Market Overview

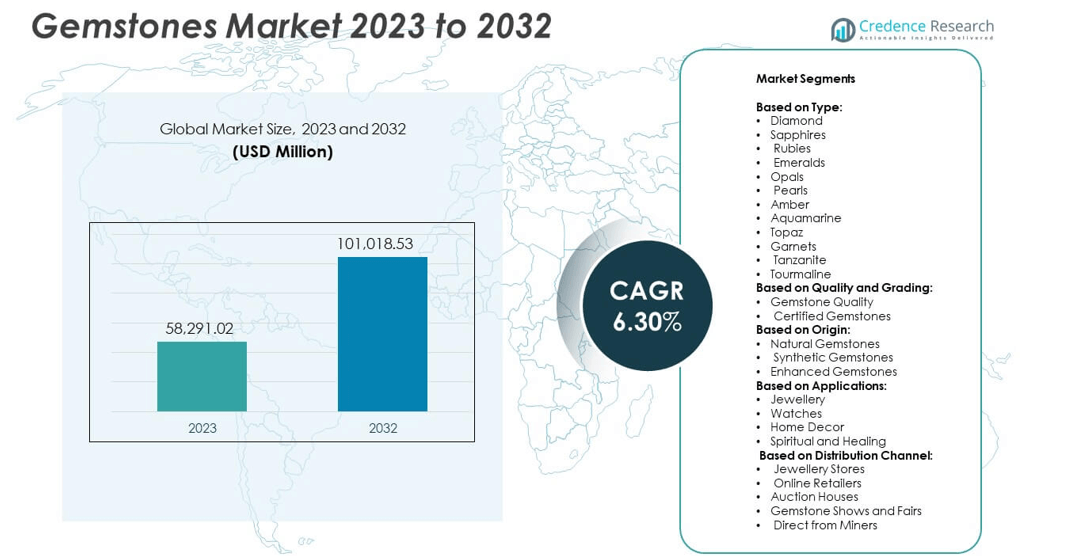

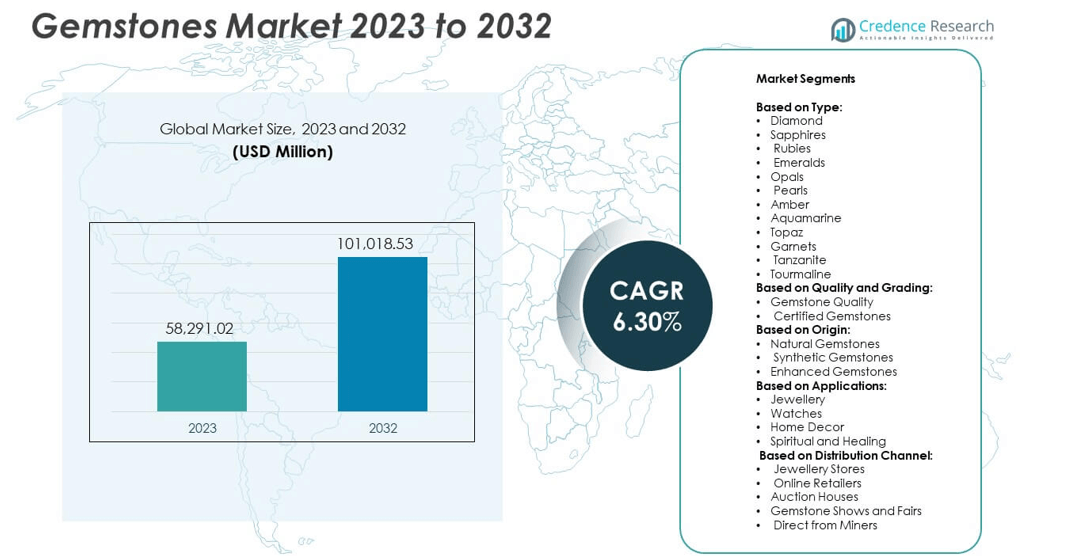

The Gemstones Market size was valued at USD 58,291.02 million in 2023 and is anticipated to reach USD 101,018.53 million by 2032, at a CAGR of 6.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gemstones Market Size 2024 |

USD 58,291.02 million |

| Gemstones Market, CAGR |

6.30% |

| Gemstones Market Size 2032 |

USD 101,018.53 million |

The Gemstones market grows through strong consumer demand for luxury goods, cultural traditions, and rising middle-class affluence across emerging economies. Drivers include increasing disposable incomes, technological advancements in mining and processing, and heightened awareness of ethical sourcing supported by certification and traceability. Trends highlight the rapid adoption of lab-grown gemstones, growing preference for colored varieties, and expansion of digital platforms that enhance accessibility and personalization. It also reflects the influence of sustainability, with brands adopting circular economy models and transparent supply chains. Together, these dynamics position gemstones as both cultural symbols and modern lifestyle investments.

The Gemstones market demonstrates strong geographical presence across Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa, each contributing through distinct cultural, economic, and resource-driven factors. Asia-Pacific leads growth with India and China driving high consumption due to traditions and rising affluence, while North America and Europe sustain demand through established luxury brands and advanced retail networks. Latin America and Africa play crucial roles as leading suppliers of colored gemstones and diamonds. Key players shaping the industry include De Beers Jewellers Ltd, Tiffany & Co., ALROSA, and Rio Tinto Diamonds, each leveraging mining strength and brand value.

Market Insights

- The Gemstones market was valued at USD 58,291.02 million in 2023 and is projected to reach USD 101,018.53 million by 2032, growing at a CAGR of 6.30% during the forecast period.

- The market is driven by rising consumer demand for luxury goods, cultural significance of gemstones in weddings and traditions, and increasing disposable incomes in emerging economies.

- Key trends include the growing adoption of lab-grown gemstones, rising preference for colored stones such as emeralds and sapphires, and expansion of e-commerce platforms that enhance accessibility and personalization.

- Competitive dynamics remain strong, with leading players such as De Beers Jewellers Ltd, Tiffany & Co., ALROSA, and Rio Tinto Diamonds investing in ethical sourcing, branding, and advanced processing technologies to strengthen market position.

- The industry faces restraints such as fluctuating raw material supply, price volatility, and challenges related to authenticity and counterfeiting, which impact consumer trust and operational stability.

- Regionally, Asia-Pacific leads growth, supported by cultural traditions and large-scale consumption in India and China, while North America and Europe maintain steady demand through established luxury markets and strong retail networks.

- Latin America and Africa contribute significantly as resource-rich suppliers of emeralds, diamonds, and other colored gemstones, while the Middle East benefits from affluent consumers and high demand for luxury jewelry collections.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Demand for Luxury and Fashion Products

The Gemstones market benefits from a steady rise in consumer demand for luxury and fashion-oriented products. High-end jewelry, designer accessories, and premium lifestyle goods drive consistent growth across both developed and emerging economies. Consumers associate gemstones with status, exclusivity, and long-term value, making them attractive purchases for occasions such as weddings and anniversaries. Strong branding strategies by global jewelry houses reinforce this trend. It gains further traction from the influence of social media and celebrity endorsements that shape consumer preferences. Expanding disposable incomes in Asia-Pacific and Middle East economies also fuel demand for premium gemstones.

- For instance, Tiffany & Co. reported global net sales of over 4,400,000 jewelry pieces in 2022, with high-end gemstone collections contributing significantly to sales in North America and Asia.

Technological Advancements in Mining and Processing

The Gemstones market strengthens with advancements in mining and processing technologies. Modern techniques ensure better extraction efficiency, minimize waste, and improve overall supply reliability. Cutting-edge processing tools enhance gemstone clarity, durability, and brilliance, which increases their appeal to both retail and industrial buyers. It gains momentum from the adoption of automated grading systems and AI-driven quality assessment tools that reduce human error. Mining companies invest heavily in sustainability-oriented technologies to reduce environmental impact. Growing application of blockchain-enabled traceability also reassures consumers about authenticity and ethical sourcing.

- For instance, De Beers implemented its Tracr blockchain platform in 2022, successfully tracking 25,000 high-value diamonds from mine to retailer, ensuring transparency in supply chains.

Growing Focus on Ethical Sourcing and Transparency

The Gemstones market expands under the rising focus on ethical sourcing and transparency. Increasing consumer awareness about conflict-free supply chains compels producers and retailers to adopt responsible practices. Global initiatives such as the Kimberley Process strengthen industry credibility by ensuring stones are free from conflict-related concerns. It encourages brands to highlight sustainability and ethical compliance as competitive differentiators. Retailers now promote traceable gemstones with certifications, building stronger trust with buyers. Younger generations, particularly millennials and Gen Z, prioritize sustainability and social responsibility in purchase decisions, further amplifying this trend.

Expansion of Emerging Markets and Retail Channels

The Gemstones market experiences significant momentum from the rapid expansion of emerging markets and diversified retail channels. Asia-Pacific countries, especially India and China, demonstrate strong cultural affinity for gemstones, boosting large-scale consumption. Online platforms and digital marketplaces now serve as crucial distribution channels, increasing accessibility and variety for global customers. It also gains traction from international tourism, where gemstone purchases are associated with cultural significance and luxury experiences. Retailers continue to diversify portfolios by offering customized gemstone jewelry tailored to local tastes. The growing presence of organized retail networks in developing nations further strengthens sales opportunities.

Market Trends

Rising Popularity of Lab-Grown Gemstones

The Gemstones market observes a strong trend toward lab-grown alternatives that offer affordability, sustainability, and consistency in quality. Consumers increasingly view synthetic gemstones as viable options due to their identical physical and chemical properties compared to natural stones. It gains wider acceptance among environmentally conscious buyers who prioritize ethical sourcing. Jewelry brands highlight lab-grown stones in collections to attract younger demographics. The shift toward customization and personalization supports this adoption further. Retailers position lab-grown gemstones as both fashionable and socially responsible choices.

- For instance, ALROSA supplied over 11,600,000 carats of diamonds with provenance certificates in 2021, assuring consumers of conflict-free origins.

Integration of Digital Platforms and E-Commerce

The Gemstones market leverages digital platforms and e-commerce to enhance customer reach and convenience. Online jewelry stores and marketplaces provide extensive catalogs, transparent pricing, and certified authentication. It enables consumers to compare quality and value before making purchases, leading to stronger confidence. Augmented reality tools allow virtual try-on experiences, which increase engagement and reduce purchase hesitation. The rise of omnichannel retailing blends in-store luxury with digital flexibility, reinforcing sales. Global brands invest in interactive platforms to build long-term customer loyalty.

- For instance, Blue Nile has served over 2.7 million customers and launched around 40 asset‑light showroom to complement its digital reach.

Increasing Demand for Colored Gemstones

The Gemstones market reflects rising demand for colored varieties such as emeralds, sapphires, and rubies. Shifting consumer preferences from traditional diamonds to vibrant, unique stones reshape jewelry design trends. It benefits from growing awareness of cultural and astrological significance tied to specific colors. Luxury houses showcase bold, colorful designs to meet the evolving tastes of high-net-worth individuals. Demand also grows in the fashion industry, where colored gemstones are featured prominently in accessories. The diversification of choices allows brands to cater to wider customer segments.

Focus on Sustainability and Circular Economy Models

The Gemstones market aligns with global sustainability trends through recycling, reuse, and circular economy models. Retailers adopt buy-back and resale programs to extend the lifecycle of gemstone jewelry. It supports reduced environmental impact while offering customers value retention and flexibility. Brands integrate blockchain-based traceability to ensure ethical sourcing and complete supply chain visibility. Eco-conscious consumers respond positively to transparency in production and certification. This trend reinforces the credibility of companies that position themselves as sustainable luxury leaders.

Market Challenges Analysis

Fluctuating Raw Material Supply and Price Volatility

The Gemstones market faces significant challenges due to fluctuations in raw material availability and pricing. Natural gemstone supply depends heavily on mining conditions, geopolitical stability, and regulatory frameworks in producing countries. It creates uncertainty for manufacturers and retailers who rely on consistent supply for global demand. Price volatility often impacts profit margins and disrupts long-term planning for industry players. Limited reserves of high-quality stones intensify competition, while reliance on artisanal mining raises concerns about reliability. Retailers struggle to maintain stable pricing structures when raw material costs vary unpredictably.

Concerns Over Authenticity, Counterfeiting, and Regulatory Compliance

The Gemstones market also encounters persistent challenges related to authenticity, counterfeiting, and compliance with global standards. It remains vulnerable to fraudulent practices where synthetic or low-quality stones are misrepresented as premium products. Counterfeit gemstones erode consumer trust and damage brand credibility in both offline and online retail channels. Regulatory requirements such as the Kimberley Process demand strict monitoring, which adds compliance costs for producers and sellers. Growing consumer awareness of ethical sourcing amplifies the risk for brands unable to prove transparency. Companies must invest in certification, blockchain traceability, and advanced grading systems to safeguard authenticity and maintain market confidence.

Market Opportunities

Expansion Through Emerging Markets and Growing Middle-Class Affluence

The Gemstones market holds significant opportunities in emerging economies where rising middle-class affluence drives luxury consumption. Countries such as India, China, and Brazil exhibit strong cultural and social connections with gemstone jewelry, creating sustained demand. It gains further momentum from increasing disposable incomes that allow wider access to premium and mid-range gemstone products. Tourism also plays a crucial role, with travelers purchasing gemstones as symbols of cultural identity and luxury experiences. Global brands expanding retail footprints in these markets position themselves to capture long-term growth. The appeal of gemstones in weddings, festivals, and gifting occasions reinforces steady consumption patterns.

Innovation in Sustainable Practices and Digital Transformation

The Gemstones market finds new opportunities in sustainability-driven practices and digital transformation. Consumers show strong interest in ethically sourced gemstones supported by blockchain-based traceability and transparent certifications. It encourages brands to highlight responsible sourcing as a core differentiator, strengthening customer loyalty. Growth in e-commerce and virtual retailing further expands accessibility, particularly among younger generations. Technological tools such as augmented reality and AI-powered customization create engaging, personalized shopping experiences. Companies that combine sustainability with digital innovation are well-positioned to capture evolving consumer expectations and establish leadership in the global market.

Market Segmentation Analysis:

By Type:

Reflecting consumer preferences and cultural significance. Diamonds remain the most dominant category, supported by their association with luxury, weddings, and high-value investments. Sapphires, rubies, and emeralds follow closely, valued for their rarity, brilliance, and use in premium jewelry collections. It also shows robust demand for opals, pearls, and amber, which cater to niche markets and traditional applications. Aquamarine, topaz, garnets, tanzanite, and tourmaline gain traction among younger consumers seeking variety, affordability, and unique color options. The diverse range of gemstones allows retailers to cater to both luxury buyers and mass-market segments.

- For instance, De Beers mined 34.6 million carats of diamonds, making it the leading global diamond supplier and reinforcing dominance in luxury categories.

By Quality and Grading:

It plays a crucial role in defining value and consumer trust. Gemstone quality is assessed based on clarity, cut, color, and carat, with high-quality stones commanding premium prices. Certified gemstones hold growing importance, as consumers seek assurance of authenticity, ethical sourcing, and compliance with global standards. It creates opportunities for certification agencies and grading laboratories to expand their influence in the supply chain. Strong demand for certified stones reflects rising awareness among buyers who prioritize transparency and investment-grade purchases. Quality-focused segmentation reinforces brand credibility and long-term customer relationships.

- For instance, the Gemological Institute of America (GIA) issues over 2.5 million gemstone grading reports annually, supporting global trade with certified authenticity.

By Origin:

It shapes market growth further, with natural gemstones continuing to lead due to their rarity and intrinsic value. Synthetic gemstones gain significant momentum, offering affordability and consistency in appearance while appealing to environmentally and ethically conscious consumers. It also highlights the role of enhanced gemstones, which use treatments to improve color and durability, thus widening their appeal in the mid-range market. Demand for lab-grown and enhanced stones expands as younger demographics prioritize sustainability and personalization. This segmentation ensures a balanced portfolio for producers and retailers catering to multiple consumer expectations. Overall, the Gemstones market benefits from diversified segments that collectively strengthen its global reach and resilience.

Segments:

Based on Type:

- Diamond

- Sapphires

- Rubies

- Emeralds

- Opals

- Pearls

- Amber

- Aquamarine

- Topaz

- Garnets

- Tanzanite

- Tourmaline

Based on Quality and Grading:

- Gemstone Quality

- Certified Gemstones

Based on Origin:

- Natural Gemstones

- Synthetic Gemstones

- Enhanced Gemstones

Based on Applications:

- Jewellery

- Watches

- Home Decor

- Spiritual and Healing

Based on Distribution Channel:

- Jewellery Stores

- Online Retailers

- Auction Houses

- Gemstone Shows and Fairs

- Direct from Miners

Based on the Geography:

-

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The Gemstones market in North America accounts for 24% of the global share, reflecting its strong position driven by high consumer spending on luxury goods. The United States leads demand, supported by established jewelry brands, advanced retail networks, and strong cultural ties to gemstone purchases for weddings, engagements, and special occasions. Canada contributes to growth with active mining operations, particularly in diamonds, which enhance regional supply. It benefits from robust online retail adoption, allowing brands to expand access to certified gemstones. Consumer awareness of ethical sourcing also drives demand for conflict-free stones, shaping the strategies of regional retailers. North America continues to remain a mature yet lucrative market, sustained by both tradition and modern lifestyle preferences.

Europe

Europe holds 20% of the Gemstones market, reflecting its deep-rooted heritage in luxury jewelry and gemstone artistry. Leading fashion hubs such as France, Italy, and the United Kingdom drive consumption, supported by globally recognized luxury houses. The market is influenced by strong consumer preferences for colored gemstones like sapphires, rubies, and emeralds, often featured in bespoke jewelry collections. It is further shaped by strict sustainability and ethical sourcing regulations, which elevate consumer trust and brand credibility. Growing demand for certified gemstones fuels opportunities for grading institutions and certification agencies. Europe also benefits from tourism-related gemstone sales, especially in luxury shopping districts across major cities.

Asia-Pacific

Asia-Pacific dominates the Gemstones market with a commanding 38% share, making it the largest regional contributor. India and China serve as the primary drivers, owing to cultural traditions, weddings, and rising middle-class affluence that encourage large-scale consumption of gemstones. The region benefits from strong domestic mining activities as well as a large pool of skilled artisans engaged in cutting, polishing, and jewelry manufacturing. It also demonstrates significant growth in online jewelry sales, appealing to younger consumers seeking certified and traceable gemstones. Rising disposable incomes and lifestyle upgrades further fuel demand for premium products. Asia-Pacific’s position strengthens continuously, making it the most dynamic growth hub for global gemstone trade.

Latin America

Latin America contributes 8% of the global Gemstones market share, largely supported by resource-rich countries such as Brazil and Colombia. These nations are recognized for producing high-quality emeralds, amethysts, and other colored gemstones that cater to international demand. It maintains a steady role as a supplier to global jewelry manufacturers while also developing its domestic luxury markets. Growth in middle-class spending supports increasing consumption of gemstones for cultural and celebratory purposes. Challenges related to infrastructure and regulatory compliance sometimes limit full-scale growth potential. Nonetheless, the region plays a strategic role in supplying premium gemstones to global markets.

Middle East & Africa

The Middle East & Africa region holds 10% of the Gemstones market, supported by its unique positioning as both a producer and consumer hub. Africa contributes significantly through diamond-rich nations such as Botswana, South Africa, and Namibia, which are key suppliers in the global trade. The Middle East, particularly the Gulf countries, demonstrates high demand for luxury jewelry and gemstone collections due to cultural traditions and high-income consumers. It benefits from strong tourism and duty-free retail channels, which enhance gemstone sales across premium retail networks. Investments in ethical mining practices and certification add credibility to exports. The combination of resource availability and affluent consumer bases makes the region a critical segment in the global gemstone industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arctic Star Exploration Corp.

- Diamcor Mining Inc

- Swarovski Group

- Stornoway Diamond Corporation

- Petra Diamonds Limited

- Dominion Diamond Corporation

- Fura Gems Inc.

- Pala International Inc.

- Zales Corporation

- Debswana Diamond Company (Pty) Limited

- PJSC ALROSA

- Anglo American PLC

- Lucara Diamond Corp.

- Gitanjali Gems Ltd (India)

- Rockwell Diamonds Inc.

- Manihar Group of Gems & Jewellery

- Pangolin Diamonds Corporation

- Gem Diamonds Limited

- KGK Group

- Mountain Province Diamonds Inc.

- MIF Gems Co Ltd.

- Blue Nile

- Trans Hex Group Ltd.

- De Beers Jewellers Ltd

- ALROSA

- Merlin Diamonds Limited

- Botswana Diamonds P.L.C

- Tiffany & Co.

- Rio Tinto Diamonds

Competitive Analysis

The leading players in the Gemstones market include De Beers Jewellers Ltd, Tiffany & Co., ALROSA, Rio Tinto Diamonds, Petra Diamonds Limited, Gem Diamonds Limited, Lucara Diamond Corp., and Swarovski Group. These companies shape the competitive landscape through strategic mining operations, advanced processing, branding excellence, and expansion into global retail networks. The market demonstrates high concentration, with established players dominating both supply and distribution channels. Leading miners secure long-term contracts to ensure consistent availability of high-quality stones, while luxury brands emphasize exclusivity, design innovation, and heritage appeal to strengthen consumer loyalty. Sustainability and ethical sourcing serve as critical differentiators, with companies investing in blockchain-enabled traceability and certifications to maintain trust. Global players continue to expand into digital platforms, offering consumers transparency and convenience through certified online sales. Innovation in lab-grown gemstones and diversification into colored varieties add new dimensions to competition, enabling firms to capture evolving consumer preferences. The market reflects a balance of resource-based advantages and brand-driven strategies, where leadership depends on operational efficiency, supply reliability, and consumer engagement. Competitive intensity remains strong, driven by a combination of tradition, modern technology, and rising demand across both developed and emerging regions.

Recent Developments

- In July 2025, Diamcor Mining Inc. applied for a Management Cease Trade Order (MCTO). This was due to delays in completing their funding objectives. The company also announced plans to finalize arrangements with Tiffany & Co. to defer formal insolvency proceedings, aiming to complete funding by August 29, 2025.

- In May 2025, Arctic Star Exploration Corp. provided a detailed update on its Timantti diamond project in Finland, including updates on landowner payments, financing expectations, and ongoing exploration efforts. The company also secured the Timantti project and unveiled new insights into the kimberlites.

- In April 2024, PJSC ALROSA acquired a smaller diamond mining company to expand its production capacity. This acquisition is expected to increase their output by 20%, enhancing their competitive edge in the market.

Market Concentration & Characteristics

The Gemstones market demonstrates moderate to high concentration, with a few global players dominating mining, supply, and luxury branding, while smaller firms operate in niche segments. It reflects characteristics of both a resource-driven and consumer-driven industry, where control over reserves and brand equity determine competitiveness. Leading mining companies secure consistent access to high-quality stones, while established luxury brands leverage heritage, craftsmanship, and global retail networks to capture premium demand. It shows strong reliance on certifications, grading systems, and ethical sourcing practices, which have become central to maintaining consumer trust. The market also highlights diversity, with segments ranging from diamonds and colored stones to synthetic and enhanced gemstones, catering to varied consumer profiles. It remains influenced by cultural traditions, social significance, and lifestyle shifts, making demand highly dynamic. The presence of organized retail, digital channels, and lab-grown alternatives introduces new competitive layers, while artisanal miners and regional suppliers continue to play vital roles. Overall, the Gemstones market balances exclusivity, tradition, and innovation, with concentration driven by resource ownership and consumer brand recognition.

Report Coverage

The research report offers an in-depth analysis based on Type, Quality and Grading, Origin, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for gemstones will grow steadily with rising middle-class affluence in emerging economies.

- Lab-grown gemstones will gain wider acceptance due to affordability and ethical sourcing.

- Colored gemstones will experience stronger demand driven by fashion and personalization trends.

- Digital platforms and e-commerce will expand global access to certified gemstones.

- Blockchain traceability will strengthen transparency and consumer trust in supply chains.

- Sustainability initiatives will shape mining, processing, and retail strategies.

- Luxury brands will continue to dominate premium segments through exclusivity and heritage appeal.

- Certification and grading systems will play a larger role in purchase decisions.

- Emerging markets in Asia-Pacific and the Middle East will drive significant consumption growth.

- Innovation in jewelry design and customization will influence consumer preferences.