Market Overview:

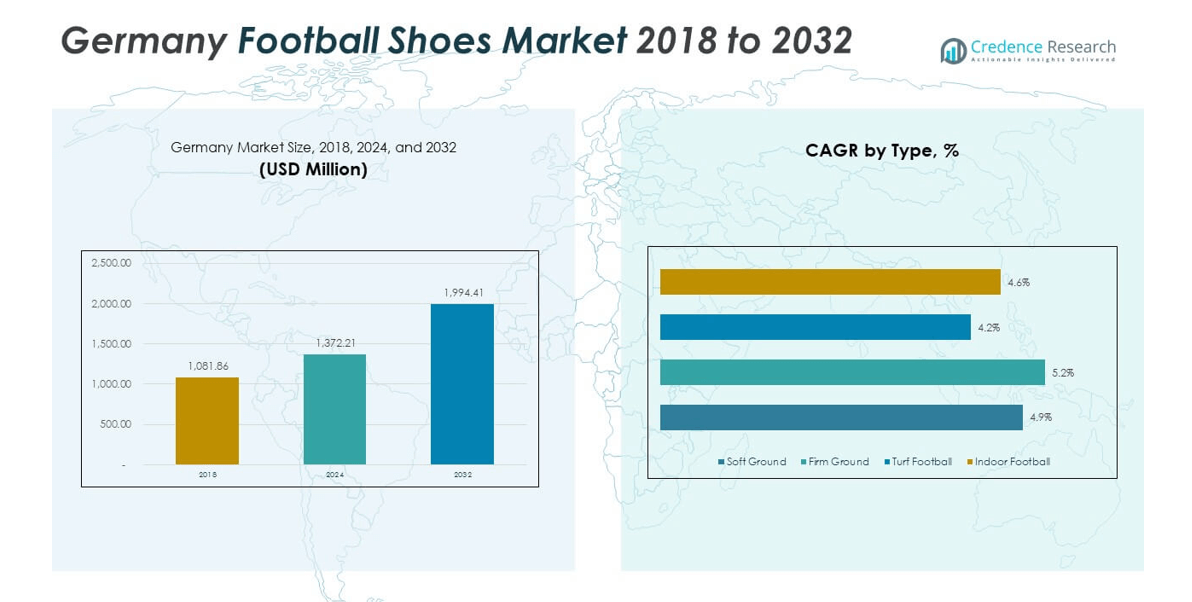

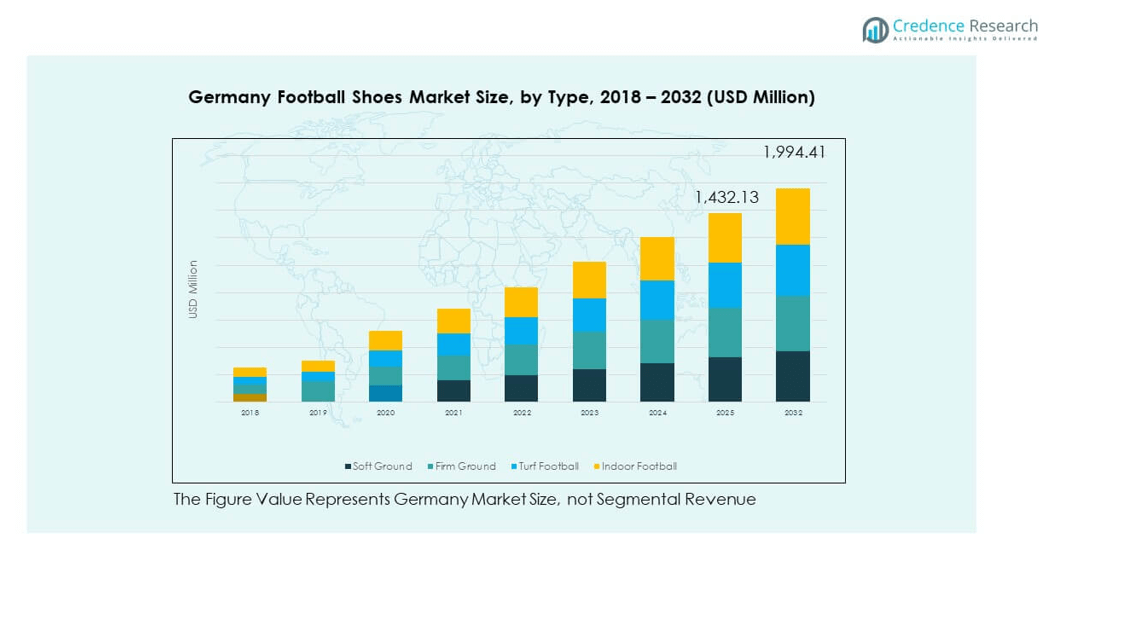

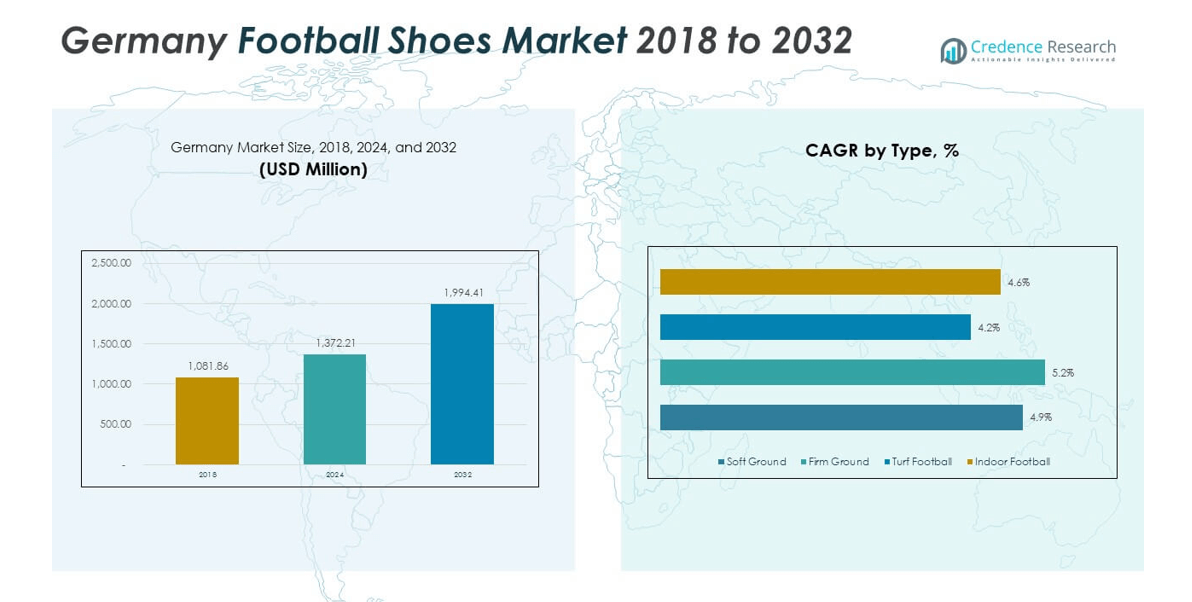

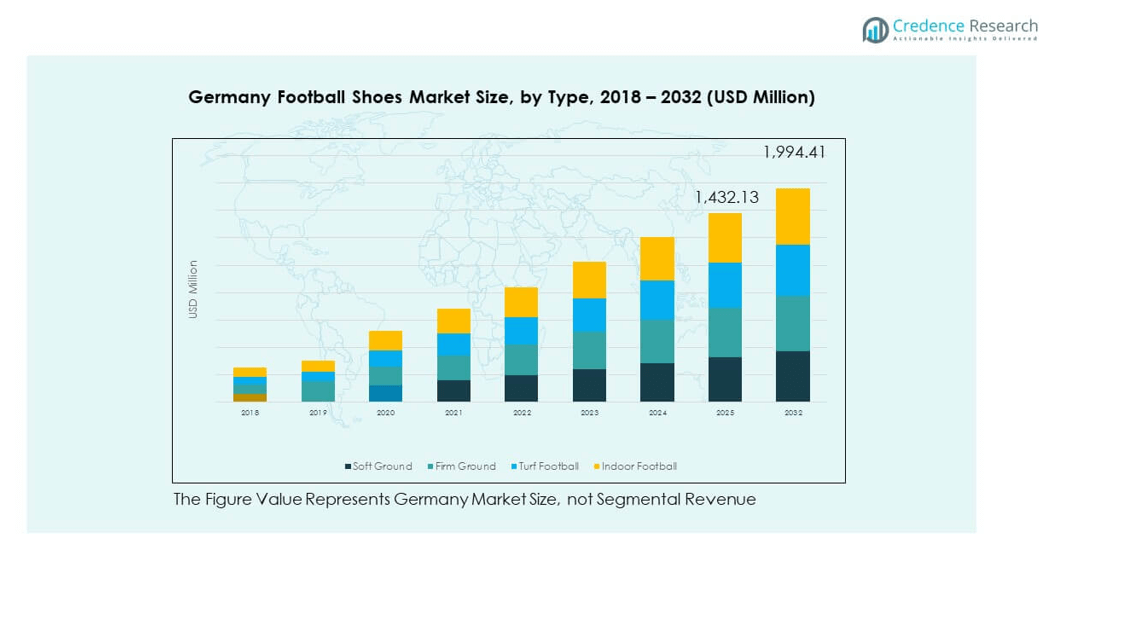

The Germany Football Shoes Market size was valued at USD 1,081.86 million in 2018, increased to USD 1,372.21 million in 2024, and is anticipated to reach USD 1,994.41 million by 2032, at a CAGR of 4.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Football Shoes Market Size 2024 |

USD 1,372.21 million |

| Germany Football Shoes Market, CAGR |

4.79% |

| Germany Football Shoes Market Size 2032 |

USD 1,994.41 million |

Growth in the Germany Football Shoes Market is driven by the country’s strong football culture, supported by Bundesliga clubs, youth academies, and community participation. Consumers demand performance-focused footwear with lightweight construction, durable studs, and multi-surface adaptability. Digital platforms enabling customization further boost consumer engagement and brand loyalty. Sustainability also shapes the market, as companies adopt recycled and eco-friendly materials in production. Continuous innovation and product endorsements by professional athletes reinforce brand appeal and maintain steady sales momentum.

Western Germany leads the Germany Football Shoes Market, supported by Bundesliga clubs and advanced retail networks, making it a hub for premium sales and sponsorship activity. Southern Germany follows with strong demand linked to high-profile teams and professional academies. Northern and Eastern regions are emerging markets, driven by grassroots football, rising youth participation, and strong e-commerce adoption. Each region contributes uniquely, reflecting differences in cultural engagement, consumer behavior, and product accessibility. This regional diversity strengthens the overall structure of the market.

Market Insights

- The Germany Football Shoes Market was valued at USD 1,081.86 million in 2018, grew to USD 1,372.21 million in 2024, and is projected to reach USD 1,994.41 million by 2032, expanding at a CAGR of 4.79%.

- Western Germany leads with 42% share, supported by Bundesliga clubs, advanced retail presence, and premium consumer demand, making it the most influential regional market.

- Southern Germany holds 28% share, driven by Bayern Munich’s global fan base, active academies, and preference for high-performance footwear, strengthening its role in the overall market.

- Northern and Eastern Germany account for 30% share, with Berlin, Hamburg, and Leipzig driving adoption. These regions also represent the fastest-growing markets, fueled by grassroots football, strong youth participation, and rising e-commerce penetration.

- Segment distribution indicates firm ground shoes account for 46% of sales, reflecting dominance in natural grass use, while indoor football shoes hold 18%, supported by futsal and indoor league growth across Germany.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Strong Football Culture and Widespread Consumer Participation

The Germany Football Shoes Market benefits from the country’s deep football tradition supported by Bundesliga clubs and community leagues. Football remains the most popular sport, influencing consumer behavior across all age groups. Parents invest in premium youth shoes due to growing grassroots programs. Strong loyalty to national teams increases sales of officially endorsed products. Local retailers also witness steady growth from amateur leagues and indoor tournaments. Global brands expand their product lines to match German consumers’ performance demands. Fashion-conscious buyers purchase models blending style with sport. This cultural connection drives steady growth across the market.

- For instance, Bundesliga clubs operate some of Europe’s most structured youth academies, with the DFL making academy systems mandatory since 2001. This framework has ensured a steady flow of homegrown players into Bundesliga squads, reinforcing Germany’s strong culture of youth development.

Focus on Performance Enhancements Through Advanced Shoe Design

Consumer demand favors football shoes built with lightweight materials, durable studs, and improved traction systems. The Germany Football Shoes Market grows stronger as brands compete through innovation. Professional athletes influence design by demanding comfort without compromising speed or control. Shoe models featuring breathable uppers and flexible outsoles gain attention from serious players. Strong focus on multi-surface compatibility also fuels demand. Manufacturers launch adaptive fit technologies for better foot stability. Clubs and academies encourage players to adopt advanced footwear. It helps players maximize potential while reinforcing trust in branded performance shoes.

Growing Interest in Digital Personalization and Custom Fit Options

Brands invest in digital platforms to support custom color, fit, and material selection. Consumers in the Germany Football Shoes Market value identity expression through unique design. Nike By You and Adidas customization tools attract loyal buyers. Athletes use platforms to match club colors or personal symbols. Customized products create repeat purchasing behavior and brand attachment. Strong integration of digital marketing highlights new collections quickly. Consumers perceive personalization as a premium experience. It increases both online engagement and in-store traffic, strengthening direct-to-consumer sales channels.

- For instance, Nike By You allows German consumers to customize every aspect of their football shoes, from color to materials, and add a unique personal ID, officially verified and publicly available on Nike’s customization portal for shoes in 2025.

Sustainability Focus and Eco-Friendly Shoe Materials Development

Eco-conscious buyers influence companies to adopt recycled materials in shoe production. The Germany Football Shoes Market witnesses stronger alignment between sustainability and consumer choice. Recycled polyester uppers and bio-based outsoles reduce environmental impact. Large brands highlight sustainability credentials in advertising campaigns. Younger consumers prioritize buying eco-friendly products without performance trade-offs. Sustainable sourcing creates competitive advantages for industry leaders. It ensures compliance with European sustainability regulations while addressing ethical demands. The sustainability trend continues shaping production and purchasing patterns across the football shoe industry.

Market Trends

Rising Adoption of Smart Technologies in Football Footwear Design

Wearable integration gains traction with connected football shoes recording movement and performance metrics. The Germany Football Shoes Market shows growing adoption of sensor-enabled footwear. Players analyze real-time data to improve agility and training outcomes. Professional clubs encourage players to adopt advanced technologies. Consumer interest in self-improvement drives growth of connected footwear. Shoe models offering data synchronization with mobile apps enhance appeal. Fitness-conscious buyers see value in tracking accuracy. It positions smart footwear as a niche but expanding trend.

Expansion of Limited Edition Collaborations and Exclusive Product Launches

Brands emphasize exclusivity through collaborations with athletes, designers, and clubs. The Germany Football Shoes Market capitalizes on consumer desire for uniqueness. Limited edition drops increase urgency and boost premium sales. Collectors and younger demographics respond strongly to scarcity-driven campaigns. Retailers highlight collaborations in flagship stores and online platforms. Club-branded models gain traction among fan communities. It strengthens brand prestige and consumer loyalty. Such campaigns consistently elevate visibility and market differentiation.

Shifts in Retail Strategy Through Omnichannel Sales Platforms

Hybrid retail models integrate digital and physical shopping experiences. The Germany Football Shoes Market benefits from stronger e-commerce integration with physical outlets. Click-and-collect options improve customer convenience and trust. Virtual try-on tools help consumers test fit before purchase. Local sports shops collaborate with online platforms to reach broader audiences. Retailers focus on inventory optimization to balance demand across regions. It creates faster product availability and better service experiences. Stronger omnichannel presence strengthens sales resilience.

- For instance, Nike’s omnichannel strategy connects physical stores, online platforms, and mobile channels, offering services such as click-and-collect, direct shipping, and in-store mobile checkout. This model enables consumers in Germany and worldwide to shop seamlessly across multiple touchpoints.

Increased Influence of Fashion and Lifestyle Appeal in Football Footwear

Football shoes evolve beyond sport into fashion-driven footwear. The Germany Football Shoes Market witnesses higher sales from style-oriented consumers. Streetwear culture merges with professional footwear design. Casual buyers wear football-inspired shoes in non-sport settings. Limited colorways and trendy silhouettes attract fashion-conscious demographics. Brands collaborate with influencers to promote lifestyle appeal. It bridges sportswear with broader fashion trends. The blending of function and fashion secures wider consumer interest.

- For example, in September 2025, Puma celebrated Memphis Depay becoming the Netherlands men’s all-time top scorer by producing 51 limited-edition MD51 ULTRA football boots, each pair presented to family, friends, mentors, and figures who supported him.

Market Challenges Analysis

High Competition and Price Sensitivity Among Consumers in Key Segments

The Germany Football Shoes Market faces intense rivalry among global and local brands. High competition leads to frequent product launches and price wars. Price-sensitive consumers often shift toward mid-range or discount offerings. Retailers struggle to maintain premium pricing under such conditions. Online platforms intensify pressure with heavy discounts and bundled promotions. Smaller brands find it difficult to compete against established players. It forces consistent innovation to maintain competitive advantage. The challenge reflects the market’s fast-moving nature and consumer expectations.

Counterfeit Products and Supply Chain Vulnerabilities Across Retail Channels

Counterfeit football shoes affect brand reputation and consumer trust in the Germany Football Shoes Market. Online marketplaces often distribute fake models at reduced costs. Such practices undercut genuine sales and damage brand credibility. Supply chain disruptions further increase delivery delays and stock shortages. Global manufacturers rely on raw materials subject to market fluctuations. It increases vulnerability in production schedules and inventory planning. Brands invest in anti-counterfeiting technologies to secure products. Maintaining strong supply chain resilience remains a significant challenge for the industry.

Market Opportunities

Expansion Into Women’s Football and Rising Female Participation Rates

The Germany Football Shoes Market shows strong potential in the women’s category. Growing participation in professional leagues and grassroots levels fuels demand. Brands design women-specific fits to capture this expanding segment. Female athletes drive visibility through sponsorships and endorsements. Retailers highlight collections dedicated to women’s football. It strengthens inclusivity and widens the consumer base. Women’s football continues gaining cultural acceptance and media coverage. The opportunity creates a sustainable growth pathway.

Adoption of Digital Engagement Models and Direct-to-Consumer Growth Channels

Direct online sales platforms enhance brand visibility and consumer connection in the Germany Football Shoes Market. Brands invest in mobile apps, AI-driven recommendations, and virtual trials. Consumers gain seamless access to limited editions and exclusive models. Digital tools build loyalty through personalized promotions and interactive campaigns. It reduces reliance on third-party retailers and improves profit margins. Virtual events showcase new collections to online audiences. Strong digital engagement increases repeat purchase intentions. This opportunity accelerates the long-term shift toward consumer-centric retail.

Market Segmentation Analysis

The Germany Football Shoes Market

By type is divided into soft ground, firm ground, turf football, and indoor football shoes. Firm ground shoes dominate demand due to their compatibility with natural grass fields and extensive use in professional and amateur matches. Soft ground shoes hold steady appeal in wetter conditions, especially in northern regions. Turf football shoes gain traction from rising futsal and training activities. Indoor football shoes also see consistent demand, supported by the country’s indoor leagues and community-level tournaments.

- For instance, the Nike Air Zoom Mercurial (2024) incorporates a three-quarter length Zoom airbag inside the plate, delivering 10% more energy return than its predecessor, with a Tri-Star stud pattern engineered for improved multidirectional traction.

By stud segment, the market covers metal studs, rubber studs, and flat sole designs. Metal studs remain vital for professional athletes seeking maximum grip on moist surfaces. Rubber studs gain popularity among recreational players due to versatility and comfort. Flat sole shoes, typically used for indoor formats, align with the increasing participation in futsal and indoor events. It reflects the balance between performance-driven and lifestyle-oriented footwear choices.

By sales channel, retail outlets continue to hold a significant share due to consumer reliance on physical trials before purchase. E-commerce platforms experience rapid expansion with digital tools and wide product availability. Direct-to-consumer models grow strongly, supported by brand-owned stores and customization platforms that appeal to younger demographics. It highlights a shift toward hybrid sales strategies aimed at delivering convenience, personalization, and direct engagement with football enthusiasts.

- For instance, Puma’s Direct-to-Consumer business, covering retail and e-commerce, grew by 16.6% in 2024 on a currency-adjusted basis, with e-commerce sales alone rising 21.1%, according to the company’s audited annual filings.

Segmentation

By Type

- Soft Ground

- Firm Ground

- Turf Football

- Indoor Football

By Stud

- Metal Studs

- Rubber Studs

- Flat Sole

By Sales Channel

- Retail Channels

- E-commerce

- Direct to Consumer

Regional Analysis

Western Germany

Western Germany dominates the Germany Football Shoes Market with a 42% share, supported by its strong football heritage and presence of Bundesliga clubs. The region is home to major urban centers such as Cologne, Dortmund, and Düsseldorf, which serve as key retail and distribution hubs. Demand is high among both professional athletes and amateur players, fueling consistent sales. Brands launch flagship stores in these cities to strengthen consumer engagement. Sponsorship deals with local clubs further drive product visibility. It remains the most influential region for shaping footwear preferences nationwide.

Southern Germany

Southern Germany accounts for 28% of the market, driven by Bayern Munich’s global brand and grassroots football culture. Cities such as Munich and Stuttgart host thriving retail ecosystems with premium sports stores. Consumers in this region show a strong preference for high-performance models due to active participation in professional leagues and academies. Direct-to-consumer channels also perform well in urban areas. The cultural importance of football ensures steady growth across multiple sales channels. It continues to attract major investments from global brands seeking to expand market reach.

Northern and Eastern Germany

Northern and Eastern Germany collectively hold a 30% share of the Germany Football Shoes Market, with growing demand in cities like Berlin, Hamburg, and Leipzig. The expansion of community football programs drives higher adoption among youth segments. E-commerce penetration is particularly strong in these areas, enabling access to broader product ranges. Lower saturation compared to western regions creates growth opportunities for emerging brands. Local clubs and sponsorship initiatives enhance visibility across grassroots levels. It is steadily developing into a competitive zone with rising consumer engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nike Inc.

- Adidas AG

- Puma SE

- Umbro

- Mizuno

- Lotto Sport Italia

- New Balance

- KEEZA

- Skechers

- Sokito

- Other Key Players

Competitive Analysis

The Germany Football Shoes Market is characterized by intense competition among global and regional players. Nike, Adidas, and Puma dominate market share with extensive product portfolios and strong sponsorships of Bundesliga clubs. Adidas leverages its German heritage to maintain a loyal consumer base, while Nike invests heavily in digital customization platforms. Puma strengthens its position through athlete endorsements and innovation in lightweight models. Secondary players such as Mizuno, Umbro, and Lotto Sport Italia focus on niche segments and mid-range offerings. Emerging brands like Sokito and KEEZA highlight sustainability and personalization to appeal to younger consumers. It remains a market where product innovation, distribution networks, and brand identity strongly influence competitiveness.

Recent Developments

- In July 2025, PUMA extended its long-standing partnership with Borussia Dortmund, reinforcing its commitment to develop football shoes and gear that align with the club’s energetic and fast-paced football style while catering to Dortmund’s global fanbase.

- In January 2025, PUMA introduced the Unlimited football boots pack, which includes the latest versions of the FUTURE 8, ULTRA 5, and KING ULTIMATE models. These boots were developed to address the evolving performance demands of Germany’s football community, offering new design elements aimed at optimal fit and agility on the pitch.

- In March 2024, the German Football Association (DFB) announced that Nike will become the official supplier of all national teams starting in 2027. The agreement ends Adidas’s over 70-year run supplying kits and equipment. The new deal with Nike runs until 2034. It includes kits, apparel, and related gear.

Report Coverage

The research report offers an in-depth analysis based on Type, Stud and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Sustainability-focused football shoes will gain traction with growing demand for eco-friendly materials.

- Expansion in women’s football participation will open new product categories and increase inclusivity.

- Digital platforms offering customization and direct-to-consumer sales will strengthen brand loyalty.

- Growth in e-commerce penetration will enhance nationwide accessibility across urban and rural areas.

- Smart footwear with data tracking features will create niche demand among performance-driven athletes.

- Limited edition collaborations with clubs and designers will drive exclusivity and premium sales.

- Youth participation in grassroots programs will stimulate recurring demand for entry-level shoes.

- Fashion integration into football footwear will expand consumer appeal beyond sporting purposes.

- Regional clubs’ sponsorships will continue to drive visibility and influence consumer purchasing trends.

- Stronger investments in omnichannel strategies will solidify brand competitiveness in a crowded marketplace.