Market Overview

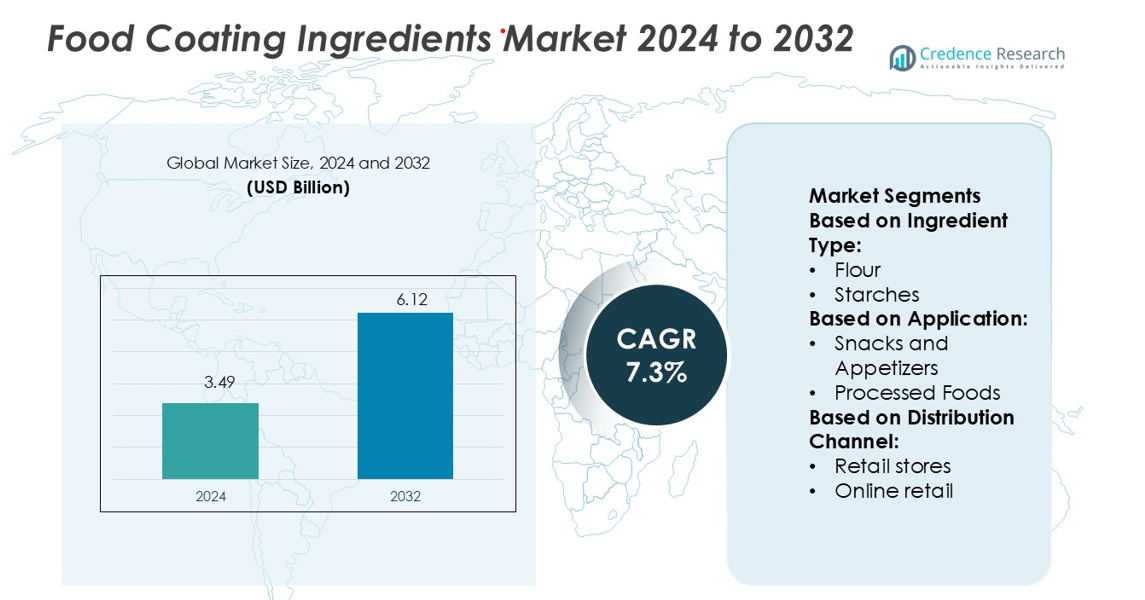

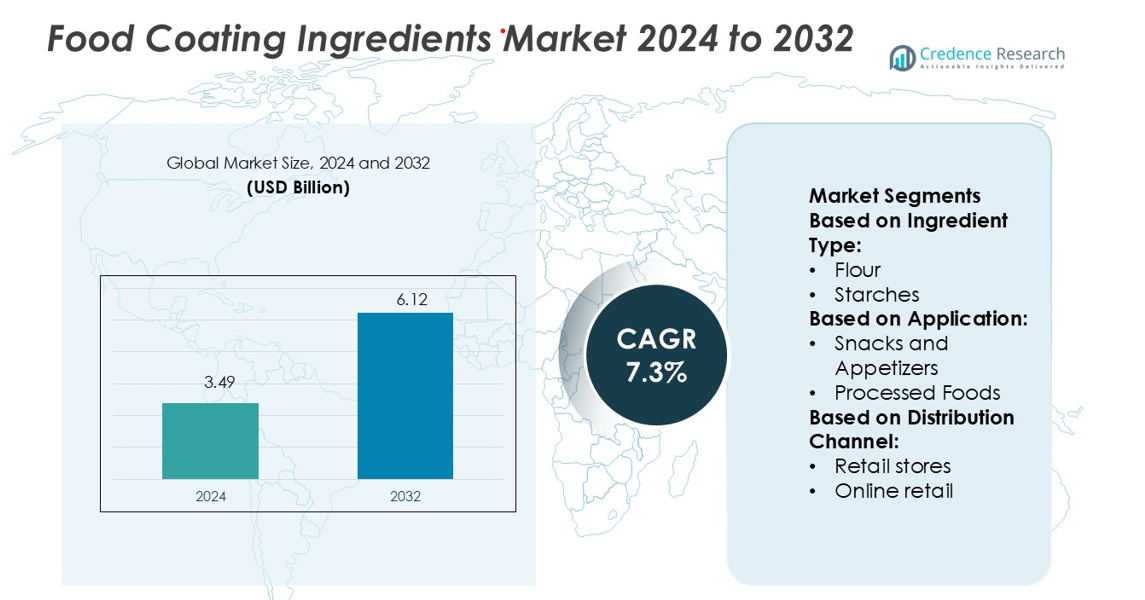

Food Coating Ingredients Market size was valued USD 3.49 billion in 2024 and is anticipated to reach USD 6.12 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Coating Ingredients Market Size 2024 |

USD 3.49 billion |

| Food Coating Ingredients Market, CAGR |

7.3% |

| Food Coating Ingredients Market Size 2032 |

USD 6.12 billion |

The food coating ingredients market is characterized by strong competition among top players such as Sensory effects Ingredient Solutions, Cargill Inc., Archer Daniels Midland Company (ADM), Ingredion Inc., Ashland Inc., Agrana Beteiligungs-AG, Bowman Ingredients, Tate & Lyle PLC, PGP International, Inc., and DE Nemours and Company. These companies focus on product innovation, clean-label solutions, and advanced processing technologies to strengthen their market positions. Asia Pacific leads the global market with a 36.1% share, driven by rapid urbanization, growing fast-food chains, and increasing demand for processed foods. Strategic partnerships, R&D investments, and strong distribution networks give these players a competitive edge in meeting evolving consumer preferences.

Market Insights

- The Food Coating Ingredients Market was valued at USD 3.49 billion in 2024 and is projected to reach USD 6.12 billion by 2032, at a CAGR of 7.3%.

- Rising demand for processed and ready-to-eat foods is a key market driver, supported by the growth of fast-food chains and expanding foodservice sectors.

- Asia Pacific leads with a 36.1% share, followed by North America at 34.5% and Europe at 28.2%, reflecting strong consumer demand and advanced processing infrastructure.

- Batter and breadcrumb segments hold a dominant share due to their wide use in bakery, snacks, and fried foods, supported by technological innovations for better texture and shelf life.

- Intense competition among leading companies and raw material price volatility act as key restraints, while innovation in clean-label and plant-based coatings creates new growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Ingredient Type

Batter dominates the ingredient type segment with the highest market share due to its strong functionality in enhancing texture, flavor retention, and moisture sealing. Batter coatings are widely used in fried products for achieving consistent and crisp outer layers. Rising consumer demand for ready-to-eat and convenience foods further supports this sub-segment. Continuous innovations in gluten-free and clean-label batter formulations also strengthen market adoption across foodservice and packaged food industries.

- For instance, a research study found that replacing part of the hydrocolloid blend with 0.5–1.0 % β-d-glucan in gluten-free baked goods resulted in no significant change in mass, volume or total baking loss — illustrating how clean-label batters can match traditional texture metrics.

By Application

Fried foods hold the largest market share in the application segment, driven by their widespread popularity across fast food, QSR, and frozen product categories. Coating ingredients improve product shelf life, oil absorption control, and flavor enhancement. Global fast-food expansion and increasing demand for fried snacks are key growth drivers. Manufacturers are also focusing on healthier formulations with reduced oil retention, aligning with evolving consumer preferences for better-for-you fried products.

- For instance, Cargill reports that over the past 25 years it removed approximately 500,000 metric tons of industrially produced trans-fatty acids (iTFAs) from the global food supply.

By Distribution Channel

Supermarkets lead the distribution channel segment with a significant market share, supported by their broad product variety and ease of availability. These retail outlets offer a wide range of coated food products and ingredients, attracting both household and commercial buyers. Expanding modern retail infrastructure, promotional campaigns, and in-store product visibility drive this channel’s dominance. The growth of organized retail chains continues to reinforce market penetration for coating ingredient products.

Key Growth Drivers

Rising Demand for Convenience Foods

The increasing consumption of ready-to-eat and processed foods is driving market growth. Busy lifestyles and urbanization are pushing consumers toward products that require minimal preparation. Coating ingredients enhance product taste, texture, and shelf life, making them essential for quick-service and packaged foods. Food producers are focusing on innovative batter and breadcrumb formulations to meet this growing demand. The expanding fast-food and bakery segments further boost the need for coating ingredients across multiple applications, including snacks, fried foods, and confectionery products.

- For instance, ADM’s PurelyForm™ Texture Solution 100 Series—a clean-label dry blend of plant-based texturants—was measured in drip-testing for frozen novelties: after 30 minutes at room temperature, the lab-made commercial control formula melted by 52 g of its weight, whereas the formula with PurelyForm™ melted by only 17 g.

Expansion of the Global Foodservice Industry

The rapid growth of quick-service restaurants (QSRs), cafes, and catering services is fueling demand for coating ingredients. These outlets rely on batters, breadcrumbs, and seasonings to maintain consistent taste and texture. Rising consumer spending on dining out and the globalization of cuisines are key factors supporting this growth. The expansion of food chains in emerging markets like Asia Pacific and Latin America is creating strong demand for high-quality coating solutions to support mass production and product standardization.

- For instance, Novel Cellulosics platform, Ashland achieved nature-derived content exceeding 84 % in its Natrathix™ Bio Cellulose thickener, which enables crystal-clear gels with high electrolyte tolerance and wide pH compatibility.

Innovation in Coating Technologies and Ingredients

Ongoing product innovation is a major growth driver for this market. Manufacturers are introducing clean-label, gluten-free, and plant-based coating ingredients to meet evolving consumer preferences. Advanced processing technologies are improving coating adhesion, crispiness, and oil absorption control. R&D investments are enabling the development of multifunctional coatings that enhance both sensory appeal and product stability. These innovations support differentiation and premium positioning, particularly in bakery, fried food, and snack segments.

Key Trends & Opportunities

Shift Toward Clean Label and Natural Ingredients

Consumer preferences are shifting toward natural and transparent ingredient lists. Food coating manufacturers are replacing artificial additives with plant-based, allergen-free, and preservative-free ingredients. This trend aligns with rising health awareness and regulatory pressures favoring clean-label products. Companies are using natural starches, proteins, and seasonings to meet these demands without compromising taste or functionality. The shift creates strong growth opportunities for producers targeting health-conscious consumers and premium food categories.

- For instance, PROMITOR® Soluble Fibre, which is well-tolerated at 40 g/day bolus and up to 65 g/day multiple doses, supporting high inclusion in product formulations without sacrificing texture.

Growing Penetration of E-Commerce Distribution

E-commerce platforms are transforming the distribution of food coating ingredients. Online retail enables broader market reach, direct consumer engagement, and easier product customization. Food manufacturers and suppliers are leveraging digital platforms to launch niche coating products and offer flexible order quantities. The rise of cloud kitchens and small-scale processors also drives this channel. Improved logistics and cold chain infrastructure support stable product delivery, expanding the market for specialty coating ingredients globally.

- For instance, PGP International offers a gluten-free certified rice breading product line, as well as a separate line of high-protein soy crisps, some of which feature a protein content of around 80% and can be used for nutritional claims in various food applications.

Technological Integration in Processing

Automation and advanced coating systems are reshaping food production. Coating technologies with improved control over thickness and uniformity are helping reduce ingredient waste and enhance product quality. Manufacturers are integrating precision coating machines and automated lines to achieve consistent results at scale. This technology adoption improves operational efficiency, reduces costs, and strengthens quality control, creating new opportunities for ingredient and equipment providers in both developed and emerging markets.

Key Challenges

Volatility in Raw Material Prices

The market faces challenges due to fluctuating prices of key raw materials like wheat, corn, and proteins. Global supply disruptions, climate change, and trade policies often impact ingredient availability and cost. These fluctuations affect production margins and pricing strategies for manufacturers. Small and mid-sized producers are particularly vulnerable, as they face limited flexibility in absorbing price variations. Maintaining competitive pricing while ensuring quality becomes a major operational challenge.

Stringent Regulatory and Labeling Requirements

Evolving food safety regulations and labeling standards are adding complexity to the market. Compliance with international standards such as FDA, EFSA, and FSSAI requires significant investment in product testing and certification. Restrictions on certain additives and allergens further limit formulation flexibility. Manufacturers must adapt quickly to avoid penalties or market exclusion. Meeting these regulatory demands increases operational costs and lengthens product launch timelines, posing a challenge for market expansion.

Regional Analysis

North America

North America holds a 34.5% share of the food coating ingredients market, driven by high demand for processed and convenience foods. The region’s mature foodservice sector, widespread adoption of QSR formats, and preference for ready-to-eat snacks support strong ingredient consumption. Rising consumer interest in clean-label and plant-based products further boosts innovation in coating formulations. Major players are expanding R&D activities to create healthier, allergen-free solutions that align with evolving regulatory standards. The United States remains the dominant market, supported by large-scale manufacturing capacity and established distribution channels.

Europe

Europe accounts for 28.2% of the market share, supported by its strong bakery, confectionery, and snack industries. The region’s focus on clean-label ingredients and strict food safety standards is shaping coating ingredient formulations. Demand for gluten-free, organic, and allergen-free coatings is rising due to changing consumer preferences. Countries such as Germany, France, and the U.K. lead the market, supported by advanced food processing infrastructure and strong retail networks. Regulatory alignment across the EU enhances product standardization, while ongoing innovation in sustainable coating technologies drives market growth.

Asia Pacific

Asia Pacific leads the global market with a 36.1% share, supported by rapid urbanization and expanding foodservice industries. Growing consumption of processed foods and increasing disposable incomes drive demand for coating ingredients in countries like China, India, and Japan. Fast-food chains and bakery segments are growing quickly, creating opportunities for batter, starch, and seasoning formulations. Manufacturers are localizing product offerings to match regional taste preferences. Investment in modern processing technologies and cold chain logistics further strengthens regional market performance, positioning Asia Pacific as the key growth hub.

Latin America

Latin America represents 8.1% of the market share, driven by rising consumption of fried and baked foods. Brazil and Mexico are key contributors, supported by expanding retail networks and fast-food chains. Local manufacturers are focusing on cost-effective coating solutions to meet price-sensitive consumer segments. Growing urban populations and increasing acceptance of convenience foods are further boosting market demand. Strategic investments in processing infrastructure and distribution channels are enhancing the region’s competitiveness. Clean-label coating ingredients are gradually gaining traction in response to changing consumer preferences.

Middle East & Africa

The Middle East & Africa holds a 6.3% market share, with growth driven by expanding QSR chains and food retail development. The UAE, Saudi Arabia, and South Africa are major contributors, supported by rising urbanization and increasing consumer spending on processed foods. Investments in modern food processing facilities and logistics networks are strengthening market presence. Global players are entering partnerships with regional distributors to tap into the growing demand for batter and seasoning blends. Health-conscious trends are slowly influencing ingredient choices, creating opportunities for premium clean-label offerings.

Market Segmentations:

By Ingredient Type:

By Application:

- Snacks and Appetizers

- Processed Foods

By Distribution Channel:

- Retail stores

- Online retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the food coating ingredients market features key players including Sensory effects Ingredient Solutions, Cargill Inc., Archer Daniels Midland Company (ADM), Ingredion Inc., Ashland Inc., Agrana Beteiligungs-AG, Bowman Ingredients, Tate & Lyle PLC, PGP International, Inc., and DE Nemours and Company. The food coating ingredients market is marked by strong innovation, strategic expansion, and product diversification. Companies are focusing on developing clean-label, gluten-free, and plant-based coating solutions to address changing consumer preferences and regulatory pressures. Advanced processing technologies are enhancing product texture, shelf life, and functionality, supporting wide adoption across bakery, confectionery, and snack segments. Global players are expanding their production capacities and strengthening distribution networks to target high-growth regions. Strategic collaborations and investments in R&D are key tactics used to maintain competitiveness, improve efficiency, and deliver differentiated, sustainable ingredient solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Sarda Bio Polymers introduced clean-label, plant-based hydrocolloid solutions for meat and alternative protein applications. Their offerings include guar gum, cassia tora gum, konjac, xanthan, carrageenan, tamarind xyloglucan, and CMC, designed to enhance texture with minimal processing while emphasizing sustainability and performance.

- In May 2025, AGRANA, a global producer of specialty starch-based ingredients hailing from Austria, has unveiled a new line of clean-label starches, branded as AGENAPURE, expanding its product portfolio.

- In April 2025, Arla Foods Ingredients launched the Lacprodan MicelPure portfolio at Vitafoods Europe 2025, including a range of MCI solutions that are relevant for medical nutrition.

- In February 2024, Ingredion, Inc. has introduced Novation Indulge 2940 starch, a non-GMO functional native corn starch, to broaden its range of clean label texturizers. The company noted that this starch could enhance the texture for gelling and co-texturizing in dairy products, dairy alternatives, and desserts

Report Coverage

The research report offers an in-depth analysis based on Ingredient Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean-label and natural coating ingredients will continue to rise.

- Plant-based and allergen-free formulations will gain strong market traction.

- Technological advancements will enhance product texture and processing efficiency.

- Fast-food and bakery sector expansion will boost ingredient consumption.

- Asia Pacific will remain the fastest-growing regional market.

- Strategic mergers and acquisitions will strengthen global supply chains.

- R&D investment will focus on sustainable and functional ingredient innovation.

- E-commerce will emerge as a key distribution channel for specialty coatings.

- Regulatory compliance will shape product development strategies.

- Premium and value-added coating solutions will drive market differentiation.