Market Overview

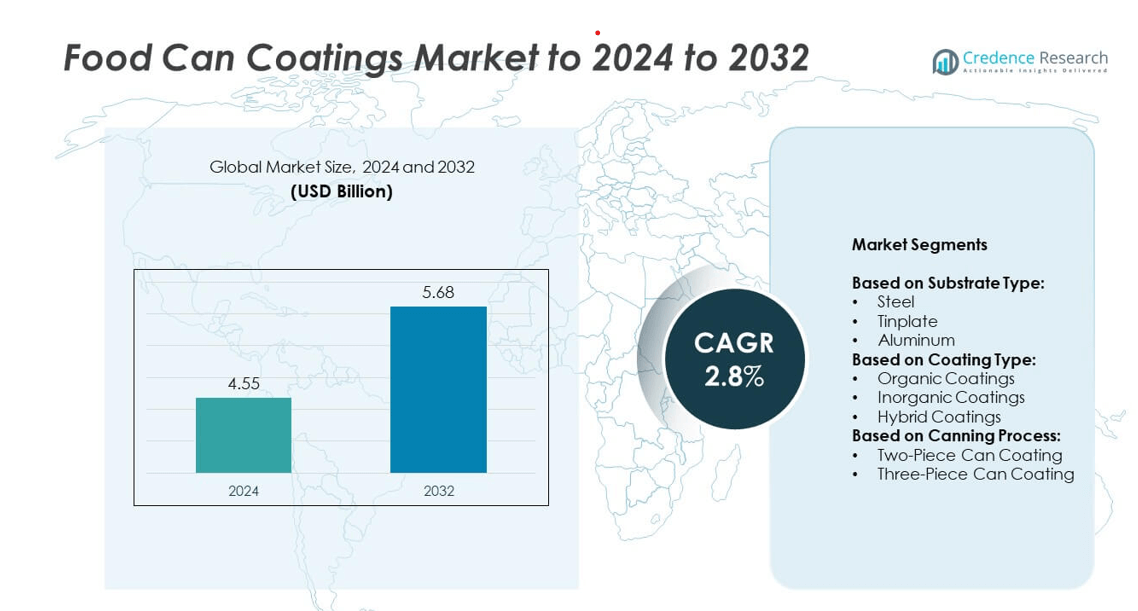

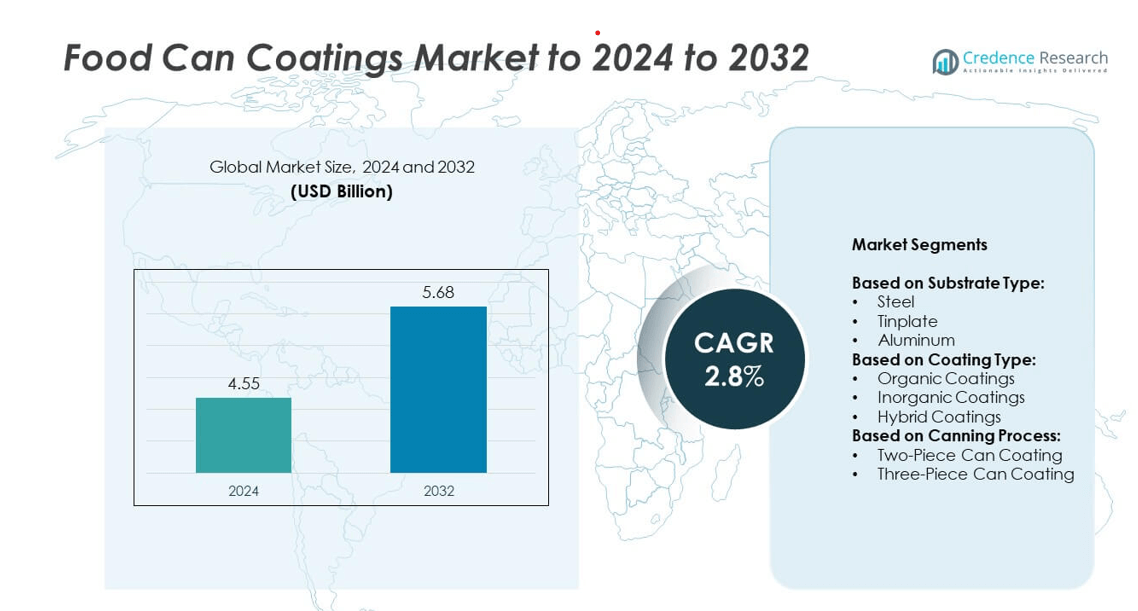

The Food Can Coatings Market size was valued at USD 4.56 Billion in 2024 and is anticipated to reach USD 5.68 Billion by 2032, at a CAGR of 2.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Can Coatings Market Size 2024 |

USD 4.56 Billion |

| Food Can Coatings Market, CAGR |

2.8% |

| Food Can Coatings Market Size 2032 |

USD 5.68 Billion b |

The food can coatings market is highly competitive, with leading players such as SherwinWilliams, BASF, PPG, Akzo Nobel, Axalta Coating Systems, and The Chemours Company focusing on sustainable and high-performance solutions. These companies emphasize innovations in BPA-free, waterborne, and hybrid coatings to meet stringent food safety regulations and growing consumer demand for eco-friendly packaging. Regional analysis shows that North America commanded the largest share, accounting for 32% of the global market in 2024, driven by strong demand for packaged and processed foods. Europe followed with 27%, supported by strict regulatory frameworks, while Asia Pacific captured 28% and continues to emerge as the fastest-growing region.

Market Insights

- The food can coatings market was valued at USD 4.55 Billion in 2024 and is projected to reach USD 5.68 Billion by 2032, growing at a CAGR of 2.8%.

- Rising demand for packaged and ready-to-eat foods is driving growth, supported by urbanization, lifestyle changes, and consumer preference for longer shelf-life products.

- Market trends highlight the rapid adoption of BPA-free, waterborne, and hybrid coatings, with increasing investments in sustainable and eco-friendly technologies to meet regulatory and consumer expectations.

- The competitive landscape features global players focusing on expanding product portfolios, enhancing production efficiency, and adopting bio-based materials to differentiate in a highly regulated environment.

- Regionally, North America led with 32% share in 2024, followed by Europe at 27% and Asia Pacific at 28%, with the latter being the fastest-growing region; by segment, organic coatings held the largest share at over 50%, supported by strong demand across canned food categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Substrate Type

Steel dominated the food can coatings market in 2024, accounting for over 45% share. Its strength, durability, and cost-effectiveness make it widely used in packaging canned vegetables, soups, and ready-to-eat meals. Tinplate and aluminum follow closely, with tinplate preferred for its corrosion resistance and aluminum favored in lightweight packaging. Rising demand for long-shelf-life foods and increasing adoption of steel in mass-scale food canning operations continue to drive this segment’s growth. Expanding use of aluminum in beverage cans adds diversification, but steel remains the primary choice in food preservation.

- For instance, an International Tin Association (ITA) report noted a decline in global refined tin production to 371,200 tonnes in 2024, attributed to supply disruptions in Myanmar and Indonesia, which represents a 2.7% decrease from the 381,500 tonnes produced in 2023.

By Coating Type

Organic coatings held the largest share of the market, exceeding 50% in 2024. These coatings are preferred for their flexibility, adhesion, and strong resistance to food acids, especially in canned fruits, juices, and sauces. Inorganic coatings are used for high-temperature resistance, while hybrid coatings are gaining traction as sustainable alternatives. Regulatory focus on BPA-free and eco-friendly coatings has accelerated the adoption of advanced organic formulations. Continuous innovation in bio-based resins and waterborne technologies further strengthens the dominance of organic coatings across major food packaging applications.

- For instance, Kansai Paint works with ceramic and silicate coatings; it recorded consolidated net sales of ¥509.1 billion in fiscal year 2022 and ¥562.3 billion in fiscal year 2023.

By Canning Process

Two-piece can coating led the market with more than 60% share in 2024. This process, commonly used in beverages and processed foods, offers superior sealing, reduced material use, and higher production efficiency. Three-piece cans remain relevant for bulk packaging, sauces, and dairy products but face competition due to higher weight and material requirements. The growing demand for lightweight, airtight, and cost-effective food packaging has fueled the expansion of two-piece can coatings. Manufacturers continue to invest in high-speed production lines and sustainable coatings to meet consumer and regulatory requirements in this segment.

Key Growth Drivers

Rising Demand for Packaged and Processed Foods

The increasing consumption of ready-to-eat meals, canned vegetables, and beverages has become the primary growth driver in the food can coatings market. Urbanization and busy lifestyles are pushing consumers toward convenient packaged food, boosting demand for coated cans that ensure safety and extended shelf life. Steel and aluminum cans coated with protective layers provide resistance against corrosion and food reactions, which supports market expansion. The growing middle-class population in emerging economies further accelerates adoption of food cans, reinforcing this segment as the key driver of industry growth.

- For instance, Ball Corporation states it produces over 107 billion recyclable cans annually, reflecting strong demand for coated metal packaging.

Stringent Food Safety and Regulatory Standards

Stringent global regulations focusing on consumer safety and packaging quality drive the adoption of advanced food can coatings. Regulatory bodies are increasingly restricting the use of hazardous substances such as BPA, pushing manufacturers to adopt BPA-free, waterborne, and bio-based coating solutions. This compliance-driven innovation enhances product safety while ensuring market competitiveness. Food brands emphasize coatings that prevent contamination and preserve nutritional value, directly supporting long-term market growth. Growing health awareness among consumers makes regulatory compliance a crucial driver for coating manufacturers worldwide.

- For instance,Ball’s STARcan (lighter weight can design) reached 56 % of its total can volume in one recent year.

Shift Toward Sustainable and Eco-Friendly Coatings

Sustainability is reshaping the food packaging sector, with rising demand for eco-friendly coatings. Manufacturers are investing in hybrid and organic coatings that reduce environmental impact while maintaining performance. Consumers and retailers prefer sustainable packaging solutions, leading to increased adoption of recyclable and bio-based coating technologies. This trend is further reinforced by government policies encouraging green packaging practices. The integration of waterborne coatings and low-VOC technologies provides opportunities for long-term adoption, making eco-sustainability a major driver of growth in the food can coatings market.

Key Trends & Opportunities

Adoption of BPA-Free and Waterborne Coatings

A major trend in the food can coatings market is the rapid transition toward BPA-free formulations. Growing consumer health concerns and regulatory pressure have accelerated innovation in waterborne and alternative resin technologies. Manufacturers are focusing on high-performance BPA substitutes that provide durability without compromising safety. This shift presents opportunities for companies offering sustainable solutions that meet both regulatory standards and consumer expectations. With demand for safe packaging solutions increasing worldwide, the move toward BPA-free coatings represents a crucial opportunity for growth in the coming years.

- For instance, CANPACK’s Bydgoszcz project adds ~1 billion cans per year.

Technological Advancements in Coating Materials

Ongoing research in nanotechnology and hybrid coatings is creating new opportunities in food can applications. Advanced coatings enhance chemical resistance, flexibility, and adhesion while improving sustainability profiles. Hybrid formulations combining organic and inorganic features are gaining traction in high-demand applications, particularly for acidic and carbonated foods. These innovations reduce production costs and expand coating lifespans, providing added value for manufacturers and food companies. With continuous development in material science, technological advancements will remain a key opportunity shaping the future of food can coatings globally.

- For instance, UACJ’s Fourth Mid-Term Management Plan, covering fiscal years 2024–2027, targets a business profit of ¥60 billion and EBITDA of ¥100 billion by fiscal year 2027. The plan also aims to increase can stock sales volume to 935,000 tonnes by fiscal year 2027.

Key Challenges

High Raw Material Costs and Supply Chain Pressures

The food can coatings market faces significant challenges from volatile raw material prices, particularly for resins, solvents, and specialty chemicals. Disruptions in global supply chains further exacerbate cost pressures, impacting manufacturers’ margins. Fluctuations in steel and aluminum prices also add to production uncertainties. These cost challenges make it difficult for smaller manufacturers to compete with larger players, slowing innovation adoption in price-sensitive markets. Companies are focusing on localized supply chains and material efficiency to overcome these hurdles while sustaining profitability.

Stringent Environmental Regulations on Coating Production

Environmental restrictions on volatile organic compounds (VOCs) and solvent-based coatings pose another key challenge. Compliance with strict emission standards increases production costs, as manufacturers must invest in cleaner technologies and eco-friendly formulations. While sustainable coatings create opportunities, the shift requires significant R&D expenditure and technological upgrades. Smaller companies often struggle to meet these requirements, limiting their global competitiveness. Balancing regulatory compliance with cost-effectiveness remains a major obstacle for the industry, particularly in emerging markets where cost-sensitive buyers dominate demand.

Regional Analysis

North America

North America accounted for 32% of the food can coatings market in 2024, driven by strong demand for packaged and processed foods. The United States dominates regional growth due to high consumption of canned beverages, soups, and ready-to-eat meals. Rising consumer preference for BPA-free and sustainable coatings has accelerated the adoption of organic and hybrid solutions. The presence of established coating manufacturers and stringent FDA regulations ensure consistent product quality. Growth is further supported by innovation in eco-friendly coatings and high investments in packaging technologies, making North America a key revenue contributor to the global market.

Europe

Europe held 27% of the market share in 2024, supported by stringent EU regulations on food safety and sustainability. The region’s focus on BPA-free coatings and low-VOC formulations drives adoption across canned foods and beverages. Germany, France, and the UK are leading markets due to high packaged food consumption and strong retail networks. Sustainable packaging initiatives and circular economy policies further boost demand for hybrid and organic coatings. Growing popularity of ready-to-eat products and advancements in canning technology reinforce Europe’s role as a significant player in the global food can coatings market.

Asia Pacific

Asia Pacific captured 28% of the food can coatings market share in 2024, emerging as the fastest-growing region. Rapid urbanization, population growth, and rising disposable incomes are fueling demand for canned foods and beverages. China, Japan, and India dominate consumption due to expanding middle-class populations and changing dietary habits. Increasing investment in food processing industries and growth of retail chains further enhance regional adoption. The region also benefits from expanding local manufacturing capacities, providing cost advantages. Rising demand for eco-friendly and durable coatings positions Asia Pacific as a central growth hub for the industry.

Latin America

Latin America accounted for 7% of the global food can coatings market in 2024, with Brazil and Mexico leading consumption. Growing demand for affordable packaged foods and beverages is driving adoption of coated cans. Economic development, expanding supermarkets, and changing consumer lifestyles support steady market growth. While the region lags in advanced coating technologies, increasing focus on regulatory compliance and sustainability is creating opportunities. Rising imports of coated cans and greater investments in local production facilities are expected to strengthen Latin America’s position in the global market during the forecast period.

Middle East & Africa

The Middle East & Africa represented 6% of the food can coatings market in 2024. Growth is supported by rising demand for canned meat, fish, and dairy products in Gulf countries, along with expanding retail networks in Africa. Saudi Arabia, UAE, and South Africa are key markets, driven by increasing reliance on packaged food products. Limited local manufacturing capacity and dependency on imports restrict rapid expansion. However, rising population, urbanization, and gradual adoption of sustainable coatings provide growth opportunities. Government initiatives to strengthen food security are expected to support long-term demand for food can coatings in this region.

Market Segmentations:

By Substrate Type:

By Coating Type:

- Organic Coatings

- Inorganic Coatings

- Hybrid Coatings

By Canning Process:

- Two-Piece Can Coating

- Three-Piece Can Coating

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The food can coatings market features a competitive landscape led by global players such as SherwinWilliams, Flint Group, RPM International, Dainichiseika Colors Chemicals, BASF, BioBond, Toagosei, Toyo Ink SC Holdings, Akzo Nobel, Arkema, Henkel, PPG, Axalta Coating Systems, Valspar, DIC Corporation, and The Chemours Company. Competition is shaped by continuous innovation in coating technologies, particularly in the development of BPA-free, waterborne, and hybrid formulations that comply with strict regulatory frameworks. Companies focus on expanding product portfolios that address food safety, sustainability, and shelf-life extension requirements. Strategic investments in eco-friendly resins and bio-based materials are becoming vital to maintain competitiveness. Regional expansion, partnerships with food processing industries, and advancements in manufacturing efficiency are also central to strengthening market presence. The landscape is further influenced by rising consumer demand for safe and sustainable packaging, pushing manufacturers to adopt cleaner technologies and differentiate through performance, cost efficiency, and compliance-driven innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SherwinWilliams

- Flint Group

- RPM International

- Dainichiseika Colors Chemicals

- BASF

- BioBond

- Toagosei

- Toyo Ink SC Holdings

- Akzo Nobel

- Arkema

- Henkel

- PPG

- Axalta Coating Systems

- Valspar

- DIC Corporation

- The Chemours Company

Recent Developments

- In 2025, PPG launched three new bisphenol A non-intent (BPA-NI) coatings for easy-open ends of aluminum beverage cans: PPG Innovel PRO 2489, PPG Innovel EVO 6720, and PPG iSENSE 5018

- In 2025, BioBond Launched a new line of biobased protective coatings for the food processing and distribution sectors in February.

- In 2024, AkzoNobel Packaging Coatings introduced the Securshield 500 Series, a PVC-free and bisphenol-free internal coating for easy-open can ends.

Report Coverage

The research report offers an in-depth analysis based on Substrate Type, Coating Type, Canning Process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising demand for packaged foods.

- BPA-free and sustainable coatings will dominate future product development.

- Organic and hybrid coatings will expand as safer alternatives gain preference.

- Asia Pacific will continue to emerge as the fastest-growing regional market.

- North America and Europe will lead in regulatory-driven innovations.

- Manufacturers will invest heavily in eco-friendly and low-VOC formulations.

- Advanced technologies such as nanocoatings will improve durability and performance.

- Increasing health awareness will accelerate demand for safe packaging solutions.

- Global supply chain improvements will enhance production efficiency.

- Partnerships between food processors and coating suppliers will strengthen market expansion.