Market Overview

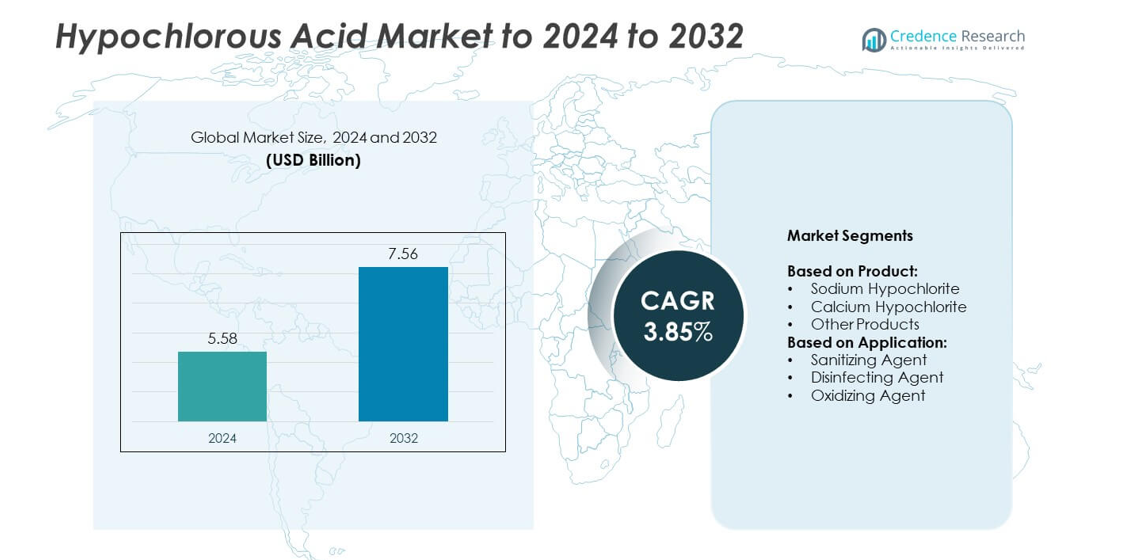

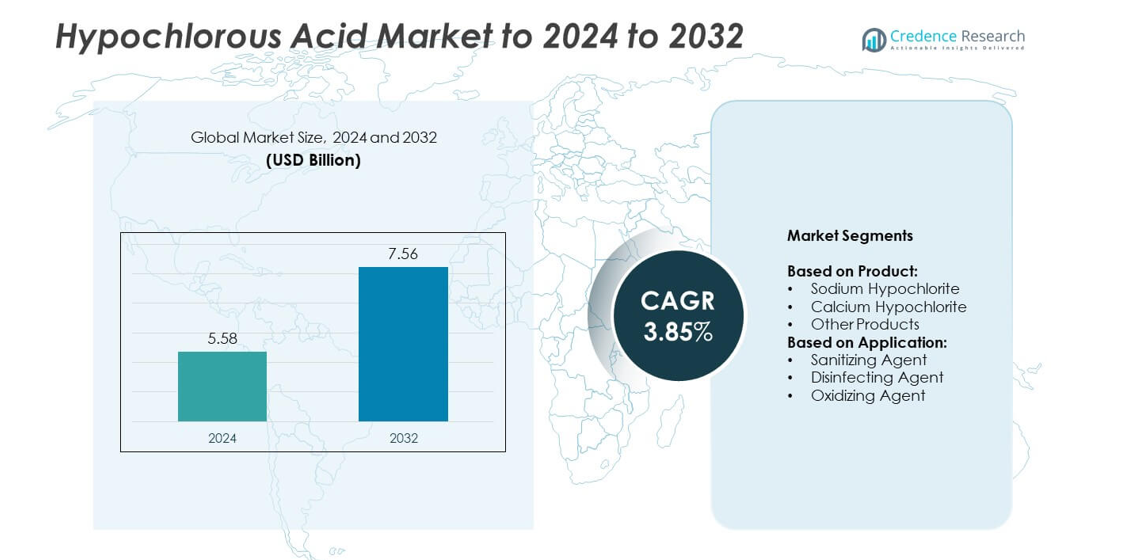

The Hypochlorous Acid Market size was valued at USD 5.58 Billion in 2024 and is anticipated to reach USD 7.56 Billion by 2032, at a CAGR of 3.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hypochlorous Acid Market Size 2024 |

USD 5.58 Billion |

| Hypochlorous Acid Market, CAGR |

3.85% |

| Hypochlorous Acid Market Size 2032 |

USD 7.56 Billion |

The hypochlorous acid market is shaped by prominent players such as Sonoma Pharmaceuticals, BASF SE, Aditya Birla Chemicals, Lonza, Nouryon, AGC Chemicals, and Lenntech B.V., who focus on innovation, regulatory compliance, and sustainability to strengthen their market position. These companies invest in research and development to enhance product stability, expand applications, and meet rising demand across healthcare, food safety, and water treatment sectors. Regionally, North America led the market in 2024 with a 37% share, supported by advanced healthcare infrastructure and stringent sanitation regulations, while Europe followed with 29% share, driven by strict environmental and hygiene standards.

Market Insights

- The hypochlorous acid market was valued at USD 5.58 Billion in 2024 and is projected to reach USD 7.56 Billion by 2032, growing at a CAGR of 3.85%.

- Rising demand for eco-friendly disinfectants in healthcare, food safety, and water treatment is a key driver boosting market expansion across developed and emerging economies.

- Growing adoption of hypochlorous acid in packaged food safety, healthcare wound care, and consumer cleaning products highlights an important market trend supporting long-term growth.

- Competition is defined by leading companies focusing on stability improvements, sustainability, and regulatory compliance, with strategies aimed at developing advanced formulations and expanding global reach.

- North America led the market with 37% share in 2024, followed by Europe with 29%, while Asia Pacific held 23%; by application, disinfecting agents dominated with over 55% share, reinforcing their role as the leading segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Sodium hypochlorite dominated the hypochlorous acid market in 2024 with a share of over 50%. Its dominance is driven by extensive use in cleaning, water treatment, and sanitation solutions. Demand is further supported by its cost-effectiveness and wide availability for large-scale applications across residential, industrial, and municipal sectors. Calcium hypochlorite follows as a key product segment, mainly applied in water purification and swimming pool disinfection. Other product variants serve niche needs, but sodium hypochlorite’s broad acceptance and regulatory approvals ensure its continued leadership throughout the forecast period.

- For instance, Olin has multiple chlor-alkali facilities, including a major complex in Freeport, Texas, and another in Plaquemine, Louisiana. As of 2022, Olin had been taking steps to reduce its overall capacity to improve market values, including announcing the permanent shutdown of 225,000 ECU tons of diaphragm-grade chlor-alkali capacity at its Freeport facility.

By Application

Disinfecting agents accounted for the largest share in 2024, holding more than 55% of the market. Rising demand in healthcare, food processing, and public sanitation facilities supports this dominance. Increasing focus on infection control and hygiene compliance in both developed and emerging economies has further accelerated usage. Sanitizing agents are also experiencing steady growth, particularly in household cleaning and packaged food sectors. Oxidizing agent applications, though smaller in share, are gaining traction in industrial water treatment. However, disinfecting agents remain the core growth driver due to sustained public health and safety concerns.

- For instance, the U.S. Environmental Protection Agency (EPA) and other sources note that U.S. chlorine production capacity was reduced in 2021 due to facility closures and other factors, including extreme weather events like winter storm Uri, which temporarily took around 80% of U.S. production capacity offline in February 2021.

Market Overview

Rising Demand for Disinfection and Sanitation

Growing emphasis on hygiene in healthcare, food processing, and public facilities drives hypochlorous acid demand. The COVID-19 pandemic accelerated awareness, but sustained adoption continues due to strict hygiene regulations. Governments and industries prefer hypochlorous acid-based products for their safety, cost efficiency, and proven efficacy against pathogens. With healthcare systems expanding globally and consumer preference for safe cleaning solutions increasing, this driver remains the most influential factor shaping long-term growth of the market.

- For instance, Ittehad Chemicals (Pakistan) lists 49,500 tons per year installed capacity for sodium hypochlorite (liquid bleach) in its annual capacity data.

Expanding Applications in Water Treatment

Hypochlorous acid plays a vital role in municipal and industrial water treatment. Rising concerns over waterborne diseases and the need for efficient purification solutions fuel product adoption. Municipalities rely on sodium hypochlorite for large-scale disinfection, while industries deploy calcium hypochlorite for reliable water management. Growing urbanization and infrastructure projects in emerging economies are further accelerating demand. This application base strengthens the market’s position as a sustainable solution for clean water supply.

- For instance, OxyChem supplies liquid chlorine in railcars with a 90-ton capacity each.

Supportive Regulatory Approvals and Eco-Friendly Profile

Hypochlorous acid’s eco-friendly and non-toxic nature has earned approvals from regulatory authorities for safe usage. Unlike other disinfectants with harsh chemical residues, hypochlorous acid decomposes into harmless substances, reducing environmental risks. Increasing preference for green chemicals in healthcare, agriculture, and consumer products is boosting adoption. Regulatory backing further assures safety compliance, making it a trusted solution across industries. This regulatory support strengthens global market penetration and positions hypochlorous acid as a sustainable growth driver.

Key Trends and Opportunities

Adoption in Food Safety and Packaging

Food safety concerns are driving the use of hypochlorous acid as a disinfectant for packaging and processing facilities. Its ability to control microbial contamination without leaving harmful residues supports compliance with stringent food safety regulations. Rising demand for packaged food and beverages globally further enhances adoption. The opportunity to develop specialized formulations for food applications is expected to open new revenue streams for manufacturers in the coming years.

- For instance, FILTEC lists Xylem OSEC B-Pak capacities from 0.3 to 960 kg/day.

Integration into Healthcare and Consumer Products

Healthcare facilities increasingly use hypochlorous acid for wound care, surface disinfection, and medical equipment cleaning. Its non-toxic and gentle profile makes it suitable for sensitive applications compared to conventional disinfectants. Consumer adoption is also growing in personal care sprays, home cleaning products, and sanitizers. Companies are innovating to launch user-friendly and branded consumer-grade solutions. This trend strengthens demand and creates opportunities to diversify product portfolios into fast-growing healthcare and consumer segments.

- For instance, Contamac’s HyClear contains 0.01% HOCl and has an unopened shelf life of up to 18 months.

Key Challenges

Storage and Stability Issues

One major challenge limiting widespread adoption is the instability of hypochlorous acid solutions. The compound tends to degrade quickly, losing effectiveness if not stored under controlled conditions. Manufacturers face difficulties in maintaining product strength across transportation and shelf-life, which impacts scalability in retail and industrial markets. Overcoming these limitations requires technological advancements in formulation and packaging. Addressing stability challenges remains critical to ensure broader acceptance across end-user industries.

Competition from Alternative Disinfectants

The market faces competition from established disinfectants such as chlorine, hydrogen peroxide, and alcohol-based solutions. These alternatives are widely available, cost-effective, and backed by strong supply chains. Although hypochlorous acid offers eco-friendly advantages, price sensitivity and familiarity with traditional disinfectants hinder market penetration in certain sectors. To overcome this challenge, manufacturers need to highlight performance benefits and develop competitive pricing strategies. Market education and differentiation will play a crucial role in strengthening its position.

Regional Analysis

North America

North America held the largest share of the hypochlorous acid market in 2024, accounting for 37%. The region’s leadership is supported by strong demand from healthcare, food processing, and water treatment sectors. The United States drives most of the revenue due to advanced healthcare infrastructure and strict sanitation regulations. Rising consumer awareness of eco-friendly disinfectants further strengthens adoption. Investments in research and product innovation by key manufacturers also contribute to sustained growth. Canada and Mexico show increasing uptake in municipal water treatment, reinforcing the region’s dominant role in the global market.

Europe

Europe captured 29% of the hypochlorous acid market in 2024, positioning it as the second-largest region. Demand is driven by stringent regulatory standards for hygiene, food safety, and environmental protection. The healthcare sector plays a vital role, with hospitals and clinics increasingly using hypochlorous acid-based disinfectants for safer patient care. Rising emphasis on sustainable cleaning solutions also supports growth across industries. Countries like Germany, France, and the United Kingdom lead adoption, while Eastern Europe shows emerging potential. The combination of regulatory backing and consumer preference for eco-friendly products continues to reinforce market expansion across the region.

Asia Pacific

Asia Pacific accounted for 23% of the hypochlorous acid market in 2024, driven by rapid urbanization and industrialization. Growing concerns over public health and waterborne diseases have spurred adoption in water treatment and sanitation projects. Countries like China, India, and Japan are at the forefront, with expanding healthcare infrastructure and rising packaged food demand supporting usage. The region’s strong population base and increasing awareness of hygiene standards further fuel demand. Government initiatives promoting clean water and sustainable disinfectants enhance adoption, making Asia Pacific a fast-growing region with significant opportunities for market expansion.

Latin America

Latin America represented 7% of the hypochlorous acid market in 2024, with growth largely concentrated in Brazil and Mexico. Demand is mainly driven by rising awareness of sanitation and healthcare facility requirements. Expanding urban populations have increased the need for clean water and effective disinfecting solutions. Food and beverage industries are also adopting hypochlorous acid for safety compliance, contributing to regional growth. However, limited infrastructure and high competition from low-cost alternatives slightly restrain market potential. Despite these challenges, rising investments in municipal sanitation and public health programs provide steady growth prospects for the regional market.

Middle East and Africa

The Middle East and Africa held a 4% share of the hypochlorous acid market in 2024, the smallest among all regions. Adoption is supported by rising demand for water treatment solutions in arid regions and increasing investments in healthcare infrastructure. Gulf countries lead usage due to their focus on modern sanitation systems and public health initiatives. In Africa, growing awareness of hygiene and gradual improvements in healthcare access are contributing to uptake. However, limited technological advancement and higher reliance on traditional disinfectants remain challenges. Despite these constraints, steady growth is expected with ongoing regional development projects.

Market Segmentations:

By Product:

- Sodium Hypochlorite

- Calcium Hypochlorite

- Other Products

By Application:

- Sanitizing Agent

- Disinfecting Agent

- Oxidizing Agent

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The hypochlorous acid market is characterized by the presence of leading companies such as Sonoma Pharmaceuticals, Aditya Birla Chemicals, ACURO Organics Limited, Ultrapure HOCL, BASF SE, Swiss Chemi Pvt. Ltd., Surpass Chemical Company, Nufarm, AGC Chemicals, Lenntech B.V., Lonza, and Nouryon. The market landscape reflects strong competition, where players focus on product innovation, regulatory compliance, and expansion of application areas. Strategies emphasize developing stable formulations, improving storage solutions, and expanding eco-friendly product lines to meet rising demand across healthcare, food safety, and water treatment industries. Many companies invest in advanced R&D to enhance efficiency and reduce production costs, supporting broader adoption. Partnerships with healthcare providers, municipalities, and industrial users help strengthen market presence and long-term contracts. Global expansion, particularly in emerging markets, is also a key growth strategy. The overall competitive scenario is defined by innovation, sustainability initiatives, and a strong focus on meeting evolving sanitation and environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, BASF introduced its HyPure hypochlorous acid product, developed specifically for water treatment and disinfection applications.

- In 2023, Sonoma Pharmaceuticals Entered into an exclusive distribution agreement with Advancing Eyecare to add its Pure&Clean Vision hypochlorous acid product line to Advancing Eyecare’s portfolio.

- In 2023, Lenntech B.V. announced an expansion of its hypochlorous acid production capacity to meet the growing demand in the water treatment market.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth with rising demand for eco-friendly disinfectants.

- Healthcare applications will remain the primary revenue driver due to infection control needs.

- Water treatment adoption will expand with increasing urbanization and sanitation projects.

- Food safety and packaging sectors will provide new opportunities for product penetration.

- Technological improvements in storage stability will enhance product shelf-life and reliability.

- Consumer products like sprays and cleaners will gain wider acceptance in households.

- Regulatory support for green chemicals will continue to favor market expansion.

- Asia Pacific will emerge as the fastest-growing region with industrial and healthcare growth.

- Competition from traditional disinfectants will push innovation and cost optimization.

- Manufacturers will invest in diversification of formulations tailored for multiple end-use industries.