Market Overview

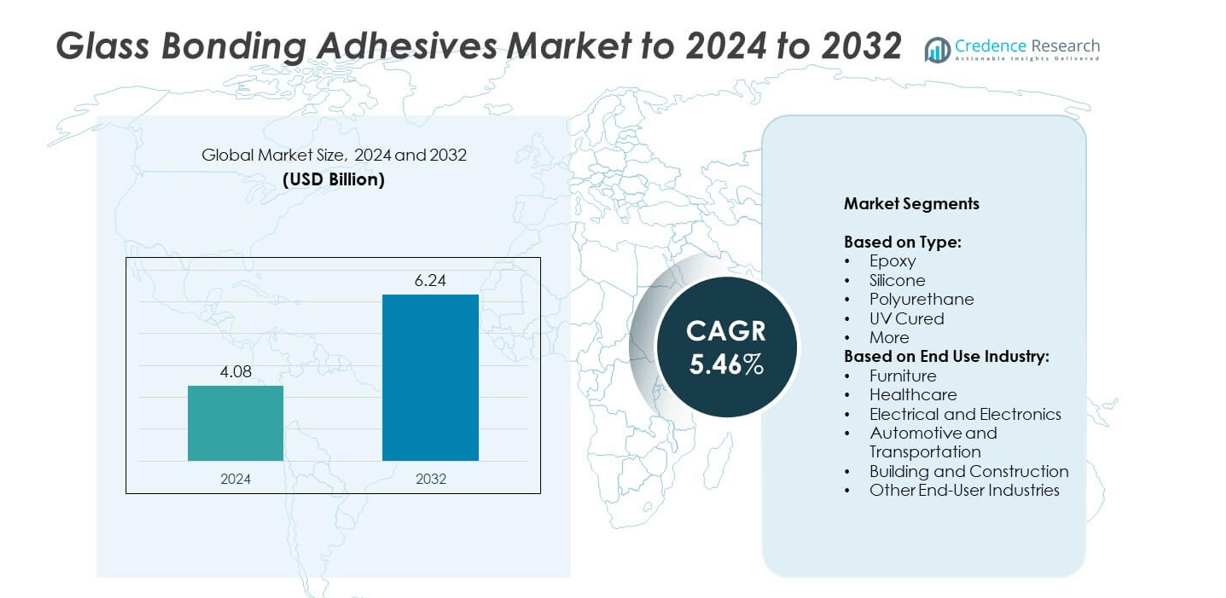

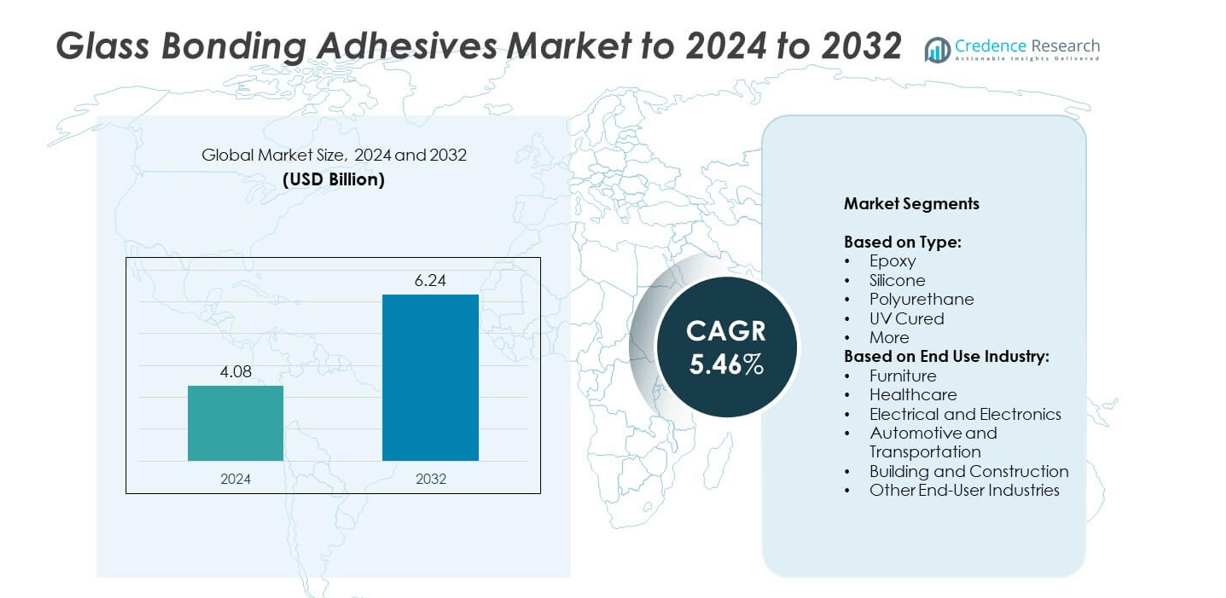

The Glass Bonding Adhesives Market size was valued at USD 4.08 Billion in 2024 and is anticipated to reach USD 6.24 Billion by 2032, at a CAGR of 5.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass Bonding Adhesives Market Size 2024 |

USD 4.08 Billion |

| Glass Bonding Adhesives Market, CAGR |

5.46% |

| Glass Bonding Adhesives Market Size 2032 |

USD 6.24 Billion |

The glass bonding adhesives market is shaped by leading companies such as Henkel AG & Co. KGaA, H.B. Fuller Company, Dymax Corporation, 3M Company, Sika A.G., Permabond Engineering Adhesives, The Dow Chemical Company, Ashland Inc., and KIWO. These players focus on technological innovations, sustainable formulations, and expanding their global reach to strengthen competitiveness. Asia Pacific emerged as the leading region in 2024, accounting for nearly 30% of the market share, driven by rapid industrialization, large-scale automotive production, and rising construction activities. North America and Europe follow closely, supported by advanced healthcare, electronics, and sustainable construction practices.

Market Insights

- The glass bonding adhesives market was valued at USD 4.08 Billion in 2024 and is expected to reach USD 6.24 Billion by 2032, growing at a CAGR of 5.46%.

- Rising demand from automotive and transportation industries is a key driver, as adhesives replace traditional fastening methods for lightweight vehicles, windshields, and lighting systems.

- UV-cured adhesives are gaining traction as a major trend, offering faster curing, high transparency, and precision, particularly in healthcare and electronics applications.

- The market is competitive, with players investing in R&D, eco-friendly formulations, and strategic partnerships to expand presence, while high costs of advanced adhesives remain a restraint for smaller manufacturers.

- Asia Pacific led with nearly 30% share in 2024 due to automotive and construction demand, followed by North America at 32% driven by advanced industries, while Europe accounted for 27% supported by sustainable building practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Epoxy adhesives held the dominant share in the glass bonding adhesives market in 2024, accounting for over 35% of total demand. Their strong mechanical strength, durability, and resistance to harsh environments make them a preferred choice for industrial and structural applications. The rising use in automotive and electronics sectors drives this dominance. Silicone adhesives follow closely due to their flexibility and weather resistance, especially in construction and outdoor applications. UV cured adhesives are gaining traction in electronics and healthcare owing to fast curing, transparency, and precision bonding.

- For instance, DELO PHOTOBOND PB437 reaches 21 MPa tensile strength after 90 s UV at 60 mW/cm², with 110% elongation and 520 MPa modulus.

By End Use Industry

The automotive and transportation segment led the glass bonding adhesives market in 2024 with more than 30% market share. Increasing demand for lightweight vehicles, improved design aesthetics, and advanced bonding solutions fuel this dominance. Adhesives are increasingly replacing traditional fastening methods in windshields, windows, and lighting systems. The building and construction industry is another major consumer, driven by architectural glass applications. Electrical and electronics industries also show steady growth as miniaturization and transparent bonding requirements rise, while furniture and healthcare sectors contribute niche but expanding demand.

- For instance, SikaTack® GO! windshield adhesive provides 8 MPa tensile strength and 6 MPa lap-shear, with a 2-hour FMVSS 212 drive-away time.

Key Growth Drivers

Rising Adoption in Automotive and Transportation

The automotive and transportation sector is a key growth driver for the glass bonding adhesives market. Growing demand for lightweight vehicles and energy-efficient solutions increases reliance on adhesives over mechanical fasteners. Glass bonding adhesives enable seamless integration of windshields, windows, and advanced lighting systems, improving both performance and aesthetics. Strict emission regulations further encourage automakers to adopt adhesives for weight reduction. This trend solidifies automotive applications as the largest contributor to market expansion.

- For instance, 3M Auto Glass Urethane 08693 develops a 1,200 psi tensile strength and 550 psi lap-shear strength (after 72 hours), with a 10–15 minute working time and full cure in 24 hours.

Expanding Use in Building and Construction

The building and construction industry strongly drives growth in the glass bonding adhesives market. Increasing urbanization and infrastructure investments create high demand for glass in façades, windows, and interior applications. Adhesives offer durability, flexibility, and strong bonding for structural glazing and decorative purposes. The rising preference for modern architectural designs with more glass usage enhances product demand. Energy-efficient construction practices also fuel growth, as adhesives improve sealing and insulation performance. This makes construction one of the fastest-growing end-use industries.

- For instance, DOWSIL™ 995 shows ±50% movement capability and typically achieves an ultimate tensile strength of 2.41 MPa (350 psi) after 7 days, as tested per ASTM standards. A longer-term tensile strength of 1.17 MPa is documented after 21 days under specific test conditions (ASTM C1135).

Advancements in Adhesive Technologies

Technological advancements act as a critical driver for the glass bonding adhesives market. The development of UV-cured adhesives allows fast curing, transparency, and precision, meeting the requirements of healthcare and electronics industries. Innovations in epoxy and silicone formulations enhance bonding strength, heat resistance, and durability across demanding environments. These advancements support adoption in diverse industries, from automotive to medical devices. R&D investments by key manufacturers accelerate innovation, enabling high-performance products that align with evolving customer needs and sustainability goals.

Key Trends & Opportunities

Shift Toward UV-Cured Adhesives

One major trend is the growing adoption of UV-cured adhesives, particularly in healthcare and electronics. These adhesives provide high transparency, rapid curing, and strong bonding without heat, making them ideal for delicate glass components. Electronics manufacturers increasingly rely on UV-cured solutions for displays and sensors. The demand for medical devices with precise bonding is also fueling growth. Their eco-friendly profile and reduced curing time open significant opportunities for market expansion in sectors requiring accuracy and sustainability.

- For instance, Henkel LOCTITE® AA 349 cures at 100 mW/cm² for 40 s and achieves 11 N/mm² steel-to-glass tensile strength.

Sustainability and Green Adhesives

Another important trend shaping the market is the shift toward eco-friendly adhesive solutions. Regulatory pressure on VOC emissions and rising environmental awareness encourage adoption of sustainable formulations. Manufacturers are focusing on bio-based, solvent-free, and recyclable adhesives for glass bonding. These products appeal to construction and automotive industries seeking greener alternatives. As industries move toward carbon neutrality, demand for sustainable adhesives will continue to grow. This trend offers long-term opportunities for companies investing in green innovations and regulatory compliance.

- For instance, Permabond UV630 delivers 14 N/mm² tensile strength (ISO 37), remains effective at temperatures down to -55 °C, and is optically clear with a refractive index of >1.490.

Key Challenges

High Cost of Advanced Adhesives

The high cost of advanced glass bonding adhesives remains a significant challenge. Products like UV-cured and high-performance epoxy adhesives are priced higher due to complex formulations and manufacturing processes. This creates cost barriers for small-scale industries and limits adoption in price-sensitive markets. Automotive and construction companies often weigh the cost-benefit ratio before large-scale use. Although performance benefits are strong, price sensitivity in developing regions could restrict faster market penetration. Balancing affordability with quality is a major hurdle for manufacturers.

Stringent Regulatory Compliance

Stringent environmental and safety regulations pose another challenge to the glass bonding adhesives market. Adhesive formulations must comply with restrictions on VOC emissions, chemical usage, and worker safety standards. Adapting to different regional frameworks such as REACH in Europe and EPA rules in the U.S. increases compliance costs. Companies must invest heavily in reformulating products and testing to meet evolving standards. This slows innovation cycles and limits product availability in regulated markets. Regulatory complexity remains a barrier to faster industry growth.

Regional Analysis

North America

North America accounted for around 32% of the glass bonding adhesives market in 2024, driven by strong demand from the automotive, healthcare, and construction sectors. The U.S. leads the region with high adoption in lightweight vehicles and advanced medical devices, supported by strict regulatory standards for safety and emissions. Growth is further supported by investments in smart infrastructure projects and technological innovation in adhesive formulations. Canada contributes steadily with rising demand in construction and electronics, while Mexico shows growth potential from expanding automotive manufacturing hubs. Overall, the region benefits from mature industries and strong innovation capacity.

Europe

Europe held about 27% of the glass bonding adhesives market in 2024, with demand largely influenced by automotive and building applications. Germany, France, and the U.K. are major contributors due to advanced automotive manufacturing and sustainable construction trends. Strict environmental regulations such as REACH and emphasis on low-VOC adhesives encourage the adoption of eco-friendly formulations. Structural glazing and use of adhesives in luxury cars further strengthen market share. Investments in renewable energy and smart building projects also fuel consumption, making Europe a key growth region for sustainable adhesive technologies.

Asia Pacific

Asia Pacific dominated the glass bonding adhesives market with nearly 30% share in 2024, making it the fastest-growing region. China leads due to rapid industrialization, large-scale automotive production, and expanding construction activities. India and Southeast Asia follow with rising investments in healthcare, electronics, and infrastructure projects. Japan and South Korea contribute significantly through advanced electronics and automotive applications. Growing demand for lightweight vehicles, smart devices, and modern architecture drives adhesive adoption. The region benefits from cost-effective manufacturing, a large consumer base, and increasing government support for industrial and construction expansion.

Latin America

Latin America represented about 6% of the global glass bonding adhesives market in 2024, with growth primarily led by Brazil and Mexico. Expanding automotive assembly plants and construction projects fuel adhesive adoption in these countries. Demand in healthcare and electronics is also growing steadily, though on a smaller scale. The region’s market is moderately impacted by economic fluctuations and import dependencies. However, increasing urbanization and government initiatives for infrastructure improvement present growth opportunities. Local manufacturing developments and rising consumer interest in modern design further support adhesive consumption in the region.

Middle East and Africa

The Middle East and Africa accounted for around 5% of the glass bonding adhesives market in 2024, driven by infrastructure development and rising construction activities. Countries such as the UAE and Saudi Arabia lead due to high investments in commercial buildings, modern architecture, and transport projects. South Africa adds growth from the automotive sector, while healthcare applications are expanding across smaller economies. Although the region’s share is limited, demand is expected to grow as urbanization and industrial projects increase. Rising adoption of advanced building materials and smart infrastructure supports gradual market expansion.

Market Segmentations:

By Type:

- Epoxy

- Silicone

- Polyurethane

- UV Cured

- More

By End Use Industry:

- Furniture

- Healthcare

- Electrical and Electronics

- Automotive and Transportation

- Building and Construction

- Other End-User Industries

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Dymax Corporation, Ashland Inc., 3M Company, Henkel AG & Co. KGaA, Sika A.G., Permabond Engineering Adhesives, H.B. Fuller Company, The Dow Chemical Company, and KIWO are among the prominent companies shaping the competitive landscape of the glass bonding adhesives market. The market is highly competitive, with players focusing on expanding product portfolios, enhancing adhesive performance, and aligning with sustainability requirements. Companies emphasize research and development to create advanced solutions with improved bonding strength, durability, and environmental compliance. Strategic moves such as partnerships, acquisitions, and regional expansions strengthen market presence and help address industry-specific demands. Strong distribution networks and technical support services provide an edge in gaining customer trust across automotive, construction, healthcare, and electronics industries. Innovation in UV-cured and eco-friendly adhesives has become central to competitive positioning, as regulatory compliance and customer preferences shift toward greener solutions. This competitive environment is expected to intensify with growing end-user demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dymax Corporation

- Ashland Inc.

- 3M Company

- Henkel AG & Co. KGaA

- Sika A.G.

- Permabond Engineering Adhesives

- B. Fuller Company

- The Dow Chemical Company

- KIWO

Recent Developments

- In 2023, Henkel introduced Loctite 3296, a dual-cure adhesive using both UV and thermal curing, for bonding lenses in Advanced Driver-Assistance Systems (ADAS) sensors.

- In 2023, H.B. Fuller Launched Swift Melt 1515-I, a biocompatible adhesive for microporous medical tape applications, which is able to function in extreme climatic conditions like those found in India, the Middle East, and Africa.

- In 2023, Sika AG Acquired MBCC Group, a specialist in construction chemicals and solutions that included glass bonding adhesives.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand in automotive and transportation.

- Construction applications will continue to grow, driven by modern architectural designs.

- Adoption of UV-cured adhesives will increase due to faster curing and precision.

- Healthcare and electronics industries will drive demand for transparent bonding solutions.

- Sustainability will remain a key focus with bio-based and solvent-free formulations.

- Asia Pacific will lead growth with strong automotive and construction activities.

- Europe will push eco-friendly adhesive adoption under strict regulatory frameworks.

- Cost reduction strategies will improve access in price-sensitive markets.

- Technological innovations will enhance adhesive strength and durability.

- Strategic collaborations and R&D investments will shape long-term competitiveness.