Market Overview

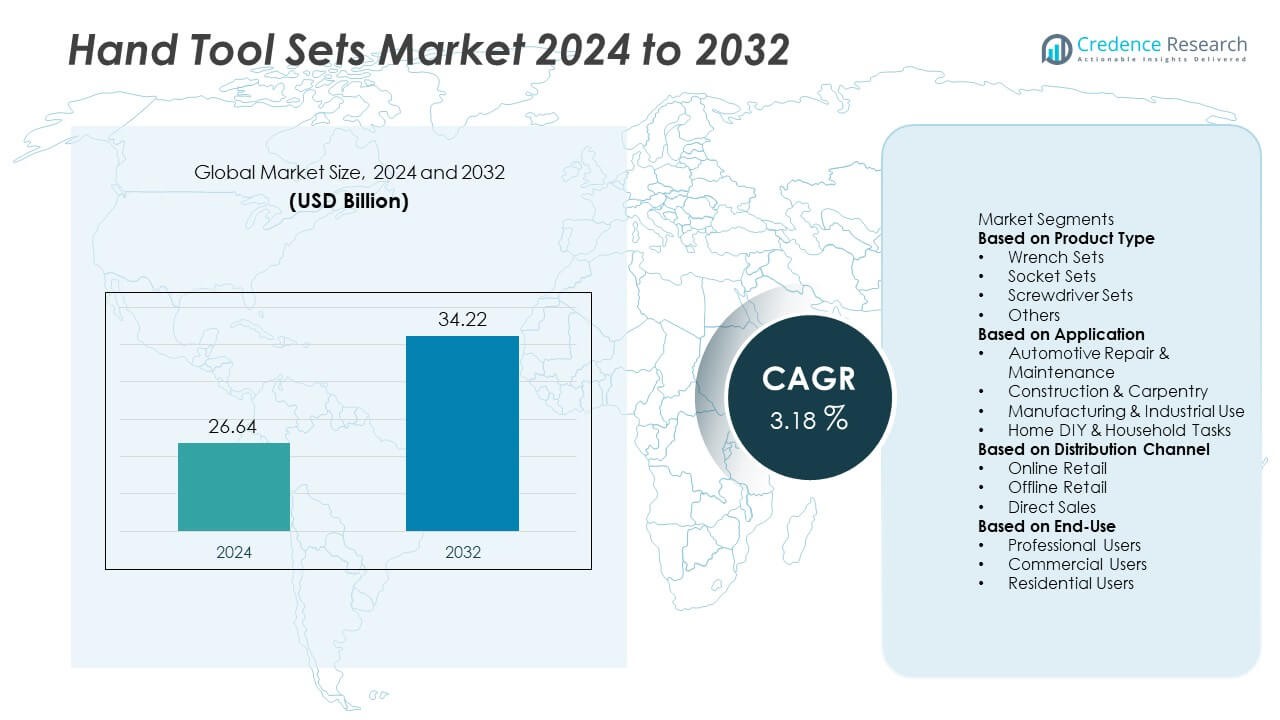

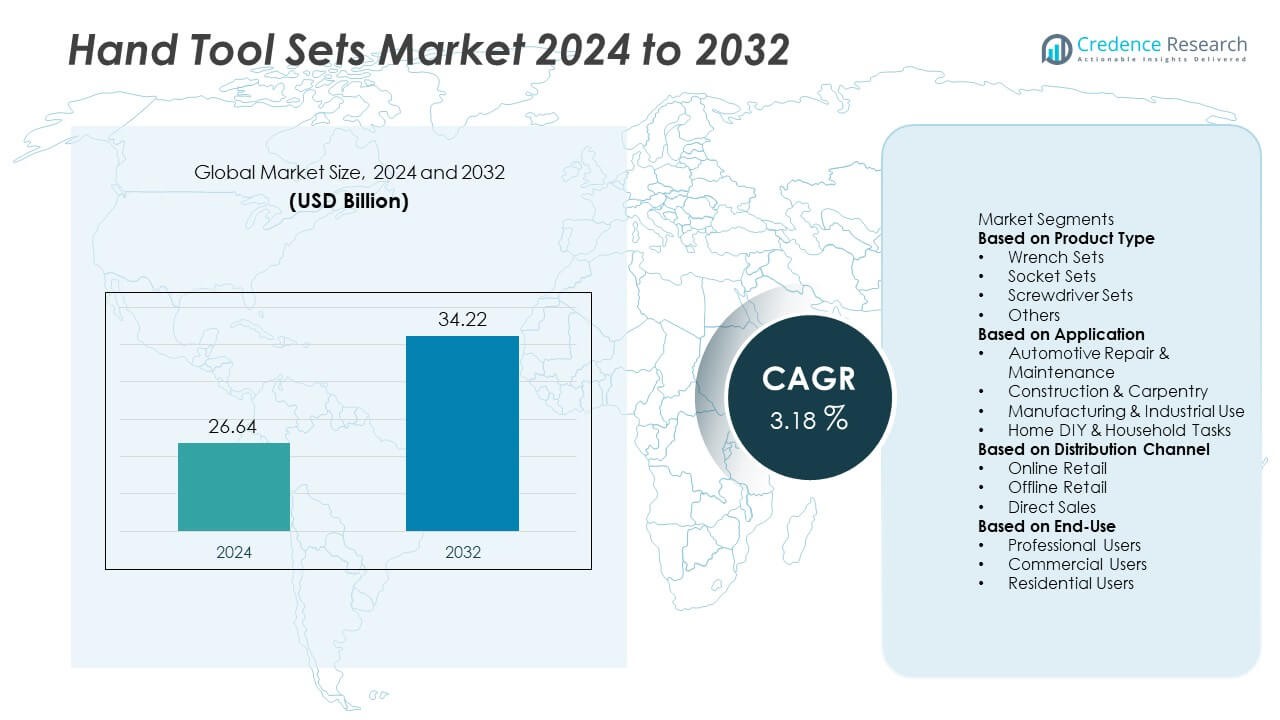

The Hand Tool Sets Market was valued at USD 26.64 billion in 2024 and is projected to reach USD 34.22 billion by 2032, registering a CAGR of 3.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hand Tool Sets Market Size 2024 |

USD 26.64 Billion |

| Hand Tool Sets Market, CAGR |

3.18% |

| Hand Tool Sets Market Size 2032 |

USD 34.22 Billion |

The Hand Tool Sets market is driven by leading players such as Stanley Black & Decker, Snap-on Incorporated, Bosch Power Tools, Apex Tool Group, Klein Tools, Makita Corporation, Hilti Corporation, Wurth Group, Techtronic Industries, and Channellock Inc. These companies strengthen their competitive position through durable tool designs, advanced materials, ergonomic features, and wide product portfolios serving automotive, construction, and industrial users. North America leads the market with a 32% share, supported by strong DIY culture and a large automotive repair base. Europe follows with a 28% share, driven by high-quality manufacturing standards, while Asia Pacific holds a 30% share, reflecting strong industrial growth and rising demand for professional and household tool sets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hand Tool Sets market was valued at USD 26.64 billion in 2024 and is projected to reach USD 34.22 billion by 2032, growing at a 3.18% CAGR during the forecast period.

- Market growth is driven by rising automotive repair activity, expanding construction projects, and increasing DIY adoption, with wrench sets leading the product segment at 37% due to high usage in mechanical and maintenance tasks.

- Key trends include growing demand for ergonomic, corrosion-resistant tools, increasing uptake of combination tool kits, and rapid expansion of online retail platforms offering bundled professional and household tool sets.

- Competitive strength improves as major players invest in advanced steel materials, enhanced grip designs, and large distribution networks across hardware stores and digital marketplaces, supporting wider product availability.

- Regionally, North America holds a 32% share, Europe accounts for 28%, and Asia Pacific maintains strong momentum with a 30% share, supported by rising industrialization, manufacturing growth, and broad adoption across professional and residential applications.

Market Segmentation Analysis:

By Product Type

Wrench sets hold the dominant position in the product type segment with a 37% market share, driven by their essential role in automotive repair, machinery assembly, and general maintenance tasks. Their versatility, compatibility with multiple fastener sizes, and strong durability make them a preferred choice for professionals and DIY users. Socket sets and screwdriver sets also show steady demand as consumers seek complete, multi-purpose tool kits. Growth in home improvement activities and rising purchases of multi-functional combination tool sets support overall segment expansion.

- For instance, Stanley Black & Decker introduced a forged-steel wrench line with products, such as those under the Proto brand, that offer a wide range of torque capabilities, with some heavy-duty models capable of handling up to 800 Newton-meters (approximately 600 foot-pounds) or even higher using torque multipliers, improving durability for professional tasks.

By Application

Automotive repair and maintenance lead the application segment with a 41% market share, supported by rising vehicle ownership, increasing aftermarket repair needs, and frequent servicing requirements. Professional mechanics and workshops rely on high-strength hand tool sets for precision and safety in engine work, tire services, and component replacements. Construction and carpentry also maintain strong demand due to ongoing infrastructure growth, while household DIY applications rise as consumers invest more in home upgrades. Industrial manufacturing continues to adopt durable and ergonomic tool sets to support assembly and maintenance operations.

- For instance, Snap-on Incorporated produces electronic torque and angle wrenches with an accuracy of ±2% of the indicated value in clockwise direction (CW) from 20-100% of full scale, or specialized digital torque testers used for calibration with a minimum accuracy of ±0.5%. These tools are designed for durability and precision, complying with standards like ISO 6789.

By Distribution Channel

Offline retail dominates the distribution channel segment with a 54% market share, driven by strong consumer preference for physical inspection, instant availability, and expert guidance from hardware and specialty stores. Brick-and-mortar retailers remain the primary choice for professionals seeking heavy-duty tool sets. Online retail is expanding rapidly as e-commerce platforms offer price transparency, bundled tool kits, and wide product choices. Direct sales also grow moderately, especially among industrial buyers looking for bulk purchases. The rise of omnichannel shopping and digital catalogs continues to support market penetration across all regions.

Key Growth Driver

Rising Demand from Automotive Repair and Maintenance

The steady increase in vehicle ownership and aging fleets drives strong demand for hand tool sets used in routine repairs, component replacements, and servicing operations. Automotive workshops depend on durable wrench sets, socket sets, and screwdriver kits to ensure accurate and safe mechanical work. Growth in aftermarket services and expanding technician networks further supports the segment. Electric vehicle expansion also fuels demand for specialized tool sets required for battery maintenance and electrical system work. As consumers prioritize timely repairs and performance upgrades, tool set purchases continue to rise across professional and personal use.

- For instance, Knipex introduced insulated tools certified for electrical safety up to 1,000 volts for EV maintenance.

Expansion of DIY and Home Improvement Activities

Increasing homeowner interest in renovation, repair, and small-scale construction boosts demand for easy-to-use, multi-functional hand tool sets. Lockdown-driven behavioral shifts accelerated DIY adoption, and the trend remains strong as consumers continue engaging in self-maintenance tasks. Homeowners prefer versatile kits that include screwdrivers, pliers, and hammers for assembling furniture, fixing fixtures, and handling routine household tasks. Online tutorials and social media content further encourage DIY culture. This shift drives steady market expansion as residential users purchase compact and affordable tool sets for personal projects.

- For instance, Wurth Group designed ergonomic screwdrivers to achieve a specific, repeatable tightening force for precise applications, with some models offering an adjustable range typically between 1 to 3.5 newton-meters (100 to 350 newton-centimeters).

Growth in Construction and Industrial Applications

Rising construction activities, infrastructure expansion, and industrial modernization significantly increase the use of hand tool sets across carpentry, electrical work, metal fabrication, and plant maintenance. Professionals rely on high-strength and ergonomic tool sets to improve productivity and ensure safety at job sites. Industrial maintenance teams use socket and wrench sets for equipment servicing and assembly-line adjustments. Demand further grows as manufacturers invest in advanced tool designs with enhanced grip, corrosion resistance, and improved durability. Ongoing industrial upgrades continue to support long-term tool adoption.

Key Trend & Opportunity

Increasing Adoption of Ergonomic and High-Durability Tools

Manufacturers focus on ergonomically designed tool sets that reduce user fatigue and enhance precision during long working hours. Tools made from chrome-vanadium steel, alloy steel, and corrosion-resistant coatings gain traction due to higher durability and long service life. Grip-enhanced handles and lightweight designs improve usability for both professionals and DIY users. The trend creates opportunities for brands offering premium, long-lasting tool sets tailored to specialized tasks. Demand for high-performance tools increases across automotive, industrial, and heavy-duty applications, driving innovation in material science and product engineering.

- For instance, Klein Tools developed pliers made of custom, US-made tool steel with induction-hardened cutting knives designed for superior edge life and durability when cutting materials like ACSR, screws, nails, and most hardened wire.

Rapid Growth of Online Retail and Customized Tool Kits

Online platforms attract buyers seeking convenience, price transparency, and access to a wide range of tool sets. E-commerce growth accelerates as users prefer bundled kits that include multiple tools for varied applications. Brands increasingly offer customizable tool sets, allowing buyers to select tools based on specific needs, such as automotive repair, electrical work, or home maintenance. Digital retail channels also support product comparisons and customer reviews, influencing purchasing decisions. This trend opens strong opportunities for manufacturers to expand their digital presence and enhance product visibility.

- For instance, Techtronic Industries (TTI) owns brands such as Milwaukee, which developed the PACKOUT modular storage system that features individual tool boxes with varying weight capacities, such as a medium tool box with a 75 lbs (approximately 34 kg) capacity.

Key Challenge

Availability of Low-Cost Counterfeit and Substandard Products

The market faces rising competition from low-quality and counterfeit tool sets that compromise durability, safety, and performance. These products often use inferior materials and lack proper manufacturing standards, leading to tool breakage and safety risks for users. Their significantly lower prices appeal to cost-sensitive buyers, making it harder for established brands to compete on pricing. Counterfeit items also damage brand reputation and reduce consumer trust in legitimate manufacturers. Ensuring quality control and increasing awareness about certified products remain critical challenges for the market.

Fluctuating Raw Material Prices and Supply Chain Disruptions

Volatility in steel, alloy, and coating material prices directly impacts production costs for hand tool sets. Supply chain disruptions, driven by geopolitical issues, transportation delays, and labor shortages, create uncertainty in material availability. Manufacturers often struggle to maintain stable pricing while ensuring consistent product quality. These challenges affect profit margins and limit production flexibility, especially for small and mid-sized tool makers. Market resilience depends on improved sourcing strategies, diversified supplier networks, and better inventory management to mitigate cost and supply risks.

Regional Analysis

North America

North America holds a 32% market share in the Hand Tool Sets market, driven by high demand from automotive repair, construction, and home improvement activities. The U.S. leads regional consumption due to strong DIY culture, widespread professional tool usage, and a well-established automotive aftermarket. Growth in residential renovation projects and expansion of commercial construction further support demand for durable and ergonomic tool sets. Skilled trade professions, including electricians, plumbers, and carpenters, also contribute significantly to tool purchases. Increasing adoption of premium tool sets with enhanced materials and improved grip designs continues to strengthen market growth across the region.

Europe

Europe accounts for a 28% market share, supported by strong industrial maintenance needs, expanding manufacturing activity, and established construction sectors across Germany, the U.K., and France. Demand is driven by professional users who rely on high-quality steel tools for precision and durability in mechanical, electrical, and carpentry applications. The region also sees growing interest in ergonomically designed and corrosion-resistant tool sets, especially in industrial workshops and automotive service centers. Strict quality standards encourage adoption of certified tools, while the rising popularity of DIY home maintenance supports additional market expansion across residential users.

Asia Pacific

Asia Pacific leads growth momentum with a 30% market share, driven by large-scale manufacturing, expanding automotive production, and strong growth in residential construction. China, India, Japan, and South Korea dominate demand due to rising industrialization and increasing reliance on hand tools for machinery assembly and repair tasks. The growing middle class boosts DIY tool purchases, while small and medium enterprises expand adoption of professional-grade tool sets. Affordable production capabilities and strong distribution networks support high-volume sales. Expanding infrastructure projects and rapid urbanization continue to reinforce Asia Pacific as a key market for hand tool sets.

Latin America

Latin America holds a 6% market share, supported by growing construction activity, increasing household repair needs, and expanding automotive services across Brazil, Mexico, and Argentina. The region experiences rising demand for cost-effective and durable tool sets used in carpentry, plumbing, and vehicle maintenance. Local workshops and contractors rely on medium-duty tool sets to support daily operations. Economic constraints influence consumer preference for competitively priced tools, but demand for higher-quality professional sets is growing gradually. Government-backed infrastructure development and rising home renovation activities also contribute to steady market growth.

Middle East & Africa

The Middle East & Africa region accounts for a 4% market share, driven by expanding construction projects, industrial development, and growing automotive repair services. Gulf countries, including the UAE and Saudi Arabia, adopt high-quality hand tool sets for commercial and industrial applications due to strong investment in infrastructure and manufacturing. Africa shows growing demand in urban centers as electricians, mechanics, and contractors increase tool usage. Affordability remains a key factor in purchasing decisions, but demand for durable, multi-purpose tool sets continues to rise. Continued economic diversification across the region supports long-term market expansion.

Market Segmentations:

By Product Type

- Wrench Sets

- Socket Sets

- Screwdriver Sets

- Others

By Application

- Automotive Repair & Maintenance

- Construction & Carpentry

- Manufacturing & Industrial Use

- Home DIY & Household Tasks

By Distribution Channel

- Online Retail

- Offline Retail

- Direct Sales

By End-Use

- Professional Users

- Commercial Users

- Residential Users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hand Tool Sets market is shaped by major players such as Stanley Black & Decker, Snap-on Incorporated, Bosch Power Tools, Apex Tool Group, Klein Tools, Makita Corporation, Hilti Corporation, Wurth Group, Techtronic Industries, and Channellock Inc. These companies compete by offering durable, high-performance tool sets designed for automotive repair, construction, industrial maintenance, and DIY applications. Market leaders focus on advanced material engineering, ergonomic designs, and corrosion-resistant finishes to enhance tool durability and user comfort. Many brands invest in expanding product portfolios through combination kits and specialized sets tailored for professionals. Strong distribution networks, including hardware stores, specialty outlets, and e-commerce platforms, strengthen market reach. Companies also invest in digital marketing and brand loyalty programs to drive customer engagement. Growing demand for premium tools and rising safety standards continue to influence competitive strategies across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Channellock, Inc. introduced a new line of precision levels and layout tools, expanding its hand-tool set offerings.

- In March 2025, Bosch Power Tools launched a new hand tool range of over 100 products, including pliers, screwdrivers, ratchet sets, wrenches, hammers, saws and spirit levels.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hand tool sets will rise as construction, automotive repair, and maintenance activities continue to expand.

- DIY adoption will strengthen as more consumers take on home improvement and repair tasks.

- Premium ergonomic and corrosion-resistant tools will gain wider acceptance among professional and household users.

- Online retail will grow faster, increasing access to bundled and customizable tool sets.

- Manufacturers will invest in stronger materials and precision designs to enhance tool durability and performance.

- Growth in skilled trades such as plumbing, electrical work, and carpentry will support long-term tool demand.

- Industrial modernization will increase the need for heavy-duty and high-torque tool sets in manufacturing.

- Hybrid distribution models combining offline retail and e-commerce will shape future buying behavior.

- Sustainable packaging and eco-friendly tool designs will become more important for brands.

- Expanding automotive aftermarket services will continue to drive consistent demand for multifunctional tool sets.