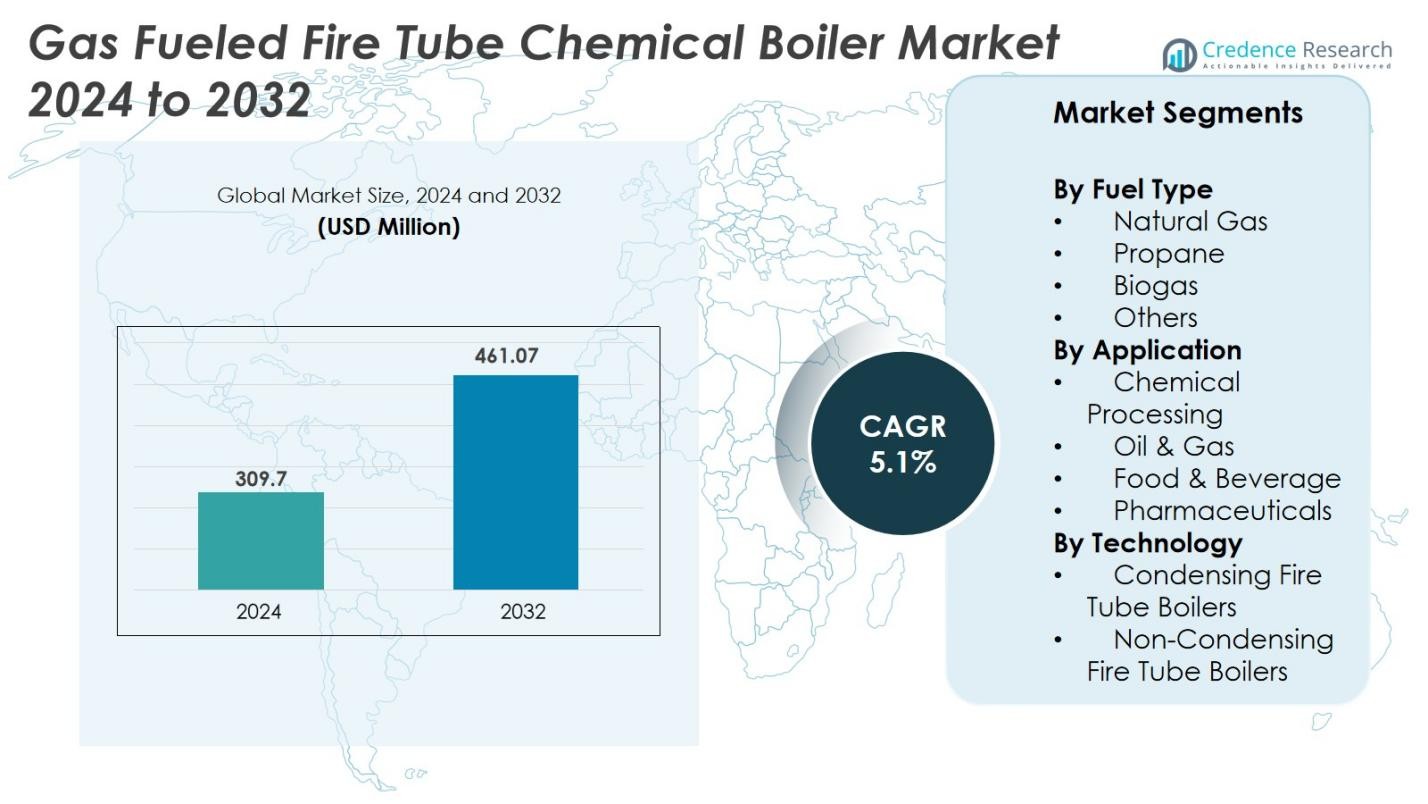

Gas Fueled Fire Tube Chemical Boiler Market size was valued at USD 309.7 Million in 2024 and is anticipated to reach USD 461.07 Million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fueled Fire Tube Chemical Boiler Market Size 2024 |

USD 309.7 Million |

| Gas Fueled Fire Tube Chemical Boiler Market, CAGR |

5.1% |

| Gas Fueled Fire Tube Chemical Boiler Market Size 2032 |

USD 461.07 Million |

The Gas Fueled Fire Tube Chemical Boiler market is led by prominent companies such as Cleaver-Brooks, Bosch Industriekessel, Miura America, Hurst Boiler, and Viessmann, all known for their advanced boiler technologies and strong industrial presence. These players dominate through comprehensive product portfolios, digital monitoring integration, and adherence to low-emission standards. Asia-Pacific emerges as the leading region, commanding 38% of the global market share, driven by rapid industrialization and expanding chemical and food processing sectors. North America and Europe follow, benefiting from stringent efficiency regulations and widespread adoption of natural gas-based heating systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Gas Fueled Fire Tube Chemical Boiler market was valued at USD 309.7 million in 2024 and is projected to reach USD 461.07 million by 2032, registering a CAGR of 5.1% during the forecast period.

- Strong demand from the chemical processing and food & beverage industries, driven by the need for efficient steam and heat systems, is fueling market growth.

- Key trends include the adoption of condensing boilers with over 61% segment share and rising integration of IoT-based monitoring and fuel-flexible hybrid systems.

- Major market players such as Cleaver-Brooks, Bosch Industriekessel, and Miura America dominate the competitive landscape through technology advancements, low-NOx solutions, and global distribution networks.

- Asia-Pacific leads with a 38% regional share, followed by North America at 28% and Europe at 24%, while the chemical processing segment holds the dominant application share at around 42%.

Market Segmentation Analysis

By Fuel Type

In the Gas Fueled Fire Tube Chemical Boiler market, the Natural Gas segment dominates with an estimated 58% market share in 2024. This is driven by widespread availability, lower emissions compared to other fossil fuels, and escalating energy efficiency mandates across industrial facilities. Propane holds a smaller yet steady share due to its preference in remote chemical and food processing plants where pipeline infrastructure is scarce. Biogas is emerging rapidly as sustainability becomes a priority, while the “Others” category, including LPG and fuel oil, continues to serve niche industrial settings with specific fuel requirements.

- For instance, HoSt Bioenergy specializes in designing and operating industrial boiler plants that run on biogas and agricultural waste, supplying customized biogas-fired boilers for chemical manufacturing and food processing clients focused on maximizing thermal efficiency and carbon capture integration.

By Application

The Chemical Processing segment leads with approximately 42% market share in 2024, driven by the high demand for consistent steam generation in diverse chemical reactions, heating, and distillation applications. Oil & Gas follows closely, particularly in refineries and upstream installations where fire tube boilers offer cost-effective heat transfer. The Food & Beverage sector is growing steadily, fueled by increased hygiene and sterilization requirements. Meanwhile, Pharmaceuticals is emerging as a key sub-segment, boosted by strict compliance norms and rising investments in healthcare infrastructure globally.

- For instance, Isotex Corporation offers packaged fluidized bed boilers for pharmaceutical clients, including an 8000 kg/hr steam boiler installed in Gujarat, India, supporting pharmaceutical API manufacturing with compliance to regulatory norms and clean steam requirements.

By Technology

Condensing Fire Tube Boilers hold the dominant position with around 61% of the market share in 2024, benefitting from high operational efficiency, reduced carbon footprints, and incentives promoting adoption of low-emission systems. Their capability to recover latent heat from exhaust gases gives them a notable performance edge. Non-condensing boilers, while still prevalent due to lower upfront costs, are gradually being phased out in regions with stringent emission regulations. However, they continue to serve traditional and cost-sensitive industries, especially in regions with less developed sustainability mandates.

Key Growth Drivers

Rising Demand for Energy-Efficient Industrial Heating Systems

The adoption of gas fueled fire tube chemical boilers is steadily increasing as industries seek more energy-efficient heating solutions to reduce operational costs and environmental impact. These boilers, particularly condensing models, deliver efficiency levels of up to 98%, significantly lowering fuel consumption and emissions. Their ability to recover heat from exhaust gases makes them highly suitable for chemical, pharmaceutical, and food processing industries where continuous steam supply is critical. Additionally, government incentives and policies favoring high-efficiency technologies are accelerating market uptake.

- For instance, Bosch Industriekessel’s double-flame tube boilers achieve efficiency levels up to 98% through integrated economizers and heat recovery, making them ideal for variable steam demands in chemical and pharmaceutical plants.

Growing Stringency in Emission Regulations Across Industrial Sectors

Stringent environmental regulations, particularly around NOx and CO2 emissions, are compelling industries to replace traditional boilers with cleaner and compliant gas-fired fire tube systems. Regulatory bodies like the EPA in the U.S. and EU directives are driving the shift toward low-emission technologies. This paves the way for advanced fire tube boilers equipped with low-NOx burners and automated combustion control systems. In chemical and allied industries, compliance with sustainability targets is no longer optional, leading to systematic upgrades.

- For instance, Babcock & Wilcox has developed patented low-NOx multi-fuel burners successfully applied across industrial boilers to reduce NOx emissions by over 90%, supporting compliance with EPA standards.

Expanding Chemical and Food Processing Industries in Emerging Economies

Emerging markets in Asia-Pacific and Latin America are witnessing rapid industrialization, particularly in the chemical and food & beverage sectors, which are major end users of gas fueled fire tube boilers. Infrastructure investments, growing disposable incomes, and increasing emphasis on food quality standards are fueling the installation of compact and efficient boiler systems. In countries like India and Brazil, government initiatives promoting natural gas consumption are also boosting adoption. The boilers’ compact footprint, ease of operation, and suitability for diverse heat and steam applications make them ideal for expanding mid-sized chemical plants and food processing units.

Key Trends & Opportunities

Integration of Digital Monitoring and IoT in Boiler Operations

The integration of digital monitoring, predictive maintenance, and IoT-based platforms is emerging as a transformative trend in the gas fueled fire tube boiler market. Advanced systems now feature real-time performance tracking, early fault detection, and energy optimization via smart controls, enabling plant operators to significantly reduce downtime and maintenance costs. This trend is particularly relevant in chemical plants where process continuity is paramount. Manufacturers offering cloud-based analytics and remote diagnostics gain a competitive edge, and customers adopting such solutions achieve greater operational transparency.

- For instance, Cleaver-Brooks launched its Prometha® Connected Boiler Solutions, providing users with 24/7 cloud-based monitoring and analytics that flag performance anomalies and enable remote diagnostics—capabilities that have helped customers lower unplanned shutdowns by up to 10%.

Shift Toward Hybrid and Biofuel-Compatible Boiler Designs

A growing opportunity lies in the development of hybrid boiler systems capable of switching between natural gas and renewable fuels like biogas or hydrogen blends. As industries transition toward carbon-neutral energy sources, boilers adaptable to multiple fuels offer long-term value. Manufacturers are increasingly investing in R&D to design systems that emit lower greenhouse gases and comply with future energy policies. This trend aligns with corporate sustainability goals, particularly among large chemical and pharmaceutical companies aiming to reduce carbon footprints. Hybridizable boilers allow industries to leverage clean energy without compromising heating reliability, creating a unique selling point as energy markets evolve.

- For instance, Grant has innovated its Vortex condensing boiler range to be compatible with HVO (hydrotreated vegetable oil) biofuel, allowing property owners to reduce carbon emissions without costly retrofitting and supporting rural and hard-to-heat homes with cleaner energy solutions.

Key Challenges

High Initial Investment and Retrofit Costs

Despite their operational and environmental advantages, gas fueled fire tube chemical boilers face significant challenges related to high upfront costs. The installation of advanced condensing boilers, along with smart controls and efficiency enhancements, requires substantial capital investment. In emerging markets, smaller chemical plants and food processors may opt for cheaper alternatives or delay upgrades due to budget constraints. Retrofit projects involving replacement of outdated systems also encounter logistical and financial hurdles. These cost barriers slow down market penetration, especially in regions without adequate financing options or policy incentives. Without strategic subsidies or flexible financing models, adoption rates may remain subdued in cost-sensitive sectors.

Volatility in Natural Gas Prices and Supply Chain Disruptions

The market is highly vulnerable to fluctuations in natural gas prices, which directly impact operational costs for industrial users. Geopolitical tensions, seasonal demand spikes, and supply chain constraints can cause significant price volatility, undermining the economic advantages of gas-fired boilers. Additionally, disruptions in natural gas infrastructure—particularly in regions lacking robust pipeline networks—pose reliability issues. Industries reliant on uninterrupted steam supply may find these risks unacceptable, opting instead for alternative heating systems or multi-fuel options. To address this challenge, boiler manufacturers and end users increasingly require contingency plans, fuel flexibility, or strategic sourcing agreements to mitigate price and supply uncertainties.

Regional Analysis

North America

North America holds a notable share of 28% in the Gas Fueled Fire Tube Chemical Boiler market. The region benefits from widespread natural gas infrastructure, stringent emission regulations, and a mature chemical and petrochemical sector. The U.S., in particular, drives market growth due to extensive investments in efficiency upgrades and digital boiler controls. Government incentives promoting low-emission industrial heating further accelerate adoption. Moreover, the rising emphasis on decarbonization in industrial operations encourages chemical processors and food manufacturers to transition to high-efficiency gas-fired fire tube systems, supporting steady market expansion in the region.

Europe

Europe accounts for 24% of the global market share, driven by strong environmental regulations and early adoption of condensing boiler technologies. Countries like Germany, France, and the Netherlands are leading users, transitioning from oil-fired systems to cleaner gas-fire tube alternatives. The region’s industrial sectors, including pharmaceuticals and specialty chemicals, rely heavily on high-performance boilers to meet stringent energy-efficiency targets. Additionally, the European Union’s decarbonization policies and carbon credit frameworks are expected to boost demand further. Retrofit opportunities in legacy industrial plants, coupled with energy efficiency grants, continue to support steady growth across European markets.

Asia-Pacific

Asia-Pacific dominates the global landscape with an estimated 38% market share, fueled by rapid industrialization, strong growth in chemical and food processing industries, and expanding natural gas distribution networks. China and India emerge as frontrunners due to large-scale infrastructure projects and government investments encouraging energy-efficient industrial systems. Growing awareness of sustainability and the adoption of advanced boiler technologies further support regional demand. Manufacturers are increasingly targeting mid- to large-sized industrial facilities in the region with compact and hybrid boiler models. With increasing emphasis on industrial automation and decarbonization, Asia-Pacific is poised for long-term market leadership.

Latin America

Latin America holds 6% of global market share and is gradually adopting gas fueled fire tube boilers as the chemical and food processing industries expand. Brazil and Mexico lead regional adoption due to investment in process industries, support for natural gas infrastructure, and rising energy efficiency awareness. However, limited pipeline networks in rural areas and economic constraints slow broader market penetration. Despite these challenges, industrial expansion and policy push for cleaner fuel usage are expected to drive growth. Government-backed initiatives promoting lower-carbon alternatives also present opportunities for wider adoption of advanced fire tube boiler technologies.

Middle East & Africa

The Middle East & Africa region represents 4% of the market, driven primarily by oil & gas processing and petrochemical industries. The United Arab Emirates and Saudi Arabia are prominent users, with demand centered around refineries and downstream chemical units seeking reliable and efficient steam generation. Although the use of gas is widespread, the pace of transition to advanced boiler systems is slower due to legacy infrastructure and lower regulatory pressure. However, growing investment in industrial diversification and cleaner fuel technologies is expected to create modest growth avenues in the medium term, especially in emerging African markets.

Market Segmentations

By Fuel Type

- Natural Gas

- Propane

- Biogas

- Others

By Application

- Chemical Processing

- Oil & Gas

- Food & Beverage

- Pharmaceuticals

By Technology

- Condensing Fire Tube Boilers

- Non-Condensing Fire Tube Boilers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Gas Fueled Fire Tube Chemical Boiler market is characterized by a mix of global manufacturers and regional specialists offering a broad range of high-efficiency and emission-compliant boiler solutions. Key players such as Cleaver-Brooks, Hurst Boiler, Bosch Industriekessel, Miura America, and Viessmann dominate the market with extensive product portfolios, advanced combustion technologies, and strong after-sales service networks. Companies like Fulton Boiler Works, Superior Boiler, and Johnston Boiler also compete actively by focusing on compact designs and customized solutions for mid-sized chemical and food processing plants. Strategic initiatives including product innovation, digital integration, and regional expansion are prevalent as market players strive for differentiation. Investments in IoT-based monitoring, low-NOx burner technologies, and hybrid systems support evolving customer needs for energy efficiency and regulatory compliance. Mergers and regional partnerships further enhance distribution capabilities, allowing suppliers to capture emerging opportunities across Asia-Pacific and Latin America.

Key Player Analysis

- Miura America (USA)

- Superior Boiler (USA)

- Babcock Wanson (France)

- Viessmann (Germany)

- Cleaver-Brooks (USA)

- Johnston Boiler (USA)

- Bosch Industriekessel (Germany)

- Unilux Advanced Manufacturing (USA)

- Fulton Boiler Works (USA)

- Hurst Boiler (USA)

Recent Developments

- In November 2025, Watts Water Technologies, Inc. completed the acquisition of Superior Boiler, the portfolio of fire‑tube, water‑tube and condensing boilers.

- In September 2025, ClearSign Technologies Corporation announced an order for comprehensive testing of a 100 % hydrogen‑capable burner from a major petrochemical customer, signalling a shift toward hybrid/clean‑fuel fire‑tube boiler solutions.

- In June 2024, Superior Boiler announced new regional partnerships in multiple U.S. states to enhance its fire‑tube and related boiler equipment sales network.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of condensing fire tube boilers will accelerate due to increasing demand for high-efficiency industrial heating solutions.

- Integration of digital controls and IoT-enabled predictive maintenance will become standard in modern boiler systems.

- Hybrid and multi-fuel compatible boilers will gain traction as industries transition toward low-carbon operations.

- Chemical processing and pharmaceutical sectors will remain the primary end users, driving consistent market demand.

- Government incentives for cleaner fuel technologies will encourage faster adoption of gas-fired systems in emerging economies.

- Asia-Pacific will continue to dominate the global market, supported by rapid industrial expansion and energy transitions.

- Retrofit and replacement of aging boiler infrastructure will create significant opportunities for new installations.

- Manufacturers will increasingly focus on low-NOx and ultra-low emission technologies to comply with tightening regulations.

- Customization and modular designs will meet the specialized needs of mid-sized industrial facilities.

- Strategic partnerships and acquisitions will enhance distribution networks, especially in Latin America and Southeast Asia.